Revealing The Leading Insurance Companies - A Detailed Contrast |

Authored by-Rao Haney

The insurance market is changing swiftly as it accepts brand-new technology and also digital improvement. Consequently, companies that are willing to introduce and also adopt a customer-centric mindset have an edge over their competitors.

related webpage will cover the top insurer for auto, house, as well as life insurance policy. We will also highlight some of the most effective life insurance policy firms that use lax underwriting for those with a pre-existing wellness problem.

New York City Life

New York Life offers a variety of life insurance policies with a wide range of alternatives. Their business has actually been around for 175 years as well as supplies experienced advice from their insurance policy agents. They have an excellent track record and exceptional client contentment ratings. They use a range of policy options as well as substantial cyclists to make them one-of-a-kind from the competition.

New york city life is a wonderful choice for anybody seeking an irreversible life insurance policy. They have entire life as well as global policies that are developed to last for a person's life time and build cash value. They likewise offer a variety of various investment alternatives as well as offer accessibility to economic advice for their clients.

They have a reduced grievance ratio with the National Association of Insurance Coverage Commissioners as well as have superb client satisfaction ratings. They have a comprehensive site where you can start a claim or download service forms.

Northwestern Mutual

Founded in 1857 in Wisconsin when the state was only 9 years old, Northwestern Mutual is a mutual company with no private shareholders. Consequently, they have the ability to return earnings directly to insurance holders in the form of reward checks. These returns can be utilized to pay premiums, increase cash money value or acquisition additional coverage.

This firm is known for its monetary strength and also high consumer complete satisfaction ratings. In fact, they rank fourth in J.D. https://zenwriting.net/asuncion64cruz/top-7-techni...s-as-an-insurance-policy-agent , and also they have very low complaint prices.

They also offer a selection of financial products, including retirement as well as investment solutions. The Milwaukee-based business takes care of properties for institutional customers, pooled financial investment cars as well as high-net-worth people. It provides on-line solutions such as quotes as well as an online client website for insurance policy holders.

Banner Life

With a customer solution ranking of A+ from the Better Business Bureau, Banner Life is one of the top companies for those looking to purchase life insurance. They likewise have an extensive website with lots of details to aid consumers comprehend their choices and also the process.

The company provides competitive prices for term life insurance in a variety of health and wellness categories and also even offers some no-medical exam plans. They are additionally among minority insurance firms to use tables for smokers and also those with serious problems like diabetic issues, liver disease B or C, and coronary artery disease without adding a level added.

Furthermore, their Term Life And also plan allows for the conversion to long-term coverage, and also their Universal Life Step UL plan has a great rate of interest. Banner operates in every state besides New York, which is offered by their sister business William Penn

. Lincoln National

Lincoln Financial provides a range of insurance policy and investment products, including life insurance and also office retirement plans. The business rewards client satisfaction and also flaunts a strong online reputation in the individual financing press. It additionally does well in our positions for economic stability, item and also feature range, as well as the general purchasing experience.

The company is a Lot of money 250 firm as well as rankings amongst the top life insurance companies in regards to financial stamina ratings from AM Finest, Fitch, as well as Moody's. It likewise flaunts a reduced issue index rating according to NerdWallet's analysis of information from the National Association of Insurance Policy Commissioners.

In addition to being a solid selection for life insurance coverage, the company sustains the community through its philanthropic initiatives. The Lincoln Financial Structure gives away millions to a variety of not-for-profit organizations.

Prudential

Prudential uses a variety of life insurance plans and also has good ratings from credit score agencies. However, simply click the following website page does have a lower customer satisfaction rating as well as even more grievances than expected for its dimension.

The business likewise does not provide entire life insurance, which is the most usual sort of permanent life insurance plan. This restricts the number of options readily available to clients.

In addition to supplying high quality products, Prudential has a good reputation for its area participation. Its staff members volunteer and devote their time to aid their local communities.

Prudential is presently running a series of ads throughout America. These ads are focusing on financial wellness and highlighting the relevance of getting life insurance policy. Several of their advertisements include a dad that is worried about his little girls in case of an unexpected death.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Unlocking The Keys To Closing Bargains As An Insurance Policy Representative |

Content writer-Berntsen Miles

Insurance policy agents are qualified professionals that market life, home mortgage defense and disability insurance. They need to have the ability to discover, bring in and also keep clients. They must additionally have a good understanding of policy insurance coverage as well as terms, along with the ability to work out.

https://blogfreely.net/gayle264magen/how-to-proper...omers-as-an-insurance-coverage closing methods, which are scripts planned to persuade leads to purchase. These methods can annoy some buyers, however.

1. Know Your Item

As an insurance coverage agent, you have an one-of-a-kind marketing proposal. You can aid clients sort through complicated details and also choose that will shield their family members in case of an emergency situation or catastrophe.

To do this, you must understand your items well and also recognize exactly how they collaborate. This will assist you construct trust fund with your clients and address their objections.

There are several shutting methods that you can make use of to shut life insurance policy sales. One is the assumptive close, where you assume that your prospect intends to buy. This can be reliable with a customer who prepares to devote, yet it can be off-putting for those who are still determining.

2. Know Your Possibility

Supplying value to your clients and demonstrating that you recognize their needs is the very best means to shut a bargain. Clients are more probable to trust agents that make the initiative to find out about their issues and provide a remedy that addresses them.

It's also vital to know your leads' existing policies. With Cover Attach, insurance verification is simply a click away and also you can quickly source your client's statement web pages, insurance claim records and car details. This can aid you qualify leads much faster, shorten sales cycles and also strengthen customer relationships. Try it today!

3. Know Yourself

Insurance policy agents have two ways to market themselves: their insurance provider or themselves. One of the most efficient way to market yourself is to be yourself.

Informing tales of just how you have actually assisted clients is a great means to build depend on and keep prospects psychologically engaged. It additionally assists to set you apart from the stereotyped salesperson that people dislike.

Creating a network of close friends as well as colleagues to resort to for advice can enhance your insurance coverage service and also give referrals for brand-new customers. This will give you the possibility to display your market understanding and also experience while building an ever-expanding book of company. That can bring about an uncapped earning capacity.

4. Know Your Competitors

When you recognize your competition, it becomes a lot easier to discover methods to separate on your own and win organization. This could be a particular insurance product, a distinct solution that you use, or even your character.

Asking customers why they chose to work with you over your competitor can assist you determine what sets you apart. Their responses may amaze you-- and they might not have anything to do with rates.

Establishing partnerships with your prospects and also customers is a big part of insurance coverage marketing. This can be done through social networks, e-mail, or even a public presentation at an event. Watercraft Insurance Application will certainly construct count on and establish you up for even more opportunities, like cross-selling or up-selling.

5. Know Yourself as an Expert

As an insurance agent, you'll function carefully with customers to determine their danger and also construct a security strategy that meets their requirements. Telling stories, describing the worth of a plan, and also asking concerns are all methods to aid your clients find their right insurance coverage.

Lots of insurance coverage representatives choose to help a single firm (called restricted agents) while others partner with several business (called independent representatives). Despite your preference, you'll gain from networking with other insurance experts. Their knowledge as well as experience can supply very useful understanding as well as support for your profession. Additionally, connecting with click for more can increase your consumer base as well as recommendations.

6. Know Yourself as a Person

If you recognize yourself as a person, you can interact your proficiency and also worth to clients in ways that really feel genuine. A customer that counts on you is more likely to trust you and come to be a repeat client.

Closing a handle the insurance policy business is far more than just a deal. You are marketing safety and also comfort to individuals that have special requirements.

