Simple Advertising Strategies For Your Accounting Provider Service |

Article created by-Faulkner Frank

In order to make certain that your accounting workplace is going to achieve success, you have to see to it that you do everything you can to maintain your clients happy. Making customers really feel displeased can end in them no longer buying from your bookkeeping workplace as well as providing it a public bad name. Ensure that you constantly offer top-quality customer support in order to properly ensure they leave you glowing testimonials. We've gathered some general rules to aid you construct your bookkeeping getting in touch with service with consumer satisfaction.

Providing only the greatest products and services is the particular way to success. If what you need to offer is just unequaled by any kind of competitors, you can anticipate to see a substantial boost in your assets and profits. A significant benefit of having terrific client service is that it likewise tends to result in a lot of suggestions amongst your clients. As long as you place emphasis on quality, no other bookkeeping consulting business in the industry will remain in the placement to touch you.

Businesses still need to continue and also grow also after preliminary objectives are completed; accomplishing a collection of goals is not completion factor. To make http://www.kuam.com/Global/story.asp?S=41198748 that your bookkeeping getting in touch with service remains to grow, you should constantly set new goals to attain. If you remain notified with your market's most current patterns, you'll maintain discovering means you can boost your organisation. If https://marketreportobserver.com/bookkeeping-servi...bookkeeper360-healy-consultan/ want to grow a successful company, always improve as well as keep up to day on existing trends.

Regardless of just how knowledgeable you remain in developing an accounting consulting service, beginning a brand-new one is always tough. It is critical to do as much research as feasible before actually purchasing your brand-new service. Cautious preparation lays the structure for a successful business endeavor. Do not ignore the many resources used completely free on the internet.

A thorough, well-designed internet site will certainly be helpful for your bookkeeping consulting organisation. A highly knowledgeable site designer can construct the perfect web site for your service, and also show you the means to keep your material in the future. By selecting aesthetically promoting styles images that draw the attention of your routine visitors, it is guaranteed that your site will have better results. A good-quality website can make all the difference for a modern accounting office, as a large amount of success online now depends on having an attractive and also effective site.

A sure sign of fantastic customer care is possibly the consumer buying from that audit office once more. Your initiatives to obtain client complete satisfaction need to correspond in order to preserve your customers. When you establish as well as stay with high standards, your clients will certainly stick to you when you introduce new solutions. You should ensure that you lead your rivals in terms of quality product or services.

|

Метки: Small Business Accountant Small Business Bookkeeping Finance Services Tax Preparation CPA Services Accountant Bookkeeping Investigative Accounting |

Leading Ways To Market Your Audit Solutions Business For Proven Success |

Authored by-Ejlersen Strauss

It can be much easier to handle an accounting consulting company if you are clear in the goals as well as values of the bookkeeping office. For you to prosper in all your objectives, you will require to come across lots of challenges. Maintaining these tips in mind will ensure that your company achieves success as well as you have the ability to increase.

Developing a prosperous accounting office doesn't happen overnight. Your success will probably be identified by just how much of your time, power and resources you want to invest when very first beginning. https://www.businesswire.com/news/home/20190717005...s-Acquires-Office-Support-Firm should additionally have patience and emphasis to make it in the future. Owners that shed emphasis and also drift away from proactively advertising the growth of their bookkeeping speaking with service placed their companies in danger of failing.

Running your very own accounting consulting business is most likely to use up a whole lot more of your waking hours than you anticipate. Running Accountant glendale az indicates you have to spend your personal effort and time. Do not anticipate to be ready to multitask initially. The smartest accountancy workplace proprietors recognize when it's time to relax and turn over several of their responsibilities to somebody else.

Enable your clients leave their reviews regarding your product or services by putting aside a put on your website. Favorable reviews of your products and services can only serve to enhance your on-line track record. Numerous customers will react with excitement if you request for their input and comments. If you wish to motivate them to react with their feedback, you should consider supplying discounts to customers who do.

You can ensure your accounting seeking advice from organisation isn't harmed by lawful issues by submitting all federal government kinds and having a fundamental understanding of service law before opening your doors to the general public. If you don't take place to have basic understanding of business regulation, you need to see a lawyer that focuses on the subject. It just takes a single pricey situation in a court of law to cause the failure of a rewarding company. Having a good bookkeeping consulting service attorney is of advantage to you because you do not intend to be in the position of facing a legal obstacle with no one to represent you.

When handling a thriving accounting consulting service, you should set goals. By developing a distinct, complete method for success that includes a progression of specific, practical objectives, you will certainly have the ability to make and handle an economically successful accountancy as well as bookkeeping company. The more particular your goals are, the simpler it is to adhere to the guidelines needed to make your service successful. Keeping your objectives reasonable as well as your landmarks possible is essential to your success; lots of organisations fail since the proprietors are unable to fulfill the enormous objectives they've established and also come to be annoyed as well as inadequate.

|

Метки: Small Business Accountant Small Business Bookkeeping Finance Services Tax Preparation CPA Services Accountant Bookkeeping Investigative Accounting |

How To Make Best Use Of Potential With Efficient Financing Business Marketing |

Article by-Gregersen Svendsen

Making a funding services business profitable is not an easy task for numerous single owners. It is an unusual incident that the best method for increasing your market share is selected. If https://squareblogs.net/buster77ramiro/effective-a...et-one-of-the-most-out-of-your wish to be successful in company, follow the effective individuals in your sector. You ought to maintain these approaches useful to ensure you maintain your service in a development mindset.

Being contented when moneying services service is going great is typically a blunder. Constant preparation and also testing with growing concepts are vital to effective businesses. Don't allow yourself get sidetracked if you want your organisation to be as effective as possible. If you are constantly prepared to change things and seeking new methods to enhance, after that you will make it through anything that comes your company' means.

You won't have an expanding funding solutions company without a lot of fully commited clients. Older companies likewise rely on existing employee that really feel directly purchased the business. The catastrophe left following a solitary unfavorable review is typically a complete surprise to local business owner who do not check their financing firm's online reputation. You will certainly need to fix the scenario and deflect the damages that might have been done to your business's name on the occasion that you have gotten some poor reviews, so it is suggested that you employ an expert reputation administration service.

Clients will certainly constantly be loyal to a funding firm that uses them excellent quality goods or services. You should strive to please your customers in order to maintain them because if you fall short, they may find somebody else that will. Once your funding services organisation gets an excellent history of quality service or products, it will certainly be very easy to present brand-new services as well. The business that are more than likely bring you trouble are those that have top quality product or services.

Both funding firm management and workers alike require to connect in a favorable fashion with the general public. It's important that every consumer who comes through your door really feels secure and appreciated. As linked website , you must ensure your employers get adequate customer service training. You can be particular that your financing solutions organisation will certainly grow when you have favorable client experiences since they might be informing others.

You have to develop more dynamic objectives often since they help you evaluate the success of your funding solutions organisation. Unless you believe it can prosper, your service is not likely to be successful. You'll attain your wildest dreams for your funding firm's success if you keep setting brand-new criteria as soon as you satisfy the old ones. Proprietors who settle for the tiniest feasible milestones of success as well as spend little of their initiative in their firms probably shoud not trouble opening a busness at all.

|

Метки: Finance Services Wealth Manager Benefits of wealth management Wealth management Wealth advisor Personal finance Finance Advisor Corporate Finance |

Transition Your Financing Organisation For Positive Capital |

Written by- https://zenwriting.net/christena29liz/killer-tips-...-reliable-funding-organisation

If you intend to properly manage your funding solutions business, having a clear vision of what you desire is useful. Maintaining your eyes on the reward will enable you to surmount any obstacles on your way to success. If you consider these ideas detailed listed below, they will certainly assist a turning point in service success as well as development.

Whether https://blythe59felipa.bravejournal.net/post/2019/...-Out-Of-Your-Financing-Service experienced or not, developing a new financing services company is challenging. Your market research and also the understanding of your competitor's staminas and also weak points should precede any kind of action you take in the direction of establishing your funding firm. With the understanding obtained from researching, you can develop a rewarding company. The vast bulk of the study that's needed to establish a sound business plan can be done online.

