Enhancing Your Wide Range: An Extensive Method To Financial Investment Monitoring |

Personnel Writer-Erlandsen Short

When it comes to expanding your riches via investment monitoring, the path to success hinges on a holistic technique that thinks about different aspects. From risk analysis to profile diversification and maximizing returns, there's a tactical method behind every choice. By recognizing just how risk resistance shapes your investment choices, you lay a strong structure. However what regarding navigating the complexities of diversification and taking full advantage of returns? Stay tuned to uncover the crucial elements that can elevate your wide range monitoring game to brand-new heights.

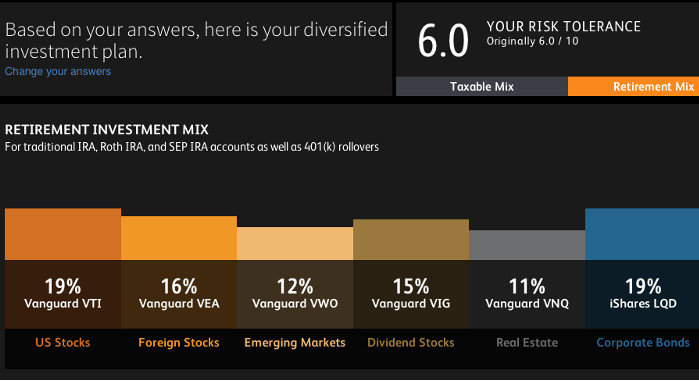

Understanding Threat Resistance

When evaluating your investment choices, recognizing your danger tolerance is critical for making notified decisions. Your risk tolerance refers to just how much market fluctuations and potential losses you fit with in your investment profile.

It's important to evaluate your danger resistance honestly to straighten your investments with your monetary objectives and emotional convenience level. Variables such as your age, financial obligations, financial investment timeline, and general monetary scenario play a significant duty in establishing your threat resistance.

To assess your threat tolerance accurately, take into consideration exactly how you 'd feel and react in various market circumstances. Are you happy to endure temporary losses for potentially higher lasting gains, or do you like extra secure, conventional financial investments?

Comprehending your threat resistance will certainly help you choose financial investments that line up with your convenience degree and financial purposes, inevitably leading to a well-balanced and varied portfolio. Keep in linked web page , it's crucial to periodically reassess your threat tolerance as your financial circumstance and objectives advance gradually.

Diversifying Your Portfolio

Understanding the importance of expanding your profile is vital for taking care of threat and making the most of possible returns in your financial investments. Diversification entails spreading your financial investment across various possession courses, sectors, and geographic areas to reduce the impact of any kind of solitary investment's efficiency on your overall portfolio. By diversifying, you can possibly decrease the volatility of your portfolio and lessen the threat of significant losses.

When you expand your profile, you're essentially not placing all your eggs in one basket. As an example, as opposed to investing all your money in one stock, you can spread your financial investments across stocks, bonds, property, and various other properties. By doing this, if one field experiences a downturn, the other financial investments in your profile can assist offset potential losses.

In addition, diversity can additionally aid you record opportunities for development in different market sections. By having a well-diversified portfolio, you can enhance your chances of accomplishing much more stable returns over the long-term while managing danger efficiently.

Making the most of Returns

To make best use of returns on your financial investments, consider implementing approaches that straighten with your financial objectives and risk tolerance. One effective approach is to diversify your financial investment profile throughout various property courses such as stocks, bonds, property, and products. By spreading your financial investments across different types of assets, you can decrease the danger of substantial losses in case one field underperforms.

An additional means to make the most of returns is to on a regular basis evaluate and rebalance your profile. Market changes can cause your possession allowance to differ your initial strategy. By rebalancing, you guarantee that your profile continues to be lined up with your investment purposes and risk tolerance.

Furthermore, take into consideration purchasing tax-efficient accounts such as IRAs and 401( k) s to minimize the impact of taxes on your investment returns. Keeping a long-term point of view and preventing emotional decisions during market volatility can also help you attain higher returns on your financial investments.

Verdict

In conclusion, by understanding your risk resistance, expanding your profile, and making the most of returns, you can take a comprehensive method to expanding your wealth.

Bear in mind to frequently assess and rebalance your portfolio, and maintain a lasting viewpoint to attain your economic objectives.

With the appropriate methods in position, you can navigate market fluctuations and make educated decisions that line up with your comfort level and goals.

Financial Advisement focused, remain diversified, and watch your wide range grow.

Engage In The Detailed World Of Financial Investment Management, Where The Critical Use Of Diversity And The Pursuit Of Maximizing Returns Are Crucial In Unlocking Economic Success |

Web Content Writer-Bager Honore

When it involves growing your wide range via financial investment management, the course to success lies in an all natural technique that thinks about numerous factors. From danger assessment to profile diversification and enhancing returns, there's a tactical technique behind every choice. By recognizing exactly how threat tolerance forms your investment selections, you lay a solid foundation. However what concerning navigating the complexities of diversity and maximizing returns? Keep tuned to discover the essential parts that can raise your riches monitoring video game to brand-new elevations.

Comprehending Danger Resistance

When assessing your investment choices, comprehending your threat tolerance is important for making informed choices. Your threat tolerance refers to just how much market changes and prospective losses you're comfortable with in your financial investment portfolio.

It's necessary to examine your threat resistance truthfully to align your financial investments with your financial objectives and emotional comfort level. Elements such as your age, economic responsibilities, financial investment timeline, and overall financial situation play a significant duty in establishing your threat resistance.

To analyze your risk resistance precisely, take into consideration just how you 'd really feel and respond in different market circumstances. Are you happy to stand up to temporary losses for possibly higher lasting gains, or do you prefer much more secure, traditional investments?

Comprehending your danger resistance will aid you select financial investments that align with your convenience level and economic objectives, ultimately bring about a well-balanced and varied portfolio. Keep in mind, it's essential to periodically reassess your danger tolerance as your economic scenario and goals develop gradually.

Expanding Your Profile

Understanding the value of diversifying your portfolio is essential for handling risk and optimizing potential returns in your investments. click the up coming web page entails spreading your investment throughout different asset classes, industries, and geographical regions to minimize the impact of any kind of solitary financial investment's efficiency on your total profile. By expanding, you can potentially reduce the volatility of your profile and lessen the risk of significant losses.

When you expand your profile, you're basically not placing all your eggs in one basket. For example, instead of spending all your cash in one stock, you can spread your investments across supplies, bonds, real estate, and various other assets. By doing this, if one sector experiences a downturn, the other financial investments in your profile can help counter potential losses.

Furthermore, diversity can also assist you record opportunities for development in various market sectors. By having a well-diversified portfolio, you can enhance your possibilities of achieving extra steady returns over the long-term while managing risk successfully.

