What Does a Public Insurance adjuster Do And Also Just How Can They Assist You? |

Content create by-Kruse McLain

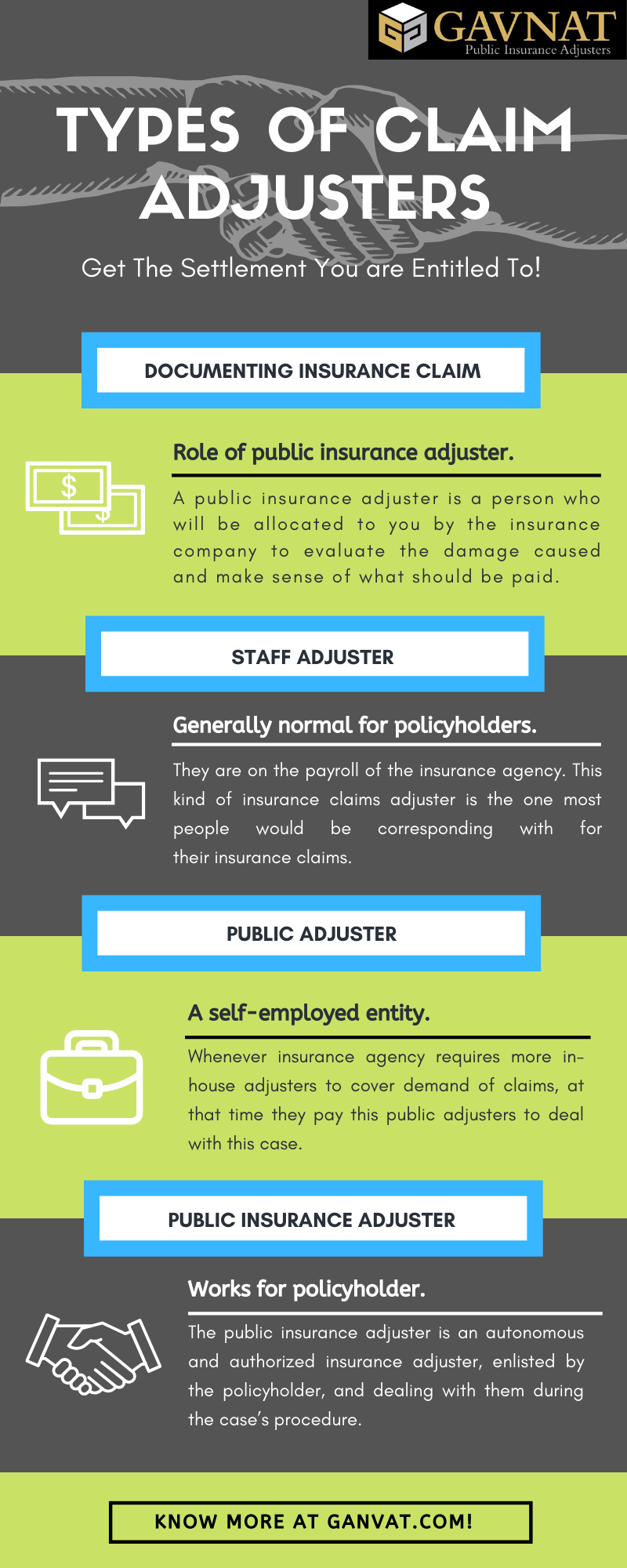

Public insurance adjusters are independent public agents who work for insurance firms to help individuals acquire all that they are qualified to from insurance disagreements. They aid in assessing repair as well as restoring expenses, keep track of the circulation of insurance proceeds and claims, and connect with residence insurance coverage providers to speed up their claim authorizations. They do not represent any specific business or specific as well as can not represent more than one insurance provider. Their costs are normally figured out by the quantity of damages, loss, or devastation that took place. Insurance policy agents likewise obtain a portion of the last negotiation or award quantity if they work out settlement supplies with an insurance coverage company.

Insurance policies give public insurance adjusters with the authority to get in exclusive facilities when required in order to assist an insured client with insurance policy issues. Insurance suppliers normally call for public insurance adjusters to go into exclusive properties in order to refine a case. In case an insurance policy holder breaks this guideline, they can be held directly accountable for the expenses of damages they cause. Additionally, they might face severe lawful consequences for neglecting the rights of others in their organization.

Insurance coverage premiums and also loss settlements vary substantially from one state to another. The price of insurance protection varies according to each insurance firm's risk aspects and costs. more info may decline to issue a policy or cost greater premiums than required if a public insurer is not used to refine a case. If an insured individual does not have enough proof of loss to sustain a negotiation, they might not be qualified to recover funds.

Insurance providers use a number of approaches to figure out the amount of the loss that need to be supported in a negotiation. Normally, insurers use an estimate of the substitute costs that arise from the date of loss. Estimations are prepared based upon historical data. In order to get estimates from numerous various companies, a client ought to speak to multiple insurance suppliers. A certified public adjuster will normally consult with an insured customer to review the specifics of their insurance claim. The insured representative will certainly then give the information needed in order to refine the claim.

The extent of the work carried out by a public insurer differs relying on the cases background of the guaranteed. Often https://en.gravatar.com/jfpublicadjusters1 will certainly involve substantial residential property damage. Other times the job will certainly focus on more economical sources of loss.

The size of the loss ought to figure out the amount of funds that should be paid by the insurance adjuster. Insurance policy claims entailing building damage typically involve big quantities of cash. Insurance companies will often need home owners to provide extensive proof of loss prior to a settlement can be agreed upon.

In order to sustain an insurance policy claim, it is required for the insurer to have affordable proof of a loss. Often times a loss of this nature may require months or perhaps years to get to a negotiation. Insurance service providers are not required to wait till a certain amount of time has come on order to send such proof. However, a request needs to be submitted within a practical amount of time in order for a case to be taken into consideration affordable.

When there is a loss entailing personal effects, a house owner or various other property owner might agree with the insurance adjuster to become part of an arrangement. Such an agreement can define what harms the insured is accountable for covering. The terms and conditions of the agreement can differ significantly. It is very important that property owners make themselves aware of any type of arrangements they become part of with their adjusters. A request for such info ought to be made to the insurance adjuster any time throughout the claim process. The terms set can influence the settlement in several ways.

| Комментировать | « Пред. запись — К дневнику — След. запись » | Страницы: [1] [Новые] |