Understanding Insurance Policy Insurer and also Public Claims Insurance Adjusters, Individual That Readjust Your Insurance claims |

Article writer-Borregaard Woods

The Insurance coverage Regulatory authorities are a team of Insurance coverage Brokers that keep the rules as well as guidelines of Insurance related to Insurance coverage Claims, Public Insurers, Insurance Brokers, Insurance Policy Brokers, Insurance Coverage Insurers as well as other specialist workers. They make certain that Insurance Companies and also their Agents comply with the rules as well as policies relating to Insurance policy related jobs. https://www.mapquest.com/my-maps/ec3293f2-1f90-4dc9-903f-4a2e9fce5bbb carry out lots of jobs to ensure that the guidelines and also guidelines are followed in all genuine and also honest means. Read the Full Guide consist of Public Adjusting, claim management, project management, and also insurance-related audits.

A public insurance insurer is required by legislation to be licensed in all states. This person does all jobs associated with Insurance policy insurance claims, Public Adjusters, Insurance Brokers, Insurance Coverage Professionals, as well as other insurance company staff members. They are not accountants or designers; instead, they do as task managers for insured clients. They assess the present condition of a structure, both structurally and functionally, as well as suggest means to improve the building's look. In doing so, they educate the insurance company regarding any type of damages that has been or is expected to be covered by the insurance policy holder.

When a public insurer goes to a meeting with the insured policyholder, the Insurance policy Regulator will assess all proof connecting to the damage to the residential property. If the proof reveals that the insurance holder's case for loss is unreasonable, the general public Adjuster will certainly make a reasonable settlement deal to the insurance policy holder. In several instances, the general public Insurer is aided by a group of experts consisting of lawyers, designers, as well as designers. The goal of these individuals is to get the most effective fair settlement feasible for the insurance policy holder while saving the firm money in premiums as well as enabling it to keep business running while paying the claim.

While some state federal governments enable "commissioning" or "inspection" of buildings before releasing a Public Adjuster's certification, the majority do not. Furthermore, even evaluation might be waived in particular circumstances. As an example, if the framework has actually been stated a calamity, there might be an amount of time during which the Public Adjuster is not permitted to check it. In this case, the insurance provider will make the decision whether to check it. There are likewise circumstances where the general public Insurance adjuster have to evaluate the framework and afterwards concerns an order relieving the proprietor from future claims. In these instances, the Insurance policy Regulator is accredited to inspect the structure as well as decide if he figures out that there is factor to believe the structure may require enhancement.

A lot of public insurers receive settlement for their solutions from the insurance company. The Insurance coverage Regulator have to approximate the fee that should be accumulated in advance; generally, this cost is around one hundred dollars. Insurance private investigators who are appointed to this job do not have a responsibility to the general public; nonetheless, they might choose to follow up with the examination and send a report on their findings if the customer so needs. If the Insurance Regulator locates that a public claim was submitted that is not valid, the fee required by legislation is reimbursed to the plaintiff.

Insurance coverage detectives strive to gather on all legitimate insurance claims, but the Insurance Regulatory authority has the authority not to enforce penalties if a public insurance claim is not promoted. Nevertheless, he can refer the situation to the Insurance Claim Testimonial Council if he finds that an insurance claim was not filed within the applicable period. If the council locates that the policyholder did not work out the case appropriately, he may choose to refer the situation back to the insurance coverage service provider for negotiation. It is extremely uncommon for an Insurance coverage Adjuster to refer a case to the insurance policy service provider for settlement. Nonetheless, when he does refer an instance, the insurance policy service provider is responsible for speaking to the insurance policy holder to try to discuss a negotiation.

If a public insurance adjuster refers an insurance claim to the Insurance coverage Insurance Claim Testimonial Council, the Insurance Coverage Regulatory authority has the power to refer the case back to the cases department of the insurance company. If the insurance claims division consents to the settlement offer, the deal is binding on both sides. If not, after that the Insurance Regulator can refer the instance back to the insurance company's underwriters for consideration.

The Insurance provider can decrease or accept the offers from the Public Insurance adjusters. However, ought to a firm accept the offer from a public adjuster, then he has the responsibility to finish the insurance claim procedure and pay the premiums as well as deductible in behalf of the guaranteed. Ought to a business decrease the settlement deal from a public insurer, after that he needs to inform the Insurance coverage Regulator of his choice in composing. If the business does not complete the whole case procedure within the proposed period, after that it must pay the premiums and finish the insurance claim settlement.

|

|

Public Insurance Adjusters And Also Their Settlement Claims |

Written by-Ivey Estes

A Public Insurer is an independent professional that services your behalf to safeguard your legal rights as an insurance policy holder. He/she functions only for you and also is not tied to any type of certain insurance provider. Instead, the insurance coverage firm will normally designate its very own public insurer to look after its passions. You are described this insurance adjuster by your insurance coverage.

Claims by staff members: You can also end up being a sufferer of a "public adjuster" when you suffer loss or damage from injuries suffered at the workplace. In several insurance plan these claims are taken care of by the same individual that represents you in the court process. If the case requires a big amount of money to be paid, the insurance company commonly assigns one of its own public insurers to deal with the case. The general public adjuster's duty is to work out the claim promptly. To do this he/she needs to determine the extent of the losses or damages suffered from the occasion and also get a price quote of the case from the other party(s) associated with the legal action.

https://www.spglobal.com/marketintelligence/en/new...rophe-claims-handling-59265048 provide for an evaluation of the loss, or loss element. The insurance coverage normally specify that the appraiser selected should have a good track record and also a good track record in the settlement area. Great public adjusters are very proficient and also knowledgeable in their area of expertise. An appraisal is typically a quote of the loss or damages incurred and also is made use of as a consider determining the claim settlement. An assessment is a process that involves a great deal of difficult mathematical calculations and also is an extremely tiresome and also time consuming procedure for an ordinary individual to do.

When you work with a public insurer you need to be aware of the function he/she is supposed to play when managing your situation. When you employ an excellent public adjuster he/she is intended to perform the following tasks: he/she ought to explore the incident of the loss; examine the level of the loss; examine the medical documents needed for the insurance claim negotiation; gather information of all witnesses; examine the residential or commercial property as well as devices damaged; assess the monetary impact of the loss on the plaintiff; as well as perform the needed follow up treatments. All these treatments are expected to be executed with reasonable care and diligence. If these procedures are not complied with the threat of the claimant winning the claim but losing the settlement or obtaining only very little compensation is increased.

Insurance companies typically have a system of internal review and quality assurance for their insurance claims. A company adjuster is selected based upon the suggestions of this internal evaluation and quality assurance procedure. However click here to read is also important for the plaintiff to select an ideal company insurer. For this purpose they can hire a trustworthy personal injury legal representative to carry out an independent testimonial of the case. If the attorney is pleased that the case is well offered and also does not have any type of significant errors then the attorney may refer the claimant to the appropriate firm insurance adjuster.

It is not essential that the Public Insurer will bill a fee for his services. Yet the firm adjuster might bill some amount for his info solutions including his study of the medical records, photos, mishap records, cops record if there is one, and various other various information about the accident and also its causes. In Some Cases the general public Adjuster may request some additional information in order to prepare a good negotiation amount and for this the applicant might need to supply him with additional information such as the quantity recuperated up until now, what is left as a last negotiation quantity and the reasons behind the claim.

The good public adjuster will always charge a fee for his solutions. The size of the fee depends on the nature of the insurance claim that is being assessed. Claims for tiny problems are normally cheap, as there are many complaintants for the same loss. On the other hand insurance claims like those for major losses are expensive, as the process entails gathering proof, witnesses, etc. Some business may also bill extra for the solutions of an excellent public adjuster. A big loss involving significant properties like an organization or a residence can bring about a rise in the total compensation amount.

