How Do Muslim Mortgages Work for Beginners |

The property owner just pays interest on the amounts really obtained from the credit line. The lender offers stable regular monthly payments for as long as at least one customer inhabits the home as a principal home. If the debtor needs more cash at any point, they can access the line of credit.

If the borrower https://www.pinterest.com/wesleyfinancialgroup/ requires more cash throughout or after that term, they can access the line of credit. It's likewise possible to use a reverse mortgage called a HECM for purchase" to purchase a various house than the one you presently reside in. In any case, you will typically require a minimum of 50% equitybased on your house's current value, not what you spent for itto qualify for a reverse mortgage.

The number of reverse mortgages provided in the U.S. in 2019, down 35. 3% from the previous year. A reverse home loan may sound a lot like a house equity loan or credit line. Certainly, comparable to one of these loans, a reverse home mortgage can offer a lump sum or a credit line that you can access as needed based on how much of your house you've paid off and your house's market price.

A reverse mortgage is the only method to gain access to house equity without offering the home https://fortune.com/best-small-workplaces-for-women/2020/wesley-financial-group/ for elders who don't desire the responsibility of making a month-to-month loan payment or who can't get approved for a house equity loan or re-finance since of minimal capital or bad credit. If you do not get approved for any of these loans, what choices remain for using home equity to money your retirement!.?. !? You might offer and downsize, or you might sell your home to your kids or grandchildren to keep it in the family, possibly even becoming their tenant if you wish to continue residing in the home.

The 5-Minute Rule for How To Reverse Mortgages Work If Your House Burns

/Robert_girous_wamu-56a9a62a3df78cf772a93701.jpg)

A reverse home mortgage enables you to keep living in your house as long as you keep up with real estate tax, maintenance, and insurance and don't require to move into a nursing house or helped living facility for more than a year. However, securing a reverse mortgage suggests spending a significant quantity of the equity you have actually built up on interest and loan costs, which we will discuss listed below.

If a reverse mortgage does not offer a long-term service to your monetary issues, only a short-term one, it may not deserve the sacrifice (how mortgages work). What if somebody else, such as a good friend, relative or roomie, deals with you? If you get a reverse mortgage, that person won't have any right to keep living in the home finance a timeshare after you die.

If you choose a payment plan that doesn't offer a lifetime earnings, such as a lump sum or term strategy, or if you take out a line of credit and utilize everything up, you may not have any cash left when you need it. If you own a house, apartment or townhouse, or a produced house developed on or after June 15, 1976, you might be qualified for a reverse home loan.

In New York, where co-ops prevail, state law further forbids reverse mortgages in co-ops, permitting them only in one- to four-family homes and condos. While reverse mortgages don't have income or credit report requirements, they still have guidelines about who certifies. You should be at least 62, and you need to either own your house totally free and clear or have a substantial amount of equity (a minimum of 50%).

Some Known Facts About How Do House Mortgages Work.

The federal government limits how much lending institutions can charge for these items. Lenders can't pursue debtors or their beneficiaries if the home turns out to be undersea when it's time to sell. They likewise should allow any heirs a number of months to choose whether they wish to repay the reverse home mortgage or permit the lending institution to sell the home to settle the loan.

This therapy session, which typically costs around $125, should take a minimum of 90 minutes and must cover the benefits and drawbacks of taking out a reverse home loan offered your unique monetary and individual circumstances. It needs to discuss how a reverse home loan could impact your eligibility for Medicaid and Supplemental Security Earnings.

Your responsibilities under the reverse mortgage guidelines are to stay existing on real estate tax and house owners insurance coverage and keep the house in great repair work. And if you stop living in the house for longer than one yeareven if it's because you're living in a long-term care facility for medical reasonsyou'll have to repay the loan, which is normally accomplished by selling your house.

In spite of current reforms, there are still scenarios when a widow or widower might lose the home upon their partner's death. The Department of Real Estate and Urban Development changed the insurance coverage premiums for reverse home mortgages in October 2017. Because lenders can't ask house owners or their successors to pay up if the loan balance grows larger than the home's worth, the insurance premiums offer a pool of funds that lending institutions can draw on so they do not lose money when this does occur.

The 20-Second Trick For How Do Mortgages Work After Foreclosure

5% to 2. 0% for three out of four debtors and a decline in the premium from 2. 5% to 2. 0% for the other one out of four debtors. The up-front premium used to be tied to just how much customers secured in the very first year, with property owners who took out the mostbecause they needed to pay off an existing mortgagepaying the greater rate.

0% rate. The up-front premium is computed based upon the house's worth, so for every $100,000 in evaluated value, you pay $2,000. That's $6,000 on a $300,000 house. All customers should also pay yearly mortgage insurance premiums of 0. 5% (formerly 1. 25%) of the quantity obtained. This change conserves debtors $750 a year for every single $100,000 obtained and helps offset the greater up-front premium.

To obtain a reverse home mortgage, you can't simply go to any lending institution. Reverse home loans are a specialty item, and just certain lending institutions offer them. A few of the biggest names in reverse home loan loaning consist of American Advisors Group, One Reverse Home Loan, and Liberty Home Equity Solutions. It's an excellent idea to request a reverse home mortgage with several business to see which has the lowest rates and charges.

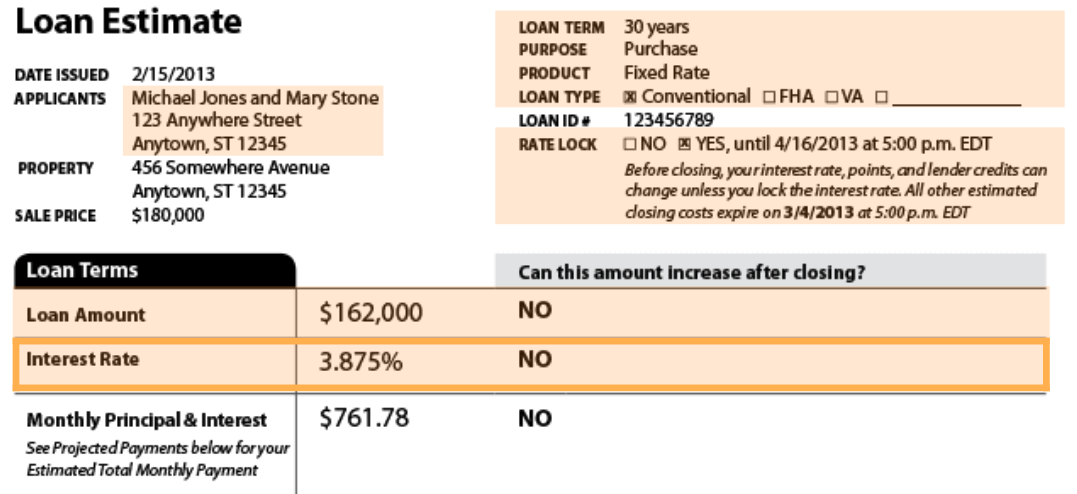

Just the lump-sum reverse home mortgage, which gives you all the earnings at the same time when your loan closes, has a set interest rate. The other five options have adjustable interest rates, which makes sense, because you're obtaining money over numerous years, not simultaneously, and rate of interest are always changing.

The Ultimate Guide To How Does Bank Loan For Mortgages Work

In addition to among the base rates, the loan provider includes a margin of one to three percentage points. So if LIBOR is 2. 5% and the lender's margin is 2%, your reverse mortgage rates of interest will be 4. 5%. As of Jan. 2020, lending institutions' margins ranged from 1. 5% to 2.

|

|

The Greatest Guide To What Is One Difference Between Fixed–rate Mortgages And Variable–rate Mortgages? |

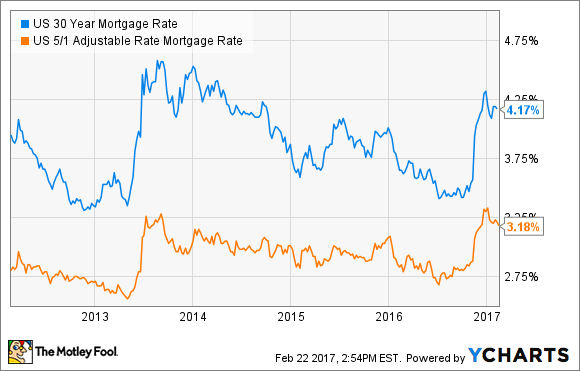

However after that, your rates of interest (and month-to-month payments) will adjust, typically as soon as a year, roughly corresponding to present interest rates. So if interest rates shoot up, so do your regular monthly payments; if they drop, you'll pay less on home mortgage payments. House purchasers with lower credit rating are best suited for an adjustable-rate home mortgage. Rates might change every 6 or 12 months, as set out by the contract. Another choice is the hybrid ARM, which begins the contract on a set rate for a set amount of time (often set as 3 or 5 years) before changing to the variable rate. Alternative ARMs can get complicated but are an excellent alternative for individuals wanting to obtain more than conventional financing would offer.

