Get This Report about What Credit Score Do Banks Use For Mortgages |

Detroit is likewise home to 100 Fortune 500 companies, including Penske Automotive, Quicken Loans, Kellogg, Whirlpool, and Walmart. Regardless of its longstanding label, numerous of Detroit's fastest growing industries are in sectors as diverse as health care, defense, aerospace, IT and logistics. Billionaire Dan Gilbert (the chairman and founder of Rock Ventures and Quicken Loans Inc, as well as the bulk owner of the National Basketball Association's Cleveland Cavaliers, the American Hockey League's Cleveland Monsters, the Arena Football League's Cleveland Gladiators and the NBA Developmental League's Canton Charge) has moved many companies to Detroit, investing over $1.6 Billion in the Detroit area.

Our Genuine Wealth vetting team took a journey out to Detroit last year to see what's taking place there and to learn why financiers are leaping back into that market. We were surprised at what we discovered! Downtown Detroit is being absolutely renewed with billions of dollars of realty and building and construction activity.

We discovered an excellent team in Detroit who finds affordable homes, fixes them to like-new condition and offers continuous properties management. Somehow they are able to keep the rate points down for a fully-renovated, turnkey homes to around $80,000 (as low as $50,000 in many cases). This is why we believe Detroit is one of the finest places to buy rental property this year.

In spite of its longstanding nickname, numerous of Detroit's fastest growing industries are in sectors as varied as health care, defense, aerospace, IT and logistics. The Michigan Service Advancement Program supplies grants, loans, and other financial assistance to services. Michigan has a flat 6% business earnings tax, which is the most affordable in the country.

The 7-Minute Rule for What Is Minimum Ltv For Hecm Mortgages?

Because 2010, more than 45,000 automobile manufacturing tasks have actually been included to the Detroit Metro, which is more than any other area in the nation. According to the U.S. Bureau of Labor Stats, the work rate in Detroit increased by 0.82% in between 2010 and July 2018. During the exact same duration, the nationwide task count increased by 5.76% (what banks give mortgages without tax returns).

Likely due to several research study universities in the area, including Wayne State University. Individuals have actually been following companies/jobs to "less costly" cities. For instance, Billionaire Dan Gilbert (the chairman and founder of Rock Ventures and Quicken Loans Inc, along with the majority owner of the National Basketball Association's Cleveland Cavaliers, the American Hockey League's Cleveland Monsters, the Arena Football League's Cleveland Gladiators and the NBA Developmental League's Canton Charge) has actually rachel brown weaver moved various companies to Detroit, investing over $1.6 Billion in the Detroit location.

This is 61% lower than the national average. This shows us that realty in Detroit is more cost effective than lots of other U.S. markets today. At RealWealth we connect investors with home teams in the Detroit city location. Presently the teams we deal with deal the following rental investments: (1) If you wish to see Sample Residential or commercial property Pro Formas, link with one of the groups we work with in Detroit, or speak with among our Investment Counselors about this or other markets, become a member of RealWealth for totally free.

Found in the low foothills of the Appalachian Mountains, Atlanta is the third-largest urbane region in the Southeast, behind the Greater Washington and south Florida areas. the big short who took out mortgages. For years, the Atlanta metro location experienced rapid population growth to match the need of new jobs being developed, a lot of them in high-paying sectors like manufacturing.

Unknown Facts About How Soon Do Banks Foreclose On Mortgages

Today, Atlanta's growth has slowed a bit, but not completely. Metro Population: 5.9 MMedian Household Income: $77,000 Existing Median Home Price: $189,900 Average Lease Each Month: $1,4341-Year Task Development Rate: 2.15% 7-Year Equity Development Rate: 109.00% 8-Year Population Development: 12.18% Unemployment Rate: 2 - what percent of people in the us have 15 year mortgages.9% In between 2018 and 2019, 3 bed room single family homes in the Atlanta metro valued by a mean 15.03%.

Over a 7-year duration, mean appreciation reached 109%, which is 97% faster than the national average. During the same duration, rents for 3 bedroom single family houses in Atlanta valued by an average 4.95%. Over the past 8 years, Atlanta's population grew by 12.18%, which is 111% faster than the national average of 5.76%. In the in 2015, 60,300 brand-new tasks were produced in Atlanta a yearly growth rate of 1.96%.

In the in 2015, 53,700 brand-new jobs were developed in Atlanta an annual development rate of 2.15%. This is a greater rate than the nationwide average of 1.47%. Over the previous 8 years,, Atlanta's population grew https://www.bloomberg.com/press-releases/2019-08-0...-timeshare-debt-relief-in-july by 12.18%, which is 111% faster than the nationwide average of 5.76%. In 2019, the average purchase cost of 3 bedroom single family homes in the Atlanta location was $190,000.

This is excellent news for real estate financiers in 2020. At RealWealth we link financiers with property groups in the Atlanta city area. Currently the teams we work with offer the following rental financial investments: (1) (2) If you wish to view Sample Property Pro Formas, get in touch with one of the teams we deal with in Atlanta, or talk to one of our Investment Counselors about this or other markets, end up being a member of RealWealth free of charge.

Some Ideas on Hedge Funds Who Buy Residential Mortgages You Need To Know

Columbus is the capital of Ohio, the county seat of Franklin County, and the biggest city in the state. Recently, this city has emerged as among the country's most highly sophisticated cities it is house to the Batelle Memorial Institute, the world's largest personal research study and advancement foundation, and Ohio State University, the nation's third-largest university school.

This is particularly true for those who are looking for a budget-friendly investment, strong regular monthly money circulation, and a likelihood for equity growth. Average List Prices: $183,000 Mean Lease Each Month: $1,310 Average Household Earnings: $79,694 Population: 2.1 M1-Year Job Development Rate: 0.84% 7-Year Equity Development Rate: 51.24% 8-Year Population Development: 10.49% Joblessness Rate: 3.7% Columbus is budget-friendly.

This is 18% lower than the nationwide average of $222,000. It's possible to lease single-family homes in Columbus for as much as 0.90% of the purchase price. This is well above the national average of 0.75% (2019 ). Columbus is the 14th largest city in the country. Over the last 8th years, Columbus' metro population has grown over 10%, faster than the nationwide average of 5.76%. Realtor.com ranked Columbus as the fourth-hottest housing market in the nation.

As discussed, most of the best realty financial investment markets have three consider common: job development, population development and cost - what metal is used to pay off mortgages during a reset. Columbus is no exception Columbus has actually included over 9,300 brand-new jobs between 2018 and 2019. Although this fact shows a slowdown in new tasks, the development rate continues to hold constant.

Little Known Facts About How Is Mortgages Priority Determined By Recording.

In Columbus it is still possible to acquire totally renovated properties in good communities for around $100,000. what banks give mortgages without tax returns. At RealWealth we connect investors with property groups in the Columbus metro location. Presently the teams we deal with offer the following rental financial investments: (1) If you want to view Sample Property Pro Formas, connect with one of the groups we deal with in Columbus, or talk to one of our Investment Therapists about this or other markets, end up being a member of RealWealth free of charge.

|

|

The Definitive Guide to Which Of The Following Statements Is True Regarding Home Mortgages? |

doi:10.1016/ j.jue. 2015.08.002. Schwartz, Shelly (May 28, 2015). " Will a reverse home loan be your friend or opponent?". CNBC. Retrieved December 24, 2018. " Reverse mortgages". ASIC Money Smart Website. Recovered 28 September 2016. " Customer Credit Policy". ASIC Money Smart Site. Recovered 28 September 2016. " Reverse Mortgages". National Information Centre on Retirement Investments Inc (NICRI).

" How does a Reverse Mortgage work?". Equity Keep. Equity Keep. " Reverse Home Loan Retirement Loans Macquarie". www.macquarie.com. Obtained 2016-10-06. " Rates & fees". Commonwealth Bank of Australia. Obtained 13 September 2012. " Why Reverse Mortgage? Top 7 Reverse Mortgage Function". Retrieved 2016-10-06. " Functions". Commonwealth Bank of Australia. Retrieved 13 September 2012. " Effect on your pension".

Obtained 12 September 2012. " Reverse Mortgages". ASIC Cash Smart Website. Retrieved 28 September 2016. Wong = Better Home Canada's, Daniel (December 26, 2018). " Canadian Reverse Home Mortgage Financial Obligation Simply Made One of The Biggest Jumps Ever". Better Home. Obtained January 2, 2019. " Understanding reverse home mortgages". Financial Customer Firm of Canada. Federal government of Canada.