Spend some time to think about what makes you unique as a person. You can use journaling or meaningful contacting explore your passions, personality, and also values.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Exactly How To Save Cash On Insurance Coverage Premiums With The Right Insurance Provider |

Content create by-Valdez Erickson

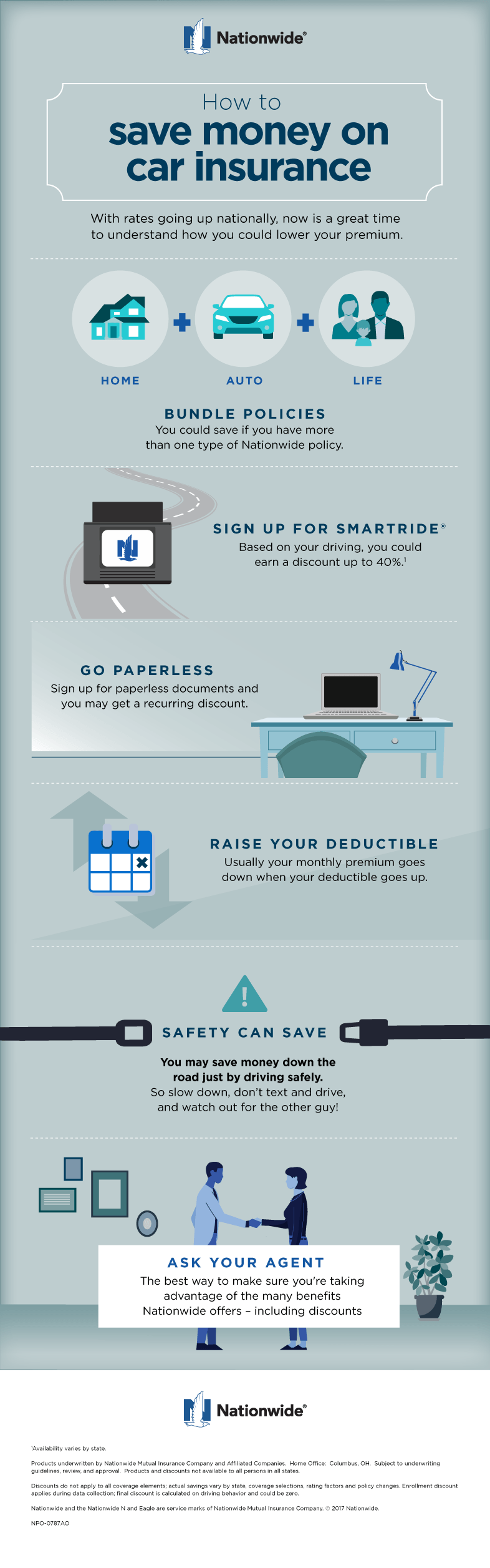

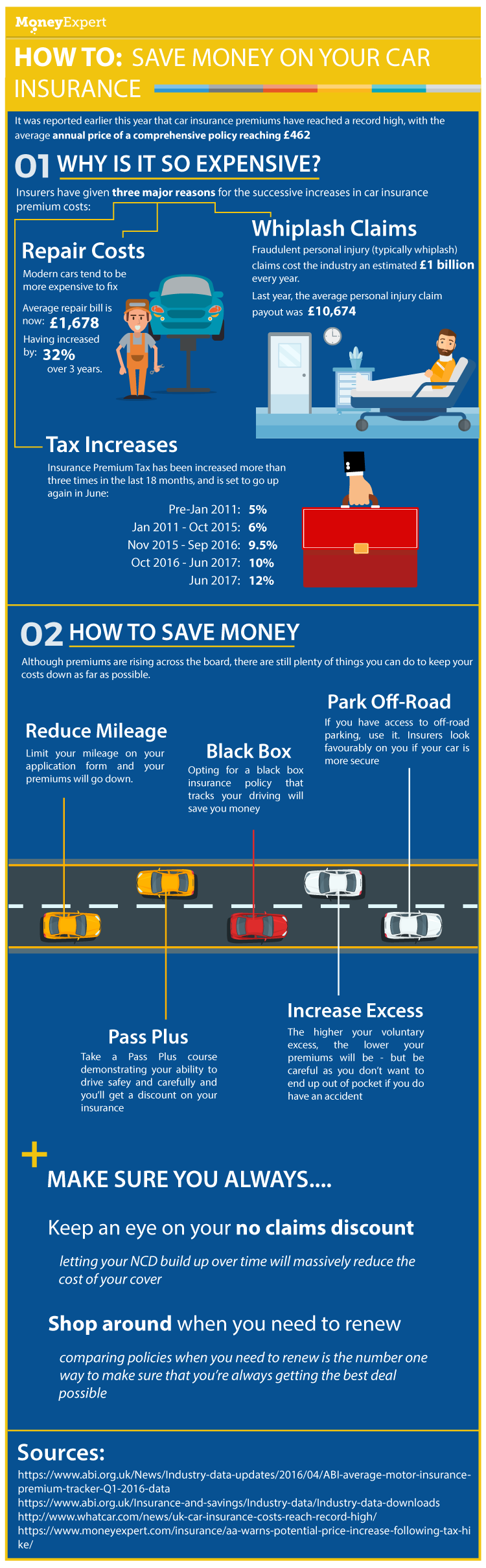

You may believe that there's absolutely nothing you can do to lower your cars and truck insurance premium, but WalletHub has actually found a couple of methods to save. Boosting Excess Liability (yet not so high that you can't pay for to pay it) can conserve you money, as can taking a chauffeur safety and security training course or mounting an anti-theft device.

1. Shop Around

Whether you're purchasing health and wellness, car or life insurance policy, it pays to look around. Some insurance providers provide on the internet quote tools that can save you time and effort by revealing numerous prices for the plan you're taking into consideration.

Various other variables like credit scores, a safe driving document and also packing plans (like vehicle and also house) can additionally reduce your rates. You ought to likewise frequently analyze your protection needs and also reassess your premium prices. This is specifically vital if you strike life turning points, such as a new child or obtaining wed. Likewise, you must occasionally consider your lorry's value and consider switching to a usage-based insurance coverage program, like telematics.

2. Know Your Insurance coverage

Utilizing these strategies will need time and also effort, yet your work will certainly be compensated with lower yearly costs for years to come.

Other ways to conserve include paying your policy six or a year at a time, which costs insurer less than monthly repayments. Also, getting rid of insurance coverage you don't require, like roadside help or rental cars and truck compensation, can save you cash.

Your credit report, age and location also impact your prices, in addition to the car you drive. Bigger vehicles, like SUVs and pickup trucks, expense even more to insure than smaller cars. Selecting an extra fuel-efficient car can lower your premiums, as will selecting usage-based insurance policy.

3. Drive Safely

There are lots of points you can manage when it concerns decreasing your car insurance prices. Some approaches consist of taking a defensive driving training course, boosting your insurance deductible (the quantity you need to pay before your insurance coverage starts paying on a claim) as well as switching to a much safer car.

Some insurance providers also provide usage-based discount rates and telematics gadgets such as Progressive Photo, StateFarm Drive Safe & Save and Geico DriveEasy. These can lower your rate, but they may also raise it if your driving routines come to be less safe with time. Consider using public transportation or car pool, or decreasing your gas mileage to get approved for these programs.

4. Get a Telematics Gadget

A telematics device-- or usage-based insurance (UBI)-- can conserve you money on your automobile insurance coverage. Basically, you connect the device into your automobile and it tracks your driving actions.

Insurer then use that data to determine just how high-risk you are. And https://blogfreely.net/cathey79tyree/the-role-of-t...olicy-representative-practices set your premiums based upon that. Typically, that can imply considerable cost savings.

Yet take care. One negative choice, such as racing to beat a yellow light, might transform your telematics tool into the tattletale of your life. That's since insurance companies can utilize telematics information to decrease or deny cases. As well as they might even withdraw price cuts. That's why it is necessary to evaluate the trade-offs before registering in a UBI program.

5. Get a Multi-Policy Discount

Getting car as well as home insurance from the same service provider is commonly a terrific means to save money, as several respectable insurance providers offer discounts for those that purchase several policies with the same carrier. Additionally, best health insurance agents near me provide telematics programs where you can earn deep price cuts by tracking your driving practices.

Various other methods to conserve include downsizing your vehicle (if possible), carpooling, and utilizing public transportation for job and also recreation. Also, maintaining your driving record tidy can save you money as many insurance provider offer accident-free and great vehicle driver discount rate policies. Numerous carriers also give client loyalty discount rates to lasting customers. These can be substantial discounts on your costs.

6. Get a Good Price

Boosting your deductible can lower the amount you pay in the event of an accident. Nonetheless, it is very important to ensure you can afford the greater out-of-pocket price prior to committing to a higher insurance deductible.

If you have a bigger car, consider scaling down to a smaller sized auto that will set you back less to guarantee. Similarly, think about switching over to an extra gas reliable lorry to reduce gas prices.