If you employ an expert insurance coverage adjuster then the business will absolutely offer you a guarantee. Insurance policy adjusters have particular guidelines and regulations to follow while taking care of insurance claims cases. They need to adhere to the regulations of the state in which they work. For that reason, it is much better to hire a professional public insurer for your needs. These adjusters or their representatives need to be accredited by the state.

|

|

The Function of a Public Insurance Adjuster - Just How You Can Gain From Hiring One |

Content create by-Kruse Valdez

Not too long ago, there made use of to be a time when an insurance policy representative or insurance policy insurer was going to a deposition eventually when the insurer's insured celebration was there. During that time, the insured event would make a several minute speech to the Insurance Insurer and also inform him all the information regarding why they had actually made the insurance claim as well as why the insurance coverage service provider had actually declined it. A verbal reaction by client was practically uncommon. Well, with the substantial development in Claims processed recently, a lot of Insurance coverage Insurance adjusters have actually become entirely desensitized to spoken responses. Therefore, several Insurance policy Adjusters have absolutely no persistence and will simply not even make the effort to go through the claim details with a plaintiff.

Not too long ago, there utilized to be a possibility when an Insurance coverage Insurer was going to a deposition and also when the insured celebration stood up to leave, the Insurance Insurance adjuster would certainly lean over and also say, "You better mind off because the public adjuster is waiting on me." https://www.americanpress.com/insurance-officials-...91-11eb-846b-93e34057e50d.html of client after that spoke volumes. With large dazzling eyes, he promptly leaned over to his attorney as well as discussed just how his world had shaken up the very day of his loss which he was totally overwhelmed ... He continued, "I do not require your insurance policy any longer!" The attorney giggled and claimed, "No, obviously you don't. You're lucky I'm right here."

While it is true that an Insurance coverage Adjuster is usually offered the chance to act in the duty of a "personal assistant," this does not mean that they necessarily receive any expert help throughout the insurance claims process. As a matter of fact, many Specialist Obligation Insurance policy Insurance claims advisors (PLI) do not also obtain any compensation from the insurance holders' insurance policy service provider till they have actually made all of their claims for settlement. If you could try this out is offered with any kind of settlement prior to the client gets his/her final case, it is at the discretion of the specialist responsibility insurance policy service provider to determine if and how much they will certainly permit the Insurance policy Adjuster to receive. If an Insurance policy Insurance adjuster is provided any payment whatsoever, the Expert Responsibility Insurance coverage Insurance claim expert will certainly have to set up an account in their own name to receive their portion of the settlement.

One more common circumstance that commonly presents difficulties for public adjusters is when they are called as a result of a legal representative or other expertly working client's specialist neglect. Insurance policy insurance adjusters are frequently placed into a really hard placement. Initially, they must identify if the situation ought to move forward, as well as the degree of the claim. Second, they have to determine who is inevitably responsible for making the settlement.

In several circumstances, specialist obligation insurance companies need insurance holders to sign over the full negotiation quantity in order to clear up the case, including legal fees. On top of that, most indemnity insurance companies will need that insurance holders to sign over the civil liberties to future negotiations on the occasion that the initial case is not successful. When these 2 variables enter into play, it comes to be incredibly challenging for a client to identify whether they are indeed managing a Public Insurer, and also whether their legal rights have been properly secured. The good news is, there are particular methods that assert negotiation brokers use that can aid customers establish if their Public Insurance adjuster is absolutely an independent professional or merely acting in concert with their company.

There are two main ways that insurance company adjusters can make their calls. First, they may call the client's insurance policy provider and request consent to go to the client. When the adjuster arrives at the client's home or workplace, the broker will normally be needed by regulation to ask for permission to talk with the policyholder. In several circumstances, insurance holders will certainly be frightened by the Public Insurance adjuster as well as will certainly allow the adjuster unconfined access to their home. Insurance companies are not called for to reveal this fact, yet it is best for insurance holders to be aware that the majority of insurers will never ever ask for permission to talk with them.

Some insurance suppliers like to deal with direct public insurance adjusters, having them call or personally go to the home or place of work of the policyholder in order to sue. However, most people who obtain this phone call are not comfy with the concept of a stranger coming onto their residential or commercial property to decide regarding their insurance plan. Insurance coverage providers who have actually picked this method will certainly commonly remind insurance policy holders that the whole purpose of having an insurance plan was to provide security from unanticipated disasters. While it is comforting to know that public insurance policy insurers are professionals that are educated to choose that are in the best rate of interest of their client, some individuals discover it upsetting that their insurance coverage has actually been altered by any means. While some individuals may not locate this intrusive of an activity to be necessary, various other insurance policy holders will certainly find that it makes their insurance policy declares significantly more probable to be resolved out of their own pocket.

When an insurance coverage case has been filed, the public insurance coverage insurer will certainly work to get all of the evidence necessary to make a sensible decision regarding whether the case is legitimate. Occasionally this procedure can be rather straightforward as well as can include just a phone call. In other instances, the whole procedure can take months, if not years, to solve. Regardless, of how long it takes to get to a settlement, getting a payout is typically preferable to being required to pay for costly repair expenses, or having damage covered by an insurance policy claim that can have been spent for by a different insurance holder. No matter how long it considers an insurance provider to get to a verdict concerning an insurance coverage case, most individuals locate it preferable to spend for the settlement as opposed to face being compelled to pay for unexpected expenses or to repair damages to their property brought on by a 3rd party's negligence.

|

|

Public Insurance Policy Adjuster - An Individual To Get In Touch With For Easy Settlement Of Your Claims |

Article by-Vester Sampson

A Public Insurer is a fiduciary, or representative of their customer in a case scenario. You, your representative, are engaged by the insurance company to secure your passions while making an insurance claim. She or he executes exclusively for your interests and also has nothing else connections to the insurance coverage industry. The insurance coverage firm will designate its adjuster to manage its passions only.

Insurance companies are underwriting business tasks consisting of insurance claims for injuries or problems to people or property. As an example, a car is harmed while in a person's backyard. An insurance policy policeman is called to identify the extent of the damages. The insured auto owner calls a Public Insurer to notify the insurance company of a big loss. The insurance coverage police officer identifies that there is a large loss resulting in a negotiation. http://id-page-jf-public-adjusters-ny-nj.s3-website.us-east-2.amazonaws.com/ insured is informed of the quantity of the settlement upon receipt of the notification from the insurance policy provider.

Insurance policies generally specify that a public insurance adjuster needs to evaluate the properties where the insured lorry is harmed and also evaluate any associated systems at the same time. please click the next site are accountable for determining the source of the loss, inspecting the broken automobiles as well as determining repair service costs. In order for an insurance policy holder to recover cash paid to them by an insurance holder's policy, the insured have to provide evidence that the insurance policy holder is not responsible for the loss. Insurance coverage typically allow for changes based upon new evidence of damages.

If the general public Adjuster establishes that the insured is accountable for the loss, an adjustment will certainly be made. This adjustment is generally made on a per crash basis. However, it might likewise be based on the level of damage to the structure of the premises. Insurance policies frequently provide for extra stipulations on claims made by the Public Adjuster. For instance, an insurer may state that public insurance adjusters must inspect all locations of a service if a claim is filed against an entrepreneur. Sometimes, additional specifications may also relate to personal injuries or residential property damages insurance claims made by the Public Adjuster.

Insurance plan generally offer that an excellent public insurer will certainly make an assessment of the damaged structure. An assessment is typically the very first step in getting damages. Insurance companies are not constantly as forthcoming as they could be when it comes to assessments. A great public adjuster will take the time to extensively examine the facilities in order to figure out the actual damage to the structure as well as any other products situated on the property. The insurance adjuster will have the ability to utilize the appropriate tools to establish truth level of the damage.

Insurance coverage frequently define that public insurance adjusters need to charge an affordable cost for their solutions. The fee can differ considerably in between insurance suppliers. Frequently, the fees associated with smaller sized insurance claims are a lot greater than the costs charged for bigger insurance claims. As a result, it is necessary that you collaborate with a business that will not bill you an unreasonable fee simply to resolve your insurance claim.

