Usual Errors That Impede Your Earnings Possible And Ways To Avoid Them |

Write-Up Created By-William Parsons

To enhance your revenue Velocity and avoid common challenges, consider this: Are you unknowingly preventing your financial growth by making avoidable blunders? By attending to vital factors like diversity, easy income chances, and effective money management, you can possibly unlock a course to faster revenue streams. Stay tuned to discover sensible strategies for maximizing your revenue Velocity and securing an extra prosperous economic future.

Absence of Diversification

When managing your revenue Velocity, one usual blunder to prevent is the absence of diversification in your financial investments. Putting all your money right into a solitary financial investment can be risky. If that financial investment doesn't carry out well, you can deal with considerable losses. Diversifying your financial investments throughout different asset courses, markets, and geographic areas can help spread out risk and potentially enhance returns.

By branching out, you can lower the effect of a solitary financial investment underperforming. As an example, if you only buy one market which field experiences a slump, your entire profile can suffer. However, if you have investments in numerous fields, the negative effect of one sector's bad efficiency can be balanced out by others performing well.

Think about diversifying not simply throughout various sorts of investments yet likewise across different danger degrees. By stabilizing https://influencermarketinghub.com/make-money-online/ , high-return financial investments with even more secure, low-risk options, you can develop a well-shaped profile that straightens with your economic goals and run the risk of tolerance.

Ignoring Passive Earnings Opportunities

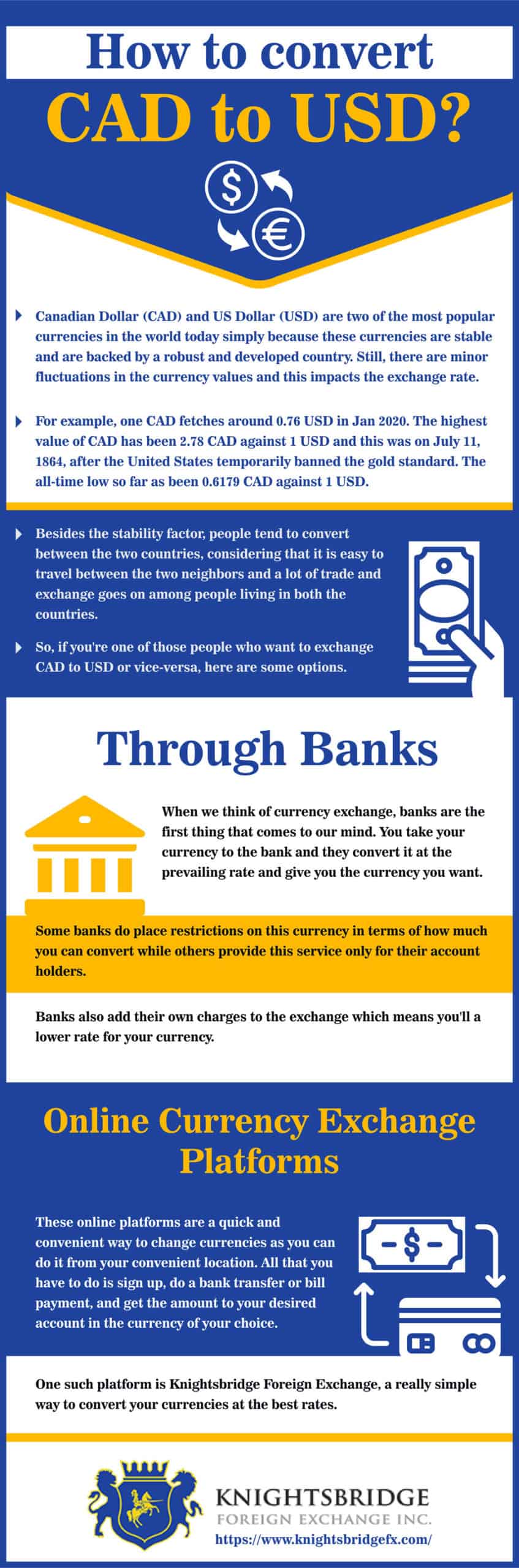

Among the hustle of managing your revenue Velocity, forgeting easy revenue possibilities can prevent your monetary growth potential. Passive income streams can give you with additional cash without needing continuous initiative on your part. By neglecting these possibilities, you could be losing out on a chance to boost your total income.

Purchasing dividend-paying supplies, rental residential properties, or creating electronic products are simply a couple of instances of passive revenue sources that can create money for you while you concentrate on other elements of your life.

Failing to explore passive earnings choices not just restricts your earning potential but likewise keeps you entirely reliant on active income, which can be unsteady and minimal in growth. Take the time to research study and understand different passive income avenues that line up with your rate of interests and monetary objectives.

Poor Finance

Many people have problem with inadequate finance, bring about financial instability and missed out on opportunities for development. It's crucial to focus on efficient finance to improve your revenue Velocity.

One usual error is spending beyond your means beyond your ways. By creating Ways To Build Passive Income and tracking your costs, you can make sure that you're living within your economic limitations.

Failure to save and invest is another mistake. Alloting a part of your revenue for savings and investments can assist secure your economic future and increase your riches over time.

In addition, overlooking to pay off high-interest financial obligations quickly can drain your finances. Focus on paying off financial debts with high-interest prices to stay clear of collecting unneeded rate of interest costs.

Last but not least, not having an emergency fund can leave you susceptible to unforeseen economic problems. Developing an emergency fund with at least 3 to six months' worth of expenditures can offer a monetary safeguard during difficult times.

Final thought

To conclude, to stay clear of decreasing your revenue Velocity, make certain to diversify your financial investments, benefit from passive revenue possibilities, and method reliable finance. By spreading danger, exploring brand-new revenue streams, and remaining on top of your funds, you can increase your revenue development and secure an extra stable financial future. Don't let common mistakes hold you back from attaining your financial objectives-- do something about it now to optimize your income Velocity.

Strategies To Drawing In Personal Capital: Taking Control Of Your Economic Fate |

Posted By-Madsen Lowery

When it involves safeguarding private financing for your monetary objectives, recognizing the subtleties of building relationships with possible investors can be the linchpin to your success. By leveraging your network and sharpening your pitch, you can open doors to opportunities that may have seemed out of reach. However, remember, the trip does not end there. The real challenge depends on browsing the complexities of investor expectations and preserving a balance in between self-confidence and humbleness in your approach.

Identifying Prospective Investors

When recognizing potential capitalists for raising private money, begin by constructing a network within your market. Networking permits you to get in touch with people that understand your area and might have an interest in spending. Go to market events, sign up with professional organizations, and engage with others in your specific niche to increase your circle of calls. By promoting relationships with market peers, you increase your opportunities of finding capitalists who resonate with your business vision.

Additionally, take advantage of online platforms like LinkedIn to connect with specialists in relevant areas. Talk, share understandings, and showcase your competence to draw in potential capitalists. Building a solid on the internet presence can make you more noticeable to individuals looking for financial investment possibilities.

In addition, take into consideration seeking recommendations from coworkers, coaches, or good friends that may have links to potential capitalists. https://www.sportskeeda.com/gta/5-profitable-ways-earn-gta-online-money-january-19-24 can carry weight and assist you develop trust with brand-new capitalists. Keep in mind, growing connections takes some time, so be patient and relentless in your initiatives to determine suitable capitalists within your market.

Crafting Compelling Investment Proposals

Crafting engaging financial investment proposals is essential for bring in prospective capitalists to your company. When creating these propositions, focus on clearly detailing the investment possibility, including essential details such as business design, market evaluation, monetary estimates, and possible returns.