Check out other discounts, such as multi-vehicle, multi-policy, great chauffeur, risk-free driving and military price cuts. In addition, some insurance provider use usage-based or telematics insurance programs that can conserve you cash by keeping an eye on how much you drive. Ask your company for more details on these programs.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Exactly How To Save Cash On Insurance Costs With The Right Insurance Company |

Authored by-Valdez Donahue

You may believe that there's nothing you can do to lower your cars and truck insurance coverage costs, yet WalletHub has found a few means to save. Improving your insurance deductible (however not so high that you can not manage to pay it) can save you money, as can taking a driver safety and security course or mounting an anti-theft device.

1. Search

Whether you're looking for wellness, vehicle or life insurance policy, it pays to shop around. Some insurance firms supply on the internet quote devices that can conserve you time and effort by showing numerous prices for the plan you're considering.

Other factors like credit rating, a safe driving record as well as packing plans (like cars and truck and home) can likewise lower your rates. You ought to additionally regularly assess your protection needs and also reassess your premium expenses. This is specifically essential if you hit life landmarks, such as a new kid or obtaining married. Similarly, you should regularly consider your automobile's worth as well as consider switching over to a usage-based insurance policy program, like telematics.

2. Know Your Insurance coverage

Utilizing these techniques will certainly need some time and initiative, however your job will certainly be rewarded with reduced annual costs for years ahead.

Other methods to conserve consist of paying your policy 6 or a year at a time, which costs insurance companies less than regular monthly payments. Additionally, removing insurance coverage you do not require, like roadside help or rental automobile reimbursement, can save you money.

https://zenwriting.net/carey83patrina/leading-7-te...s-as-an-insurance-policy-agent , age as well as area also affect your rates, in addition to the lorry you drive. Bigger vehicles, like SUVs as well as pickup, cost even more to guarantee than smaller sized cars. Choosing an extra fuel-efficient vehicle can reduce your costs, as will choosing usage-based insurance policy.

3. Drive Securely

There are several points you can control when it comes to decreasing your automobile insurance policy prices. Some strategies consist of taking a defensive driving training course, raising your insurance deductible (the quantity you have to pay prior to your insurance coverage begins paying on an insurance claim) and also changing to a safer automobile.

Some insurance providers additionally provide usage-based discounts as well as telematics gadgets such as Progressive Photo, StateFarm Drive Safe & Save and Geico DriveEasy. These can decrease your price, but they might also increase it if your driving practices end up being much less risk-free over time. Think about making use of mass transit or carpooling, or decreasing your gas mileage to get approved for these programs.

4. Get a Telematics Device

A telematics device-- or usage-based insurance policy (UBI)-- can conserve you money on your auto insurance policy. Generally, you plug the tool into your automobile and also it tracks your driving behavior.

Insurance provider then utilize that data to figure out how risky you are. And they establish your costs based on that. Commonly, that can mean substantial cost savings.

Yet beware. https://news.wgcu.org/section/crime/2023-05-15/jur...f-defrauding-elderly-investors , such as racing to defeat a yellow light, might transform your telematics device right into the tattletale of your life. That's since insurance companies can use telematics information to lower or deny cases. As well as they may even revoke discounts. That's why it is very important to consider the trade-offs before enlisting in a UBI program.

5. Obtain a Multi-Policy Discount

Getting car and also home insurance policy from the very same carrier is usually a terrific way to conserve cash, as several credible insurance providers offer price cuts for those that purchase several policies with the exact same service provider. Furthermore, some insurance suppliers supply telematics programs where you can earn deep discount rates by tracking your driving behaviors.

Other ways to conserve consist of downsizing your automobile (ideally), car pool, as well as making use of public transportation for job as well as recreation. Additionally, keeping Auto Owners Insurance driving record tidy can conserve you cash as a lot of insurance companies use accident-free and also excellent motorist discount policies. Many carriers likewise give client commitment price cuts to long-term clients. These can be significant discount rates on your costs.

6. Get an Excellent Rate

Raising your deductible can decrease the amount you pay in the event of an accident. Nevertheless, it is essential to see to it you can afford the greater out-of-pocket price prior to committing to a greater insurance deductible.

If you own a larger vehicle, consider scaling down to a smaller sized automobile that will certainly set you back less to guarantee. Furthermore, take into consideration switching over to a much more gas effective lorry to save on gas expenses.

Explore various other price cuts, such as multi-vehicle, multi-policy, great driver, safe driving and armed forces price cuts. Furthermore, some insurer offer usage-based or telematics insurance programs that can conserve you money by keeping an eye on how much you drive. Ask your carrier for more details on these programs.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Recognizing The Different Sorts Of Insurance Policies As A Representative |

Created by-Meyer Wiggins

Insurance coverage is an essential financial investment that safeguards you as well as your properties from financial loss. Insurance representatives as well as agencies can aid you comprehend the various types of insurance plan available to meet your requirements.

Representatives define the numerous choices of insurer and can finish insurance sales (bind insurance coverage) in your place. Independent agents can deal with several insurance service providers, while slave or unique insurance policy representatives represent a single company.

Captive Representatives

If you're aiming to purchase a particular sort of insurance plan, you can get in touch with captive representatives that collaborate with one certain provider. https://zenwriting.net/titus71damion/the-ultimate-...cessful-insurance-policy-agent sell just the plans provided by their employer, which makes them professionals in the types of coverage and discount rates used.

They likewise have a strong partnership with their business and also are typically required to meet sales allocations, which can affect their capability to assist clients objectively. They can offer a variety of policies that fit your needs, however they won't be able to present you with quotes from other insurer.

Captive agents normally work with big-name insurance companies such as GEICO, State Ranch as well as Allstate. They can be an excellent source for customers that intend to support local businesses and establish a long-term connection with a representative that comprehends their area's distinct risks.

Independent Brokers

Independent representatives typically deal with multiple insurance provider to offer their customers' plans. This allows them to give a much more individualized as well as personalized experience for their customers. They can also help them re-evaluate their coverage in time and advise new plans based upon their requirements.

https://santiago6454kary.wordpress.com/2023/07/20/...ce-representative-must-master/ can provide their clients a selection of plan alternatives from several insurance policy service providers, which indicates they can give side-by-side contrasts of rates as well as protection for them to pick from. They do this without any ulterior motive and also can help them discover the plan that really fits their distinct requirements.

The best independent agents know all the ins and outs of their different product and are able to address any type of inquiries that turn up for their customers. https://www.marketwatch.com/picks/we-are-retired-a...r-should-we-trust-her-e01d8d6b is an invaluable solution as well as can conserve their clients time by managing all the information for them.

