Usage These Tips And Also Make The Right Choices Regarding Insurance Policy |

Content written by-Forrest Amstrup

No doubt, there is a lot of advice about insurance available. You may have heard others discussing the subject. Well, here are some handy suggestions to help you make some decisions regarding insurance, read on:

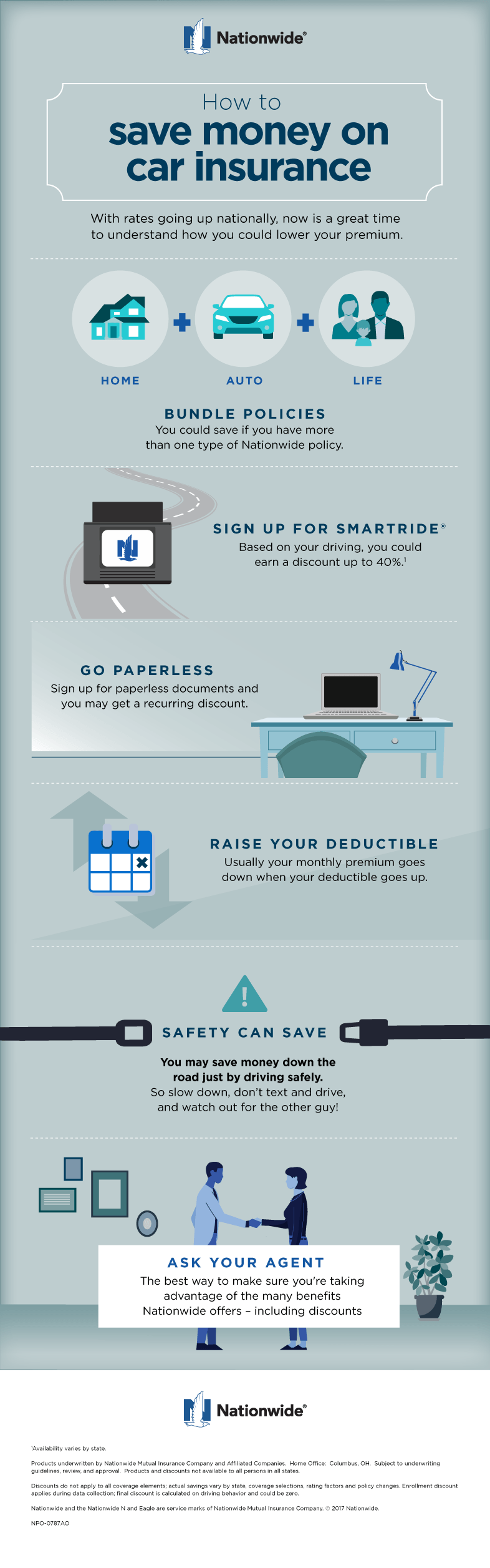

Save money on your insurance premiums by raising your deductible. You can save $100 or more on your auto insurance premium by raising your deductible from $250 to $500. Likewise, if you increase your homeowner's deductible from $500 to $1,000, you could save even more. Even increasing your health insurance deductible helps you save money on premiums.

Look at the pluses and minuses of different ways of the different methods of buying insurance and decide what works for you. You can buy insurance through a direct agent, direct through the company, or through a financial planner. They all have their own reasons for choosing them, make the choice that works best for you.

To make sure https://docs.google.com/document/d/1wXZi2tPhPPpA0RQspjkSUBoZorooPZNw6GgUt8CAbTE/edit is providing the coverage that you are paying for make sure that you talk to your agent when you make any large purchase. Most policies have limits for any single item. If you buy a new ring that is worth $5,000 you may need to add an endorsement to cover it fully.

Boat insurance is a must for all motorists. This will ensure that if your boat is damaged due to certain types of incidents, you are covered for the costs to repair or replace it. This insurance coverage can also cover injury to people that might be involved, as well.

Your insurance rates are likely set by zip code. If you live near a big city, the closer your zip code to the actual city center, the higher your rates will be. Consider this when looking for a new place to live. Just one zip code away could seriously lower your payment.

Look for a pet insurance company that does not have a "maximum lifetime benefit" clause. These clauses basically mean that they will only pay a certain amount for a policy item throughout the life of your pet. Once you hit that limit, the rest of the costs are up to you.

To be absolutely certain that an individual is getting the optimum deal on their insurance coverage, they have to research rates and comparison shop. Being educated about the different companies can help you receive the best plan. Arm one's self with as much knowledge as possible so that one can make an intelligent decision when one is ready to purchase insurance.

Avoid making monthly payments and instead pay your premium on an annual basis to save up to 60 dollars a year. Most companies charge between 3 to 5 dollars a month if you are paying every month. Put your money aside, and make the payment once a year or every six months instead of paying the extra fee.

If you have not filed an insurance claim for years, check with your agent to see if you could be eligible for a discount. After a few years without filing a claim, an insurance company wants to keep you around. Use the advantage you have to negotiate for a better rate.

Often, you will wish to consult other customer reviews of certain insurance companies before investing your money in their policies. By consulting websites like Angie's list and other such user comments, you can gain a sense of the current public opinion toward an insurance company. If most of the company's patrons are satisfied, that may help you form a decision, and vice-versa.

The best way to keep your insurance premiums low is to never file a claim for a small item. When you are considering filing a claim, take into account the amount your premium is likely to go up and how much extra that will cost you. Next, compare that to just click the following page claiming, and if the claim amount is lower you should pay for it yourself. This could save you hundreds of dollars in the long-term.

Use a personal insurance agent. They may be able to help you find the right kind of coverage for you and your family. They will know the guidelines and restrictions of different policies and will be able to get the one that will cost you as much as you like and give you the coverage that you need.

When shopping for coverage, make sure to get quotes from multiple insurers and for different plans within a particular company. The prices of insurance plans vary wildly and you could be missing out on saving hundreds of dollars a year by not shopping around. Consider working with an insurance broker, who can help you understand your various options.

Before you choose to buy any policy, it is important to research and find out if any other company offers a better rate or service than the company you are considering. Searching online can provide you with a wealth of information about various insurance companies. The JD Power website offers customer satisfaction ratings on many well-known insurance companies. If you want to check to see if there is a record of a complaint that has been filed against an organization, check the NAIC website. You can also find out how well-established a company is by visiting ambest.com.

Don't just go with the first car insurance quote you hear. Of course, every insurance company is going to present its deal as if it were the best. It is important that you make an aggressive comparison to decide which one is the best for you and your situation. Compare policy benefits limits, ranges of coverage, premium quotes and deductibles to determine which car insurance policy will suit you best.

Go to a local agency for purchasing insurance. This way, you can talk face-to-face with someone. You can often get a much better deal by working with the agent in person, as their main aim is to please you. They also know that you may show up any time you have questions or concerns. Getting insurance from a local agency can be a tad bit more expensive, but it is well worth it if you can get the one-on-one interaction you need.

When purchasing insurance of any type it is always important to obtain at least three quotes and do a line by line comparison of what you are getting for your money. You must compare deductibles, coverage for various categories, and the rating for the insurance company. How quickly do they settle claims? Doing some research up front will save you time and money in the long run.

You should now see why getting an insurance policy is very popular and very important. There is a ton of information on how to start looking for a policy that works with you and for you. By following these tips, you are well on your way to getting that perfect policy.

|

|

Fantastic Tips To Make The Most Effective Insurance Coverage Choice |

Written by-Alston Kragh

There have been so many changes to all types of insurance throughout the years that people these days just don't know for sure what they are shopping for anymore. If you feel like this, you aren't alone, and you don't have to be alone. You can get a great deal of information right online to help you understand just what you are shopping for, and these insurance tips will get you started.

When you are getting an insurance quote make sure to tell them anything and everything that may qualify you for a discount. For instance, high school might have been ten years ago, but you were an honor student and that qualifies you for a discount. Another thing that qualified me for a discount was that I work in the medical field, so be sure to tell them where you work. We all love saving money, so be sure to ask about all possible discounts.