Begin by crafting a captivating executive summary that provides a concise overview of the chance. Clearly specify the issue your company resolves and exactly how it sticks out in the marketplace.

Present a comprehensive analysis of the target market, competition, and development capacity to display the practicality of the investment. Furthermore, consist of a comprehensive break down of the economic forecasts, demonstrating a strong understanding of revenue streams, costs, and anticipated productivity.

To make your proposition stick out, make sure that your writing is clear, concise, and free of jargon. Usage visuals such as graphes and graphs to improve understanding and make the information extra absorbable.

Keep in mind to tailor your proposition to the details needs and choices of your target financiers, highlighting exactly how their investment can bring about shared success. By crafting engaging financial investment propositions, you boost your opportunities of bring in potential capitalists and securing the financing needed for your business.

Building Trust Fund and Credibility

To establish effective relationships with potential capitalists, concentrating on structure trust and reputation is extremely important. Capitalists need to feel confident in your stability, skills, and commitment to providing on your assurances. One way to construct count on is by being transparent about your history, experience, and performance history. Share success stories, endorsements, and any kind of pertinent achievements that demonstrate your capability to supply outcomes.

simply click the up coming web site is also enhanced by being arranged and specialist in your communications. Respond promptly to questions, provide detailed information when requested, and follow up on dedications. Show that you're serious about your financial investment chances which you value the count on that financiers place in you.

Structure trust and reputation takes time and initiative, however it's vital for drawing in private money for your endeavors. By constantly showing sincerity, reliability, and skills, you can develop a strong credibility that will bring in financiers that are eager to companion with you in attaining economic success.

Final thought

In conclusion, by concentrating on developing a strong network, crafting compelling proposals, and building depend on and reputation, you can encourage your economic future via raising personal money. Remember to seek references, customize your propositions to capitalists' needs, and preserve professionalism in all communications. With these techniques in position, you can draw in the best financiers and safeguard the funding you need for your monetary endeavors.

Wanting To Understand How Easy Income Streams Can Raise Your Income Potential? Look Into The Transformative Impacts Of Easy Income Streams Immediately |

Article Created By-Sanders Milne

As you navigate the landscape of individual money, one important aspect that can considerably shape your monetary trip is the presence of easy income streams. These streams have a distinct ability to influence not just your existing earning possibility but also the speed at which your total income grows. By diving into the world of passive income, you open avenues that can possibly change the way you create wealth. Intend to uncover how passive earnings streams can thrust your revenue Velocity to new elevations?

Comprehending Income Velocity

Comprehending Earnings Velocity is critical for any individual wanting to build numerous streams of easy revenue. Earnings Velocity refers to just how quickly money steps through your different earnings resources. It determines the rate at which your money is earned and reinvested, inevitably affecting your total monetary growth. By realizing Earnings Velocity, you can enhance your easy earnings streams to generate wealth extra successfully.

To determine Income Velocity, you require to take into consideration both the frequency and quantity of revenue gotten from your different resources. https://smb.irontontribune.com/article/Barnaje-DAO...oryId=66a71f25d3a3cc00089b806e flows, the quicker you can reinvest it to create much more revenue. This cycle accelerates your wealth-building process and enables you to diversify your financial investments better.

Benefits of Passive Revenue Streams

To fully understand the benefits of easy revenue streams, it's necessary to identify exactly how they can enhance your monetary stability and develop opportunities for lasting riches accumulation. Easy revenue provides you with a consistent flow of incomes without needing constant energetic participation. This means you can earn money also while you rest, take a trip, or concentrate on other endeavors.

One significant advantage of passive income streams is the ability to diversify your earnings sources, reducing dependancy on a solitary resource of revenues. This diversification can help guard you versus economic downturns or unforeseen events that may influence a traditional work.

Additionally, look at more info can offer you more adaptability and flexibility in just how you allocate your time, as it does not tie you to a dealt with timetable or place.

In addition, passive earnings streams have the possible to expand with time, especially when reinvested into income-generating possessions. This compounding impact can substantially improve your general riches accumulation in the long run. By incorporating easy income streams right into your financial technique, you can develop a more safe and flourishing future on your own.

Accelerating Earnings With Easy Earnings

Now, let's accelerate your profits via passive earnings. By leveraging easy revenue streams, you can raise your general earnings Velocity and economic security. Passive revenue resources like rental residential or commercial properties, dividend-paying supplies, or online companies can produce cash with very little recurring effort from you. These streams of earnings job relentlessly in the background, constantly contributing to your incomes without requiring your straight involvement.

To quicken your earnings, think about diversifying your passive income resources. Having numerous streams can provide you with a safeguard and ensure a steady circulation of cash even if one resource briefly falters.

Furthermore, reinvesting the passive earnings you earn can additionally boost your incomes gradually. By compounding your returns, you can increase the growth of your wealth and produce a snowball impact where your earnings boost significantly.

Take control of your monetary future by proactively seeking easy revenue opportunities. With devotion and wise financial investment selections, you can rapidly raise your earnings via passive earnings, setting on your own on the course to monetary flexibility and an extra secure financial future.

Conclusion

Finally, expanding your earnings streams with easy resources can considerably enhance your overall income Velocity. By generating consistent revenues with minimal effort, you can increase your wealth-building journey and potentially achieve economic freedom earlier. Benefit from the benefits of easy earnings to enhance the speed at which cash moves via your different resources and take pleasure in the compounding returns that include it. Keep expanding and expanding your passive income streams to protect a more effective and sustainable financial future.

Approaches For Raising Private Money: Encouraging Your Financial Future |

Team Author-Harboe McCullough

When it involves protecting personal funding for your monetary objectives, understanding the nuances of building partnerships with possible capitalists can be the cornerstone to your success. By leveraging your network and honing your pitch, you can open doors to opportunities that may have seemed out of reach. However, bear in mind, the trip doesn't end there. https://www.shopify.com/au/blog/passive-income-ideas on navigating the intricacies of capitalist assumptions and maintaining an equilibrium between confidence and humility in your approach.

Identifying Prospective Financiers

When determining possible financiers for raising private money, start by constructing a network within your market. Networking permits you to get in touch with people that comprehend your field and may have an interest in investing. Go to industry events, sign up with professional companies, and engage with others in your niche to expand your circle of calls. By fostering connections with market peers, you enhance your opportunities of discovering capitalists that resonate with your service vision.

Additionally, leverage online systems like LinkedIn to get in touch with specialists in associated fields. Engage in conversations, share understandings, and display your know-how to draw in prospective capitalists. Developing a solid online existence can make you more visible to individuals looking for investment possibilities.

Furthermore, think about looking for references from coworkers, coaches, or buddies who might have links to prospective financiers. Personal referrals can carry weight and aid you develop depend on with new financiers. Keep in mind, growing relationships requires time, so be patient and consistent in your initiatives to determine ideal investors within your sector.

Crafting Compelling Financial Investment Proposals

Crafting engaging investment proposals is essential for bring in potential investors to your business. When producing these propositions, concentrate on plainly describing the financial investment possibility, including vital details such as business version, market analysis, economic forecasts, and potential returns.

Beginning by crafting a captivating executive summary that provides a concise summary of the possibility. Plainly specify the trouble your company resolves and how it stands apart on the market.

Existing an in-depth evaluation of the target audience, competitors, and development capacity to display the practicality of the financial investment. Furthermore, consist of a thorough break down of the financial projections, showing a solid understanding of income streams, expenses, and anticipated productivity.