Optimizing Returns

To maximize returns on your investments, think about implementing methods that line up with your financial goals and run the risk of resistance. One effective approach is to diversify your financial investment portfolio across various asset classes such as stocks, bonds, realty, and products. By spreading your investments across different kinds of possessions, you can reduce the risk of significant losses in case one sector underperforms.

One more way to take full advantage of returns is to consistently evaluate and rebalance your profile. Market fluctuations can cause your property allotment to deviate from your initial plan. By rebalancing, you ensure that your portfolio remains straightened with your investment objectives and run the risk of tolerance.

In addition, think about purchasing tax-efficient accounts such as Individual retirement accounts and 401( k) s to minimize the effect of tax obligations on your investment returns. Maintaining a lasting viewpoint and staying clear of psychological choices during market volatility can additionally assist you attain greater returns on your investments.

Conclusion

To conclude, by understanding your danger resistance, diversifying your portfolio, and optimizing returns, you can take a thorough method to expanding your riches.

Bear in mind to regularly assess and rebalance your portfolio, and keep a long-lasting viewpoint to achieve your financial objectives.

With https://mgyb.co/s/KyEZv in position, you can browse market variations and make informed decisions that straighten with your comfort level and objectives.

Keep concentrated, stay varied, and see your riches grow.

Check Out The Vast Selection Of Easy Earnings Possibilities Beyond The Horizon And Learn Exactly How To Create Your Own Trip Towards Financial Independence |

Posted By-Cross Valdez

As you browse the world of passive income and methods for monetary freedom, you'll find yourself at an important crossroads where decisions form your economic future. The appeal of earning while you rest is enticing, yet the path to real financial security needs careful preparation and notified selections. By discovering the subtleties of passive income generation and applying tailored methods, you are laying the foundation for a more safe tomorrow. So, as you ponder the possibilities that await, consider this overview as your compass in the trip towards monetary independence.

Comprehending Passive Income Basics

To attain monetary self-reliance, recognizing the fundamentals of passive earnings is crucial. Easy income is money made with marginal initiative with resources like rental properties, financial investments, or online organizations. Unlike energetic earnings, which calls for constant time and effort, easy revenue permits you to make money while you sleep or concentrate on various other quests.

By setting up streams of passive income, you can produce a constant capital that helps you achieve monetary stability and liberty.

One vital aspect of easy revenue is that it needs a preliminary investment of time, cash, or both. Whether it's purchasing a rental property, investing in dividend-paying stocks, or creating an online training course, there's typically an ahead of time commitment required to get the easy earnings stream up and running. Nonetheless, as soon as developed, these resources of easy earnings can provide a reliable source of earnings in time, aiding you construct wealth and protect your financial future.

Recognizing these essentials is crucial for anyone looking to break free from the typical paycheck-to-paycheck cycle and work towards monetary independence.

Exploring Various Passive Earnings Streams

Take into consideration exploring various passive income streams to diversify your sources of revenue and improve your economic security. Ways To Earn Passive Income is crucial to building a robust easy revenue portfolio.

One alternative is investing in dividend-paying stocks, where you can earn routine earnings based on the company's earnings. Property investments, such as rental buildings or crowdfunded real estate projects, can likewise supply a consistent stream of easy income.

Another avenue to check out is developing and selling electronic products like e-books, online training courses, or supply digital photography. Peer-to-peer lending platforms supply a means to gain interest by lending cash to people or organizations.

Additionally, affiliate advertising and marketing enables you to make compensations by promoting other firms' products. Do not neglect the possibility of developing a YouTube channel or a blog site to create passive revenue with ads, sponsorships, and associate advertising and marketing.

Implementing Passive Income Techniques

Explore functional steps for executing passive income strategies to increase your journey in the direction of economic freedom. Beginning by setting clear objectives and specifying the passive income streams that line up with your interests, skills, and resources. Research various passive income possibilities such as realty financial investments, dividend-paying stocks, or producing electronic items like e-books or online courses. As soon as you have recognized possible streams, establish an in-depth plan detailing just how you'll produce easy revenue from each source.

Next, act by spending time and effort into building and growing your passive income streams. This may involve producing a blog or YouTube network, acquiring rental buildings, or buying stock exchange index funds. Uniformity is essential to success in easy income generation, so see to it to frequently keep track of and change your approaches as needed.

Automate as much of the process as feasible by leveraging devices and modern technology to simplify your passive revenue streams. Usage automation software for email marketing, work with online assistants to manage routine jobs, or set up automated payments for passive investments. By carrying out these methods efficiently, you can produce a sustainable resource of passive revenue that will certainly remain to expand over time.

Final thought

Congratulations on taking the primary step towards economic freedom by learning more about passive earnings techniques!

By comprehending https://drive.google.com/file/d/1sHhq6nxPujtzxAM7UMbVu1ckzmegE1F1/view?usp=sharing , discovering various streams, and applying these methods, you're well on your means to developing a lasting income resource with minimal initiative.

Maintain setting clear objectives, performing research study, and investing effort and time into creating your passive earnings streams.

With dedication and persistence, you can accomplish your objective of monetary stability and self-reliance.

Best of luck on your journey!

The Mission For Financial Freedom: Browsing The Online Money-Making Landscape |

Write-Up Produced By-Oh Jorgensen

When it concerns accomplishing monetary flexibility with on-line methods, the possibilities are endless. You might be surprised by the varied variety of possibilities awaiting you in the vast electronic landscape. From e-commerce endeavors to freelance jobs, each path uses one-of-a-kind prospects that can lead the way to a much more protected monetary future. By purposefully navigating this realm, you can unlock the possibility for not just stability yet also development. So, are you all set to discover the boundless horizons of making money online and uncover the key to your monetary freedom?

Expanding Income Streams

To optimize your on the internet revenues, think about diversifying your earnings streams to secure multiple resources of profits. Counting entirely on one source of income can be risky in the ever-changing landscape of the digital world. By spreading your incomes throughout different systems or ventures, you not only guard on your own against possible downturns in one location but likewise open up chances for raised profits.

One way to diversify your revenue streams is by discovering various online platforms such as ecommerce websites, freelancing systems, or affiliate advertising and marketing. Each platform offers one-of-a-kind possibilities to generate earnings, permitting you to tap into different markets and audiences. Additionally, you can think about creating and offering electronic items, providing on-line programs or seeking advice from solutions, and even delving right into easy earnings streams like buying supplies or real estate.

Structure an Online Visibility

Consider developing a strong on-line visibility to enhance your visibility and reach in the electronic realm. Building a solid online visibility includes creating and keeping a site or blog that showcases your competence, passions, or items. Your on the internet system acts as a digital store, attracting potential clients, consumers, or followers.

Make Read the Full Article of social media networks like Facebook, Instagram, Twitter, and LinkedIn to engage with a more comprehensive target market and drive website traffic to your web site. Consistency in posting top quality material and connecting with your audience is key to building a dedicated following.