When purchasing insurance, make sure you buy it over the internet. Most insurance companies offer discounts for those who purchase their coverage over the internet rather than in person or over the phone. Some offer discounts between 5-15%. It may not seem like a lot at first, but it adds up over time.

Don't try to inflate the value of your car or truck. All this accomplishes is raising your premium. In https://www.facebook.com/jfpublicadjusters/ that your car is written off or stolen, the insurance company is only going to pay the market value of your car at the time of the incident.

If you are aging and worry about your income, you should purchase a disability income insurance. If you become unable to work, your insurance will give you enough money to support yourself and your family. This kind of insurance is relatively cheap and secures your financial future no matter what happens.

One of the best ways to save money on insurance is by maintaining a good credit score. Most insurance companies these days take into account the customer's credit score as part of the calculation done for insurance rates. With that said, maintaining a good credit score could help save money.

In order to get good rates on insurance and the best way to save money, is to shop around for different rates. Different companies use different kinds of formulas in calculating insurance rates and therefore, will have different rates depending on the individual's specifications. By shopping around, lots of money can be saved.

Make sure that your pet care insurance policy includes preventative care packages, as well. Paying for things like flea, tick, and heartworm prevention medications can get very expensive. Be positive you have a policy where preventative care is included for your pets, to save yourself both the extra time and money.

Insurance for businesses can be expensive if you don't have the right kind of precautions in place. Having alarm systems, video surveillance systems and security personnel can keep you from paying through the nose for your premiums. These may be somewhat expensive as an upfront cost, but overall they will pay for themselves in insurance cost savings.

In some instances, a part a good financial strategy is selecting the correct insurance plan. If, for example, you pick a policy that has a high deductible, you will pay less each month, but if something does happen you will pay the high deductible out of pocket at that time. ny public adjuster to this it is important to weigh out how each scenario would affect you financially and choose your insurance policy accordingly. Sometimes it is better to pay a little more each month to know you will not have to pay a higher deductible if something does happen.

Insurance on an individuals boat or other water craft can make all the difference when an accident happens or something unexpected comes up. The insurance will cover any injury related costs, damage to property, and even damage to the water craft. Insurance is a must have item for any water craft one may have.

Ask your insurance agent for a list of the discounts they offer, and check each one to see if you qualify. If you do not use an agent, check with the website you use and find it there. Spending a little extra time on the search can help you save a lot of money.

Insurance on an individuals boat or other water craft can make all the difference when an accident happens or something unexpected comes up. The insurance will cover any injury related costs, damage to property, and even damage to the water craft. Insurance is a must have item for any water craft one may have.

Having a cell phone, especially a high-tech modern cell phone, is more and more common. So is the risk of having that cell phone robbed, lost or broken. Purchasing the insurance for your cell phone up front, is advised to halt the risk of headaches later, if anything happens to your cell phone.

The best time to switch insurance providers is when your policy is up for renewal. Canceling a policy at the end of it's term means you won't have to pay a cancellation fee, which saves you money. You also can let your current insurer know that you plan on canceling and moving to another insurance company and they may offer you a discount to match the new company's offer, or even better it.

In order to maximize your savings, check into the possibly of getting all of your insurance needs bundled into one multi-policy. For example, if you need homeowner's insurance and auto insurance coverage, you can typically find insurance companies which offer both. By combining all of your insurance policies through one company, you have the potential to obtain considerable savings.

Before you commit to buying property and moving, learn about the insurance prices in that area. It's important to note that automobile insurance premiums are higher in areas where there are more accidents and thefts. If you find that very high premiums are quoted for a particular area, think about moving to a different neighborhood in order to reduce your costs.

If a new insurance policy was a recent purchase of yours, be certain that the insurer sends you a paper policy copy in the mail. When you receive the hard copy, you have confirmation that your premium payment was forwarded over to the provider by your agent.

By applying these tips, you could save money on your monthly premiums and deductibles. Remember to do your research and to compare prices before you choose a policy. A customer who knows what insurance is about will choose a better insurance plan and pay a fair price. These tips should help you choose wisely.

|

|

Fantastic Suggestions On How To Find The Insurance Coverage You Required. |

Content author-Mcclain Amstrup

Insurance... We all have it. We all need it. So how do we get the most out of our money? There is a lot to know and a lot to avoid when it comes to any kind of insurance. Take the advice laid out here to understand what you can do to cash in on savings, and make your insurance policies the most beneficial they can be.

If you own a small business, you must have the proper liability insurance coverage for your business. This is because you must always be in a situation where, if you are sued, you have the coverage you need to pay for your company's legal defense. You will also need to be covered so that the plaintiff's legal fees can be paid, in the event you do not win the case. If you do not have proper liability insurance, you can go out of business very quickly just trying to pay your legal fees.

Consolidating all of your insurance policies under one roof can help you save a bundle on your premiums. Insurance companies commonly give big discounts to people who have multiple policies. Talk to your insurance company and ask for a quote on other forms of insurance to see how much money you could save.

Before you choose an insurance policy, be sure to shop around so you know what your options are. There are many online services which can give you quotes from a number of different insurance companies, or you can hire a private insurance broker who can give you options and help you decide which is right for you.

When filing an insurance claim, be sure to write down the claim number as soon as your are given it and keep it in a safe place. This is helpful because you will need this number at any point that you speak with the insurance company about the claim. You may find it helpful to copy this in multiple locations such as on your computer and phone.

Insurance is not only for peace of mind, but it can help you recoup costs if damage occurs to your property or person. There is insurance for most things today, from jewelry to homes. If you owe money on certain types of possessions, such as houses and cars, you may be required to have insurance on them.

If you are a small business owner, you must make sure that you have all of your insurance needs covered, to protect you and your business. One thing that you should have is E&O insurance, which is better known as Errors and Omissions business coverage. This insurance protects your business from customer lawsuits.

Although you can lower premiums by taking a higher deductible, you should be aware of the costs. Although your monthly premiums will be lower, you will have to pay for any small incidents on your own. Remember to consider these small expenses when deciding the best choice for yourself.

If you're having trouble generating interest in your product, do a quality check. Is your Web site, e-book or blog content interesting? Does it provide solutions to real problems? Is the content up to date and relevant right now? Is your content's writing style worth reading? If you're pumping a lot of energy into marketing but aren't getting very much interest in your product, you may need to improve the product itself.

Look out for multi-insurance policy discounts. Sometimes just click the following internet site will offer customers a discount of 10% or more if they take out several contracts at the same time, for example home insurance, auto insurance and health insurance. So, when asking for insurance quotes from various insurance companies, be sure to ask them if they offer any discounts for taking out multiple policies.

When purchasing an insurance policy of any kind, do try to pay the premium on an annual basis. While the smaller monthly payment option may be easier to budget for, many insurance companies charge an additional fee for this convenience and add it to your premium. This fee can add an additional 10 to 15% to your annual cost.

Thoroughly read your insurance policy, and do so several times. Many people do not bother reading their policies at all before they sign them, and later find out that they are overpaying, or that their policy was actually inadequate concerning important coverage details. Paying special attention to detail when reading through, can help prevent this.

Check with your provider to make sure that you are benefiting from all of the discounts that are available for renter's insurance. You can get a discount for living in a gated community and many other things that may have not been considered when you opened your policy that could be saving you money.

Check with your agent about every six months to learn about any discounts that you may be eligible for. You can save ten to twenty percent with these discounts. It may not sound like a lot, but by the end of the year it could add up to some serious cash in your pocket.

If you are in the market for certain types of insurance it would be very helpful if you made an effort to clean up your credit report before that time. Some insurance companies will view your credit report and deny you coverage or force you to pay for more expensive coverage.

Whatever type of insurance you need, it is best to shop around before choosing a company. Some people use the same car or homeowners insurance carrier their parents use just because it's more convenient. Most of the big insurers want to retain customers for a long period of time and will offer discounts for using them for all your insurance needs.