To make your proposition stand out, make sure that your writing is clear, succinct, and free of jargon. Usage visuals such as charts and graphs to boost understanding and make the details extra digestible.

Remember to tailor your proposition to the certain requirements and preferences of your target financiers, highlighting just how their investment can result in shared success. By crafting compelling investment propositions, you boost your chances of attracting prospective financiers and securing the funding needed for your organization.

Building Trust Fund and Integrity

To establish effective connections with potential capitalists, concentrating on building depend on and trustworthiness is paramount. please click the up coming article require to feel confident in your integrity, competence, and dedication to supplying on your assurances. One means to build trust is by being transparent concerning your background, experience, and performance history. Share success stories, testimonials, and any type of appropriate achievements that show your capability to supply outcomes.

Credibility is also boosted by being arranged and expert in your interactions. React promptly to queries, offer thorough details when asked for, and follow through on commitments. Show that you're serious about your financial investment possibilities and that you value the trust fund that financiers place in you.

Building trust and trustworthiness requires time and initiative, but it's vital for attracting personal money for your ventures. By continually demonstrating sincerity, dependability, and competence, you can develop a solid online reputation that will certainly draw in financiers that are eager to companion with you in achieving economic success.

Final thought

To conclude, by concentrating on developing a solid network, crafting engaging proposals, and building trust fund and reputation, you can empower your financial future through elevating exclusive money. Bear in mind to seek references, tailor your proposals to financiers' needs, and maintain professionalism in all communications. With these strategies in place, you can attract the best capitalists and safeguard the funding you require for your economic undertakings.

Unwind The Intricacies Of Bank Loan And Discover Vital Approaches To Secure Financing For Your Venture'S Development And Success |

Write- best trading platforms Written By-Sloan Simonsen

When it comes to browsing the globe of bank loan, recognizing the ins and outs of securing funding is crucial for your venture's success. From understanding the different funding kinds to conference eligibility demands, there's a whole lot to think about in your quest of financial support. By grasping the subtleties of each funding choice and implementing tactical actions to boost your application, you can position your organization for potential growth and sustainability. However just how specifically can you guarantee that your financing trip is on the right track?

Sorts Of Local Business Loans

There are 5 main types of bank loan that cater to different financial demands and circumstances.

The initial kind is a term funding, where you borrow a round figure of money that's paid back over a set period with a dealt with or variable rate of interest. This is suitable for long-lasting financial investments or huge acquisitions for your company.

Next off, we have actually a business line of credit report, which offers you with a revolving credit line that you can draw from as needed. It's an adaptable option for handling cash flow variations or covering unexpected costs.

After that, there's the SBA financing, assured by the Small company Management, using affordable terms and lower deposits. It appropriates for businesses looking for budget-friendly financing.

try this website is devices funding, where the devices you're acquiring functions as collateral for the financing.

Finally, we've invoice funding, where you receive bear down superior billings to enhance capital.

Pick the financing type that finest straightens with your service objectives and financial needs.

Certifications and Eligibility Requirements

To qualify for a bank loan, your credit history and monetary background play an essential role in identifying qualification. Lenders use these factors to analyze your capacity to pay back the financing. Normally, an excellent credit history, preferably above 680, shows your credit reliability. Your monetary history, including your service's earnings and success, will likewise be reviewed to ensure your business can maintain lending payments.

In addition to credit score and monetary background, loan providers may take into consideration other qualification criteria. These might consist of the size of time your service has actually been operating, its market, and the purpose of the car loan. Some lending institutions might call for a minimal annual income or cash flow to get approved for a car loan. Giving accurate and comprehensive monetary info about your business will certainly help lending institutions examine your qualification more effectively.

It's important to examine the certain certifications and qualification criteria of different lending institutions prior to making an application for a bank loan. Recognizing these needs can help you prepare a strong finance application and increase your possibilities of safeguarding the funding your endeavor requires.

Tips to Enhance Loan Authorization Opportunities

To enhance your chances of securing authorization for a small business loan, consider applying techniques that can enhance your funding application. Begin by guaranteeing your organization and personal credit rating are in great standing. Lenders often utilize credit rating to analyze your creditworthiness and figure out the funding terms.

In addition, prepare an in-depth organization strategy that details your business's objective, target market, financial estimates, and just how you plan to make use of the funding funds. A well-thought-out organization strategy demonstrates to loan providers that you have a clear approach for success.

Additionally, gather all necessary paperwork, such as income tax return, economic declarations, and legal records, to support your loan application. Supplying full and precise details can help expedite the authorization procedure.

It's likewise beneficial to build a strong connection with the lending institution by connecting freely and promptly reacting to any ask for added details. Finally, take into consideration offering security to safeguard the funding, which can minimize the loan provider's risk and improve your authorization opportunities.

Verdict

Now that you recognize the different types of small business loans and how to boost your approval opportunities, you prepare to secure financing for your venture.

Remember to maintain good credit, have a strong company plan, and build connections with lenders.

By adhering to these ideas, you'll be well on your method to obtaining the financial support you require to expand and broaden your service. Good luck!

|

Метки: Financial Technology CFD Trading Platform Trading Software Small Business Loans Financial Services |

Relocate Away From Well Established Income Methods To Internet-Based Wealth Production - Unveil The Paths To Economic Autonomy And Success |

Post Author-Willard Kirkegaard

If you prepare to transform your economic landscape and use the capacity of on the internet earnings generation, this overview holds the crucial to opening a globe of chances. By complying with practical actions and tested strategies, you can begin your journey to monetary freedom today. Discover just how to browse the on-line earning landscape with confidence and accuracy, setting yourself on a course to success that aligns with your goals and aspirations. Study the realm of on-line revenue generation and take the first step towards a brighter financial future.

Getting Going: Establishing the Structure

To begin your on the internet lucrative journey, develop a solid foundation by outlining your goals and recognizing your abilities and interests. Beginning by establishing clear purposes wherefore you intend to attain economically. Are you seeking to earn extra income, change your present work, or develop a long-lasting sustainable online service? Comprehending your objectives will certainly aid form your course and maintain you motivated along the way.

Next, take https://www.savethestudent.org/make-money/make-money-amazon.html of your abilities and rate of interests. What're you efficient? What do you appreciate doing? Recognizing your toughness and enthusiasms will assist you in selecting the right on the internet profitable opportunities that line up with what you master and what you love. Whether it's composing, graphic layout, social media monitoring, or any other skill, there are numerous ways to monetize your abilities online.

Exploring Different Online Earning Opportunities

When wanting to explore various online earning possibilities, consider your special abilities and passions to discover the very best fit for you. Analyze what you excel at and what you take pleasure in doing. This can assist you narrow down the myriad of choices available and focus on something that lines up with your staminas and enthusiasms.

One prominent way to earn money online is via freelancing. If you have abilities in creating, visuals design, shows, or any other area, you can supply your solutions on systems like Upwork, Consultant, or Fiverr.

One more choice is to start a blog or YouTube channel. If you're experienced regarding a specific subject or have an ability you intend to share, creating material and monetizing it via advertisements, sponsorships, or affiliate advertising can be financially rewarding.

Earn Money Online Fast is also a prospering field. You can market items on systems like Etsy, ebay.com, or Amazon, or perhaps create your very own on-line store. Dropshipping, where you offer products without holding supply, is an additional prominent choice. Whatever path you select, ensure it lines up with your skills and rate of interests for the very best chance of success.