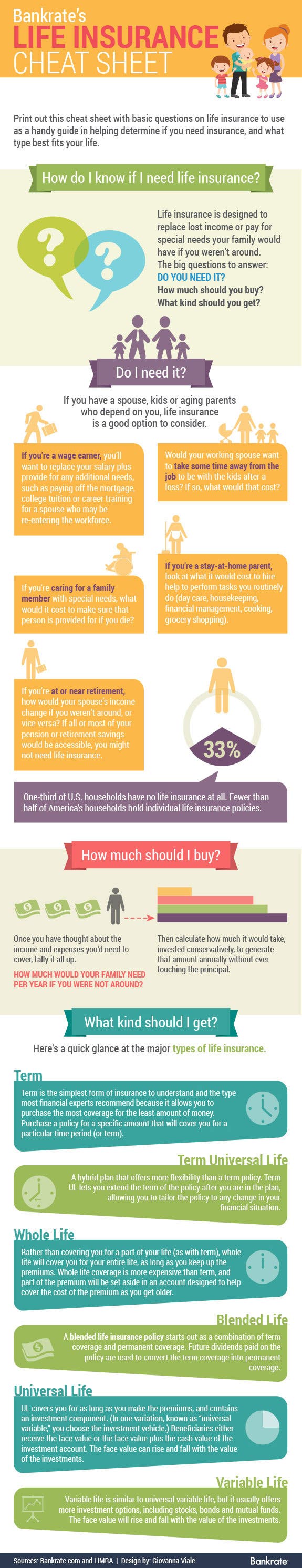

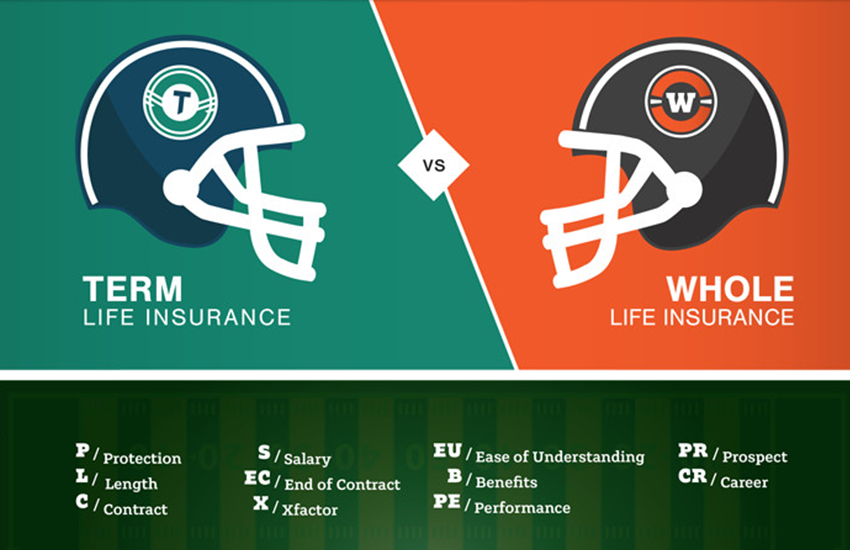

Life Insurance

Life insurance policies normally pay money to marked recipients when the insured passes away. The beneficiaries can be an individual or business. People can get life insurance policy policies straight from an exclusive insurance firm or with group life insurance supplied by employers.

Many life insurance policy policies need a medical examination as part of the application process. Simplified concern as well as guaranteed concerns are readily available for those with health issue that would certainly or else stop them from getting a traditional plan. Permanent plans, such as whole life, include a financial savings element that collects tax-deferred as well as might have greater costs than term life plans.

Whether selling a pure defense strategy or a more complicated life insurance policy policy, it is necessary for a representative to fully comprehend the features of each item as well as just how they connect to the client's details situation. This helps them make informed suggestions as well as prevent overselling.

Health Insurance

Health insurance is a system for funding clinical costs. It is generally financed with payments or taxes and also provided via personal insurance providers. Private health insurance can be bought individually or through team policies, such as those supplied through companies or professional, civic or religious groups. Some kinds of health and wellness protection consist of indemnity plans, which reimburse insurance holders for certain costs up to a set restriction, took care of treatment strategies, such as HMOs and PPOs, and self-insured strategies.

As an agent, it is essential to comprehend the different types of insurance policies in order to assist your customers discover the best alternatives for their demands and also budgets. However, blunders can take place, and if a mistake on your part triggers a customer to shed money, errors and also noninclusions insurance can cover the expense of the fit.

Long-Term Care Insurance Policy

Long-lasting care insurance policy aids individuals spend for house health and wellness assistant services as well as assisted living home treatment. It can likewise cover a part of the expense for assisted living and various other domestic treatment. Policies usually cap how much they'll pay per day and over an individual's life time. Some policies are standalone, while others incorporate insurance coverage with other insurance policy products, such as life insurance policy or annuities, and also are known as hybrid plans.

Lots of specific long-term treatment insurance coverage need medical underwriting, which indicates the insurance provider asks for individual information as well as might request records from a medical professional. A pre-existing problem may exclude you from obtaining advantages or could cause the plan to be terminated, professionals alert. Some policies use a rising cost of living rider, which enhances the everyday benefit quantity on a basic or compound basis.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

The Relevance Of Building And Also Keeping Relationships As An Insurance Representative |

Content written by-Daniels Morsing

Insurance representatives are involved in individuals's lives throughout landmark events as well as difficulties. Compare Motorcycle Insurance Quotes with them as well as constructing partnerships should be leading of mind.

Strong client relationships benefit both the agent and the customer. Completely satisfied Personal Excess Liability Insurance come to be advocates, causing even more policy renewals as well as increased sales possibilities. Customer connections additionally foster commitment, which results in better client retention rates.

Client service

Providing outstanding client service is crucial to building and also preserving partnerships as an insurance policy representative. This includes the method which representatives communicate with leads before they become customers. If the first interaction really feels too sales-oriented, it can shut off prospective customers. It also includes exactly how they treat existing customers.

When insurance coverage customers need support, such as when they have a claim to file, they desire a rep that understands and also feels sorry for their circumstance. Empathy can defuse demanding circumstances and also make customers seem like their needs are necessary to the business.

In addition, insurance coverage agents ought to correspond with current customers regularly to guarantee they're meeting their expectations and also staying on top of any kind of modifications in their lives that could influence their coverage. vehicle insurance agent near me can include birthday celebration or vacation cards, e-mails to talk about any forthcoming landmarks and also conferences to assess renewals.

References

Getting referrals is just one of the most effective means to expand your business as an insurance policy agent. By concentrating on connecting with people in certain sectors, you can establish yourself as the best professional and bring in a stable stream of customers.

When a customer trust funds their insurance policy representative, they're most likely to stay loyal. In addition, dedicated customers will become advocates and also refer new company to the agent. These references can offset the cost of acquiring new customers via traditional approaches.

By offering a favorable customer experience throughout the prospecting stage, representatives can develop connections that will last a very long time, even when various other insurance firms supply reduced costs. This calls for producing a defined approach for customer interaction administration, inserting customized provides right into transactional messages, and providing individualized experiences. Customers today expect this type of interaction. Insurers who don't satisfy expectations run the risk of falling behind. The bright side is that forward-thinking insurance agents understand this and have a competitive advantage.

Networking

Whether you're a social butterfly or a bit more withdrawn, networking is among the very best methods for insurance policy representatives to grow their companies. Even if your customers do not develop into a network of their own, they're most likely to state you to loved ones that may need some insurance coverage.

Having a strong network of prospective customers can make all the difference in your insurance sales success. If you have a steady stream of real-time insurance policy leads, you can focus on structure connections with your current customers and also quickening the procedure of obtaining them new business.

Seek networking chances at insurance policy industry occasions and even at other types of local events. As an example, attending a meeting of your neighborhood Chamber of Commerce or Merchants Organization can be an excellent place to fulfill fellow entrepreneur and form connections that can help you grow your insurance policy agency. The same opts for social media groups that are geared toward professionals in business community.

Communicating

The insurance market is competitive, as well as it takes a great deal of work to stay top of mind with customers. Developing a great consumer experience from the beginning will certainly make your consumers more probable to stick with you, even if an additional agent provides reduced rates.

Being an insurance policy agent isn't practically marketing, it's about assisting people navigate a complex location and shield themselves against unanticipated financial loss. Helping them with their economic choices can also make them trust your recommendations, which translates right into repeat service and recommendations.

A customer's partnership with an agent is tested when they have a claim. That's when a representative can show they care, which can strengthen their partnership. Utilizing tailored advertising to talk is essential since not all clients value the same communications channel. Some could prefer email e-newsletters, while others could want to meet in-person or gain access to details online. It is very important for agents to know their clients' choices so they can be offered when the time comes.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

The Future Of Insurance Coverage Agents: Adapting To Changing Customer Demands |

Written by-Flindt Hooper

The insurance policy market is going through a significant technical overhaul. Yet will it make insurance policy representatives obsolete?

Local business owner and also consumers constantly place ease as the most crucial factor in their policy acquiring decisions. Agents can meet customer needs for electronic, seamless, and also hybrid assistance by embracing technology that equips them to drive brand-new organization.

1. Customization

A customized experience can make consumers seem like they are being listened to and recognized. This is an essential action toward structure commitment, referrals as well as retention.

Insurance industry leaders have started to reorient their companies around customers, as opposed to products. This strategy can help insurers produce customized digital experiences as well as provide more value to clients.

For instance, insurance suppliers have the ability to recognize low-risk customers and also give them with less costly premiums by utilizing information gathered with telematics, IoT and machine learning. Some are likewise able to immediately adjust quotes based on way of life modifications.

Boosting the performance of electronic self-service can additionally improve the client experience. While a human agent will certainly still be required for even more complex purchases, the capability to interact swiftly as well as effectively across electronic networks can assist expand organization in 2023 and also past. This will need a robust modern technology infrastructure to support consumer communications and enable more aggressive risk-prevention solutions. It will also be essential to make sure the uniformity of the customer experience throughout different communication channels.

