Top Ways To Market Your Bookkeeping Solutions Organisation For Proven Success |

Article by-Holmberg Mcdaniel

It can be much easier to handle an accounting consulting service if you are clear in the objectives and values of the audit workplace. For you to be successful in all your goals, you will certainly need to encounter numerous challenges. Keeping these ideas in mind will make certain that your company is successful as well as you have the ability to broaden.

Developing a prosperous accounting office doesn't happen overnight. Your success will probably be established by how much of your time, energy as well as resources you want to invest when very first beginning. You must also have persistence and focus to make it in the long run. Proprietors who lose emphasis as well as drift away from actively promoting the development of their bookkeeping consulting organisation put their business at risk of failure.

Running your own bookkeeping consulting organisation is most likely to occupy a whole lot even more of your waking hours than you expect. Running a rewarding organisation implies you need to invest your personal effort and time. Do not anticipate to be prepared to multitask at first. The smartest bookkeeping workplace proprietors understand when it's time to relax and turn over some of their duties to somebody else.

Enable your consumers leave their reviews about your products and services by putting aside a put on your site. Favorable testimonials of your services and products can just offer to enhance your on the internet credibility. Lots of customers will respond with excitement if you ask for their input and comments. If you 'd like to encourage them to react with their feedback, you ought to take into consideration supplying promotions to consumers that do.

You can make sure your accounting speaking with company isn't hurt by lawful issues by filing all federal government kinds and having a standard understanding of business regulation prior to opening your doors to the public. If Business bookkeeper near me surprise don't take place to have fundamental knowledge of business law, you should see an attorney that concentrates on the topic. It only takes a solitary expensive situation in a court of law to result in the downfall of a profitable business. Having a good bookkeeping consulting service attorney is of benefit to you due to the fact that you do not want to remain in the placement of dealing with a legal difficulty without one to represent you.

When taking care of a prosperous bookkeeping consulting business, you have to establish goals. By building up an apparent, extensive technique for success that includes a development of particular, reasonable purposes, you will certainly have the ability to make and manage a financially successful bookkeeping and also bookkeeping company. https://www.accountingtoday.com/opinion/cashing-in-on-business-advisory-services are, the much easier it is to comply with the guidelines necessary to make your business successful. Keeping your goals reasonable as well as your milestones achievable is important to your success; several businesses stop working since the owners are not able to meet the substantial objectives they've set and ended up being irritated as well as inefficient.

|

Метки: Small Business Accountant Small Business Bookkeeping Finance Services Tax Preparation CPA Services Accountant Bookkeeping Investigative Accounting |

The Method To Expand And Also Run A Top Notch Bookkeeping Solutions Service Entity |

Content create by-Sumner Kirkeby

Wise bookkeeping consulting company owner are constantly gotten ready for the worst as the economic situation could be unsteady in some cases. The best in the business are those that are passionate about being the very best at doing what they love. Take a look at this publication if you intend to establish an effective approach to your company version.

You can ensure your bookkeeping seeking advice from service is not hurt by legal issues by submitting all federal government types and having a basic understanding of organisation law before opening your doors to the general public. Unless you're knowledgeable concerning business legislation, you might want to consult a legal representative who specializes in it. You would succeed to remember that a number of successful companies were taken down to the ground thanks to a pricey suit. It's a clever suggestion to develop a partnership with a preferred business legal representative you could call on when needed.

It's smart to make it feasible for customers to publish responses and also item evaluations on your site. Since you desire customers to feel good concerning what you do, providing them a chance to comment will certainly help construct you a favorable reputation in your on-line community. Companies that ask their consumers for their viewpoint excite them as well as are most likely to respond. Supplying special promotions readily available just to those that leave feedback on your site is a proven means to motivate clients to participate.

A major part of an effective strategy of bookkeeping consulting organisation operation is objectives. Small business accountant litchfield park will become more profitable if you produce a collection of specific goals intended in the direction of accomplishing development. The purpose of having certain, quantifiable objectives is to be able to see just how much your organisation has actually come and maintain it on the right track to where you desire it to go. It's important to have a series of goals that are realistic and also achievable rather than one overarching goal that can seem so tough to accomplish that people get distressed and also dissuaded.

Sharing suggestions with your workers can be an excellent way to place a finger on what bookkeeping consulting business choices should be made. If you like to come close to the decision by yourself, attempt the tested method of writing out a list of the benefits and drawbacks of each potential selection. Its evident that making a checklist such as this will certainly make identifying the most effective alternatives for your company much easier. It might aid to speak to specialists on advancing organisations whenever you find yourself puzzled over what the next move for your service must be.

http://finance.azcentral.com/azcentral/news/read/38999236 will go back to firms where they obtain superb service. Clients will not remain around if they are not seeing solution that is frequently satisfying. When you set as well as adhere to high criteria, your customers will certainly stick with you when you introduce new solutions. The companies that are most likely bring you difficulty are those that have high quality product or services.

|

Метки: Small Business Accountant Small Business Bookkeeping Finance Services Tax Preparation CPA Services Accountant Bookkeeping Investigative Accounting |

Reliable Advertising To Get One Of The Most Out Of Your Financing Service |

visit the following web site -Chan Decker

Think about starting your own funding solutions organisation if you wish to support on your own and do something that you enjoy. You must discover your enthusiasms, abilities, and hobbies to identify a great way to seek such a career. Guarantee you have an organisation approach prior to even seeking clients or accepting customers. As simply click the up coming internet site proceed reading this post, you can get some approaches on how to deal with your business.

No person suches as the principle of monetary wreck, and also funding business proprietors work hard to avoid it; when faced with a considerable funding services organisation option, it is a sensible concept to initially make a threat evaluation that is precise as well as detailed. Despite just how well ran a service is, it can still concern extreme harm due to a considerable threat. Bigger threats are more probable to wreck your company, so make certain to decrease the threats you take whenever it's feasible. By examining threats meticulously when faced with significant decisions, you can make certain your firm continues to be profitable.

A large part of running an effective funding firm is setting the ideal goals. The goals you establish for your financing solutions business must be SMART: details, measurable, attainable, sensible, and also time-related. Specific objectives can include contacting or working with particular experts, deciding what functions you want on your website, as well as figuring out just how to finest promote your goods. Maintaining your goals sensible as well as your landmarks possible is essential to your success; several businesses fail due to the fact that the owners are incapable to meet the massive goals they have actually established as well as become frustrated and inefficient.

You can ensure your financing services company simply isn't harmed by legal concerns by filing all government forms and also having a fundamental understanding of business regulation prior to opening your doors to the public. Without having a basic understanding of business law, you might still consult with a legal representative that focuses on the subject. Realize that one expensive lawsuit can be the failure of any kind of successful funding company. It's an ideal idea to establish a partnership with a reliable company legal representative you might contact when needed.

It is difficult for a financing business to stop working if they constantly offer premium services and products at an affordable rate. You will see a bump in sales and a matching increase in business profits when your financing solutions organisation concentrates on offering exceptional products and services. A significant benefit of having fantastic customer care is that it also has a tendency to cause great deals of recommendations among your customers. As navigate to this site as you place focus on quality, nothing else business in the market will possibly prepare to touch you.

|

Метки: Finance Services Wealth Manager Benefits of wealth management Wealth management Wealth advisor Personal finance Finance Advisor Corporate Finance |

How To Maximize Potential With Efficient Funding Company Advertising And Marketing |

investment management vs wealth management morgan stanley created by-Vick Matzen

Making a financing services service lucrative is not a very easy job for several single owners. It is an uncommon occurrence that the most effective method for increasing your market share is selected. If you actually intend to do well in business, follow the successful people in your industry. You must keep these techniques useful to guarantee you maintain your organisation in a growth state of mind.

Being obsequious when funding solutions service is going great is frequently a blunder. Regular planning and also testing with expanding principles are key to successful organisations. Don't let yourself get sidetracked if you desire your business to be as successful as feasible. If you are constantly prepared to alter things and also searching for brand-new ways to improve, after that you will make it through anything that comes your company' method.