Regardless of the type of insurance that you are looking to purchase, going to an insurance broker is a great idea. For every kind of insurance, there are many vendors and firms, and they all have several products to choose from. An insurance broker will be able to analyze your specific needs and provide you with a list of recommendations. Most brokers also have access to special discounts that may not be available to you, directly.

Some types of coverage require pre-approval before submitting a claim. If you receive pre-approval for a claim, be sure to document the name or contact information of the person providing the approval. This helps if you later experience any problems having the claim paid or approved. Most companies record policy notes when customers call, but having a specific name to contact can make the claim process simpler.

When purchasing insurance of any type it is always important to obtain at least three quotes and do a line by line comparison of what you are getting for your money. You must compare deductibles, coverage for various categories, and the rating for the insurance company. How quickly do they settle claims? Doing some research up front will save you time and money in the long run.

https://medium.com/@jfpublicadjusters was stated at the beginning of the article that insurance can be an important investment. It is so very true but it is a lesson that some people learn the hard way by not having it when they need it most. This article can help you to decide what insurance you need to secure your future.

|

|

Time Conserving Insurance Policy Guidance For Virtually Everybody |

Written by- https://s3.ca-central-1.amazonaws.com/financial-ad...berta-22/infinite-banking.html

Whether you are new to the insurance world, wanting to combine your policies, or shopping for better rates or coverage, you probably have some questions. Here you will find lots of helpful information that will make it fast and easy to learn more about the often confusing world of insurance.

When selecting a company that sells travel insurance, always go with a third-party company. While many airlines and cruises sell travel insurance, it is most likely designed to protect the company offering the trip, not the consumer. Travel insurance is a great investment, but only if it works for you.

If you own a small business, make sure you have the right insurance. An insurance should cover any damages that your employees might accidentally cause to your customers, as well as the value of the building and inventory. A small business insurance can be quite expensive, but is absolutely necessary.

To find the right insurance policy, you need to be aware of what the provider is selling you. Insurance is no easy world to comprehend, but when things become too confusing, you should seek help from the company. If you do not think the company is being truthful, ask a person you know to help you.

When filing an insurance claim for your business, you should always keep track of the time you spend and any expenses you incur in the process of preparing the claim. Most business insurance policies specifically cover claim preparation costs, so don't be afraid to ask for the money you're entitled to.

To make sure your insurance claim gets processed quickly and correctly, you should make note of who your adjuster is at the company. Many companies will hire an independent adjuster to make the visit to determine how accurate the damages reported are, but the adjuster who actually works for your company, is the one who makes the final determination of your case.

If you find your insurance too expensive, look for a cheaper one. Make sure you know how much your current insurance will charge you for canceling your policy. It might be more interesting to wait until you have to renew your insurance to switch so that you do not pay a ridiculously high cancellation fee.

Shop around, do your homework, and get the best rates on your premiums. Knowledge about different insurers and policy information gives people the power to choose only the coverage they really need and keep their insurance prices as low as possible. The more one knows about insurance the better off they will be when it comes time to get an insurance plan.

When you decide to go shopping for a new insurance policy, make sure you're comparing identical coverage packages. https://www.healthinsurance.org/obamacare/how-immigrants-are-getting-health-coverage/ may find a low rate offered by an insurance company, but you have to ask them what kind of coverage you will be getting and what your deductible will be to ensure it is actually saving money while getting the same coverage you currently have. Being under-insured is just as bad as paying too much for your insurance!

When renewing pet insurance, you should look over the forms carefully. You may be shocked to find that a condition diagnosed in the previous year is listed as a pre-existing medical condition upon renewal with some pet insurers. You should steer clear of the shady insurance companies who practice this sort of business.

Consider buying a renter's insurance policy after renting your new place. This policy doesn't cover the structure of the home, but pays for your belongings. Take pictures of your furniture, books, jewelry, CD and DVD collection, TV and electronics, so you can prove to the insurance company that you owned them.

When selecting your insurance coverage, be aware of your assets. People with more assets to protect, especially homeowners, should have more insurance coverage than people with fewer assets. This is because if you are underinsured for your auto, for example, and you get into a major accident that causes hundreds of thousands of dollars in damage, you could end up liable for those damages and lose your assets.

Do not try to cover up the fact that your injury or loss was self inflicted. If you lie and say that your bag was stolen out of your hand, when it was actually stolen because you left it on the table while you were dancing, will prevent your insurance company from covering your loss and you could face insurance fraud charges.

When shopping for car insurance, be sure to ask about discounts. You may be able to get lowered rates for insuring more than one car, for holding all of your insurance (car, health, home, dental) with one company, for taking a defensive driving course, and for many more specific conditions. Be sure your agent tells you about any condition that might save you money on car insurance.

Insurance is a big deal. Make sure that the companies you are dealing with are licensed and covered by your state's guaranty fund. This fund is what will pay for things if your company should ever go into default. Check with your state's insurance department in order to find out specific information about each company before you make any decisions about which company to purchase through.

Know when your insurance policy expires. This is important so you can renew the policy before the policy expires. There is no grace period at renewal time and if you have a lapse in coverage, you may find it costing more to get a new policy started or even more difficult to get one.

If you submit an insurance claim and it is denied, always take the time to appeal the denial. At times insurance carriers initially deny a claim and then later are willing to reconsider the claim. Unless the circumstances of your claim are specifically excluded on your policy, appealing a denial can be well worth the time and effort.

When looking for insurance, make it personal. Meet with insurance agents from different companies and see what they have to offer. A lot of the time they have special deals and incentives to get you to buy theirs because they want to make the sale. If you meet with them personally, you are more likely to get a deal that you might miss out on if you just deal with a company online or over the phone.

If you feel that you are paying too much for your renter's insurance premiums, you may want to check with your insurance company to find out if the place that you are renting is considered to be a high risk structure. The higher premiums may be due to the fact that the building that you are renting is high risk and the cost is being passed on to you.

Having insurance coverage is not an option for a lot of things in life. While we want to save money and be as frugal as possible, we also need to make sure that we are adequately covered in the event that we need to use it. Using the tips found here, you will be able to have good insurance coverage at a price you can live with.

|

|

Insurance Policy Does Not Have To Be Tough With These Easy Tips |

Written by-Olsson Valencia

You've worked hard to acquire the things you own, and now it's time to take the necessary steps to make sure you've adequately protected them. Read our smart tips about best practices for getting home, auto, health, life, and other types of insurance, and for understanding what your policy covers.

When find more info choose insurance for your car, qualify your insurer first. Besides evaluating coverage, it is also in your best interest to look for reviews on their customer service, claim responsiveness and even rate increases. Knowing who you are dealing with ahead of time can help you set expectations with your insurer.

When involved in an insurance claim, be sure to get as many quotes as possible on your own. This will ensure that you can stand your ground versus an insurance adjuster as well as ensure you are getting a fair quote. If there is a debate, be sure to calmly confront your adjuster and assume that they are not trying to cheat you.

Make sure you get insurance to cover work-related property when you have a telecommuting or independent contracting job. If you work from home, your rental or home owner's insurance policy does not cover work-related items such as computer equipment used for work so having a separate policy protects work-related property from theft or damage.

Check with your current insurance company for discounts before you consider switching insurers. You can even be upfront about the reason for your inquiry. If you have been a good customer you may be surprised what sort of deals your insurer may offer you. Good customers are valuable assets to insurance companies, and they will take steps to hang onto them.

In order to guarantee the best policy price, comparison shopping and research are critical. Having knowledge of the various insurance options available is the only real way anyone can know they are optimally covered or if they are paying the prevailing market rates. When one knows more about insurance, the better prepared they are when getting a plan.

Insurance is not only for peace of mind, but it can help you recoup costs if damage occurs to your property or person. There is insurance for most things today, from jewelry to homes. If you owe money on certain types of possessions, such as houses and cars, you may be required to have insurance on them.