2. Ease

The COVID-19 pandemic increased this trend, however digital-savvy customers were currently driving it. To flourish in this environment, insurance coverage agents need to adapt to meet their consumers where they are.

https://blogfreely.net/cherelle98tonda/the-ultimat...fective-insurance-policy-agent can help them do this. Automated tools estimate policies, complete applications and also assess risks. But human judgment stays essential when it concerns special scenarios such as possibility clinical conditions, services with difficult plan kinds or start-ups that need aid searching for insurance companies happy to cover their risk profile.

To maximize these possibilities, insurance firms can equip their networks with electronic client interaction tools like instantaneous messaging and also video chat for more comprehensive reach. They can additionally use hassle-free, digitized processes that improve benefit as well as minimize processing hold-ups for both events. These consist of on-line consultation organizing for appointment conferences with prospects and consumers, digital signatures for brand-new service and also advising videos for products that can be revealed on tablet computer computer systems. These can significantly boost conversion rates.

3. Wheelchair

Like inputting, insurance coverage representatives may soon be replaced by computers that price estimate prices, complete applications and evaluate dangers. However fortunately is that brand-new modern technology can also assist agents stay relevant as well as lucrative.

For example, chatbots can supply info swiftly, and automation as well as anticipating modeling take gut instinct out of underwriting choices. And also service insurance policy industries remove the need to meet with a representative, permitting customers to get instant or near-instant choices.

Customer expectations for a smooth, customized and engaging experience like the ones they get from leading merchants as well as ridesharing business are pushing insurers to revamp their front-end experiences. Installing plans into customers' ecological community trips, incorporating telematics data from noncarrier partners and also automobile OEMs into underwriting engines and also supplying flexible usage-based insurance coverage are several of the means to do it. These modifications require service providers to change their existing sales networks, but those that do will reap the incentives of a much more customized and also engaged client base.

4. Benefit

Guaranteeing today's generation of customers implies satisfying them where they are, not attempting to require them into an old system. In please click the next document , insurance policy representatives will certainly end up being procedure facilitators and also product teachers. Their job will be assisted by AI tools, remote interactions and also various other innovations that help them serve a wider consumer base.

This shift in workflow will also enable insurers to use customers a smooth digital and also hybrid sales trip. https://blogfreely.net/chanell387lindsay/how-to-ef...-clients-as-an-insurance-agent consists of remote guidance, electronic self-serve platforms as well as in-person meetings when practical for the customer.

This flexibility is key to drawing in and maintaining younger clients, which will certainly drive future development for the market. Along with communicating with more youthful customers with the channels they favor (message, conversation, email and also video clip), insurance agents should also have the ability to determine and also support leads utilizing technology-backed information. This can enhance conversion rates, rise sales chances and assist prevent expensive mistakes like a missed sale. This will certainly be specifically essential as insurance companies upgrade legacy systems.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Exactly How To Efficiently Interact With Clients As An Insurance Representative |

Article writer-Hunter Iversen

Insurance agents must have the ability to efficiently connect with clients, whether they are sending out e-mails, giving phone calls or perhaps sending handwritten notes. These approaches can aid construct trust fund and also foster client commitment.

Improving client communication via a client site can also make it much easier for customers to handle their plans and also reduce aggravations throughout demanding situations.

1. Paying attention Skills

When consulting with consumers, an insurance coverage agent should be able to listen diligently in order to comprehend the consumer's requirements. In addition, insurance representatives should have the ability to respond to the customer with verbal as well as non-verbal signs.

Practicing these skills can assist an insurance policy representative come to be a much better communicator. A few of the most essential listening skills consist of preserving eye get in touch with, avoiding interruptions and concentrating on the audio speaker.

Ineffective communication can have a negative influence on a client's experience with an insurance firm, specifically if the agent stops working to offer clear explanations of plans. Insurance coverage companies can enhance their customer care by encouraging staff members to be critical listeners throughout staff meetings and by supplying training on just how to successfully communicate with clients. Having the appropriate interaction skills can help an insurance coverage agent close more sales and boost customer retention.

2. Verbal Abilities

Spoken abilities involve the capability to convey ideas or info via spoken words. This can include face-to-face conversations, phone calls, taped messages, e-mails and also letters. Having solid verbal interaction skills can aid an insurance policy representative verbalize their concepts plainly, involve with customers and also develop genuine partnerships with their customers.

Insurance policies can be intricate, as well as misunderstandings can result in pricey blunders that result in client frustration as well as poor testimonials. Having actually solid written interaction skills is essential for an insurance agent to efficiently interact with their clients and construct depend on.

This includes creating e-mails, texts, letters as well as mailers that are clear as well as succinct without using lingo or acronyms. In additional resources , it is important to check all communications prior to sending them bent on guarantee they are devoid of spelling as well as grammatic mistakes.

3. Listening Abilities

Listening abilities include taking in and also recognizing words of one more individual. It calls for perseverance, the ability to evaluate out disturbances and also an open mind. Active listening strategies consist of paraphrasing, making clear and also summing up. These are techniques that can help an insurance agent get the details they require from their client and communicate with them successfully.

Effective listening additionally involves supplying feedback to the audio speaker. This can be verbal or nonverbal and allows the audio speaker to know that their message was recognized and also valued. When a client receives positive responses, they are more probable to remain loyal to the firm and also advise it to others. This can lead to future business and also new leads. This is why great communication is key to an agency's success. It also aids to prevent misconceptions and develop trust fund.

4. Verbal Skills

Verbal abilities entail the capability to share details plainly and also briefly. This is an important element of insurance policy agents' professions as they must have the ability to describe complicated policies to clients in such a way that they can comprehend.

When representatives speak in a way that's complicated, customers might become disappointed as well as lose trust fund. They'll also likely search for another representative that can much better explain things to them.

To enhance your verbal communication abilities, practice proactively listening and also avoiding disturbances throughout conversations. Additionally, try to broaden your vocabulary as well as make use of new words to help you share on your own more precisely. Finally, review books on public speaking and also contacting additional establish these abilities. These pointers can aid you build solid, long-term partnerships with your customers. Consequently, this will increase your service and also make the job more fulfilling.

5. Listening Skills

As an insurance agent, you need to have the ability to listen to your customers' requirements, concerns as well as worries in order to offer them with the right remedies for their specific situations. Great listening abilities can aid you develop, keep and raise customer commitment.

Effective paying attention entails understanding as well as accepting the audio speaker's ideas, sensations as well as points of view without judgement. simply click the following webpage includes maintaining eye get in touch with, concentrating on the audio speaker as well as not being sidetracked by background sound or various other visual interruptions.

When consulting with your customers, it is essential to wait up until they are done sharing their tale prior to using a service. Jumping in too soon may create them to really feel that you are not thinking about what they have to claim. You need to likewise avoid interrupting, completing their sentences for them or making remarks that demonstrate dullness or rashness.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Leading 7 Methods To Generate Leads As An Insurance Coverage Agent |

Content written by-Salomonsen Rojas

Insurance policy representatives need a constant circulation of result in expand their service. But generating quality leads isn't simple. Right here are some smart methods that can help.

A specialized link with an electronic insurance policy application that's home to real, bindable quotes is a simple means to generate leads. Use it in an e-mail, on social networks or in marketing.

1. Construct a solid on the internet presence

As an insurance policy representative, you need a solid sales pipe. You have to load it with top quality leads that become customers.

Online marketing strategies offer a range of alternatives for new organization generation. They can aid you generate leads at a portion of the preliminary investment price contrasted to standard approaches.

Developing content that offers worth to your target market can be a reliable means to bring in brand-new clients to your website. Nonetheless, you ought to make sure that this web content relates to your audience's requirements.

Providing your company on online business directories can enhance regional presence. It can likewise match your search engine optimization initiatives by magnifying brand awareness.

2. Get noted on credible review sites

Obtaining leads is a fundamental part of developing your insurance policy service. But https://www.forbes.com/advisor/travel-insurance/advantages-travel-insurance-agents/ , in particular, can discover it tough to generate adequate top quality leads.

Focusing on material advertising is one method to generate more insurance policy leads. Create pertinent and also beneficial material that aids your target market fix their issues and also build a bond with your brand name.

You can additionally use social media to improve your lead generation. Posting articles on your LinkedIn and Quora web pages can help you connect with even more certified leads. You can also host instructional webinars to draw in possible clients as well as improve your credibility.

3. Usage clear calls to action

Insurance coverage is a solution market that prospers or withers on the quality of its list building strategies. Utilizing clear, straight phone call to activity is one means to produce top quality leads.