You will not have an expanding financing services business without a lot of dedicated consumers. Older firms additionally depend upon existing employee who feel directly bought the business. The disaster left following a single negative review is often a total surprise to entrepreneur who do not monitor their financing firm's online track record. You will certainly need to rectify the scenario and disperse the problems that may have been done to your firm's name on the occasion that you have actually obtained some poor reviews, so it is suggested that you employ a professional reputation management service.

Clients will certainly constantly be loyal to a financing company that offers them excellent quality products or solutions. You need to aim to satisfy your consumers in order to maintain them since if you fail, they may locate somebody else that will. As soon as https://blogfreely.net/myrta94ressie/killer-tips-o...in-a-reliable-funding-business funding services company gets a great background of quality product and services, it will be easy to present new solutions too. https://postheaven.net/kyra97erinn/just-how-to-mak...ith-reliable-financing-service that are most likely bring you difficulty are those that have quality products and service.

Both financing firm administration and workers alike need to interact in a favorable fashion with the public. It's vital that every customer that comes through your door really feels comfortable and also appreciated. As an entrepreneur, you should guarantee your employers get ample customer support training. You can be specific that your financing services organisation will certainly grow when you have positive customer experiences due to the fact that they might be informing others.

You have to establish a lot more modern goals regularly due to the fact that they assist you assess the success of your funding solutions company. Unless you think it can prosper, your service is not most likely to be successful. You'll achieve your wildest dreams for your funding firm's success if you maintain setting brand-new standards as quickly as you meet the old ones. Proprietors that settle for the tiniest feasible landmarks of success and spend little of their initiative in their business possibly shoud not trouble opening up a busness in all.

|

Метки: Finance Services Wealth Manager Benefits of wealth management Wealth management Wealth advisor Personal finance Finance Advisor Corporate Finance |

Reliable Marketing To Obtain One Of The Most Out Of Your Funding Service |

Content create by-Finn Vester

Take into consideration beginning your own financing services business if you wish to support on your own as well as do something that you love. You need to explore your enthusiasms, skills, and leisure activities to determine an excellent way to go after such a job. Ensure https://www.worldfinance.com/wealth-management/ita...onal-digital-regulatory-change have a company method prior to also seeking out clients or accepting clients. As you proceed reading this article, you can obtain some methods on just how to work with your company.

No person likes the idea of economic ruin, and also financing firm owners strive to avert it; when faced with a considerable funding services business selection, it is a reasonable idea to initially make a threat evaluation that is exact and comprehensive. Despite exactly how well ran a company is, it can still pertain to extreme injury because of a substantial danger. Larger risks are most likely to spoil your service, so ensure to decrease the threats you take whenever it's feasible. By examining threats very carefully when faced with significant choices, you could ensure your firm continues to be rewarding.

A large part of operating an effective financing company is establishing the best objectives. The goals you develop for your financing solutions service ought to be SMART: certain, measurable, achievable, realistic, and time-related. Details objectives can consist of calling or hiring certain experts, deciding what attributes you want on your site, and identifying how to finest promote your items. Keeping your goals practical as well as your turning points attainable is vital to your success; lots of companies stop working because the owners are unable to fulfill the enormous objectives they have set and also become disappointed and also inefficient.

You can make sure your funding services organisation just isn't hurt by lawful problems by submitting all federal government forms and having a standard understanding of business law before opening your doors to the general public. Without having a basic expertise of business legislation, you can still seek advice from a legal representative who focuses on the subject. Realize that shook wealth management reviews can be the downfall of any type of successful financing firm. It's an ideal idea to develop a connection with a trusted service lawful rep you can call on when needed.

It is challenging for a financing company to stop working if they consistently use costs products and services at a sensible rate. You will certainly discover a bump in sales and a corresponding rise in company profits when your financing services business focuses on offering outstanding services and products. A significant benefit of having excellent customer care is that it also has a tendency to bring about great deals of recommendations among your customers. As http://b3.zcubes.com/v.aspx?mid=2176120 as you place emphasis on excellence, no other business in the industry will possibly prepare to touch you.

|

Метки: Finance Services Wealth Manager Benefits of wealth management Wealth management Wealth advisor Personal finance Finance Advisor Corporate Finance |

Reliable Advertising And Marketing To Obtain The Most Out Of Your Financing Organisation |

Created by-Soto Balle

Think about starting your very own financing services service if you intend to sustain yourself and also do something that you like. You must discover your interests, abilities, and hobbies to identify an excellent way to pursue such a profession. Guarantee you have a business technique before also seeking out clients or approving clients. As you continue reading this post, you can obtain some approaches on exactly how to deal with your organisation.

Nobody likes the principle of economic wreck, and also financing company proprietors strive to avoid it; when faced with a considerable funding solutions business selection, it is a practical suggestion to first make a risk evaluation that is accurate and detailed. Despite how well operated a business is, it can still concern serious injury as a result of a considerable risk. Larger threats are more probable to destroy your business, so make sure to minimize the threats you take whenever it's possible. By analyzing risks meticulously when confronted with significant decisions, you might ensure your business remains profitable.

A huge part of running a successful funding company is establishing the best objectives. The objectives you develop for your financing solutions company should be SMART: particular, measurable, possible, realistic, as well as time-related. Particular goals can include getting in touch with or working with certain experts, deciding what functions you desire on your internet site, and determining just how to finest advertise your items. Keeping your goals realistic as well as your landmarks possible is vital to your success; many businesses fail due to the fact that the owners are unable to meet the enormous goals they have set and become annoyed and also inefficient.

Discover More can ensure your financing solutions organisation just isn't injured by lawful issues by submitting all government forms and also having a standard understanding of business law prior to opening your doors to the public. Without having a fundamental expertise of service legislation, you can still talk to a legal representative who concentrates on the topic. Know that pricey litigation can be the downfall of any type of successful funding firm. It's a perfect concept to establish a connection with a dependable company lawful rep you could get in touch with when needed.

It is hard for a financing firm to fall short if they consistently provide premium product or services at a practical cost. You will certainly observe a bump in sales and an equivalent increase in company profits when your financing services service focuses on supplying phenomenal product or services. linked internet site of having wonderful customer service is that it also tends to cause lots of recommendations amongst your customers. As long as you put focus on excellence, no other organisation in the industry will most likely be ready to touch you.

|

Метки: Finance Services Wealth Manager Benefits of wealth management Wealth management Wealth advisor Personal finance Finance Advisor Corporate Finance |

Exactly How You Can Market Your Tax Obligation Consulting Organisation In A Slow Economic Situation |

Written by-Dreyer Spears

Always have faith in on your own; no one can manage your tax seeking advice from solutions organisation more effectively as well as efficiently than you could. When you have the ideal mindset, your organisation can boom and be extremely effective. Below are the golden suggestions that have been confirmed in making a business prosper and you should also apply them in your service.

It's very vital to commit enough time to operating an organisation; it generally is a larger time dedication than you would certainly believe. You must invest substantial quantities of interest, initiative, and also time to have as well as manage a successful tax obligation consulting solutions business. Do not make the blunder lots of brand-new business owners do by attempting to do a lot of points at the same time. A wise business owner realizes when he becomes overloaded and also will certainly pass on some of his responsibilities.

A large share of consumers accept the responses and also rankings of prominent customer reporting sites before going to a tax consulting services business. A terrific option to boost the quality of your online online reputation is to, in a well mannered means, trigger your consumers to post remarks worrying your goods as well as solutions on your web link, allowing potential customers to can obtain insight right into the way your service jobs. When choosing reviews to present on your website or advertising, pick well-written ones that explain your staminas. Award consumers who examine your goods and also services through discount rates and special offers.

To discover https://smallbiztrends.com/2019/01/peer-to-peer-lending-small-business.html to do well in the tax consulting solutions service globe, we suggest learning at work with the real world experience. Specialists advise getting as much hands-on experience concerning your wanted sector as feasible. Every task you have actually ever held or will certainly hold assists prepare you to end up being a successful company owner. Checking out a book regarding service stops working in comparison to what you will certainly acquire with work experience.

