Further Advice On Straightforward Get Out Of Debt Fast Secrets |

Getting My Get Out Of Debt Fast To Work

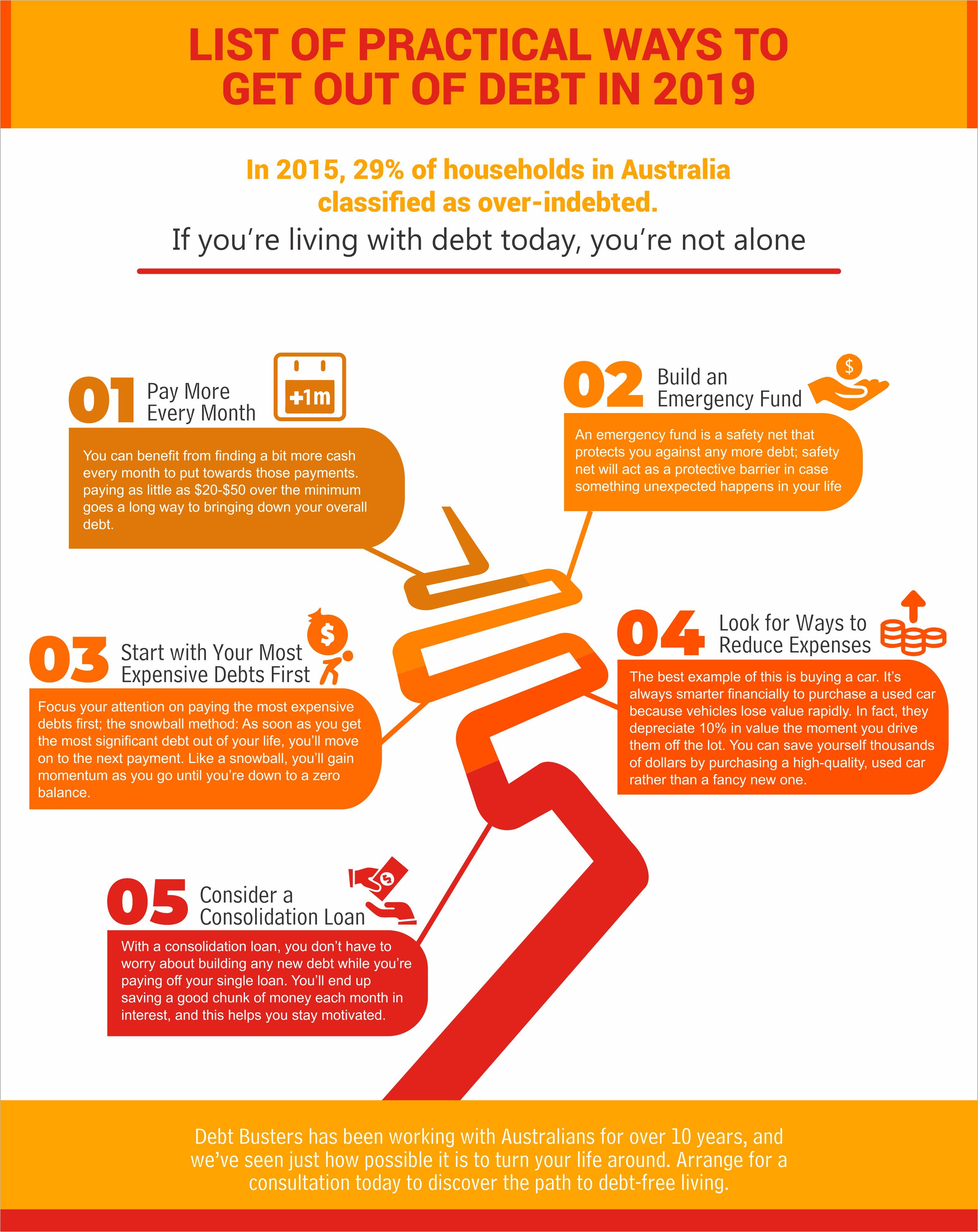

The question is this-- which debt will you put your additional money towards very first? The first thing is not to get too hung up on this question. Depending upon your scenario, one method might be better than another, however if you consistently pay for your debt without incurring more debt, you'll make fantastic development despite which debt you pay first.

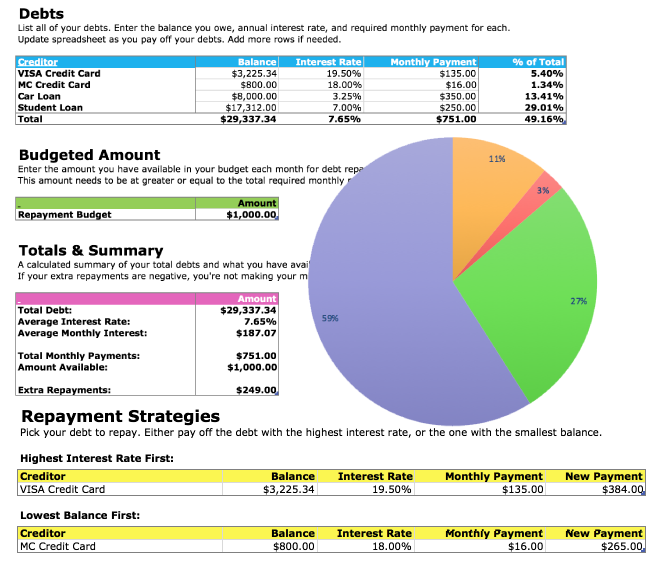

This approach will lead to the most affordable interest charges and the fastest debt payment possible. Smallest Balance First: This is the Dave Ramsey method. He suggests targeting the debt with the smallest balance initially. While that debt might not have the greatest interest rate, the theory is to get one debt paid off as quickly as possible.