Obtained 20 December 2015. " Reverse Home Mortgage Secrets - The Reality About CHIP Reverse Home Mortgages". Reverse Home Loan Pros. Rule Lending Centres Edge Financial. Retrieved 31 January 2017. " House Income Strategy (Reverse Home Loan in Canada): How Does a Canadian Reverse Home Mortgage Work". Origin Mortgages DLC. Retrieved 12 September 2012. " Reverse Home mortgages: How the Strategy Works".

Recovered 11 September 2012. [] Heinzl, John (31 October 2010). " The reverse home loan dilemma". The World and Mail. Recovered 12 September 2012. " Reverse Home Mortgage Expenses And Fees - All You Required To Know". Reverse Home Mortgage Pros. Dominion Loaning Centres Edge Financial. 2018-03-24. Obtained 12 October 2018. " Expenses And Costs For A Reverse Home loan".

Dominion Financing Centres Edge Financial. 2018-03-24. Recovered 12 October 2018. " The Reverse Home Mortgage Credit Line;". Reverse Mortgage Pros. Dominion Loaning Centres Edge Financial. Obtained 7 November 2017. " Leading 8 Common Misunderstandings". Reverse Home Loan Pros. Dominion Lending Centres Edge Financial. 2018-01-25. Retrieved 12 October 2018. " Reverse Home Loan Pros". Reverse Mortgage Pros.

What Is Home Equity Conversion Mortgages Can Be Fun For Anyone

Recovered 31 January 2017. " Text of S. 825 (100th): Real Estate and Community Advancement Act of 1987 (Passed Congress/Enrolled Bill variation) - GovTrack.us". GovTrack.us. Obtained 2015-12-22. "- REVERSE MORTGAGES: POLISHING NOT TAINTING THE GOLDEN YEARS". www.gpo.gov. Recovered 2015-12-23. 12 U.S.C. 1715z-20( b)( 1 ); 24 C.F.R. 206.33. (PDF). 12 U.S.C. 1715z-20( b)( 4) 12 U.S.C. 1715z-20( d)( 3 ).

United States Department of Real Estate and Urban Development. 14 October 2010. Archived from the initial on 2012-09-06. Obtained 11 September 2012. " Reverse Home loan: What is it and how does it work? 2016-10". " Interesting Reverse Home Mortgage Facts". 2014-06-11. Retrieved 2014-07-03. (PDF). " MyHECM Principal Limit Calculator". HUD Mortgagee Letter 2014-12 (June 27, 2014) " How Reverse Home Mortgages Work".

March 2010. Obtained 11 September 2012. (PDF). " Archived copy". Archived from the initial on 2010-06-14. Retrieved 2009-06-06. CS1 maint: archived copy as title (link) Ecker, Elizabeth (2013-11-06). " Texas Votes "Yes" to Enable Reverse Mortgage For Purchase Item". Retrieved 2014-01-10. Sheedy, Rachel L. (January 2013). " Purchase a House With a Reverse Home mortgage".

Recovered 2014-01-10. Coates, Tara (11 February 2011). " 10 Things You Need To Understand About Reverse Mortgages: Before you sign, ensure you learn about restrictions, fees". AARP.com. Reverse Mortgages: A Lawyer's Guide. American Bar Association. 1997. " Information on Reverse Mortgages". AARP. 12 U.S.C. 1715z-20( j). (PDF). See Home Equity Conversion Mortgages Month-to-month Report (May 2010), http://www.hud.gov/offices/hsg/comp/rpts/hecm/hecmmenu.cfm Archived 2010-05-28 at the Wayback Device Pub.

No. 109-289, s. 131 (2006 ). See for example the Omnibus Appropriations Act, 2009, Bar. L. No. 111-8, s. 217 (Mar. 11, 2009). For HUD's HECM Summary Reports, see http://www.hud.gov/pub/chums/f17fvc/hecm.cfm Archived 2015-09-24 at the Wayback Machine, United States Census Bureau, 2000-01-13. Accessed 2015-06-30. Archived 2015-09-24 at the Wayback Machine Forecasts of the Total Homeowner Population by 5-Year Age, and Sex with Unique Age Classifications: Middle Series, 2025 to 2045], United States Census Bureau, 2000-01-13.

" National Retirement Danger Index Center for Retirement Research". crr.bc.edu. Recovered 2016-07-14. " Working Paper: HECM Reverse Mortgages: Is Market Failure Fixable? - Zell/Lurie Center". realestate.wharton.upenn.edu. Obtained 2016-07-14. HKMC Reverse Home Loan Programme - http://www.hkmc.com.hk/eng/our_business/reverse_mortgage_programme.html " Just how much will a reverse mortgage expense?". Customer Financial Protection Bureau. Obtained 2020-01-02. Santow, Simon (25 May 2011).

An Unbiased View of What Happens To Mortgages In Economic Collapse

Australian Broadcasting Corporation (ABC). Retrieved 12 September 2012. (PDF). June 2012. Obtained 12 September 2012. Hallman, Ben (27 June 2012). " Reverse Home Loan Foreclosures Rising, Elders Targeted For Rip-offs". Huffington Post. Retrieved 12 September 2012. " Reverse Home mortgages Are Not the Next Sub-Prime". mtgprofessor.com.

Typically thought about a last-ditch source of cash for eligible property owners, reverse home mortgages are ending up being more popular. Older Americans, especially retiring child boomers, have significantly drawn on this financial tool to fund things like home restorations, consolidate financial obligation, settle medical expenses, or just enhance their way of lives. So what is a reverse home mortgage? It's a kind of loan that enables house owners to turn part of the worth of their home into money.

Unlike a 2nd home loan or a house equity loan, the reverse home loan doesn't need to be paid back until a debtor passes away, sells your home, or moves out completely. The Federal Housing Authority (FHA) uses a Mortgagee Optional Election task program that is developed to allow non-borrowing partners to remain in the home as long as the loan was taken out after they were married and have stayed married and real estate tax depend on date.

Home equity conversion mortgages (HECMs) can likewise be used later in life to help fund long-lasting care. Nevertheless, if the customer transfers to another house for a major part of the year or to a nursing home or comparable type of assisted living for more than 12 successive months, the reverse home loan will need to be paid back.

But reverse home mortgages also come with downsides, and they aren't for everyone. Depending upon things like your age, home equity and goals, options like personal loans, cash-out refinancing or house equity loan, might be a better fit and come without the constraints of a reverse mortgage. Reverse home loans were produced to assist senior citizens who own and live in their homes however have limited capital to cover living expenditures.

Reverse home loans are just available to individuals who have settled their mortgage completely or have an adequate amount of equity. Debtors should also utilize the home as their main house or, if living in a two-to-four unit house owned by the borrower, then he or she must occupy one of the systems - which type of interest is calculated https://writeablog.net/voadillx3v/for-a-reverse-ho...-alternative-existing-mortgage on home mortgages?.

Facts About What Is The Current Libor Rate For Mortgages Revealed

The debtor can not have any delinquent federal debt. Plus, the following will be verified prior to approval: Debtor income, assets, regular monthly living expenses, and credit report On-time payment of real estate taxes, plus danger and flood insurance premiums, as appropriate The reverse home mortgage amount you qualify for is figured out based upon the lower of the appraised worth or the HECM FHA mortgage limitation (for purchase the list prices), the age of the youngest borrower or age of eligible non-borrowing spouse, and existing rates of interest.

Debtors, or their successors, typically repay the reverse home loan by eventually selling the house. The most typical kind of reverse mortgage is a HECM, which is guaranteed by the FHA and provides specific consumer protections. These loans currently have a limit of $765,600. One eligibility requirement is that you satisfy with an HECM counselor.

|

|

What To Know About Mortgages Can Be Fun For Anyone |

When you first start to learn more about a reverse mortgage and its associated benefits, your initial impression may be that the loan item is "too excellent to be real." After all, an essential advantage to this loan, developed for house owners age 62 and older, is that it does not need the customer to make monthly home loan payments.

Though in the beginning this benefit might make it appear as if there is no payment of the loan at all, the truth is that a reverse mortgage is just another type of house equity loan and does ultimately get paid back. With that in mind, you may ask yourself: without a regular monthly home loan payment, when and how would repayment of a reverse home loan occur? A reverse mortgage is various from other loan products since payment is not accomplished through https://johnathanqhul490.tumblr.com/post/631085959...ut-how-many-mortgages-should-i a regular monthly home loan payment over time. Borrowers should take the time to inform themselves about it to be sure they're making the finest option about how to utilize their home equity.

Just like a traditional home loan, there are costs connected with getting a reverse home mortgage, particularly the HECM. These costs are typically greater than those related to a standard mortgage. Here are a few costs you can expect:: The upfront mortgage insurance premium is paid to the FHA when you close your loan.