If a public insurance policy adjuster determines that the case is qualified for a settlement, he will prepare a complete report that will certainly exist to the insured event. It is not unusual for the insurance adjuster to send this record to the insurance coverage service provider or the court that is handling the situation. In many cases, the adjuster may have a minimal time period to prepare the record. Insurance providers as well as courts often require that the insurance adjuster supply this thorough details to the parties involved in the situation.

When a Public Insurer has actually figured out that a water damage case is qualified for a settlement, he will prepare a final record. The final record will certainly include a supply of the damaged residential or commercial property, a price quote of the negotiation quantity as well as a checklist of all expenditures related to the case. You must read this record very carefully as well as ask concerns regarding these products. A great public insurer will describe to you what products are not covered by the policy as well as how those things will be evaluated at the negotiation quantity.

|

|

Public Adjusters And Also Their Payment Cases |

Authored by-Davidson McKenzie

A Public Adjuster is an independent expert that services your part to secure your legal rights as a policyholder. He/she functions only for you and also is not connected to any kind of particular insurer. Rather, the insurance coverage agency will usually designate its very own public adjuster to look after its interests. https://www.usatoday.com/story/money/columnist/202...eds-after-disaster/3523319001/ are described this insurer by your insurance policy.

Insurance claims by employees: You can also become a target of a "public adjuster" when you suffer loss or damages from injuries endured at work. In many insurance coverage these cases are handled by the same individual that represents you in the court process. If the claim calls for a big quantity of cash to be paid out, the insurer frequently appoints among its very own public insurance adjusters to take care of the insurance claim. The public insurer's role is to settle the case swiftly. To do this he/she has to establish the extent of the losses or damages dealt with the event and also acquire a quote of the insurance claim from the other celebration(s) involved in the legal action.

Insurance policies normally provide for an evaluation of the loss, or loss variable. The insurance coverage usually define that the evaluator selected need to have a good reputation and an excellent track record in the negotiation field. Excellent public adjusters are really proficient and also knowledgeable in their location of experience. An assessment is normally a price quote of the loss or damages incurred as well as is utilized as a factor in figuring out the case negotiation. An assessment is a process that entails a great deal of challenging mathematical calculations as well as is a really tedious and time consuming procedure for an average individual to execute.

When you hire a public adjuster you require to be aware of the role he/she is intended to play when managing your instance. When you work with an excellent public insurer he/she is expected to perform the following obligations: he/she ought to examine the incident of the loss; evaluate the degree of the loss; review the medical paperwork required for the claim settlement; collect information of all witnesses; check the residential or commercial property as well as tools damaged; examine the financial impact of the loss on the claimant; and perform the necessary follow up treatments. All these treatments are supposed to be done with practical care as well as persistance. If these procedures are not complied with the risk of the claimant winning the case yet losing the negotiation or obtaining just minimal payment is boosted.

Insurance provider generally have a system of interior evaluation as well as quality assurance for their claims. A business insurer is chosen based on the suggestions of this inner testimonial and quality assurance process. Nevertheless it is additionally vital for the claimant to select a suitable firm insurance adjuster. For this purpose they can employ a trustworthy accident attorney to conduct an independent testimonial of the situation. If the legal representative is pleased that the case is well offered and does not include any serious errors then the legal representative might refer the complaintant to the ideal business insurance adjuster.

It is not needed that the Public Insurance adjuster will certainly charge a fee for his services. But the company adjuster may charge some quantity for his information solutions including his study of the medical records, images, mishap reports, cops report if there is one, as well as various other miscellaneous information about the mishap and its reasons. In Some Cases the Public Adjuster could ask for some added details in order to prepare an excellent settlement amount as well as for this the applicant may require to provide him with more details such as the quantity recouped up until now, what is left as a last settlement amount and the reasons behind the case.

link web site will certainly constantly bill a charge for his services. The dimension of the cost depends upon the nature of the insurance claim that is being examined. Claims for tiny problems are typically economical, as there are lots of claimants for the exact same loss. However insurance claims like those for significant losses are pricey, as the procedure includes gathering proof, witnesses, and so on. Some business could even charge extra for the services of an excellent public insurer. A big loss involving major possessions like a company or a house could bring about an increase in the complete settlement quantity.

If you hire a specialist insurance policy adjuster then the company will certainly provide you an assurance. Insurance coverage insurers have particular guidelines and laws to follow while taking care of insurance claims situations. They need to adhere to the policies of the state in which they work. As a result, it is better to work with an expert public insurer for your needs. These adjusters or their reps need to be accredited by the state.

|

|

Understanding Insurance Policy Insurer as well as Public Claims Adjusters, Person That Change Your Insurance claims |

Article created by-Borregaard Valdez

The Insurance Regulatory authorities are a team of Insurance coverage Agents that maintain the policies and guidelines of Insurance connected to Insurance coverage Claims, Public Insurers, Insurance Coverage Brokers, Insurance Coverage Brokers, Insurance Insurance adjusters as well as various other specialist workers. They ensure that Insurance provider and also their Representatives adhere to the policies as well as guidelines referring to Insurance coverage relevant jobs. They carry out several jobs to make certain that the rules and regulations are complied with in all legit and ethical methods. These tasks consist of Public Adjusting, claim administration, project monitoring, and insurance-related audits.

A public insurance policy adjuster is called for by regulation to be licensed in all states. He or she executes all jobs associated with Insurance coverage cases, Public Adjusters, Insurance Coverage Brokers, Insurance Coverage Agents, and also other insurance company staff members. They are not accounting professionals or engineers; instead, they do as job supervisors for insured customers. They analyze the existing problem of a building, both structurally as well as functionally, as well as suggest ways to improve the structure's look. In doing so, they inform the insurer about any damage that has actually been or is expected to be covered by the insurance holder.

When a public insurance adjuster attends a conference with the insured policyholder, the Insurance coverage Regulator will review all proof associating with the damages to the property. If the evidence reveals that the insurance holder's claim for loss is unreasonable, the Public Insurance adjuster will make a fair negotiation offer to the insurance holder. In lots of circumstances, the general public Insurer is assisted by a group of specialists including attorneys, engineers, and designers. The goal of these individuals is to get the most effective reasonable negotiation possible for the insurance policy holder while saving the company money in premiums as well as enabling it to maintain the business running while paying the case.

While some state governments permit "appointing" or "assessment" of structures before releasing a Public Insurance adjuster's certificate, the majority do not. In please click the following page , even examination might be forgoed in particular situations. For instance, if the structure has actually been declared a calamity, there might be a time period during which the Public Insurance adjuster is not allowed to inspect it. In this case, the insurance provider will make the decision whether or not to inspect it. There are additionally https://www.reddit.com/user/jfpublicadjust where the general public Adjuster need to examine the framework and then concerns an order easing the proprietor from future insurance claims. In these circumstances, the Insurance Regulator is licensed to inspect the building and also make the decisions if he establishes that there is reason to believe the structure might need enhancement.

Many public insurers receive payment for their services from the insurer. The Insurance coverage Regulator need to estimate the cost that needs to be collected beforehand; generally, this charge is around one hundred bucks. Insurance coverage investigators who are appointed to this job do not have an obligation to the public; however, they may pick to follow up with the examination as well as send a record on their searchings for if the customer so wishes. If the Insurance coverage Regulatory authority discovers that a public insurance claim was submitted that is not legitimate, the charge required by law is refunded to the plaintiff.

Insurance private investigators make every effort to accumulate on all valid cases, yet the Insurance coverage Regulator has the authority not to impose fines if a public claim is not upheld. Nevertheless, he can refer the case to the Insurance Case Testimonial Council if he discovers that a case was not submitted within the applicable period. If the council locates that the insurance holder did not work out the case effectively, he might choose to refer the situation back to the insurance policy provider for settlement. It is very unusual for an Insurance coverage Insurer to refer an instance to the insurance policy service provider for arrangement. Nonetheless, when he does refer an instance, the insurance coverage service provider is in charge of calling the insurance policy holder to attempt to bargain a negotiation.

