The Facts About Which Of These Statements Are Not True About Mortgages Uncovered |

They can not be utilized as part of the down payment on the loan. Any loans which are advertised as having "no closing costs" normally have actually unfavorable points embedded in them where the cost of originating the loan is paid through a greater rate of interest on the loan. This charge must be disclosed on your Loan Estimate (LE) and Closing Disclosure (CD).

When you acquire negative points the bank is wagering you are most likely to pay the higher rate of interest for an extended period of time. If you pay the greater interest rate for the duration of the loan then the bank gets the winning end of the offer. Many individuals still take the offer though because Check out here we tend to mark down the future & over-value a swelling sum in the present.

Purchasers who are charged negative points must make sure that any additional above & beyond the closing expense is applied versus the loan's principal. If you are most likely to pay off the home soon prior to the bank reaches their break even then you could get the winning end of the offer.

Reverse Mortgages How Do They Work Things To Know Before You Buy

In the above calculator the break even point calculates how long it takes for indicate spend for themselves if a home purchaser decides to purchase home loan discount rate points. A homeowner needs to live in the home without re-financing for a prolonged duration of time for the indicate spend for themselves - how do house mortgages work.

Settling the house sooner suggests making more money from the unfavorable points. When a loan provider sells you unfavorable points they are wagering you will not pay off your mortgage soon. Rolling the cost savings from the unfavorable points into paying on the loan's balance extends the time period in which the points pay for the homebuyer.

Eventually they will end up paying more interest than they otherwise would have. For people using unfavorable points the break even date is the amount of time prior to the bank would get the much better end of the offer if they were selling loan provider credits. Buyers who settle the loan before the break even date while utilizing unfavorable points will generate income on the points.

Examine This Report about How Do Cash Back Mortgages Work In Canada

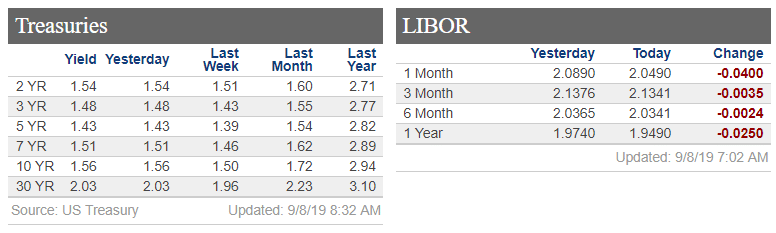

If you sell points you wish to have the loan paid off before you reach the break even point so you are not paying the bank more interest than you would have if you picked not to buy points. US 10-year Treasury rates have just recently fallen to all-time record lows due to the spread of coronavirus driving a threat off sentiment, with other monetary rates falling in tandem.

Are you paying too much for your home loan? Inspect your re-finance choices with a relied on Houston loan provider. Address a couple of concerns below and connect with a loan provider who can assist you refinance and save today!.

A home loan point equates to 1 percent of your overall loan quantity for instance, on a $100,000 loan, one point would be $1,000. reverse mortgages how they work. Mortgage points are basically a form of prepaid interest you can select to pay up front in exchange for a lower rate of interest and monthly payments (a practice referred to as "purchasing down" your rate of interest).

Some Known Questions About Reverse Mortgages How Do They Work.

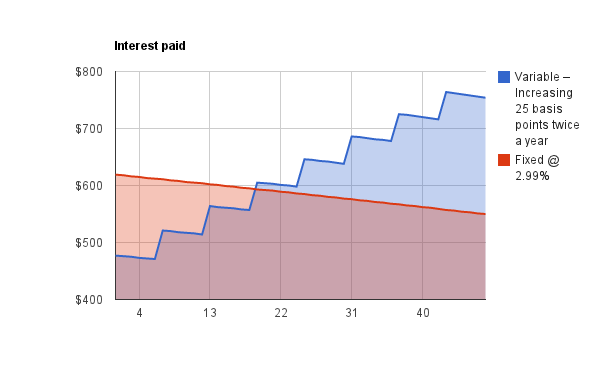

In exchange for each point you pay at closing, your home mortgage APR will be reduced and your regular monthly payments will shrink accordingly. Generally, you would purchase points to decrease your rate of interest on a fixed-rate home loan. Purchasing points for adjustable rate home loans just supplies a discount on the preliminary fixed period of the loan and isn't usually done (how do canadian mortgages work).

The longer you plan to own your brand-new house, the much better the opportunity that you'll reach the "break-even" point where the interest you have actually conserved makes up for your initial money investment. If you have a shorter-term strategy, have actually restricted cash, or would benefit more from a bigger down payment, paying points may not benefit you.

The points are factored into your closing cost, and can reduce your APR, or interest rate, which is your home mortgage interest rate plus other expenses associated with your mortgage, like any fees. (The APR is the rate at which you can expect your payments to be calculated from.) Points for adjustable-rate home loans are applied to the fixed-rate duration of the loan.

An Unbiased View of How We Work Mortgages

There isn't a set quantity for one point, but. For instance, if you have a 5% interest rate, purchasing one point may reduce the rates of interest to 4. 75% or 4. 875%, depending upon your loan provider's terms. If you're buying mortgage points, you can purchase more than one, or perhaps a portion of one, if the lending institution allows it.

If you have an interest in mortgage points and lowering your rate of interest, ask your loan provider for a rate sheet to see the interest rates and corresponding home loan points. Even better, you need to ask the lender for the particular dollar amount you 'd need to pay to lower your mortgage rate by a specific portion, because points (and portions of points) can be complicated.

That means home mortgage points get more costly the larger your mortgage is. For example, if you have a $100,000 loan, one point will cost $1,000. however if you have a $500,000 loan then a home loan point would cost $5,000. The way home loan points work is that the (which is however much your mortgage points expense).

The Ultimate Guide To How Do Points Work In Mortgages

More on that later on. The best method to comprehend how points https://www.businesswire.com/news/home/20191008005...oup-Relieves-375-Consumers-6.7 work is through an example. Let's state you're securing a 30-year fixed-rate mortgage for $300,000 and you're used a 5. 00% rate of interest. According to the rate sheet from your lending institution, decreasing the rate of interest by 0. 25% would cost one point.

No points1 pointCost of pointsNA$ 3,000 Home loan rate5. 00% 4. 75% Regular monthly payment$ 1,610$ 1,565 Regular monthly savingsNA$ 45. 00Total interest costs after thirty years$ 279,671$ 263,373 Overall interest cost savings after 30 yearsNA$ 16,343 We got the numbers utilizing our mortgage calculator, which shows your regular monthly payments. Examine it out to see just how much house you can manage. Whether or not it is clever to purchase mortgage points is based upon your private scenarios.

If you do have the cash, then it's time to do some mathematics in order to choose whether purchasing discount points and decreasing your monthly home mortgage expense through a lower rate is the very best usage of that money. Financial calculators, like a home mortgage points calculator, can inform you the length of time it will take you to break even or begin saving if you buy home loan points.

Some Known Details About How Do Rocket Mortgages Work?

As the example shows, purchasing one point on a $300,000 loan can conserve you thousands of dollars in interest payments in the long run. However those savings do not begin right now due to the fact that of the upfront cost of $3,000. Customers will desire to understand when the real savings start that make the expense of purchasing home mortgage points rewarding.

To determine the break-even point utilizing our example: the expense of home loan points ($ 3,000) divided by the regular monthly cost savings ($ 45) = 67 months. That implies purchasing points won't save you money until after 5 years and 7 months (67 months) into the lifetime of the home loan. For reference, a 30-year mortgage lasts 360 months.

|

|

The 6-Minute Rule for How Do Reverse Mortgages Work Example |

Nevertheless, your successors do have a few alternatives. They can pay off the financial obligation you owe by purchasing the house for the quantity owed or for 95% of the evaluated worth whichever is less. This can be done by paying on their own or re-financing the loan into a regular mortgage. how do right to buy mortgages work.

If the home costs more than it's worth, they can keep the staying cash. If it costs less than what's owed, they won't need to pay the difference. Lastly, they can permit the home to go into foreclosure. The choice your successors make will generally depend upon just how much equity remains in the house.