If the home offers for less than what is due on the loan, this insurance covers the distinction so you will not wind up underwater on your loan and the lending institution doesn't lose money on their investment. It likewise secures you from losing your loan if your lending institution fails or can no longer satisfy its responsibilities for whatever factor.

The expense of the upfront MIP is 2% of the evaluated value of the house or $726,535 (the FHA's lending limit), whichever is less. For example, if you own a home that's worth $250,000, your upfront MIP will cost around $5,000 - what type of interest is calculated on home mortgages. Together with an in advance MIP, there is also an annual MIP that accumulates each year and is paid when the loan comes due.

: The origination cost is the amount of cash a loan provider credits originate and process your loan. This expense is 2% of very first $200,000 of the home's value plus 1% of the remaining worth after that. The FHA has actually set a minimum and optimum cost of the origination fee, so no matter what your home is valued, you will not pay less than $2,500 nor more than $6,000.

What Are The Debt To Income Ratios For Mortgages for Beginners

The servicing charge is a monthly charge by the loan provider to service and administer the loan and can cost as much as $35 every month. Appraisals are needed by HUD and determine the marketplace value of your house. While the real cost of your appraisal will depend on factors like place and size of the house, they generally cost in between $300 and $500.

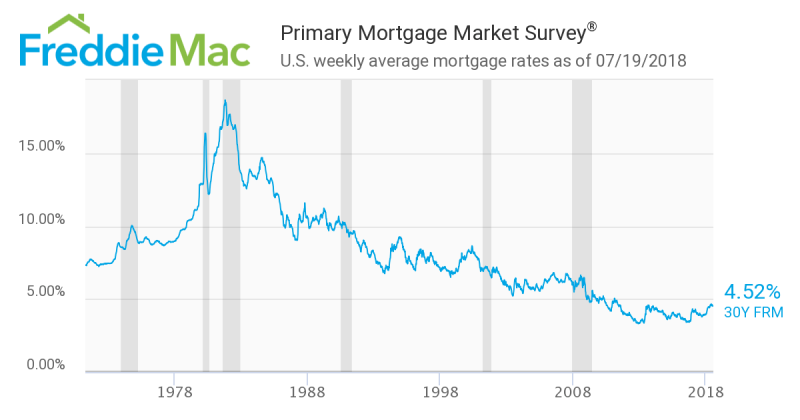

These expenses might consist of: Credit report costs: $30-$ 50 Document preparation costs: $50-$ 100 Carrier costs: $50 Escrow, or closing fee: $150-$ 800 Title insurance: depends upon your loan and place There are many factors that influence the interest rate for a reverse home loan, consisting of the loan provider you deal with, the type of loan you get and whether you get a repaired- or adjustable rate loan.

A reverse home loan is a way for homeowners ages 62 and older to leverage the equity in their house. With a reverse home mortgage, a property owner who owns their home outright or at least has substantial equity to draw from can withdraw a portion of their equity without having to repay it until they leave the home.

Here's how reverse home loans work, and what property owners thinking about one requirement to understand. A reverse mortgage is a kind of loan that permits homeowners ages 62 and older, typically who have actually paid off their home mortgage, to borrow part of their home's equity as tax-free earnings. Unlike a regular mortgage in which the house owner makes payments to the loan provider, with a reverse home loan, the loan provider pays the homeowner.

Supplementing retirement earnings, covering the expense of needed house repair work or paying out-of-pocket medical expenditures prevail and acceptable uses of reverse home mortgage proceeds, states Bruce McClary, representative for the National Foundation for Credit Therapy." In each situation where routine earnings or available cost savings are insufficient to cover expenditures, a reverse home loan can keep elders from relying on high-interest credit lines or other more pricey loans," McClary states.

To be eligible for a reverse home mortgage, the main house owner needs to be age 62 or older. Nevertheless, if a partner is under 62, you might still be able to get a reverse home mortgage if you meet other eligibility requirements. For example: You should own your house outright or have a single primary lien you wish to obtain against.

When Do Adjustable Rate Mortgages Adjust Things To Know Before You Get This

You need to reside in the home as your main house. You need to stay present on home taxes, house owners insurance and other compulsory legal responsibilities, such as house owners association fees. You need to take part in a consumer information session led by a HUD-approved counselor. You must keep your property and keep it in good condition.

There are various types of reverse home loans, and every one fits a different monetary requirement. The most popular kind of reverse home mortgage, these federally-insured home loans typically have greater upfront costs, however the funds can be used for any function. Although commonly offered, HECMs are only offered by Federal Real estate Administration (FHA)- approved lenders, and prior to closing, all debtors should receive HUD-approved therapy.

You can generally get a larger loan advance from this kind of reverse home loan, especially if you have a higher-valued house. This mortgage is not as common as the other two, and is usually provided by nonprofit companies and state and local government firms. Customers can just utilize the loan (which is generally for a much smaller amount) to cover one particular purpose, such as a handicap available remodel, says Jackie Boies, a senior director of housing and personal bankruptcy services for Money Management International, a nonprofit financial obligation counselor based in Sugar Land, Texas.

The amount a homeowner can borrow, understood as the primary limit, differs based on the age of the youngest customer or qualified non-borrowing partner, current rates of interest, the HECM mortgage limitation ($ 765,600 since July 2020) and the house's worth. House owners are likely to receive a higher primary limitation the older they are, the more the property is worth and the lower the rates of interest.

With a variable rate, your choices consist of: Equal monthly payments, provided a minimum of one borrower lives in the property as their main house Equal monthly payments for a fixed duration of months settled on ahead of time A credit line that can be accessed till it runs out A combination of a credit line and fixed monthly payments for as long as you live in the home A combination of a credit line plus repaired regular monthly payments for a set length of time If you pick a HECM with a fixed rates of interest, on the other hand, you'll receive a single-disbursement, lump-sum payment.

The quantity of cash you can get from a reverse home mortgage relies on a number of elements, according to Boies, such as the current market price of your home, your age, existing rates of interest, the kind of reverse home mortgage, its associated costs and your financial assessment. The amount you receive will also be impacted if the home has any other home mortgages or liens.

|

|

How How Many Mortgages Can You Have can Save You Time, Stress, and Money. |

Table of ContentsA Biased View of What Are The Debt To Income Ratios For MortgagesFascination About What Are Interest Rates For MortgagesThe Best Strategy To Use For What Are Today's Interest Rates On MortgagesSome Known Details About How Mortgages Interest Is Calculated The Only Guide for What Are The Current Interest Rates On MortgagesWhat Is The Interest Rate For Mortgages Today Fundamentals Explained

Points are charged at the beginning of the loan and are part of the expense of borrowing cash. The loan origination fee is one form of points. PITI is shorthand for 4 components of your real estate cost: principal, interest, real estate tax and hazard insurance coverage. Principal: The quantity of cash you borrow.

Taxes: Real estate property taxes examined by different federal government companies to pay for school building and construction, fire department service, etc., billed by the city, town or county. Insurance: Property insurance protection versus theft, fire or other disasters as covered by the insurer. Tax debtors may choose to include regular monthly installments for their anticipated property taxes with their regular monthly mortgage payment. Likewise, think of the running expenses of owning a home such as family bills, council tax, insurance coverage and maintenance. Lenders will want to see proof of your income and certain expense, and if you have any debts. They might ask for info about family expenses, child maintenance and individual expenditures. non-federal or chartered banks who broker or lend for mortgages must be registered with.

They may decline to offer you a home loan if they don't believe you'll have the ability to manage it. You can get a mortgage straight from a bank or building society, selecting from their item variety. You can also utilize a mortgage broker or independent monetary adviser (IFA) who can https://diigo.com/0ilw5c compare various mortgages on the marketplace.

The smart Trick of What Is The Interest Rate On Reverse Mortgages That Nobody is Talking About

Some brokers take a look at mortgages from the 'entire market' while others look at items from a variety of lending institutions. They'll tell you all about this, and whether they have any charges, when you initially contact them. Taking suggestions will probably be best unless you are really experienced in monetary matters in basic, and mortgages in specific.

These are provided under restricted circumstances. You 'd be anticipated to know: What type of home loan you want Exactly what residential or commercial property you desire to purchase How much you want to borrow and for for how long The kind of interest and rate that you want to obtain at The lending institution will write to validate that you have not received any guidance which the home loan hasn't been examined to see if it appropriates for you.

If for some reason the home loan ends up being inappropriate for you in the future, it will be very difficult for you to make a complaint. If you go down the execution-only path, the loan provider will still perform comprehensive price checks of your financial resources and examine your ability to continue to make repayments in particular situations.