If a public insurance adjuster refers a case to the Insurance policy Insurance Claim Testimonial Council, the Insurance Regulator has the power to refer the situation back to the cases division of the insurance company. If the cases department accepts the negotiation deal, the offer is binding on both sides. Otherwise, then the Insurance policy Regulator can refer the case back to the insurance company's underwriters for consideration.

The Insurance provider deserve to decline or approve the deals from the Public Adjusters. However, must a firm accept the offer from a public adjuster, then he has the obligation to finish the case process as well as pay the premiums as well as deductible on behalf of the insured. Should a business decline the settlement deal from a public adjuster, after that he must inform the Insurance Regulatory authority of his decision in composing. If the business does not finish the whole claim process within the recommended amount of time, then it needs to pay the costs and also complete the case negotiation.

|

|

What is a Public Insurance Coverage Insurance Adjuster And Also Why You Required One? |

Content create by-Borregaard Sampson

Cases made by locals in Florida have actually frequently been submitted to a Public Insurer. These representatives do an essential role in the insurance coverage industry. Claims submitted to them must be processed within a reasonable quantity of time. Cases will be either turned down or approved, reliant upon the kind of claim submitted. One of the essential functions of this agent is to aid the client with insurance claims that remain in their benefit.

Claims reps work directly with consumers to recognize their specific needs as well as customize a special remedy to fulfill those requirements. They then develop a strategy with the client to accomplish that purpose. In some instances, public adjusters operate individually, while others work as agents for insurance companies or various other governmental companies. Insurance policy claims representatives usually experience state training programs that present expertise about the insurance sector. Those needed to function as insurance claims agents should be accredited by the Florida Department of Insurance Policy.

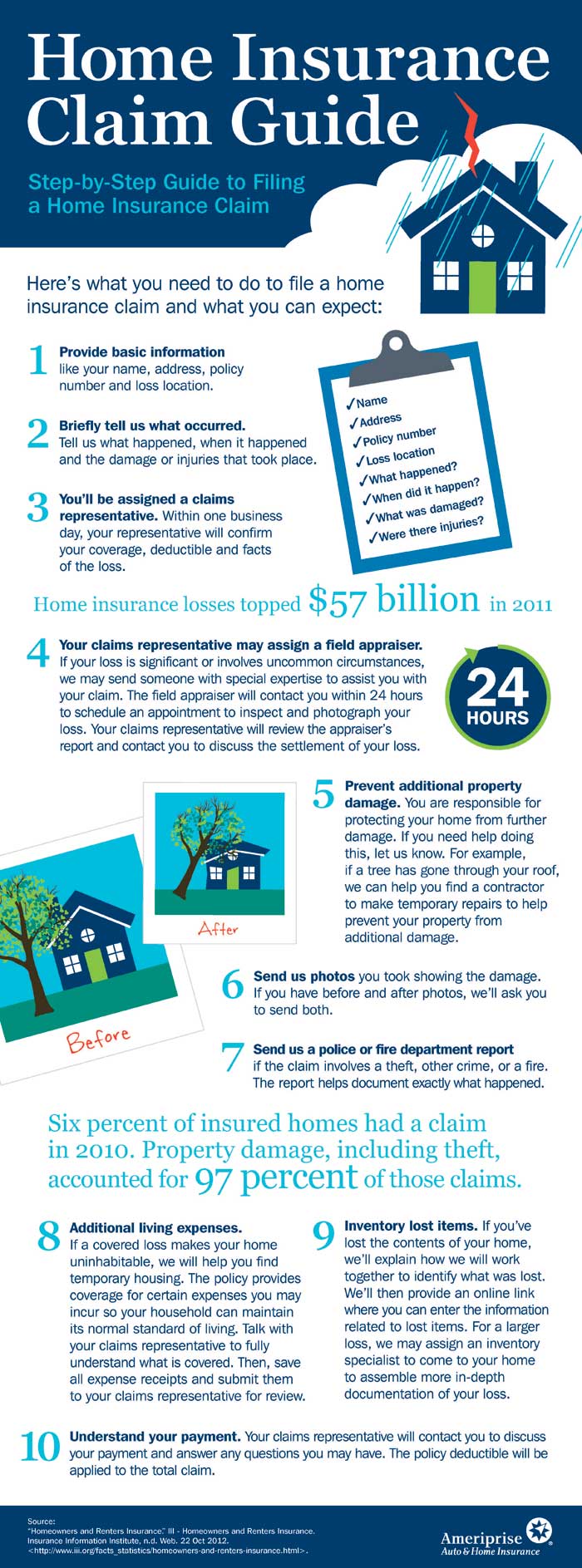

Insurance claims agents work carefully with insurance policy agents and other experts in order to process the entire case. This might include gathering details from clients, submitting documents, interacting with insurer, tracking repair work and reviewing photos and documents. Insurance claims agents are likewise responsible for making sure the accuracy of completed forms and also completing any essential settlement prior to making a final report to the consumer. A public adjuster performs added functions such as carrying out quality assurance assessments as well as carrying out follow up investigations.

Insurance policy premiums are based upon several variables, such as the client's capacity to pay. The cases procedure has a direct effect on this price. Insurance coverage can either boost or lower the total quantity of the policy costs paid for any loss. In case of a big loss, it is often beneficial to have a public insurance adjuster examine and evaluate the claim to establish whether or not the policy will be enhanced.

Insurer rely heavily upon public insurers to manage their claims. Insurance companies utilize public adjusters to help them figure out the value of a harmed residential property. Insurance policies can be adjusted to show a precise worth of a building after an insurance policy claim has actually been filed. After an Insurance Insurance adjuster figures out the real damages of an insured residential or commercial property, the business will certainly frequently request that the insured to pay an added premium on the plan in order to cover the additional expenditures.

Insurance provider need to compensate for any type of loss that is directly pertaining to the general public's loss. https://bisouv.com/energy/2951049/insurance-claims...ms-claims-applied-epic-filetr/ for these prices may be available in the form of an increase to the insurance holder's policy, or it may can be found in the form of an included cost on top of the typical premium. Insurance provider make use of the general public adjuster to help them establish the settlement amount for each and every case. Insurance holders must request a rise to the plan from the Insurer. If the insurance policy holder sues against the insurer with unreasonable grounds, they could be forced out of company.

https://www.adjustersinternational.com/pubs/adjust...property-loss-professionals/2/ are implemented by public adjusters either via class action claims or with individual issues. The Insurance Company's main goal is to provide affordable assurance to the insurance policy holders that they will not be adversely affected by the loss. In order to choose if the policyholder has presented a valid situation, a reasonable amount of proof requires to be accumulated. Insurer insurance policy holders require to be careful that they do not miss out on any kind of essential proof which they receive all the negotiation amounts they should have.

Insurance policyholders must not allow a public insurance coverage adjuster to bully them right into opting for a reduced negotiation quantity. Actually, they need to ask the general public Insurance coverage Insurer to define specifically what the policyholder should submit to the insurer in order to settle the claim. The insurer should be able to offer the insurance holder a breakdown of things that they will be paying for in the case of an occasion like this. The Public Insurance Insurer must likewise have the ability to provide a breakdown of precisely what the insurance holder will be in charge of if the insurance holder does not be successful in obtaining a reasonable negotiation.

|

|

What Are Insurance Coverage Claims Insurer - Should You Hire One? |

Article writer-Woodard Walton

A public insurer is an independent insurance claims handler/claims analyst that represents for the insurance policy holder in working out as well as aiding the insured/ insured celebration in assisting to settle its insurance claim. Public Insurance adjusters is independent insurance coverage agents. They are certified by the California Insurance Code Section 766. Public Insurers is not used by the insurance provider, but are independent insurance coverage reps who are in charge of the fiduciary duty of encouraging their clients about different issues connected to their insurance policy.