Keep in mind what items could cause an increase in your renter's insurance. what is it worth will raise your premiums if you have certain breeds of dogs or if you own a waterbed. Don't make split decisions on purchasing certain items without checking to see if it will affect your coverage and your premiums.

Know your credit score before you go shopping for insurance. Your credit does influence the quotes you will receive when you are on the hunt for coverage. If you know you have a high credit score, use that information to your advantage to push for a lower premium, you'll usually get it.

If you have fire insurance and you are getting ready to file a claim, it is important to make sure you have all necessary information available. This way, you get proper coverage. On your claim, make sure to put the condition of the home, the date of the loss, the location of the damage, type of damage and loss, and related injuries.

Save on all of your insurance policies with multiple policy discounts. If you have separate home, life, car and health insurance policies, it may be worth checking with each of your companies for quotes on your other policy types. Many insurance companies will offer a discount if you carry multiple policies with them.

Improve your credit score before shopping for insurance. Many companies will charge a higher premium if you have bad credit. Bad credit is considered a risk and insurance premiums are all about managing risk. Improving your credit can end up saving you hundreds of dollars a year on your premiums.

When filing a claim be sure to be completely honest with the insurance agent even if the situation is embarrassing to you. Not being totally honest can lead the agent you speak with to invalidate your insurance policy altogether, or red flag the account and deny your entire insurance claim.

Always ask your insurer what you're covered for when your insurance policy is up for renewal. If you do not bother to check your coverage, your rates may increase. Even though it's more expensive, higher premiums are worth the full coverage.

Having a cell phone, especially a high-tech modern cell phone, is more and more common. So is the risk of having that cell phone robbed, lost or broken. Purchasing the insurance for your cell phone up front, is advised to halt the risk of headaches later, if anything happens to your cell phone.

Ensure that you receive fast payments in the event of insurance claims through the use of endorsements. Endorsements that prove the value of your most valuable property, such as expensive jewelry, pieces or artwork or state-of-the-art video equipment, are obtained and provided by you to your insurance company. In the event of a fire, flood or anything that results in your property being damaged, stolen or lost, you can receive payouts to cover the cost much quicker, when the specific items are endorsed.

Make sure that your pet insurance policy covers chronic diseases. Most pet insurance policies cover all the common diseases, however, many do not cover chronic diseases, such as cancer or diabetes. These chronic diseases often require you to purchase expensive medications on a monthly basis and if your pet insurance provider refuses to pay for the medications, you could get into debt very quickly.

If you want to save money, obtain insurance only as you have a need for it. Don't purchase insurance just because most people get it or because you are familiar with the company.

Before you commit to an insurance carrier, you may first wish to consult your state's insurance department. Many state departments keep a great deal of information about all carriers. Your state insurance department is a valuable resource to check on rates, coverage, or any complaints that are outstanding when you are deciding on which carrier to choose.

If you submit an insurance claim and it is denied, always take the time to appeal the denial. At times insurance carriers initially deny a claim and then later are willing to reconsider the claim. Unless the circumstances of your claim are specifically excluded on your policy, appealing a denial can be well worth the time and effort.

The information you learned should give you the confidence so that you will be able to go out and make the right choice for your insurance needs. Now you should better be able to understand coverage, find affordable rates, keep your family safe, and be prepared for any losses that may occur.

|

|

Solid Overview On Just How To Obtain Low-Cost Insurance Coverage |

Content written by-Lambertsen Cotton

You've been looking all day for good tips on insurance, but have found nothing of use so far. It can be frustrating with the amount of unverified information out there. Pay close attention to the tips provided in this article, and you should find plenty of good information to help you on your way to being an expert in the subject.

When selecting a company that sells travel insurance, always go with a third-party company. While many airlines and cruises sell travel insurance, it is most likely designed to protect the company offering the trip, not the consumer. Travel insurance is a great investment, but only if it works for you.

If you do not feel prepared to deal with insurance companies yourself, you should go see a local insurance agent that will help you compare prices and choose the best insurances possible. An insurance agent is not very costly and could save you money by selecting the right insurance for you.

If you own a small business, you must have the proper liability insurance coverage for your business. This is because you must always be in a situation where, if you are sued, you have the coverage you need to pay for your company's legal defense. You will also need to be covered so that the plaintiff's legal fees can be paid, in the event you do not win the case. If you do not have proper liability insurance, you can go out of business very quickly just trying to pay your legal fees.

If you are aging and worry about your income, you should purchase a disability income insurance. If https://s3.ca-central-1.amazonaws.com/financial-ad...berta-22/infinite-banking.html become unable to work, your insurance will give you enough money to support yourself and your family. This kind of insurance is relatively cheap and secures your financial future no matter what happens.

Insurance for pets is must have especially if you own many animals. It can help to cut down costs for sick and well animal visits, vaccinations, and treatments of multiple pets at one time. The costs of caring for pets can be just as expensive as people. This is why insurance is a good idea.

Often, you will wish to consult other customer reviews of certain insurance companies before investing your money in their policies. By consulting websites like Angie's list and other such user comments, you can gain a sense of the current public opinion toward an insurance company. If most of the company's patrons are satisfied, that may help you form a decision, and vice-versa.

Even if your insurance company covers it, refrain from filing claims. This could raise your premiums which will cost you more over time. It is not uncommon for an insurance company to provide discounts for not making any claims for specific periods of time. Your full coverage will still be there if you ever have a major accident.

If you want to save a large amount on your insurance, you should increase your deductibles. If you don't plan on filing any claims in the future, then you'll never have to pay the deductible to process a claim. In https://www.programmableweb.com/news/13-notable-insurance-apis/brief/2019/03/25 , you'll be saving as much as 15% to 30% on your premiums.

Do not settle for a pet insurance company with delayed coverage. When you purchase the insurance, you should be able to hang up the phone knowing that your furry loved one is covered should anything go wrong. Immediate coverage should not cost anything extra. If it does, the company you are dealing with may be disreputable.

Compare multiple insurance options before buying to do it right. The power of the internet makes insurance comparison quick and painless, where it once was laborious and frustrating. Bear in mind, the false sense of accuracy that quick internet research gives you, though. Inspect competing quotes carefully, to make sure you are actually comparing equivalent policies.

If you know you will be changing or updating your plan for any reason, do your research with other companies first. You can search for the new add-ons you will be placing on your policy, and find out how much they would be for others. You can save a lot of effort and money.

Talk to people you trust about their experiences with various insurance companies. Many time you will find out whether an insurance company is good or bad by asking about others' experiences.

Don't just go with the first car insurance quote you hear. Of course, every insurance company is going to present its deal as if it were the best. It is important that you make an aggressive comparison to decide which one is the best for you and your situation. Compare policy benefits limits, ranges of coverage, premium quotes and deductibles to determine which car insurance policy will suit you best.

When any insurance policy has been purchased, take some time to sit down and read the fine print. Do not automatically assume that the policy is exactly as the seller presented it to you. There may be details in the terms and conditions that were not mentioned and discourage you from keeping the product. All policies have a short cancellation period after the date of purchase just in case it is needed.

Be aware that the premium quoted to you initially is subject to change as your policy goes through the underwriting and approval process. Most insurance company quotes are accurate, but there may be some differences in premiums once your prior claim history is pulled or your credit report is reviewed.

If you are switching insurance companies, keep your current policy in force until your new policy is issued. This can prevent you from experiencing a lapse in coverage if there is a delay with the new company. You don't want to be without coverage because sometimes, the new company's price is not that same as the quote you were given or your application is denied.

When looking for insurance, make it personal. Meet with insurance agents from different companies and see what they have to offer. A lot of the time they have special deals and incentives to get you to buy theirs because they want to make the sale. If you meet with them personally, you are more likely to get a deal that you might miss out on if you just deal with a company online or over the phone.