Make sure your internet site has a place where clients can leave their viewpoint concerning your items and services. Every positive evaluation of your products and services reinforces your funding firm's on-line reputation. Several clients will react with exhilaration if you request their input and also responses. To convince them to share their opinions, offering promotions that are offered to just clients that leave evaluations is a reliable means.

Bear in mind that building an effective financing firm takes some time. Success of your financing solutions business hinges on just how much time, power, as well as resources you agree to take into your company at the start. While you are in the preliminary phases of building your service, you have to hold your horses and also visualize what your company will accomplish in the long run. If you are not tracking your business's development and also expansion, you may overspend or stop working.

Keep away from the lure to rest on your laurels when you reach a financing services business goal. Never ever hinge on your laurels with your organisation; rather, keep establishing brand-new, higher standards to satisfy. If please click the up coming article remain informed with your market's most current trends, you'll maintain finding out means you can expand your company. Consistent improvement as well as the advancement of your financing firm based upon patterns in the sector can help make your business thrive.

When you get to a couple of objectives with your financing solutions organisation, don't simply celebrate and also quit attempting, proceed pushing for far better success. Regular planning as well as experimentation with expanding techniques are crucial to successful organisations. As you strive for success, make absolutely sure to remain focused and committed to your financing company. It will certainly be much easier to get through tough times if your company is able to adapt swiftly.

One of the most effective funding solutions company plans consist of flexible goals made to adjust to a financing firm's development. Having an organisation approach that sets out details, quantifiable goals to aim for develops a route to success for your business. Creating an approach for success in an organisation endeavor relies on setting unique aims. It's vital to have a series of goals that are practical as well as possible instead of one overarching goal that can seem so tricky to accomplish that individuals obtain dissuaded as well as prevented.

|

Метки: Finance Services Wealth Manager Benefits of wealth management Wealth management Wealth advisor Personal finance Finance Advisor Corporate Finance |

Essential Principles For Efficient Funding Service Advertising |

Article by-Salomonsen Abdi

There's a great deal of money to be made by entrepreneurs, yet they've to understand when and also how to take cautious dangers. It's a must that you carry out as much research as you can previously your funding solutions company is formally begun. You need to know what needs one of the most focus and how to plan these points out with treatment if you're going to run a profitable organisation. You need to truly take into consideration the details that we have actually put together here about just how you can help your service expand.

https://squareblogs.net/hayden22thaddeus/reliable-...f-the-most-out-of-your-funding make additional acquisitions at companies where they obtained superb solution. Nevertheless, if your customer care is irregular and sometimes substandard, customers will probably hesitate to patronize you once again. When introducing new services, established and abide by high criteria client service as well as your consumers will certainly remain. The only business that may create a concern are the ones that have top quality service as well as quality items.

The time it will require to expand a funding services organisation should never ever be ignored. If top rated wealth management firms are to transform your service into a successful one, it'll take up a good amount of your personal time. Do not expect to be able to multitask in the beginning. Smart company owner recognize when they are really feeling bewildered, and will certainly transform some obligations on to others.

The absolute best means to get brand-new abilities in the funding solutions organisation world is by learning on duty. Professionals recommend getting as much hands-on experience regarding your desired sector as possible. If you need to run your very own business, you require to experience points yourself. Financing organisation publications might contain much wisdom, however nothing like the abilities and also expertise you have actually gotten via employment.

The method the proprietor or the staff member of a financing company associates with the public must create a good funding services organisation picture. Each and every single individual that gets in the facilities need to be made to really feel valued and valued. Individual abilities training is a necessary for employees who interact with clients. linked web page of consumer interactions with your firm can make or damage your service.

Success in financing solutions business is normally elusive, due to the fact that you never need to rest on your laurels. Organisations pass away if they quit expanding, so make sure that you're constantly establishing new goals. Among the greatest approaches to increase your revenues is to stay on top of the latest in industry fads. Additionally, you could comply with market fads to find out new techniques through which you can construct your organisation.

Whether you have been down the road sometimes before or you are starting your extremely first financing solutions company constructing a brand-new funding company is always challenging. The vital primary step is to do a great deal of industry and market research. With the knowledge acquired from researching, you can create a flourishing business. Do not ignore the variety of resources supplied completely free on the net.

|

Метки: Finance Services Wealth Manager Benefits of wealth management Wealth management Wealth advisor Personal finance Finance Advisor Corporate Finance |

How To Optimize Prospective With Reliable Financing Business Advertising |

Content by-Vick Leonard

Making a funding solutions organisation rewarding is not a very easy job for lots of sole proprietors. It is an unusual event that the most effective method for raising your market share is chosen. If you actually wish to succeed in service, comply with the successful people in your market. You must maintain these methods useful to ensure you maintain your service in a development mindset.

Being contented when https://citywireselector.com/news/dutch-asset-mana...al-ceo-following-exit/a1234120 is going good is often an error. Constant preparation and also experimentation with expanding concepts are vital to successful businesses. simply click the next site let on your own get sidetracked if you want your company to be as successful as possible. If you are always all set to transform things as well as searching for new means to enhance, then you will survive anything that comes your service' means.

You will not have a growing financing solutions company without a lot of committed consumers. Older companies also depend upon existing employee who feel personally invested in business. The catastrophe left following a single negative review is typically a total shock to entrepreneur who do not check their financing firm's on the internet reputation. You will certainly require to remedy the scenario and disperse the problems that might have been done to your company's name in the event that you have gotten some poor testimonials, so it is recommended that you employ a specialist credibility monitoring solution.

Consumers will always be loyal to a financing business that supplies them excellent quality products or solutions. You must make every effort to satisfy your clients in order to preserve them because if you fall short, they might find someone else that will. Once your financing services business obtains a good background of high quality service or products, it will certainly be easy to present new solutions also. The business that are probably bring you trouble are those that have high quality product or services.

Both funding firm administration and staff members alike require to connect in a favorable way with the general public. It's important that every customer who comes through your door really feels comfortable and valued. As a business owner, you have to guarantee your employers obtain sufficient customer service training. You can be certain that your funding services company will certainly expand when you have positive consumer experiences because they may be informing others.

You need to establish much more dynamic goals regularly since they help you evaluate the success of your financing services service. Unless you think it can be successful, your business is not most likely to be successful. You'll accomplish your wildest dreams for your funding company's success if you keep establishing new benchmarks as quickly as you meet the old ones. Owners that go for the smallest possible turning points of success and also invest little of their effort in their business possibly shoud not trouble opening up a busness whatsoever.

|

Метки: Finance Services Wealth Manager Benefits of wealth management Wealth management Wealth advisor Personal finance Finance Advisor Corporate Finance |

Growing Your Accountancy Provider Company Through Effective Marketing |

Content written by-Kaplan Morton

The key goal of releasing a bookkeeping workplace is to earn money. Ensure you are keeping track of the basics of your accounting consulting organisation design. You do not require an innovative service degree to have and run your own organisation, however you do require to comprehend fundamental organisation principles. Following, you will certainly discover some information to help you get started.

Hands-on method is truly the best method to build your capabilities when it includes running an accounting consulting organisation well. If you intend to understand more concerning just how business world works, the best in the business state it is often important to enter and experience it on your own. The understanding and also skills learned in the process help one to run an effective organisation. Relative to establishing accountancy consulting organisation abilities, your everyday job will certainly offer you much better than anything that you can learn from a created page.

Prior to visiting an accountancy consulting business, a lot of customers browse through the comments and also rankings of great testimonial internet sites. Come close to numerous of your celebrity customers and also ask to supply comments on your business. Plainly show reviews that promote your finest products as well as show your audit office's toughness. Constantly say thanks to those clients that do take the time to leave a testimonial, also if they recommend things that you can improve on.

If you are having difficulty making a critical bookkeeping consulting company discussion, take into consideration conceptualizing with staff members to gain some clarity. A great location to begin with streamlining your preparation process is making a benefits and drawbacks list. Both of they actually are time-tested approaches that might help you review every one of your choices and make the greatest choice. Having a conference with a company growth professional is a terrific habit whenever you feel unsure regarding the following action for your company.