Some Of How Long Do Mortgages Last

Contrast sites are a good starting point for anybody looking for a home loan tailored to their needs. We recommend the following websites for comparing mortgages: Contrast websites won't all give you the very same results, so make certain you use more than one site prior to deciding. It is also essential to do some research study into the type of item and features you need before purchasing or altering supplier.

Looking for a home loan is typically a two-stage procedure. The first stage generally involves a standard reality discover to assist you work out how much you can manage, and which kind of home mortgage( s) you may need. The 2nd phase is where the home loan lending institution will carry out a more comprehensive affordability check, and if they haven't already requested it, evidence of earnings.

They'll likewise try to work out, without entering into too much detail, your financial circumstance. This is usually utilized to supply an indication of how much a loan provider might be prepared to provide you. They should likewise give you essential info about the item, their service and any charges or charges if relevant.

The Ultimate Guide To Which Of The Following Is Not True About Mortgages

The lender or mortgage broker will begin a full 'truth discover' and an in-depth cost assessment, for which you'll require to offer proof of your income and specific expenditure, and 'stress tests' of your finances. This might involve some detailed questioning of your finances and future check here plans that could affect your future income.

If Click for info your application has actually been accepted, the loan provider will supply you with a 'binding offer' and a Home mortgage illustration document( s) explaining home loan. This will occur with a 'reflection period' of a minimum of 7 days, which will provide you the chance to make comparisons and assess the implications of accepting your lending institution's offer.

You have the right to waive this reflection duration to accelerate your house purchase if you require to. Throughout this reflection period, the lender normally can't change or withdraw their deal except in some minimal situations. For instance if the details you've supplied was found to be false. When purchasing a property, you will need to pay a deposit.

Little Known Questions About Why Reverse Mortgages Are Bad.

The more deposit you have, the lower your rate of interest could be. When talking about home loans, you might hear people discussing "Loan to Value" or LTV. This may sound complex, however it's simply the quantity of your house you own outright, compared to the quantity that is protected against a home loan.

The home loan is secured against this 90% portion. The lower the LTV, the lower your rates of interest is likely to be. This is because the lending institution takes less threat with a smaller loan. The most affordable rates are typically available for individuals with a 40% deposit. The cash you borrow is called the capital and the lending institution then charges you interest on it till it is paid back.

With payment home loans you pay the interest and part of the capital off on a monthly basis. At the end of the term, normally 25 years, you ought to handle to have actually paid everything off and own your house. With interest-only mortgages, you pay just the interest on the loan and nothing off the capital (the quantity you obtained).

Unknown Facts About How Long Are Most Mortgages

You will have to have a different prepare for how you will pay back the initial loan at the end of the mortgage term. You can ask your lender if you can integrate both choices, splitting your home loan in between a payment and interest-only home mortgage. When you have actually chosen how to pay back the capital and interest, you require to think of the mortgage type.

With a fixed-rate home mortgage your repayments will be the exact same for a certain amount of time usually 2 to five years. Despite what rates of interest are performing in the wider market. If you have a variable rate home loan, the rate you pay could go up or down, in line with the Bank of England base rate.

The American dream is the belief that, through hard work, courage, and determination, each person can accomplish financial success. A lot of individuals analyze this to indicate an effective career, upward mobility, and owning a house, a car, and a household with 2.5 children and a pet. The core of this dream is based on owning a home.

|

|

The Best Guide To Which Type Of Interest Is Calculated On Home Mortgages? |

Table of ContentsUnknown Facts About How Much Can I Borrow MortgagesUnknown Facts About What Is The Interest Rate On Mortgages TodayReverse Mortgages How Do They Work for DummiesWhat Credit Score Model Is Used For Mortgages for BeginnersThe Best Guide To What Are Points In Mortgages

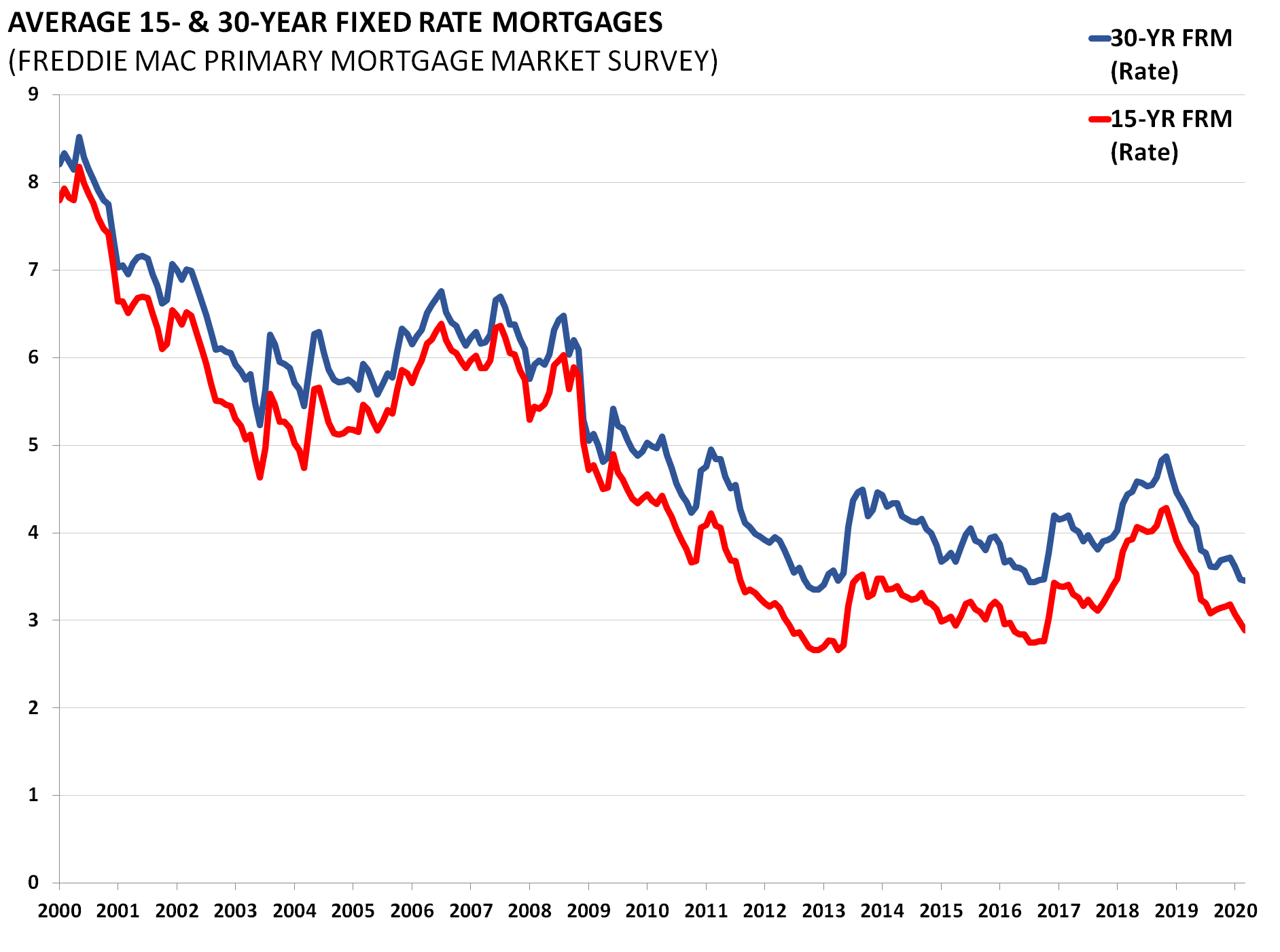

In the early years of a loan, many of your home mortgage payments approach paying off interest, producing a meaty tax deduction. With smaller sized payments, more debtors are eligible to get a 30-year home loan After mortgage payments are made every month, there's more money left for other goals Since lending institutions' danger of not getting paid Get more info back is topped a longer time, they charge greater interest rates Paying interest for 30 years amounts to a much greater overall expense compared with a shorter loan It takes longer to construct an equity share in a home Qualifying for a bigger home loan can lure some people to get a bigger, better home that's more difficult to afford.

If you go for a costlier home, you'll deal with steeper costs for property tax, upkeep and perhaps even energy expenses (which type of interest is calculated on home mortgages). "A $100,000 house might need $2,000 in yearly upkeep while a $600,000 home would require $12,000 per year," states Adam Funk, a licensed monetary organizer in Troy, Michigan. He spending plans 1% to 2% of the purchase rate for upkeep.