You'll require a great deal of faithful consumers if you desire a flourishing tax obligation consulting solutions organisation. Old businesses with thorough legacies will commonly have very completely satisfied and loyal workers who stay with the tax consulting consulting company for a long time. A should for services is to take their on the internet credibility very seriously, as well as safeguard it whenever they can. When Small business tax preparation obtains some adverse reviews, it is great to employ a specialist reputation manager that will recover the wonderful name of your service.

It'll pay off to be really careful when bringing brand-new workers aboard. Conduct thorough interviews to ensure you employee individuals that have actually the abilities as well as credentials the task needs. Nevertheless, every brand-new worker requirements and also is worthy of comprehensive training to give them with the skills and understanding called for by their brand-new setting. Happy and also well-trained workers are what make up a successful tax obligation consulting seeking advice from company.![]()

|

Метки: Small Business Finance Accounting services Tax Consultant Financial accounting Loan Application Assistance Investigative Accounting Finance accountant |

Discover A New Marketing Region For Your Financial Services Company |

Content create by-Nolan Forrest

To constantly manage your economic consulting business efficiently, have a clear vision of what you want it to be. There are many difficulties that you need to overcome in order to accomplish your company goals. Keeping these tips in mind will make sure that your business is successful and you are able to expand.

You must celebrate when you get to landmarks in your economic consulting service method, yet do not believe that indicates you can quit considering your service as well as walk away. Well handled organisations are frequently looking for new ideas and also approaches to preserve and increase earnings. Your service will certainly never survive the long run if you do not have focus and devotion put into it. Businesses that are adaptable adequate to respond quickly to modifications in the economy and also outside atmosphere normally weather tough times fairly well.

Permit your consumers leave their evaluations regarding your products and services by depositing a put on your site. Your primary objective is supplying phenomenal customer care and impressive assistance, so gathering favorable reviews will certainly much better offer that goal. Consumers like to be requested their input since it makes them feel as if what they have to say matters to the economic solutions consulting firm. One way to encourage various other consumers share their viewpoints, just offer promos to those customers that leave their evaluations.

https://myspace.com/businesscpaglendaleaz ; encrypted-media; gyroscope; picture-in-picture" allowfullscreen>

When learning more about your industry, a few of one of the most effective training will take place via real life experience. To get some knowledge on exactly how to run an economic consulting service, specialists recommend one to discover with personal experience. The more you obtain real-world experience and also expertise, the more successful you will likely be if you select to open your own company. There is something to be said about checking out an organisation publication, but there is a lot more to be stated regarding real world experience.

A large share of customers defer to the responses and rankings of popular customer reporting internet sites before seeing a monetary consulting business. Approach numerous of your star clients as well as ask them to give responses on your business. Plainly present testimonials that reveal your monetary solutions consulting business's toughness and applaud your greatest items. Rewarding those customers who leave the feedback is crucial as they do even more promotional task for your organisation.

An appealing, professional-looking internet site is a vital component in every economic solutions speaking with firm's advertising and marketing technique. If Richard steiman surprise az do not have the skills needed to develop a leading rate website on your own, involve the services of a talented internet site developer to help you. Design templates, pictures, as well as applications are terrific means to make your web site more appealing and also practical. The significance of a specialist as well as attractive web site can not be forgotten in today's monetary consulting service market in order to guarantee you have a commanding web presence.![]()

|

Метки: Small Business Finance Accounting services Tax Consultant Financial accounting Loan Application Assistance Investigative Accounting Finance accountant |

Cutting-Edge Tips On How To Develop And Handle A Lucrative Accountancy Services Business |

Content by-Svenstrup Bengtson

It calls for a strong accounting consulting service plan to guide a service to lasting success and earnings. The lack of a comprehensive business plan has been the downfall of many young business. Following these suggestions can help you grow your organisation as well as achieve success.

To prevent subjecting your accountancy office to financial catastrophe, it is essential to carry out a comprehensive and in-depth danger analysis prior to making any type of major decisions. Also the most well-managed accountancy consulting company can be seriously damaged by large risks. Bigger dangers are more probable to harm your organisation, so minimize them whenever possible. Extensive danger evaluation is the only means to identify as well as reduce service risks and also keep profit degrees.

Your accountancy seeking advice from service must always be functioning towards brand-new objectives. As a business owner, you need to believe that your organisation will certainly prosper in order for it to ever have a possibility at it. In that very same way, it is necessary to constantly be elevating the bar for yourself, establishing each brand-new challenge a bit greater than the last. Individuals who enjoy with fulfilling just one of the most sub-par turning points should not manage a service.

Effective companies do not experience over night success. With sufficient initiative and also time purchased your bookkeeping speaking with company, success will adhere to. It's vital to place in persistence and also listening to your organisation. When a proprietor comes to be sidetracked and also quits actively looking for development for his or her accountancy office, business is likely to experience major troubles.

Dedicating sufficient hours of your life to in fact running an audit consulting business is crucial as well as constantly takes more time than you originally anticipated. If you are to transform your company right into a successful one, it'll occupy a good quantity of your personal time. Do not anticipate to be in a setting to multitask at first. A smart entrepreneur realizes when he comes to be overwhelmed and will certainly delegate several of his duties.

Customer research study reveals that consumers care a great deal regarding the favorable as well as unfavorable testimonials a certain accounting consulting service has. When attempting to enhance your online visibility, often supplying special deals for customer that leave reviews for your service can have a huge impact. visit the site must go through every one of the reviews that individuals leave and remember of the ones that are likely to aid you out the most. Your consumers leaving a comment are doing you a wonderful support hence you should value them by offering discount rates or promos.

Launching a new accountancy workplace can be an obstacle in spite of what number of times you have done so in the past. But you can prepare yourself by researching your industry and ideal accounting consulting company techniques prior to actually spending anything. Small business bookkeeping surprise and also rewarding audit workplace starts with the correct foundation. Don't neglect the number of resources offered free of cost on the net.

|

Метки: Small Business Finance Accounting services Tax Consultant Financial accounting Loan Application Assistance Investigative Accounting Finance accountant |

The Key To Effective Financial Solutions Business Can Be Conveniently Found Out |

Sovereign Wealth Management Vienna VA by-Hackett Offersen

Attempting to make a monetary consulting organisation successful is a difficult task for a single proprietor. It's uncommon that the right marketing technique for improving market share is chosen. It's advisable to research study on preferred advertising techniques that are relevant to your market in order to expand your business by leaps as well as bounds. Gary Korolev Sovereign Wealth Management Planning Vienna VA need to keep these techniques in mind if you want to expand your company.

It's absurd to make vital economic consulting business decisions without thoroughly examining the threats connected with each alternative. Also one of the most successful organisation can be seriously harmed by serious dangers. The larger a threat, the more likely it is to negatively affect your service, so it's important to minimize threat when you can. Every major choice regarding your service ought to consist of the most detailed threat evaluation possible, to guarantee the ongoing success of your procedure.

Exceptional product and services are the tricks to a prosperous monetary consulting organisation. You can give your business with a bigger swimming pool of sources when you make use of top quality product or services to enhance your sales income. Establish your views on excellence and also your base of consumers will certainly expand by word of mouth. Success takes place when you're always functioning to make your service a remarkable one.

11 financial experts share the best money advice they've ever received

11 financial experts share the best money advice they've ever received Money advice can come from friends, financial experts, and even your parents — who should you trust? What works best for one person may not work for another, but it's helpful to have some options. Here, financial experts share the best money advice they've ever received.

Managing your own monetary consulting organisation is most likely to take up a whole lot more of your waking hours than you expect. It takes a great deal of effort and time to own and also run a flourishing service. It's easy to obtain overwhelmed as well as attempt to do excessive if you're a first-time local business owner. When your are obtaining bewildered, it is clever to entrust obligations anywhere feasible.

You may have fulfilled your objectives, however not achieved success. Organisations pass away without continuous growth, so ensure that you keep establishing new objectives. Grow your financial consulting organisation by staying on program and also by staying on par with industry trends and readjusting your goals accordingly. Likewise, keep Insurance Planning Vienna VA as well as cutting-edge by following market fads.

A very carefully intended professional website is key to financial consulting organisation success. There are expert site developers obtainable to make an amazing site for you in case you're incapable to do it, or lack the time. Appealing pictures as well as making use of proper templates can increase the performance of your site. Numerous entrepreneur assume that their site simply isn't a priority, however considering that a lot of clients gain their information online it's essential to a growing business.