As an example, a web site that is optimized for pertinent keyword phrases will certainly draw in clients who are currently looking for an agent. Getting detailed on trustworthy review websites can also raise your consumer base and produce recommendations.

Remember, though, that it takes time to obtain results from these initiatives. Monitor your pipe very closely, as well as utilize efficiency metrics to refine your marketing strategy.

4. Buy leads from a lead service

The insurance policy biz can be a challenging one, also for the most skilled representatives. That's why it pays to utilize practical advertising and marketing approaches that are confirmed to produce leads and transform them right into sales.

For example, using an appealing web site with fresh, relatable material that positions you as a regional expert can bring in online website traffic. Getting listed on trusted testimonial sites can assist also. As well as having a chatbot is a must-have for insurance digital marketing to aid customers reach you 24x7, also when you run out the office.

5. Support leads on LinkedIn

Lots of insurance coverage representatives are in a race against time to connect with possible customers prior to the leads weary as well as take their organization elsewhere. This procedure is frequently referred to as "functioning your leads."

Insurance policy firms can produce leads on their very own, or they can acquire leads from a lead solution. Purchasing leads saves money and time, yet it is essential to recognize that not all lead services are produced equivalent.

To get the most out of your list building efforts, you require a lead service that specializes in insurance coverage.

6. Request customer reviews

Insurance coverage agents flourish or wither based on their capacity to connect with prospects. Obtaining as well as nurturing quality leads is necessary, particularly for new agents.

On-line content advertising, an effective as well as cost effective method, is an efficient means to produce leads for your insurance organization. Think of what your target audience is looking for and develop handy, informative web content that resonates with them.

Reviews, in message or sound format, are an outstanding tool for developing depend on with potential customers. These can be uploaded on your web site or utilized in your e-mail newsletter as well as social networks.

7. Outsource your lead generation

Maintaining a constant pipe of qualified leads can be challenging for insurance policy representatives, particularly when they are hectic servicing existing clients. Outsourcing your list building can liberate your time to focus on expanding your service and also getting new clients.

Your site is one of the very best devices for generating insurance coverage leads. It ought to be very easy to browse and offer clear calls to action. Additionally, https://www.deltaplexnews.com/state-farm-insurance...vides-insurance-coverage-tips/ is very important to get noted on reputable evaluation sites and also use testimonies.

An additional terrific method to generate insurance policy leads is with web content marketing. By sharing relevant, informative write-ups with your target market, you can construct trust fund and also develop yourself as an idea leader in the sector.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

The Ultimate Guide To Coming To Be An Effective Insurance Coverage Agent |

Content create by-Blanton Soelberg

New insurance agents typically have impractical expectations. They see seasoned representatives making "X" quantity of cash each year and anticipate to make that today, however achieving success takes some time and also devotion.

Remaining on top of new market techniques and increasing your knowledge beyond the insurance policy field will certainly assist you give customized recommendations to your insureds.

1. Establish a Solid Brand Name

A solid brand is essential when it involves bring in brand-new customers as well as keeping current ones. Establishing an online visibility is one way to do this. This might consist of publishing useful blogs, developing video material, and sending regular emails with important danger management approaches.

Insurance coverage representatives likewise need to have outstanding customer service abilities. Clients value timely actions to their questions, e-mails, and phone calls.

Creating a solid customer base takes some time and also effort. Buying advertising methods can help you achieve your goals much faster.

2. Develop a Sales Channel

Sales funnels are marketing tools developed to record the largest pool of potential customers and then slim them down into a smaller team of loyal consumers. They work best when they are developed with details objectives for specified target audiences as well as are performed utilizing engaging advertising material.

look at more info is commonly broken down into four stages-- Understanding, Rate Of Interest, Decision and Action. Each phase represents a various attitude that requires a distinct messaging method. In the last, your prospect ends up being a consumer by making a purchase or picking not to acquire.

3. Target Your Suitable Consumers

Frequently, possible insurance clients will run a search prior to they get in touch with an agent. It is crucial for representatives to be leading of mind for these prospects, which can be done by creating informative blog sites or implementing e-mail advertising and marketing.

Insurance coverage is a challenging market, and potential customers will require a mindful representative who can explain items in a clear as well as concise manner. In addition, agents that go above as well as past for their clients will certainly obtain recommendations as well as construct a network of relied on connections.

Coming to be a successful insurance policy agent calls for hard work and also determination. However, by staying current on insurance advertising fads and concentrating on customer support, representatives can start to see success in their service.

4. Establish a Structured Insurance Coverage Sales Cycle

Insurance coverage is a complicated business and you need to have a strong work principles, great client service as well as a capacity to discover rapidly. Additionally, you need to have a strong grasp on your insurance coverage products as well as carriers. Taking sales training courses such as Sandler, Opposition or Craig Wiggins is an outstanding method to get the essential understanding.

Honesty is likewise key in insurance, as misleading representatives don't normally last long in the sector. https://www.albanyherald.com/news/retired-insuranc...b7-11ed-b26f-13b076ef0bb2.html 's likewise vital to support your leads, so guarantee that you respond to queries as well as calls promptly.

5. Nurture Your Leads

Discovering clients can be hard, specifically for a brand-new insurance policy agent. Nevertheless, there are a few methods that can assist you nurture your leads and grow your organization.

One strategy is to concentrate on a specific niche within the insurance market. For instance, you might pick to offer life or service insurance. Then, become an expert in these particular locations to attract even more clients.

One more means to generate leads is by networking with various other experts. This can consist of lending institutions as well as home mortgage brokers, who commonly have connections with prospective customers.

Cold-calling might have a poor track record, but it can still be an efficient list building device for numerous representatives. By utilizing efficient manuscripts and also chatting points, you can have an effective conversation with possible leads.

6. Develop a Strong Network

Insurance coverage representatives have to have the ability to connect with people on an individual degree and produce connections that last. A strong network assists insurance coverage agents obtain company when times are difficult, as well as it likewise permits them to offer a higher level of service to their clients.

Creating a durable portfolio of insurance products can aid a representative diversify their revenue and serve the demands of numerous insureds. Furthermore, supplying monetary solutions like budgeting or tax prep work can offer clients an additional factor to pick a representative rather than their competitors.

7. Be Always Learning

Insurance policy representatives need to continually learn more about the items as well as carriers they sell. This requires a significant quantity of motivation as well as grit to be effective.

It's also essential to stay up to day on the insurance coverage industry, sales methods and also state-specific guidelines. Taking continuing education training courses and also attending seminars are fantastic ways to hone your skills and also stay on par with the most up to date advancements.

Lastly, client service is crucial for insurance representatives. Being timely in replying to e-mails, telephone call or sms message is a terrific method to develop depend on and loyalty with customers.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Automobile Insurance Policy Is A Need In Order To Drive Legitimately |

Content by-Owens McDougall

Many Americans report that shopping for auto insurance, and the decision of which company and which policy to choose, can often be extremely stressful. Companies can vary tremendously in terms of their coverage of claims, availability, and service, and with so many options available, how do you know which is the right choice for you?

Most people today are purchasing their auto insurance via the Internet, but you should remember not to be sucked in by a good-looking website. Having the best website in the business does not mean a company has the best insurance in the business. Compare the black and white, the details. Do not be fooled by fancy design features and bright colors.

The year and options on your vehicle will play a large roll in how much your insurance premium is. Having a newer car with lots of safety features can save you some, but if you have it financed you will also have to pay more for full coverage.

One overlooked way to save money on your car insurance is to stick with the same company for an extended period of time. Most insurance companies offer reduced rates to long-term customers which can add up to big savings over time. So, find an insurance agency to your liking, stick with them and watch your premiums go down.

If you have an alarm system or immobilizer installed on your car, your premium may be reduced. https://youngsinsuranceburlington.blogspot.com/202...r-insurance-for-high-risk.html from theft has a main role in calculating your insurance coverage. To further reduce your premium, you can install a tracker. This will provide more theft protection resulting in an even lower premium.

You will serve yourself better by acquiring various quotes for car insurance. Rates can vary dramatically from one company to the next. To make sure that you are not spending too much on your insurance, you will want to shop around for new quotes at least one time ever year. Make sure this year's quote is for the same coverage as last year.

Take a course on safe driving. First, you will want to check and see if your car insurance provider offers any discounts for safe driving courses. Many do. Having taken one might qualify you for a discount. The courses themselves are not very expensive and usually do not take more than a week or two to complete.