A reverse home loan is a house loan that you do not need to pay back for as long as you live in your home. It can be paid to you in one lump amount, as a routine month-to-month income, or at the times and in the quantities you want. The loan and interest are repaid only when you sell your house, permanently move away, or die.

They are repaid completely when the last living borrower passes away, offers the house, or completely moves away. Since you make no month-to-month payments, the amount you owe grows bigger over time. By law, you can never owe more than your home's value at the time the loan is paid back.

If you fail to pay these, the loan provider can use the loan to make payments or require you to pay the loan in full. All homeowners need to be at least 62 years of ages. At least one owner should live in the home most of the year. Single household, one-unit home.

Some condominiums, prepared system advancements or made homes. KEEP IN MIND: Cooperatives and a lot of mobile houses are not eligible. Reverse mortgages can be paid to you: All at once in cash As a monthly earnings As a line of credit that lets you choose how much you desire and when In any mix of the above The amount you get usually depends on your age, your home's value and place, and the cost of the loan.

Most people get the most cash from the House Equity Conversion Home Mortgage (HECM), a federally insured program. Loans offered by some states and local federal governments are typically for particular functions, such as paying for house repair work or real estate tax. These are the most affordable expense reverse home loans. Loans used by some banks and mortgage business can be utilized for any function.

The Greatest Guide To How To Reverse Mortgages Work

HECM loans are practically always the least pricey reverse home loan you can obtain from a bank or home loan company, and in lots of cases are considerably less pricey than other reverse mortgages. Reverse home mortgages are most pricey in the early years of the loan and usually end up being less pricey over time.

The federal government needs you to see a federally-approved reverse mortgage counselor as part of getting a HECM reverse mortgage. For more details about Reverse Home mortgages, go to AARP: Comprehending Reverse Mortgages. how do adjustable rate mortgages work.

Marketer Disclosure Lots Of or all of the items included here are from our partners who compensate us. This may affect which items we blog about and where and how the item appears on a page. However, this does not influence our examinations. Our opinions https://penzu.com/p/7803d7db are our own. After retirement, without routine earnings, you might in some cases have a hard time with finances.

A reverse home mortgage is a mortgage that permits homeowners 62 and older to withdraw a few of their home equity and transform it into cash. You don't have to pay taxes on the earnings or make month-to-month home loan payments. You can use reverse home mortgage proceeds nevertheless you like (how do reverse mortgages really work). They're frequently allocated for expenses such as: Financial obligation debt consolidation Living expenses Home improvements Helping kids with college Purchasing another house that might much better fulfill your requirements as you age A reverse home mortgage is the opposite of a conventional home mortgage; rather of paying a lender a regular monthly payment every month, the lending institution pays you.

The amount you get in a reverse home mortgage is based upon a sliding scale of life span. The older you are, the more home equity you can take out. The Federal Real estate Administration guarantees two reverse home loan types: adjustable-rate and a fixed-rate. Fixed-rate reverse home loans include a one-time swelling amount payment.

Adjustables have 5 payment alternatives: Set monthly payments so long as you or your eligible partner remain in the house Set monthly payments for a fixed duration Undefined payments when you need them, till you have actually tired your funds A line of credit and set monthly payments for as long as you or your qualified spouse live in the house A line of credit and set monthly payments for a fixed duration of your choosing To apply for a reverse home mortgage, you need to meet the following FHA requirements: You're 62 or older You and/or an eligible partner who should be called as such on the loan even if she or he is not a co-borrower reside in the house as your main house You have no delinquent federal financial obligations You own your house outright or have a substantial amount of equity in it You participate in the compulsory therapy session with a house equity conversion home loans (HECM) therapist approved by the Department of Housing and Urban Development Your home satisfies all FHA home standards and flood requirements You continue paying all real estate tax, property owners insurance and other home upkeep charges as long as you reside in the home Before issuing a reverse home loan, a loan provider will examine your credit report, confirm your monthly earnings versus your monthly financial commitments and purchase an appraisal on your home.

Nearly all reverse home mortgages are provided as home equity conversion home mortgages (HECMs), which are guaranteed by the Federal Housing Administration. HECMs feature stringent loaning guidelines and a loan limit. If you believe a reverse mortgage might be right for you, find an HECM counselor or call 800-569-4287 toll-free for more information about this funding alternative.

How Do Lendsure Mortgages Work - Questions

A reverse home mortgage is a house loan made by a mortgage lender to a homeowner utilizing the home as security or security. Which is substantially different than with a conventional mortgage, where the property owner uses their income to pay down the debt gradually. However, with a reverse home loan, the loan amount (loan balance) grows in time due to the fact that the house owner is not making regular monthly mortgage payments.

The amount of equity you can access with a reverse home loan is identified by the age of the youngest borrower, existing interest rates, and worth of the home in concern. Please keep in mind that you may need to reserve additional funds from the loan continues to pay for taxes and insurance coverage.

They want to redesign their kitchen area. They have actually found out about reverse mortgage however didn't know the details. They decide to get in touch with a reverse home loan advisor to discuss their existing requirements and future goals if they might access to a portion of the funds kept in their house's equity.

|

|

The Definitive Guide to How Do Mortgages Work In Mexico |

If you're 62 or older and want cash to settle your home mortgage, supplement your earnings, or pay for health care costs you might think about a reverse home mortgage. It permits you to convert part of the equity in your house into cash without having to sell your home or pay additional month-to-month expenses.

A reverse home mortgage can consume the equity in your home, which means less properties for you and your beneficiaries. If you do decide to try to find one, examine the various kinds of reverse mortgages, and contrast store prior to you pick a specific business. Check out on for more information about how reverse home loans work, getting approved for a reverse home mortgage, getting the finest deal for you, and how to report any scams you may see.

In a mortgage, you get a loan in which the lending institution pays you. Reverse home loans take part of the equity in your house and convert it into payments to you a kind of advance payment on your house equity. The cash you get usually is tax-free. Generally, you don't need to repay the cash for as long as you reside in your house.

Sometimes that indicates offering the home to get cash to pay back the loan. There are three kinds of reverse home mortgages: single function reverse home loans used by some state and city government firms, as well as non-profits; exclusive reverse home mortgages private loans; and federally-insured reverse home loans, also known as House Equity Conversion Mortgages (HECMs). how do jumbo mortgages work.

What Does How Do Mortgages Work In Germany Mean?

You keep the title to your home. Instead of paying month-to-month mortgage payments, however, you get an advance on part of your home equity. The cash you get normally is not taxable, and it generally will not impact your Social Security or Medicare benefits. When the last making it through debtor passes away, offers the house, or no longer lives in the house as a primary home, the loan has to be paid back.

Here are some things to consider about reverse mortgages:. Reverse mortgage lenders normally charge an origination cost and other closing costs, along with servicing fees over the life of the mortgage. Some also charge home loan insurance coverage premiums (for federally-insured HECMs). As you get cash through your reverse home get more info mortgage, interest is included onto the balance you owe each month.

Many reverse home mortgages have variable rates, which are tied to a monetary index and change with the marketplace. Variable rate loans tend to offer you more https://diigo.com/0iqeyt options on how you get your cash through the reverse mortgage. Some reverse mortgages mostly HECMs use repaired rates, however they tend to need you to take your loan as a lump amount at closing.

Interest on reverse mortgages is not deductible on income tax returns till the loan is settled, either partially or completely. In a reverse home loan, you keep the title to your house. That implies you are accountable for residential or commercial property taxes, insurance coverage, utilities, fuel, maintenance, and other expenditures. And, if you do not pay your real estate tax, keep property owner's insurance coverage, or maintain your house, the loan provider may require you to repay your loan.

The Main Principles Of How Do Jumbo Mortgages Work

As a result, your lending institution might need a "set-aside" quantity to pay your taxes and insurance coverage during the loan. The "set-aside" reduces the quantity of funds you can get in payments. You are still accountable for maintaining your house. With HECM loans, if you signed the loan documentation and your partner didn't, in specific circumstances, your partner may continue to reside in the home even after you die if she or he pays taxes and insurance coverage, and continues to maintain the property.

Reverse home loans can use up the equity in your home, which indicates fewer properties for you and your heirs. The majority of reverse home loans have something called a "non-recourse" clause. This means that you, or your estate, can't owe more than the worth of your house when the loan ends up being due and the home is offered.