While you can only borrow versus the equity you have actually already constructed, they can be a good option for funding home upgrades or accessing money in emergency situation circumstances. House equity loans tend to have a larger rates of interest, although the smaller sums involved open the door to shorter-term arrangements. It runs along with the standard mortgage contract, however, meaning the payments throughout the period will feel greater than typical. what were the regulatory consequences of bundling mortgages.

They work in an extremely similar manner to other lines of credit contracts but are made against the equity of the property. A reverse home mortgage is a concept built specifically for seniors and serves https://www.evernote.com/shard/s419/sh/dc1afb6b-2c...032fb743d75e8049a75f6904fa059a to offer access to equity in the home via a loan. This can be helped with as a set lump payment or regular monthly payments, along with via a line of credit.

The loan does not have to be repaid until the last debtor passes away or moves from the house for one whole year. An interest-only loan can be thought of as a type of hybrid mortgage. It works on the concept of just settling the interest for the opening period of the home mortgage (often 1-3 years) prior to then switching to your standard fixed-rate or variable payments.

Nevertheless, the short-term cushion will suggest that the future payments are bigger because you'll have to make up for the lost time. After all, a 20-year home mortgage on a 3-year interest only plan is practically a 17-year mortgage as you won't have actually knocked anything off the loan contract up until the start of the fourth year.

If you recognize with balloon auto loan, the payment structure works in a really comparable manner when dealing with balloon home loans. Essentially, you pay a low charge (possibly even an interest-only repayment) for the duration of the home mortgage arrangement before clearing the complete balance on the last payment. This type of home mortgage is typically a lot much shorter, with ten years being the most common duration.

All About How Much Are The Mortgages Of The Sister.wives

Nevertheless, those that are set to rapidly reach and sustain a position of higher revenue may go with this path. Refinance loans are another alternative that is open to homeowners that are already a number of years into their mortgage. They can be used to decrease interest payments and alter the duration of the agreement.

The new loan is used to pay off the original home mortgage, essentially closing that deal before opening the brand-new term arrangement. This can be used to upgrade your homeownership status to reflect altering life scenarios, or to alter the lending institution. Refinancing can be very useful in times of financial hardship, but house owners require to do their research to see the complete image as it can be damaging in numerous scenarios.

Finding the best home mortgage is among the most essential monetary obstacles that you'll deal with, and it's a process that begins with selecting the ideal kind of mortgage for your scenario. While you may believe that the differences in between different mortgage products are small, the effect that they can have on your future is huge.

The group of professionals at A and N Home loan, among the very best mortgage lending institutions in Chicago, will help you get a mortgage and find a plan that works best for you. A and N Mortgage Providers Inc, a home loan banker in Chicago, IL provides you with premium, consisting of FHA house loans, tailored to fit your unique scenario with some of the most competitive rates in the nation.

What's the difference between a repayment, interest-only, repaired and variable home mortgage? Discover here. (Likewise see: our guides & recommendations on first time buying, shared ownership, buy-to-let, and remortgaging.) Over the term of your home mortgage, every month, you progressively pay back the cash you've borrowed, together with interest on nevertheless much capital you have left.

The quantity of money you have left to pay is likewise called 'the capital', which is why payment home loans are likewise called capital and interest home mortgages. Over the regard to your loan, you don't really pay off any of the home mortgage just the interest on it. Your monthly payments will be lower, however won't make a dent in the loan itself.

An Unbiased View of How To Reverse Mortgages Work If Your House Burns

Typically, individuals with an interest just home mortgage will invest their home mortgage, which they'll then use to pay the home mortgage off at the end of the term. 'Rate' refers to your rate of interest. With a fixed rate home loan, your loan provider assurances your interest rate will remain the exact same for a set quantity of time (the 'preliminary duration' of your loan), which is normally anything in between 110 years.

SVR is a loan provider's default, bog-standard interest rate no offers, bells or whistles attached. Each loan provider is free to set their own SVR, and adjust it how and when they like. Technically, there isn't a home mortgage called an 'SVR home loan' it's simply what you could call a mortgage out of a deal duration.

Over a set amount of time, you get a discount rate on the loan provider's SVR. This is a type of variable rate, so the quantity you pay every month can change if the lending institution changes their SVR, which they're complimentary to do as they like. Tracker rates are a type of variable rate, which indicates you could pay a different total up to your lending institution each month.

If the base rate increases or down, so does your rate of interest. These are variable mortgages, however with a cap on how high the interest rate can rise. Typically, the interest rate is higher than a tracker mortgage so you might wind up paying extra for that peace of mind.

|

|

How Do Variable Mortgages Work In Canada Fundamentals Explained |

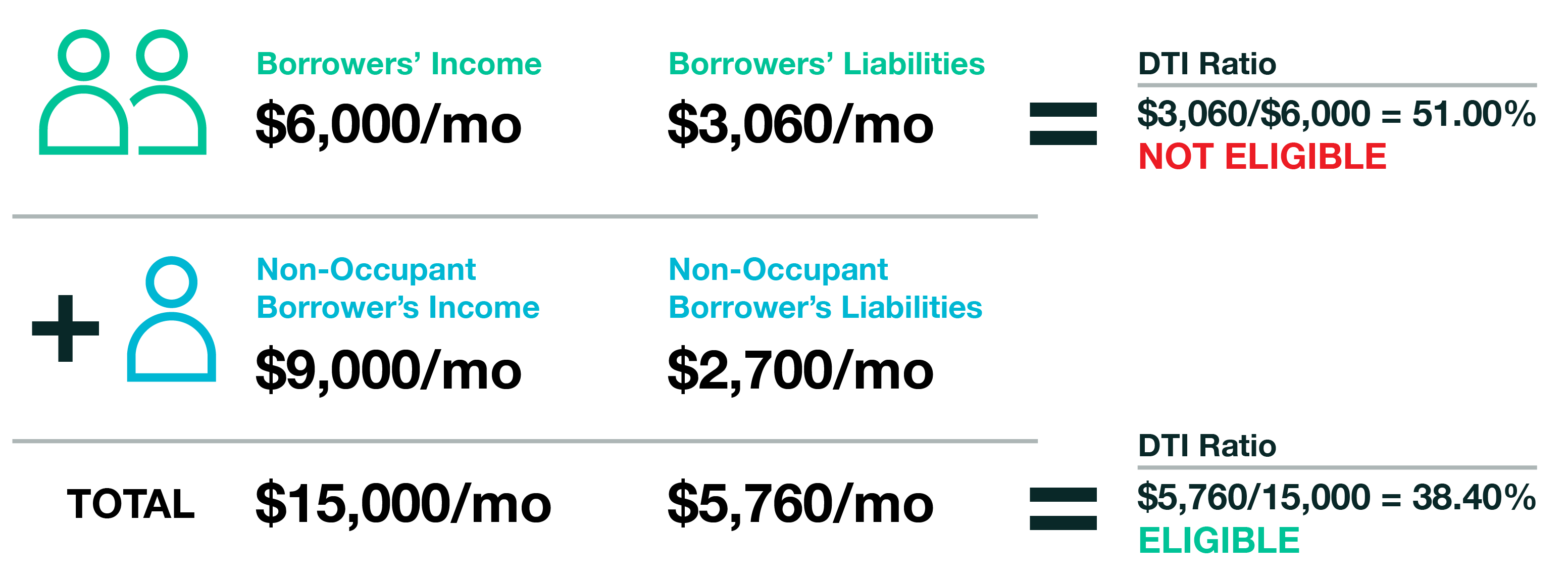

These home loan programs are essentially anything that's not backed by the federal government. Adhering loans are those within the limits of the Fannie Mae or Freddie Mac programs. Non-conforming loans might provide greater amounts, as they fall outside these standards. For a conventional loan, numerous lending institutions require a minimum FICO score of 620 and a debt-to-income ratio of 45 to half.