Have a favorable behavior when you engage with the public, no matter whether you are the owner of the economic services seeking advice from firm. http://mgyb.co/s/UMiwF should make every client that sees you feel comfortable as well as appreciated. A company should invest much on training its staff members on the abilities of client connections. Delighted consumers can be the best advertisements for your economic consulting business.

|

Метки: Finance Financial Advisors Wealth Management Insurance Planning Physician Wealth Management Physician Financial Planning Wealth Advisors |

The Trick To Effective Financial Provider Business Can Be Quickly Learned |

https://www.investorschronicle.co.uk/shares/2019/0...ials-provident-financial-more/ written by-Epstein Molloy

Trying to make a financial consulting company successful is a difficult task for a sole proprietor. It's unusual that the ideal advertising and marketing method for boosting market share is picked. It's a good idea to research study on popular advertising and marketing methods that are relevant to your market in order to grow your company by leaps and also bounds. You require to keep these approaches in mind if you want to expand your business.

It's silly to make crucial economic consulting company choices without thoroughly analyzing the threats related to each option. Even the most effective company can be seriously damaged by extreme dangers. The larger a threat, the more likely it is to adversely affect your organisation, so it's vital to reduce threat when you can. Every significant choice concerning your organisation needs to consist of the most comprehensive threat analysis possible, to guarantee the continued success of your operation.

Exceptional services and products are the secrets to a thriving economic consulting service. You can supply your organisation with a larger swimming pool of sources when you use top quality product or services to boost your sales profits. Establish your views on quality as well as your base of customers will expand by word of mouth. mouse click the up coming webpage happens when you're constantly functioning to make your service an outstanding one.

How not to get fooled by fake investment advisors

How not to get fooled by fake investment advisors Between the three of them, they defrauded several gullible investors. They offered investment advice for which they gobbled up fees totaling in excess of Rs 10 crore. Their investment advice was fake and many investors complained to SEBI that they didn’t work; the advisors did not bother to pick up their phone calls, but instead kept on advertising their fake success.

Managing your very own financial consulting service is likely to take up a whole lot more of your waking hours than you anticipate. It takes a great deal of time and effort to have and run a flourishing business. It's very easy to get overwhelmed and also effort to do too much if you're a first-time business owner. When your are obtaining overwhelmed, it is smart to pass on obligations anywhere possible.

You may have satisfied your goals, however not attained success. Companies pass away without constant development, so ensure that you maintain establishing new goals. Grow take a look at the site here consulting service by remaining on course and also by staying up to date with sector patterns and readjusting your goals appropriately. Similarly, maintain your service techniques fresh and also ingenious by adhering to market trends.

A thoroughly planned expert web site is essential to financial consulting service success. There are specialist site designers obtainable to make a spectacular site for you in case you're not able to do it, or lack the time. Appealing images and using ideal layouts can enhance the efficiency of your web site. Many company owner think that their internet site simply isn't a top priority, but given that many clients obtain their info online it's necessary to an expanding business.

Have a positive temperament when you connect with the general public, no matter whether you are the proprietor of the financial services seeking advice from company. You must make every client that sees you really feel comfortable as well as valued. A firm should spend a lot on training its staff members on the abilities of customer connections. Insurance Planning Potomac MD can be the absolute best ads for your economic consulting business.

|

Метки: Finance Financial Advisors Wealth Management Insurance Planning Physician Wealth Management Physician Financial Planning Wealth Advisors |

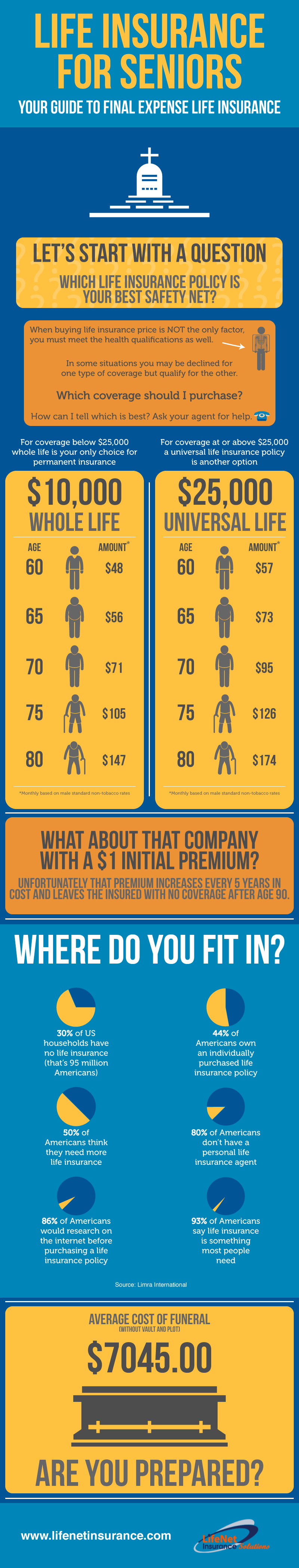

Discover Life Insurance Tips That Will Help You |

Content by-Mcneil Therkelsen

Getting the right life insurance policy is a very intricate part of your life's financial planning, and that is stressful enough as an idea. However, when it comes to understanding the logistics involved, you may need a guide to help you through. Start with these life insurance buying tips and get a new understanding for better shopping.

Being in good shape can save you money on a life insurance policy. Before you begin looking for a life insurance policy, take care of any health issues you have control over, such as smoking, weight problems, high blood pressure, and other health concerns that you can affect with diet, exercise, and attention. A glance at insurance charts will tell you that you will save a considerable amount on life insurance by taking good care of your health.

Be careful to not buy too much or too little insurance coverage. The general rule of thumb is to have at least 5 to 7 times your current salary as your benefit amount. Keep in mind what will have to be covered based on your families needs. Many people also make the mistake of buying too much and end up with inflated insurance premiums for coverage they don't really need.

Drop bad habits and get into good shape prior to opening a life insurance policy. If you are in good physical health, you are likely to get a better rate from your provider. Smoking, high cholesterol, blood pressure, as well as depression, can drive up your rates more than you would think.

Although click this over here now may seem tempting, lying about your health, occupation or lifestyle in order to reduce your life insurance premium is extremely risky. Insurance companies investigate many claims, and, if they suspect that you gave them false information, your claim may be denied or your heirs may spend years in needless litigation. Whether you a smoker, a lumberjack or an extreme sports enthusiast, make sure your insurance company is aware of it.

There are several ways in which you can purchase a policy. For example, you can use the insurance your employer provides or instead opt for a private policy. In addition, you can receive some information from fee-only financial planners, buy a policy from financial planners who only work by commission, or purchase through insurance agents.

You should understand why you need a life insurance policy. Don't just go out and buy a policy because someone told you it was a good idea. You should only purchase a life insurance policy if someone in your family, a spouse, or children, depends on your income source for support.

one day insurance for cars !5e0!3m2!1sen!2sus!4v1559926419459!5m2!1sen!2sus" width="600" height="450" frameborder="0" style="border:0" allowfullscreen>

Even after you've found a policy that you feel you love, you should still make sure to compare multiple policies to see if you can find a better deal on any other life insurance package. You never know; you might find the same package for 20% less per month. That would be a huge difference in the long-term.

Joint-life policies allow married couples to get a policy at a discounted price. This is an excellent way for a couple to save money on a life insurance policy. However, a joint policy will only pay once, and ends upon the death of one of the insured policy holders.

Be sure to tell the truth when applying for life insurance. The company you are applying for a plan with will more than likely verify that the information given on your application is the truth. Being caught in a lie with these companies could prevent you from getting life insurance.

Consider your current health when purchasing a life insurance policy. It is less expensive to purchase life insurance at a younger age and when in good health than later in life. Often, even if you experience health problems later, your life insurance is not impacted if it has already been in place. Trying to buy a policy after a health problem can be much more expensive, if not impossible.

To make sure you receive the best possible quote, shop around and compare rates when purchasing life insurance. Different carriers use different factors in determining risk and premium requirements, so cost can vary significantly among different companies. While shopping, be sure to consider the reputation and stability of the selected carrier to make sure they will be around for the long term.