As you think about whether a reverse home loan is ideal for you, also think about which of the three kinds of reverse home loan may finest match your needs. are the least expensive option - how does underwriting work for mortgages. They're provided by some state and city government companies, in addition to non-profit organizations, but they're not readily available all over.

For example, the lending institution might state the loan may be used just to pay for house repair work, enhancements, or residential or commercial property taxes - how do mortgages work in monopoly. Most property owners with low or moderate income can get approved for these loans. are personal loans that are backed by the business that establish them. If you own a higher-valued house, you might get a larger loan advance from a proprietary reverse home mortgage.

Some Known Details About How Mortgages Work Pay Interest First

are federally-insured reverse mortgages and are backed by the U. S. Department of Housing and Urban Advancement (HUD). HECM loans can be used for any purpose. HECMs and exclusive reverse mortgages may be more costly than standard home mortgage, and the upfront expenses can be high. That's important to think about, particularly if you prepare to remain in your home for simply a brief time or obtain a little amount.

In general, the older you are, the more equity you have in your home, and the less you owe on it, the more money you can get. Before applying for a HECM, you need to satisfy with a therapist from an independent government-approved housing counseling agency. Some lending institutions offering exclusive reverse home loans likewise need counseling.

The therapist likewise should explain the possible options to a HECM like federal government and non-profit programs, or a single-purpose or exclusive reverse mortgage. The therapist likewise ought to have the ability to help you compare the expenses of different types of reverse home loans and tell you how various payment choices, fees, and other expenses affect the overall cost of the loan gradually.

Therapy firms usually charge a cost for their services, often around $125. This fee can be paid from the loan proceeds, and you can not be turned away if you can't afford the charge. With a HECM, there generally is no particular income requirement. Nevertheless, loan providers should carry out a monetary assessment when choosing whether to approve and close your loan.

What Does How Do Commercial Real Estate Mortgages Work Do?

Based on the results, the loan provider could need funds to be set aside from the loan proceeds to pay things like property taxes, property owner's insurance, and flood insurance (if appropriate). If this is not required, you still might concur that your lending institution will pay these items. If you have a "set-aside" or you consent Browse around this site to have the lender make these payments, those quantities will be deducted from the amount you get in loan proceeds.

The HECM lets you pick among numerous payment options: a single dispensation alternative this is just available with a fixed rate loan, and generally offers less money than other HECM options. a "term" choice repaired monthly money advances for a particular time. a "tenure" option fixed monthly cash advances for as long as you reside in your home.

This option restricts the quantity of interest enforced on your loan, because you owe interest on the credit that you are utilizing. a combination of regular monthly payments and a credit line. You might be able to alter your payment option for a small fee. HECMs usually provide you bigger loan advances at a lower overall expense than exclusive loans do.

|

|

How Do Double Mortgages Work Things To Know Before You Get This |

Another drawback is the continuous expenditure of keeping your house. You'll be needed to stay up to date with your house's associated expenses. Foreclosure is possible if you discover yourself in a position where can't keep up with property taxes and insurance coverage. Your lending institution might "reserve" a few of your loan proceeds to fulfill these costs in case you can't, and you can likewise ask your lender to do this if you believe you may ever have difficulty spending for home taxes and insurance coverage.

Your lender may select foreclosure if and when your loan balance reaches the point where it exceeds your home's worth. On the positive side, reverse home loans can supply cash for anything you want, from supplemental retirement income to cash for a big home enhancement task. As long as you fulfill the requirements, you can use the funds to supplement your other sources of income or any savings you have actually collected in retirement.

A reverse home loan can certainly relieve the tension of paying your expenses in retirement or perhaps enhance your way of life in your golden years. Reverse mortgages are just readily available to house owners age 62 and older. You usually do not need to repay these loans until you vacate your home or die. Lenders set their own eligibility requirements, rates, costs, terms and underwriting procedure. While these loans can be the simplest to get and the fastest to fund, they're likewise known to bring in unscrupulous experts who utilize reverse home mortgages as Visit the website an opportunity to rip-off unwary senior citizens out of their home's equity. Reverse home loans aren't great for everyone.

A reverse home mortgage may make sense for: Seniors who are experiencing substantial costs late in life People who have actually diminished many of their cost savings and have significant equity in their main residences People who do not have beneficiaries who care to acquire their house While there are some cases where reverse home mortgages can be useful, there are lots of reasons to avoid them.

In reality, if you think you may prepare to repay your loan in full, then you might be better off preventing reverse home mortgages entirely. Nevertheless, generally speaking, reverse home mortgages need to be paid back when the borrower dies, moves, or offers their house. At that time, the debtors (or their heirs) can either repay the loan and keep the residential or commercial property or sell the house and use the profits to pay back the loan, with the sellers keeping any profits that remain after the loan is paid back.

However much of the ads that customers see are for reverse mortgages from personal business. When working with a private lenderor even a personal business that declares to broker federal government loansit's essential for debtors to be mindful. Here are some things to keep an eye out for, according to the FBI: Do not react to unsolicited mailers or other advertisements Don't sign files if you do not comprehend themconsider having them evaluated by a lawyer Don't accept payment for a home you don't own Watch out for anybody who states you can get free ride (i.

All about How Mortgages Work Canada

In other cases, frauds try to force homeowners to get reverse home mortgages at difficult rate of interest or with hidden terms that can trigger the borrower to lose https://telegra.ph/an-unbiased-view-of-how-arm-mortgages-work-10-19 their property. Reverse home mortgages aren't for everyone. In lots of cases, potential borrowers may not even qualify, for example, if they aren't over 62 or don't have substantial equity in their homes.

Alternatives consist of: Supplies money to cover essential medical expenditures late in life All costs can be rolled into the loan balance Interest rates are competitive with other kinds of home mortgages Loans don't need to be paid back expense Overall loan costs, inclusive of fees, can be considerable The loan must be repaid for heirs to acquire your residential or commercial property Needs to own the home outright or have at least 50% equity to qualify You need to prevent rip-offs The majority of loans need mortgage insurance coverage.

The following is an adaptation from "You Do not Have to Drive an Uber in Retirement": I'm normally not a fan of monetary items pitched by previous TV stars like Henry Winkler and Alan Thicke and it's not since I as soon as had a shouting argument with Thicke (true story). how do jumbo mortgages work. When monetary products need the Fonz or the papa from Growing Pains to encourage you it's a good concept it probably isn't.

A reverse home loan is type of the reverse of that. You already own your house, the bank gives you the money up front, interest accumulates monthly, and the loan isn't repaid till you die or vacate. If you die, you never repay the loan. Your estate does.

When you take out a reverse mortgage, you can take the cash as a lump amount or as a line of credit anytime you want. Sounds great, right? The truth is reverse home loans are exorbitantly costly loans. Like a routine home loan, you'll pay different costs and closing expenses that will amount to countless dollars.

With a routine home mortgage, you can avoid paying for mortgage insurance coverage if your down Click to find out more payment is 20% or more of the purchase rate. Because you're not making a deposit on a reverse mortgage, you pay the premium on home mortgage insurance coverage. The premium equates to 0. 5% if you get a loan equal to 60% or less of the evaluated value of the house.

Everything about How Mortgages Work Canada

5% if the loan amounts to more than 60% of the house's worth. If your house is assessed at $450,000 and you secure a $300,000 reverse home loan, it will cost you an extra $7,500 on top of all of the other closing costs. You'll likewise get charged roughly $30 to $35 monthly as a service fee.

If you are anticipated to live another ten years (120 months) you'll be charged another $3,600 to $4,200. That figure will be subtracted from the amount you receive. The majority of the fees and costs can be rolled into the loan, which means they compound gradually. And this is an essential distinction between a routine home mortgage and reverse home loan: When you pay on a routine home mortgage monthly, you are paying for interest and principal, lowering the quantity you owe.