Maximizing Your Earning Potential

Boost your online income by leveraging your existing skills and exploring brand-new revenue streams. Start by recognizing your strong suits and finding means to monetize them. If you're a skilled author, take into consideration freelance writing, producing an e-book, or starting a blog. For those with an ability for graphic design, provide your services on freelancing systems or sell electronic possessions online. In addition, if you excel in a certain topic, you can create revenue by tutoring students online or developing online courses.

Expanding your revenue resources is key to optimizing your earning possibility. Instead of relying exclusively on one system or income, spread your abilities across numerous channels. This can involve selling products on a shopping site, giving consulting solutions, and even buying supplies or cryptocurrencies. By expanding, you not only enhance your earning potential however also shield yourself from changes in any solitary market.

Moreover, consider upgrading your skills or acquiring new ones to remain affordable in the ever-evolving on-line landscape. Take online programs, participate in webinars, or sign up with specialist networks to broaden your understanding and competence. The even more versatile and adaptable you are, the far better equipped you'll be to seize lucrative possibilities and increase your on the internet earnings.

Final thought

Since you have the tools and expertise to begin generating income online, it's time to act and transform your desires right into truth.

By complying with the actions outlined in this guide, you can unlock a globe of earning opportunities and create a lasting source of income that straightens with your skills and interests.

Do not wait any type of longer, begin gaining today and take control of your financial future!

Embrace Financial Self-Sufficiency: Ways To Produce Passive Revenue And Live Life By Your Own Standards |

Post By-Madden Wilkins

You're keen to discover the opportunities of economic freedom and easy earnings, looking for a lifestyle that grants you freedom and flexibility. Imagine a life where your money helps you, allowing you to seek your interests and dreams without being tied down by standard restrictions. Through calculated preparation and smart investments, you can unlock the doors to a globe where your income streams constantly, providing you the freedom to shape your days according to your desires. The course to monetary flexibility is available; all it takes is the determination to step into this realm of possibility.

Comprehending Easy Earnings

To genuinely understand the concept of passive income, consider it as a stream of profits produced with very little continuous initiative or straight participation. Passive earnings is essentially cash that can be found in consistently with little to no initiative on your part once the first work is done. This form of revenue permits you to generate income without actively benefiting it regularly, offering you with economic flexibility and adaptability in exactly how you pick to invest your time.

Purchasing rental residential or commercial properties, developing and marketing digital items, participating in associate advertising and marketing, or even making nobilities from creative jobs are all examples of easy revenue streams. By diversifying your passive revenue resources, you can alleviate threat and make sure an extra secure economic future.

It is essential to comprehend that while easy earnings can give monetary safety and security, it often requires upfront financial investments of time, money, or both. However, Passive Income Ideas 2023 -lasting benefits of developing easy earnings streams can outweigh the initial initiative needed.

Structure Several Income Streams

Expanding your revenue sources is essential to building monetary stability and protection. Counting on a solitary source of income can leave you susceptible to unforeseen modifications. By producing multiple streams of income, you can expand your threat and make sure an extra constant circulation of money can be found in.

One method to develop numerous income streams is by checking out different chances such as starting a side business, investing in stocks or realty, or taking on freelance work. Each additional earnings stream you establish adds one more layer of security to your economic portfolio.

In addition, having several sources of income can likewise provide you with the adaptability to pursue your rate of interests and enthusiasms without the consistent stress over making ends fulfill. It enables you to have even more control over your economic future and opens up possibilities for achieving your long-term goals. Beginning small, explore various opportunities, and progressively accumulate your revenue streams to open higher monetary flexibility and self-reliance.

Designing Your Ideal Way Of Living

Think about exploring various choices to create a lifestyle that aligns with your worths and aspirations. To make your perfect way of living, beginning by imagining how you wish to invest your days. Recognize tasks that bring you pleasure and satisfaction. Whether it's taking a trip the globe, servicing interest jobs, or spending top quality time with enjoyed ones, be deliberate about structuring your life around what matters most to you.

Next off, analyze your economic goals and figure out the revenue streams needed to support your desired way of living. This could include structure easy income resources like financial investments, on-line services, or rental residential or commercial properties. By creating passive income, you can produce extra freedom and flexibility in how you assign your time and sources.

In addition, prioritize self-care and health in your way of living design. Make time for activities that nourish your body, mind, and heart. Whether it's practicing mindfulness, working out, or enjoying pastimes, self-care plays an important function in preserving a well balanced and satisfying life.

just click the up coming web site have the devices to open financial flexibility and live life on your terms.

By creating easy revenue streams and developing a way of life that aligns with your desires, you can develop a lasting source of earnings that calls for marginal recurring effort.

Diversifying your earnings sources and focusing on self-care will lead you towards a fulfilling and well balanced life.

Beginning taking action today to pave the way towards your ideal future.

Write- Passive Income Ideas -Madden Houston

You're keen to check out the opportunities of financial self-reliance and easy revenue, looking for a way of living that gives you autonomy and adaptability. Think of a life where your cash helps you, enabling you to seek your passions and desires without being restrained by traditional constraints. With strategic planning and smart investments, you can unlock the doors to a globe where your revenue moves constantly, granting you the freedom to shape your days according to your desires. The course to economic freedom is accessible; all it takes is the readiness to step into this world of opportunity.

Understanding Passive Earnings

To really comprehend the concept of easy income, consider it as a stream of earnings created with minimal ongoing effort or straight involvement. Easy earnings is essentially cash that comes in routinely with little to no effort on your part once the initial job is done. This type of earnings enables you to generate income without actively helping it on a regular basis, offering you with financial liberty and flexibility in exactly how you choose to spend your time.

Investing in rental residential properties, producing and marketing digital items, participating in affiliate marketing, or perhaps gaining aristocracies from imaginative works are all instances of easy earnings streams. By expanding your passive earnings sources, you can mitigate danger and make certain a more stable monetary future.

It is essential to recognize that while passive earnings can offer economic safety, it frequently needs in advance financial investments of time, money, or both. However, the long-term advantages of establishing easy income streams can surpass the preliminary effort needed.

Structure Numerous Revenue Streams

Diversifying your revenue sources is essential to constructing monetary security and safety and security. Relying on a single source of income can leave you vulnerable to unanticipated changes. By developing several streams of income, you can expand your danger and ensure an extra consistent circulation of money being available in.

One way to build numerous income streams is by checking out various chances such as beginning a side service, investing in supplies or realty, or handling freelance work. Each additional revenue stream you establish includes an additional layer of safety to your financial profile.

In addition, having multiple sources of income can additionally supply you with the flexibility to pursue your interests and interests without the consistent bother with making ends meet. It enables you to have even more control over your financial future and opens possibilities for achieving your lasting goals. Beginning tiny, explore different opportunities, and slowly accumulate your income streams to unlock greater monetary freedom and freedom.

Designing Your Suitable Way Of Life

Take into consideration exploring different choices to produce a lifestyle that straightens with your values and desires. To develop your suitable way of living, beginning by visualizing how you wish to spend your days. Determine activities that bring you joy and gratification. Whether it's taking a trip the world, servicing passion tasks, or spending quality time with liked ones, be willful about structuring your life around what issues most to you.

Next off, evaluate your monetary goals and establish the revenue streams required to sustain your wanted way of life. https://www.fool.com/investing/stock-market/types-of-stocks/income-stocks/ could entail structure easy income resources like financial investments, online organizations, or rental buildings. By generating passive revenue, you can develop much more liberty and flexibility in how you allocate your time and resources.