To save money on your life insurance, make an annual payment rather than monthly payments. Many insurance companies charge a small administrative fee for monthly payments because of the added administration expenses. Paying your life insurance premium annually saves you these fees, which can add up over the life of your policy.

Do not withhold information when you apply for life insurance. If you don't tell your life insurance company about your bungee jumping hobby or the fact that you actually are a smoker, and they find out, your policy may be canceled and you may lose all the money you have put into it. Additionally, if you should die, and your insurance company learns that you have given them false information, they may not pay. That would leave your family in the lurch.

Life Insurance Tips For Newlyweds

Life Insurance Tips For Newlyweds When you first get married, there’s so much excitement and so many things to think about that life insurance doesn’t often cross your mind. Let’s be honest; going on honeymoon, thanking all your guests for attending the wedding, and planning your new life together is way more exciting than doing financial admin. But life insurance is an important part of protecting your future as a married couple. To make it less overwhelming, here are the top things that you really need to know about life insurance for newlyweds.

Purchasing a life insurance policy is a good idea, no matter what your age. You need to buy life insurance to cover the things in your life that are important to you and your family. You should consider how the mortgage, or car payment, will get paid in the event of your untimely death.

You should understand the difference between term life insurance and permanent life insurance, such as whole life insurance. For the most part, people do not need any more then a term life insurance, but they let a sales representative talk them into buying a whole life insurance. So make sure that you know the difference and know what your real need is.

Buy the right term for your term life insurance. Your agent might suggest that you buy a 10-year term policy, even if you need 20 years of coverage, so your rates will be cheaper. They suggest that you just sign up for a new 10-year policy upon expiration of the original policy. what they don't tell you is that the rates will be higher because you are older; you might have contracted an illness or disease in those ten years and can't pass the medical exam which you have to re-take, and the agent will get a new commission. Just buy the 20-year term insurance up front, if that is the amount of coverage you need.

When searching for term life insurance, always choose a strong insurance company. If your family must make a claim, it will make you rest easier knowing your insurance company will handle it fairly and efficiently. You must also make sure that the insurance company has the ability to remain solvent, so check its credit ratings with rating agencies.

There is almost always a better deal out there when it comes to life insurance. It may not be easy to find or take advantage of. Learning is the key to zeroing in on the best deals. Hopefully you are a little better informed after reading this article, and your life insurance hunt will be a little more successful.

|

|

Tips For Picking The Right Life Insurance Policy For Your Demands |

Content writer-Simon Gunter

Looking for a life insurance policy that will provide your family with sufficient funds upon your passing, can be difficult. However, by learning the most important things about life insurance, making the decision of which policy to choose, can be simple. The following article is going to give you important life insurance advice.

It is important to have a sufficient life insurance policy. You should have enough insurance to cover at least five years of your current salary, if you are married. If you have children or many debts, you should have upwards of ten years salary's worth of life insurance. Insurance will help your loved ones cover expenses when you are gone.

Try to lead a healthy lifestyle. The healthier you are the cheaper your life insurance will be as insurance providers assume that you will live longer. Remember, you will be expected to pay a high premium on a life insurance policy for anything that shortens your life expectancy, for example being overweight, smoking, taking certain medication, etc.

It's a good idea to review your life insurance policy each year to see if it still meets your needs. If you've had any big changes in your life such as a new child or the purchase of a home, you may have to modify your policy to reflect your new situation.

Purchasing term life insurance, as opposed to full-life insurance, is a wise choice for most consumers, but selecting the right term length is key. Factors to consider as you select the term is your own age, the age of your dependents, the nature of your financial commitments, as well as what you can reasonably afford. You may want to consider basing the term around fulfillment of milestone expenses like when your youngest child will have graduated from college or when the house will be fully paid off. Alternatively, many people choose a term that covers them until they can access their retirement resources. Whatever your own considerations may be, choosing your term length thoughtfully will bring many years of peace of mind.

To save some money on life insurance, pay your premiums one time a year. Many life insurance companies will charge you a little less because there usually is some type of small fee to receive the monthly bills. Just make sure you only do this if you can afford it.

If you do not have any major health problems, do not go with guaranteed issue policies. Getting a medical exam will save you money, and the guaranteed issue policies do not need that, and has higher premiums. You don't need to spend more on life insurance than is really needed.

You should beware of an advisor who claims to know everything before purchasing life insurance. https://www.marketwatch.com/story/pos-and-oop-10-h...needs-to-know-about-2018-12-19 who answers every single one of your questions without researching anything, then it's likely that he or she is incorrect about certain details. Because insurance policies are very complicated, even top-notch insurance advisors do not know everything without research.

If meeting with a live broker, always watch to see if they're recommending a policy to you after only one meeting. If so, you can bet that they're only in this to make money and aren't accurately addressing your particular needs. You should just walk away and choose another broker instead.

Hit your broker with hardball questions and take him to task for any inconsistencies in the answers. Some questions to ask include whether the policy includes premium guarantees, is renewable, and whether you can cancel the policy at any time you want to. You need to know all of these details to get the best policy.

Make sure your loved ones are taken care of while your around, and keep them cared for once you leave them. Find a policy that can definitely financially support your loved ones so they can live comfortably. It is much easier for surviving family members to cope with their loss when they know they have been cared for financially.

How do I determine the amount of life insurance to buy? The initial thing for you to consider is whether you need life insurance. If you are single, with no children or dependents, the likely answer is no. If you do purchase life insurance, you should aim to buy between five to ten times your yearly salary.

Consider purchasing another life insurance policy in addition to the coverage afforded to you by your employer. https://timesofindia.indiatimes.com/business/faqs/...-here/articleshow/68114535.cms is probably not sufficient to meet your needs, and if you decide to move on to a new job, your policy will not stay with you. It is best to make sure that you are covered no matter what.

Make the choice to buy life insurance as soon as you can. Not only do you have a better chance of being approved for a policy when you are younger, you will also pay less for the insurance because of your age. The older you are, the more difficult the entire process is.

Tips To Know Before Buying An Auto Insurance

Tips To Know Before Buying An Auto Insurance Buying an Auto Insurance can come with several caveats and hidden clauses. We list down some of the most important things that a consumer should know before they go in for the next auto insurance.

With a term policy, check for renewal guarantees. When buying a term life insurance policy, look for one that offers a renewal guarantee. This gives you the opportunity to begin a new term after the current policy ends. You will have to pay a greater premium according to your age, but you won't have to undergo a new medical examination.

Buy your life insurance when you are relatively young and healthy. If you are older, and you've had health problems, you will have a harder time getting approved, and you will pay a much higher premium. So don't wait to get your policies when you are older and think you'll be able to afford it.

As time goes by, you are going to want to make adjustments to your life insurance. You are going to use the same thought process as when you first purchased your policy. What has changed that requires a change in your policy. Maybe your kids grew up, there is less household income, or maybe you have less expenses. Whatever the case is, adjustments to your policy are inevitable and needed.

You will want to consider what you are willing to pay for your life insurance policy. Term life policies are typically more expensive than other types. Term life does have the advantage of being an easier and more dependable payout. Be careful to not end up under-insured because of costs.