In addition to social networks, consider guest publishing on various other internet sites or teaming up with influencers in your particular niche to broaden your reach. Networking within on-line communities and participating in appropriate discussion forums can likewise help establish your credibility and enhance your online presence. Bear in mind to enhance your website for online search engine (SEARCH ENGINE OPTIMIZATION) to improve your exposure in online searches.

Monetizing Your Abilities

If you have beneficial abilities, there are numerous means to turn them right into a source of income online. Whether you excel in composing, visuals style, programs, advertising, or any other ability, there's a need for your expertise in the electronic globe.

One popular way to monetize your skills is by freelancing on platforms like Upwork, Freelancer, or Fiverr. These websites attach you with customers seeking certain solutions, enabling you to display your abilities and generate income on a job basis.

Furthermore, you can produce and market electronic items associated with your skills. As an example, if you're a talented professional photographer, you can offer supply pictures, Lightroom presets, or digital photography overviews online. If you have a knack for teaching, you could provide on the internet training courses or tutorials on platforms such as Udemy or Teachable.

One more choice is to supply consulting services based upon your know-how through video calls or email document.

Generate Passive Income Online , by diversifying your earnings streams, building a solid online visibility, and monetizing your skills, you can lead the way to economic flexibility.

Welcome the opportunities that the on the internet globe offers, and take proactive actions to maximize your making potential.

With decision and strategic preparation, you can accomplish long-lasting security and adaptability in your monetary journey.

Start discovering the endless possibilities of making money online today to protect your financial future.

The Roadway To Financial Freedom: Checking Out Online Income Opportunities |

Authored By-Hogan Stougaard

When it involves attaining monetary liberty through on-line avenues, the possibilities are endless. You might be stunned by the diverse range of possibilities awaiting you in the large digital landscape. From shopping ventures to freelance jobs, each course offers distinct leads that can lead the way to a more safe financial future. By tactically browsing this world, you can unlock the capacity for not simply stability but also development. So, are Legit Ways To Earn Money From Home set to discover the limitless horizons of making money online and find the secret to your financial self-reliance?

Diversifying Earnings Streams

To optimize your on the internet revenues, consider diversifying your income streams to secure numerous sources of income. Depending exclusively on one income source can be high-risk in the ever-changing landscape of the digital world. By spreading your earnings throughout different platforms or endeavors, you not only secure yourself versus potential declines in one location but also open up opportunities for enhanced profits.

https://www.shopify.com/blog/how-to-sell-photos-online to diversify your earnings streams is by discovering different online systems such as ecommerce websites, freelancing platforms, or affiliate advertising. Each platform supplies unique opportunities to generate income, enabling you to tap into different markets and audiences. In addition, you can think about creating and offering electronic items, supplying online courses or seeking advice from services, or even diving right into easy earnings streams like investing in stocks or real estate.

Structure an Online Visibility

Think about establishing a strong on the internet presence to enhance your visibility and reach in the electronic realm. Developing a solid online existence involves developing and keeping a site or blog that showcases your experience, interests, or items. Your online system acts as an online storefront, bring in possible clients, consumers, or fans.

Use social media sites channels like Facebook, Instagram, Twitter, and LinkedIn to involve with a more comprehensive target market and drive website traffic to your site. Uniformity in publishing quality content and communicating with your target market is essential to building a faithful following.

In addition to social networks, take into consideration guest posting on various other internet sites or teaming up with influencers in your specific niche to expand your reach. Networking within on the internet areas and joining pertinent online forums can likewise aid develop your reliability and raise your online presence. Keep in mind to enhance your internet site for online search engine (SEO) to improve your presence in online searches.

Monetizing Your Skills

If you have useful abilities, there are numerous means to turn them into an income source online. Whether you master writing, visuals style, shows, advertising, or any other skill, there's a demand for your experience in the electronic globe.

One prominent method to monetize your abilities is by freelancing on platforms like Upwork, Consultant, or Fiverr. These sites link you with clients looking for specific services, enabling you to display your abilities and generate income on a task basis.

In addition, you can produce and market electronic products related to your skills. For instance, if you're a skilled professional photographer, you could sell stock images, Lightroom presets, or photography overviews online. If you have a propensity for mentor, you could supply online training courses or tutorials on systems such as Udemy or Teachable.

An additional choice is to give consulting solutions based upon your knowledge with video clip calls or email correspondence.

Verdict

To conclude, by expanding your revenue streams, developing a strong on the internet visibility, and monetizing your skills, you can pave the way to monetary liberty.

Embrace the opportunities that the on-line globe deals, and take proactive steps to maximize your making possibility.

With determination and calculated planning, you can achieve long-term security and adaptability in your economic trip.

Start discovering the limitless possibilities of generating income online today to safeguard your monetary future.

Mystery Awaits As You Uncover The Diverse And Promising Opportunities To Make Money Online - Are You All Set To Confiscate The Digital Chances? |

Short Article Composed By-Reddy Blackburn

As you browse the vast realm of on the internet opportunities, a globe of prospective waits for those with the understanding to take it. From freelancing to e-commerce and affiliate marketing, the opportunities to create income vary and promising. Online Side Business Ideas supplies one-of-a-kind benefits and possibilities for development. By taking click this link in the direction of exploring these online endeavors, you might find yourself on a journey towards monetary success and freedom in the digital landscape.

Freelancing Opportunities

If you're seeking to make money online, freelancing provides a flexible and profitable alternative. As a consultant, you have the liberty to choose your tasks, set your rates, and work from anywhere. Platforms like Upwork, Consultant, and Fiverr connect you with clients seeking a vast array of services, from creating and visuals layout to programs and digital advertising.

To prosper in freelancing, it's important to display your abilities effectively through an engaging profile and portfolio. Highlight your expertise, past work examples, and customer endorsements to attract potential customers. Constructing a solid on the internet existence via social media sites and specialist networking websites can additionally help you reach a larger audience and safeguard even more projects.

Handling your time and financial resources effectively is vital when freelancing. Set clear objectives, produce a routine, and track your revenue and expenditures to guarantee you stay organized and profitable. By supplying premium job, preserving good interaction with customers, and constantly improving your skills, you can build a successful freelancing occupation and attain monetary independence.

Ecommerce Ventures

To broaden your online earning prospective past freelancing, think about venturing right into shopping for new possibilities in marketing products or services directly to customers. Shopping uses a system to reach a larger target market and generate earnings with on the internet sales. Establishing an on-line shop is simpler than ever before with various systems like Shopify, WooCommerce, or Etsy that offer user-friendly interfaces for creating a virtual storefront.

When beginning your e-commerce venture, it's essential to determine a niche market or item that straightens with your rate of interests and has need out there. Conduct comprehensive marketing research to understand your target market's requirements and choices, allowing you to customize your offerings as necessary. Additionally, invest in creating top notch product pictures and descriptions to bring in potential clients and raise sales.

Furthermore, take into consideration integrating electronic marketing approaches such as social media advertising, search engine optimization (SEO), and e-mail marketing to drive traffic to your on-line store and improve exposure. By leveraging the power of shopping, you can tap into a lucrative online market and maximize your earning capacity.