Public Insurers has three primary tasks. First, they need to submit all suitable insurance claims forms as well as reports. Second, they should prepare the records to properly discharge or settle the case if it is declined by the insurance company. Third, they must provide the client with an estimate of all required repairs or restoration job.

Insurance provider utilize Public Insurers to make the resolution of the settlement quantity on smaller sized insurance claims. The Insurance coverage Division does not consider the Public Insurer's referral when making these resolutions. If https://www.pressdemocrat.com/article/business/san...e-battles-with-insurance-comp/ thinks the negotiation amount should be more than what the insurer identifies, she or he will certainly recommend the client to sue for loss contingency. If the customer does so, the general public Adjuster receives a percentage of the claimed settlement. If the insurer agrees, after that the general public Insurance adjuster issues a final decision in case and forwards the referral to the customer.

Insurance coverage agents that stand for the general public Adjuster also play a vital duty in the whole settlement process. In most cases, these individuals have access to delicate details. When the Public Insurer determines that a settlement amount should be higher than what the insurance provider identifies, the insurance adjuster offers the information to the customer. Insurance coverage representatives might advise their customer to take the offer from the insurance provider, if they do not intend to take the chance of needing to pay more problems. Insurance coverage adjusters are usually the last hope for clients who do not have the time or resources to go after alternate opportunities.

Just how can you make sure that you do not come to be the next victim of Insurance policy Insurer abuse? The most convenient method is to just ask the Public Insurance adjuster for paperwork concerning his/her suggestions. A great Insurance policy agent will certainly be more than happy to provide such documents. As a matter of fact, it's much better to have documented proof revealing that your insurance claim was without a doubt justified, instead of having to resort to hasty solutions that may hurt you in the future. Furthermore, you need to guarantee that you completely understand the role that the Public Insurance adjuster plays in your insurance market.

Insurance Agents for Home Insurance Policy (PIP) are required by legislation to be objective. To do this, they have to sign up with a nationwide organization. The National Organization of Insurance Coverage Commissioners (NACH) has actually outlined regulations and also standards on just how members ought to behave. Among these are specifications that insurers openly stand for the passions of all insurance policy holders, even those who might have a various perspective. Although NACH makes certain that insurance policy holders are dealt with rather, it does not guarantee that they will constantly act in your benefit. Because of this, it's always important to check with NACH prior to consenting to preserve a PIP agent or insurer on your behalf.

What is much more disturbing concerning the recent newspaper article is that several of the people whose houses were destroyed had actually not been effectively educated. Numerous property owners merely minimize the loss, thinking that insurance insurers will certainly iron out any problems with no problem in any way. In https://en.gravatar.com/jfpublicadjusters , insurance companies are not just worried about the payout, but likewise with making certain that their customer's residential or commercial property is structurally sound. This is why it is vital that house owners do their very own research as well as connect with local public insurers and also skilled home inspectors to help them analyze the damages. If property owners also question the authenticity of a PIP rep, it's ideal to steer clear of the circumstance completely, as fraudulence is just as actual as negligence.

Plainly, property owners have a number of concerns when it concerns insurance policy cases insurers. These are extremely actual issues that are worthy of serious factor to consider, also when house owners feel that they ought to have some input. As even more property owners recognize the benefits of getting in touch with local PIP agents and hiring them for their services, the number of complaints and also bad moves should start to drop. Given these points, it is clear that home owners require to make themselves extra familiar with completely they can secure themselves from the unsafe whims of insurance coverage insurers.

|

|

Exactly How Can A Public Insurer Can Aid You With Your Insurance policy Insurance claim |

Article by-Davidson Estes

A Public Insurer is an individual or company that benefits the Insurance policy Department, either straight or via their insurance coverage carriers. Public adjusters function to help insurance holders in getting all of the compensation that they are qualified to from insurance policy disputes. They additionally work with other agencies within the Insurance coverage Division to review repair expenses, keep an eye on the circulation of insurance coverage payments as well as claims, and communicate with other insurer. If a public insurance adjuster's responsibilities conflicts with those of an Insurance Representative, the general public Insurance adjuster may be designated to execute the job of the Insurance Representative. This can be a fantastic benefit to insurance holders who would certainly or else have to function to get the same benefits as an agent.

Insurance coverage Representatives receive a portion of the pay when a loss is reported. In many states, insurance holders are required to offer the Insurance coverage Division with a copy of the loss declaration, which is a file that details every sort of loss that occurs throughout a year. When a Public Insurance adjuster is contacted to choose worrying whether to license a loss, they must take into consideration every one of the proof that is presented to them. Occasionally https://insurancenewsnet.com/oarticle/cfo-jimmy-pa...id-in-hurricane-sally-recovery will certainly be in the form of loss statements or photos.

Insurance Public Adjusters does not take the place of an Insurance coverage Agent however rather serve to aid them. Insurance Policy Public Adjusters is responsible for examining loss claims and figuring out whether they need to be licensed. If an insurer receives a qualification, it means that the general public adjuster has found that the insurer did in fact offer coverage for the loss that was described in the plan. If there are concerns as to whether or not the loss must be covered, after that the general public adjuster will figure out whether the loss ought to be covered by the insurer or if a substitute policy need to be issued.

When an Insurance coverage Public Insurance adjuster determines that a claim needs to be covered, they initially analyze the extent of the damage. The general public insurer will check the home and also take pictures to help them with their computations. After the examination is full, the public adjuster will create a record defining the outcomes. This record will also include a recommendation regarding what should be done about the loss. A great public adjuster will certainly function carefully with their Insurer's Insurance Representative and their Insurance representative might really visit the website in order to much better understand the damages as well as where it is located.

Insurance policy Public Insurers can function straight with the guaranteed. Nonetheless, sometimes, they might need to work through the Insurer. They will certainly call the Insurer as well as provide their findings to them. If the Insurer figures out that an insurance claim should be filed, they will request for the general public Insurer's suggestion as well as will certainly go forward with it. In some cases, the Insurance Public Insurer will not really sue yet will still upgrade the Insurance Company concerning the status of the claim. This can be done by sending out a follow up letter.

Insurance Coverage Public Adjusters has a certain scope of work. https://docs.google.com/document/d/1BGgzZj42yenqgv...lGUbdeDYJGq4z0-3KBdzxk/preview entails losses that are within the extent of the Insurance provider's plan. In other words, if the residential or commercial property is ruined from a natural catastrophe, the general public Insurance adjuster may not have a scope of work that includes various other situations. The term "range of job" refers to the scope of obligations that the Public Insurer will certainly have when the insured loss is being taken care of. This is why occasionally Insurance policy Public Adjusters will leave an insurance claim alone as well as just submit a record if another thing causes the loss to proceed or if the general public needs to understand about the loss.

When a Public Insurer determines the loss, they take into consideration the complete expense of all damages (direct and indirect) and also any type of connected interest. An excellent public adjuster will have a detailed formula that will specify what kind of loss you are dealing with. Occasionally the insurance company will adjust the rate as opposed to what the public adjuster determines. This is to adjust for inflation.

An excellent public insurer will certainly additionally make an in-depth report of the loss. This record will normally information the sort of damage that happened, the quantity of loss, the amount of reconstruction needed, and also a quote of future repair service costs. All this info is valuable for the Insurance Company in determining whether a claim will be made as well as that will spend for it. This can additionally help reduce the danger to the firm. Insurance Policy Public Insurers is extremely vital and also numerous firms rely upon their services.

|

|

Public Adjusters And Their Payment Cases |

Article by-Woodard Sampson

A Public Insurance adjuster is an independent professional who deals with your part to shield your legal rights as an insurance holder. He/she works exclusively for you and is not linked to any particular insurer. Instead, the insurance coverage firm will usually assign its own public insurance adjuster to deal with its rate of interests. You are described this adjuster by your insurance plan.