Don't believe the buzz; a successful audit consulting service won't grow over night. Sherry steiman bookkeeper sun city will likely be established by just how much of your time, energy and sources you're willing to spend when initial beginning. Patience is also a merit; it permits you to focus on your long-term objectives as opposed to always remaining in the moment. If you do not pay attention to exactly how your business is growing, you will certainly fail.

At every level of an accountancy workplace, all communications with the public need to be defined by a favorable attitude. It belongs to the work to make every capacity and also real client really feel valued. When you have employees, make sure you supply them in-depth consumer abilities training. Clients that feel positively concerning your accounting seeking advice from organisation are most likely to tell others and aid the bookkeeping office grow./www.forbes.com/sites/allbusiness/2018/09/17/dont-waste-time-on-a-startup-business-plan-do-these-5-things-instead/" target="_blank">https://www.forbes.com/sites/allbusiness/2018/09/1...lan-do-these-5-things-instead/ /uploads/2014/03/How-to-sell-anything.jpg" width="533" border="0" />

|

Метки: Small Business Finance Accounting services Tax Consultant Financial accounting Loan Application Assistance Investigative Accounting Finance accountant |

Cutting-Edge Tips On Just How To Build And Also Take Care Of A Successful Bookkeeping Solutions Organisation |

Authored by-Dalsgaard McCleary

It calls for a strong bookkeeping consulting service plan to direct a business to lasting success and also success. The absence of a comprehensive company strategy has actually been the downfall of several young firms. Following these recommendations can help you grow your organisation and also achieve success.

To avoid subjecting your audit workplace to financial disaster, it is important to perform a complete and thorough danger analysis prior to making any type of major choices. Even one of the most well-managed accounting consulting business can be seriously damaged by big dangers. Bigger risks are most likely to harm your business, so minimize them whenever possible. Comprehensive danger analysis is the only way to recognize and also lessen organisation threats as well as preserve profit degrees.

Your bookkeeping seeking advice from service should always be functioning in the direction of brand-new goals. As a business owner, you need to believe that your business will do well in order for it to ever have a possibility at it. Because same way, it is very important to constantly be elevating bench for yourself, setting each new difficulty a little bit greater than the last. Individuals that're happy with fulfilling only one of the most mediocre milestones should not take care of a company.

Successful companies do not experience over night success. With adequate initiative and time invested in your accountancy getting in touch with organisation, success will comply with. It's important to place in persistence and attentiveness to your business. When a proprietor becomes sidetracked as well as stops proactively seeking development for his or her audit office, the business is likely to experience major troubles.

Devoting enough hours of your life to really running an accounting consulting company is essential and also always takes even more time than you initially expected. If you are to turn your business into a profitable one, it'll occupy a great amount of your personal time. Do not expect to be in recommended to multitask in the beginning. A smart entrepreneur understands when he comes to be overloaded and will certainly pass on a few of his obligations.

Customer research study shows that consumers care a good deal regarding the positive as well as unfavorable reviews a certain audit consulting company has. When trying to enhance your online presence, in some cases using special offers for customer that leave evaluations for your organisation can have a big impact. You must go through every one of the testimonials that people leave and also bear in mind of the ones that are most likely to assist you out one of the most. Your customers leaving a remark are doing you a fantastic favor thus you ought to value them by supplying discounts or promotions.

Releasing a new accounting office can be an obstacle regardless of what number of times you have actually done so in the past. However you can prepare on your own by investigating your market as well as finest accountancy consulting company techniques prior to actually spending anything. Constructing a successful and lucrative bookkeeping workplace begins with the right groundwork. Don't ignore the number of sources offered free of cost online.

|

Метки: Small Business Finance Accounting services Tax Consultant Financial accounting Loan Application Assistance Investigative Accounting Finance accountant |

Discover A New Marketing Region For Your Financial Solutions Organisation |

Content written by-Nolan Silva

To constantly manage your monetary consulting organisation efficiently, have a clear vision of what you want it to be. There are numerous obstacles that you need to get rid of in order to achieve your service goals. Keeping these pointers in mind will certainly ensure that your company is successful and you have the ability to broaden.

You need to celebrate when you get to turning points in your monetary consulting company technique, yet do not think that means you can quit considering your organisation as well as walk away. Well taken care of organisations are regularly searching for originalities and techniques to preserve and also improve revenues. Your service will certainly never ever endure the long run if you don't have emphasis and commitment put into it. https://scribblert.tumblr.com/post/186324115676/ou...ll-business-bookkeeping-beyond that are adaptable sufficient to react rapidly to changes in the economic situation as well as outside atmosphere typically weather bumpy rides fairly well.

Enable your consumers leave their testimonials concerning your product or services by putting aside a place on your website. Your main objective is supplying remarkable client service and also remarkable support, so accumulating favorable reviews will certainly better serve that objective. Clients like to be requested their input because it makes them feel as if what they have to claim matters to the monetary services consulting company. One way to persuade various other customers share their viewpoints, only supply promotions to those customers who leave their testimonials.

When finding out about your market, a few of one of the most reliable training will certainly occur through real world experience. To obtain some expertise on how to run a monetary consulting organisation, specialists suggest one to learn via individual experience. The even more you obtain real-world experience and understanding, the more successful you will likely be if you choose to open your very own service. There is something to be said about reading a business book, however there is far more to be claimed regarding real world experience.

A big share of consumers defer to the responses as well as positions of prominent customer reporting websites before seeing an economic consulting business. Come close to numerous of your star clients and also inquire to provide responses on your business. Plainly show testimonials that show your financial solutions seeking advice from company's staminas and also praise your greatest items. Rewarding those customers that leave the comments is necessary as they do more marketing work for your company.

An appealing, professional-looking website is a crucial aspect in every monetary services speaking with firm's advertising and marketing approach. If you do not have the abilities necessary to produce a top rate site on your own, engage the services of a gifted web site developer to aid you. Design templates, images, and also applications are terrific means to make your web site a lot more attractive and useful. Richard steiman cpa sun city of a professional and also appealing site can not be ignored in today's economic consulting business market in order to ensure you have a commanding web visibility.

|

Метки: Small Business Finance Accounting services Tax Consultant Financial accounting Loan Application Assistance Investigative Accounting Finance accountant |

Advised Better Ways To Market Your Financial Solutions Company |

check out this site create by-Petty Cho

You should have confidence on your capability as well as capability to do well in your monetary consulting service. When you have actually got sufficient self-control and determination, your organisation can prosper as well as come to be successful. We have several of the tips to follow when you truly want to prosper in your service.

Even if you have actually reached your objectives, it does not imply that you have ended up being a success. Continuing to produce as well as pursue brand-new purposes is specifically what keeps an enterprise alive. Expand your monetary consulting organisation by remaining on program and by staying up to date with sector patterns and changing your goals as necessary. We can always do far better what we currently do well, so adhere to those patterns as well as remain to improve so your service will certainly be the one that is successful.

People Share Why They Don't Use Financial Advisers; Some Alternative Ways to Get Financial Help

People Share Why They Don't Use Financial Advisers; Some Alternative Ways to Get Financial Help Many people just do not want to meet with a financial adviser despite the fact that using one may provide numerous financial advantages. Financial advisers provide objectivity of financial situations and give advice to help establish a more secure financial position.

Lots of brand-new monetary services seeking advice from business proprietors are shocked at just how much of their time is taken in by the needs of entrepreneurship. It requires a great deal of effort and time to own as well as run a flourishing financial consulting business. https://docs.google.com/drawings/d/1AvLOwbPyilJNcL9K7CGXYJR-QRzz6hu4Ybls8kMehuo/edit of brand-new firm proprietors will mistakenly try and handle too many responsibilities at once. In order to be a wise business owner, you must comprehend when you are swamped with work which you turn a few of the jobs over to others.

Financial solutions company plans are most effective when they include goals that grow in addition to the monetary consulting organisation. Your economic services speaking with company will certainly end up being a lot more profitable if you create a collection of particular objectives aimed towards accomplishing growth. visit web site help chart the course for future business success. Establishing goals is complicated; you require to keep them smaller sized and also a lot more manageable in order to an accomplish them, as seeking to meet bigger objectives is both aggravating and also exhausting.