If you feel that you are paying too much for your renter's insurance premiums, you may want to check with your insurance company to find out if the place that you are renting is considered to be a high risk structure. The higher premiums may be due to the fact that the building that you are renting is high risk and the cost is being passed on to you.

As this article has shown you, you don't have to be a rocket scientist to be educated enough to research and buy an insurance policy. You just need to have a little bit of knowledge to make an informed decision. You can take this advice and feel much more at ease about you and your families insurance.

|

|

Know What You Required To Know To Make The Best Insurance Policy Decision |

Content create by-Zhu Kehoe

There have been so many changes to all types of insurance throughout the years that people these days just don't know for sure what they are shopping for anymore. If you feel like this, you aren't alone, and you don't have to be alone. You can get a great deal of information right online to help you understand just what you are shopping for, and these insurance tips will get you started.

Before the adjuster for your insurance claim shows at your location, be sure to find out what their name will be. This will assist in your security and the smoothness of your overall claim. It is possible that a fake adjuster may attempt to gain access to your house or property for their own bad intentions.

When you are filing a claim with an insurance company, ask for your claim number at the end of the original conversation with your agent. Write down and keep this number for reference. Any time you call for an update on your claim, you'll need this number, so it's better to have it on hand.

Seek out an insurance company that can take care of everything you need. It is more than likely when you combine health, home, life, and car insurance all into one plan with a company, you should get a great discount because of this. You can actually increase your rate for homeowners insurance when you move your insurance from your car to another company that doesn't own your home.

Before you choose an insurance policy, be sure to shop around so you know what your options are. There are Security which can give you quotes from a number of different insurance companies, or you can hire a private insurance broker who can give you options and help you decide which is right for you.

There may be a price to pay if you choose to raise your deductible in lieu of lower premiums. This will reduce your monthly bill, but you will have to pay something out of your pocket if something happens. Just keep the additional expenses in mind when you figure out the best plan for you.

Make sure you understand what is and is not included in your insurance policy. The world of insurance can be very confusing; do not hesitate to ask your insurance company for more details. If you feel that a provider is not being up-front with you about something, you can always ask another person for help.

Find a pet insurance company that allows you to submit claims in multiple ways. Some companies only allow you to fax in your claims, and if you are not near a fax machine, this will be troublesome. The best insurance companies will allow you to not only fax in your claim, but also have the vet call or email it for you.

Make sure your pet's insurance policy states that premiums will only increase with age. Shady pet insurance companies will attempt to increase your premiums with the amount of claims you submit, so you need to research the company and stay away from them. Age should be the only factor for premium increases, no matter the case.

Avoid making monthly payments and instead pay your premium on an annual basis to save up to 60 dollars a year. Most companies charge between 3 to 5 dollars a month if you are paying every month. Put your money aside, and make the payment once a year or every six months instead of paying the extra fee.

Dead bolt locks will save you some money on your renter's insurance premiums. If you already have a policy, check with your agent to be sure that you are getting the discount. If you do not have the lock on your apartment, check with your landlord to see if one could be installed.

A yearly review of their insurance policies is a habit everyone should practice. Make sure that all information on your policy is correct and update it with any changes. Make sure you are receiving credit for such things as automatic seat belts on your automobile policy and security monitoring on your home owners policy.

Insurance will save one's car, another driver's car, items in one's apartment, cover the bills for a sick pet, reimburse one for a trip that got cancelled because of bad weather, or pay medical bills.

You should know the different types of insurance available to you and whether you will need them or if they are required by the state you live in. For instance, most states require you have minimum coverages which vary in different states. Make sure you have the minimum coverage and no more unless you need it.

If you are unsure about whether you should file an insurance claim, do not call your insurance company and make that type of inquiry. Try to ask someone else that does not work for your insurance company because many companies add these calls to your file as incidents and they will try to use them to increase your premiums.

The price is not the only thing that matters when trying to get a good insurance provider. You want to work with a person and company that is easy to work with as well as being rather responsive, so be sure to ask around and see who has had a good experience with their company.

Regardless of the type of insurance that you are looking to purchase, going to an insurance broker is a great idea. For every kind of insurance, there are many vendors and firms, and they all have several products to choose from. An insurance broker will be able to analyze your specific needs and provide you with a list of recommendations. Most brokers also have access to special discounts that may not be available to you, directly.

If https://s3.ca-central-1.amazonaws.com/financial-ad...berta-22/infinite-banking.html is available to you, you should always purchase your insurance from a large insurance company. Small insurance companies frequently go out of business and rarely has the personnel or technology required to provide you with the best customer service. If a small insurance company goes out of business you may lose any prepaid expenses you deposited.

If you have fire insurance and you are getting ready to file a claim, it is important to make sure you have all necessary information available. This way, you get proper coverage. On your claim, make sure to put the condition of the home, the date of the loss, the location of the damage, type of damage and loss, and related injuries.

In the article above, you were given some suggestions that will hopefully help you make some decisions. There is some much information on insurance that is available. Apply the tip that fits your own circumstances. Make wise decisions regarding insurance.

|

|

Insurance Policy Insurance Coverage Made Simple: Getting One Of The Most From Your Insurance Plan |

Authored by-Ballard Goldman

Whether you are new to the insurance world, wanting to combine your policies, or shopping for better rates or coverage, you probably have some questions. Here you will find lots of helpful information that will make it fast and easy to learn more about the often confusing world of insurance.

When you choose insurance for your car, qualify your insurer first. Besides evaluating coverage, it is also in your best interest to look for reviews on their customer service, claim responsiveness and even rate increases. Knowing who you are dealing with ahead of time can help you set expectations with your insurer.

It may go without saying, but someone needs to put it out there. When it comes to insurance, just tell the truth! I heard a story about a guy who had his windshield shattered who did not report it to his insurance company for two weeks. In that two weeks he changed his policy to include zero deductible comprehensive so it wouldn't cost him anything to fix it. Lo and behold the insurance found out! Can you guess where he is now?

When dealing with an insurance claim, be sure to keep accurate logs of the time and money that you spent on preparing the information needed for your claim. You may be entitled to a reimbursement for time spent. It is possible that you may need to hire help, or it may also be possible that you lose work time when preparing the claim.

You've probably heard the phrase about 15 minutes can save you 15%, but you might find that by spending just a couple of minutes on the phone with your current insurance provider can also save you money. When https://s3.ca-central-1.amazonaws.com/financial-ad...berta-22/infinite-banking.html is nearing the expiration date, call your insurance provider and ask them for a re-quote on your policy. They will have the incentive to give you the most favorable pricing in order to retain your business. Since they already have all your information, it probably won't take 15 minutes and you can save time and money.

Whatever kind of insurance you are buying, remember it is little different than any other service you purchase. Comparison shopping will help you find the best insurance deal. Just remember that insurance policies come with different and idiosyncratic terms of service. A policy that looks cheap at first glance might prove to be a bad deal after careful examination.

Don't rule out using an insurance broker. An insurance broker can save you time by doing a lot of research then presenting you with the insurance policies best suited to your needs. They can also explain legal terms in insurance policies and they can often offer you great discounts on policies.

Having a higher deductible may give you a lower premium, but it can be costly down the road. Although your monthly premiums will be lower, you will have to pay for any small incidents on your own. You need to take these hypothetical expenses into account when you're crunching the numbers of any insurance policy.

Make sure your pet's insurance policy is clear and easy to read. You do not want to get lost in the lingo and find out you are paying extra for services you do not need. Ask for clarification if necessary, and don't allow yourself to be taken in by scam policies.

Look at the pluses and minuses of different ways of the different methods of buying insurance and decide what works for you. You can buy insurance through a direct agent, direct through the company, or through a financial planner. They all have their own reasons for choosing them, make the choice that works best for you.