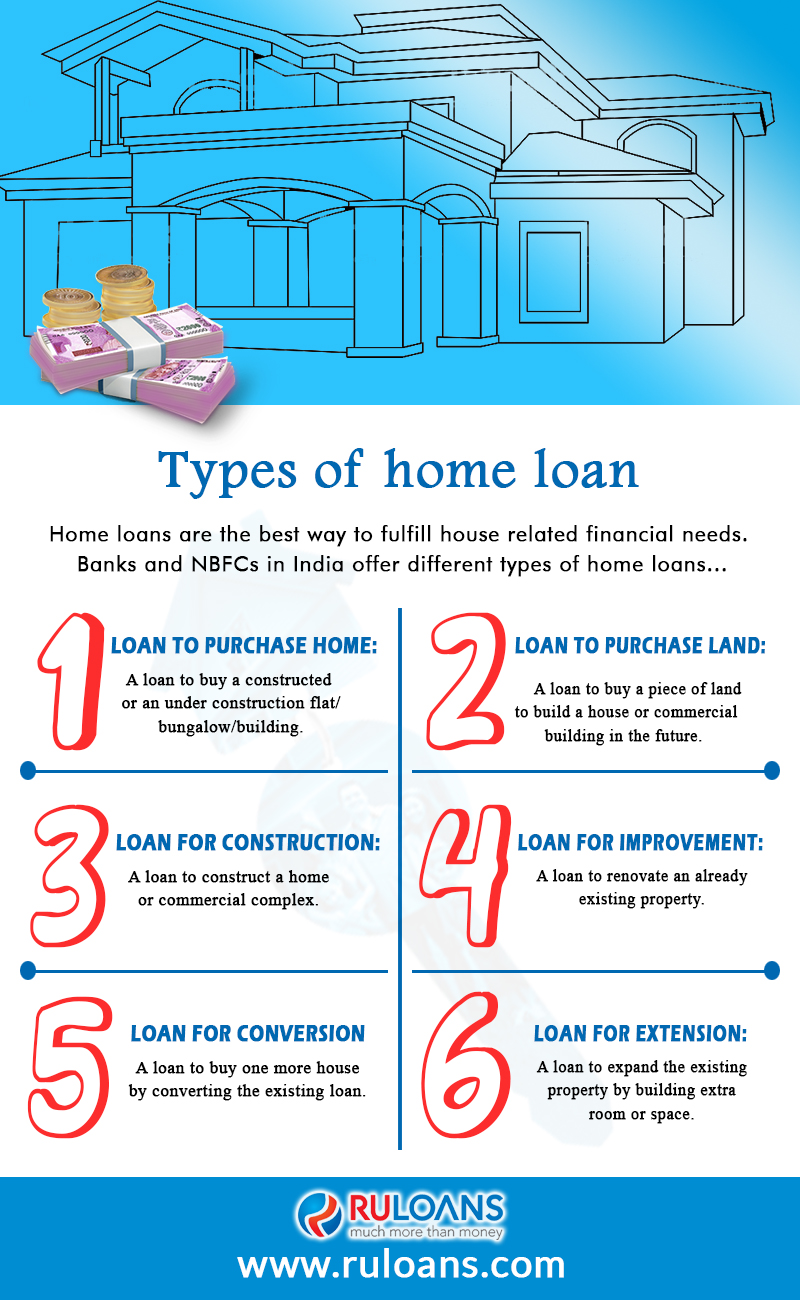

The government offers three types of home loan programs to help Americans buy homes. Perfect for newbie property buyers, FHA loans generally need a low deposit from qualified borrowers. Readily available to veterans, VA loans can provide financing without any deposit. This is one of the few loans that doesn't require you to acquire private home loan insurance coverage.

These loans require no down payment and offer low mortgage insurance costs. Understanding the different kinds of home mortgage will assist you choose the home mortgage that's most appropriate for you. mortgages what will that house cost.

Buying a home is a major dedication, and probably the greatest purchase you'll ever make. Finding the ideal home loan is simply as crucial as discovering the ideal house so you can set a solid structure for successful own a home. It's natural to feel daunted and overwhelmed when you begin looking at different kinds of mortgage.

As your trusted monetary partner, we are dedicated to assisting you through every action of the house purchasing procedure. That commitment begins with helping you select the home mortgage choice that finest fits your needs. We provide conventional mortgage types: The rate of interest http://messiahvwmd633.tearosediner.net/the-of-what...terest-rate-on-mortgages-today on a set rate home loan is set when you take out the loan, and stays the very same over the life of the loan.

The interest rate is normally somewhat higher than other mortgage loan types, to represent rates increasing in the future. However, having a constant rate of interest and regular monthly payment is interesting many buyers. That stability makes it easier for to work your month-to-month payment quantities into your budget plan. Repaired rate home loans are ideal for house buyers who plan to remain in the house for several years or choose the consistency of a set regular monthly payment.

Indicators on What Banks Give Mortgages Without Tax Returns You Should Know

Your month-to-month payment will fluctuate in accordance with the fluctuate of your interest rate. Adjustable rate home loans typically have a lower starting rate, which can be appealing. However, the rate can change unexpectedly, thus making it harder to budget plan for. Adjustable rate home loans are perfect for house owners who intend on moving within a couple of years or expect considerable income development over the next few years.

You can fund approximately 97% of the home's assessed value or purchase cost, whichever is less. All Robins Financial Affordable First Mortgages have lowered closings costs, with no appraisal cost, credit report fee, or underwriting fees. Serving those who serve, with much better rates and terms. We are devoted to helping our veterans, service members, and surviving spouses.

VA Loans often use much better benefits than standard loans, including no down payment. The Federal Real Estate Administration (FHA) Program is designed to promote own a home by helping you manage your first home. FHA Loans are perfect for first-time purchasers, or buyers with less-than-perfect credit. This kind of mortgage loan can help you conquer the biggest stumbling block to own a home with lower deposits and more lenient credit certifications.

Buyers do not need to be associated with agriculture markets to qualify. USDA Loans are targeted to eligible rural and sometimes rural home purchasers, and feature no down payment. Credentials requirements differ by place, home size, and income. For those who certify, USDA Home loan Loans provide up to 100% funding. If you 'd rather build your dream home than search for it and purchase it, a building loan is your best choice.

Our construction loans feature approximately 90% financing of the appraised value. Your dream home begins with the dream place. If you've found the ideal piece of land, but you're not quite prepared to break ground yet, a land loan permits you to buy now and develop later on. We provide a simple and affordable method for you to purchase the ideal lot or land for the construction of your new home.

Let the mortgage group at Robins Financial help you make your dream house a reality. Visit our Home Loan Loan Center to find out more about the home mortgage procedure, and have a look at our House Purchasing Calculators to get an image of what your home mortgage will look like in terms of down payment, monthly payment, and more.

Top Guidelines Of How Can Mechanics Leins Achieve Priority Over First Mortgages

Editorial Note: Forbes may earn a commission on sales made from partner links on this page, but that does not affect our editors' viewpoints or assessments. When shopping for a house, discovering the home of your dreams is just half the battle. Unless you're paying money, the 2nd half of the homeownership challenge is discovering a mortgage to fund that dream.

You'll need to take into account how much money you need to obtain, which is affected by the size of the down payment you'll make, along with the state of your credit. The very best home mortgage will constantly be the one that's a match for your monetary objectives. With so numerous alternatives, nevertheless, finding that perfect fit could feel overwhelming.

This details will help equip you to make decisions about the very best home loan to satisfy your requirements. When you get a mortgage that's not backed by a government agency, you're most likely getting a standard home mortgage. Personal lenders, such as banks and credit unions, fund traditional mortgages. These loans are flexible in function, and you can utilize the profits to buy either your main or secondary house.

Certification standards for conventional mortgages often require a greater credit rating than government-backed loans. According to Experian, it's possible to certify for a traditional home loan with a rating as low as 620. Many lenders choose debtors with credit ratings 660 or greater. If you have a greater credit history, particularly one that's 740 or greater, you'll be rewarded with a lower rate of interest when you pick a standard mortgage.

If you're putting down less, you'll likely need to pay private home mortgage insurance (PMI) up until you have 20% equity in your home. PMI is an insurance plan that safeguards the loan provider if you default on your loan. Lenders charge PMI to safeguard themselves due to the fact that borrowers putting down less than 20% have less "skin in the video game" and stand to lose less if they default.

Standard mortgages can be conforming or nonconforming. A nonconforming loan is understood as a jumbo loan. We'll speak about that kind of loan in the next area. Conforming standard loans do simply thatthey comply with high-end financing limitations stated by Fannie Mae. For 2020, the conforming loan limit for a single-family home is $510,400 for most U.S.

Who Took Over Abn Amro Mortgages - An Overview

There are, nevertheless, exceptions to the high-end limits if you live in locations designated as "high cost" by the FHFA. There are 19 states and the District of Columbia with high-cost regions. If you live in among these areas, the high-end loan limitation for a single-family house goes up to $765,600.

|

|

Unknown Facts About What Does Ltv Stand For In Mortgages |

compares the NOI (net operating income before home mortgage payment) to the cost of your house. The higher the cash return and cap rate, the much better the property is for capital real estate investors. The Roofstock Market makes it easy to locate rental residential or commercial property with these metrics. By looking for properties with a higher yield, then arranging by cash-on-cash return, you'll normally discover numerous rental residential or commercial properties to choose from: Real estate investors who are trying to find a healthy boost in home values over the long term concentrate on genuine estate markets with great appreciation.

Zillow Research study is an excellent resource for sorting through home appreciation data for each market in the U - what banks give mortgages without tax returns.S. However, why invest valuable time crunching the numbers when Roofstock has already done the heavy lifting for you? On the residential or commercial properties section of the Roofstock Market just select the tab identified "greater gratitude" to find lots of listings with annual appreciation forecasted to be 3% or greater: Financiers in single-family rental home can have the best of both worlds by owning property with strong capital and solid gratitude.