Insurance claims by staff members: You can also become a sufferer of a "public insurer" when you suffer loss or damage from injuries suffered at work. In several insurance policies these insurance claims are taken care of by the exact same person who represents you in the court proceedings. If the case needs a huge amount of cash to be paid, the insurer commonly designates one of its very own public adjusters to handle the insurance claim. The general public insurer's role is to clear up the claim rapidly. To do this he/she must establish the extent of the losses or problems dealt with the event and also acquire a price quote of the insurance claim from the various other celebration(s) associated with the suit.

Insurance coverage generally attend to an assessment of the loss, or loss variable. The insurance policies normally specify that the evaluator chosen should have a good reputation and also a great record in the settlement area. Great public adjusters are really competent and experienced in their location of competence. An appraisal is normally an estimate of the loss or damages sustained as well as is utilized as a consider determining the insurance claim negotiation. hop over to this site is a procedure that involves a lot of challenging mathematical computations and also is a really tedious and time consuming process for a typical individual to execute.

When you employ a public insurer you need to be knowledgeable about the function he/she is intended to play when handling your instance. When you employ an excellent public insurance adjuster he/she is supposed to perform the following tasks: he/she needs to explore the event of the loss; assess the extent of the loss; review the clinical documentation required for the claim negotiation; collect information of all witnesses; examine the home and also tools harmed; review the financial effect of the loss on the claimant; as well as perform the required follow up procedures. All these procedures are expected to be executed with affordable care as well as diligence. If these procedures are not followed the danger of the claimant winning the claim however losing the negotiation or getting just minimal settlement is enhanced.

Insurer usually have a system of interior review and also quality control for their cases. A firm adjuster is chosen based on the suggestions of this internal testimonial and quality control procedure. Nevertheless it is likewise important for the complaintant to choose an appropriate business insurer. For this objective they can work with a reliable accident attorney to carry out an independent evaluation of the situation. If the lawyer is pleased that the case is well presented and does not contain any kind of significant errors after that the lawyer may refer the plaintiff to the ideal company insurance adjuster.

It is not required that the Public Insurance adjuster will certainly bill a cost for his services. But the firm insurer may bill some amount for his information solutions including his research of the medical records, pictures, mishap records, police report if there is one, and also other assorted info concerning the accident as well as its causes. In Some Cases the Public Insurer may ask for some additional info in order to prepare a good settlement amount and for this the candidate could need to provide him with further details such as the amount recuperated thus far, what is left as a final settlement quantity as well as the factors behind the case.

world claims public adjuster will certainly always bill a fee for his services. The dimension of the fee relies on the nature of the insurance claim that is being examined. Insurance claims for tiny problems are usually economical, as there are many plaintiffs for the exact same loss. As a matter of fact insurance claims like those for major losses are expensive, as the procedure includes celebration proof, witnesses, etc. Some business could even charge a lot more for the solutions of a good public adjuster. A large loss entailing significant properties like an organization or a house can lead to an increase in the complete compensation amount.

If you hire a professional insurance policy insurer then the company will certainly offer you a warranty. Insurance coverage adjusters have certain rules and policies to adhere to while managing insurance claims instances. They have to adhere to the guidelines of the state in which they function. Consequently, it is much better to hire a professional public insurer for your demands. These adjusters or their reps need to be certified by the state.

|

|

Insurance Policy Public Adjuster - What Are The Duties Of This Insurance Specialist? |

Article writer-Woodard Valdez

An Insurance Insurer is responsible for the adhering to functions: Analyzing loss occurrence for policyholders, supplying policyholder instructions, preparing all loss situations for submission to the Insurance coverage Department, and also carrying out various other related responsibilities. An Insurance Insurer has lots of duties and does several features that are needed for processing insurance claim cases. What exactly is a Public Adjuster and what do they do? What are the different sorts of Insurance Insurance adjusters?

The Insurance sector employs many types of Insurance Adjusters as well as every one has their very own details obligations and task features. Generally there are https://www.phillyvoice.com/zenith-public-adjuster...ce-fraud-tacony-philly-rubber/ of Insurance Adjusters; Insurance Coverage Public Insurer (IPA); Insurance Loss Expert (OLA); as well as Specialist Obligation Insurance Insurance Adjuster (PLI). Insurance Policy Public Insurance adjuster is in charge of standard underwriting functions such as establishing loss policy conditions as well as submitting loss cases to the Insurance policy Department. Insurance Loss Underwriter is primarily responsible for all areas of insurance-related purchases and also tasks. As the name suggests, an Expert Responsibility Insurance Insurer is focused on situations including claims, while a Professional Liability Insurance policy Insurer may likewise be accountable for executing investigations on claim rejections.

Insurance policy Public Insurance adjuster's primary task is to assess loss situations submitted by an Insurance Plaintiff and to accept or refute such case. Typically the IPA will perform its own investigation of the legitimacy of the insurance policy case as well as will carefully examine the entire claim to determine whether or not the case stands. When the claim has been thoroughly examined by the IPA, it will send out a letter to the Insurance Company intimating such findings to the Insurance Company and also will officially alert the Insurer that they have requested additional review of the matter. In this way, the Insurance Public Insurer assists in saving time for both the Insurance Company as well as the Insurance Policy Public Insurer. If there are premises to think illegal insurance claims submitted by particular clients, the general public Adjuster will actively investigate such instances to figure out the validity of the case.

Insurance policy Public Insurer fees are normally rather reduced in contrast with the per hour rate billed by legal representatives. Insurance coverage Public Adjuster prices are based upon the experience as well as credentials of the Public Adjuster. Insurance coverage Public Insurer charge can vary relying on the degree of damages. It additionally relies on the variety of claims dealt with throughout any kind of one month by the Insurance Public Adjuster. In addition to the common rates, some Insurance Public Insurer fee added retainer charges.

The general public Insurance adjuster plays a vital role in assisting an Insurer make great financial choices. Insurance Policy Public Insurance adjusters has accessibility to vital information that is not usually offered to the public. Insurance policy Public Adjusters also plays a role in assisting the public recognize the significance of insurance claim settlements. Basically, they aid protect the general public from irresponsible insurance company techniques. This is due to the fact that they work as a watchdog and also ensure that the public is protected from business that violate insurer policy. For instance, if there are way too many claims filed for a specific target, an Insurance coverage Public Adjuster might suggest that the Insurance provider data a class action match against the Insurer.

Public Insurer fees are typically fairly low, which makes them interesting most Insurance policy Public Adjuster clients. However, Insurance Public Adjuster fee ought to be considered carefully before deciding to work with a certain Public Insurer. Some common inquiries that should be answered prior to you decide to employ a certain Public Insurance adjuster consist of:

Do I require to work with more than one public insurance adjuster to manage my insurance policy claim? A Public Adjuster is normally designated to one insurance coverage claim at once. As a result, you do not need to always employ two separate public insurers to manage your insurance coverage claim. In addition to this, a lot of insurance provider prefer that the general public Adjuster's cost is included in the price of the insurance costs. Actually, https://www.kickstarter.com/profile/jfpublicadjusters/about offer a price cut for choosing to have their Public Insurer service is included as part of their insurance costs rather than an added costs by themselves.

Just how can I obtain my insurer to cover the problems I triggered throughout my crash? Public Adjusters commonly makes presumptions regarding how the damages will certainly be reviewed by your insurer. They can typically offer you with an estimate based upon the information included in your insurance case, yet the last resolution of whether or not the insurance company will certainly cover your problems relaxes in your hands.

|

|

Insurance Representatives - What Are Public Insurers? |

Authored by-Dreier Walton

An Insurance policy agent or broker is a person that markets Insurance coverage. Insurance coverage Agents serve the public through Insurance Brokers who help Insurance Companies. Claims agents are the "liaison" for Insurance Representatives and Insurance companies. Insurance claims representatives will certainly earn money by the Insurer in behalf of the customer.