Affiliate Advertising And Marketing Strategies

Wondering exactly how to increase your online incomes via affiliate advertising methods? Look no further! To optimize your revenues, it's necessary to choose the best affiliate programs that straighten with your niche. Picking services or products that resonate with your audience will substantially enhance your possibilities of success.

Next, concentrate on producing top notch web content that promotes these affiliate products normally. Whether it's through involving article, insightful video clips, or engaging social media updates, offering value to your audience is crucial. By developing trust fund and credibility, you'll enhance the possibility of conversions.

Furthermore, utilize numerous advertising and marketing channels to reach a more comprehensive audience. Try out e-mail campaigns, search engine optimization strategies, and social networks advertising to drive web traffic to your affiliate links. Bear in mind, consistency is type in keeping and expanding your associate advertising earnings.

Last but not least, evaluate your performance on a regular basis to determine what approaches are functioning best for you. By monitoring metrics such as click-through rates, conversion rates, and compensation earnings, you can refine your technique and maximize your outcomes. With commitment and calculated application, you can open the complete potential of affiliate advertising and marketing and increase your on the internet earnings significantly.

Final thought

You've now seen the diverse series of opportunities readily available to make money online.

Whether you select freelancing, ecommerce, or associate advertising and marketing, there's capacity for economic development and success in the digital world.

By exploring these opportunities and putting in the initiative, you can unlock lucrative chances and develop a sustainable income stream.

So go on, dive in, and begin earning money online today!

Delve Into The Ultimate Source For Generating Passive Income: Approaches For Getting Financial Self-Reliance |

Post By-Crews Clapp

As you navigate the world of easy earnings and methods for financial freedom, you'll find yourself at a crucial crossroads where decisions shape your economic future. The appeal of gaining while you rest is tempting, yet the path to real economic stability requires careful planning and notified selections. By uncovering the nuances of easy revenue generation and carrying out tailored methods, you are laying the foundation for an extra secure tomorrow. So, as you consider the possibilities that await, consider this overview as your compass in the journey towards financial freedom.

Understanding Easy Earnings Essentials

To attain monetary self-reliance, comprehending the essentials of easy income is critical. Easy income is money earned with very little effort with sources like rental residential or commercial properties, investments, or online businesses. Unlike energetic earnings, which needs constant effort and time, passive revenue permits you to make money while you sleep or concentrate on other quests.

By establishing streams of passive earnings, you can create a consistent capital that aids you achieve economic stability and flexibility.

One vital aspect of passive earnings is that it requires an initial financial investment of time, cash, or both. Whether it's buying a rental building, purchasing dividend-paying stocks, or creating an on-line training course, there's usually an in advance commitment required to obtain the passive income stream up and running. However, when developed, these resources of passive income can give a reliable source of profits in time, helping you develop wide range and secure your financial future.

Understanding these fundamentals is important for anybody aiming to damage without the typical paycheck-to-paycheck cycle and job towards monetary self-reliance.

Exploring Different Passive Income Streams

Consider discovering various easy revenue streams to diversify your resources of revenue and improve your economic stability. Diversification is crucial to developing a durable easy earnings profile.

One alternative is buying dividend-paying stocks, where you can gain normal revenue based on the business's profits. Realty investments, such as rental homes or crowdfunded real estate tasks, can also offer a steady stream of passive income.

visit this hyperlink to discover is creating and marketing electronic items like e-books, on-line training courses, or supply digital photography. Peer-to-peer lending platforms provide a method to gain interest by providing money to individuals or services.

In addition, affiliate advertising and marketing allows you to make commissions by advertising other firms' items. Don't ignore the possibility of producing a YouTube network or a blog site to create easy income through ads, sponsorships, and associate advertising and marketing.

Implementing Passive Income Approaches

Explore practical actions for implementing passive earnings approaches to accelerate your journey in the direction of financial self-reliance. Start by setting clear objectives and specifying the easy income streams that straighten with your rate of interests, skills, and resources. Study click this link as real estate investments, dividend-paying supplies, or developing digital items like ebooks or on-line programs. When you have actually identified possible streams, create a comprehensive strategy detailing just how you'll create easy earnings from each source.

Next, do something about it by spending time and effort into structure and growing your passive revenue streams. This may involve producing a blog or YouTube network, buying rental homes, or purchasing stock market index funds. Uniformity is vital to success in passive income generation, so see to it to consistently check and readjust your methods as needed.

Automate as much of the process as possible by leveraging devices and modern technology to simplify your easy income streams. Usage automation software program for email advertising, employ digital aides to handle routine tasks, or established automatic settlements for easy investments. By applying these techniques effectively, you can develop a sustainable source of passive income that will continue to expand over time.

Verdict

Congratulations on taking the first step towards economic freedom by learning about easy revenue approaches!

By recognizing the fundamentals, checking out different streams, and implementing these approaches, you're well on your method to producing a lasting earnings source with marginal effort.

Keep setting clear goals, conducting research, and spending time and effort right into establishing your passive income streams.

With devotion and determination, you can achieve your goal of monetary stability and freedom.

Good luck on your trip!

Explore The Vast Variety Of Passive Income Possibilities Beyond The Horizon And Discover Exactly How To Produce Your Own Journey In The Direction Of Financial Freedom |

Developed By-Cross Clapp

As you navigate the realm of easy income and methods for monetary self-reliance, you'll find yourself at a critical crossroads where decisions shape your monetary future. The appeal of making while you rest is enticing, yet the course to real monetary stability calls for mindful planning and educated options. By discovering the nuances of passive earnings generation and executing tailored methods, you are laying the structure for a more safe tomorrow. So, as you ponder the possibilities that wait for, consider this guide as your compass in the trip towards monetary independence.

Comprehending Easy Income Essentials

To achieve financial self-reliance, recognizing the fundamentals of passive revenue is critical. https://mgyb.co/s/QCrMs is cash gained with very little initiative via resources like rental homes, investments, or online businesses. Unlike energetic income, which needs continuous effort and time, passive revenue permits you to generate income while you rest or focus on various other pursuits.

By setting up streams of easy revenue, you can produce a constant capital that assists you attain economic security and freedom.

One crucial facet of easy revenue is that it calls for a first investment of time, money, or both. Whether it's purchasing a rental residential or commercial property, investing in dividend-paying supplies, or producing an on the internet course, there's typically an in advance commitment required to obtain the passive income stream up and running. However, as soon as established, these sources of easy income can supply a reliable source of profits over time, helping you construct riches and safeguard your economic future.

Comprehending these essentials is vital for any individual looking to break devoid of the traditional paycheck-to-paycheck cycle and work towards monetary independence.

Discovering Different Easy Earnings Streams

Consider checking out different passive revenue streams to diversify your resources of profits and improve your monetary stability. Diversity is crucial to building a durable easy revenue profile.