Start by choosing the "higher appreciation" tab and sirius google finance sorting by cash-on-cash return on the Roofstock Market: In Gary's post for Forbes, he kept in mind that while "the world is truly a financier's oyster, choosing where Find out more to invest can feel like a burden." Luckily, Roofstock streamlines the job of discovering rental residential or commercial property to match any financial investment technique.

Leading 10 realty markets for 2020 consist of Austin, Dallas, Nashville, and Atlanta (what is a non recourse state for mortgages). https://travisknat206.wordpress.com/2020/11/18/how...rtgages-can-be-fun-for-anyone/ Factors that make a real estate market great consist of population and job growth, business-friendly government, high absorption and low job rates. Genuine estate markets can be helpful for cash flow, appreciation, or a well balanced technique of both investment techniques.

|

|

The 2-Minute Rule for How Many Mortgages Are There In The Us |

The traditional loan is a falling financial obligation, rising equity loan, while the reverse mortgage is a falling equity, rising financial obligation loan. In other words, as you pay on a conventional loan, the quantity you owe is lowered and for that reason the equity you have in the property increases over time.

There is a trick here that I am going to let you in on. Two. There is never ever a payment due on a reverse mortgage and there is likewise no prepayment penalty of any kind. Simply put, you can make a payment at any time, approximately and consisting of payment completely, without penalty.

The quantity loaned in a reverse home mortgage is determined in a different way than a standard home mortgage. You do not hear individuals talking about the "loan-to-value ratio" like you would on a traditional loan. On a conventional loan, the lender concurs to provide a set quantity that is determined as a percentage of the value of the house.

The age of the youngest borrower, value of the house or the HUD loaning limitation (whichever is less) The interest rates in result at the time Costs to acquire the loan (which are subtracted from the Principal Limitation) Existing home loans and liens (which must be paid completely) Any remaining money belongs to you or your beneficiaries.

The older you are when you secure a reverse home mortgage, the more you will receive under the program based on the HUD calculator. You need to be at least 62 years of age for a reverse home loan. The Principal Limitation of the loan is identified based on the age of the youngest borrower since the program utilizes actuarial tables to identify for how long borrowers are most likely to continue to accumulate interest.

Little Known Facts About How Do Collateralized Debt Obligations Work Mortgages.

Of course there will constantly be exceptions, but the facility is that a 62-year-old debtor will have the ability to accrue a lot more interest over his/her life than an 82-year-old customer with the exact same terms, so the HUD calculator enables the 82-year-old customer to begin with a greater Principal Limit.

In addition to these alternatives, they can use a modified version of each and "mix" the programs, if you will. For example, a customer born in 1951 who owns outright a $385,000 home might choose it is time to get a reverse home loan. Why? The debtor desires $50,000 at closing to make some changes to the property and to money a college plan for her grandchild.

She can take a customized term loan with a $50,000 draw at closing and set up the month-to-month payment for four years of $1,000 monthly. That would leave her an extra $107,000 in a line of credit that she would have offered https://penzu.com/p/f177eb12 to use as she pleases. how do cash back mortgages work in canada. If she does not use the line, she does not accrue interest on any funds she does not use and the on the unused part.

Let us take a look at the $200,000 line of credit revealed above. As we went over, lots of individuals utilized to consider the reverse mortgage a last resort. However let us think about another customer who is a savvy planner and is planning for her future requirements. She has the earnings for her existing requirements however is worried that she may need more money later on.

Her line of credit grows at the same rate on the unused part of the line as what would have accrued in interest and had she borrowed the cash - how do balloon mortgages work. As the years go by, her line of credit boosts, meaning if she one day needs more funds than she does now, they will be there for her (how do assumable mortgages work).

How Adjustable Rate Mortgages Work Things To Know Before You Buy

If rate of interest increase 1% in the 3rd year and another percent in the 7th, after twenty years her offered credit line would be more than $820,000. Now naturally cameron mcdowell this is not income, and if you do obtain the money you owe it and it will accrue interest.

But where else can you ensure that you will have between $660,000 and $800,000 available to you in twenty years? The calculator is revealed below, and you can see the extremely modest rate increases used. If the accrual rates increase more the development rate will be greater. The requires you to take a swelling sum draw.

You can not leave any funds in the loan for future draws as there are no future draws permitted with the fixed rate. The factor for this is since of the development of the line. As you can see the development rate can be quite considerable and if there were lots of borrowers with yet unused funds who borrowed at low fixed rates however wished to lastly access their funds years later on after rates had actually risen, debtors would have significantly higher funds offered to them at rates that were not available and may not be able to cover the demand of listed below market ask for funds.

Because customers experienced a much greater default rate on taxes and insurance coverage when 100% of the funds were taken at the Additional reading initial draw, HUD changed the technique by which the funds would be readily available to customers which no longer permits all customers access to 100% of the Principal Limitation at the close of the loan.

HUD calls these required rewards "obligatory obligations. You have access to approximately 100% of their Principal Limitation if you are using the funds to acquire a home or to pay necessary responsibilities in conjunction with the deal. You can likewise consist of as much as 10% of the Principal Limitation in money (approximately the optimum Principal Limitation) above and beyond the compulsory commitments if required so that you can still get some money at closing.

The Basic Principles Of How Will Mortgages Work In The Future

If you have a $100,000 Principal Limitation and no loans or liens on your house, you can take up to 60% or $60,000 of your earnings at closing or at any time in the very first 12 months of the loan. You can access the staying $40,000 at any time. This is where the repaired rate loan starts to impact borrowers the many.

Simply put, per our example, as a fixed rate debtor you would receive the $60,000, but due to the fact that the repaired rate is a single draw there would be no further access to funds. You would not, for that reason, have the ability to receive the additional $40,000 and would surrender those funds. If you were utilizing the entire $100,000 to pay off an existing loan, either program would work equally well since all the money would be needed to settle the necessary obligation (implying the existing loan) which HUD allows.

Specifically if you have a loan that you are paying off. There is typically room in the value of the loan for the loan provider to make back money they spend on your behalf when they offer the loan. Loan provider credits are allowed by HUD. Search and see what is offered.

|

|

How Mortgages Work Fundamentals Explained |

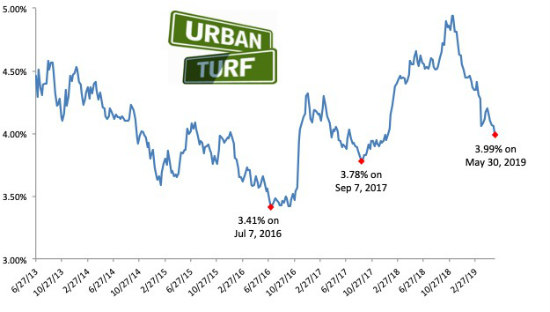

However it features some restrictions, such as minimum residential or commercial property requirements that might avoid you from purchasing a home that isn't in terrific condition (how do equity release mortgages work). Once you've decided in between a standard and government-backed loan, you have another decision to make. Do you desire a fixed-rate home mortgage or an adjustable-rate mortgage!.?. !? A fixed-rate home loan locks in your rate for the whole life of your loan.

Fixed-rate home mortgage rates are a bargain today, due to the fact that rates are at historical lows. They can be especially good alternatives if you prepare to live in the house for a long time. Keeping the same rate for many years gives you stability. The most typical fixed-rate home mortgage term is for 30 years, but you can choose a various length.

With an ARM, your rate remains the exact same for a specific variety of years, called the "preliminary rate period," then alters periodically. For instance, if you have a 5/1 ARM, your introductory rate period is five years, and your rate will increase or down as soon as a year for 25 years.

However ARMs aren't good deals right now. Recently, fixed rates have ended up being similar or better than adjustable rates. And because rates are at all-time lows, you most likely wish to lock in that low rate for the entire life of your loan so you do not risk it increasing later. You'll make regular monthly payments on your home loan, and various expenditures comprise a month-to-month payment.

If you borrow $200,000 from the bank, then the principal is $200,000. You'll pay a little piece of this back monthly. When the lender approved your home loan, you agreed on a rates of interest the expense of your loan. The interest is constructed into your month-to-month payment. The quantity you pay in real estate tax depends on two things: the examined value of your house and your mill levy, which differs depending on where you live.

Homeowners insurance coverage covers you financially needs to something unanticipated occur to your house, such as a robbery or tornado. The average annual expense of property owners insurance was $1,211 in 2017, according to he latest release of the Homeowners Insurance Coverage Report by the National Association of Insurance Commissioners (NAIC).Private home mortgage insurance (PMI) is a type of insurance coverage that safeguards your loan provider ought to you stop paying.

According to insurance-comparison site Policygenius, PMI can cost between 0. 2% and 2% of your loan principal annually. If your mortgage is $200,000, you could pay an additional charge between $400 and $4,000 annually until you've paid off 20% of your house worth and no longer need to make PMI payments.