Avoid making monthly payments and instead pay your premium on an annual basis to save up to 60 dollars a year. Most companies charge between 3 to 5 dollars a month if you are paying every month. Put https://www.vox.com/health-care/2020/1/29/21075388...ies-have-universal-health-care , and make the payment once a year or every six months instead of paying the extra fee.

If you are applying for car insurance and you are a student it would greatly help you if you have good grades in school. There are many auto insurance carriers that will provide discounts on premiums for students that have grades that are above a particular GPA, since it shows them that you are trustworthy.

If you want an easy way to get lower insurance rates and premiums, try requesting a high deductible. You can save several hundred dollars a year simply by requesting a plan with a higher deductible. Just make sure that you have the financial security to pay the deductible when you get into an accident.

The best time to switch insurance providers is when your policy is up for renewal. Canceling a policy at the end of it's term means you won't have to pay a cancellation fee, which saves you money. You also can let your current insurer know that you plan on canceling and moving to another insurance company and they may offer you a discount to match the new company's offer, or even better it.

Remember that the cheapest plan is not always the best plan. Make sure to understand exactly what you will be paying before signing on the dotted line. If you have a very low cost plan, check on what the deductible amounts are. It may be better for you to pay more per month than to have to pay thousands of dollars out of pocket before your insurance kicks in.

When you are trying to consider how much insurance to buy it is best to purchase as much as you can comfortably afford. This is a good idea because you would not like it if you end up having losses that exceed your coverage and the difference in the premium was just a few dollars more.

When you are trying to consider how much insurance to buy it is best to purchase as much as you can comfortably afford. This is a good idea because you would not like it if you end up having losses that exceed your coverage and the difference in the premium was just a few dollars more.

Go through any photographs you have. If you are filing an insurance claim, it could be time to break out your old snapshots. Look for any pictures that feature the thing that was damaged. Put these aside and be sure to keep them handy. Supply them to your insurance provider, if necessary.

In conclusion, we have provided you some of the most crucial aspects regarding insurance. We hope that you not only were able to learn something, but also will be able to apply it. Follow our advice and you will be one step closer to being an expert in this subject.

|

|

Purchasing Insurance Policy Made Easy: The Things You Required To Know |

Content written by-Stilling Cotton

Insurance and finance are two words that usually do not go together. When you find yourself in the market for insurance you will soon learn that your financial obligations are a large factor that will determine what type of insurance you need, what you can afford, and what you actually purchase.

If you are looking to save money on insurance, research into group rates in associations you may already be a part of. Organizations like AAA, AARP, and university alumni associations sometimes offer great insurance rates for their members. This can help you both save money and utilize the benefits of the organization that you are a part of.

The bigger the deductible, the lower your insurance costs will be. Just keep the amount of the deductible in a savings account in case of a claim. Many claims fall below the deductible amount, so neither you or the company has to bother with the claims process, saving everyone time and keeping the cost of the policy low.

You should consider purchasing renter's insurance for your apartment. You certainly own valuables and other personal possessions, which would need to be replaced at your own expense if anything should happen to them. In this event, you should take out a personal property policy, which will cover your possessions and valuables.

It is always cost-effective for you to shop around when searching for insurance. People get tend to get complacent and settle for sub-par insurance if it's what they're already used to, rather than investigating new companies. When you are purchasing a product that could differ in price by hundreds of dollars, it is definitely worth your time to shop around to get the best price.

If you own a small business, you must have the proper liability insurance coverage for your business. This is because you must always be in a situation where, if you are sued, you have the coverage you need to pay for your company's legal defense. You will also need to be covered so that the plaintiff's legal fees can be paid, in the event you do not win the case. If you do not have proper liability insurance, you can go out of business very quickly just trying to pay your legal fees.

When on the hunt for pet insurance, research companies thoroughly. Pet insurance companies have a very high fail rate, so you want to find a company that has been around for a while. The longer a company has been in business, the more stable you can trust it to be.

If you find your insurance too expensive, look for a cheaper one. Make sure you know how much your current insurance will charge you for canceling your policy. It might be more interesting to wait until you have to renew your insurance to switch so that you do not pay a ridiculously high cancellation fee.

If you're changing your current policy or starting a new one, check it for completeness of coverage. If you don't address holes in your insurance your rates might even go up. Having full insurance coverage is well worth the cost of the premiums.

Make sure not to fall behind on any monthly insurance premiums. Missing a payment or two can cause many insurance companies to cancel your policy in full. It would be a shame to allow that to happen and then something happens at that time and you are not covered.

Know your credit score before you go shopping for insurance. Family economics does influence the quotes you will receive when you are on the hunt for coverage. If you know you have a high credit score, use that information to your advantage to push for a lower premium, you'll usually get it.

In order to maximize your savings, check into the possibly of getting all of your insurance needs bundled into one multi-policy. For example, if you need homeowner's insurance and auto insurance coverage, you can typically find insurance companies which offer both. By combining https://s3.ca-central-1.amazonaws.com/financial-ad...berta-22/infinite-banking.html of your insurance policies through one company, you have the potential to obtain considerable savings.

A sure-fire way to save money on your insurance is to stay with your current insurance company. Having a track record with the company of paying your premiums on time and not filing many claims, will tell the company you are a safe bet to insure. In turn, they will keep your premiums low and give you special discounts for being a loyal customer.

Be sure to take your time when considering car insurance. There are many competitive companies to choose from and lots of different kinds of car insurance. Be sure to choose a company that has a good reputation and lots of good recommendations. Give yourself plenty of time to review all that they have to offer. In this way, you can be sure of making a wise choice.

Make sure all information provided during the insurance application process is correct. Providing incorrect information or deliberately withholding information could lead to your policy being declared void if you ever submit a substantial claim. No matter your prior claim history, it is better to provide full information and ensure you are covered than risk not having coverage when you need it.

Be aware that the premium quoted to you initially is subject to change as your policy goes through the underwriting and approval process. Most insurance company quotes are accurate, but there may be some differences in premiums once your prior claim history is pulled or your credit report is reviewed.

Many people don't realize this but you can consolidate your insurance policies, such as your car and homeowner's insurance to the same company. Most insurance companies will give you a discount on both policies for doing this and you can save anywhere from 5% to 20% on your insurance just by doing this.

To keep yourself and your assets protected, don't think of insurance as a luxury. Insurance may seem like wasted money when you don't need it, but when you're in a crisis situation you'll be happy to have it. Don't skimp on your coverage, and get all the insurance you think you may need.

If you feel that you are paying too much for your renter's insurance premiums, you may want to check with your insurance company to find out if the place that you are renting is considered to be a high risk structure. The higher premiums may be due to the fact that the building that you are renting is high risk and the cost is being passed on to you.

As stated at the beginning of the article, there are many different types of insurance available. Hopefully you have discovered ways you can insure yourself and/or your property that you hadn't thought of before. Having insurance gives you piece of mind that in the unfortunate event of a tragedy, illness, or accident, you and your family will be covered, and a bit more prepared.

|

|

Great Insurance Advice And Tips For Consumers |

Article writer-Sweeney Mueller

These tips will explain the differences between different types of insurances, as well as, provide guidance on how to find attractive prices. You cannot afford to spend too much on insurance, but you can surely spend some time learning more about insurance. An educated customer will make much better choices.

Save money on your insurance premiums by raising your deductible. You can save $100 or more on your auto insurance premium by raising your deductible from $250 to $500. Likewise, if you increase your homeowner's deductible from $500 to $1,000, you could save even more. Even increasing your health insurance deductible helps you save money on premiums.

When you are filing a claim with an insurance company, ask for your claim number at the end of the original conversation with your agent. Write down and keep this number for reference. Any time you call for an update on your claim, you'll need this number, so it's better to have it on hand.

Seek out an insurance company that can take care of everything you need. It is more than likely when you combine health, home, life, and car insurance all into one plan with a company, you should get a great discount because of this. You can actually increase your rate for homeowners insurance when you move your insurance from your car to another company that doesn't own your home.