One alternative is purchasing dividend-paying supplies, where you can gain normal income based on the business's earnings. Real estate financial investments, such as rental properties or crowdfunded realty tasks, can likewise provide a consistent stream of easy revenue.

Another opportunity to check out is developing and selling digital items like electronic books, online training courses, or supply digital photography. https://time.com/personal-finance/article/how-to-make-money-fast/ -to-peer lending systems supply a means to make rate of interest by providing money to people or businesses.

Furthermore, affiliate advertising and marketing permits you to make compensations by promoting other companies' products. Don't neglect the capacity of producing a YouTube network or a blog site to create passive income via ads, sponsorships, and associate advertising and marketing.

Implementing Passive Earnings Approaches

Check out sensible steps for carrying out easy revenue techniques to accelerate your journey towards financial freedom. Start by setting clear objectives and specifying the easy income streams that align with your passions, skills, and resources. Research study numerous easy revenue chances such as realty investments, dividend-paying stocks, or creating digital items like e-books or on the internet courses. As soon as you have actually identified prospective streams, create a detailed strategy detailing just how you'll produce easy income from each source.

Next off, act by investing effort and time right into structure and expanding your passive revenue streams. This may include creating a blog site or YouTube network, acquiring rental residential or commercial properties, or investing in stock market index funds. Consistency is key to success in passive earnings generation, so make sure to routinely keep an eye on and readjust your approaches as needed.

Automate as much of the procedure as feasible by leveraging tools and modern technology to improve your easy income streams. Use automation software application for email marketing, work with online aides to handle routine jobs, or set up automatic repayments for passive investments. By executing these methods successfully, you can develop a sustainable resource of easy revenue that will certainly remain to expand gradually.

Conclusion

Congratulations on taking the primary step in the direction of monetary independence by finding out about easy earnings techniques!

By recognizing the essentials, exploring different streams, and implementing these approaches, you're well on your means to producing a sustainable income resource with very little effort.

Maintain establishing clear goals, conducting study, and investing time and effort into developing your passive revenue streams.

With devotion and determination, you can accomplish your goal of monetary security and independence.

Good luck on your journey!

Develop Proficiency In Riches Monitoring With An Individualized Roadmap Comprising Of 5 Actions - Discover The Concepts For Achieving Monetary Prosperity |

Material Writer-Schwarz Nichols

In today's complex financial landscape, guaranteeing your wide range is managed effectively is vital. By following a structured technique and dedicating time to comprehend your monetary goals and risk tolerance, you are taking the very first steps towards a safe economic future. The procedure of creating a personalized riches administration plan in five easy actions can provide you with quality and instructions in accomplishing your ambitions. Let's check out exactly how these steps can assist you browse the world of wealth administration with confidence and objective.

Examine Your Economic Situation

Before creating a personalized wealth monitoring plan, it's vital to thoroughly evaluate your existing economic scenario. Begin by gathering all your economic records, consisting of bank declarations, investment accounts, debts, and any other pertinent paperwork. Bear in mind of your earnings resources, expenditures, possessions, and responsibilities to get a clear image of where you stand monetarily.

Next, calculate your total assets by deducting your total obligations from your overall properties. This will give you a snapshot of your general economic health. Identify any kind of locations where you may be spending beyond your means or have room for renovation, such as reducing unneeded expenditures or boosting your cost savings rate.

Assess your short-term and lasting monetary goals to determine what you want to achieve with wide range management. Understanding your financial goals will certainly assist direct the advancement of a personalized plan that straightens with your purposes. By analyzing your financial situation thoroughly, you'll be much better outfitted to make enlightened decisions and set reasonable goals for your riches monitoring journey.

Specify Your Financial Goals

To define your economic goals successfully, beginning by imagining where you intend to be monetarily in the future. Think about what economic success resembles to you. Consider short-term goals such as repaying financial debts or saving for a vacation, in addition to long-lasting objectives like retirement planning or acquiring a home. Assess your worths and top priorities to align your economic objectives with what genuinely matters to you.

Setting certain and quantifiable objectives is vital. Establish how much cash you require to accomplish each goal and the timeline you want to complete it in. Whether it's saving a certain amount for a deposit on a home in five years or retiring easily at a particular age, clarity on these details will assist your riches monitoring strategy.

In addition, do not forget to take another look at and modify your monetary goals occasionally. Life scenarios alter, therefore might your top priorities. Keep https://www.businessinsider.com/millionaire-changed-the-way-handle-money-2024-4 and adjust your objectives as required to remain on track towards monetary success.

Establish a Personalized Investment Method

Craft a tailored investment method tailored to your monetary goals and run the risk of tolerance. Begin by analyzing your objectives - are you saving for retirement, a significant purchase, or just looking to expand your wide range? Recognizing your purposes will direct your financial investment decisions.

Next off, consider your danger resistance. How comfortable are you with market fluctuations? https://squareblogs.net/luvenia76kent/delving-into...als-used-by-an-economic-expert will help establish the mix of financial investments that's right for you.

As soon as you have a clear image of your objectives and run the risk of resistance, it's time to establish a varied investment portfolio. Diversification aids spread out threat throughout different asset classes, minimizing the effect of volatility on your total profile. Take into consideration a mix of stocks, bonds, realty, and various other financial investments based upon your threat tolerance and time perspective.

Consistently evaluation and change your investment method as required. Life situations and market problems alter, so it is necessary to adjust your plan appropriately. By staying informed and positive, you can ensure that your investment method remains aligned with your economic goals.

Implement Danger Management Methods

When executing threat management methods, it's critical to analyze potential risks to your financial investment portfolio. Begin by expanding your investments across various property classes to reduce risks. This diversification helps spread risk and can shield you from significant losses if one market underperforms. In addition, consider including stop-loss orders to immediately market a protection when it reaches a fixed price, limiting prospective losses.

An additional essential risk monitoring technique is to consistently assess and change your portfolio's allotment. Market problems transform, impacting various property classes in different ways. By rebalancing your portfolio regularly, you can ensure that it lines up with your threat resistance and monetary goals.

Moreover, it's wise to consider investing in possessions adversely correlated with the stock market. These assets, such as bonds or rare-earth elements, can function as a bush during securities market recessions, decreasing total portfolio danger.

Review and Readjust On A Regular Basis

On a regular basis examining and readjusting your investment portfolio is essential to guaranteeing it remains straightened with your risk resistance and financial objectives. Markets are dynamic, and what might have been suitable for you at one factor might not be the most effective fit in the future. By reviewing your financial investments on a regular basis, you can ensure that your profile remains to reflect your present monetary situation and goals.

Consider establishing a routine to assess your portfolio a minimum of annually or whenever there are significant modifications in your life, such as a new task, marriage, or the birth of a kid. During these evaluations, assess whether your property appropriation still matches your risk resistance and if your investments are performing as expected. If needed, make changes to realign your profile with your goals.

Final thought

Now that you have finished these 5 simple actions to create a personalized wealth administration strategy, you're well on your way to achieving your economic goals and securing your future.