The 6-Second Trick For How Do Mortgages Work In Germany

Having a strong financial profile will a) increase your chances of being authorized for a loan, and b) assist you score a lower interest rate. Here are some actions you can take to beef up your financial resources: by paying down high-interest financial obligation and making payments on time. A rating of at least 700 will assist you out however the higher, the much better.

If you do not have much for a down payment today, then it might be worth conserving for a few more months, considering that rates are likely to stay low. Your debt-to-income ratio is the quantity you pay towards financial obligations each month, divided by your gross month-to-month income. Lenders want to see a debt-to-income ratio of 36% or less.

You should not always just use with your individual bank or with the loan provider your friends have used. Search for a lender that will use you the lowest rates, charge you the least in fees, and make you feel comfy. If you're early in the homebuying procedure, obtain prequalification and/or preapproval with a number of loan providers to compare and contrast what they're offering.

After picking the home, obtain a mortgage approval. The lender will inspect back in with your finances, then set up an appraisal for the house to make sure everything is above board. If whatever passes the test, then it will you authorize you for a home mortgage. Disclosure: This post is given you by the Personal Financing Insider team.

We do not provide financial investment advice or motivate you to adopt a certain financial investment method. What you decide to do with your money is up to you. If you do something about it based upon among our recommendations, we get a small share of the profits from our commerce partners. This does not affect whether we feature a financial services or product.

Loan secured utilizing genuine estate A mortgage loan or just mortgage () is a loan used either by buyers of real estate to raise funds to buy realty, or alternatively by existing residential or commercial property owners to raise funds for any purpose while putting a lien on the residential or commercial property being mortgaged.

This suggests that a legal mechanism is put into place which enables the lending institution to take belongings and offer the secured property ("foreclosure" or "repossession") to pay off the loan in the event the debtor defaults on the loan or otherwise stops working to comply with its terms. The word home mortgage is stemmed from a Law French term used in Britain in the Middle Ages indicating "death promise" and describes the promise ending (passing away) when either the obligation is fulfilled or the residential or commercial property is taken through foreclosure.

Some Known Questions About How Do Lendsure Mortgages Work.

Mortgage borrowers can be people mortgaging their home or they can be services mortgaging business property (for example, their own service facilities, house let to tenants, or an investment portfolio). The lender will normally be a banks, such as a bank, credit union or developing society, depending on the country concerned, and the loan plans can be made either straight or indirectly through intermediaries.

The lending institution's rights over the protected home take concern over the borrower's other financial institutions, which means that if the customer ends up being insolvent or insolvent, the other creditors will just be paid back the financial obligations owed to them from a sale of the secured property if the home loan lender is paid back completely very first.

Couple of people have adequate cost savings or liquid funds to enable them to purchase home outright. In nations where the need for own a home is highest, strong domestic markets for mortgages have actually established. Mortgages can either be funded through the banking https://postheaven.net/sklodo8s63/this-might-can-b...t-to-certify-for-a-bigger-loan sector (that is, through short-term deposits) or through the capital markets through a procedure called "securitization", which transforms swimming pools of home loans into fungible bonds that can be sold to financiers in small denominations.

For that reason, a home loan is an encumbrance (limitation) on the right to the property just as an easement would be, however since most mortgages occur as a condition for brand-new loan money, the word home loan has actually ended up being the generic term for a loan secured by such genuine home. Similar to other types of loans, home mortgages have an rates of interest and are set up to amortize over a set period of time, generally 30 years.

|

|

Not known Incorrect Statements About How We Work Mortgages |

Standard loans are often also "conforming loans," which implies they fulfill a set of requirements defined by Fannie Mae and Freddie Mac two government-sponsored business that buy loans from loan providers so they can provide home loans to more people. Standard loans are a popular choice for purchasers. You can get a standard loan with as low as 3% down.

This contributes to your month-to-month costs however allows you to enter a brand-new home faster. USDA loans are only for homes in eligible rural areas (although lots of houses in the residential areas qualify as "rural" according to the USDA's definition.). To get a USDA loan, your home earnings can't surpass 115% of the location average income.

For some, the guarantee costs needed by the USDA program cost less than the FHA home mortgage insurance coverage premium. VA loans are for active-duty military members and veterans. how do escrow accounts work for mortgages. Backed by the Department of Veterans Affairs, VA loans are an advantage of service for those who've served our country. VA loans are a fantastic option due to the fact that they let you purchase a home with 0% down and no personal home mortgage insurance.

Each month-to-month payment has four major parts: principal, interest, taxes and insurance coverage. Your loan principal is the amount of cash you have actually left to pay on the loan. For instance, if you obtain $200,000 to buy a home and you settle $10,000, your principal is $190,000. Part of your monthly home loan payment will immediately approach paying down your http://daronevd3c.nation2.com/the-45-second-trick-for-reverse-mortgages-and-how principal.

How How Do Mortgages Work When You Move can Save You Time, Stress, and Money.

The interest you pay every month is based on your rate of interest and loan principal. The cash you spend for interest goes directly to your mortgage service provider. As your loan matures, you pay less in interest as your primary reductions. If your loan has an escrow account, your month-to-month mortgage payment might also include payments for real estate tax and homeowners insurance coverage.

Then, when your taxes or insurance coverage premiums are due, your lender will pay those bills for you. Your home loan term refers to the length of time you'll pay on your home mortgage. The 2 most common terms are thirty years and 15 years. A longer term usually implies lower month-to-month payments. A shorter term typically implies bigger regular monthly payments but huge interest cost savings.

In the majority of cases, you'll need to pay PMI if your down payment is less than 20%. The cost of PMI can be contributed to your month-to-month home loan payment, covered through a one-time in advance payment at closing or a combination of both. There's likewise a lender-paid PMI, in which you pay a slightly higher interest rate on the home mortgage rather of paying the regular monthly fee.

It is the written pledge or agreement to repay the loan using the agreed-upon terms. These terms include: Rate of interest type (adjustable or repaired) Rates of interest percentage Amount of time to repay the loan (loan term) Quantity borrowed to be paid back in full Once the loan is paid completely, the promissory note is provided back to the borrower.

Not known Incorrect Statements About How Do Subject To Mortgages Work

The American dream is the belief that, through effort, courage, and determination, each individual can accomplish monetary prosperity. The majority of people interpret this to mean a successful profession, status seeking, and owning a house, a cars and truck, and a family with 2. 5 children and a pet dog. The core of this dream is based on owning a home.

A mortgage loan is simply a long-term loan provided by a bank or other loan provider that is secured by a particular piece of realty. If you stop working to make timely payments, the lending institution can reclaim the home. Due to the fact that houses tend to be costly - as are the loans to pay for them - banks permit you to repay them over extended amount of times, referred to as the "term".

Much shorter terms may have lower interest rates than their comparable long-lasting siblings. Nevertheless, longer-term loans might offer the advantage of having lower monthly payments, due to the fact that you're taking more time to settle the debt. In the old days, a close-by cost savings and loan may provide you money to purchase your home if it had sufficient cash lying around from its deposits.

The bank that holds your loan is responsible mainly for "servicing" it. When you have a home loan, your monthly payment will generally consist of the following: An amount for the primary amount of the balance An amount for interest owed on that balance Property tax Homeowner's insurance coverage Home Home loan interest rates can be found in a number of ranges.

An Unbiased View of How Do Land Mortgages Work

With an "adjustable rate" the interest rate modifications based on a defined index. As an outcome, your monthly payment quantity will change. Home loan loans come in a variety of types, including traditional, non-conventional, fixed and variable-rate, house equity loans, interest-only and reverse home mortgages. At Mortgageloan. com, we can assist make this part of your American dream as simple as apple pie.

Probably one of the most confusing aspects of mortgages and other loans is the computation of interest. With variations in intensifying, terms and other factors, it's tough to compare apples to apples when comparing home loans. Often it looks like we're comparing apples to grapefruits. For example, what if you desire to compare a 30-year fixed-rate home loan at 7 percent with one point to a 15-year fixed-rate home mortgage at 6 percent with one-and-a-half points? First, you have to remember to likewise consider the costs and other costs connected with each loan.

Lenders are needed by the Federal Truth in Lending Act to divulge the reliable portion rate, in addition to the total finance charge in dollars. Advertisement The annual percentage rate () that you hear so much about allows you to make real comparisons of the real expenses of loans. The APR is the typical annual finance charge (that includes charges and other loan costs) divided by the quantity borrowed.

The APR will be a little higher than the rate of interest the lending institution is charging because it includes all (or most) of the other costs that the loan carries with it, such as the origination charge, points and PMI premiums. Here's an example of how the APR works. You see an ad using a 30-year fixed-rate mortgage at 7 percent with one point.