Your insurance should not be too expensive if you drive less than 7500 miles a year. You can drive less by taking public transportation instead, or by sharing rides with your coworkers. Make sure you can provide a proof to your insurance company that you drive under 7500 miles a year.

Look for state health insurance policies. While federal health programs exist for low-income families, some states are working towards adopting low-cost health insurance plans for middle-class families. Check with your state department of health, to find out if these low cost plans are offered in your area, as they can provide great comprehensive coverage for a minimal cost.

Do not forget to remove drivers from your car insurance plan. If you add a child or any other individual as a driver to your plan, do not forget to remove them when they are no longer using that vehicle. If you don't remove them, you are paying more money than you need to be.

To get the best deals on car insurance you should be sure to understand the types of policies. This is because there are many types of coverage and they each protect you in different situations. Some of them will be more expensive but also provide higher coverage, while others will be much cheaper but not protect you as much.

Pay your insurance in full when it is due rather than paying it in monthly installments. Your insurance company may charge you more if you choose to pay monthly because of the convenience of it. If you have to, take out a small loan to avoid paying fees to the insurance company.

Begin your search for lower car insurance rates online. Companies have so much information located on the internet, including what kind of coverage they have available and even discounts that you might be eligible for. You can take your time to look through everything and make the best decision for you. Be careful not to judge how good a company is solely by the look of their website.

If you are a person who has had car insurance for years but never had an accident then an insurance company who offers vanishing deductibles may be perfect for you. If you are not getting in accidents then you should be rewarded, and this kind of program offers you a reward.

One way to reduce the insurance premiums on a car is to ensure it is parked in a safe location. Generally speaking, parking a car on the street or in a driveway is less secure than parking it in a garage or secured lot. Most insurance companies take note of this distinction and offer discounts for safer parking arrangements.

Find out about your deductibles before you ever need any work done. Sometimes you may not realize you got a great low auto insurance rate by agreeing to pay a huge amount out of your pocket before any repairs will start. Get hold of your insurance rep and ask them to explain it to you.

You can reduce your auto insurance policy premium by buying a vehicle that qualifies for some type of discount, or one that doesn't carry a surcharge. Ask your agent about the cost of insuring a vehicle you are interested in before you decide on buying it.

If you want to get cheap auto insurance rates one of the things that you can do is to build up your reputation as a safe driver. If you had no claim in 5 five years, your insurance can be reduced by as much as 75 percent. Insurance companies will give you lower car insurance rates if they know that you can stay away from accidents.

Though simple, the tips listed above could save hundreds and thousands of dollars per year on expensive auto insurance payments. The point is, take your time and calculate your costs carefully. Get ahead of the curve and be prepared for what you will need to pay before you even go to get your vehicle. youngs insurance fort erie and research is the key to saving.

|

Метки: Auto Insurance Car Insurance General Insurance Home Insurance House Insurance Insurance Agents Car Insurance Company |

Finding Vehicle Insurance Policy That Fits Your Needs |

Content create by-Clayton Butt

A lot of people are finding it more and more difficult to find the right type of auto insurance that is right for them. You have to just make sure you understand everything there is to learn when it comes to auto insurance. With these tips here, you can learn some insights on making the right choice.

Buying car insurance online can help you find a great deal. Insurance companies often provide a discount for online applications, since they are easier to deal with. Much of the processing can be automated, so your application doesn't cost the company as much. You may be able to save up to 10%.

Before you buy any "extras" for you car, have a conversation with your agent to see if this would change your auto insurance premiums. If you pay $700 for new tires that just add a mere $200 value to your car, you will not be reimbursed for that difference should your car be stolen.

Most states require that you pay for liability insurance. You need to be aware of the regulations regarding minimum insurance coverage in your state. If your vehicle is not insured when you are in an accident, there will not only be serious financial consequences, but there will also be consequences from your local authorities.

If your car is not particularly valuable, go ahead and select the minimum amount of liability, when you purchase auto insurance. This is the bare-bones coverage legally mandated by your state. While minimum liability provides very limited financial assistance when you make a claim, your needs will probably be modest if your car is modest, too. Minimum liability coverage is the cheapest insurance that you can get.

Join an appropriate car owners' club if you are looking for cheaper insurance on a high-value auto. Drivers with exotic, rare or antique cars know how painfully expensive they can be to insure. If you join a club for enthusiasts in the same situation, you may gain access to group insurance offers that give you significant discounts.

To get the best price on your auto insurance policy, make sure that the one you currently have includes correct information about your vehicle. Double check the listed age and make of your car and look to see that the mileage they have is right. Make sure that any special circumstances, such as a short drive to work, are mentioned.

Get a car insurance quote before you purchase a new vehicle. One of the major factors in how much your policy will cost you is the kind of car that you own. The same brand of car with a different model can change your yearly rates by a thousand dollars. Make sure you know that you can afford the insurance before you leave with the car.

The more claims you file, the more your premium will increase. If you do not need to declare a major accident and can afford the repairs, perhaps it is best if you do not file claim. Do some research before filing a claim about how it will impact your premium.

To get the best price on your auto insurance policy, make sure that the one you currently have includes correct information about your vehicle. Double check the listed age and make of your car and look to see that the mileage they have is right. Make sure that any special circumstances, such as a short drive to work, are mentioned.

If you severely damage your vehicle or total it, the insurance company will offer you an amount they think your vehicle is worth. If you don't agree with the value they give you, get quotes from different auto dealers and prove the value of your car, to make sure you are getting the right amount.

When purchasing car insurance, do not get unnecessary add-ons. Things like Motor Club, Travel Club, and Accidental Death Insurance are rarely used and just end up costing you more money each year. Instead, source for this article with things you will use, such as collision coverage, liability and property damage, and bodily injury coverage.

Be sure to understand the terminology used in your car insurance policy. Even when you talk to your agent, he will be talking about things like comprehensive, collision, and liability. Make sure that you understand what is meant by all of this, this way you will be able to ask all the questions you may have and understand the answers that you will be getting.

When purchasing auto insurance it is important for you know your policy types. What does your car insurance actually cover? Be sure to check out all the separate components of your policy and make sure they fit your needs. Some of those components are bodily injury liability, collision coverage, comprehensive coverage (or physical damage, uninsured motorist coverage, medical payments, and property damage liabilities.

When https://driving.ca/features/insurance/will-a-singl...ion-affect-your-auto-insurance are shopping for auto insurance, it is always a good idea to get at least three quotes before you make a decision. By doing so, you ensure that you have found the best deal for you. Compare rates and what each company has to offer such as roadside assistance.

When you are looking for car insurance, try to purchase it online. Many car insurance companies tend to offer a reduction by filling out an application online. This is because most of the application process this way is automated so they do not have to spend money on processing it.

Be sure to understand the terminology used in your car insurance policy. Even when you talk to your agent, he will be talking about things like comprehensive, collision, and liability. Make sure that you understand what is meant by all of this, this way you will be able to ask all the questions you may have and understand the answers that you will be getting.

Make sure you know what kind of coverage you have in your policy. Be aware of what your auto insurance is actually insuring. Many things affect the final cost of the policy. There is bodily injury liability, property damage liability, medical payments, uninsured motorist protection, collision coverage, and comprehensive coverage.

Don't hesitate to price compare when you're looking for an auto insurance policy, as prices can vary widely. The internet has made it increasingly easy to check around for the best price on a policy. Many insurers will give you instant quotes on their website, and others will e-mail you with a quote within a day or two. Make sure that you give the same information to each insurer to guarantee you're getting an accurate quote, and take into account any discounts offered, as these can vary between insurers.