Additionally, focus on self-care and well-being in your way of life style. Make time for activities that nourish your body, mind, and soul. Whether it's practicing mindfulness, exercising, or taking pleasure in leisure activities, self-care plays a critical duty in keeping a well balanced and meeting life.

Final thought

You now have the tools to open financial liberty and live life on your terms.

By creating passive earnings streams and developing a lifestyle that aligns with your aspirations, you can produce a sustainable resource of income that calls for minimal ongoing effort.

Expanding your revenue sources and prioritizing self-care will certainly lead you in the direction of a meeting and well balanced life.

Begin acting today to lead the way towards your excellent future.

Behavioral Money: Financial Advisors' Insight Right Into Customer Psychology |

Written By-Pedersen Rouse

As a monetary expert, browsing the detailed landscape of customer psychology is paramount to offering efficient advice. Understanding the subtleties of behavior predispositions and exactly how they influence monetary choices can considerably affect the outcomes for your clients. By recognizing these patterns and customizing your method as necessary, you can develop trust, drive purposeful discussions, and eventually steer clients in the direction of economic success. But just how can https://blogfreely.net/fran86geraldo/expanding-you...hnique-to-financial-investment master the art of deciphering customer psychology to enhance your consultatory skills further?

Value of Client Psychology

Recognizing your customer's psychology is an important aspect of economic advising. By delving right into the inspirations, worries, and decision-making processes of those you advise, you can customize your referrals to much better match their private demands.

One crucial element of customer psychology is the level of danger tolerance they have. Some clients might be much more risk-averse, favoring conservative investments, while others may be much more comfortable with higher-risk alternatives for the possibility of greater returns. Recognizing and respecting these distinctions is necessary in directing customers towards economic success.

Furthermore, comprehending your customer's objectives and purposes is crucial. Whether they're saving for retirement, a kid's education, or a major acquisition, lining up investment methods with these desires can boost client complete satisfaction and count on your suggestions.

In addition, knowing any biases or psychological reactions that might influence their economic choices is vital. By acknowledging and attending to these mental factors, you can aid customers make more enlightened and reasonable selections that align with their long-lasting financial objectives.

Common Behavioral Prejudices

Typical behavioral prejudices can dramatically influence economic decision-making and might cause suboptimal outcomes for capitalists. One usual bias is overconfidence, where investors think they have actually more control and knowledge than they really do, causing too much trading or high-risk financial investments.

Verification bias is an additional prevalent problem, where individuals choose information that sustains their existing ideas while neglecting inconsistent evidence. This prejudice can prevent financiers from making well-informed choices based upon all offered data.

In addition, loss aversion can cause financiers to focus on avoiding losses over making the most of gains, resulting in missed out on chances for development. Herd mindset is yet an additional prejudice, where people comply with the activities of the majority without seriously evaluating details.

https://money.usnews.com/investing/articles/where-...-professional-financial-advice can cause market bubbles or crashes as a result of irrational decision-making based upon team habits instead of sound analysis. Recognizing these common prejudices is crucial for financial consultants to assist clients navigate the complexities of the market and make informed choices lined up with their long-lasting goals and risk tolerance.

Strategies for Effective Guidance

To effectively guide clients with the complexities of economic decision-making, you should execute tailored techniques that address their behavior prejudices and motivate sound investment techniques. Start by cultivating open communication to recognize your clients' monetary goals, threat tolerance, and previous experiences. By developing this structure, you can personalize your support to match their private demands properly.

Use behavior money principles to counter usual predispositions like loss aversion or insolence. Enlighten clients on these prejudices and help them acknowledge when feelings may be clouding their judgment. Urge sensible decision-making by concentrating on long-term objectives instead of temporary market changes.

Consistently testimonial and adjust financial investment portfolios to make certain placement with customers' goals and run the risk of accounts. By remaining aggressive and versatile, you can aid customers navigate changing market problems and remain on track in the direction of their monetary aspirations.

Deal continuous assistance and guidance to reinforce favorable monetary actions and reduce potential pitfalls. Equip customers to make enlightened choices by providing education and learning and resources that improve their monetary literacy. By utilizing these strategies, you can direct your customers in the direction of monetary success while addressing their behavior tendencies.

Verdict

In conclusion, as a financial expert, understanding client psychology and behavioral prejudices is crucial for supplying efficient guidance.

By recognizing typical biases and implementing customized strategies, you can aid clients make more informed financial choices lined up with their objectives.

By leveraging behavior money concepts, you can construct trust, foster open interaction, and sustain lasting financial success for your customers.

Engaging With Financial Consultants Can Provide Useful Assistance In Establishing A Solid Economic Plan Aimed At Securing Your Future |

Produced By-Jennings Lambertsen

When it comes to protecting your monetary future, having a knowledgeable economic consultant by your side can make all the difference. By delving into your monetary landscape and customizing methods to fit your one-of-a-kind objectives, these experts offer a roadmap towards long-lasting monetary security. From retired https://squareblogs.net/gloria50lucius/master-the-...-necessary-actions-to-secure-a to investment diversity, economic advisors offer an alternative technique that can pave the way for a safe and flourishing future. So, how exactly do these professionals navigate the complexities of financing to ensure your monetary well-being?

Financial Evaluation and Goal Setting

Before producing a strong financial strategy, it's crucial to carry out a detailed financial analysis and plainly specify your objectives. Start by collecting all your financial papers, consisting of revenue declarations, financial institution declarations, financial investment accounts, and any kind of debts you may have. Take a close take a look at your spending routines to understand where your money is going each month. https://www.fidelity.co.uk/services/advice/ will certainly give a clear picture of your existing economic scenario and assistance determine areas for enhancement.

Next off, it is necessary to set particular, measurable, attainable, relevant, and time-bound (SMART) objectives. Whether you aim to get a home, save for your kids's education, or retire easily, specifying your goals will offer your financial strategy direction and objective. Be Global Portfolio Management about your objectives and consider both short-term and lasting desires.

Custom-made Financial Investment Methods

Exactly how can economic advisors customize financial investment approaches to suit your distinct economic goals and take the chance of tolerance?

Financial advisors have the proficiency to evaluate your monetary situation comprehensively, taking into consideration factors such as your revenue, expenditures, possessions, responsibilities, and long-term goals. By recognizing your threat resistance, time perspective, and investment choices, they can produce a customized investment technique that lines up with your specific needs and comfort level.

Financial advisors make use of various investment automobiles such as supplies, bonds, mutual funds, and exchange-traded funds to develop a varied profile that stabilizes danger and possible returns according to your preferences. They can likewise integrate tax-efficient methods to optimize your investment development while decreasing tax obligation effects.

With recurring surveillance and adjustments, economic consultants make certain that your financial investment technique continues to be in accordance with your evolving monetary objectives and market conditions. By functioning closely with an economic expert to create a customized investment strategy, you can feel great that your financial future is in qualified hands.

Retirement and Estate Planning

To safeguard your economic future, it is very important to consider retired life and estate planning as integral components of your total economic approach. Retirement preparation involves setting particular economic objectives for your post-working years and determining just how to achieve them. A monetary advisor can aid you navigate retirement account choices, such as 401( k) s or Individual retirement accounts, and create a personalized plan tailored to your demands. By starting very early and frequently examining your retirement plan, you can ensure you're on track to satisfy your future financial goals.

Estate preparation, on the other hand, focuses on managing your possessions and ensuring they're dispersed according to your desires after you die. This process involves producing a will, establishing trusts, and assigning beneficiaries. A monetary consultant can aid you in creating an estate strategy that minimizes tax obligations and optimizes the value of your estate for your heirs.