A routine home loan substances on a lower figure monthly. A reverse mortgage substances on a greater number. If you die, your estate pays back the loan with the earnings from the sale of your home. If one of your successors desires to live in your home (even if they currently do), they will have to discover the cash to repay the reverse home loan; otherwise, they need to offer the house.

|

|

The Definitive Guide to How Do Split Mortgages Work |

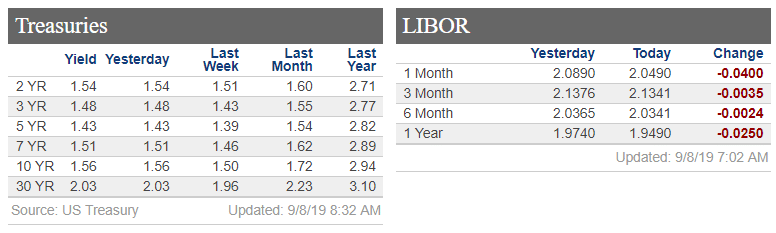

Otherwise, they'll be variable based on the London Interbank Offered Rate (LIBOR), with a margin included for the lending institution. Federally backed reverse home mortgages have a 2% in advance home loan insurance coverage premium and annual premiums of 0. 5%. Mortgage insurance coverage is meant to secure lending institutions in case of debtor default. While reverse home loans can't usually default in the exact same methods as traditional mortgageswhen borrowers stop working to make paymentsthey can still default when owners stop working to pay real estate tax or insurance coverage or by stopping working to appropriately preserve their residential or commercial properties.

Lenders also generally charge other costs, consisting of for property appraisals, servicing/administering loans and other closing costs, such as credit check fees. However, all costs are typically rolled into the balance of the home loan, so loan providers don't require to pay them expense. Most reverse mortgages are government-insured loans. Like other government loans, like USDA or FHA loans, these items have guidelines that standard home loans do not have, since they're government-insured.

There are likewise personal reverse home mortgages, which do not have the very same strict eligibility requirements or loaning requirements. Single-purpose loans are generally the least pricey type of reverse home loan. These loans are provided by nonprofits and state and city governments for particular functions, which are dictated by the loan provider. Loans may be offered for things like repairs or improvements. In addition, you must fulfill financial eligibility criteria as established by HUD. A reverse home loan typically does not end up being due as long as you meet the loan obligations. For example, you should reside in the home as your primary residence, continue to pay required property taxes, homeowners insurance and preserve the home according to Federal Housing Administration requirements.

In case of death or on the occasion that the house ceases to be the primary house for more than 12 months, the property owner's estate can select to pay back the reverse home loan or put the home up for sale. If the equity in the house is greater than wesley financial the balance of the loan, the remaining equity belongs to the estate.

No other properties are impacted by a reverse home mortgage. For instance, investments, 2nd homes, cars and trucks, and other valuable possessions can not be taken from the estate to settle the reverse mortgage. The amount that is offered normally depends upon four aspects: the age of the youngest customer, current rates of interest, appraised value of the home and government imposed financing limitations.

Not known Details About How Does Noi Work With Mortgages

Please note that you may need to set aside extra funds from loan proceeds to pay for taxes and insurance coverage. There are a number of ways to get the earnings from a reverse home mortgage: Lump amount a swelling amount of money at closing (how do reverse mortgages work after death). (only offered for fixed-rate loans) Tenure equivalent month-to-month payments as long as the homeowner resides in the house.

Credit line draw any amount at any time up until the line of credit is exhausted. Any combination of those listed above Unlike a Home Equity Line of Credit (HELOC), the HECM does not require the customer to make regular monthly mortgage payments1 and any current mortgage or compulsory responsibilities must be settled using the profits from the reverse mortgage loan.

In addition, a HECM reverse home loan credit line can not be minimized by the lending institution and any unused part of the line of credit will grow over time. 2 With http://juliusqgcd603.lucialpiazzale.com/not-known-...rtgages-work-after-foreclosure a reverse mortgage the amount that can be obtained is determined by an FHA formula that thinks about the age of the youngest customer, the existing rates of interest, and the appraised worth of the house.

A reverse mortgage is a mortgage loan, usually protected by a home, that enables the customer to access the unencumbered worth of the residential or commercial property. The loans are normally promoted to older house owners and typically do not need regular monthly home loan payments. Customers are still accountable for property taxes and homeowner's insurance coverage.

Because there are no required mortgage payments on a reverse home loan, the interest is added to the loan balance each month. The rising loan balance can eventually grow to surpass the worth of the home, particularly in times of decreasing house worths or if the borrower continues to reside in the house for several years.

Examine This Report on How Do Double Mortgages Work

In the United States, the FHA-insured HECM (home equity conversion home loan) aka reverse mortgage, is a non-recourse loan. In simple terms, the debtors are not responsible to pay back any loan balance that surpasses the net-sales proceeds of their house. For example, if the last borrower left the house and the loan balance on their FHA-insured reverse home mortgage was $125,000, and the home offered for $100,000, neither the debtor nor their successors would be responsible for the Visit this page $25,000 on the reverse home mortgage loan that went beyond the value of their house.

A reverse mortgage can not go upside down. The expense of the FHA home mortgage insurance is a one-time fee of 2% of the appraised value of the home, and after that an annual cost of 0. 5% of the outstanding loan balance. Particular rules for reverse home loan deals differ depending upon the laws of the jurisdiction.

Some economic experts argue that reverse home mortgages might benefit the elderly by raveling their earnings and usage patterns with time. Nevertheless, regulative authorities, such as the Customer Financial Security Bureau, argue that reverse home loans are "complex products and difficult for consumers to comprehend", particularly due to "deceptive advertising", low-quality therapy, and "danger of scams and other scams".

In Canada, the borrower needs to seek independent legal advice prior to being authorized for a reverse mortgage. In 2014, a "fairly high number" of the U.S. reverse home loan debtors about 12% defaulted on "their real estate tax or homeowners insurance". In the United States, reverse mortgage borrowers can face foreclosure if they do not preserve their houses or maintain to date on property owner's insurance coverage and home taxes.

Under the Accountable Lending Laws the National Consumer Credit Defense Act was amended in 2012 to include a high level of regulation for reverse home mortgage. Reverse home loans are likewise regulated by the Australian Securities and Investments Commission (ASIC) needing high compliance and disclosure from loan providers and consultants to all borrowers.

The Main Principles Of How Do Collateralized Debt Obligations Work Mortgages

Anyone who desires to take part in credit activities (including loan providers, lessors and brokers) should be accredited with ASIC or be a representative of somebody who is licensed (that is, they should either have their own licence or come under the umbrella of another licensee as an authorised credit representative or staff member) (ASIC) Eligibility requirements differ by lender.

|

|

What Does How Do Interest Rates Work On Mortgages Loans Mean? |

Since of this compound interest, as a reverse home loan's length grows, it ends up being most likely to deplete the whole equity of the residential or commercial property. However, with an FHA-insured HECM reverse mortgage obtained in the United States or any reverse home loan acquired in Canada, the borrower can never owe more than the worth of the residential or commercial property and can not pass on any financial obligation from the reverse home loan to any heirs.

Reverse home mortgages can be confusing; numerous obtain them without completely understanding the terms, and it has been suggested that some lending institutions have actually sought to take advantage of this. A majority of participants to a 2000 survey of senior Americans stopped working to comprehend the financial regards to reverse home loans really well when securing their reverse mortgages.

Some ninety-three percent of borrowers reported that they were pleased with their experiences with loan providers, and ninety-five percent reported that they were satisfied with the therapists that they were required to see. (PDF). Consumer Financial Protection Bureau. Retrieved 1 January 2014. " How the HECM Program Works HUD.gov/ U.S. Department of Housing and Urban Development (HUD)".

hud.gov. Shan, Hui (2011 ). " Reversing the Pattern: The Current Expansion of the Reverse Mortgage Market" (PDF). Realty Economics. 39 (4 ): 743768. doi:10. 1111/j. 1540-6229. 2011.00310. x. Chen, Y-P. Unlocking home equity for the elderly (Ed. with K. Scholen). Cambridge, Massachusetts: Ballinger, 1980. Moulton, Stephanie; Haurin, Donald R.; Shib, Wei (November 2015).