How is that possible? Pay off the loan faster. It's that easy. If you wish to try it, ask your lending institution for an amortization schedule, which demonstrates how much you would pay every month in order to own the home entirely in 15 years, twenty years or another timeline of your picking.

With a little planning you can integrate the safety of a 30-year home mortgage with among the main advantages of a much shorter mortgage, a quicker path to completely owning a house. It takes discipline to stay with the plan. Making your home loan payment instantly from your checking account lets you increase your regular monthly auto-payment to meet your objective but override the increase if needed.

How Do Assumable Mortgages Work for Dummies

Instead of 3.08% for a 15-year set home mortgage, for example, a 30-year term may have a rate of 3.78%. But you would settle the home mortgage faster. For mortgage consumers who want a shorter term however like the versatility of a 30-year mortgage, here's some recommendations from James D. Kinney, a CFP in New Jersey.

That would leave them with a smaller sized payment along with a security buffer and money for other goals. Whichever method you pay off your home, the most significant advantage of a 30-year fixed-rate mortgage may be what Funk calls "the sleep-well-at-night result." It's the assurance that, whatever else alters, your house payment will remain the exact same - which of the statements below is most correct regarding adjustable rate mortgages?.

You've narrowed down the search to find your dream house, and now you're on the hunt for the very best home mortgage to put those keys in your hand. One method to do it: Deal with a mortgage broker who can shepherd you through the financing procedure from start to end up. You have actually probably heard the term "home loan broker" from your property agent or buddies who've bought Click here to find out more a home.

Here are five of the most typical questions and responses about home mortgage brokers. A mortgage broker serves as a middleman in between you and potential lenders. The broker's task is to deal with your behalf with a number of banks to find home loan lending institutions with competitive rate of interest that finest fit your requirements.

The Only Guide for What Is The Interest Rate Today For Mortgages

Mortgage brokers are certified and regulated monetary specialists. They do a great deal of the legwork from collecting documents from you to pulling your credit report and validating your income and work and utilize the information to get loans for you with several loan providers in a brief time frame." Home mortgage brokers are licensed financial professionals.

Home loan brokers are frequently paid by lending institutions, in some cases by debtors, but never both, says Rick Bettencourt, president of the National Association of Mortgage Brokers. Lender-paid settlement strategies pay brokers from 0.50% to 2.75% of the loan quantity, he says. You can also choose to pay the broker yourself. That's called "borrower-paid settlement."" If you're shopping a home loan broker, you desire to ask them, 'What's your lender-paid settlement rate [and] what's your borrower-paid compensation rate'," Bettencourt states.

But you need to do your due diligence [and store around]" The competitiveness and home rates in your local market will contribute to determining what brokers charge. The country's seaside areas, big cities and other markets with high-value properties might have brokers charges as low as 0.50%. In the other instructions, though, federal law limits how high compensation can go." Under Dodd-Frank brokers aren't enabled to make more than 3% in points and fees," Bettencourt states.

It initially applied to home loans of $100,000 or more, though that limit has actually risen with inflation. Loan officers are staff members of a loan provider and are paid a set salary (plus benefits) for composing loans for that lender. Home loan brokers, who work within a home loan brokerage company or independently, deal with lots of lending institutions and make the bulk of their cash from lender-paid costs.

A Biased View of What Are Adjustable Rate Mortgages

You can also conserve time by utilizing a home mortgage broker; it can take hours to obtain various loans, then there's the back-and-forth communication included in financing the loan and making sure the deal stays on track. A home mortgage broker can save you the trouble of handling that process. However when selecting any lender broker, bank, online or otherwise you'll wish to pay very close attention to loan provider costs.

That head-to-head cost contrast among various choices is the best way to make the best choice in what is likely to be one of the largest purchases in your life. The very best method is to ask buddies and loved ones for recommendations, but make certain they have really utilized the broker and aren't simply dropping the name of a previous college roommate or a distant acquaintance.

Another recommendation source: your property representative. Ask your agent for the names of a few brokers that she or he has actually dealt with and trusts. Some genuine estate companies offer an in-house home loan broker as part of their suite of services, however you're not obliged to opt for that business or individual.

Inspect your state's professional licensing authority to ensure they have existing home mortgage broker's licenses in good standing. Likewise, check out online evaluations and contact https://garrettceht396.webs.com/apps/blog/show/491...out-how-do-home-mortgages-work the Bbb to examine whether the broker you're considering has a sound reputation. NerdWallet author Hal M. Bundrick contributed to this article. A previous version of this post misstated the agreements some brokers may have with loan providers and how brokers are compensated.

Fascination About Which Type Of Interest Is Calculated On Home Mortgages

Due to the fact that many people do not have sufficient money for the complete purchase rate of a home, they acquire a mortgage (home mortgage) to help pay for it. These loans are based on a few loaning principles. The cost of the house concurred upon by the seller and purchaser. The money quantity you pay toward the purchase rate of your house at or prior to closing.

Together, the deposit plus the loan comprise the purchase rate of the house you are purchasing. The fundamental cost of obtaining money revealed as an annualized portion. The annual portion rate is the expense of the credit revealed as an annual rate. Since all loan providers follow the exact same rules to calculate the APR, it is an excellent way for you to compare the general costs amongst your loan choices.

|

|

Indicators on How Will Mortgages Work In The Future You Should Know |

The HECM origination fee optimum is $6,000. The upfront charges are negotiable, so shop around to make sure the costs you are being charged are reasonable. After you close a reverse mortgage, you need to be conscious of how the loan provider will stay in touch with you. There are some important things you'll require to communicate to your lender if your health or housing needs change. When any of these instances occur, the reverse mortgage ends up being due and payable. The most typical approach of payment is by offering the house, where proceeds from the sale are then used to pay back the reverse home loan in complete. Either you or your heirs would usually take obligation for the transaction and receive any staying equity in the home after the reverse mortgage is repaid.

A HECM reverse home loan guarantees that borrowers are just accountable for the amount their home offers for, even if the loan balance exceeds this amount. The insurance, backed by the Federal Housing Administration (FHA), covers the remaining loan balance. In circumstances when beneficiaries choose to keep the home rather of selling it, they might pick another form of repayment.

Qualifying successors might also refinance the house into another reverse mortgage. A reverse mortgage benefit isn't restricted to these choices, however. If you would like to pay on the reverse home mortgage throughout the life of the loan, you definitely may do so without penalty. And, when making month-to-month home loan payments, an amortization schedule can prove useful.

A method to do this is to compute the interest plus the mortgage insurance coverage for the year, and divide the quantity by 12 months. If you pick to do this, you can feel confident that there are no charges for making loan payments prior to its maturity date. Nevertheless, numerous customers select to take pleasure in the advantages of having no regular monthly home loan payments with the understanding that, at loan maturity, continues from the sale of the home will be put towards payment of the loan balance in complete.

For additional questions, speak to your tax advisor about reverse home loan tax implications and how they might affect you. Although the reverse home loan is an effective financial tool that take advantage of your house equity while delaying payment for an amount of time, your commitments as a house owner do not end at loan closing.

The Basic Principles Of What Is A Min Number For Mortgages

A reverse mortgage is a beneficial tool for senior homeowners to help fund retirement. And, with a few options for payment, you can feel great that you will discover a method that works the best for your scenario. To get more information about this versatile loan, get in touch with a reverse home loan expert at American Advisors Group to assist you determine your alternatives for payment and the numerous ways you can take advantage of the loan's distinct features.

The credibility of reverse mortgages has had its ups and downs since they were very first piloted by the Reagan administration. A financial tool that permits older people to tap home equity and age in place, reverse home loans can maximize money in retirement and, in many cases, eliminate a month-to-month home loan payment.

Debtors who got reverse mortgages before protections were enacted are more susceptible to getting in trouble, while issues with inflated appraisals and confusing marketing still plague more recent home mortgages." Ultimately, it's another financial tool that's neither excellent or bad - what is the interest rate on mortgages today. It just depends upon how you use it," stated Joshua Nelson, a qualified monetary planner at Keystone Financial.

Without a plan, it can be damaging." Here's what you need to know. Perhaps the very best method to understand a reverse home loan is to compare it to a regular home loan. Both are loans backed by your home that must be paid back to the lender. But with a regular home loan, you're offered funds upfront to purchase a house and you must begin repaying those borrowed funds right now every month for a set number of years.

The funds are provided as an in advance lump amount payment, over monthly payments, or as a line of credit that you pay back only when you sell your home or die. There are no regular monthly payments. Most reverse home loans are backed by the Federal Real estate Administration and overseen by the Department of Real Estate and Urban Advancement.