By examining your present situation, defining clear goals, establishing a customized financial investment strategy, carrying out threat administration techniques, and routinely reviewing and adjusting your plan, you have taken essential actions towards monetary success.

Maintain the great and continue to prioritize your economic well-being.

Exploring The Impacts Of Taxes On Your Wide Range Management Portfolio |

Material Written By-Nance Kruse

As you browse the realms of riches administration, taxes can wield a considerable influence on the trajectory of your monetary trip. Comprehending exactly how taxes converge with your financial investment portfolio is not just an issue of conformity however a calculated consideration that can shape your riches build-up course. By untangling more resources of tax effects, you open doors to a world where informed decisions lead the way for optimum economic results. Remain tuned to untangle the layers of tax obligation impact and uncover exactly how you can guide your riches management ship towards smoother tax waters.

Tax Obligation Implications on Investments

When spending, consider exactly how tax obligations affect your profile's growth and overall returns. recommended you read can significantly influence the performance of your financial investments. Capital gains, returns, and rate of interest revenue are all subject to taxes, which can eat into your earnings. Comprehending the tax obligation implications of various types of financial investments is critical for maximizing your after-tax returns.

Resources gains tax obligation is applied to the earnings made from offering assets such as supplies or realty. The price varies depending on how long you held the asset before marketing it. Short-term resources gains, from properties held for less than a year, are exhausted at a greater rate than long-lasting capital gains. Rewards from supplies are additionally taxable, with rates varying based upon whether they're qualified or non-qualified returns.

Passion earnings from bonds or interest-bearing accounts goes through earnings tax. The tax rate relies on your overall revenue degree. By being mindful of these tax implications and thinking about tax-efficient investment approaches, you can much better position your portfolio for development and enhanced general returns.

Methods for Tax Optimization

To maximize taxes in your riches administration portfolio, think about applying strategic tax-saving techniques. One reliable strategy is tax-loss harvesting, which involves selling financial investments muddle-headed to counter resources gains and decrease gross income. By rebalancing your portfolio with this method, you can minimize tax responsibilities while keeping your investment goals.

Another beneficial method is investing in tax-efficient funds that aim to reduce distributions, such as index funds or exchange-traded funds (ETFs). These funds commonly have lower turnover rates, leading to fewer capital gains circulations, thus minimizing your tax worry.

Utilizing pension, such as Individual retirement accounts and 401( k) s, can additionally be advantageous for tax obligation optimization. Payments to these accounts are usually tax-deductible, and profits grow tax-deferred till withdrawal, enabling you to possibly decrease your present tax bill and make the most of long-term growth.

Additionally, take into consideration gifting valued securities to charity as opposed to cash money. This technique can assist you stay clear of resources gains taxes while supporting a cause you respect. Implementing these tax obligation optimization approaches can improve your wealth monitoring portfolio's total tax effectiveness and possibly raise your after-tax returns.

Taking Full Advantage Of Tax Performance in Wealth Administration

Take into consideration ways to make the most of tax obligation performance in your wide range monitoring profile to maximize your general economic strategy. One effective strategy is to make use of tax-advantaged accounts such as Person Retirement Accounts (IRAs) and 401( k) s. By contributing to these accounts, you can potentially lower your taxable income while saving for retired life. In addition, strategic possession place within your portfolio can aid reduce tax obligation ramifications. Placing tax-inefficient investments like bonds in tax-advantaged accounts and holding tax-efficient financial investments such as stocks in taxed accounts can improve tax obligation performance.

One more means to make the most of tax effectiveness is via tax-loss harvesting. This method involves marketing investments that have actually experienced a loss to balance out funding gains and possibly reduce your tax responsibility. In addition, remaining educated about tax regulation adjustments and making use of tax-efficient financial investment automobiles like index funds or exchange-traded funds (ETFs) can better maximize your riches management portfolio's tax efficiency. By carrying out these strategies, you can improve your after-tax returns and take advantage of your financial investment portfolio.

Conclusion

Since you understand the influence of tax obligations on your wealth administration profile, you can take positive actions to enhance tax efficiency and make best use of returns.

By carrying out techniques like tax-loss harvesting and investing in tax-efficient funds, you can reduce tax obligation worries and enhance after-tax returns.

Remember, knowing tax obligation implications is vital for lasting development and sustainability of your financial investment profile.

Keep educated and make notified choices to secure your monetary future.

Riches Defense Methods For Navigating Market Volatility |

Article Writer-Collier Bishop

In times of market volatility, safeguarding your wide range requires a steady hand and a well-balanced plan. As unpredictabilities impend, it ends up being crucial to take on methods that can protect your financial resources from the tornado. By comprehending the subtleties of threat management and the power of varied investments, you can lay the groundwork for an extra safe financial future. But what specific techniques can really strengthen your wide range against the uncertain tides of the marketplace? Allow's discover the crucial methods that can aid you navigate these rough waters with confidence.

Relevance of Diversification

When browsing market volatility, diversifying your financial investments stays a vital technique for mitigating risk and optimizing returns. By spreading your financial investments across different property courses, sectors, and geographical regions, you can reduce the influence of a slump in any one particular location. This means that if a specific sector is experiencing a decrease, other areas of your profile may still be doing well, helping to cancel potential losses.

Diversity isn't practically spreading your investments thinly; it has to do with critical allocation based upon your threat resistance and economic goals. By integrating possessions that don't relocate the exact same instructions under the exact same conditions, you can produce an extra stable financial investment mix. As Global Portfolio Manager , matching stocks with bonds can help support the influence of stock market fluctuations on your general profile.

In times of uncertainty, such as during market volatility, the significance of diversification is multiplied. It provides a level of protection that can help you weather the storm and keep your investments on the right track in the direction of your long-term goals.

Using Threat Administration Strategies

To browse market volatility properly, using threat management techniques is crucial to secure your financial investments and reduce potential losses. One crucial approach is setting stop-loss orders, which instantly offer your assets if they get to an established rate, limiting your drawback risk.

Furthermore, diversifying your profile throughout various property classes can aid spread out threat and lower the influence of market variations on your total wide range.

Another effective threat management strategy is hedging using alternatives or futures agreements. By acquiring these economic instruments, you can safeguard your financial investments from negative rate motions. It's vital to frequently examine and readjust your danger monitoring strategies as market problems transform to guarantee they stay reliable.

In addition, preserving an enough emergency fund can give a monetary pillow during turbulent times, lowering the requirement to offer financial investments at a loss. Remember, staying informed concerning market trends and consulting from economic specialists can additionally assist you make even more enlightened decisions when executing danger monitoring strategies.

Long-Term Investment Approaches

Navigating market volatility effectively includes not only carrying out danger administration strategies yet also adopting calculated long-term investment techniques to safeguard your economic future. When considering lasting investment methods, it's important to focus on the big picture and resist making spontaneous choices based upon temporary market fluctuations. Diversity is crucial; spreading your investments across various asset courses can aid reduce threat and improve overall returns with time.