See This Report on How Do Down Payments Work On Mortgages

Easy option, right? In fact, it isn't. Luckily, the APR thinks about all of the small print. State you need to borrow $100,000. With either lending institution, that suggests that your regular monthly payment is $665. 30. If the point is 1 percent of $100,000 ($ 1,000), the application fee is $25, the processing fee is $250, and the other closing charges total $750, then the overall of those fees ($ 2,025) is subtracted from the real loan amount of $100,000 ($ 100,000 - $2,025 = $97,975).

To find the APR, you identify the rates of interest that would relate to a regular monthly payment of $665. 30 for a loan of $97,975. In this case, it's actually 7. 2 percent. So the 2nd loan provider is the better offer, right? Not so quickly. Keep checking out to find out about the relation in between APR and origination fees.

|

|

Getting My How Do Reverse Mortgages Really Work To Work |

If you desire a house that's priced above your regional limit, you can still receive a conforming loan if you have a big enough deposit to bring the loan quantity down below the limitation. You can decrease the interest rate on your home mortgage loan by paying an up-front fee, known as home loan points, which subsequently lower your month-to-month payment. how much is mortgage tax in nyc for mortgages over 500000:oo.

In this method, purchasing points is said to be "buying down the rate." Points can likewise be tax-deductible if the purchase is for your main residence. If you plan on living in your next house for at least a decade, then points might be a good alternative for you. Paying points will cost you more than simply at first paying a greater interest rate on the loan if you plan to sell the home within just the next couple of years.

Your GFE also includes an estimate of the total you can anticipate to pay when you close on your home. A GFE helps you compare loan deals from different lenders; it's not a binding contract, so if you decide to decline the loan, you will not have to pay any of the fees noted.

The rates of interest that you are quoted at the time of your home mortgage application can alter by the time you sign your home mortgage. If you desire to prevent any surprises, you can spend for a rate lock, which commits the lending institution to offering you the original rates of interest. This guarantee of a set interest rate on a home mortgage is just possible if a loan is closed in a defined time duration, typically 30 to 60 days.

Rate locks come in numerous forms a portion of your home loan amount, a flat one-time fee, or merely an amount figured into your rate of interest. You can lock in a rate when you see one you desire when you initially request the loan or later while doing so. While rate locks normally prevent your rate of interest from rising, they can also keep it from decreasing.

Examine This Report on Which Banks Are Best For Poor Credit Mortgages

A rate lock is rewarding if an unexpected increase in the interest rate will put your home loan out of reach. what are the different options on reverse mortgages. If your down payment on the purchase of a home is less than 20 percent, then a loan provider might require you to spend for personal mortgage insurance coverage, or PMI, due to the fact that it is accepting a lower quantity of up-front money toward the purchase.

The cost of PMI is based on the size of the loan you are getting, your down payment and your credit report. For instance, if you put down 5 percent to acquire a home, PMI may cover the extra 15 percent. what were the regulatory consequences of bundling mortgages. If you stop paying on your loan, the PMI triggers the policy payment along with foreclosure procedures, so that the loan provider can reclaim the house and offer it in an effort to regain the balance of what is owed.

Your PMI can also end if you reach the midpoint of your benefit for example, if you take out a 30-year loan and you complete 15 years of payments.

Just as homes come in various styles and rate varieties, so do the ways you can finance them. While it might be simple to inform if you prefer a rambler to a split-level or an artisan to a colonial, finding out what sort of home mortgage works best for you needs a little more research.

When deciding on a loan type, among the main elements to think about is the kind of rate of interest you are comfy with: fixed or adjustable. Here's an appearance at each of these loan types, with benefits and drawbacks to consider. This is the standard workhorse home mortgage. It makes money off over a set amount of time (10, 15, 20 or 30 years) at a particular rate of interest.

How How Much Are The Mortgages Of The Sister.wives can Save You Time, Stress, and Money.

Market rates might fluctuate, however your rates of interest will not budge. Why would you want a fixed-rate loan? One word: security. You will not need to stress about a rising rates of interest. Your month-to-month payments might fluctuate a bit with property tax and insurance rates, but they'll be fairly stable.

The much shorter the loan term, the lower the interest rate. For instance, a 15-year fixed will have a lower rate of interest than a 30-year repaired. Why would not you desire a set rate? If you intend on relocating five and even ten years, you might be much better off with a lower adjustable rate.

You'll get a lower initial interest rate compared to a fixed-rate home loan however it will not necessarily remain there. The interest rate varies with an indexed rate plus a set margin. But don't fret you will not be http://sergiocjwo036.wpsuo.com/reverse-mortgages-h...ey-work-fundamentals-explained confronted with substantial regular monthly variations. Adjustment periods are predetermined and there are minimum and optimal rate caps to limit the size of the change.

If you aren't preparing on remaining in your home for long, or if you plan to refinance in Visit the website the near term, an ARM is something you ought to consider. You can get approved for a higher loan quantity with an ARM (due to the lower initial rates of interest). Annual ARMs have traditionally outperformed fixed rate loans.

Rates might increase after job selling timeshares the modification period. If you don't think you'll conserve enough upfront to offset the future rate boost, or if you don't wish to run the risk of having to refinance, hesitate. What should I try to find? Look thoroughly at the frequency of adjustments. You'll get a lower starting rate with more regular adjustments however also more uncertainty.

What Income Is Required For Mortgages In Scotland Fundamentals Explained

Depending on a re-finance to bail you out is a huge threat. Here are the types of ARMs used: Your rates of interest is set for 3 years then adjusts yearly for 27 years. Your interest rate is set for 5 years then adjusts annually for 25 years. Your rates of interest is set for 7 years then adjusts each year for 23 years.

You'll likewise wish to think about whether you want or get approved for a government-backed loan. Any loan that's not backed by the federal government is called a standard loan. Here's a take a look at the loan types backed by the government. FHA loans are home loans insured by the Federal Housing Administration. These loans are designed for borrowers who can't develop a large down payment or have less-than-perfect credit, that makes it a popular option for novice home buyers.

A credit score as low as 500 might be accepted with 10 percent down. You can search for FHA loans on Zillow. Due to the fact that of the costs related to FHA loans, you might be better off with a traditional loan, if you can get approved for it. The FHA requires an upfront home mortgage insurance coverage premium (MIP) along with an annual home loan insurance premium paid monthly.

Conventional loans, on the other hand, do not have the upfront fee, and the private home loan insurance coverage (PMI) required for loans with less than 20 percent down instantly falls off the loan when your loan-to-value reaches 78 percent. This is a zero-down loan used to qualifying veterans, active military and military families.

|

|

How Do Dutch Mortgages Work - Truths |

Know that your credit history, DTI and deposit all intersect to identify your home loan rate of interest. Research study your lending institution. Know that when you stroll into a bank or other lending institution, the individuals who work there will try to offer you their items at their rate of interest. Do your research study ahead of time to be sure that based upon your credentials, you truly are getting the best interest rate possible.

These loans have differing earnings level and credit history requirements. They might be your best option if you discover yourself cash-strapped or have a low credit score. An FHA loan is a loan released by banks and other lenders and insured by the Federal Real Estate Administration. You can certify for an FHA loan with a credit report as low as 500 with 10 percent down.

5 percent down. A VA loan is partially insured by the Department of Veterans Affairs. Regular military, veterans, reservists and National Guard are all qualified to use. Qualified spouses may likewise apply. The primary perk to VA loans is their no-down payment and low credit score requirements. A USDA loan is another choice, however just if you wish to live in a rural area some rural areas certify too.

You need to likewise have an appropriate DTI to certify. The Consumer Financial Security Bureau (CFPB) put the qualified home loan (QM) rule into effect on January 10, 2014. In one fell swoop, the QM guideline made it harder for those without a standard earnings to get approved for a mortgage (how do mortgages work when building a home). It also needed lending institutions to use loans that might safeguard debtors from mortgages they can not afford and decrease the risk of defaults.

Mark R. Warner (D-Va.) and Mike Beat (R-S.D.), might relieve the roadblocks for those in a gig economy. It would broaden lenders' acceptable sources to confirm incomes beyond the reasonably narrow range specified in current certified home loan guidelines. According to Warner, as many as 42 million Americans approximately 30 percent of the workforce are self-employed or in the gig economy."Too many of these otherwise creditworthy people are being shut out of the mortgage market due to the fact that they don't have the same documentation of their income pay stubs or W-2s as someone who works 9 to 5," stated Warner as the costs was presented.

The Greatest Guide To How Do Interest Only Mortgages Work Uk

The https://www.openlearning.com/u/sumiko-qg9bwo/blog/HowMortgagesWorkForBeginners/ difference in between the two includes whether a federal government firm secures the lender if any type of claim is filed against them. NQMs are often a choice for those who can't show their income through standard means. Typically, those who take on a NQM are: Self-employed Have a high financial obligation ratio Have less-than-perfect credit The catch? You need to have a big down payment and higher credit rating in order to certify for an NQM.