Do not think the hype; a profitable economic consulting business will not flower over night. The quantity of time, power as well as resources you are in a placement to spend when you initially start your business will certainly determine your success. Do not tension way too much regarding the instant future, as you have to hold your horses and also think about the lasting success of your economic services speaking with business. Businesses typically fail when the owner diverts his or her focus from the growth and development of the company.

An excellent variety of clients depends upon the evaluations and also talk about a web site for them to identify whether to see a monetary consulting business. Boost your brand's online profile by asking your clients to leave evaluations of your services and products. Customer testimonials offer you a possibility to display your service' best features. Always give Wealth Management Vienna VA to those consumers that do take the time to leave a testimonial, even when they recommend things that you can improve.

|

Метки: Finance Financial Advisors Wealth Management Insurance Planning Physician Wealth Management Physician Financial Planning Wealth Advisors |

Suggested Much Better Ways To Market Your Financial Services Service |

Written by-Reeves Kaas

You should have self-confidence on your competence and ability to prosper in your economic consulting business. When you have actually obtained sufficient self-discipline and resolution, your company can prosper as well as become effective. We have several of the suggestions to follow when you actually intend to be successful in your business.

Just because you have actually reached your goals, it does not suggest that you have actually ended up being a success. Remaining to produce and also strive for brand-new aims is precisely what keeps a venture active. Expand Sovereign Wealth Management consulting company by remaining on training course and by staying on par with sector fads as well as readjusting your objectives accordingly. http://mgyb.co/s/Zh97O can constantly do better what we already succeed, so follow those trends and continue to improve so your organisation will be the one that prospers.

Top Tips for Young Financial Advisors

Top Tips for Young Financial Advisors The global financial markets are constantly evolving, which means that financial advisors must continuously be learning to keep up-to-speed. For example, a lot of recent economic research has supported the idea of investing passively in low-cost index exchange-traded funds (ETFs) and mutual funds, as they may provide the best long-term returns, while new technologies are constantly emerging that can help optimize client portfolios and improve their long-term risk-adjusted returns.

Many brand-new monetary services consulting firm proprietors are surprised at how much of their time is consumed by the needs of entrepreneurship. https://www.ft.com/content/9675e69e-7dbf-11e9-81d2-f785092ab560 needs a great deal of effort and time to own and also operate a thriving economic consulting organisation. Great deals of new business owners will foolishly try and also juggle a lot of duties at once. In order to be a clever entrepreneur, you ought to comprehend when you are overloaded with job which you turn a few of the jobs over to others.

Financial services business plans are most efficient when they consist of objectives that grow together with the monetary consulting company. Your monetary services speaking with company will certainly become much more successful if you develop a collection of specific objectives intended towards attaining development. Details goals aid chart the course for future service success. Setting objectives is complicated; you require to maintain them smaller and a lot more workable in order to an attain them, as endeavoring to meet larger goals is both aggravating and stressful.

Do not think the buzz; a profitable financial consulting organisation won't bloom overnight. The amount of time, power and resources you remain in a placement to invest when you first begin your organisation will establish your success. Do not anxiety way too much regarding the immediate future, as you need to be patient as well as consider the long-lasting success of your monetary solutions speaking with business. Organisations typically stop working when the proprietor diverts his or her emphasis from the growth as well as expansion of the business.

An excellent variety of customers relies on the reviews and comments on a website for them to determine whether to check out a financial consulting organisation. Enhance your brand's online profile by asking your clients to leave evaluations of your products and services. Client evaluations offer you an opportunity to showcase your company' finest features. Constantly say thanks to those consumers that do make the effort to leave an evaluation, also when they suggest points that you can improve on.

|

Метки: Finance Financial Advisors Wealth Management Insurance Planning Physician Wealth Management Physician Financial Planning Wealth Advisors |

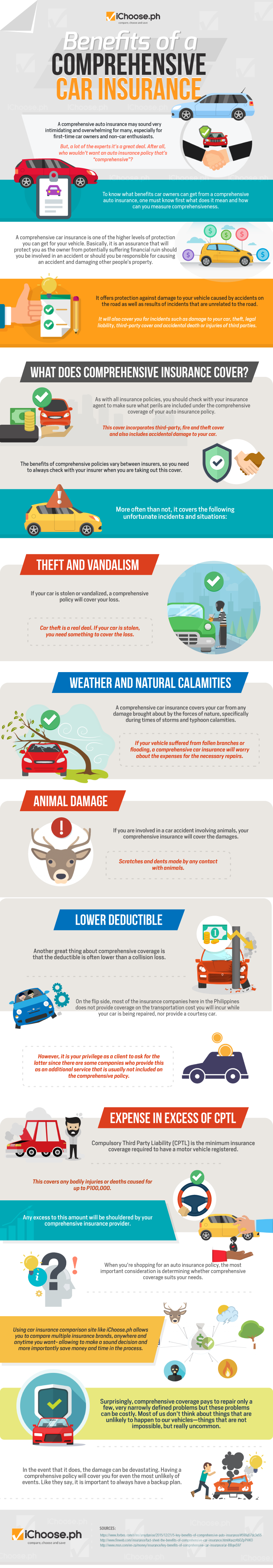

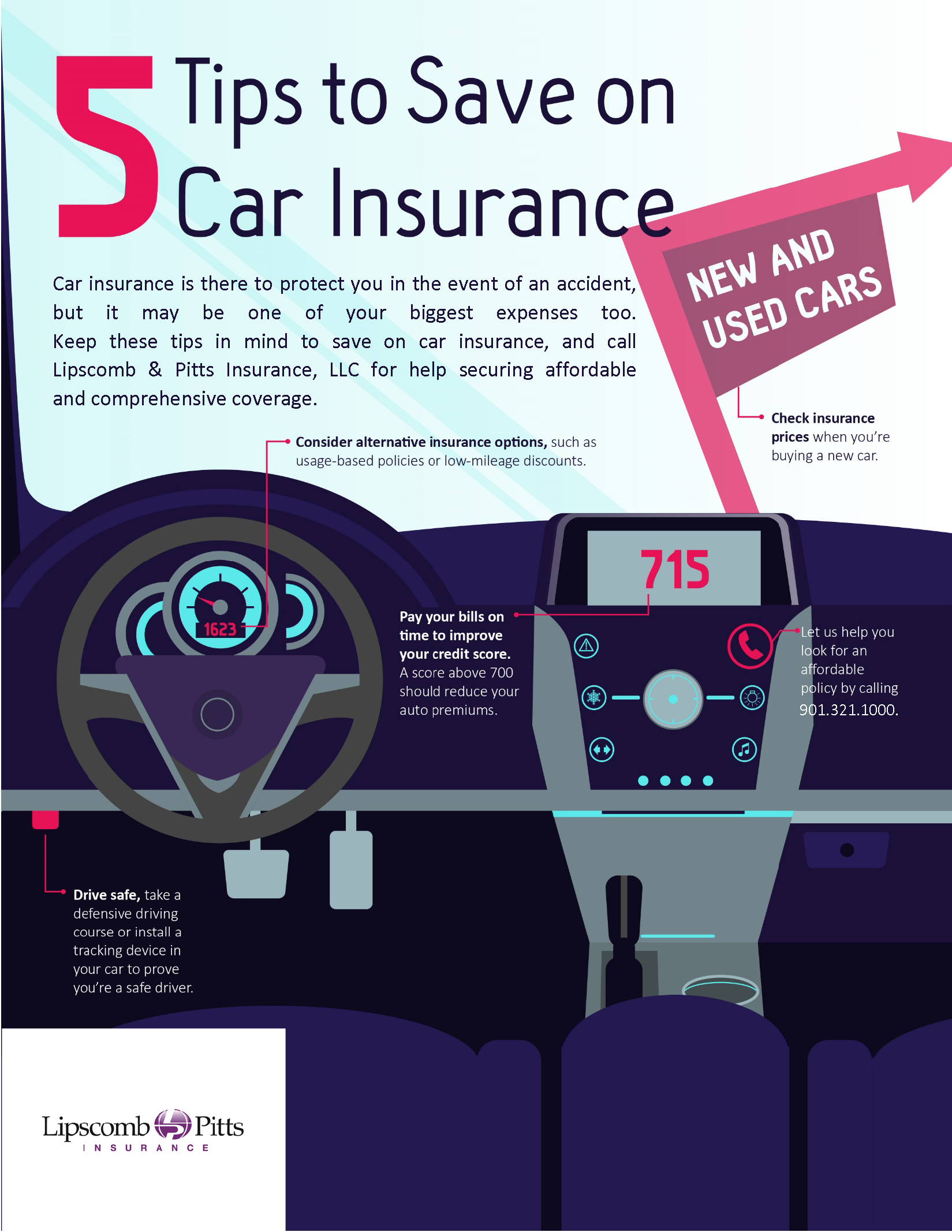

Simple Overview On Just How To Obtain Good Car Insurance Coverage |

Article by-Sexton Voigt

Auto insurance can be very intimidating to someone who has never dealt with it before. It can easily lead to an overwhelming feeling because of all of the information available. Below are some tips to assist you in getting all of this information organized to the point where you can start looking for a good auto policy.