As you now may be starting to understand, the auto insurance purchasing process does not need to be as painful as it once was. The important thing to remember is to explore your options. By following the tips and advice from this article, you will help to ensure that you have the best experience, while getting the best deal possible.

|

Метки: Auto Insurance Car Insurance General Insurance Home Insurance House Insurance Insurance Agents Car Insurance Company |

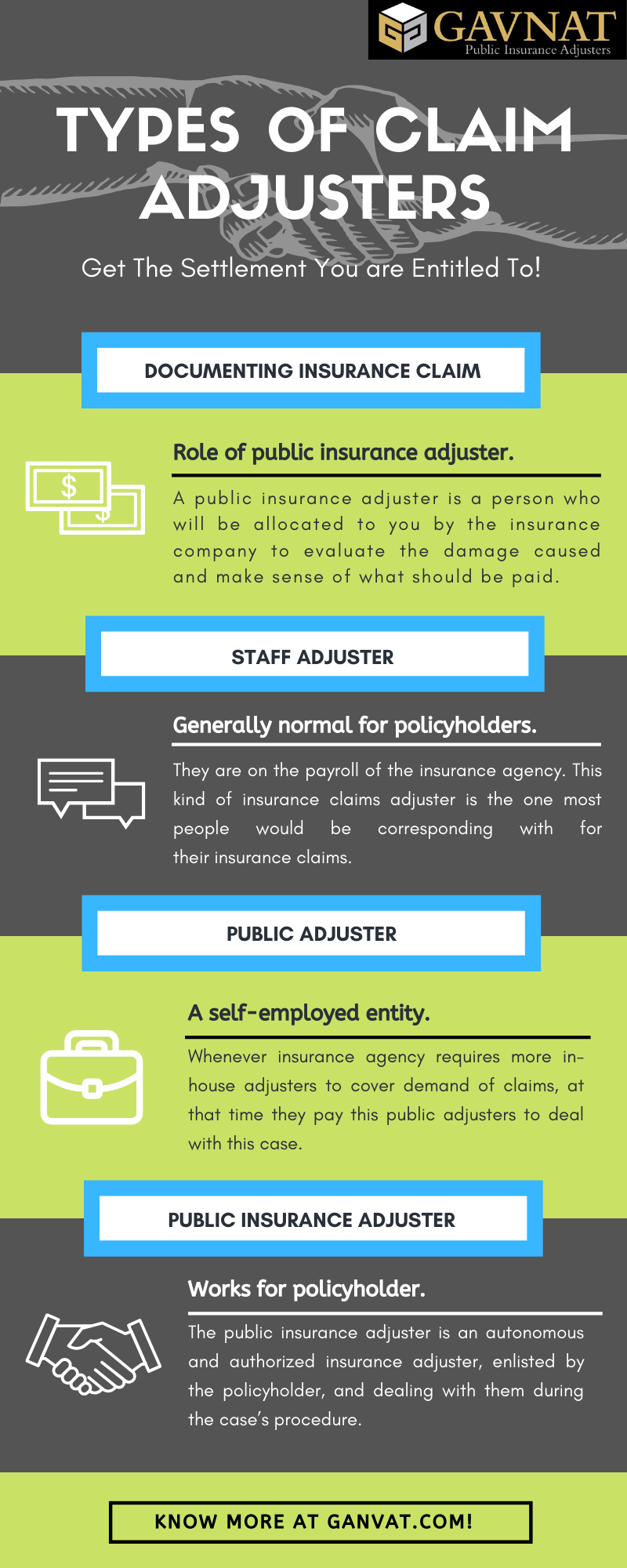

What Is A Public Insurer And How Do They Function? |

Authored by-Holgersen Snedker

What is a Public Adjuster? A public insurer, additionally known as an independent assessor, is an independent specialist acting only in behalf of the insured's lawful passions. The insured pays the public adjuster, not the insurance provider, for his/her services. https://www.insurancejournal.com/news/national/2020/10/07/585714.htm limit the authority of public adjusters to the assessment of property damage as well as losses and also restrict their liability to the payment of advantages to the wounded, as well as restrict their capability to change injury insurance claims.

If you are involved in an auto accident, your insurer might have selected a "public insurer" to represent your interests prior to the Insurance coverage Insurance adjuster. The insurance provider's insurance adjuster will investigate your claim and review your documents. Your adjuster will accumulate information from witnesses, pictures, cops records, repair service estimates, as well as other proof to make a good public insurer's report. The Insurance Adjuster's job is to apply all the info to determine that need to pay you for your injuries.

When your insurance holder's insurance coverage claim is denied, the adjuster will certainly typically seek the case strongly. The insurance adjuster's report is typically attached to the decision of the Insurance Adjuster to award the insurance holder an insurance claim amount. Although the Insurance Adjuster's choice can be appealed, if the allure is rejected by the court, the Public Insurance adjuster will certainly not be needed to make a last record.

In many states, the cost for having a Public Insurance adjuster's report is not a required component of your policy. Nonetheless, many public insurance adjusters charge a practical fee for their aid. On top of that, the Insurance Company may ask for an added fee from the general public Insurer in case of a denial of a claim. These charges are normally a portion of the actual loss amount.

Insurer can discover a number of ways to stay clear of paying a public insurer's charge. Some firms try to have a public insurance adjuster remove himself from the instance. If this takes place, the Insurance Company will still receive every one of the repayment cash that the public insurance adjuster was spent for. Various other firms try to obtain the Insurance coverage Insurer to not list any adverse aspects concerning your case.

Insurance provider that have public insurance adjusters usually have a different division responsible for making resolutions of the loss and repayment amount. As part of their work, the general public insurer will see the real site where the crash occurred. He or she will certainly review the site and listen to the claims from consumers. From these brows through, the business insurer will certainly prepare a modified report that will information every one of the information of your insurance claim.

When the Public Insurance adjuster makes his record, the Insurance Company will usually call for an assessment to determine an accurate loss quantity. This assessment, which is frequently carried out by an appraiser who is independent of the firm that carried out the case, is extremely handy for the Insurance Company. look at this site will make use of the assessment as an overview to make sure that they can make an exact determination of the loss. Along with an evaluation, if the Insurance Company has a good claim insurer, he or she might request that a specialist (such as a land appraiser) likewise review the loss record to make sure that the case is being made to an exact requirement.

There are two key reasons why the Insurance policy Public Insurance adjuster bills a cost. First, she or he need to investigate the insurance claim and also prepare an accurate account. Second, he or she should gather the appropriate quantity of the fee from the insurance policy holder. If the insurance policy holder tests the accuracy of the report, the general public insurance coverage adjuster need to justify his or her charging the fee in composing. In some states, insurance policy holders are allowed to make their own ask for dealing with mistakes as well as noninclusions; if this is the case, the insurance holder has to be provided written notice of the right to make such a request.

What Is A Public Insurance adjuster And How Do They Work? |

Article writer-Boll Snedker

What is a Public Insurer? A public insurance adjuster, additionally called an independent assessor, is an independent professional acting entirely in behalf of the insured's lawful passions. The insured pays the general public adjuster, not the insurer, for his/her services. State legislations restrict the authority of public insurance adjusters to the evaluation of residential or commercial property damage as well as losses as well as restrict their responsibility to the settlement of advantages to the wounded, as well as limit their capacity to adjust accident cases.

If you are associated with an automobile mishap, your insurance provider might have appointed a "public insurer" to represent your rate of interests prior to the Insurance coverage Insurance adjuster. The insurance company's adjuster will certainly explore your claim and also examine your papers. Your insurance adjuster will accumulate info from witnesses, photographs, police records, repair work price quotes, as well as various other proof to make a great public insurance adjuster's record. The Insurance Adjuster's task is to use all the details to establish that should pay you for your injuries.

When your insurance holder's insurance policy claim is denied, the adjuster will frequently pursue the case strongly. The adjuster's report is usually connected to the decision of the Insurance coverage Insurer to award the insurance policy holder an insurance claim quantity. Although the Insurance coverage Adjuster's choice can be appealed, if the charm is denied by the court, the general public Adjuster will certainly not be required to make a last report.

In many states, the charge for having a Public Adjuster's record is not a required component of your policy. Nonetheless, numerous public insurers bill a practical fee for their support. In addition, the Insurance Company may request an extra charge from the Public Insurer in case of a rejection of a claim. These fees are typically a percent of the actual loss amount.

Insurance companies can discover numerous ways to stay clear of paying a public insurance adjuster's cost. Some firms attempt to have a public adjuster remove himself from the instance. If this occurs, the Insurer will certainly still obtain every one of the reimbursement money that the general public insurer was spent for. Other firms try to get the Insurance coverage Insurer to not note any type of negative elements concerning your insurance claim.

Insurer that have public adjusters usually have a different division in charge of making determinations of the loss as well as settlement amount. As part of their job, the general public insurer will certainly check out the real site where the crash occurred. He or she will certainly review the site and pay attention to the claims from customers. From these brows through, the company insurer will prepare a modified report that will certainly detail every one of the details of your claim.