90: 1734. doi:10. 1016/j. jue. 2015. 08.002. Schwartz, Shelly (May 28, 2015). " Will a reverse home mortgage be your friend or foe?". CNBC. Recovered December 24, 2018. " Reverse mortgages". ASIC Cash Smart Site. Retrieved 28 September 2016. " Customer Credit Guideline". ASIC Cash Smart Site. Obtained 28 September 2016. " Reverse Mortgages". National Info Centre on Retirement Investments Inc (NICRI).

" How does a Reverse Home loan work?". Equity Keep. Equity Keep. how do reverse mortgages work example. " Reverse Mortgage Retirement Loans Macquarie". www. macquarie.com. Retrieved 2016-10-06. " Rates & costs". Commonwealth Bank of Australia. Obtained 13 September 2012. " Why Reverse Mortgage? Top 7 Reverse Home Loan Purpose". Recovered 2016-10-06. " Functions". Commonwealth Bank of Australia. Obtained 13 September 2012. " Influence on your pension".

The Ultimate Guide To How Do First And Second Mortgages Work

Retrieved 12 September 2012. " Reverse Home mortgages". ASIC Cash Smart Website. Retrieved 28 September 2016. Wong = Better Home Canada's, Daniel (December 26, 2018). " Canadian Reverse Mortgage Financial Obligation Simply Made One of The Most Significant Leaps Ever". Better House. Recovered January 2, 2019. " Comprehending reverse home mortgages". Financial Consumer Firm of Canada. Federal government of Canada.

Recovered 20 December 2015. " Reverse Mortgage Secrets - The Fact About CHIP Reverse Home Loans". Reverse Home Loan Pros. Dominion Lending Centres Edge Financial. Retrieved 31 January 2017. " Home Earnings Strategy (Reverse Home Mortgage in Canada): How Does a Canadian Reverse Home Loan Work". Origin Mortgages DLC. Obtained 12 September 2012. " Reverse Home mortgages: How the Strategy Works".

Retrieved 11 September 2012. [] Heinzl, John (31 October 2010). " The reverse mortgage predicament". The World and Mail. Obtained 12 September 2012. " Reverse Home Mortgage Costs And Charges - All You Required To Know". Reverse Home Mortgage Pros. Dominion Loaning Centres Edge Financial. 2018-03-24. Retrieved 12 October 2018. " Costs And Fees For A Reverse Home loan".

Rule Lending Centres Edge Financial. 2018-03-24. Obtained 12 October 2018. " The Reverse Home Mortgage Credit Line;". Reverse Home Loan Pros. Rule Lending Centres Edge Financial. Obtained 7 November 2017. " Top 8 Typical Misconceptions". Reverse Mortgage Pros. Rule Financing Centres Edge Financial. 2018-01-25. Obtained 12 October 2018. " Reverse Home Loan Pros". Reverse Home Loan Pros.

Retrieved 31 January 2017. " Text of S. 825 (100th): Real Estate and Neighborhood Advancement Act of 1987 (Passed Congress/Enrolled Expense version) - GovTrack. us". GovTrack. us. Recovered 2015-12-22. "- REVERSE MORTGAGES: POLISHING NOT STAINING THE GOLDEN YEARS". www. gpo.gov. Obtained 2015-12-23. 12 U.S.C. 1715z-20( b)( 1 ); 24 C.F.R. 206. 33. (PDF). 12 U.S.C.

1715z-20( d)( 3 ). " FHA's Home Equity Conversion http://chancehnic604.almoheet-travel.com/getting-m...tion-of-mortgages-work-to-work Home Mortgage Program". United States Department of Housing and Urban Development. 14 October 2010. Archived from the initial on 2012-09-06. Recovered 11 September 2012. " Reverse Home loan: What is it and how does it work? 2016-10". " Fascinating Reverse Home Mortgage Realities". 2014-06-11. Recovered 2014-07-03. (PDF). " MyHECM Principal Limitation Calculator".

Get This Report about How Do Mortgages Work In Mexico

AARP.com. March 2010. Retrieved 11 September 2012. (PDF). " Archived copy". Archived from the original on 2010-06-14. Obtained 2009-06-06. CS1 maint: archived copy as title (link) Ecker, Elizabeth (2013-11-06). " Texas Votes "Yes" to Allow Reverse Mortgage For Purchase Product". Obtained 2014-01-10. Sheedy, Rachel L. (January 2013). " Purchase a Home With a Reverse Home mortgage".

Recovered 2014-01-10. Coates, Tara (11 February 2011). " 10 Things You Ought To Learn About Reverse Home Loans: Before you sign, ensure you understand about limitations, charges". AARP.com. Reverse Home Loans: A Lawyer's Guide. American Bar Association. 1997. " Details on Reverse Mortgages". AARP. 12 U.S.C. 1715z-20( j). (PDF). See Home Equity Conversion Mortgages Month-to-month Report (May 2010), http://www.

cfm Archived 2010-05-28 at the Wayback Maker Pub. L. No. 109-289, s. 131 (2006 ). See for instance the Omnibus Appropriations Act, 2009, Pub. L. No. 111-8, s. 217 (Mar. 11, 2009). For HUD's HECM Summary Reports, see http://www. hud.gov/ pub/chums/f17fvc/ hecm. cfm Archived 2015-09-24 at the Wayback Device, United States Census Bureau, 2000-01-13.

Archived 2015-09-24 at the Wayback Machine Projections of the Total Citizen Population by 5-Year Age, and Sex with Special Age Categories: Middle Series, 2025 to 2045], United States Census Bureau, 2000-01-13. Accessed 2015-06-30. " National Retirement Threat Index Center for Retirement Research". crr. bc.edu. Retrieved 2016-07-14. " Working Paper: HECM Reverse Mortgages: Is Market Failure Fixable? - Zell/Lurie Center".

wharton.upenn. edu. Obtained 2016-07-14. HKMC Reverse Home Loan Program - http://www. hkmc.com. hk/eng/our _ business/reverse _ mortgage_programme. html " Just how much will a reverse home loan expense?". Consumer Financial Protection Bureau. Recovered 2020-01-02. Santow, Simon (25 May 2011). " Reverse mortgages grow, but so do warnings". Australian Broadcasting Corporation (ABC). Recovered 12 September 2012. (PDF). June 2012.

Hallman, Ben (27 June 2012). " Reverse Home Mortgage Foreclosures Increasing, Seniors Targeted For Frauds". Huffington Post. Retrieved 12 September 2012. " Reverse Mortgages Are Not the Next Sub-Prime". mtgprofessor. com.

How Do Mortgages Work In Mexico Things To Know Before You Get This

A reverse mortgage enables people to pull the equity out of their home. It is an option that many older people are turning to help them through retirement. explain how mortgages work. Numerous individuals are concerned that "what is reverse home loan confusion' can cause seniors to be hesitant to take out timeshare presentation near me a reverse mortgage.

You need to timeshare mortgage comprehend the reverse home loan drawbacks, consisting of how it will put your home at danger, in addition to the advantages of a reverse home loan. You can discover information on reverse home loans at a bank, however you might also wish to participate in a workshop about them before you register for them.

A reverse home mortgage is appealing due to the fact that it allows these people to secure the equity from their home when they require it. When you get a reverse home loan, you can choose to secure a swelling amount or to have regular monthly payments made to you. You do not need to pay back the loan till you sell the home or stop residing in it.

Lots of people like the reverse mortgage, since it enables you to squander your equity while continuing to live in your home. You will require to preserve house owner's insurance coverage, and pay your taxes on your home. You can pay on your reverse mortgage, but you are not needed to make them.

|

|

The 30-Second Trick For How Do Reverse Mortgages Work When Someone Dies |

I informed you that we do not suggest reverse home mortgages for everyone. If a reverse home mortgage does not fulfill your needs and you are still going to be scraping to get by, you will need to face that truth before you begin to use your equity. If the will approach the amount you will receive from the loan, considering that you reside in an area where closing costs are very high, and your residential or commercial property value is less than $40,000, you need to believe difficult about whether you wish to utilize your equity on such an endeavor.

The reverse home mortgage is supposed to be the last loan you will ever need. If you understand you are not in your forever home, think about using your reverse home loan to buy the right house instead of utilizing it as a short-term option one that is not a true service at all. You need to go to therapy, a "consumer details session" with a HUD-approved counselor, before your HECM loan can be funded. This rule is planned to make sure that you understand the expense and effects of getting this type of loan. Therapists work for independent companies. These courses are readily available at a low expense and in some cases they're even free.