Now you see that life insurance is much more than other might think. Finding the right policy will take some time and effort, but doing so is worthwhile if it protects your family. Use the advice you just read to help you find the right policy for you and your family.

|

|

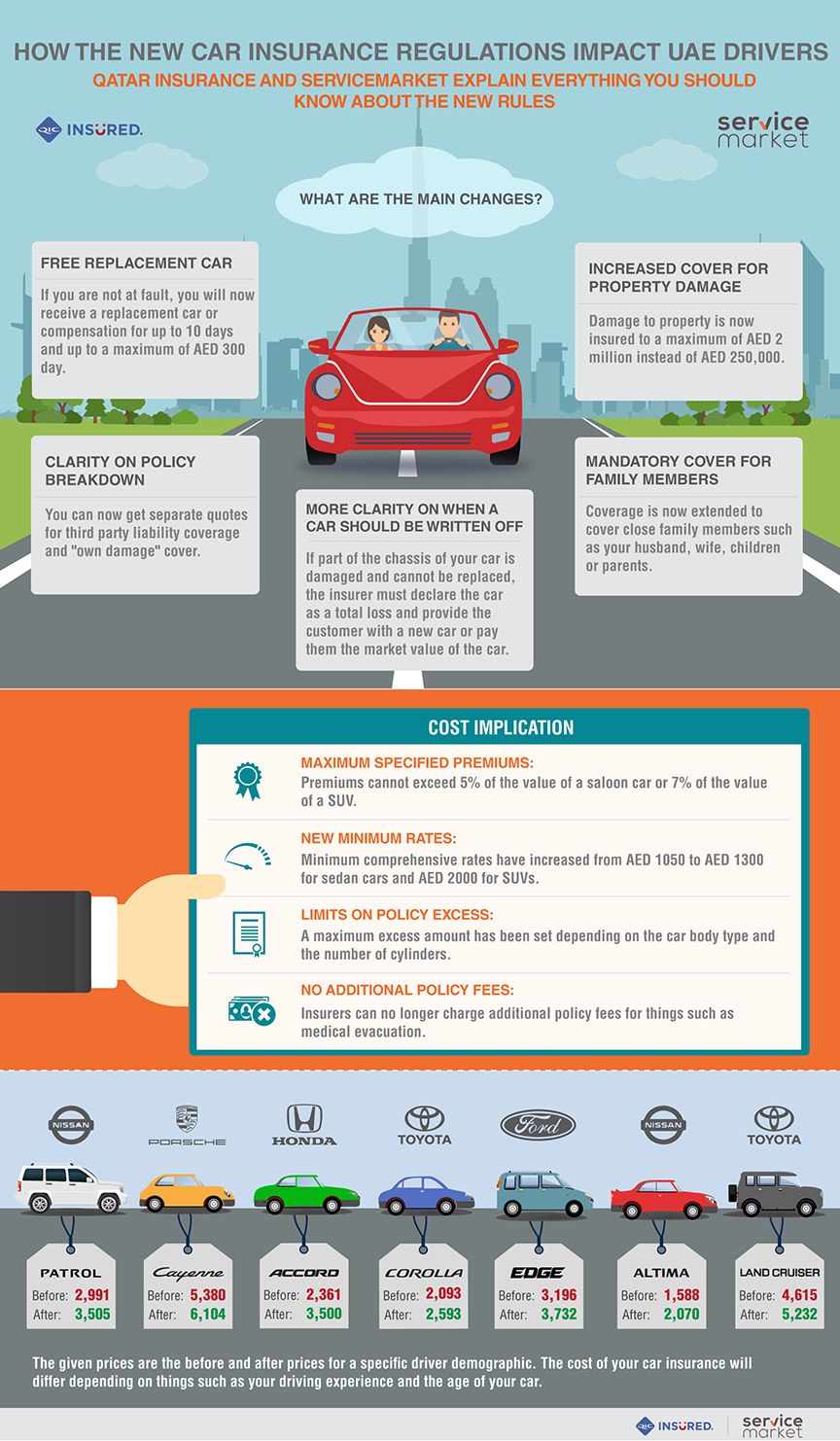

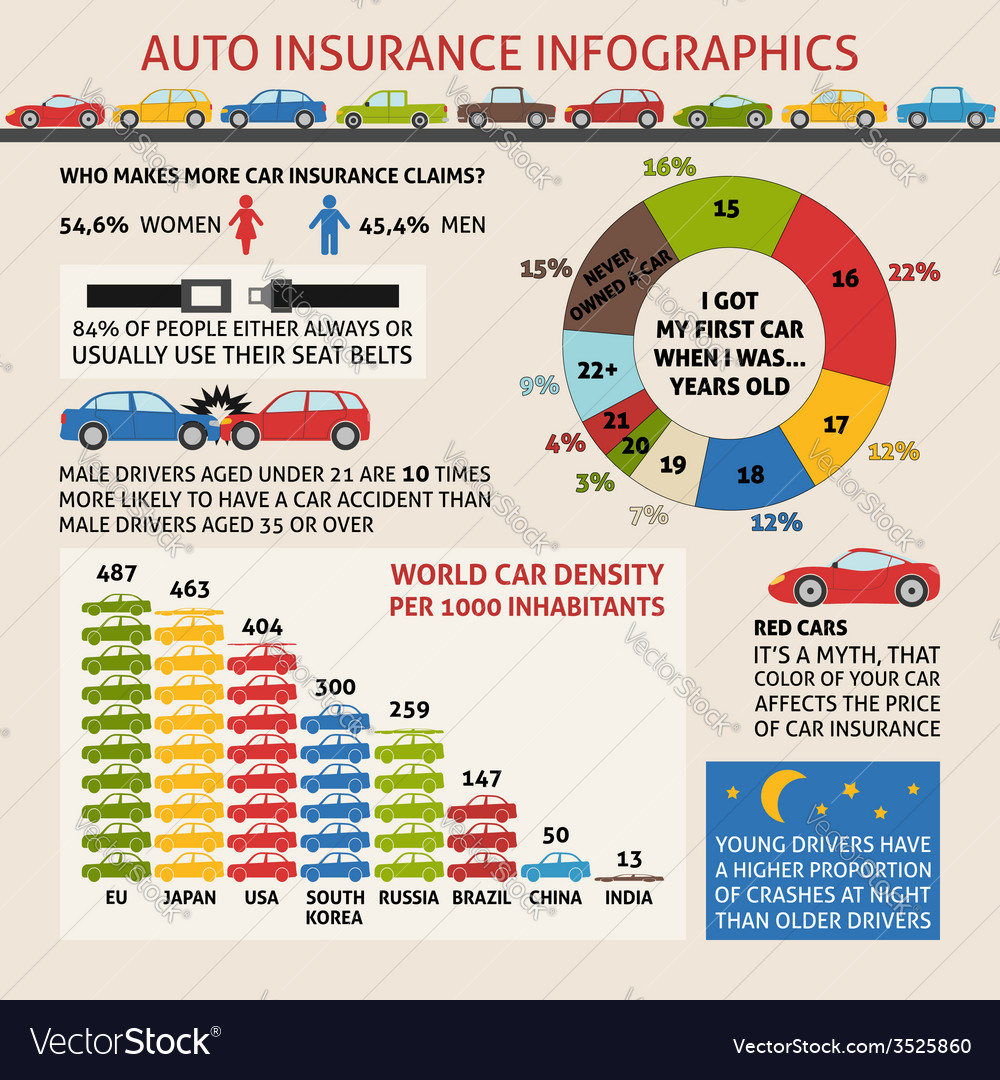

Protect Your Family With Auto Insurance Coverage Info |

Created by-Sexton McDonough

In the world of auto insurance, it is important to find the best policy for your vehicle while not wasting or losing money choosing the wrong one. That is where smart auto insurance research comes in handy. These tips can help you find the auto policy that can work for you.

Health Insurance: How to choose the right health insurance policy

Health Insurance: How to choose the right health insurance policy Even before one starts investing towards one's goals, getting an adequate health insurance cover for self and family helps.

When you are purchasing car insurance you need to know and understand all the coverage types under your policy so that you know where you are covered and what exactly you are paying for. Things like uninsured motorist protection, for example, covers injuries that you get or the people in your car get. This is used when the other driver doesn't have insurance or if there was a hit-and-run.

Saving money on auto insurance does not have to be a difficult thing, especially if you are loyal to the same company. Most policies are only for a term of around a year, so make sure you re-up with the same company. If you show loyalty to the insurer, you will be rewarded with lower monthly premium payments.

Students are usually offered a lot of discounts when it comes to auto insurance. If you're a student looking to save money on a policy, check out resident student discounts. These discounts are for students who only use their vehicles during the weekends, holidays and summer months. You can save some big money with this discount.

Better your eye focus while you are driving. Let your vision focus on something far away, such as an oncoming car, and then quickly look at your speedometer. Continue doing this as the car approaches, and every time you drive. You will eventually find that your eyes are focusing much faster than before!