First, settling a debt gives you a sensation of accomplishment, which may be simply the inspiration you require to keep on track. Second, by paying of a debt entirely, you maximize the money that was required to make month-to-month payments to that bill. While you are likely to put that cash to the next debt, in an emergency situation, you might use it for other purposes. With a charge card, as soon as the debt is paid, the card is still there to utilize once again if you so chose. For this factor, I'll typically concentrate on non-revolving debt first. Why? Since I can't go out and charge up the debt again once it's paid. This is purely a mental concern, but an essential one, especially if you fear you may lack some discipline as soon as some of your debt is settled.

While you may be tempted to put 100% of your additional cash towards debt, keeping at least a few of it aside for emergency situations will assist break the dependence lots of have on credit. When the automobile requires brand-new tires, it's better to turn to the emergency fund http://bettystarkweatherlowelluqo9.trexgame.net/he...ts-in-financial-debt-solutions than it is the charge card.

Getting The Financial Debt Solutions To Work

While many CDs do charge a charge if funds are withdrawn before completion of the term, that penalty can assist keep you from accessing the funds for anything other than a true emergency situation. In addition, there are short-term CDs readily available with 3 and even 1-month terms. When numerous people think of credit reports and credit rating, they see them as essential if you wish to use for a loan.

However your credit report and rating are also absolutely crucial to eliminating debt. With an excellent credit rating, you get approved for lower interest rates that can help reduce your overall interest charges. With bad credit, you're stuck paying double digit rates. So let's take a look at some pointers and tools that can assist you: Self Lending Institution is a distinct business that provides to assist you build your credit score.

After you've https://en.search.wordpress.com/?src=organic&q=debt solutions gotten your loan and picked a payment option, you'll be on the course to developing your credit. When you have actually completed your payments, the Get Out of Debt Fast whole principal is returned to you minus the rates of interest. Comprehend the Importance of Your Credit Rating: As noted above, your credit rating is a crucial tool in getting out of debt as rapidly as Debt Management possible.

Auto loan: With a credit score of 760, you can anticipate a vehicle loan interest rate of about 6.3%. With a score of 660, the rate increases to about 9.8%. House Equity: Outstanding credit can expect a rate of around 8% or lower, while fair credit borrowers will pay as much as 11% or higher.

The Single http://query.nytimes.com/search/sitesearch/?action...chSubmit&pgtype=Homepage#/debt solutions Strategy To Use For Personal Debt

Get your Free Credit Report: The beginning point is to get your complimentary credit report and inspect it for mistakes. Get your Free Credit History: Next you need to get your your real FICO score in exchange for registering for a complimentary trial of a credit watch program. You can constantly cancel prior to completion of the complimentary trial if you don't want to keep the service.

Do whatever is essential not to forget a payment, and make certain you make the payment far enough in advance of the due date so that there is no possibility it will be late. Do Not Close Accounts: As a general rule, don't close credit card and other revolving accounts. One of the consider identifying credit history is the quantity of debt you have in comparison to the amount of readily available credit.

You can always cut up a few of your cards if you don't wish to risk using them, however don't cancel them. Here are some other tips to improving your credit rating . While you are working to improve your credit, it is essential to be on the lookout for ways to minimize the interest rate on your debt.

Here are some tips and tools to assist you lower your rates: Refinance Your Home loan: The general guideline is that you must re-finance if you can reduce your interest rate by 1%. While that's a great starting point, it is crucial to likewise consider how long you plan to stay in the home and whether you need to transform from an adjustable rate mortgage to a safer set rate loan.

4 Simple Techniques For Personal Debt

Negotiate Lower Interest on Home Equity Lines of Credit: If you have a home equity line of credit, compare your rates of interest with current market rates. If you think you can do much better, step one is to call the mortgage company and request a lower rate. We did this effectively with our home equity line of credit.

Lower the Interest on Credit Cards: Due to the fact that rate of interest on credit cards Financial Debt Solutions have risen a lot in the in 2015, getting a lower rate on credit card debt can save a lot on interest payments. If you have a good credit rating, you can receive a 0% balance transfer credit card .

Beware with Debt Consolidation: While it is important to make the most of the most affordable interest rates possible, the one area where you desire to be really mindful is with debt consolidation business. While they may guarantee you low rates and a single payment, the number of consumer problems about such companies is blowing up.

Here are several excellent alternatives for low rate personal loans . As http://www.bbc.co.uk/search?q=debt solutions I said at the start of this post, one important element of getting out of debt is investing less and making more. While these subjects are the subject of whole books, here are a few resources to get you began: Painless Cash Saving Tips: There are greening your house , you'll discover a lot of concepts on how to knock hundreds of dollars (or more) off your regular monthly spending plan.

All About Personal Debt

This book puts cash in viewpoint and was for me a real source of inspiration to get out of debt. Earn Bonus Income: Any additional earnings goes a long method to leaving debt. I've discovered this firsthand from the cash I have actually made blogging, all of which either goes to charity or settling debt.

| Комментировать | « Пред. запись — К дневнику — След. запись » | Страницы: [1] [Новые] |