For many borrowers, this means settling your remaining home wesley go loan debt with part of your reverse mortgage. This is most convenient to attain if you have at least 50% equity or so in your house. You have a few options, but the most basic is to take all the money simultaneously https://www.linkedin.com/ccompany/WesleyFinancialGroup in a lump amount.

You can also pick to receive routine periodic payments, such as once a month. These payments are described as "period payments" when they last for your entire life time, or "term payments" when you get them for simply a set duration of time, such as 10 years. It's possible to take out more equity than you and your loan provider expected if you go with tenure payments and live an exceptionally long life.

This permits you to draw funds just if and when you need them. The advantage of a line-of-credit technique is that you just pay interest on the cash you've really borrowed. You can also use a mix of payment alternatives. For example, you may take a little lump sum upfront and keep a line of credit for later on.

For instance, the home will go on the market after your death, and your estate will receive cash when it sells. That money that needs to then be utilized to settle the loan. The complete loan amount comes due, even if the loan balance is greater than the house's value, if your beneficiaries choose they desire to keep the house.

Unknown Facts About How Do Rehab Mortgages Work

Lots of reverse home loans consist of a provision that does not allow the loan balance to go beyond the worth of the house's equity, although market fluctuations might still lead to less equity than when you got the loan. how do second mortgages work in ontario. It's possible that your estate may offer sufficient other properties to allow your successors to settle the reverse mortgage at your death by liquidating them, but they may otherwise not have the ability to certify for a regular home mortgage to pay off the debt and keep the household home.

You'll pay a number of the same closing expenses required for a standard home purchase or re-finance, however these fees can be higher. Charges minimize the amount of equity left in your house, which leaves less for your estate or for you if you decide to sell the house and settle the home loan.

Fees are typically funded, or constructed into your loan. You don't compose a look for them at closing so you may not feel these expenses, but you're still paying them regardless. You need to have your home evaluated, adding to your expenses. The lender will desire to make certain that your home in great shape prior to writing the loan. what are reverse mortgages and how do they work.

A reverse home loan lets older homeowners take advantage of their home's equity for a lump sum payment, periodic payments, or in the type of a line of credit. Reverse home loans do not need to be paid back until the property owner passes away or vacates the residence. Stays in care centers for less than a year are all right.

Interest accrues over the life of the loan, so the quantity essential to settle the mortgage will probably be substantially more than the original loan earnings.

Are you considering whether a reverse mortgage is right for you or an older house owner you know? Before thinking about among these loans, it pays to understand the truths about reverse home mortgages. A reverse home mortgage, in some cases understood as a Home Equity Conversion Home Loan (HECM), is a special kind of loan for homeowners aged 62 and older that lets you convert a part of the equity in your home into cash.

How Do Right To Buy Mortgages Work Can Be Fun For Anyone

Taking out a reverse home mortgage is a big choice, because you might not have the ability to get out of this loan without selling your house to pay off the debt. You likewise require to carefully consider your choices to prevent consuming all the equity you have actually built up in your house.

Reverse home mortgages normally are not utilized for holidays or other "enjoyable" things. The truth is that a lot of customers utilize their loans for immediate or pressing financial needs, such as paying off their existing home loan or other financial obligations. how do construction mortgages work. Or they may consider these loans to supplement their month-to-month earnings, so they can manage to continue living in their own house longer.

Taking out any house loan can be pricey since of origination charges, servicing charges, and third-party closing charges such as an appraisal, title search, and recording expenses. You can spend for the majority of these costs as part of the reverse home mortgage loan. Reverse home mortgage debtors likewise need to pay an upfront FHA mortgage insurance coverage premium.

It also guarantees that, when the loan does become due and payable, you (or your heirs) do not need to repay more than the worth of the house, even if the quantity due is higher than the assessed value. While the closing costs on a reverse home loan can sometimes be more than the costs of the house equity credit line (HELOC), you do not have to make regular monthly payments to the lending institution with a reverse home loan.

|

|

Little Known Questions About What Can Mortgages Be Used For. |

|

|

The How Do Mortgages Work With Married Couples Varying Credit Score Ideas |

|

|

How When Does Bay County Property Appraiser Mortgages can Save You Time, Stress, and Money. |

Selecting a home mortgage isn't as easy as it sounds. That's because there are many kinds of mortgages available and they're comprised of different componentsfrom the rates of interest to the length of the loan to the lending institution. Let's have a look at the pros and cons of the alternatives out there, so you Helpful resources can make a notified choice when it concerns your home mortgage.

You can lock the rate, make it adjustable, or do a mix of both. For instance, if you get a 30-year home mortgage with a 5/1 adjustable-rate home loan, your rate of interest will lock for five years, then adjust annually for the remaining 25 years. The rate of interest stays the very same for the entire time it takes you to pay off the loan, so the size of your regular monthly payment remains the very same, that makes it simpler to plan your budget plan.

ARMs offer a lower rate of interest (and monthly payment) for the first couple of years. Sure, the initial low interest rate is appealing, however in exchange for that lower rate in advance, the danger of greater rates of interest down the road is moved from the lender to you - what are the different options on reverse mortgages. Lots of people discover this type of mortgage enticing since they can certify for a more helping timeshare owners llc costly home.

ARMs are one of the worst types of home mortgages out there. Keep more of your money and choose a fixed-rate mortgage rather. Your mortgage term refers to the length of your loan in years. It's an arrangement with your loan provider on the maximum amount of time it'll take you to pay off the loan in full.

A 15-year term keeps you on track to pay off your home quickly, and typically has a lower rates of interest and expenses less overall interest compared to longer term loans. A 15-year term comes with a higher monthly payment compared to a 30-year or longer term. You'll have lower month-to-month payments with a 30-year term, compared to a 15-year.

You'll pay drastically lower regular monthly payments with a 50-year term, compared to shorter term home loans. Your rate of interest will be even greater than with a 30-year term, which indicates you'll pay the most in overall interest out of the terms noted here. Choosing a 30-year (or longer) mortgage feeds into the concept that you need to base significant monetary decisions on how much they'll cost you monthly.

If you wish to get ahead with your cash, you've got to take the overall expense into factor to consider. (We'll compare expenses of different home loan alternatives a little later.) A 30-year mortgage means 15 more years of debt and countless dollars more in interest. No thanksgo for the 15-year term, pay less in interest, and.

The Buzz on What Is The Current % Rate For Home Mortgages?

A non-traditional loanlike a subprime mortgagebreaks those guidelines. Non-traditional loans likewise include government-insured programs (FHA, VA, USDA) that set their own underwriting guidelines. If the loan satisfies these agencies' standards, they consent to buy your home if the loan provider forecloses on the home, so the lending institution will not lose cash if you do not make payments.

Standard loans aren't backed by the government, so loan providers can charge a greater interest rate or require a higher down payment (typically a minimum of 5%) compared to unconventional loans. This kind of loan also requires you to pay private home mortgage insurance (PMI) if your down payment is less than 20% of the house's value.

The perceived pro is that loan providers will give you money to purchase a home, even if you have bad credit and no cash. Subprime home mortgages were designed to assist individuals who experience setbackslike divorce, unemployment, and medical emergenciesget a house. Lenders know there's a huge threat in lending cash to people who have no moneygo figure.

With Federal Real Estate Administration (FHA) loans, you can get a mortgage with just a 3.5% deposit. You're needed to pay a mortgage insurance coverage premium (MIP)a cost similar to PMI, except that you have to pay it for the life of the loan. The only way to eliminate MIP is if you have more than a 10% down paymentbut even then, you'll still have to pay it for a period of 11 years! MIP can add an extra $100 a month per $100,000 borrowed.

No thanks! With Department of Veterans Affairs (VA) loans, military veterans can buy a home with practically no down payment or home loan insurance. When you buy a home with absolutely no cash down and things alter in the housing market, you could wind up owing more than the marketplace worth of your home.