You should consider purchasing renter's insurance for your apartment. You certainly own valuables and other personal possessions, which would need to be replaced at your own expense if anything should happen to them. In this event, you should take out a personal property policy, which will cover your possessions and valuables.

Check with organizations that you belong to and find out if they have a relationship with any insurance companies to obtain a discount. For instance, professional organizations and alumni groups sometimes partner with a certain insurance company to offer discounts to their members. This can result in savings for you.

Look at the pluses and minuses of different ways of the different methods of buying insurance and decide what works for you. You can buy insurance through a direct agent, direct through the company, or through a financial planner. They all have their own reasons for choosing them, make the choice that works best for you.

Online tools abound to help you determine what price you should be paying when changing your coverage. Use these tools to help you price out possible changes to coverage that can save you money. It may be that going to a higher deductible plan or switching to an HMO may be the right choice for you.

Remember that the cheapest plan is not always the best plan. Make sure to understand exactly what you will be paying before signing on the dotted line. If you have a very low cost plan, check on what the deductible amounts are. It may be better for you to pay more per month than to have to pay thousands of dollars out of pocket before your insurance kicks in.

Thoroughly read your insurance policy, and do so several times. Many people do not bother reading their policies at all before they sign them, and later find out that they are overpaying, or that their policy was actually inadequate concerning important coverage details. Paying special attention to detail when reading through, can help prevent this.

Health insurance, car insurance, renter's insurance, pet insurance, travel insurance.

Contact your provider and inquire as to the discounts available for bundling policies. You'll receive a discount for using them for all of your insurance needs, but you'll get an even bigger discount if you merge all of your insurance policies into a single account.

Make https://s3.ca-central-1.amazonaws.com/financial-ad...berta-22/infinite-banking.html that the medical coverage on your travel insurance is going to be enough to cover the expenses that may incur if you fall ill or get injured during your travels. Check Social Security debate in the United States to be sure that the amount your insurance provides is enough to cover the costs.

Check with your provider to make sure that you are benefiting from all of the discounts that are available for renter's insurance. You can get a discount for living in a gated community and many other things that may have not been considered when you opened your policy that could be saving you money.

The best time to switch insurance providers is when your policy is up for renewal. Canceling a policy at the end of it's term means you won't have to pay a cancellation fee, which saves you money. You also can let your current insurer know that you plan on canceling and moving to another insurance company and they may offer you a discount to match the new company's offer, or even better it.

Work toward having good commercial credit. The lower your credit score, the "riskier" you appear to be to insurance companies. You will get a much better rate on commercial insurance if your credit score is good. Pay attention to the total amount of debt you have and always pay your bills as soon as they come in.

Call your agent whenever you think of a question for which the answer isn't available in your policy. Call them up and ask them any questions that you may have. They should be willing to help and should be able to answer your questions.

Insurance protects your assets in case of an unforeseen circumstance. Insurance is a great investment due to the fact that it protects you from unexpected significant financial losses. Make sure to get it.

If you have fire insurance and you are getting ready to file a claim, it is important to make sure you have all necessary information available. This way, you get proper coverage. On your claim, make sure to put the condition of the home, the date of the loss, the location of the damage, type of damage and loss, and related injuries.

By applying these tips, you could save money on your monthly premiums and deductibles. Remember to do your research and to compare prices before you choose a policy. A customer who knows what insurance is about will choose a better insurance plan and pay a fair price. These tips should help you choose wisely.

|

|

Idea For Dealing With Insurance Policy |

Content writer-Gunn Cotton

To get any insurance policy wisely, you have to be well aware and well informed. However, you can't get all the wisest tips on your own. The tricks of the market are only found through experience, but you don't have to wait to get them. You can get the greatest tips used today right from this article.

You should consider purchasing renter's insurance for your apartment. You certainly own valuables and other personal possessions, which would need to be replaced at your own expense if anything should happen to them. In this event, you should take out a personal property policy, which will cover your possessions and valuables.

Whatever kind of insurance you are buying, remember it is little different than any other service you purchase. Comparison shopping will help you find the best insurance deal. Just remember that insurance policies come with different and idiosyncratic terms of service. A policy that looks cheap at first glance might prove to be a bad deal after careful examination.

If you own a small business, you must have the proper liability insurance coverage for your business. This is because you must always be in a situation where, if you are sued, you have the coverage you need to pay for your company's legal defense. You will also need to be covered so that the plaintiff's legal fees can be paid, in the event you do not win the case. If you do not have proper liability insurance, you can go out of business very quickly just trying to pay your legal fees.

You've probably heard the phrase about 15 minutes can save you 15%, but you might find that by spending just a couple of minutes on the phone with your current insurance provider can also save you money. When your insurance coverage is nearing the expiration date, call your insurance provider and ask them for a re-quote on your policy. They will have the incentive to give you the most favorable pricing in order to retain your business. Since they already have all your information, it probably won't take 15 minutes and you can save time and money.

You've probably heard the phrase about 15 minutes can save you 15%, but you might find that by spending just a couple of minutes on the phone with your current insurance provider can also save you money. When your insurance coverage is nearing the expiration date, call your insurance provider and ask them for a re-quote on your policy. They will have the incentive to give you the most favorable pricing in order to retain your business. Since they already have all your information, it probably won't take 15 minutes and you can save time and money.

Never pick an insurance company because they have a fancy logo, cool advertisements, or a fun mascot. Always read the fine print when you see these ads, and you may realize all is not what it seems. Take the time to research each company thoroughly, and find out which company has the best coverage for you.

Pre-paying your insurance bill can save you money on your premium. Insurance companies prefer for you to pay your insurance in a lump-sum and will reward you for saving them time and money on the costs of sending you bills. You can save payment plan fees of up to 3%!

Do not forget to check with internet only insurance companies, when searching for quotes. Many insurance companies have popped up online offering great savings over traditional insurance companies. These companies can afford to offer substantial discounts due to their lower overhead costs. Without having to pay agents, commissions, as well as, not having to deal with volumes of paperwork, they save lots of money, which is then passed on to you.

Purchasing insurance is necessary and it should factor into everyone's budget. One hundred dollars every month is far easier to handle than one hundred thousand because something unexpected happened.

Check your pet's insurance policy for information on the company requirements. Some policies require you to take your pet to the vet for a yearly check up, and pay out of pocket for it. Yearly physical exams are a great idea for pet care, but make sure the insurance company isn't forcing you to pay for it.

In order to maximize your savings, check into the possibly of getting all of your insurance needs bundled into one multi-policy. For example, if you need homeowner's insurance and auto insurance coverage, you can typically find insurance companies which offer both. By combining all of your insurance policies through one company, you have the potential to obtain considerable savings.

Keep things that could cause injury picked up around your home. It will help to avoid accidental injuries that you may have to claim on your home insurance policy. If you have to file claims on your home insurance, your rates are going to increase. So keeping things safe is going to save you money in the long run.

Be Personal development to compare prices when shopping for insurance. In this way, you can get the best deal. Many websites offer free quotes for multiple companies where you can compare policies, coverage and costs.

Insurance is a big deal. Make sure that the companies you are dealing with are licensed and covered by your state's guaranty fund. This fund is what will pay for things if your company should ever go into default. Check with your state's insurance department in order to find out specific information about each company before you make any decisions about which company to purchase through.

If https://s3.ca-central-1.amazonaws.com/financial-ad...berta-22/infinite-banking.html , purchase as much of your insurance from a single company to obtain applicable discounts. Many carriers offer significant premium reductions for customers purchasing multiple lines of insurance such as bundling home, car and life insurance. If a specific insurance company meets your needs, keeping your policies with one carrier can save you quite a bit of money.

If you are switching insurance companies, keep your current policy in force until your new policy is issued. This can prevent you from experiencing a lapse in coverage if there is a delay with the new company. You don't want to be without coverage because sometimes, the new company's price is not that same as the quote you were given or your application is denied.