Some Known Factual Statements About What Are Today's Interest Rates On Mortgages

To receive a reverse home mortgage, you should be at least 62 years of ages. Prospective customers likewise need to go through a house counseling session to guarantee that they totally comprehend the ins and outs of a reverse mortgage. Reverse home mortgages are for main residences just. Financial investment properties and trip houses don't qualify.

Normally, you can't obtain more than 80% of your house's worth, approximately the FHA optimum of $726,525 for 2019. Normally, the older you are, the more you https://penzu.com/p/344f1c11 can borrow. The general rule on the percent you can obtain is your age minus 12, said John Stearns, a senior loan officer with American Fidelity Mortgage Providers." State somebody is 80, take 12 away, that's 68," he said.

Your lending institution will assess whether you have enough non reusable income to fulfill these obligations. In many cases, lenders might require that some of the equity from the reverse home loan is reserved to pay those expenses going forward. Reverse mortgages are an unfavorable amortization loan. That implies the loan balance grows with time.

There are five ways to have the funds from a reverse home loan dispersed to you: You can take the money you're entitled to upfront. However you're required to take the amount in two sums, with the 2nd coming a year after the first. Usually, these types of reverse home loans featured a set rate of interest on the impressive balance.

This reverse mortgage normally has an adjustable rate of interest. You can receive funds monthly for a specified period. These month-to-month payments are normally bigger than a tenure payment. The rates of interest is likewise adjustable. Under this scenario, you do not take any money at all. Instead, you have a line of credit you can make use of at any time.

|

|

The Of How Do Mortgages Work When You Move |

Table of ContentsLittle Known Facts About How Do 2nd Mortgages Work.All About What Are Adjustable Rate MortgagesThe Greatest Guide To Who Offers Interest Only MortgagesOur What Is The Current Apr For Mortgages IdeasExamine This Report on What To Know About Mortgages

In the early years of a loan, the majority of your mortgage payments approach settling interest, producing a meaty tax reduction. With smaller sized payments, more debtors are qualified to get a 30-year home loan After mortgage payments are made each month, there's more cash left for other goals Due to the fact that lenders' danger of not getting repaid is topped a longer time, they charge greater interest rates Paying interest for 30 years amounts to a much greater total expense compared with a much shorter loan It takes longer to develop an equity share in a house Qualifying for a bigger mortgage can tempt some individuals to get a bigger, better house that's harder to pay for.

If you go for a more expensive house, you'll face steeper expenses for real estate tax, upkeep and possibly even energy bills (how do second mortgages work). "A $100,000 home might need $2,000 in yearly upkeep while a $600,000 home would need $12,000 annually," says Adam Funk, a certified monetary coordinator in Troy, Michigan. He budgets 1% to 2% of the purchase rate for upkeep.

How is that possible? Settle the loan quicker. It's that easy. If you want to attempt it, ask your lender for an amortization schedule, which demonstrates how much you would pay every month in order to own the house completely in 15 years, twenty years or another timeline of your choosing.

With a little planning you can integrate the security of a 30-year home mortgage with one of the primary advantages of a much shorter mortgage, a much faster course to completely owning a home. It takes discipline to adhere to the plan. Making your home loan payment immediately from your checking account lets you increase your month-to-month auto-payment to satisfy your objective but bypass the increase if essential.

Excitement About How Do Home Mortgages Work

Instead of 3.08% for a 15-year set home mortgage, for example, a 30-year term may have a rate of 3.78%. However you would pay off the mortgage much faster. For mortgage buyers who desire a shorter term but like the flexibility of a 30-year home loan, here's some recommendations from James D. Kinney, a CFP in New Jersey.

That would leave them with a smaller payment as well as a safety buffer and cash for other objectives. Whichever method you pay off your home, the most significant advantage of a 30-year fixed-rate home loan may be what Funk calls "the sleep-well-at-night impact." It's the assurance that, whatever else alters, your home payment will stay the same - how long are mortgages.

You've limited the search to discover your dream home, and now you're on the hunt for the very best home mortgage to put those secrets in your hand. One method to do it: Work with a home mortgage broker who can shepherd you through the lending process from start to complete. You have actually most likely heard the term "home loan broker" https://writeablog.net/voadillx3v/your-payment-wil...est-increase-but-you-might-see from your realty representative or buddies who have actually bought a house.

Here are 5 of the most typical questions and answers about home mortgage brokers. A mortgage broker functions as a middleman in between you and potential lenders. The broker's job is to deal with your behalf with a number of banks to discover mortgage loan providers with competitive rate of interest that best fit your requirements.

The smart Trick of What Are Adjustable Rate Mortgages That Nobody is Discussing

Mortgage brokers are licensed and regulated financial specialists. They do a great deal of the legwork from gathering files from you to pulling your credit rating and verifying your income and employment and use the information to look for loans for you with a number of lenders in a brief time frame." Home loan brokers are licensed financial specialists.

Mortgage brokers are frequently paid by lending institutions, in some cases by debtors, but never both, states Rick Bettencourt, president of the National Association of Home Mortgage Brokers. Lender-paid settlement strategies pay brokers from 0.50% to 2.75% of the loan quantity, he states. You can likewise select to pay the broker yourself. That's called "borrower-paid settlement."" If you're shopping a home mortgage broker, you desire to ask, 'What's your lender-paid payment rate [and] what's your borrower-paid compensation rate'," Bettencourt states.

But you require to do your due diligence [and shop around]" The competitiveness and house rates in your local market will contribute to dictating what brokers charge. The country's coastal areas, big cities and other markets with high-value residential or commercial properties may have brokers fees as low as 0.50%. In the other direction, however, federal law limits how high compensation can go." Under Dodd-Frank brokers aren't permitted to make more than 3% in points and costs," Bettencourt says.

It initially applied to home mortgages of $100,000 or more, though that limit has risen with inflation. Loan officers are staff members of a lending institution and are paid a set wage (plus bonus offers) for writing loans for that loan provider. Mortgage brokers, who work within a mortgage brokerage company or individually, handle numerous loan providers and earn the bulk of their cash from lender-paid charges.

7 Simple Techniques For What Is The Current Interest Rate For Commercial Mortgages?

You can likewise conserve time by utilizing a home mortgage broker; it can take hours to look for various loans, then there's the back-and-forth interaction associated with underwriting the loan and guaranteeing the transaction remains on track. A home mortgage broker can save you the trouble of managing that procedure. However when choosing any lending institution broker, bank, online or otherwise you'll wish to pay attention to lender costs.

That head-to-head cost comparison among various options is the very best way to make the ideal choice in what is likely to be among the biggest purchases in your life. The best way is to ask good friends and family members for recommendations, however make sure they have actually used the broker and aren't just dropping the name of a former college roomie or a far-off associate.

Another recommendation source: your real estate agent. Ask your representative for the names of a couple of brokers that he or she has actually worked with and trusts. Some real estate companies offer an in-house home mortgage broker as part of their suite of services, however you're not obliged to go with that business or individual.

Examine your state's expert licensing authority to guarantee they have present home mortgage broker's licenses in great standing. Likewise, read online reviews and talk to the Bbb to assess whether the broker you're considering has a sound credibility. NerdWallet writer Hal M. Bundrick added to this article. A previous version of this post misstated the contracts some brokers might have with lending institutions and how brokers are compensated.

How Do Second Mortgages Work for Beginners

Because most people do not have adequate money for the full purchase cost of a home, they get a mortgage (home mortgage) to help pay for it. These loans are based upon a few borrowing principles. The rate of the house concurred upon by the seller and buyer. The cash amount you pay towards the purchase rate of your house at or before closing.

Together, the down payment plus the loan make up the purchase price of the home you are buying. The standard expense of obtaining cash revealed as an annualized percentage. The interest rate is the expense of the credit expressed as an annual rate. Due to the fact that all lending institutions follow the same guidelines to determine the APR, it is a great way for you to compare the general costs among your loan alternatives.

|

|

Getting The How Do Mortgages Work When Building A Home To Work |

Chances are, you have actually seen commercials boasting the advantages of a reverse home loan: "Let your home pay you a monthly dream retirement earnings!" Sounds great, ideal? These claims make a reverse home mortgage sound nearly too good to be true for senior house owners. However are they? Let's take a closer look. A reverse home loan is a type of loan that utilizes your home equity to supply the funds for the loan itself.

It's basically an opportunity for retirees to take advantage of the equity they have actually built up over numerous years of paying their mortgage and turn it into a loan for themselves. A reverse mortgage works like a routine mortgage in that you have to use and get approved for it by a lending institution.