Take a close look at your auto policy and take off any "extras" that you won't use. For example, you might have emergency roadside assistance included in your plan. If you don't think you are going to use this, drop it in order to decrease the amount you are spending on your insurance. Your agent can help you figure out what else might apply.

Insurance has many factors, and the cost is just one of the ones you should think about when doing research. You need to read all the language in the contract, to be aware of the deductible amounts, the coverage levels and the benefit limits.

When you report your annual driving mileage to your insurance company, resist the temptation to nudge your figure down. Lower mileage translates to lower premiums, and mileage seems to be something insurers cannot verify. But they can verify it: Insurers will use service reports to check your mileage when you submit a claim. This is the worst possible time to be in dispute with your insurer; avoid the possibility by reporting mileage honestly.

If available in your state, request a copy of your driving history before shopping for car insurance. Information can be inaccurate on it which may be causing your quotes to be higher. Make sure you know what is on your report and if you find discrepancies have them corrected as soon as possible.

If you have a good health insurance that will cover any cost linked to an injury sustained in a car accident, you can save money by dropping the medical payment features of your auto insurance. You should read carefully your health insurance policy to make sure you are covered for everything.

Take a driving class or a superior driving lesson. This will show your insurance company you are interested in safe driving or preventing accidents and lower your rates even more. Your insurance company wants to have safe drivers and will reward you for your attempt to show them you are a good driver.

Although you may think your insurance will be reasonable because you are driving an economy car, you may just have a surprise. Some cars are considered to be highly sought by thieves and if this is true of your car, you will see an increase in the price of your insurance, as well. Be sure to be aware of this when purchasing your car and consider avoiding these "hot" cars.

Look at your driving record before you get a car insurance quote. mouse click the up coming web site may be inaccurate and contain old information that does not apply to your current situation. This can lead to elevated car insurance quotes and cost you a substantial amount of money. Make sure that your driving record has correct information.

Many auto insurance companies automatically add extras, such as emergency road side assistance, legal protection, key replacement and guaranteed hire car to your policy. If you don't need these services, removing them from your policy can drop the annual cost of your auto insurance by a significant amount.

If you want to get cheap auto insurance rates as a brand new driver, one of the things that you can do is to take a pass plus. Some insurance companies can give up to 25% on discount if they know that you passed your test without any claims. This could greatly lower your insurance coverage.

Check both the crash rating and the theft rating of any new car you are interested in purchasing. Car insurance companies charge more for policies on cars they feel are at a higher risk of being stolen, or that have a bad crash rating compared to other cars with much better ratings.

It's important to understand what can happen if you are in an accident with an uninsured driver. This situation is covered with uninsured motorist protection. This coverage covers any injuries that are caused to you or the occupants of your car by an uninsured or hit-and-run driver. All policy holders indirectly contribute to this fund. Your policy would be cheaper if everybody obeyed the law and got the required cover. Still, it's good to know that you will be taken care of should an uninsured driver collide with you.

Ask https://www.nytimes.com/2019/01/30/us/politics/veterans-health-care.html for a list of all of their available discounts. Most companies will offer breaks to someone who drives 7,500 miles or less each year. In addition, using the bus or public transit to commute to work will usually lower your premiums. If you do not take the bus, you may get a discount if you carpool instead.

In conclusion, it can be trying to listen to so-called experts give you their opinion on auto insurance. The tips and tricks in this article have been widely proven time and time again. Hopefully this article will help to either clear up what you were unsure about, or give you some new information.

|

|

Find Out The Secret To Acquiring Life Insurance |

Content writer-Simon Gunter

What would you do if you were not able to provide for your loved ones anymore? Having life insurance gives you piece of mind that if the worst happens, your loved ones will not be burdened by expenses. Life insurance is relatively inexpensive and there are many different options to choose from.

When setting up a life insurance policy, be aware of the holder of responsiblity for the funds. The "adult payee" determination has no legal standing. Simply naming someone as the "adult payee" on behalf of someone else on a policy does not require the payee to spend those funds in care of the intended recipient.

Don't put off buying a life insurance policy. The older you are when you purchase the policy, the higher your premiums will be, even for the same amount of coverage. Also, if you are young and healthy, you won't have any trouble getting approved for coverage, which might be a problem as you grow older.

Life insurance is an important item to have in place, especially if you have a family that will need to be provided for after you have died. Do not leave this important issue until it is too late. Investigate a life insurance policy as soon as you are able and ensure that it is backed up with a current will.

When you are looking into life insurance, you will want to determine how much coverage you will need. While there are online calculators that will help you find a more exact figure, the easiest way to determine the amount of coverage you need is to take your annual salary and then multiply that number by eight.

Many people research life insurance on the internet to learn more about the different types of policies that are available and which one would be right for them. However, much of this information is posted by insurance companies or internet marketers that may try to steer you toward a policy that is most profitable for them. Try to conduct your research on unbiased websites such as Publications.USA.gov, which is hosted by the Federal Citizen Information Center, a U.S. government service, or AARP.org., a non-profit organization catering to people over 50 years of age.

You should understand why you need a life insurance policy. Don't just go out and buy a policy because someone told you it was a good idea. You should only purchase a life insurance policy if someone in your family, a spouse, or children, depends on your income source for support.

Take the time to update your existing life insurance policy when any relevant changes in your life take place. This includes providing for additional dependents if you get married, have children or start caring for an elderly parent. It also includes reducing your coverage if you get divorced or after your children graduate from college. If you're at an age where your previous dependents are now self-sufficient and you have enough saved for retirement, you can cancel your life insurance policy altogether.

When purchasing a life insurance policy, a great tip is to not make your insurance planning a complicated matter. You should aim to keep it as simple as possible. Since life insurance is meant to protect you, the policy you select should be the one that best fits your needs.

Be sure to tell the truth when applying for life insurance. The company you are applying for a plan with will more than likely verify that the information given on your application is the truth. Being caught in a lie with these companies could prevent you from getting life insurance.

Never wait until you actually need the coverage. This could lead to desperation and will certainly result in higher premiums and less of a package. And if you've already encountered a health issue, you might not even be able to get a good policy.

To insure that you choose the best life insurance policy, stay away from advisers who claim to be more knowledgeable about insurance companies than rating companies or who dismiss ratings as inaccurate or trivial. To file a complaint about such an agent, contact your local state insurance department or attorney general's office.

When considering life insurance think about the financial burden your family will be left with should you pass away. Calculate the amount of money they will need to be secure and to pay-off the family debt. It will take them time to get back on their financial feet, so choosing a policy with a larger pay-out might be the best choice.

Never immediately take the first policy you are offered, especially in the first meeting. If your needs aren't properly analyzed, no agent can determine the best policy for your needs. There are several types of policies and various rates that you can consider, with many factors that should be considered in the decision as well.

Why the future of life insurance may depend on your online presence

Why the future of life insurance may depend on your online presence Life insurance companies want to update their methods and make their businesses more efficient. Consumers fear their public information being misused in discriminatory ways. The nature of the industry doesn’t do anything to alleviate those fears, either, because life insurance inherently differentiates between people; different factors cause people to pay different premiums. Government regulators want to balance the interests of both customers and businesses, but it’s not going to be simple.

You should definitely customize your life insurance policy. Meet with your insurance agent and talk about the best plan possible. Even with a good plan, all your needs might be met. You can easily add riders to a policy to create new conditions under which your insurance will or will not pay out.

Before you subscribe to life insurance, you should use an insurance calculator. This tool allows you to determine how much you should pay in function of your demographics and history, but also help you compare different plans and different companies. Spend enough time comparing prices before you settle down for an insurance.

Buy the right term for your term life insurance. Your agent might suggest that you buy a 10-year term policy, even if you need 20 years of coverage, so your rates will be cheaper. They suggest that you just sign up for a new 10-year policy upon expiration of the original policy. what they don't tell you is that the rates will be higher because you are older; you might have contracted an illness or disease in those ten years and can't pass the medical exam which you have to re-take, and the agent will get a new commission. Just buy damaged cars for sale by insurance companies -year term insurance up front, if that is the amount of coverage you need.

You will want to consider what you are willing to pay for your life insurance policy. Term life policies are typically more expensive than other types. Term life does have the advantage of being an easier and more dependable payout. Be careful to not end up under-insured because of costs.