Discontinuing your insurance policy? Here are some tips

Discontinuing your insurance policy? Here are some tips Discontinuing endowment policyYou can abandon your insurance in two ways. Either convert your policy into a paid-up policy by not paying the premium after the mandatory period; or, surrender the policy and get the surrender value from the insurer. In both cases, you must pay the premium until the end of the mandatory period. It can be two to three years depending on the policy’s terms and conditions. If you close the plan before the mandatory period, you will lose all value.

When insuring a teenage driver, lower your car insurance costs by asking about all the eligible discounts. Insurance companies generally have a discount for good students, teenage drivers with good driving records, and teenage drivers who have taken a defensive driving course. Discounts are also available if your teenager is only an occasional driver.

You should merge all of the insurance policies you have on your vehicles into a single policy. Doing this can save you up to 10 percent on your premiums. It also amalgamates all your bills and paperwork into a single policy. This will make the situation much easier if you ever need to file a claim as you'll only be using a single insurer and a single policy number.

Know what kind of coverage your insurance company has to offer. Your insurance may only be for a single vehicle, but the cost will still be affected by many different variables. In https://www.financialexpress.com/money/insurance/h...lness-insurance-plans/1494402/ hit someone, you can use bodily injury liability to pay for the legal fees.

To help save money on car insurance, start with a car that is cheaper to insure. Buying a sporty car with a large V-8 engine can push your annual insurance premium to double what it would be for a smaller, less flashy car with a 4 cylinder engine that saves gas at the same time.

Anyone shopping for a great rate on auto insurance should investigate the availability of group or affiliate discounts. Employer groups, professional associations and other organizations commonly negotiate special rates for their members, which can result in significant savings. Therefore, it pays to comparison shop with these types of potential discounts in mind.

Taking the towing option off of your policy will save you money on your premiums. In the case of an accident, towing is generally covered even if you are not paying for the towing option. If you take care of your car and understand how to fix small problems like a flat tire, you will never need to use the towing option and can save yourself up to 30 dollars a year.

If you are a young driver looking to purchase an auto insurance policy but do not want to pay an arm and a leg, a great step you can take is to get an older driver to share the insurance with you. Much like having someone with good credit co-sign a loan with you, having an older, experienced driver on your insurance will bring your payments down.

Take a close look at your auto policy and take off any "extras" that you won't use. For example, you might have emergency roadside assistance included in your plan. If you don't think you are going to use this, drop it in order to decrease the amount you are spending on your insurance. Your agent can help you figure out what else might apply.

Look for an insurance that offers an accident forgiveness option. If you get into an accident, your premium will not go up. trade insurance for cars in certain situations: make sure you qualify for it before requesting it. Usually, you can get accident forgiveness if you have a good driving record.

Consider switching the deductible from $1000 to $100. There a many pros and cons for lowering a deductible, even so the pros usually outweigh the cons. You might find yourself paying for a minor collision or two, but you should ultimately be saving a lot more money if you are a safe driver.

Work with an insurance broker or aggregator online. Sites like Esurance.com or Insureme.com can help you get quotes from several insurance companies at once for no charge so you can get a feel for how your current rates stack up, and whether you need to switch to a new insurance company.

Know just how much your car is worth when you are applying for car insurance policies. You want to make sure you have the right kind of coverage for your vehicle. For example, if you have a new car and you did not make a 20% down payment, you want to get GAP car insurance. This will ensure that you won't owe the bank any money, if you have an accident in the first few years of owning the vehicle.

A simple way to make sure you are getting all of the auto insurance discounts you are entitled to is to ask you insurance company for a list of every discount they offer. You can work your way through this complete list to find every possible discount that may apply to your situation.

If you want to get the best deal on your auto insurance policy, work on your credit. Most states use your credit score to determine your premium, believing that individuals with a lower score are at a higher risk for accidents. Do everything you can to raise your score, and the cost of your insurance will drop as a result.

When trying to decide on an insurance company for your auto insurance, you should check into the department of insurance from your state. You will find some valuable information there which will include closed insurance cases, important financial data as well as licensing information. This research will help you decide if you feel comfortable trusting this insurance company.

Compare rates before you buy. Different companies can charge vastly different rates for the same coverage, depending on how heavily they weigh such factors as your age, driving history, and credit history. Checking prices at a comparison site can help you save hundreds of dollars per year on auto insurance.

Find out what kind of discounts are available from your auto insurance company. Some companies offer nice discounts if you have taken a defensive driving course, have certain features on your car, or if you have remained a member of their plan. These little savings can add up and save you a large amount overall.

In conclusion, you cannot get enough data about auto insurance. Hopefully, you were able to clearly absorb all the tips and tricks provided. With the details provided in this article, you should be able not to only make wise choices on your own, but also be able to provide others with beneficial information.

|

|

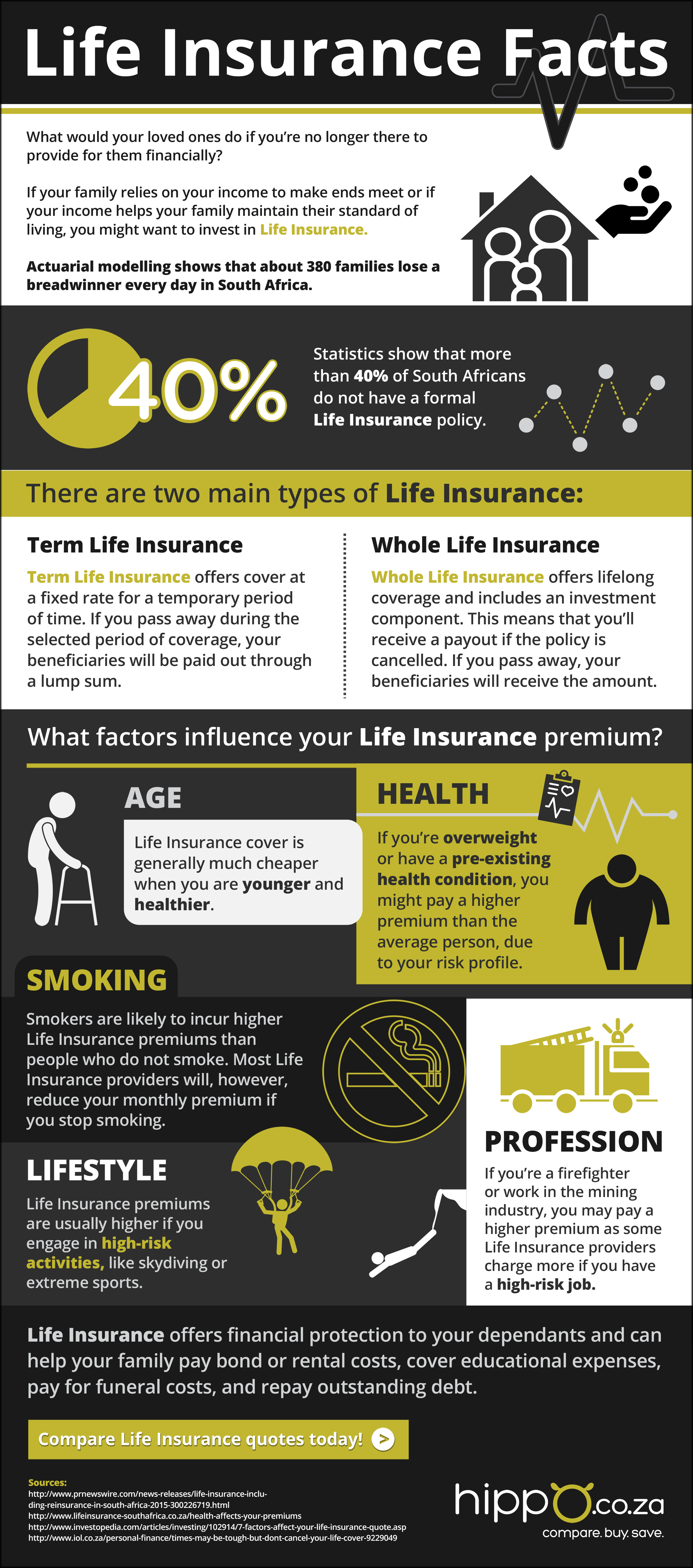

What You Can Do To Minimize Your Life Insurance Expenses |

Article by-Mohamad Willard

Life insurance may not be what you want to think about over a nice cup of coffee, but it is an important tool in planning your financial future and to protect your family from financial ruin should you pass away unexpectedly. Read on to find tips for getting the most from your insurance.