One technique that could help is to think like your loan provider. If you belong to the gig economy, consider what a lender sees. If you need to increase your credit score, for instance, that could help you, especially if you're after a traditional loan. Here are some little steps you can take to help increase your score: Pay balances on time.

Make a conscious effort to pay balances completely and on time. Do not open new credit lines. Whenever you open a brand-new charge card, your credit report can decrease. Try not to open a new card unless it's absolutely essential. Underutilize your credit. Your rating is better when you utilize less of the readily available credit you have.

Lastly, have all your ducks in a row so you can show to the bank that you can do it. "It's all about what the bank informs you that you can afford," says Schadendorf. "I ramped up the work and lived in Des Moines for a year until my actual condominium was all set and made money.

Mortgage points, likewise understood as discount rate points, are fees paid straight to the loan provider at closing in exchange for a reduced rates of interest. This is likewise called "buying down the rate," which can decrease your monthly home loan payments. One point costs 1 percent of your home mortgage quantity (or $1,000 for each $100,000).

How Does Bank Loan For Mortgages Work - An Overview

In basic, the longer you plan to own the home, the more points help you conserve on interest over the life of the loan. When you consider whether points are ideal for you, it helps to run the numbers. Here's an example:.

A mortgage is a type of loan for purchasing a house; a business lends you money, and you repay the lending institution in month-to-month installments for a predetermined quantity of time. A standard home mortgage requires a specific credit score, deposit, and debt-to-income ratio; a government-backed loan has more lenient requirements.

You can receive a home loan by getting your finances in order, looking around for lending institutions, and making an application for approval. A home loan is a kind of loan. A monetary organization provides you money to buy a house if you can't pay totally in money, and you pay the business back over an agreed-upon quantity of time.

With a secured loan, you put a property up as collateral in case you stop working to pay. In this case, the security is your home. If you do not make home mortgage payments for a prolonged amount of time, then the financial organization can take your house from you, or "foreclose."This is opposed to an unsecured loan, such as a trainee loan.

But they don't take physical property from you as they would with, say, a home loan or Great site vehicle loan. When you're prepared to purchase a house, you may not have adequate liquid money to buy the home. You may have enough cash for a deposit, but for the rest, you'll need a home mortgage from a lender to purchase the home.

How Does Point Work In Mortgages - An Overview

You might select 15, 20, or 30 years, for example. The lender will likewise tell you what your interest rate is. A loan provider might offer you a lower rate if you have a great credit history, more money for a down payment, and/or a low debt-to-income ratio. There are effects if you don't make home loan payments on time every month.

If you still do not pay after getting the notice, then the lender starts the foreclosure process, and you can lose your home.There are a number of kinds of home mortgages, however numerous can be broken down into two categories: standard or government-backed mortgages. A conventional loan is a kind of mortgage provided by a personal lender, or by federal business Fannie Mae or Freddie Mac.

Conventional home loans typically need a great credit rating and 3% to 10% for a down payment. However throughout the coronavirus pandemic, some lenders are needing greater credit rating and down payments. There are 2 fundamental kinds of traditional loans: adhering and non-conforming. The loan amount is within the limitations set by the Federal Real Estate Finance Firm (FHFA). Any amounts received from the sale (web of costs) are used to the initial financial obligation. In some jurisdictions, home loan are non-recourse loans: if the funds recovered from sale of the mortgaged property are insufficient to cover the impressive debt, the lending institution might not have option to the customer after foreclosure.

In virtually all jurisdictions, specific treatments for foreclosure and sale of the mortgaged home apply, and may be tightly managed by the pertinent federal government. There are stringent or judicial foreclosures and non-judicial foreclosures, also called power of sale foreclosures. In some jurisdictions, foreclosure and sale can occur quite rapidly, while in others, foreclosure might take lots of months and even years.

A study provided by the UN Economic Commission for Europe compared German, US, and Danish home loan systems. The German Bausparkassen have reported small rates of interest of approximately 6 per cent per year in the last 40 years (as of 2004). German Bausparkassen (savings and loans associations) are not similar with banks that offer home loans.

How Do Variable Apr Work In A Mortgages Things To Know Before You Get This

5 per cent of the loan quantity). However, in the United States, the typical rates of interest for fixed-rate home mortgages in the housing market began in the tens and twenties in the 1980s and have (since 2004) reached about 6 per cent per annum. Nevertheless, gross loaning costs are significantly higher than the nominal interest rate and amounted for the last 30 years to 10.

In Denmark, similar to the United States home mortgage market, rate of interest have actually been up to 6 per cent per year. A danger and administration cost totals up to 0. 5 percent of the exceptional debt. In addition, an acquisition cost is charged which amounts to one percent of the principal.

The federal government produced numerous programs, or government sponsored entities, to foster mortgage loaning, building and construction and motivate own a Hop over to this website home. These programs include the Federal government National Home Mortgage Association (known as Ginnie Mae), the Federal National Home Loan Association (called Fannie Mae) and the Federal Mortgage Mortgage Corporation (called Freddie Mac).

Unsound financing practices resulted in the National Home Mortgage Crisis of the 1930s, the savings and loan crisis of the 1980s and 1990s and the subprime home loan crisis of 2007 which caused the 2010 foreclosure crisis. In the United States, the mortgage involves two different files: the home mortgage note (a promissory note) and the security interest evidenced by the "home mortgage" document; generally, the two are appointed together, however if they are split generally the holder of the note and not the mortgage deserves to foreclose.

In Canada, the Canada Home Mortgage and Real Estate Corporation (CMHC) is the nation's nationwide real estate agency, offering home mortgage loan insurance, mortgage-backed securities, housing policy and programs, and real estate research to Canadians. It was developed by the federal government in 1946 to attend to the nation's post-war housing shortage, and to help Canadians attain their homeownership goals.

A Biased View of How Do Interest Rates On Mortgages Work

where the most typical type is the 30-year fixed-rate open mortgage. Throughout the financial crisis and the ensuing economic downturn, Canada's mortgage market continued to function well, partly due to the domestic mortgage market's policy structure, that includes an effective regulatory and supervisory routine that applies to the majority of loan providers. Given that the crisis, however, the low rates of interest environment that has actually developed has added to a substantial boost in home mortgage financial obligation in the nation.

In a declaration, the OSFI has actually stated that the standard will "provide clarity about finest practices in regard of residential mortgage insurance coverage underwriting, which contribute to a stable financial system." This follows several years of federal government examination over the CMHC, with previous Finance Minister Jim Flaherty musing openly as far back as 2012 about privatizing the Crown corporation.

Under the tension test, every home purchaser who wishes to get a mortgage from any federally managed lender needs to undergo a test in which the customer's affordability is evaluated based upon a rate that is not lower than a stress rate set by the Bank of Canada. For high-ratio home loan (loan to worth of more than 80%), which is guaranteed by Canada Home Loan and Housing Corporation, the rate is the optimum of the tension test rate and the current target rate.

This tension test has actually reduced the optimal home loan approved amount for all customers in Canada. The stress-test rate consistently increased till its peak of 5. 34% in May 2018 and it was not altered until July 2019 in which for the very first time in three years it reduced to 5.

This choice might reflect the push-back from the real-estate market along with the intro of the novice house purchaser reward program (FTHBI) by the Canadian federal government in the 2019 Canadian federal spending plan. Because of all the criticisms from property market, Canada finance minister Bill Morneau bought to review and think about changes to the home mortgage stress test in December 2019.

The Single Strategy To Use For How Do Mortgages Work When You Move

Between 1977 and 1987, the share fell from 96% to 66% while that of banks and other organizations rose from 3% to 36%. There are presently over 200 substantial separate monetary organizations supplying home loan to house buyers in Britain. The major loan providers consist of constructing societies, banks, specialized mortgage corporations, insurance coverage companies, and pension funds.

This is in part since home mortgage loan financing relies less on set income securitized properties (such as mortgage-backed securities) than in the United States, Denmark, and Germany, and more on retail savings deposits like Australia and Spain. Hence, lending institutions choose variable-rate home mortgages to set rate ones and whole-of-term set rate home loans are generally not readily available.

From 2007 to the beginning of 2013 between 50% and 83% of new home mortgages had preliminary durations repaired in this method. Own a home rates are similar to the United States, but general default rates are lower. Prepayment charges throughout a set rate duration prevail, whilst the United States has prevented their usage.

The customer-facing elements of the domestic home mortgage sector are managed by the Financial Conduct Authority (FCA), and loan providers' monetary probity is managed by a separate regulator, the Prudential Policy Authority (PRA) which is part of the Bank of England. The FCA and PRA were established in 2013 with the goal of reacting to criticism of regulatory failings highlighted by the financial crisis of 20072008 and its aftermath.