Conclusion

Finally, economic advisors can play a vital function in helping you develop a solid financial plan for your future.

By conducting a complete economic evaluation, setting wise objectives, and personalizing investment techniques customized to your requirements, consultants make certain that you're on track to attain your short-term and long-lasting economic objectives.

With their expertise and guidance, you can feel great in your economic outlook and safeguard your financial future.

Managing Market Irregularity: The Assistance Financial Advisors Offer In Securing Your Investments |

Financial Risk Management Produced By-Funder McGee

In times of market volatility, your economic expert works as an important ally in protecting your investments. Their competence allows them to guide you via unpredictable market conditions and help you in making educated choices. By collaborating with a monetary consultant, you get to important understandings and techniques made to protect your financial future. Keep tuned to uncover exactly how these professionals can aid you browse the intricacies of market fluctuations and make sure the security of your investments.

Understanding Market Volatility

To browse market volatility efficiently, you should stay educated and planned for fluctuations in asset worths. Market volatility refers to the fast and unpredictable modifications in the prices of stocks, bonds, and various other financial tools.

During volatile times, costs can swing significantly, causing uncertainty and possible monetary losses. read here to recognize that market volatility is an all-natural part of investing and can offer both threats and opportunities.

By staying educated about market fads, economic indications, and geopolitical occasions, you can much better anticipate and react to market volatility. Checking your investments frequently and diversifying your portfolio can aid alleviate threats connected with market variations.

Additionally, having a clear investment technique and lasting financial objectives can give a roadmap throughout unstable times.

Remember that market volatility isn't always an unfavorable point. While it can bring about short-term variations in profile worths, it can also produce getting opportunities for long-lasting capitalists.

Significance of Financial Advisors

During rough market problems, having an educated economic consultant by your side can supply very useful assistance and assistance in safeguarding your financial investments. A financial consultant brings know-how and experience to assist you browse the complexities of the market. They can supply personalized guidance tailored to your economic objectives and take the chance of resistance, guaranteeing that your financial investment method straightens with your objectives.

In addition, an economic expert can assist you remain disciplined throughout market changes, preventing emotional decision-making that could harm your long-lasting monetary success. They can provide a rational viewpoint and aid you concentrate on the bigger picture, instead of responding impulsively to temporary market activities.

Furthermore, monetary experts have accessibility to a variety of sources and tools that can help in assessing market fads, determining chances, and managing risk efficiently. By leveraging their knowledge and understandings, you can make more informed financial investment decisions and potentially boost your portfolio's performance over time.

Basically, having a monetary expert in your corner can be a useful asset in guarding your financial investments and accomplishing your economic objectives.

Techniques for Financial Investment Security

Take into consideration expanding your investment profile as a vital technique for securing your financial investments against market volatility and prospective risks. By spreading your financial investments throughout different possession classes such as supplies, bonds, realty, and products, you can minimize the impact of a downturn in any kind of solitary market.

Diversification helps minimize the threat of substantial losses while permitting prospective development opportunities in numerous industries.

One more technique for financial investment protection is to routinely assess and readjust your profile to straighten with your monetary goals and run the risk of tolerance. Rebalancing your financial investments makes sure that your profile continues to be varied and in accordance with your purposes, assisting to minimize potential losses throughout unstable market problems.

Furthermore, utilizing stop-loss orders can be an efficient device to limit losses in case of abrupt market declines. Setting fixed price levels at which securities are instantly marketed can assist protect your investments from drastic declines.

Conclusion

To conclude, economic consultants are important companions in browsing market volatility and safeguarding your financial investments. By leveraging https://writeablog.net/albertine870ivan/sharpen-yo...ent-planning-by-complying-with and sources, experts can assist you make educated choices, manage risk successfully, and remain focused on your long-lasting financial objectives.

Counting on the support of a financial consultant can offer you with assurance and confidence throughout unpredictable times in the marketplace. Bear in mind, your advisor exists to sustain you every action of the method.

Consider The Following Queries When Choosing A Monetary Consultant |

Material By-Timmons Gram

When choosing a monetary advisor, have you taken into consideration the sixty-four-thousand-dollar questions that could affect your monetary future? Recognizing their qualifications, financial investment strategies, and fee structures is vital, however what about their communication style? Exactly how they connect and enlighten you about economic matters can dramatically influence your decision-making procedure. This often-overlooked element can be a game-changer in building an effective advisor-client partnership.

Consultant's Certifications and Experience

When selecting a monetary expert, ensure you meticulously assess their certifications and experience. Look for qualifications like Qualified Financial Planner (CFP) or Chartered Financial Expert (CFA) to ensure they have actually gone through rigorous training and exams.

Experience is crucial, so inquire about how much time they have actually been in the industry and what sorts of clients they usually deal with. An experienced consultant may have come across a variety of economic circumstances, giving them valuable understandings to assist you browse your very own.

Furthermore, take into consideration the consultant's specialization. Some concentrate on retirement planning, while others excel in investment methods or tax obligation planning. Align their competence with your details needs to ensure they can give the advice you need.

Do not wait to request for references or testimonials from present clients. https://squareblogs.net/ara13otto/begin-your-retir...g-with-intelligent-tactics-and can supply useful insights into the expert's communication design, reliability, and general satisfaction of their clients.

Investment Strategy and Philosophy

Examining an advisor's financial investment technique and ideology is crucial in determining if their techniques straighten with your monetary objectives and run the risk of resistance. When examining a consultant, ask about their investment design. Are they extra inclined in the direction of energetic administration, continuously buying and selling securities, or do they favor an easy technique, focused on long-lasting development? Recognizing their approach can offer you understanding right into exactly how they make investment decisions on your behalf.

Furthermore, ask about their sights on danger. How do https://writeablog.net/antoine58lauren/acquire-kno...preparation-by-executing-vital examine risk, and what procedures do they require to alleviate it? Ensure that their approach to take the chance of aligns with your comfort level.

Moreover, ask about their record. Have they succeeded in accomplishing their customers' monetary objectives in the past? While previous efficiency isn't indicative of future results, it can provide important information concerning their investment technique.

Cost Framework and Providers

Recognizing the fee structure and services provided by a monetary consultant is necessary for making notified choices concerning your economic future. When selecting an economic consultant, guarantee you understand just how they're compensated. Some advisors bill a percent of properties under management, while others might have a fee-based on hourly prices or a flat charge. Be clear about these costs upfront to avoid surprises in the future.

Additionally, inquire about the range of services the economic consultant offers. Do https://pulse2.com/private-advisor-group-brings-in-90-million-advisor/ provide extensive financial preparation, retired life planning, financial investment monitoring, or details services tailored to your needs? Recognizing the extent of services supplied will aid you evaluate whether the expert can fulfill your monetary objectives successfully.

In addition, consider inquiring about any possible conflicts of passion that might emerge because of their fee framework. Transparency in exactly how your advisor is compensated and the solutions they provide is essential for establishing a trusting and successful economic advisor-client relationship. By diving right into these facets, you can make a knowledgeable choice when choosing a financial advisor.

Conclusion

Finally, when picking a monetary expert, it's essential to ask the right inquiries concerning their credentials, experience, financial investment strategy, fees, and potential conflicts of rate of interest.

By doing so, you can ensure that you're choosing an expert that straightens with your economic objectives, threat tolerance, and values openness in their solutions.