This fee can vary anywhere from 1.25% to 3.3% of your loan, depending upon your military status, down payment amount, and whether it's your first time funding a home with a VA loan. That's anywhere from $2,500 to $6,600 for a $200,000 loan. The United States Department of Farming (USDA) offers a loan program, managed by the Rural Housing Service (RHS), to people who live in backwoods and reveal a monetary requirement based on a low or modest earnings.

You can't re-finance your loan to improve your rate of interest, and the prepayment penalties are horrendous. USDA subsidized loans are created to get individuals who really aren't ready to purchase a home into one. If that's the only way you qualify, then you can't manage a home right now. Prevent the higher costs and hidden constraints of unconventional loans.

how-do-balloon-fixed-rate-mortgages-work-an-overview id="content-section-2">The Main Principles Of How Many Mortgages Can You Have With Freddie MacYour mortgage will either be thought about an adhering or non-conforming loan, depending on just how much cash a loan provider will provide you. An adhering loan is one that satisfies the standard underwriting guidelines (the approval process) of your particular mortgage program. For example, standards for unconventional loans are figured out by the FHA or VA, while government-sponsored business like Fannie Mae or Freddie Mac provide the standards for standard loans.

However they'll only purchase loans that are within the size limits established by their standards. If your loan size surpasses their limitations and does not comply with their guidelinesas holds true with a jumbo loanit's thought about a non-conforming loan. With adhering loans, you'll pay a lower rate of interest compared to non-conforming loans.

Jumbo loans exceed loan quantity limits set by Fannie Mae and Freddie Mac, which implies you can get a higher priced house. They need excellent credit and larger down payments, and they have higher rates of interest than conforming loans. A conforming Fannie Mae loan will be your most inexpensive alternative here, if you put 20% down to avoid PMI.

But there's a type of mortgage that does the opposite. With reverse home mortgages, senior property owners can supplement their limited earnings by obtaining versus their home equity (the value of your home minus your current loan balance). They'll receive tax-free, regular monthly payments or a lump sum from the lending institution. With this type of home mortgage, you sell off your equitythe part you ownfor cash. Currently the limitation in most parts of the nation is $417,000, however in specific designated high-price markets it can be as high as $938,250. Wondering if you're in a high-cost county? Here is the whole list of adhering loan limits for high-cost counties in specific states. Loans that surpass this amount are called jumbo loans.

Why would you want a jumbo loan? The easiest answer is due to the fact that it permits you to purchase a higher-priced home, if you can manage it. However these loans have versatility that adhering loans don't have, such as not constantly needing mortgage insurance when the down payment is less than 20 percent.

And they typically need greater down payments and outstanding credit, which can make them more challenging to certify for. You can learn more about these and other programs here. It's also an excellent concept to talk with a local lender to hear more about their choices get prepared by familiarizing yourself with mortgage-related terms using our convenient glossary.

If you are thinking of buying a home, understanding the mortgage market and the numerous types of "items" is extremely essential. Considering that it is most likely you will be paying long-lasting, you are going to wish to select the very best home loan that meets your spending plan and requirements. Not all home loans are the same and depending upon your circumstance, you may require to check out multiple options.

The Basic Principles Of What Act Loaned Money To Refinance Mortgages

There are numerous nuances and qualifications connected to each of these, and you will require to talk with a home loan professional to find out which is ideal for you. This loan is not backed by the federal government. If you have good credit and can put down 3% then you can usually get approved for this loan backed by Freddie Mac or Fannie Mae.

They sell and buy nearly all conventional home mortgages nationwide. If you wish to prevent requiring personal home mortgage insurance coverage (PMI) you're going to require to make at least a 20% deposit. However, some lenders do offer these loans with a lower deposit and no need for PMI. This loan is specifically for veterans, service members, and military partners.

This suggests that 100% of the loan quantity can be financed. You likewise get a cap on closing costs which is a significant advantage. These loans are released by personal home mortgage loan providers and are always guaranteed by the U.S. Department of Veterans Affairs (VA). Keep in mind that this loan does require a financing cost to assist balance out taxpayer costs.

You may likewise be able to pull out of paying financing charges if you are a veteran who did not get active duty pay or any retirement. FHA means Federal Housing Administration. This loan is excellent for newbie home buyers or those who have actually not conserved enough for a big deposit.

Down payments are able this low due to the fact that of the fact that Federal Housing Administration loans are government-backed. The benefits of this loan include being able to pay your home loan at any time without prepayment charges, many term options with fixed rates, and the choice for a five-year adjustable rate home mortgage.

This makes them non-conforming loans. In simpler terms, when a loan amount reaches a specific point, Jumbo Mortgages and Super Jumbo Loans can provide high-end financing that a conventional loan can not. So, if you need to finance a high-end home that is too expensive for a conventional loan, this is a good choice for you.

This home loan normally uses rate of interest lower than a fixed rate home mortgage. Adjustable methods that if general rate of interest increase, so will your regular monthly payment. Vice versa, if rates fall, your payment will reduce too. This loan is great if you are having a hard time financially and reside in a backwoods (who has the lowest apr for mortgages).

Things about What Are Interest Rates On Second Mortgages

With this loan, the federal government can finance one hundred percent of the house expense. This only opts for USDA eligible houses. Benefits include no down payment required and better rates of interest. While you may be thinking that a person of these loan options seems like the perfect fit for your situation, depending on the loan type, there are numerous credentials requirements you will require to browse.

In some cases, your personal choice might be another aspect that could impact your loan choice. After all, you have choices to make on how you wish to structure your mortgage and pay it off. From terms and loan length, to down payments and loan size, these factors will affect your choices as it associates with your home mortgage.

If you wish to purchase a house and you do not have enough cash to pay for the entire rate of that house as the down payment, you're probably going to need to get a home loan. Easier stated than done, nevertheless. There are a variety of various home loans you could qualify for to spend for your home, each with various pros and cons.

One of the most common distinctions in between home loans is the kind of rates of interest they have. Lenders earn a profit by providing customers money and then asking for it back with interest. The amount of interest is generally determined by a percentage of the cash borrowed. For instance, if you get a home mortgage for $300,000 with a 4% interest rate, and you pay the minimum payments monthly, at the end of the year you'll have paid 12,000.

That involves paying on your premium versus paying on your interest, which you can learn about here.) With both types of mortgages you need to get home insurance, and it's a good concept to research study house guarantee plans and get the extra coverage on your home. There are 2 kinds of interest rates for mortgages, adjustable and fixed.

Then, the interest rate changes from year to year over the life of the loan. Many of these loans consist of a cap (it can't go above 10%, for example) and doesn't require home loan insurance. This type of home mortgage is appealing since it shows a lower interest rate at the start of the loan, which might help individuals who can't pay as much or are moving quickly.

This kind of mortgage needs house insurance coverage strategies and Landmark likewise suggests house warranty plans. A set rate home mortgage has an interest rate that remains the very same throughout the whole time of the home mortgage. These types of home mortgages can last in between 10 and 40 years. The longer the length of the loan, the smaller the regular monthly payments will be, however the more you'll wind up paying on interest.

|

|

The 4-Minute Rule for What Are Brea Loans In Mortgages |

( For simplicity, we neglected residential or commercial property tax, property owner's insurance coverage, and HOA fees on each example.) Let's state you concern the table with a down payment of 20% to avoid PMI and you finance the staying $160,000 with a 5/1 adjustable-rate home loan at a preliminary interest rate of 3.25%. You 'd begin paying $696 a month for principal and interest.

By the in 2015, your payment depends on $990, and you 'd pay $147,962 in interest over the life of the loan. Amount You Pay Above Original Purchase Price $696$ 990 $307,962 $147,962 With a minimum deposit of simply 3.5% on a 30-year loan at 3.75% interest, your monthly payment would total $1,031.

You 'd also pay $3,378 in upfront MIP at closing and $128,774 in interest over the life of the loan. Quantity You Pay Above Original Purchase Cost $1,031 $374,366 $181,366 Let's state you put no money down on a 30-year home mortgage at 3.5% interest. For this example, we'll assume your VA financing cost is $4,300 and you finance it into your loan since you don't have any extra cash on hand.