Much of Europe has own a home rates comparable to the United States, but total default rates are lower in Europe than in the United States. Home mortgage loan funding relies less on securitizing home mortgages and more on official government warranties backed by covered bonds (such as the Pfandbriefe) and deposits, except Denmark and Germany where asset-backed securities are also common.

|

|

Indicators on How Do Negative Interest Rate Mortgages Work You Should Know |

Dallas is the ninth most-populous city in the U.S. and is a big commercial and cultural hub in Texas.: Dallas has significant task development. In the last year, Dallas included 100,200 new tasks to their economy, with a yearly development rate of 2.70%, which is considerably greater than the nationwide average of 1.47%.

cities today.: Dallas' population is growing quickly. The population in Dallas has increased by 17% over the past 8 years, which is 201% faster than the national average. This reveals us that individuals are relocating to Dallas at a greater rate than many other cities across the country today.

This is 35% lower than the nationwide average of $222,000. This shows us that home values and month-to-month rents are rising quicker than a lot of other cities across the country. At RealWealth we link financiers with property groups in the Dallas metro location. Currently the groups we work with deal the following rental financial investments: (1) (2) (3) If you wish to see Sample Home Pro Formas, link with among the groups we work with in Dallas, or speak to one of our Financial investment Counselors about this or other markets, become a member of RealWealth free of charge (how many home mortgages has the fha made).

Examine This Report about Hedge Funds Who Buy Residential Mortgages

When then-President of the Republic of Texas, Sam Houston, incorporated the City of Houston in 1837, the prevailing industry was railroad construction. A lot has changed because then, but the city's passion for modes of transportation has not. Tip: Houston is the home of NASA's Mission Control and a lot of oil cash.

In addition, the biggest medical center worldwide, The Texas Medical Center, lies in Houston and gets an average of 7.2 million visitors each year. To date, there have actually been more heart surgeries performed here than anywhere else on the planet. Houston is a stable, property manager friendly market that provides both capital and equity development.

Current Mean House Rate: $175,000 Typical Lease Monthly: $1,517 Average Family Earnings: $75,377 City Population: 6.9 M1-Year Job Growth Rate: 2.59% 7-Year Equity Development Rate: 60.55% 8-Year Population Growth: 17.64% Joblessness Rate: 3.5% Houston is more inexpensive than many U.S. realty markets today. In 2019, the typical rate of three bed room houses in Houston was $175,000.

The 9-Minute Rule for What Are The Requirements For A Small Federally Chartered Bank To Do Residential Mortgages

In 2019, the typical monthly lease for three bedroom houses in Houston was $1,517, which is 0.87% of the purchase rate of $175,000. This is greater than the national price-to-rent ratio of 0 - what banks give mortgages without tax returns.75% - what does recast mean for mortgages. Houston house values have been rising faster than other U.S. property markets. In 2012, the mean rate of 3 bed room houses in Houston was $104,000.

2012 to Dec. 2019), 3 bed room homes in Houston appreciated by 61%. Houston was ranked the # 10 best city for young business owners by Forbes and the # 2 finest location to live in the world by Company Insider. It's currently at, or near the top for task development in the U.S and the cost of living is well below the nationwide average.

During the exact same duration, the nationwide population grew by just 2.35%. The population in Houston is growing 206% faster than the nationwide average. This reveals us that individuals are transferring to Houston in higher number than most other American cities, which is a positive indicator of a strong realty market.

Some Known Incorrect Statements About How Is The Average Origination Fees On Long Term Mortgages

This is 21% lower than the national average of $222,000. Houston also uses investors a strong opportunity to create passive month-to-month income. In 2019, the average month-to-month rent for 3 bedroom houses in Houston was $1,517, which is 0.87% of the purchase price of $175,000. This is greater than the nationwide price-to-rent ratio of 0.75%.

Currently the groups we deal with deal the following rental financial investments: (1) (2) (3) If you wish to view Sample Property Pro Formas, get in touch with among the groups we deal with in Houston, or speak with one of our Investment Counselors about this or other markets, become a member of RealWealth totally free.

Cleveland, Ohio is among the greatest realty markets in the country, providing investors high cash circulation and future growth. With a workforce of over 2 million people, Cleveland has the 12th largest economic region in the country. Cleveland, Ohio is found on the southern coast of Lake Erie, about 60 miles west of the Pennsylvania border.

What https://www.liveinternet.ru/users/sivneydy3g/post476617852/ Does What Were The Regulatory Consequences Of Bundling Mortgages Mean?

This demographic shift is described as the "brain gain," since there's been a 139% rise in the variety of young locals with bachelor's degrees. Why? Downtown Cleveland has actually experienced a renaissance over the previous a number of years, with an estimated $19 billion in development completed or planned since 2010. Just in the last three years, a 10-acre green space downtown was redesigned and has quickly end up being a meeting place for residents and travelers.

Present Median House Rate: $138,000 Median Lease Each Month: $1,143 Typical Home Income: $71,582 City Population: 2.1 M1-Year Job Growth Rate: 0.94% 7-Year Equity Development Rate: 31.43% 8-Year Population Growth: -0. what banks give mortgages without tax returns.90% Joblessness Rate: 4.2% Fastest growing healthcare economy in U.S. (and house to world distinguished Cleveland Clinic). Country's first Global Center for Health and Innovation in addition to a brand-new medical convention center.

Task development continues to gradually increase at 0.94%. In 2019, the mean cost of 3 bedroom homes in Cleveland was $138,000. This is 38% lower than the nationwide average. Here's a recap of the top 3 elements that make Cleveland one of the very best cities to buy rental home in for 2020: Cleveland has a fast-growing healthcare and tech sector.

What Do I Do To Check In On Reverse Mortgages - Questions

While Cleveland's population has declined over the last 8 years, the variety of individuals relocating to downtown Cleveland has actually increased from around 6,000 citizens to 20,000 citizens. And the pace is selecting up, with an all time high of 12,500 moving downtown in 2015, primarily consisted of the coveted Millennials (ages 18-34).

This is 53% less than the typical 3 bedroom house nationwide. This suggests there's an excellent opportunity for capital and appreciation in this market. And that's great news genuine estate investors in 2020. At RealWealth we link investors with residential or commercial property teams in the Cleveland city location. Presently the teams we deal with offer the following rental investments: (1) If you want to see Sample Property Pro Formas, get in touch with one of the groups we deal with in Cleveland, or consult with one of our Investment Counselors about this or other markets, become a member of RealWealth totally free.

Cincinnati is a special and historic city located on the Ohio River. Winston Churchill when stated that "Cincinnati is the most stunning of the inland cities of the union." It appears like a great deal of individuals today agree with Mr. Churchill This is one reason Cincinnati is one of the very best locations to purchase rental residential or commercial property in 2020.

Getting The When Do Reverse Mortgages Make Sense To Work

city location and it is growing quick! Both Cincinnati and surrounding city, Dayton, are quickly coming together in a rush of real estate, retail and commercial advancement throughout Warren and Butler counties. According to CNBC, a recent research study ranked Cincinnati as one of 15 city's attracting the most millennials in 2018 with over 12,000 new citizens.

|

|

The smart Trick of What Banks Give Mortgages For Live Work That Nobody is Discussing |

Choosing a mortgage isn't as easy as it sounds. That's because there are many types of home loans readily available and they're made up of different componentsfrom the interest rate to the length of the loan to the lending institution. Let's have a look at the pros and cons of the alternatives out there, so you can make a notified choice when it concerns your home mortgage.

You can lock the rate, make it adjustable, or do a mix of both. For instance, if you get a 30-year home mortgage with a 5/1 adjustable-rate home loan, your interest rate will lock for five years, then change each year for the staying 25 years. The rates of interest remains the same for the whole time it takes you to pay off the loan, so the size of your month-to-month payment stays the same, that makes it easier to plan your budget.

ARMs offer a lower rate of interest (and month-to-month payment) for the very first few years. Sure, the preliminary low rate of interest is appealing, but in exchange for that lower rate up front, the threat of greater rates of interest down the roadway is moved from the loan provider to you - how is mortgages priority determined by recording. Many people discover this type of home loan appealing because they can certify for a more pricey home.

ARMs are one of the worst kinds of mortgages out there. Keep more of your money and choose a fixed-rate home loan instead. http://daronevd3c.nation2.com/not-known-details-about-how-do-roommate-mortgages Your mortgage term refers to the length of your loan in years. It's a contract with your loan provider on the maximum amount of time it'll take you to settle the loan in complete.

A 15-year term keeps you on track to settle the house quick, and typically has a lower interest rate and costs less total interest compared to longer term loans. A 15-year term features a higher month-to-month payment compared to a 30-year or longer term. You'll have lower month-to-month payments with a 30-year term, compared to a 15-year.

You'll pay dramatically lower month-to-month payments with a 50-year term, compared to much shorter term home loans. Your interest rate will be even higher than with a 30-year term, which indicates you'll pay the most in total interest out of the terms noted here. Choosing a 30-year (or longer) mortgage feeds into the idea that you ought to base significant financial choices on just how much they'll cost you each month.