When looking for insurance, make it personal. Meet with insurance agents from different companies and see what they have to offer. A lot of the time they have special deals and incentives to get you to buy theirs because they want to make the sale. If you meet with them personally, you are more likely to get a deal that you might miss out on if you just deal with a company online or over the phone.

If you feel that you are paying too much for your renter's insurance premiums, you may want to check with your insurance company to find out if the place that you are renting is considered to be a high risk structure. The higher premiums may be due to the fact that the building that you are renting is high risk and the cost is being passed on to you.

The information you learned should give you the confidence so that you will be able to go out and make the right choice for your insurance needs. Now you should better be able to understand coverage, find affordable rates, keep your family safe, and be prepared for any losses that may occur.

|

|

Aiming To Buy Life Insurance Policy? Look Into These Tips! |

Content create by-McKinney Johannsen

When it comes time for you to get a life insurance policy, you may wonder where to begin, as there are so many things to consider when purchasing a plan that works for you and your family. The tips in this article can provide you with what you need to know, in order to choose a good life insurance policy.

Disability insurance is a good idea, especially if you live paycheck to paycheck. It will pay you cash in the event that you are hurt, sick or can't work for any other reason. Your medical insurance will pay your doctor bills, but they won't cover your day to day living expenses.

Improve your credit score to save money on life insurance. Statistics have shown insurance companies that people with poor credit are higher risks. Raising your credit score could affect your rates differently depending on which insurer you choose, but it's always a good idea to get several quotes since every insurer evaluates new policies differently.

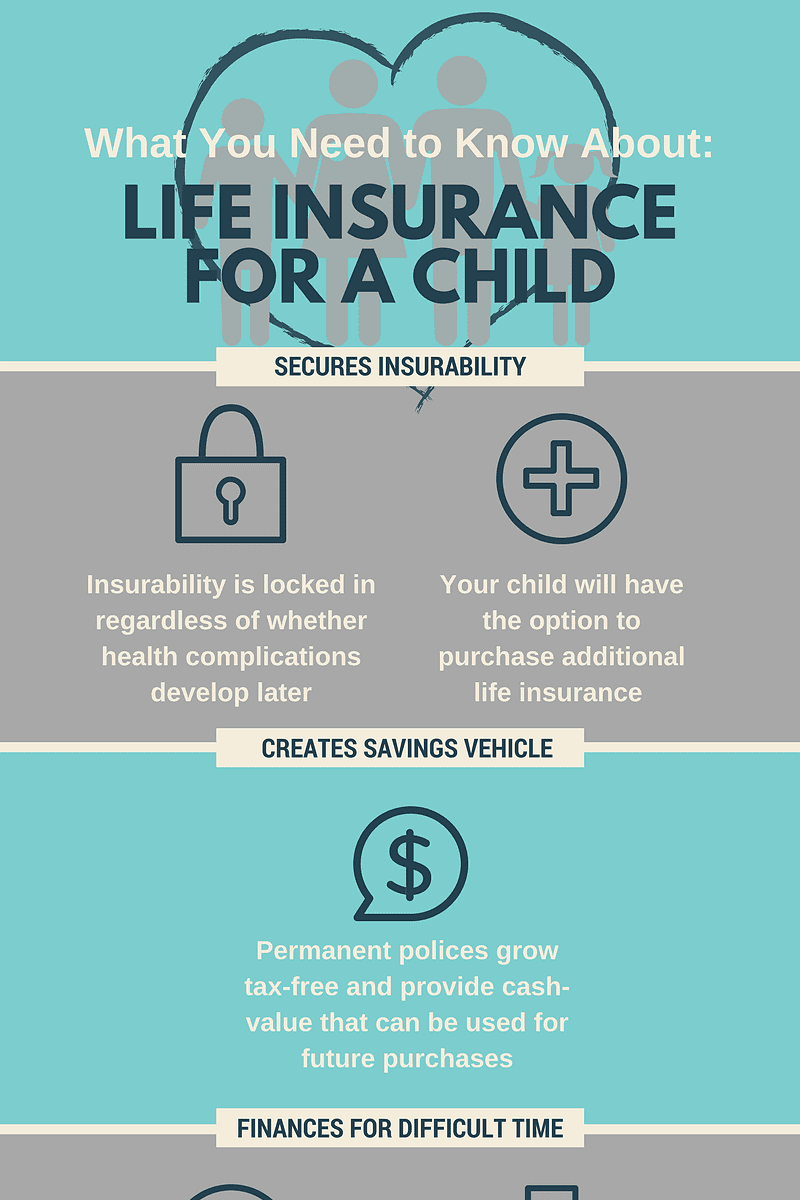

Even if you do not provide an income to your family, a life insurance policy might be worth considering. If you are a stay at home parent, there would be costs associated with child care and house upkeep in the event of your death. Funeral costs can also be expensive. Talk to an insurance expert to decide how much insurance is right for you.

When choosing a financial representative to assist you in the life insurance policy purchase process, ensure that you select an individual that you feel at ease with. This person should understand and acknowledge your goals and needs so as to be able to provide the best advice regarding products that are right for your situation.

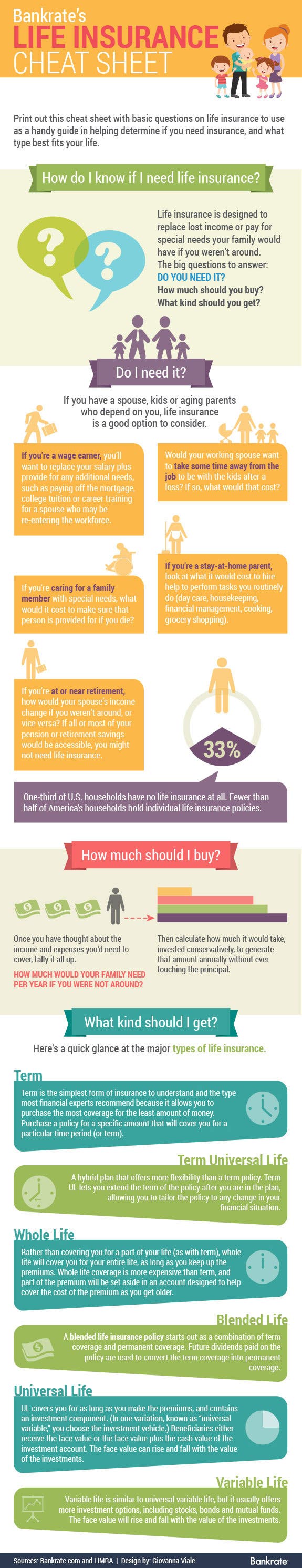

Some life insurance companies may suggest that you purchase a mortgage insurance policy, which pays off your mortgage should you die. However, it is wiser to take the amount of your mortgage into account when purchasing coverage for a term life insurance or whole life insurance policy. This makes more sense because your mortgage steadily declines over time, although your mortgage insurance premium does not. In the long run, it is more cost effective to include the amount of your mortgage in with your life insurance policy.

Many life insurance brokers and agents get paid through commission. It is therefore to their benefit to sell you the most expensive package they can with as many riders as possible. Because of this, before agreeing to a specific life insurance policy, you should get a second opinion. Make sure everything included is something that you actually need!

Always be truthful when applying for life insurance. Disclose all of your information truthfully, so that your insurance company has no reason to contest your coverage. Upon your death, the insurance company will review your policy information. Any withheld details could cause the insurance company to deny your insurance claim, which will deprive your remaining family from any insurance proceeds and defeat the purpose of all of your insurance payments.

Choose a term life policy. This form of life insurance provides the best coverage for most people from the age of 20 until 50. It is simple to understand and acquire, but it still gives your family what they need in terms of monetary security in the event of your death.

If you're unsure about what type of life insurance policy to choose or how much coverage you need, consider hiring a financial professional to aid you with your decision. There are many complicated factors to consider when choosing life insurance, and a good financial professional will consider all of them in determining your needs.