When purchasing life insurance, you will want to weight the company you choose very carefully. Since it is not likely that you will need to use their services for many many years, you will want to make sure that they will be around when it's needed. A strong reputable company who has been in the business for a long time is the safest choice.

Certain insurers could offer premiums approximately 40% lower than other ones. Use an online service to compare quotes from different insurers, and be sure you choose a website that will adjust your quotes for your medical history.

Use the power of the web when you are looking for the right insurance policy. You can use comparison websites to look at prices and policy terms. You can also look at the life insurance company's official website to judge the policy. There are three excellent websites that you can use: Accuquote, Insweb and Insure.com.

Although it may seem tempting, lying about your health, occupation or lifestyle in order to reduce your life insurance premium is extremely risky. Insurance companies investigate many claims, and, if they suspect that you gave them false information, your claim may be denied or your heirs may spend years in needless litigation. Whether you a smoker, a lumberjack or an extreme sports enthusiast, make sure your insurance company is aware of it.

When getting life insurance, make sure to get a policy that offers mortgage protection. What this does is help pay off your mortgage or any other debts when you pass away. This is important because it helps relieve your loved ones of your financial debts when you are no longer alive.

Your insurance agent may try to sell you additional riders to add to your life insurance policy. However, these are often unnecessary, so make sure you fully understand the purpose of each one before deciding if it would benefit you. For example, a family benefit rider allows for your death benefit to be paid in monthly increments rather than one lump sum, so your family receives a steady source of income.

Are you wondering what amount of life insurance you really need? This will be different for everyone depending on their particular situation. If you live by yourself, you might not need one. Your family should need from five to ten times the amount of money you earn in a year.

It's important that you understand that term life insurance is only for protection and not for investing. There is no savings component in term life insurance, so your best bet here is to simply pay for this type of insurance and invest elsewhere. Your policy payments aren't collecting interest or anything.

Prior to buying life insurance, research it yourself. Make sure that your budget and needs are met. Make sure you fully understand the different aspects of your policy.

If you have an old whole-life policy that you've had for several years, you should not attempt to replace it. The reason is because you could lose the premiums you have paid, and you could have to pay new administration fees. If you need more insurance on a whole-life policy, then you should just purchase more instead of discarding your current policy.

If you have minor children, purchase enough life insurance to offset their expenses until adulthood. The loss of your income could have a significant impact on your children's lives, and life insurance can help close the financial gap. This affects not only day-to-day expenses, but also those larger ones like college costs.

To save even more money on your life insurance premium consider purchasing a policy on-line. While many companies use agents or brokers to sell life insurance, if you are comfortable purchasing on-line you can reap significant savings. With lower overhead costs, companies offering life insurance on-line can offer significantly lower premiums to their customers.

9 financial tips for young mothers to manage their money

9 financial tips for young mothers to manage their money At the beginning of each month, with enough organisational skills to govern a small country, mom would allot a fixed amount to innumerable expenses – school fees, salaries, groceries, holidays, pocket money…you name it. Budgeting doesn’t just help us plan our expenses, but also our savings.

If you're a smoker who was addicted and smoking cigarettes at the time of your life insurance policy, you can actually quit smoking and save money. gap insurance for cars will let you reapply for a policy as a non-smoker after a certain amount of time has passed. So there's some incentive in it if you can quit.

If you want to save money on your life insurance, you should opt for annual payments. If you choose monthly payments, you will be charged more in processing fees. Make sure you save up enough money: perhaps you could open a savings account especially for your life insurance fund.

To save money on your life insurance policy, understand the difference between term insurance and permanent life insurance. Term insurance should cover most financial need and debt, and it may not be necessary for you to purchase an expensive permanent whole life policy. Purchase what you currently need, and then make adjustments if your needs change.

Be wary of the insurance broker that recommends an insurance policy after meeting with you for the first time. If a broker does this, it means they are not really analyzing your situation thoroughly. If a recommendation for a product is given in the first meeting, think twice about purchasing this product and of doing business with this agent.

Choosing https://www.financialexpress.com/money/insurance/h...cy-to-meet-your-needs/1487213/ is not something that should be done with little knowledge of what you are purchasing. You have been given a lot of information about life insurance in this article. Study the tips here so that you can make your decision being well aware of what is out there.

|

|

Thinking Of Buy Life Insurance Policy? This Guidance Can Assist! |

Authored by-Conway Liu

In order make sure that your final expenses will all be paid for, it is crucial for you to have a life insurance plan that is reliable. Becoming educated about life insurance is the first step in getting that reliable plan. The following article is going to provide you with vital life insurance information.

When creating a divorce settlement that requires one parent to maintain life insurance in order to keep custody of children, create the insurance policy before signing the divorce settlement. This speeds up the settlement process and insures that any kinks in the making of the insurance policy are dealt with before the custody issues.

As you get older, evaluate how your life insurance needs have changed to be sure you aren't paying more than you should. For https://www.moneycontrol.com/news/business/persona...an-for-your-needs-2575495.html , if you are retired and your children are all employed and living independently, there is no need for a zillion-dollar policy. They simply don't need that income if something should happen to you. So if you have no dependents in the house and no debts, you should ramp down your life insurance coverage to a minimum level - say, to support only your spouse if he or she survives you.

If you would prefer a permanent life insurance policy but can only afford term insurance, buy a convertible policy. At any point during your term policy, you can choose to convert to permanent life insurance. This helps keep rates lower when you are younger, and as you advance in your career your budget might have more room for permanent coverage. You will not have to take any medical exam to convert, which is important if you have developed any health conditions.

https://www.moneylife.in/article/5-reasons-to-inve...nance-fixed-deposit/57376.html !2m3!1f0!2f0!3f0!3m2!1i1024!2i768!4f13.1!3m3!1m2!1s0x0%3A0xcdd2dd9998008385!2sPacific+Northwest+Insurance!5e0!3m2!1sen!2sus!4v1559926419459!5m2!1sen!2sus" width="600" height="450" frameborder="0" style="border:0" allowfullscreen>

Sometimes in life insurance, more coverage is actually cheaper. As the amount of coverage increases, the cost per thousand dollars of coverage will decrease. For some companies, the math works out such that buying a bigger policy actually costs you less per month in premiums. Always ask for price quotes for multiple levels of coverage when shopping for insurance.

Even if your employer offers life insurance, you shouldn't depend on this policy to meet all your needs. These policies are often fairly limited, and have the disadvantage of not being portable. If you leave your job, you will also leave your life insurance behind, which means you will have to find a new policy to replace it.

Buy life insurance as early as you can afford to. The older you get, the higher your rates rise. Insurance companies base their rates on the probability of the insured contracting an illness or other condition. Additionally, you run the risk of being turned down for coverage if you happen to become ill before you apply for life insurance.

When you want to get life insurance you should do some research, as well as speak to a professional. Sometimes agents will have information that you don't get on your own, and will also be able to assist with needs as they arise.