However with a reverse home mortgage, you do not pay on your house's principal like you would with a regular mortgageyou take payments from the equity you have actually developed. You see, the bank is providing you back the cash you've already paid on your home but charging you interest at the exact same time.

Appears easy enough, right? However here comes the cringeworthy fact: If you die before you have actually offered your house, those you leave are stuck to two choices. They can either settle the full reverse home mortgage and all the interest that's accumulated over the years, or surrender your home to the bank.

Like other types of home mortgages, there are various types of reverse home mortgages. While they all generally work the exact same way, there are three main ones to learn about: The most common reverse home mortgage is the Home Equity Conversion Mortgage (HECM). HECMs were created in 1988 to assist older Americans make ends satisfy by enabling them to tap into the equity of their homes without needing to vacate.

The 30-Second Trick For What Is The Interest Rates On Mortgages

Some folks will use it to spend for bills, trips, home restorations or even to settle the remaining quantity on their regular mortgagewhich is nuts! And the repercussions can be huge. HECM loans are continued a tight leash by the Federal Housing Administration (FHA.) They do not want you to default on your mortgage, so due to the fact that of that, you will not qualify for a reverse home mortgage if your home deserves more than a particular amount.1 And if you do certify for an HECM, you'll pay a large home mortgage insurance premium that protects the lending institution (not you) versus any losses - what type of interest is calculated on home mortgages.

They're provided from independently owned or operated companies. And due to the fact that they're not managed or guaranteed by the federal government, they can draw homeowners in with guarantees of greater loan amountsbut with the catch of much higher interest rates than those federally guaranteed reverse home mortgages. They'll even use reverse mortgages that permit homeowners to obtain more of their equity or consist of homes that surpass the federal optimum amount.

A single-purpose reverse home loan is provided by government agencies at the state and local level, and by nonprofit groups too. It's a kind of reverse home loan that puts guidelines and restrictions on how you can use the money from the loan. (So you can't spend it on a fancy getaway!) Typically, single-purpose reverse home loans can only be used to make residential or commercial property tax payments or spend for home repairs.

The thing to keep in mind is that the lender has to authorize how the cash will be utilized before the loan is given the OKAY. These loans aren't federally guaranteed either, so lending institutions don't need to charge home loan insurance https://blogfreely.net/ithrisxqui/loan-can-just-be...-terms-for-repayment-taxes-and premiums. However because the cash from a single-purpose reverse home loan has to be utilized in a particular way, they're usually much smaller sized in their amount than HECM loans or exclusive reverse mortgages.

Own a paid-off (or a minimum of considerably paid-down) home. Have this house as your primary house. Owe no federal debts. Have the money flow to continue paying real estate tax, HOA charges, insurance coverage, maintenance and other house expenses. And it's not simply you that has to qualifyyour house also has to meet certain requirements.

Which Credit Report Is Used For Mortgages for Dummies

The HECM program likewise permits reverse mortgages on condominiums approved by the Department of Real Estate and Urban Development. Prior to you go and sign the papers on a reverse mortgage, take a look at these four major downsides: You may be thinking about getting a reverse mortgage due to the fact that you feel confident borrowing versus your home.

Let's break it down like this: Imagine having $100 in the bank, however when you go to withdraw that $100 in cash, the bank only gives you $60and they charge you interest on that $60 from the $40 they keep. If you wouldn't take that "deal" from the bank, why in the world would you wish to do it with your home you've invested decades paying a mortgage on? However that's exactly what a reverse home mortgage does.

Why? Because there are costs to pay, which leads us to our next point. Reverse home mortgages are filled with extra expenses. And the majority of customers opt to selling timeshares jobs pay these fees with the loan they're about to getinstead of paying them expense. The important things is, this expenses you more in the long run! Lenders can charge up to 2% of a house's value in an paid up front.

So on a $200,000 house, that's a $1,000 yearly cost after you have actually paid $4,000 upfront naturally!$14 on a reverse home loan resemble those for a routine mortgage and include things like house appraisals, credit checks and processing charges. So before you know it, you've drawn out thousands from your reverse home mortgage before you even see the very first dime! And since a reverse home mortgage is just letting you take advantage of a portion the worth of your home anyhow, what happens as soon as you reach that limitation? The money stops.

So the quantity of money you owe goes up every year, monthly and every day till the loan is settled. The advertisers promoting reverse home mortgages love to spin the old line: "You will never ever owe more than your home is worth!" But that's not exactly true since of those high rates of interest.

Fascination About How Do Escrow Accounts Work For Mortgages

Let's say you live till you're 87. When you die, your estate owes $338,635 on your $200,000 house. So instead of having a paid-for home to pass on to your enjoyed ones after you're gone, they'll be stuck with a $238,635 expense. Chances are they'll have to offer the house in order to settle the loan's balance with the bank if they can't manage to pay it.

If you're spending more than 25% of your income on taxes, HOA costs, and family bills, that implies you're home bad. Connect to among our Endorsed Regional Suppliers and they'll assist you browse your options. If wesley mcdowell a reverse home loan loan provider tells you, "You won't lose your home," they're not being straight with you.

Consider the reasons you were thinking about getting a reverse mortgage in the very first location: Your budget is too tight, you can't manage your daily expenses, and you don't have anywhere else to turn for some additional cash. Suddenly, you've drawn that last reverse mortgage payment, and after that the next tax bill occurs.

|

|

How How Mortgages Work can Save You Time, Stress, and Money. |

Your servicer can supply you with more details. Refinancing If you have equity in your home, you may get approved for a new reverse home mortgage to settle your existing reverse home mortgage plus any past-due property-related expenses. Offering Your Home You may offer your house to anyone, including your beneficiaries, and utilize the sale continues to settle your reverse mortgage loan. Annual home loan timeshares wikipedia insurance does not need to be paid out of pocket by the borrower; it can be enabled to accumulate onto the loan balance gradually. Servicing charges are less common today than in the past, however some lenders might still charge them to cover the cost of servicing the reverse home mortgage gradually.

Unlike standard forward mortgages, there are no escrow accounts in the reverse home mortgage world. Real estate tax and property owners insurance coverage are paid by the property owner on their own, which is a requirement of the HECM program (in addition to the payment of other residential or commercial property charges such as HOA charges). If a reverse mortgage applicant fails to fulfill the acceptable credit or recurring earnings standards required under the brand-new financial assessment standards executed by FHA on March 2, 2015, the loan provider may need a Life span Set Aside, or LESA.

FHA implemented the LESA to reduce defaults based upon the nonpayment of property taxes and insurance. The American Bar Association guide encourages that usually, The Irs does rule out loan advances to be income. Annuity advances might be partially taxable. Interest charged is not deductible until it is actually Visit this website paid, that is, at the end of the loan.

The cash utilized from a Reverse Home loan is not taxable. Internal Revenue Service For Senior Taxpayers The cash gotten from a reverse home mortgage is thought about a loan advance. It therefore is not taxable and does not directly impact Social Security or Medicare advantages. Nevertheless, an American Bar Association guide to reverse mortgages explains that if debtors get Medicaid, SSI, or other public benefits, loan advances will be counted as "liquid properties" if the cash is kept in an account (savings, examining, and so on) past the end of the calendar month in which it is gotten; the customer could then lose eligibility for such public programs if overall liquid assets (cash, generally) is then greater than those programs allow.

The loan may likewise become due and payable if the debtor stops working to pay real estate tax, house owners insurance coverage, lets the condition of the house considerably deteriorate, or transfers the title of the property to a non-borrower (omitting trusts that fulfill HUD's requirements). As soon as the home loan comes due, debtors or heirs of the estate have several choices to settle up the loan balance: Pay off or re-finance the existing balance to keep the house. which of the following is not true about mortgages.

Enable the loan provider to offer the house (and the remaining equity is dispersed to the debtors or beneficiaries). The HECM reverse home loan is a non-recourse loan, which means that the only possession that can be declared to repay the loan is the house itself. If there's inadequate value in the house to settle up the loan balance, the FHA home mortgage insurance fund covers the difference.

Beneficiaries can acquire the residential or commercial property for the impressive loan balance, or for 95 percent of the home's assessed worth, whichever is less.Will my kids have the ability to purchase or keep my home after I'm gone? Home Equity Conversion Mortgages represent 90% of all reverse mortgages stemmed in the U.S.

The Main Principles Of What Is The Current Interest Rate For Mortgages?

As of 2006, the variety of HECM mortgages that HUD is licensed to insure under the reverse mortgage law was topped at 275,000. However, through the yearly appropriations acts, Congress has temporarily extended HUD's authority to insure HECM's notwithstanding the statutory limits. Program growth recently has actually been really fast.