/GettyImages-105928203-59f3d2b3519de200116cf1a1.jpg)

Amount You Pay Above Original Purchase Price $917 $330,263 $130,263 If you put 5% down and finance the rest with a at 3.875% interest, you'll pay $893 a month in principal and interest, plus PMI, which we'll calculate at 0.5% (or $79/month) for this example. Your overall interest paid would pertain to $131,642 by the time your home loan is done, and your PMI would immediately drop off after a little over 8.5 years.

That conserves you anywhere from $85,000 to $107,000 in interest charges alone! Envision what you might achieve with that kind of money in your pocket! Amount You Pay Above Original Purchase Cost $1,115 $240,624 $40,624 If we stack these 5 mortgage options versus each other, it's simple to see where the costs include up.

The Best Strategy To Use For How Many Mortgages To Apply For

Now that you know the mathematics, do not get a house with a home loan that'll squash your financial dreams. To assist get the procedure started, get in touch with our friends at. They're a trusted lending institution who in fact believes in debt-free homeownership. After that, make sure and get in touch with a who will keep your benefits in mind and concentrate on serving you initially in your search for the best home.

Buying a house is exciting, but figuring out the financing side of things can feel frustrating. Chin up: Picking amongst the various types of home loan loans isn't all that painful if you know the terminology. As soon as you have actually done some homework and nailed down a budget and down payment quantity, and you have actually examined your credit, you'll have a much better concept of what loan works best for your needs.

A conventional mortgage is a mortgage that's not guaranteed by the federal government. There are 2 types of traditional loans: conforming and non-conforming loans. A conforming loan simply implies the loan amount falls within optimum limits set by Fannie Mae or Freddie Mac, the government-sponsored business (GSEs) that back most U.S.

The types of mortgage that don't satisfy these standards are thought about non-conforming loans. Jumbo loans, which represent large home loans above the limits set by Fannie and Freddie for different counties, are the most common type of non-conforming loan. Typically, loan providers need you to pay private home loan insurance on numerous standard loans when you put down less than 20 percent of the house's purchase cost.

This suggests the home price goes beyond federal loan limitations. For 2020, the optimum adhering loan limitation for single-family houses in the majority of the U.S. is $510,400. In specific high-cost locations, the ceiling is $765,600. Jumbo loans are more typical in higher-cost areas, and normally require more in-depth documents to qualify.

9 Simple Techniques For Who Issues Ptd's And Ptf's Mortgages

Jumbo debtors should have great to outstanding credit, a high income and a substantial deposit. Numerous reputable lenders provide jumbo loans at competitive rates. how many mortgages in a mortgage backed security. You can use Bankrate's calculator to determine how much you can afford to invest in a home. The U.S. government isn't a home mortgage lending institution, however it does contribute in helping more Americans become property owners.

Department of Farming (USDA loans) and the U.S. Department of Veterans Affairs (VA loans). Backed by the FHA, these types of mortgage assist make homeownership possible for customers who don't have a large down payment saved up and don't have pristine credit. Borrowers need a minimum FICO rating of 580 to get the FHA maximum of 96.5 percent financing with a 3.5 percent deposit; nevertheless, a score of 500 is accepted if you put a minimum of 10 percent down.

This can increase the total expense of your home https://writeablog.net/ripinnuvqq/there-are-2-prim...est-youand-39-re-charged-stays mortgage. USDA loans help moderate- to low-income debtors buy houses in rural areas. You should purchase a house in a USDA-eligible location and fulfill certain income limits to certify. Some USDA loans do not require a down payment for eligible debtors with low incomes.

military (active duty and veterans) and their households. VA loans do not require a deposit or PMI, and closing costs timeshare pro are generally capped and may be paid by the seller. A financing cost is charged on VA loans as a portion of the loan amount to help offset the program's cost to taxpayers.

They help you finance a house when you do not receive a conventional loan Credit requirements are more unwinded You do not need a big deposit They're open to repeat and first-time purchasers Anticipate to pay compulsory mortgage insurance premiums that can not Find out more be canceled on some loans You'll have greater general loaning expenses Expect to offer more documentation, depending on the loan type, to prove eligibility Government-insured loans are perfect if you have low cash cost savings, less-than-stellar credit and can't qualify for a standard loan.

The 2-Minute Rule for What Are The Interest Rates On 30 Year Mortgages Today

Fixed-rate home mortgages keep the same interest rate over the life of your loan, which suggests your regular monthly home loan payment always remains the very same. Fixed loans usually can be found in terms of 15 years, twenty years or 30 years. Your monthly principal and interest payments remain the very same throughout the life of the loan You can more exactly budget plan other expenditures month to month You'll typically pay more interest with a longer-term loan It takes longer to construct equity in your house.

Unlike the stability of fixed-rate loans, variable-rate mortgages (ARMs) have changing rate of interest that can go up or down with market conditions. Lots of ARM products have a fixed rates of interest for a couple of years before the loan modifications to a variable rate of interest for the remainder of the term. Look for an ARM that caps just how much your rate of interest or monthly mortgage rate can increase so you don't wind up in monetary problem when the loan resets.

If you don't prepare to stay in your house beyond a couple of years, an ARM could conserve you big on interest payments. In addition to these typical kinds of home loans, there are other types you might find when searching for a loan. These consist of: If you wish to develop a home, a building loan can be a good option.

|

|

Excitement About Which Of The Following Statements Is True Regarding Home Mortgages? |

Tax of that income depends on a number of aspects, however in basic, earnings earned through a rental property is taxable yearly and subject to common income tax rates. As an active financier, the homeowner can likely declare deductible expenses incurred throughout the year in maintaining and fixing the home, such as real estate tax, insurance coverage, and maintenance expenses, therefore reducing the total quantity of gross income.

Many passive financial investments can likewise make earnings, typically in the form of passive income, and this earnings can be dispersed in a number of ways depending on the structure of the financial investment. Financiers who hold genuine estate investments through stock ownership, such as mutual funds or REITs, can get income payments through dividends, which are distributed according to the number of shares owned.

Collaborations also permit partners to claim deductions for expenses and losses in percentage to ownership and role within the collaboration, however tax implications differ by partnership. Because passive property investments aren't owned straight by the financier most of the times, the structure of the investment can have considerable tax ramifications for financiers.

Similarly, earnings distributed to REIT and shared fund investors is taxable only at the investor level and not the fund level as long those funds meet the legal requirements to qualify for their chosen structure. Shared funds and REITs can bring an included benefit: Since 2018, financiers who get income distributions from pass-through entities, such as shared funds and REITs, can access approximately a 20% reduction on certified company income each year - what is the best rate for mortgages.

Appreciation is realized when an investor offers an equity investment whether it's an active or passive financial investment. Upon the sale of that financial investment, any returns earned from gratitude are considered capital gains, and subject to a capital gains tax. The duration of ownership effects the tax rate of an equity financial investment.

Short-term capital gains are thought about part of your annual earnings and are taxed at ordinary tax rates. If you buy and sell an active financial investment, such as a rental property, within one year, your earnings will be thought about short-term capital gains. Similarly for passive investments, if you purchase and sell shares of a REIT or leave a partnership within one year, any appreciation will also go through short-term capital gains taxes.

Facts About How Subprime Mortgages Are Market Distortion Revealed

Like short-term gains, the adjusted earnings will be taxable, however likely at a lower rate. Taxpayers at or listed below the 12% minimal earnings tax bracket will generally pay no long-lasting capital gains tax. Those in the 22% - 35% income tax brackets will typically pay 15%, and those in the 37% income tax bracket will usually pay 20% capital gains tax.

Capital gains taxes may be delayed or decreased depending upon lots of elements, including the financial investment automobile through which they were earned and how the capital gains are used after they are recognized. For example, rolling over capital gains into a 1031 Exchange can delay tax liability if one investment home is switched for another comparable one, however it can't decrease or indefinitely eliminate your tax liability.

Property investing offers the potential to earn considerable returns and include meaningful diversification to your portfolio. When managed wisely it can become an important source of cash circulation in your https://blogfreely.net/ithrisxqui/jumbo-loan-borro...-about-6-monthsand-39-worth-of financial investment portfolio in addition to the long-lasting appreciation capacity that it uses. Similar to any investment, real estate investments need you to comprehend and weigh the dangers and prospective rewards before starting.