A public insurance policy adjuster, also known as a public claims insurance adjuster, is a person who represents the policyholder/insured in bargaining as well as helping that policyholder/insured's insurance coverage case with their insurer. There are many points that an excellent public insurance coverage adjuster provides for his customers and also consumers. A great public insurance adjuster will make sure that the customer's insurance claim is refined quickly as well as efficiently to remove any problems, after that follow up with their client as well as ensure that the client mores than happy with the outcome. kitchen fire damage will certainly likewise promote on their clients behalf in helping them get the settlement they deserve.

In order to be a great public insurance coverage adjuster, one should have an enthusiasm concerning what they do. A Public Insurance policy Insurance adjuster will certainly have to place his/her heart and soul into aiding their customers, clients and also clients' families that have actually suffered a big loss as a result of an additional individual's neglect. They will certainly handle every one of the communication from the preliminary call till the settlement has been reached. Great public adjusters are able to change price quotes as well as numbers for large loss amounts without providing the perception that they are pushed around by their insurance coverage providers.

When collaborating with big quantities of money, public adjusters must have a thorough understanding of Insurance Service provider laws and also Payment guidelines. They have to also understand the various sorts of losses that can occur with various kinds of policies. If a business adjuster does not have an understanding of these points, they will not be able to make sure analyses that will certainly profit their client's claims.

The very best means to clarify this is to highlight a circumstance where 2 cars meet a mishap on the interstate. One automobile is completely ravaged and the various other is fairly intact. This is an instance of a full loss scenario. The insurance coverage of both automobiles will certainly reflect the losses connected with the lorries.

However, the general public Insurance policy Insurer will have a different sight of the negotiation. When they discover the complete loss circumstance, they may choose that the auto that has endured the most damages is worth more to the insurance company than the automobile that is basically intact. The public insurer's choice can mean that the policyholder needs to approve a significantly reduced settlement amount. If the policyholder challenges the value of the negotiation, they run the risk of shedding the whole settlement. On the other hand, if the insurance holder does not challenge the evaluation, the insurance company will certainly be compelled to offer the policyholder the exact same settlement that they would certainly have received if they had actually challenged the value of the negotiation.

Public Insurers is paid a per hour wage, which is often less than the hourly wage of an insured representative. Since these insurance adjusters can not deduct their own expenditures from their income, they are very sensitive to any perceived shortages in the service of their client's insurance claims. If there is a discrepancy between what the general public insurer thinks the negotiation ought to be and also what the insurer needs, the insurance provider can shed a great deal of cash. Consequently, asserts representatives are required to do very comprehensive modifications on the quotes that they offer to customers.

Finally, a great public adjuster will focus on the details of a situation. This will make sure that the negotiation arrangement is fair to both sides. It will likewise see to it that the settlement does not amount to excessive for either party. An excellent public insurer additionally recognizes exactly how to read all the relevant regulations and also policies concerning house insurance coverage and will certainly always know just how to interpret these laws in order to give the very best recommendations feasible to a customer. Finally, https://www.evernote.com/pub/jfpublicadjusters/jfpublicadjusters is vital that the general public insurance adjuster have a great online reputation in the sector. They need to construct a good credibility by continually producing top quality estimates and also responding rapidly as well as properly to any kind of inquiries or issues that their clients may have.

|

|

Why Insurance Adjusters Do Not Like Small Insurance Claims Contrast To Their Equivalents |

Article created by-Mendez Walton

Not too long ago, I was attending an important deposition when the lead insurance agents professional attorney doubted my client concerning why he would certainly worked with a public adjuster to solve the case. As the lead Insurance policy Insurer for our business, I attempted to add. Rather, with large eyes, the lead Insurance Insurance adjuster just described that his whole world was inverted that day of the mishap as well as he wasn't only just absolutely overloaded with whatever that occurred, yet additionally extremely overwhelmed by all the legal lingo as well as the tension he was really feeling. The Insurance policy Adjuster after that made it clear that he required more time to collect all of the appropriate info which he would communicate. I left the meeting not believing that this experienced Insurance policy Insurer would certainly make such a rookie blunder and further, I didn't think that a skilled Insurance Adjuster would certainly behave in such a fashion in front of me.

Lately, property claims adjuster have actually had numerous customers spoken with by a good public insurance policy insurer and all were rather stunned at how they were dealt with by the professional mediator. In one circumstances, the lead Insurance Adjuster spoke quantities without ever actually stopping to in fact hear what another professional claimed. In yet an additional instance, the lead Insurance policy Insurer preserved a warmed conversation with the plaintiff's lawful rep without ever before hearing what the other specialist had to say. One well-known insurance company even has a Public Insurer that seems to function from a roving band of telemarketers as well as that never ever actually directly goes to the claim area. Every one of these instances are extremely uncomfortable since absolutely nothing appears to be in writing where the specialist is supposed to stand and also read his/her duties to the satisfaction of the client.

As the lead Insurance Adjuster for the plaintiff I attended a meeting recently with other lawyers, the general public Insurer from our regional workplace educated the other attorneys that he would certainly be required to invest two weeks on website throughout the negotiation procedure. The general public Insurance adjuster clarified that this would be to work as an "observation" of the procedure and that it would certainly not impact his ability to bargain a negotiation for the plaintiff. I asked why the firm would certainly have a Public Adjuster goes as well as sit in on a mediation procedure that the Insurance provider must be reviewing regularly. Is the general public Insurer below to simply accumulate an income?

My understanding is that most public insurance adjusters are actually independent specialists whose services are only employed when a lawsuit is pending or has been solved. If the Public Insurer figures out that the settlement should be put, the negotiation repayment is then placed into an account up until the preferred outcome is accomplished. Exactly what does the Insurance Company expect the general public Insurance adjuster to do? read here of cases can the Public Insurance adjuster process in one year? This kind of organization seems to me to be past what a knowledgeable legal representative with experience in these kinds of cases can complete.

Lately, after serving on a Kerkorian settlement case, I met an Insurance policy Representative from Minnesota that was utilized by the same Public Insurance adjuster that had overseen my personal injury instance in Chicago. The Insurance Representative notified me that this specific Public Insurer was actually the general public Insurance policy Adjuster for another company that the Insurance policy Case Business benefited. This Public Adjuster "was not licensed by his business to handle my case" she mentioned. She recommended me not to go over the issue with the Public Insurance Insurance adjuster with my lawyer because "he might attempt to utilize you".

I was shocked at this comment since that is precisely what my Insurance coverage Case Lawyer was doing - trying to get my instance reclassified so that they could submit added claims against my settlement. My lawyer had actually told me that the present statutes and also guidelines relating to the reclassification of cases apply to injuries like my case. What the Insurance policy representative did not notify me is that the pertinent design represent personal injury cases, permits claims to be reclassified if there is a reasonable chance that future repayment can be obtained. If the general public Insurance adjuster had suggested me that future claims could be received under this Act I may have taken that into factor to consider and I may not have actually pursued my claim.

It is my professional opinion that the Insurance provider need to stop paying out claims to individuals when the Public Insurer thinks there is a good chance that future settlement can be obtained. Why? Well easy really; because the Insurance companies make more cash when their claims are reclassified than when they pay anyhow. By sending the general public Adjuster bent on proceed making comments concerning my situation, they actually raised my danger, which enhanced their general revenues.

It must additionally be noted that when dealing with the general public Insurer and/or Insurance Adjuster, it is always best to have a "plan B" simply in case. Never confess that you have a claim that is currently classified as a "big loss". Insurer will more than likely identify any kind of future insurance claim as a "big loss" if they believe that it may be reclassified as a "little loss" in the future. If they get an amount greater than their premiums, and also your insurance claim has been reclassified as a "large loss", after that you might remain in for a very unpleasant shock when the bill from the Insurance Company reveals a large loss.

|

|

Public Insurance Policy Adjuster - A Leg Up In Declaring Your Insurance policy |

Staff Writer-Woodard Carstens

Public adjusters are independent public representatives whose obligations are to analyze losses or insurance claims and assist in resolving insurance disagreements. They function very closely with house insurance policy companies to accelerate the cases for their clients, discuss with insurance policy carriers, and also submit appeals to the Insurance coverage Division for last resolution of insurance claims. These claims adjustors are normally employed by a specific insurance company, however they also might benefit various other insurance coverage companies.