Making a notified decision based upon these variables will certainly establish you on the path to attaining your financial goals with confidence.

When Looking For Monetary Consultants For Your Retirement Preparation, Be Sure To Focus On Certain Qualities That Will Certainly Cause A Fruitful Partnership |

Author-Buch Vendelbo

When searching for financial advisors to lead your retirement planning journey, bear in mind to focus on essential qualities that can make a substantial distinction in safeguarding your monetary future. From experience and know-how to reliable communication skills and a client-focused approach, each facet plays a crucial function in picking the ideal advisor for your demands. By thoroughly taking into consideration these essential high qualities, you can ensure a solid structure for your retirement planning technique.

Experience and Knowledge

When considering hiring monetary consultants for retired life preparation, prioritize their experience and proficiency. It's crucial to pick advisors that have actually a tested performance history in effectively directing clients via their retired life years. Try to find Portfolio Management who've years of experience specifically in retirement preparation, as this demonstrates their capacity to navigate the intricacies of this stage in life.

Proficiency in areas such as financial investment approaches, tax obligation planning, and estate preparation is also vital to make sure that your retired life funds are maximized and safeguarded.

Seasoned economic consultants bring a wealth of knowledge to the table, allowing them to anticipate prospective challenges and give proactive solutions. Their experience enables them to customize financial strategies to suit your one-of-a-kind objectives and conditions properly.

Interaction Abilities

Consider exactly how effectively economic experts connect with you as it substantially impacts the success of your retirement planning trip.

When searching for an economic expert, focus on locating somebody who can discuss intricate financial principles in a manner that you comprehend. Clear communication is key to ensuring that you're well-informed regarding your retired life choices and can make certain decisions.

Look for Long Term Financial Goals who actively listens to your concerns, goals, and choices. Reliable communication likewise includes regular updates on the progress of your retirement and without delay attending to any type of concerns or uncertainties you may have.

A proficient financial expert ought to be able to adapt their interaction style to suit your choices. Whether you prefer in-depth emails, telephone call, in-person conferences, or video clip seminars, your advisor ought to be able to accommodate your needs.

Clear interaction develops depend on and cultivates a solid advisor-client partnership, which is important for effective retirement planning. Make sure to assess a possible advisor's interaction skills during your initial conferences to make sure a great fit for your economic trip.

Client-Focused Technique

To make sure an effective retirement preparation experience, prioritize financial experts who focus on a client-focused strategy. When picking an economic expert for your retirement planning requirements, it's important to discover somebody who puts your rate of interests first.

A client-focused approach suggests that the consultant listens to your goals, problems, and choices diligently. By comprehending your unique economic situation and ambitions, they can customize their advice and suggestions to fit your particular requirements.

A client-focused financial consultant will certainly take the time to explain complicated monetary ideas in such a way that you can quickly comprehend. They'll involve you in the decision-making process and ensure that you're comfortable with the approaches suggested. This approach promotes count on and transparency in the advisor-client relationship, inevitably bring about a much more successful retirement preparation journey.

Additionally, https://www.bankrate.com/investing/financial-advisors/fee-only-vs-fee-based-planners/ -focused expert will prioritize regular interaction to maintain you notified about the progress of your retirement. They'll be easily available to deal with any kind of questions or unpredictabilities you may have along the road.

Verdict

To conclude, when employing monetary advisors for your retirement planning, bear in mind to prioritize experience, competence, interaction abilities, and a client-focused strategy.

Seek consultants that've a proven record in retirement preparation, can clarify complicated principles plainly, actively listen to your worries, involve you in decision-making, and maintain routine interaction.

By focusing on these vital high qualities, you can guarantee that you have a trusted companion to aid you achieve your retired life goals.

Benefit From Financial Advisors' Knowledge To Safeguard Your Financial Investments From Market Volatility And Develop Monetary Protection |

Web Content Author-James Cheng

In times of market volatility, your economic advisor acts as a vital ally in securing your investments. Their proficiency enables them to guide you through uncertain market problems and aid you in making well-informed selections. By teaming up with an economic advisor, you get to valuable insights and methods designed to protect your monetary future. Stay tuned to discover just how these professionals can assist you navigate the intricacies of market variations and ensure the safety of your investments.

Understanding Market Volatility

To browse market volatility effectively, you should stay informed and planned for changes in property values. Market volatility describes the rapid and unpredictable changes in the prices of stocks, bonds, and various other financial tools.

During unpredictable times, rates can swing substantially, causing unpredictability and prospective monetary losses. https://postheaven.net/hanh14reanna/retirement-pla...fy-and-fulfilling-retired-life to understand that market volatility is an all-natural part of investing and can provide both risks and opportunities.

By remaining educated concerning market trends, economic signs, and geopolitical occasions, you can better prepare for and respond to market volatility. Monitoring https://reuben-micah.blogbright.net/step-by-step-s...anning-for-a-serene-retirement and expanding your portfolio can help reduce risks related to market changes.

Additionally, having a clear financial investment strategy and long-term financial objectives can give a roadmap during rough times.

Bear in mind that market volatility isn't always an unfavorable thing. While it can lead to temporary variations in portfolio worths, it can also produce getting opportunities for long-term capitalists.

Value of Financial Advisors

Throughout turbulent market problems, having an educated monetary expert by your side can provide indispensable guidance and support in safeguarding your financial investments. A financial expert brings expertise and experience to aid you browse the intricacies of the market. They can provide personalized suggestions customized to your financial goals and run the risk of tolerance, ensuring that your investment approach straightens with your goals.

Moreover, a monetary consultant can aid you remain disciplined during market fluctuations, preventing psychological decision-making that could damage your long-term monetary success. They can offer a logical viewpoint and assist you focus on the larger photo, instead of responding impulsively to temporary market motions.

Additionally, financial advisors have accessibility to a large range of resources and devices that can assist in analyzing market trends, identifying possibilities, and managing risk effectively. By leveraging their knowledge and understandings, you can make more informed investment decisions and potentially boost your portfolio's performance gradually.

Basically, having an economic advisor in your corner can be a beneficial asset in securing your investments and accomplishing your economic objectives.

Methods for Investment Protection

Consider expanding your financial investment profile as a vital approach for securing your investments against market volatility and prospective threats. By spreading your financial investments across various asset classes such as supplies, bonds, real estate, and assets, you can minimize the impact of a slump in any kind of solitary market.

Diversity helps reduce the danger of substantial losses while permitting prospective development possibilities in different sectors.

An additional technique for financial investment security is to regularly examine and adjust your portfolio to line up with your economic goals and take the chance of tolerance. Rebalancing https://www.gobankingrates.com/money/financial-pla...om-dave-ramsey-over-the-years/ makes sure that your portfolio remains diversified and in accordance with your objectives, helping to mitigate prospective losses throughout stormy market conditions.

Moreover, utilizing stop-loss orders can be an effective device to restrict losses in case of sudden market recessions. Establishing fixed price levels at which securities are automatically offered can help protect your investments from drastic declines.

Final thought

To conclude, financial experts are crucial companions in browsing market volatility and protecting your investments. By leveraging their expertise and resources, consultants can assist you make notified decisions, manage risk effectively, and stay concentrated on your long-term financial objectives.

Counting on the assistance of an economic advisor can offer you with peace of mind and self-confidence throughout unpredictable times in the market. Remember, your consultant is there to support you every step of the way.