One reliable long-term strategy is dollar-cost averaging, where you frequently spend a set quantity no matter market conditions. This method can help smooth out the influence of market volatility and potentially lower your typical cost per share over the future. Additionally, buying Expat Investment Advice -paying stocks or index funds can offer a consistent income stream and possibility for funding appreciation with time.

Final thought

Finally, by expanding your financial investments, carrying out danger management strategies, and embracing lasting techniques, you can shield your wide range during market volatility.

Keep in mind to stay concentrated on your objectives, withstand impulsive choices, and regularly examine your approaches to navigate unpredictable times successfully.

With a tactical strategy and a long-term attitude, you can protect your economic future and climate rough market conditions successfully.

Technology'S Duty In The Development Of Wealth Management Techniques |

Uploaded By-James Bojesen

In the world of contemporary wealth administration, technology serves as an essential ally, revolutionizing the means monetary strategies are crafted and performed. From user-friendly algorithms to cutting-edge analytics, the tools at hand have the potential to improve the landscape of riches build-up and preservation. But just how exactly does this digital transformation convert into tangible benefits for your economic future? Allow's explore how harnessing the power of innovation can drive your riches monitoring endeavors to new elevations.

Evolution of Wide Range Management Technology

The advancement of wide range administration modern technology has actually transformed how monetary specialists connect with customers and handle assets. Nowadays, you can easily access real-time economic data, screen investments, and connect with your consultant with easy to use on the internet platforms or mobile applications. https://www.visualcapitalist.com/sp/what-people-value-in-a-financial-advisor/ have actually made it easier for you to remain informed concerning your monetary profile and make educated decisions without delay.

With the increase of robo-advisors, you have the alternative to automate your financial investment administration procedure based upon algorithms and predefined criteria. This not only saves you time however additionally gives you with a cost-effective choice to standard wealth monitoring services. Furthermore, the combination of artificial intelligence and machine learning formulas allows experts to use individualized financial recommendations tailored to your unique goals and run the risk of resistance.

Enhancing Investment Choices

Using sophisticated data analytics can significantly boost your investment choices by supplying valuable understandings right into market fads and efficiency. By leveraging innovation, you can access real-time data, anticipating analytics, and machine learning formulas that help you make even more educated investment choices. These devices can examine large quantities of info swiftly and efficiently, allowing you to recognize patterns and opportunities that might not appear via typical methods.

Additionally, technology allows you to check your investments continually and get notifies on considerable market growths. This aggressive strategy assists you remain ahead of market shifts and make prompt adjustments to your portfolio. With weblink to simulate different situations and analyze the prospective influence of different decisions, innovation empowers you to make data-driven choices customized to your financial investment goals and take the chance of resistance.

Integrating technology into your investment approach can simplify decision-making processes, decrease risks, and possibly enhance your returns. By accepting these ingenious tools, you can browse the intricate globe of attaching confidence and agility.

Personalized Financial Guidance

By leveraging individualized financial guidance, you can customize your wealth administration strategies to straighten with your details financial objectives and objectives. This customized approach permits you to get suggestions and understandings that are directly appropriate to your distinct monetary scenario. With individualized financial assistance, you have the chance to function carefully with financial advisors that make the effort to understand your individual needs and risk resistance.

Additionally, personalized economic assistance allows you to make even more educated choices relating to financial investments, cost savings, and general monetary planning. With a tailored touch, you can receive suggestions on asset allowance, retired life planning, tax methods, and a lot more, all customized to fit your particular scenarios. This degree of personalization equips you to take control of your financial future with confidence.

Final thought

To conclude, modern technology has actually revolutionized the method individuals approach wealth administration, providing innovative devices and customized support to maximize financial investment decisions.

With the evolution of robo-advisors and expert system, people can access real-time information, streamline processes, and make educated options tailored to their special demands and goals.

By leveraging modern technology in riches management techniques, individuals can efficiently attain their economic goals and browse the intricacies of the marketplace with confidence.

Prepare To Uncover How Technology Is Altering Wide Range Management Techniques In Means You Never Ever Expected |

Article By-Baird Reddy

In the realm of modern riches administration, technology acts as a crucial ally, transforming the method economic approaches are crafted and executed. From intuitive algorithms to sophisticated analytics, the tools at hand have the potential to improve the landscape of riches accumulation and conservation. But just how exactly does this electronic revolution convert into concrete benefits for your financial future? Allow's explore exactly how taking https://www.thestar.com/business/personal-finance/...2d-11ee-975f-4b77b9554e8a.html of the power of innovation can move your riches management endeavors to brand-new elevations.

Development of Wide Range Management Modern Technology

The development of wealth management modern technology has transformed exactly how economic experts connect with customers and take care of assets. Nowadays, you can easily access real-time economic data, screen investments, and communicate with your expert with user-friendly online systems or mobile apps. These technological developments have actually made it more convenient for you to remain educated concerning your monetary profile and make notified decisions promptly.

With the increase of robo-advisors, you have the choice to automate your financial investment administration procedure based on formulas and predefined standards. This not only saves you time but additionally provides you with a cost-effective alternative to typical wealth monitoring solutions. Additionally, the combination of expert system and machine learning algorithms allows consultants to use customized financial recommendations customized to your distinct objectives and take the chance of resistance.

Enhancing Investment Decisions

Making use of advanced information analytics can dramatically improve your investment choices by providing beneficial understandings into market patterns and efficiency. By leveraging technology, you can access real-time information, anticipating analytics, and machine learning formulas that help you make more informed financial investment choices. These tools can analyze substantial amounts of information swiftly and successfully, permitting you to identify patterns and possibilities that might not appear via standard approaches.

Moreover, modern technology allows you to check your financial investments constantly and get notifies on considerable market developments. This aggressive approach aids you stay ahead of market changes and make prompt adjustments to your portfolio. With the capacity to replicate various situations and assess the possible impact of various choices, modern technology equips you to make data-driven choices tailored to your investment goals and risk tolerance.

Including modern technology right into your financial investment method can streamline decision-making processes, decrease dangers, and potentially improve your returns. By welcoming https://writeablog.net/noel3truman/introducing-the...ns-regarding-wealth-management , you can browse the intricate globe of investing with confidence and dexterity.

Personalized Financial Guidance

By leveraging customized monetary advice, you can customize your riches monitoring methods to line up with your certain financial goals and purposes. This tailored technique permits you to obtain suggestions and insights that are directly appropriate to your unique financial situation. Via individualized financial support, you have the possibility to function carefully with monetary consultants who take the time to recognize your individual needs and risk resistance.

Moreover, personalized economic advice enables you to make more informed choices regarding investments, savings, and general monetary preparation. With a personalized touch, you can receive referrals on asset allowance, retired life planning, tax strategies, and much more, all personalized to suit your specific scenarios. This level of modification equips you to take control of your economic future with confidence.