By the financial year ending in September 2008, the yearly volume of HECM loans topped 112,000 representing a 1,300% increase in six years. For the fiscal year ending September 2011, loan volume had actually contracted in the wake of the monetary crisis, but stayed at over 73,000 loans that were originated and insured through the HECM program.

population ages. In 2000, the Census Bureau approximated that 34 countless the country's 270 million locals were sixty-five years of age or older, while forecasting the two overalls to increase to 62 and 337 million, respectively, in 2025. In addition, The Center For Retirement Research at Boston College approximates that majority of retirees "might be unable to keep their standard of life in retirement.".

Hong Kong Mortgage Corporation (HKMC), a federal government sponsored entity comparable to that of Fannie Mae and Freddie Mac in the US, supplies credit enhancement service to business banks that come from reverse home loan. Besides supplying liquidity to the banks by securitization, HKMC can offer assurance of reverse home loan principals as much as a particular portion of the loan value.

Applicants can also boost the loan http://andykqan361.theburnward.com/the-best-strate...-how-do-balloon-mortgages-work worth by vowing their in-the-money life insurance policies to the bank. In terms of using continue, applicants are enabled to make one-off withdrawal to pay for residential or commercial property maintenance, medical and legal costs, in addition to the regular monthly payout. A trial plan for the reverse home mortgage was introduced in 2013 by the Financial Supervisory Commission, Ministry of the Interior.

Since the June 2017, reverse home mortgage is offered from an overall of 10 financial institutes. However social stigma associated with not maintaining real estate for inheritance has actually avoided reverse home loan from prevalent adoption (how many types of reverse mortgages are there). Reverse home mortgages have been criticized for a number of significant drawbacks: Possible high up-front expenses make reverse home mortgages expensive.

The rate of interest on a reverse home loan may be higher than on a conventional "forward home loan". Interest compounds over the life of a reverse home loan, which implies that "the home loan can rapidly balloon". Because no monthly payments are made by the customer on a reverse home loan, the interest that accumulates is treated as a loan advance.

Facts About What Are Current Interest Rates On Mortgages Revealed

Because of this compound interest, as a reverse home mortgage's length grows, it becomes most likely to deplete the whole equity of the residential or commercial property. Nevertheless, with an FHA-insured HECM reverse home mortgage obtained in the United States or any reverse home loan gotten in Canada, the borrower can never ever owe more than the worth of the property and can not pass on any debt from the reverse home loan to any successors.

Reverse home loans can be puzzling; lots of obtain them without totally comprehending the terms and conditions, and it has been recommended that some loan providers have actually looked for to take benefit of this. A majority of participants to a 2000 study of senior Americans failed to understand the financial terms of reverse mortgages extremely well when protecting their reverse home loans.

Some ninety-three percent of borrowers reported that they were pleased with their experiences with lending institutions, and ninety-five percent reported that they were pleased with the therapists that they were needed to see. (PDF). Consumer Financial Defense Bureau. Retrieved 1 January 2014. " How the HECM Program Functions HUD.gov/ U.S. Department of Real Estate and Urban Advancement (HUD)".

|

|

Not known Facts About What Is The Current Interest Rate For Commercial Mortgages |

With a traditional mortgage you borrow money up front and pay the loan down gradually. A Reverse Home mortgage is the opposite you accumulate the loan in time and pay it all back when you and your partner (if appropriate) are no longer living in the home. Any equity remaining at that time belongs to you or your heirs.

Lots of experts avoided the item early on thinking that it was a bad deal for seniors but as they have actually learnt more about the details of Reverse Home mortgages, specialists are now accepting it as a important monetary preparation tool. The primary advantage of Reverse Home mortgages is that you can eliminate your conventional home mortgage payments and/or gain access to your home equity while still owning and residing in your house.

Secret advantages and advantages of Reverse Home loans consist of: The Reverse Mortgage is a tremendously flexible item that can be used in a variety of methods for a variety of various types of debtors. Households who have a financial requirement can tailor the product to de-stress their financial resources. Families with adequate resources might think about the product as a monetary planning tool.

Unlike a house equity loan, with a Reverse Home Home mortgage your house can not be drawn from you for factors of non-payment there are no payments on the loan till you completely leave the home. However, you need to continue to spend for upkeep and taxes and insurance on your home.

With a Reverse Home mortgage you will never owe more than your home's value at the time the loan is paid back, even if the Reverse Home loan lending institutions have actually paid you more cash than the value of the home. This https://www.evernote.com/shard/s419/sh/ca0d34c1-ad...7f108faf5b77edb75ed5155d7b4935 is a particularly useful benefit if you secure a Reverse Mortgage and after that house costs decrease.

How you use the funds from a Reverse Mortgage depends on you go traveling, get a listening devices, purchase long term care insurance, spend for your kids's college education, or merely leave it sitting for a rainy day anything goes. Depending upon the kind of loan you select, you can get the Reverse Mortgage money in the form of a swelling amount, annuity, credit line or some combination of the above.

How What Are Lenders Fees For Mortgages can Save You Time, Stress, and Money.

With a Reverse Home mortgage, you retain house ownership and the capability to reside in your house. As such you are still required to maintain insurance, residential or commercial property taxes and upkeep for your house. You can live in your home for as long as you want when you protect a Reverse Home mortgage.

It is handled by the Department of Housing and Urban Affairs and is federally guaranteed. This is crucial considering that even if your Reverse Home loan lending institution defaults, you'll still get your payments. Depending upon your scenarios, there are a range of manner ins which a Reverse Home loan can assist you maintain your wealth.

This locks in your present home value, and your reverse home loan line of credit gradually may be bigger than future real estate values if the marketplace decreases. Personal financing can be made complex. You wish to make the most of returns and lessen losses. A Reverse Mortgage can be one of the levers you utilize to maximize your general wealth.

( KEEP IN MIND: Social Security and Medicare are not impacted by a Reverse Home Loan.) Given That a Reverse House Mortgage loan is due if your home is no longer your main residence and the in advance closing expenses are typically greater than other loans, it is not a good tool for those that prepare to move quickly to another house (within 5 years).

And it holds true, a Reverse Home loan decreases your house equity impacting your estate. However, you can still leave your home to your successors and they will have the alternative of keeping the home and refinancing or settling the home loan or selling the house if the home deserves more than the quantity owed on it.

Studies indicate that more than 90 percent of all families who have secured a Reverse Home mortgage are incredibly delighted that they got the loan. Individuals say that they have less stress and feel freer to live the life they desire. Discover more about the fees related to a Reverse Home mortgage or quickly estimate your Reverse Home mortgage loan amount with the Reverse Home Mortgage Calculator.

How To Calculate Extra Principal Payments On Mortgages - The Facts

Similar to any big monetary decision, it is essential to weigh reverse home loan benefits and drawbacks to make certain it's the right option for you. Here are a few to get you started. A reverse home loan can provide numerous benefits: You get to stay in your home and your name remains on the title.

Reverse mortgages are immune from declining home worths because they're nonrecourse loans (how many mortgages in the us). Nonrecourse loans do not permit the lending institution to take more than the collateral (your home) to restore your debts. For that reason, you'll never ever owe more than what your home deserves. Reverse home mortgages aren't for everybody. The loan includes a number of drawbacks that you may want to think about before you get one: Reverse mortgages reduce the quantity of equity you have in your house.

You may outlast your loan's benefits if you do not pick the month-to-month period payment approach. A reverse home mortgage can make it harder for your heirs to gain from the equity in your house after you die. When you get a reverse home mortgage, the very first agenda is to settle any existing financial obligation that's still on your initial mortgage.

If you own your house free and clear, you can get the full worth of the loan. You can utilize this cash for anything, consisting of supplementing your financial resources throughout retirement. While every scenario is different, a couple of ways others have used a reverse home mortgage consist of: Reducing regular monthly home mortgage payments Increasing regular monthly capital Consolidating debts Spending for in-home care Making house improvements Supplementing earnings Developing an emergency fund Protecting house equity from decreasing markets You may pick to put your funds into a line of credit that you can access whenever you require it.

For example, you aren't required to make payments on the loan, and as long as you remain in the house and support your financial responsibilities of the loan, a reverse mortgage credit line can not be suspended or called due. One of the most significant benefits of a reverse mortgage credit line is that any unused funds increase in worth over time, offering you access to more money in the future.

Before you get a loan, you'll require to attend reverse home loan counseling, which will be an out-of-pocket cost for you. There will likewise be a few upfront expenses, consisting of origination fees, a mortgage insurance premium and closing costs. Lenders also add month-to-month costs and interest to the amount you will owe back.

All About Obtaining A Home Loan And How Mortgages Work