Engaging With Monetary Experts Can Provide Beneficial Support In Developing A Solid Economic Strategy Aimed At Safeguarding Your Future |

Material Produce By-Hickey Rohde

When it comes to securing your financial future, having a proficient financial advisor at hand can make all the distinction. By delving into your economic landscape and customizing approaches to match your unique goals, these specialists provide a roadmap in the direction of long-term economic stability. From retired Learn Even more Here to financial investment diversity, financial advisors offer a holistic method that can pave the way for a safe and flourishing future. So, exactly how exactly do these specialists browse the intricacies of financing to guarantee your monetary wellness?

Financial Evaluation and Goal Setting

Prior to producing a solid financial strategy, it's critical to carry out a thorough financial analysis and plainly define your goals. Beginning by gathering all your financial files, consisting of income declarations, bank statements, investment accounts, and any financial obligations you may have. Take a close check out your spending routines to recognize where your money is going every month. This analysis will certainly provide a clear photo of your existing financial situation and aid determine areas for improvement.

Next off, a knockout post to set specific, quantifiable, possible, relevant, and time-bound (SMART) objectives. Whether you intend to buy a home, save for your youngsters's education and learning, or retire easily, defining your goals will certainly give your monetary plan instructions and objective. Be realistic regarding your objectives and consider both temporary and long-lasting ambitions.

Customized Financial Investment Methods

Exactly how can financial experts tailor investment methods to fit your one-of-a-kind monetary goals and run the risk of resistance?

Financial experts have the experience to evaluate your economic situation adequately, taking into consideration variables such as your earnings, expenses, assets, responsibilities, and lasting purposes. By understanding your risk resistance, time perspective, and financial investment preferences, they can create a customized investment technique that lines up with your particular needs and convenience level.

Financial consultants utilize various financial investment lorries such as stocks, bonds, mutual funds, and exchange-traded funds to develop a varied profile that stabilizes threat and prospective returns according to your choices. They can additionally include tax-efficient methods to optimize your investment growth while decreasing tax obligation implications.

Via recurring surveillance and adjustments, financial consultants make sure that your investment approach stays according to your progressing economic goals and market conditions. By working carefully with an economic advisor to create a customized financial investment strategy, you can feel confident that your monetary future remains in capable hands.

Retirement and Estate Planning

To protect your financial future, it is necessary to think about retired life and estate planning as indispensable components of your overall economic technique. https://postheaven.net/brad38rick/understanding-th...ment-monitoring-techniques-for involves setting particular economic objectives for your post-working years and figuring out exactly how to attain them. A financial expert can assist you navigate retirement account options, such as 401( k) s or IRAs, and create a personalized plan tailored to your needs. By starting very early and regularly reviewing your retirement, you can ensure you get on track to fulfill your future financial purposes.

Estate planning, on the other hand, focuses on handling your assets and ensuring they're distributed according to your desires after you pass away. This procedure includes producing a will, establishing trusts, and marking recipients. An economic consultant can help you in establishing an estate strategy that decreases tax obligations and maximizes the worth of your estate for your heirs.

Verdict

In conclusion, monetary consultants can play a crucial duty in assisting you develop a strong monetary plan for your future.

By performing a detailed monetary evaluation, establishing SMART goals, and tailoring investment methods tailored to your requirements, consultants ensure that you're on track to achieve your temporary and long-lasting financial objectives.

With their competence and assistance, you can feel great in your financial expectation and safeguard your monetary future.

Discover The Approaches For Creating A Strong Economic Plan With The Expert Help Of Economic Experts - Your Pathway To A Steady Future Is Accessible! |

Written By-Jimenez Vick

When it involves safeguarding your monetary future, having a competent monetary expert by your side can make all the distinction. By delving into your monetary landscape and customizing methods to match your distinct goals, these specialists give a roadmap towards long-term economic stability. From retirement planning to investment diversity, economic advisors provide a holistic strategy that can pave the way for a safe and secure and flourishing future. So, how precisely do https://zenwriting.net/patrice70lyman/investment-m...hod-to-growing-your-wide-range browse the complexities of finance to ensure your financial health?

Financial Assessment and Setting Goal

Before developing a strong financial plan, it's critical to carry out a comprehensive financial assessment and plainly define your objectives. Begin by gathering all your monetary documents, including income declarations, bank statements, investment accounts, and any type of financial debts you may have. Take a close look at your investing practices to recognize where your money is going each month. This evaluation will certainly give a clear image of your existing financial scenario and assistance determine areas for renovation.

Next off, it is very important to set particular, measurable, achievable, appropriate, and time-bound (SMART) goals. Whether you intend to get a home, save for your kids's education, or retire easily, specifying your goals will provide your monetary plan instructions and function. Be reasonable about your purposes and think about both temporary and long-term desires.

Customized Investment Approaches

Just how can monetary advisors tailor financial investment techniques to fit your one-of-a-kind financial objectives and run the risk of resistance?

Financial advisors have the competence to evaluate your monetary situation thoroughly, considering elements such as your income, expenses, possessions, obligations, and long-term purposes. By recognizing your danger resistance, time horizon, and financial investment preferences, they can develop a tailored investment strategy that aligns with your certain requirements and comfort degree.

Global Portfolio Management use numerous investment cars such as stocks, bonds, mutual funds, and exchange-traded funds to develop a varied profile that balances danger and possible returns according to your choices. They can likewise include tax-efficient techniques to enhance your investment development while decreasing tax obligation effects.

With recurring tracking and adjustments, monetary consultants make sure that your financial investment approach remains in line with your progressing financial goals and market conditions. By functioning closely with an economic consultant to establish a personalized investment plan, you can feel confident that your monetary future is in qualified hands.

Retired Life and Estate Planning

To safeguard your financial future, it is necessary to take into consideration retirement and estate planning as essential parts of your total financial technique. Retirement planning involves setting details economic goals for your post-working years and establishing exactly how to attain them. A financial expert can help you navigate retirement account alternatives, such as 401( k) s or Individual retirement accounts, and devise a personalized strategy customized to your demands. By beginning early and frequently assessing your retirement plan, you can guarantee you're on track to fulfill your future financial objectives.

Estate preparation, on the other hand, concentrates on managing your possessions and guaranteeing they're dispersed according to your wishes after you pass away. This procedure entails developing a will, establishing counts on, and assigning beneficiaries. An economic advisor can aid you in creating an estate strategy that decreases taxes and makes best use of the value of your estate for your heirs.

Conclusion

To conclude, monetary experts can play a vital function in assisting you produce a strong economic plan for your future.

By conducting a complete financial assessment, setting clever objectives, and personalizing financial investment techniques tailored to your requirements, experts guarantee that you get on track to accomplish your short-term and long-lasting monetary objectives.

With their proficiency and support, you can feel great in your economic expectation and secure your financial future.

People Can Count On Economic Experts To Assist Them In Acquiring Their Long-Term Economic Targets |

Write-Up By-Hougaard Tang

As you browse the intricate landscape of lasting economic preparation, the assistance of a knowledgeable financial advisor can be invaluable. From setting clear goals to crafting a customized roadmap for your economic future, advisors use a strategic technique that can pave the way in the direction of achieving your goals. But just how exactly do these experts tailor their knowledge to suit your unique goals and difficulties? Let's explore the methods which financial experts can assist you open the possibility for long-term monetary success.

Understanding Your Economic Goals

To achieve your lasting economic objectives, comprehending your monetary objectives is critical. Begin by analyzing where you presently stand monetarily. Take stock of your income, expenditures, properties, and financial obligations. Recognize what you wish to achieve monetarily in the future, whether it's getting a home, saving for retirement, or funding your youngster's education and learning.