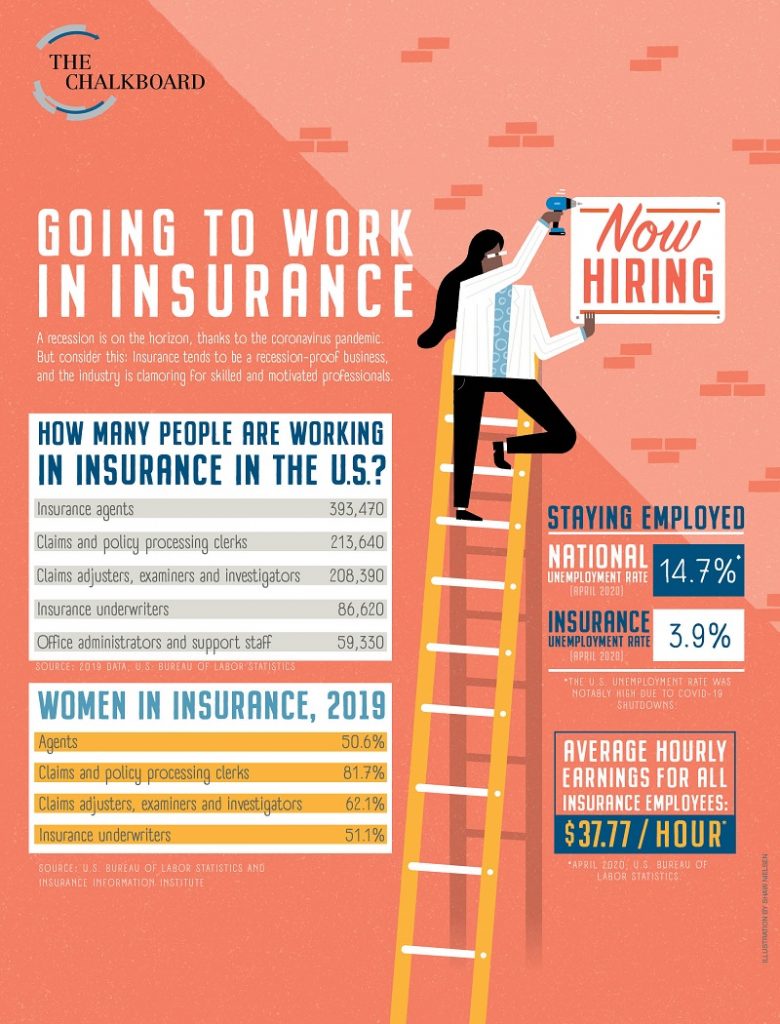

The Insurance policy Department employs lots of people each year to perform the features of public adjusters. A good public insurer has years of experience handling several sort of insurance policy claim. Public insurers likewise have a high level of understanding about laws regulating insurance policy as well as structure. In most cases, these workers aid legal representatives in dealing with real estate purchases, however they can also work as legal advice to clients who have property matters. Insurance companies pay them compensations for settling insurance coverage disputes, however the real amount paid to an insurance policy case insurance adjuster is negotiable.

One of one of the most important consider hiring an insurance policy case insurer is experience. In general, the longer a public insurer has actually been in the business of insurance case resolution, the more probable that they will have the ability to manage complicated issues that many very first time insurance adjusters might not recognize with. http://www.miamiherald.com/news/local/crime/article207492209.html are particularly careful when employing new adjusters. Insurance service providers wish to limit their direct exposure to conflicts with independent service providers that may be operating at an enhanced rate of danger because of their past experience dealing with the business. Therefore, it is important that you completely vet any kind of prospective candidate for hire with the Insurance policy Department prior to making a decision to hire them.

Insurance policy providers hire public adjusters because they help them examine the opportunity of big or small damages taking place on their property. As an example, if a client slides and falls on your firm pathway, you would like to know the level of risk or injuries present before calling the authorities. Public insurance adjusters analyze the exact same threats for services and house owners. However, they have to assess the danger in a different way. In addition to analyzing the potential for huge or little damages, public adjusters must review the risk of damages from flooding, fires, hurricanes, hurricanes, earthquakes, tree-clobbering, and also electrocution.

A great public insurance adjuster need to be very aware of the Insurance policy Code and the regulations controling insurance coverage and also insurance claims in your state. Insurance plan frequently cover water damages to structures as well as various other building, in addition to personal effects (such as garments and also electronics). An experienced insurance adjuster needs to be competent in discussing a detailed policy that covers a variety of dangers. Insurance coverage carriers desire a quick remedy to any cases situation. Because of this, they like to work with an accredited water damage insurer who has experience dealing with both events to reach a fair negotiation.

The arrangements between the insurance adjuster and the guaranteed take place on a "cash-for-claim" basis. Cash-for-claim negotiations happen when the insurance company agrees to approve less than the real settlement amount in exchange for authorizing a composed contract. The agreement details the extent of work, the moment framework in which the damages should be fixed and also any other agreed problems. An excellent insurance adjuster will certainly understand any type of adjustments to these problems and also can suit the customer.

If the insurance firm consents to a negotiation, the general public Insurance policy Insurer will certainly prepare a detailed report that defines the claim's specifics. This record will certainly lay out the building's problem and what repairs will be needed. It will likewise identify dangers related to the case as well as what fixings need to be done to decrease those dangers. Based on the details in the record, the general public insurance policy adjuster will make suggestions. If https://drive.google.com/drive/folders/1_069SqEiqDvfRN88BNMaOkwgKmffLzET?usp=sharing concurs with the recommendations, they will issue an authorization for the repair work. The whole procedure typically takes three weeks from beginning to end.

When all the needed documentation has actually been submitted as well as the negotiation arrangement has been authorized, the Public Insurance coverage Insurer will close on his or her own. The Public Insurance Insurance adjuster is generally covered by insurance policy claim negotiation advantages which supply the possibility for future economic benefits. However, the actual negotiation quantity will depend upon the real worth of the home and also the amount of job that is needed to repair it. Working with a respectable Public Insurance Insurance adjuster can assist make certain that you obtain a fair settlement. Take into consideration all the pros and cons before working with a person to handle your insurance coverage case.

|

|

A Method To Construct And Also Keep Your Own Bookkeeping Provider Business |

Posted by-Lynggaard Hegelund

Assistance yourself as well as deal with your passion by starting your own accounting consulting business. Look critically at your rate of interests, talents as well as your pastimes for a company suggestion. The extremely first and the first stage of beginning a service is generating a company strategy. Keep checking out for you to obtain valuable information to assist you with your accounting speaking with organization.

A major part of any kind of thriving accounting consulting organization operation is service objectives. Establishing a detailed business method with clear, certain and reasonable objectives is really the best method to see your accountancy office expand. Creating https://sites.google.com/site/richardsteimancpa/La...ensure-a-successful-tax-season for success in a company venture relies on establishing distinct objectives. Prevent establishing a single overarching goal, which can seem thus far away and challenging to get to that people obtain discontented as well as discouraged.

A winning bookkeeping consulting business won't happen in the blink of an eye. The success of your service depends significantly on the amount of power, time, as well as resources you are willing to take into opening your company. You need to also have perseverance and emphasis to make it over time. Owners that neglect their services throughout slow-moving times will certainly often find that they never recover when completing business choose back up.

One of the most rewarding bookkeeping consulting magnate will certainly tell you that the absolute best way to learn what you require to find out to master organization is via sensible real-world work experience. Professionals advise acquiring as much hands-on experience about your desired industry as feasible. This knowledge can help you navigate possessing your very own service successfully. Browsing a book regarding company loses on the other hand with what you can get through work experience.