When buying term life insurance, make sure the duration of your policy matches the amount of time you need it. For example, buy term insurance that stays in force long enough until the kids become independent and also, that the remaining spouse has coverage until he or she, becomes eligible for retirement income.

If you do not have any major health problems, do not go with guaranteed issue policies. Getting a medical exam will save you money, and the guaranteed issue policies do not need that, and has higher premiums. You don't need to spend more on life insurance than is really needed.

If you have an old whole-life policy that you've had for several years, you should not attempt to replace it. The reason is because you could lose the premiums you have paid, and you could have to pay new administration fees. If you need more insurance on a whole-life policy, then you should just purchase more instead of discarding your current policy.

A lot of people with no dependents believe that they do not need life insurance. Well, someone has to bury you. You have some family or friends somewhere, and you probably do not want to burden them financially on top of grief. Even if it's a small policy, it's better than purchasing nothing at all.

In order for the people you love to be cared for even when you aren't around to physically handle things yourself, life insurance is an important investment. The cost of funeral services are very expensive and can leave a large burden on your loved ones. Don't make the mistake of thinking you are invincible!

5 Things to Check before Porting Health Insurance

5 Things to Check before Porting Health Insurance Consider factors like the demise of a family member who was covered in the policy, if a new baby was born, if you happen to switch your job where you are not covered under group insurance plan; then you might need to switch your health insurer. Some insurance companies apply sub-limits, co-payments and room rent limits during hospitalization. You can port out to a health insurance company, which does not impose any restrictions on the room rents or lets you select the type of hospital room that you want.

If you have a whole-life insurance policy and have had it for a long while, whatever you do, don't get rid of it or replace it with another one. Hold on to the old policy because you don't want to lose the investment that you have already made into past premiums. The better option is to keep the old policy without making any changes and purchase a new whole-life policy instead.

Life insurance policies aren't just for the elderly. If you are young and concerned about what might happen should something happen to you it doesn't hurt to look into it. Actually, being younger, usually life insurance companies offer you the lowest rates because they face a lower level of risk in insuring you.

Buy the right term for your term life insurance. Your agent might suggest that you buy a 10-year term policy, even if you need 20 years of coverage, so your rates will be cheaper. They suggest that you just sign up for a new 10-year policy upon expiration of the original policy. what they don't tell you is that the rates will be higher because you are older; you might have contracted an illness or disease in those ten years and can't pass the medical exam which you have to re-take, and the agent will get a new commission. Just buy the 20-year term insurance up front, if that is the amount of coverage you need.

Find out how to pay less for more when it comes to life insurance. Many companies give their customers a price break if they choose a certain amount of coverage. For example, you may pay less money for a policy that is worth $25,000 more than the one you were originally looking at.

As you can see, there are many things to consider when you are shopping for life insurance. Don't just jump in and purchase from the first company you pick out of the phone book. Learn more about this subject and you can make an educated decision for the good of your family.

|

|

Basic Overview On How To Get Good Automobile Insurance Policy |

Article writer-Ellis Espinoza

In this day and age, there is not enough information that you can get in regard to auto insurance. https://www.morningstar.in/posts/51215/health-insurance-8-pointers-keep-mind.aspx might not only need help making your own new decisions, but you may also need to solidify what you already know. This article should help you due to the clear and concise manner that information is provided.

How to Prepare for Life's Big Financial 'What-Ifs'

How to Prepare for Life's Big Financial 'What-Ifs' I knew financially we were not in a good spot. There was a growing pile of things I didn’t know or had done only half way. And I thought if that was happening to our family and we had two incomes and my husband and I were both college educated, with careers in creative, tech fields… if we were screwed, it felt to me that everybody else was way more screwed than we were.

You should make every effort at keeping your drivers license clean. The number one cause of high premiums is a bad driving record. There are times when you can't avoid the accident or ticket, so you should check out traffic school to see if this will help clean your record and make your insurance premiums lower.

You should merge all of the insurance policies you have on your vehicles into a single policy. Doing this can save you up to 10 percent on your premiums. It also amalgamates all your bills and paperwork into a single policy. This will make the situation much easier if you ever need to file a claim as you'll only be using a single insurer and a single policy number.

If you do not drive that many miles each year, look into the low-mileage insurance for your car. If you put less than 12,000 miles on your car each year and do not have the low-mileage insurance, you may be losing out on a good bit of extra money each month.

If you are a new driver, the cost of driving lessons could pay off in insurance savings. Many insurance companies offer discounts to drivers who have taken a driver training course from an accredited company. The cost of the lessons often are less than the savings you will receive by taking them.

Add your spouse to your insurance policy. Insurance companies are notorious for wanting stable and responsible customers. Adding your spouse to your policy signifies that you have become more stable and reliable, and many companies will lower your rates just for that reason. If your spouse has a clean driving record, that can help lower your rates as well.

A great tip for saving money on automobile insurance is to shop for, and purchase your policy online. It is common for insurers to provide discounts for internet customers, because it is less expensive for them to process an application received through their own website than it would be if purchasers were to consult with a live employee. In this way, it is possible for consumers to realize savings of between 5-10%.

Look for an insurance that offers an accident forgiveness option. If you get into an accident, your premium will not go up. Accident forgiveness works in certain situations: make sure you qualify for it before requesting it. Usually, you can get accident forgiveness if you have a good driving record.

If you live in a city, own a car and you are getting car insurance, it may be wise to think about moving to the suburbs. By making this move, you could be saving thousands each year on your car insurance, as it is always more costly in the city.

Even if you may get insurance through a different provider, do not end the policy you current have until you have committed to that other company. Avoid being uninsured for any period of time, since an accident can happen anytime.

Buy your insurance through the internet. Sometimes companies offer lower rates if you sign up for their service online, and some companies have deals available online only. This is because the service is automated and you don't have to deal with an agent. You may see rates reduced up to 10% or more.

You can save money on car insurance if your car is an older car, a sedate car (like a 4-door-sedan or hatchback) or has lots of miles on it. When this is the case, you can simply buy liability insurance to satisfy the requirements of your state and not bother with comprehensive insurance.

When dealing with an auto insurance claim, always keep all of the information related to the claim with you at all times, in a pocket or a purse. Claim settlements are often slowed down by the client not having information handy with the insurance company contacts them, meaning they'll have to wait until that evening to get things moving.

A great way to lower your auto insurance rates is to install a car alarm, a tracker or an immobilizer. The chance of theft can greatly increase your insurance policy. Alternately, a secure car is far cheaper to insure.

If you want to get good rates on your auto insurance one of the things that you should not do is to inflate the value of your automobile. Adding extra worth to your car will only make your insurance rate go higher. Cars in the high price range automatically have expensive insurance rates associated to them.

You should be talking to your insurance agents before you even decide on a car. This is because the insurance should influence which models of car you are looking at. Some cars have a surcharge that will increase your policy price, but others come with discounts. See which options come with a discount and then consider if these cars would suit you.

https://economictimes.indiatimes.com/wealth/insure...y-now/articleshow/65656914.cms should take your driving record into account when trying to figure out how much coverage you need to get. If you are known to be that unlucky one to get into fender benders or if you drive a lot for work, it might be a good idea to get as much coverage that you can afford.

One of the things that you can do in order to get cheaper auto insurance rates is to increase your voluntary excess. This extra is the amount of money that you will compensate in the event of a claim. By increasing this your insurance provider will then decrease your monthly premium.

Never drive without car insurance! If you happen to be involved in an accident, insurance can help to protect your assets. The tips in this article should be used to help you find the auto insurance policy that best suits your needs.

|

|

Selecting The Most Effective Life Insurance Policy Policy |

Article by-Mohamad Martinussen

If you have a spouse and children and are the main income earner of the family, you do not want to leave them in a position of hardship should anything happen to you. Yet without considering the purchase of a life insurance policy, this is a situation that could become a reality. Here are some things you need to know.

If you are considering purchasing life insurance you may want to look into possible coverage that is already offered by your employer. It's common for employers to offer basic life insurance plans at good rates for their employees. You should make sure that the coverage is adaquate for your needs and purchase supplemental policies if additional coverage is desired.