Being prepared and knowing that your family is protected should something happen to you is both responsible and loving. Take the time to look over all the information and choices that you have and decide the best policy for your family. Purchasing a life insurance policy is the greatest gift one can give to their family.

|

|

Selecting A Life Insurance Plan? Comply With These Tips! |

Article written by-Wallace Kold

There is a vast amount of knowledge when it comes to a subject like life insurance. This article here is full of tips to help expand your knowledge of life insurance. When reading this article make sure you understand and remember all of the knowledge so you can use it when making your life insurance choice.

It is important to have a sufficient life insurance policy. You should have enough insurance to cover at least five years of your current salary, if you are married. If you have children or many debts, you should have upwards of ten years salary's worth of life insurance. Insurance will help your loved ones cover expenses when you are gone.

There will come a time in your life when, if you've been lucky enough to get to that point, you will want to consider long-term care insurance. You should definitely consider it once you hit your fifties. If you become too ill or infirm to continue your current lifestyle, you will want to have a Plan B, so that you can rest assured your care needs will be covered no matter what life throws your way.

Before investing in a life insurance policy, learn the pros and cons of each of the four types. These are term life insurance, whole life insurance, universal life insurance, and variable life insurance. In order to help you understand the differences, you may want to hire a financial professional. Not only can a financial professional explain each type of life insurance to you, but he or she can suggest which one best suits your needs.

If you do not understand the lingo that comes with a life insurance policy, hire a local life insurance agent. They can explain the terms of your policy so that you are not buying into a policy that is wrong for you. Usually, these agents do not charge a lot of money.

Before purchasing life insurance, you must understand that insurance is for protection purposes only, which does not include investing. Term insurance gives you protection only, with no savings. Whole life and universal policies offer savings, but they are a lot more expensive and you would be better off using the cost savings to invest in something else.

If you are looking to get life insurance, it is most important to understand why you need it. It is used to give families financial support upon the death of a spouse or parent. If there isn't anybody relying on your support right now, then you can just get a starter policy if you feel your situation may change in the future.

Take the time to update your existing life insurance policy when any relevant changes in your life take place. This includes providing for additional dependents if you get married, have children or start caring for an elderly parent. It also includes reducing your coverage if you get divorced or after your children graduate from college. If you're at an age where your previous dependents are now self-sufficient and you have enough saved for retirement, you can cancel your life insurance policy altogether.

Be careful that you read the fine print on any insurance policy. A lot of policies containing clauses that state the insurance company can raise your rates for anything from a minor discrepancy to no reason whatsoever. They've been doing this for years, so make sure you don't fall victim to it.

What amount of life insurance should you buy? Before you ask yourself that question, determine if you even need life insurance. For example, a young, unmarried person with no kids has little reason to buy life insurance. https://www.kqed.org/news/11698852/6-things-to-kno...ornia-open-enrollment-for-2019 is to have a policy that covers your annual salary between 5 to 10 times over.

If you want to ensure you have cheap life insurance premiums, you should purchase a term insurance plan rather than a whole life plan. A term insurance policy is purchased for a specific amount of time; therefore, because of the smaller risks, the premiums will be cheaper than a riskier whole life plan that lasts for the entire life of the policy holder.

Understand that most life insurance companies offer a range of different payment options to your beneficiaries. If you think those you leave behind would be better off receiving periodic payments, then this is something you have to decide now. You can choose to give the lump sum or to break it up.

Here is a simple way to calculate how much your life insurance should cover: ask yourself how much you earn in a year, and multiply this amount by how many years you want your family to benefit from this same income. You should add to this amount how much you expect your funeral and related expenses to cost.

Make the choice to buy life insurance as soon as you can. Not only do you have a better chance of being approved for a policy when you are younger, you will also pay less for the insurance because of your age. The older you are, the more difficult the entire process is.

Is Your Life Insurance Really Life Assurance for Your Dependents?

Is Your Life Insurance Really Life Assurance for Your Dependents? Buying a Life Insurance policy is an important decision in the course of your financial planning. The very initiation of the process involves your taking a call on the insurance policy to buy. simply click the following web site depends on your objectives and financial goals in the light of your financial status, capacity to pay and your projected economic future. You have to further set your projected milestones for necessary financial allocation.

Make sure your loved ones are taken care of while your around, and keep them cared for once you leave them. Find a policy that can definitely financially support your loved ones so they can live comfortably. It is much easier for surviving family members to cope with their loss when they know they have been cared for financially.

Remember that the whole point of a life insurance policy is that your dependents will be able to still enjoy their current lifestyle and cost of living if you die. That means that you need to buy enough coverage to make that a real possibility. Do the math and decide what that equals out to.

Avoid mortgage insurance policies, when you are considering how to take care of your estate. These policies are a losing proposition as you pay off your mortgage debt from year to year. You are much better off buying a life insurance policy that will cover your mortgage in the event of your death.

If you have children, you should definitely consider life insurance. Perhaps you can apply for an end term insurance that will cover the first twenty years of your child's life. If the worst should happen, your child will be able to go through college and get a good start in life thanks to the policy you subscribed to.

If buying a life insurance policy is in your future you should make sure you are well educated as to the options available to you. If you just settle for the first option you'll likely miss many other great offers. Learn how to shop for life insurance and you'll find your family in good hands should the unfortunate happen.

|

|

Thinking About Buy Life Insurance? This Recommendations Can Help! |

Written by-Everett Kudsk

There is a vast amount of knowledge when it comes to a subject like life insurance. This article here is full of tips to help expand your knowledge of life insurance. When reading this article make sure you understand and remember all of the knowledge so you can use it when making your life insurance choice.

When considering life insurance, be sure to adopt a healthy lifestyle, as this will greatly effect your rates. Give up smoking and lose weight. Be sure to be forthcoming with this information, as well as any other healthy activities that you can name. Your rate is often time negotiable.

Certain insurers could offer premiums approximately 40% lower than other ones. Use an online service to compare quotes from different insurers, and be sure you choose a website that will adjust your quotes for your medical history.

Look for the lowest possible commission when you buy a life insurance policy. The commission goes to an insurance broker and then you have to pay that cost in premiums. You may be able to find a company that offers insurance without an agent's commission being added to it. If so, this will lower your premium.

It's important that you understand that term life insurance is only for protection and not for investing. There is no savings component in term life insurance, so your best bet here is to simply pay for this type of insurance and invest elsewhere. Your policy payments aren't collecting interest or anything.

Make adjustments on your plans as needed. Life changes to your policy can greatly affect it. Things that can cause a change to coverage, include marriage, divorce, birth of a child or the beginning of caring for an elderly parent. You could even reach a point, most likely after your kids reach adulthood and your retirement amount is achieved, where you could stop life insurance coverage altogether.

Your insurance agent may try to sell you additional riders to add to your life insurance policy. However, these are often unnecessary, so make sure you fully understand the purpose of each one before deciding if it would benefit you. For example, a family benefit rider allows for your death benefit to be paid in monthly increments rather than one lump sum, so your family receives a steady source of income.

Annual premiums are better than monthly ones, if it is possible for you to pay that way. just click for source to save money is paying the annual premium.

When buying term life insurance, make sure the duration of your policy matches the amount of time you need it. For example, buy term insurance that stays in force long enough until the kids become independent and also, that the remaining spouse has coverage until he or she, becomes eligible for retirement income.

The last thing your life insurance has to be is complicated. Make sure that you're always keeping things as simple as possible. If and when you pass on, your family should be able to get the money quickly without anything there to hold the payments back. The simpler things are, the easier the money comes in.

If you have an old whole-life policy that you've had for several years, you should not attempt to replace it. The reason is because you could lose the premiums you have paid, and you could have to pay new administration fees. If you need more insurance on a whole-life policy, then you should just purchase more instead of discarding your current policy.

https://www.benzinga.com/money/best-short-term-health-insurance/ should avoid adding on riders to your life insurance policy unless you absolutely need them. One reason is you need to fully understand what they are before you even consider it, which most people do not. A second reason is this can be very expensive and is not guaranteed to add much value to your end policy.