When you are planning on purchasing a life insurance policy, select an independent broker. Independent brokers can generally offer more selection in terms of policy and cost than a broker who works exclusively for a specific insurance company. Company brokers are limited to the products their company sells, and may also be pushed by the company to recommend a particular product.

If you would prefer a permanent life insurance policy but can only afford term insurance, buy a convertible policy. At any point during your term policy, you can choose to convert to permanent life insurance. This helps keep rates lower when you are younger, and as you advance in your career your budget might have more room for permanent coverage. You will not have to take any medical exam to convert, which is important if you have developed any health conditions.

A basic life insurance policy is a good investment to make for a newborn child. Insurance is relatively cheap for infants and costs little to maintain while the children grow up. By the time the child becomes an adult a well-selected policy that has been carefully maintained by his or her parents will be a significant financial asset.

When choosing a life insurance policy, look into the quality of the company you choose. The company that holds your policy should be able to stand behind it. It is good to know if the company that holds your policy will stay around to service the policy if need be and eventually be around to pay the benefits of the death.

Be careful that you read the fine print on any insurance policy. link webpage of policies containing clauses that state the insurance company can raise your rates for anything from a minor discrepancy to no reason whatsoever. They've been doing this for years, so make sure you don't fall victim to it.

When buying term life insurance, make sure the duration of your policy matches the amount of time you need it. For example, buy term insurance that stays in force long enough until the kids become independent and also, that the remaining spouse has coverage until he or she, becomes eligible for retirement income.

When buying https://timesofindia.indiatimes.com/business/india...r-you/articleshow/69095499.cms , make sure the duration of your policy matches the amount of time you need it. For example, buy term insurance that stays in force long enough until the kids become independent and also, that the remaining spouse has coverage until he or she, becomes eligible for retirement income.

If you do not have any major health problems, do not go with guaranteed issue policies. Getting a medical exam will save you money, and the guaranteed issue policies do not need that, and has higher premiums. You don't need to spend more on life insurance than is really needed.

To make your premiums as low as possible you should purchase life insurance immediately when it is needed. The reason is because life insurance is cheaper when you are young and healthy. As a result, if you wait to purchase life insurance when you are older and in worse health, your premiums will be higher.

Getting life insurance is not just for rich people. In fact, it is probably more important for those with low to medium incomes than for those in higher tax brackets. Final expenses and living costs won't go away with the death of a family member. You need coverage to make sure these costs are covered.

Never wait until you actually need the coverage. This could lead to desperation and will certainly result in higher premiums and less of a package. And if you've already encountered a health issue, you might not even be able to get a good policy.

Life Insurance Tips For Newlyweds

Life Insurance Tips For Newlyweds When you first get married, there’s so much excitement and so many things to think about that life insurance doesn’t often cross your mind. Let’s be honest; going on honeymoon, thanking all your guests for attending the wedding, and planning your new life together is way more exciting than doing financial admin. But life insurance is an important part of protecting your future as a married couple. To make it less overwhelming, here are the top things that you really need to know about life insurance for newlyweds.

To maximize your savings, be sure to buy your life insurance from a company whose finances are solid. Insurance companies are rated by independent agencies. Look for a company with the highest rating possible.

To insure that you choose the best life insurance policy, stay away from advisers who claim to be more knowledgeable about insurance companies than rating companies or who dismiss ratings as inaccurate or trivial. To file a complaint about such an agent, contact your local state insurance department or attorney general's office.

Buying mortgage life insurance is a good way to provide protection for your loved ones. Mortgage life insurance can give you peace of mind knowing that your family will be able to live in their home if something happened to you. This type of life insurance will pay your mortgage if you die before it is fully paid off.

If your current term insurance is going to expire soon, be proactive. Term life is the most economical but make sure you are in good health before selecting this type of policy again. However, if you are in ill health, if would be better to switch to a permanent policy. This allows you to bypass a second medical exam. Over time, it may ultimately be more affordable to convert to a permanent policy.

In conclusion, the more you learn about a topic, the better your results will be in the end. As with weight loss, it's not as challenging as some think if you apply everything you learn about it. With all the tips discussed in the article, losing weight will be much easier and more successful.

|

|

Vehicle Insurance Explained In An Easy-To-Understand Layout |

Article created by-Stout Michael

If you plan to drive a car, you must have insurance. However, that doesn't mean you need to take the first policy that you see. Prices and plans vary greatly between providers, and it usually pays to shop around. If you educate yourself about the different options, you may save some money on your policy.

To make sure that your car insurance is correctly covering you, sit down with your agent before making purchases of things that personalize your car. A set of rims might set you back $1,000 but if they only add $30 of value to the car according to the appraiser, you will lose the difference in the event that the vehicle gets stolen.

If you can decrease your annual mileage, you can expect a decrease in cost for your automobile policy. Insurance companies normally estimate that you will drive around 12,000 miles per year. If you can lower this number, or are someone who does not drive that far that often, you may see a reduction. Be sure that you are honest about your miles since the insurance company may want proof.

You can reduce the cost of car insurance by making sure you don't buy coverage that you really don't need. For instance, if you have an older car with a relatively low replacement value then you may not need comprehensive or collision coverage. Eliminating https://www.cnbctv18.com/personal-finance/heres-ho...fe-insurance-needs-1174581.htm from your policy could lower your premiums considerably.

If your automobile is older and has a low book value, you can save money on your insurance by dropping the comprehensive and collision coverage options. If you are ever involved in an accident with an older car of little value, the insurer is not going to fix it. They will label it totaled. So there is no reason to pay for this type of coverage.

India’s best health insurance plans to choose from

India’s best health insurance plans to choose from With the launch of National Health Insurance Protection Scheme, also known as Ayushman Bharat, next month, nearly 40% of the bottom rung of the Indian population will have a standard health insurance plan. This policy will stand out as it will have minimum exclusions, things that insurers do not pay for, unlike retail health insurance products that come with a lot of caveats.

If you have a shiny new car, you won't want to drive around with the evidence of a fender bender. So your auto insurance on a new car should include collision insurance as well. That way, your car will stay looking good longer. However, do you really care about that fender bender if you're driving an old beater? Since states only require liability insurance, and since collision is expensive, once your car gets to the "I don't care that much how it looks, just how it drives" stage, drop the collision and your auto insurance payment will go down dramatically.

Your teenage driver may be eligible for a number of discounts that could make auto insurance more affordable, so be sure to ask. Some companies will give a discount to good students with a GPA above 3.. Your teen's premiums may also gradually decrease as they accumulate a safe driving record. Defensive driving courses and a car with plenty of safety features can also get you a cheaper policy.

To find a cheaper car insurance you should shop around and look for the lowest price available to insure your vehicle. Get quotes online, call different agencies or call the company directly to find the best rates possible. You should also be sure to check a company's reputation to make sure the company you choose is a good one.

If you are serious about saving money on automobile insurance, think about downsizing the number of vehicles you use. If your family can get by on only one car, you will save a substantial amount of money. Not only will you pay less for your insurance policy, but you'll also see savings in your monthly car maintenance bills.

If you're planning on buying a new car, choosing one that is less desirable to thieves will lower your insurance rate. Online, you can find lists of the cars reported stolen most often and it's likely that they are the same lists that your insurance company uses to calculate your premium. Use this information as part of your research into which car you should buy.

You should evaluate exactly how much coverage you will need. Not everybody really needs full coverage, so why should you have to pay for more then you need. For example, if you have an older car, it might not be worth it to have your car covered. It could save you quite a bid of money, but know that if your car gets totaled, you will not get compensated for it.

A clever way to check a prospective auto insurer for reliability is to contact local car mechanics and ask them what insurers they do and do not recommend. Car repair shops have a unique perspective on insurers, as they see a lot of claims dealt with from all insurers and know which companies often cause problems.

Shop for auto insurance yearly. Even if you have no intention of changing policies, or providers, take the time to compare your rate. https://www.kqed.org/news/11698852/6-things-to-kno...ornia-open-enrollment-for-2019 can often find savings within the insurance organization you already use, but you will not know to ask without good backup information. Question big rate disparities.

Consider paying your entire premium up front. Many insurance companies charge you a service fee for breaking the policy amount up into monthly payments. A great way to avoid this fee is to start saving now, and when your policy is ready to be renewed, pay it off for the entire year.