Final thought

To conclude, modern technology has actually revolutionized the way individuals come close to wealth monitoring, offering innovative devices and tailored guidance to maximize financial investment decisions.

With https://writeablog.net/ma71jacques/be-prepared-to-...in-guaranteeing-your-financial of robo-advisors and artificial intelligence, individuals can access real-time information, enhance procedures, and make notified choices customized to their one-of-a-kind demands and goals.

By leveraging modern technology in wide range monitoring techniques, individuals can effectively attain their economic objectives and navigate the complexities of the market with confidence.

Acquiring Belongings Insights: Discovering The Advantages Of Diversity With An Economic Expert |

Produced By-Rossen Meincke

When considering your financial investment approaches, have you ever before questioned how diversification could play a crucial duty in your monetary success? A financial expert's viewpoint on this topic supplies important understandings that can form the way you come close to threat monitoring and profile optimization. By recognizing the advantages of diversification from a professional's viewpoint, you may uncover techniques that can possibly boost your financial investment end results and safeguard your monetary future.

Importance of Diversification

Diversification is crucial for minimizing financial investment risk and enhancing possible returns. By spreading your financial investments throughout various asset classes, sectors, and geographic areas, you can safeguard your portfolio from significant losses that might emerge from variations in a single market or field. For example, if you only invest in one sector and that sector experiences a recession, your entire profile could endure. Nevertheless, by branching out and holding possessions in different markets like modern technology, healthcare, and consumer goods, you can counter losses in one area with gains in an additional.

Moreover, https://writeablog.net/ellen3perry/clearing-up-mis...e-refine-of-collaborating-with can aid you record various market chances and benefit from numerous financial problems. As an example, during times of economic development, specific fields like technology might carry out much better, while protective fields like energies might surpass during economic downturns. By expanding your financial investments, you place on your own to possibly take advantage of these varied market activities and boost your overall returns.

Risk Monitoring Methods

To protect your investments against unforeseen events and prospective losses, executing effective danger administration strategies is crucial. Asset Management is diversification, spreading your financial investments across various property courses to lower the effect of market changes on your general profile. By expanding, you can potentially decrease the threat of shedding a substantial portion of your financial investment if one field underperforms.

https://www.bankrate.com/banking/savings/how-to-save-money-as-high-school-student/ is establishing stop-loss orders. These orders automatically market a security when it reaches an established cost, aiding you limit prospective losses. Additionally, consistently assessing and adjusting your investment portfolio is vital. Market problems alter, and what might have been a sound investment at one point might no longer be suitable.

Insurance can likewise contribute in danger monitoring. Having sufficient insurance policy protection for your possessions, health, and life can supply a safeguard in case of unanticipated events. Overall, a combination of these strategies customized to your threat resistance and economic goals can assist you far better secure your investments and financial wellness.

Maximizing Financial Investment Returns

Mitigating dangers through effective strategies is a crucial step in the direction of taking full advantage of investment returns. To accomplish this, take into consideration a well balanced approach that combines numerous possession courses, such as supplies, bonds, and realty, to expand threat and improve possible returns. By expanding your portfolio, you can capture gains from different markets while decreasing the influence of market volatility on your overall investments.

One more essential facet in making the most of investment returns is to frequently examine and readjust your profile. Market problems and personal monetary goals evolve in time, so it's essential to rebalance your investments to guarantee they align with your objectives. This proactive method allows you to take advantage of possibilities for development while minimizing possible losses.

Furthermore, remaining educated regarding market trends and looking for expert advice can aid you make well-informed investment choices. A monetary expert can give important insights and support tailored to your specific needs, assisting you browse the complexities of the monetary landscape and enhance your returns. Keep in mind, the path to making best use of financial investment returns involves tactical preparation, diversity, and staying in harmony with market characteristics.

Verdict

In conclusion, diversity is a crucial technique for managing financial investment risk and making best use of returns.

By spreading your financial investments across different possession classes and markets, you can secure your profile from market changes and prospective losses.

Bear in mind to on a regular basis assess and change your profile, established stop-loss orders, and consult with a financial expert to optimize your diversification approach.

Keep notified concerning market trends and straighten your investments with your threat tolerance and economic goals for long-lasting success.

Safeguarding Your Properties In The Face Of Market Unpredictability: Reliable Methods |

Post Created By-Koefoed Velez

In times of market volatility, guarding your wide range requires a steady hand and a well-balanced plan. As unpredictabilities impend, it ends up being crucial to adopt techniques that can protect your finances from the storm. By understanding the subtleties of risk administration and the power of diversified financial investments, you can lay the groundwork for a much more safe economic future. However what details strategies can genuinely strengthen your wealth against the uncertain tides of the market? Allow's explore the essential techniques that can aid you navigate these unstable waters with confidence.

Relevance of Diversity

When browsing market volatility, diversifying your investments stays an essential method for mitigating danger and making the most of returns. By spreading your financial investments throughout various possession courses, industries, and geographical areas, you can reduce the effect of a slump in any type of one particular location. https://abcnews.go.com/GMA/Living/money-dysmorphia...ing-control/story?id=104903483 indicates that if a particular industry is experiencing a decline, other areas of your profile may still be performing well, helping to cancel possible losses.

Diversity isn't practically spreading your financial investments very finely; it has to do with strategic allotment based upon your risk resistance and financial goals. By integrating assets that do not move in the very same direction under the very same circumstances, you can produce a much more secure investment mix. As an example, coupling stocks with bonds can aid support the influence of stock market variations on your general profile.

In times of uncertainty, such as throughout market volatility, the importance of diversity is multiplied. It supplies a level of protection that can help you weather the tornado and keep your financial investments on the right track in the direction of your long-term goals.

Making Use Of Threat Administration Methods

To navigate market volatility successfully, utilizing danger monitoring strategies is crucial to guard your investments and reduce potential losses. One crucial strategy is establishing stop-loss orders, which automatically offer your possessions if they get to a predetermined price, restricting your downside threat.

Furthermore, diversifying your profile across different possession courses can assist spread out threat and lower the impact of market fluctuations on your general wealth.

One more efficient threat administration strategy is hedging making use of options or futures contracts. By acquiring these economic tools, you can safeguard your financial investments from unfavorable price motions. It's important to regularly review and adjust your danger management methods as market conditions transform to ensure they stay efficient.

Furthermore, keeping an enough emergency fund can supply a monetary pillow during unstable times, minimizing the requirement to sell investments at a loss. Keep in mind, remaining notified about market trends and seeking advice from financial experts can likewise help you make even more enlightened choices when applying risk management techniques.

Long-Term Investment Strategies

Navigating market volatility efficiently involves not only implementing risk administration strategies but likewise taking on calculated long-term investment techniques to safeguard your monetary future. When taking into consideration long-lasting financial investment methods, it's vital to focus on the big picture and resist making impulsive decisions based upon temporary market variations. Diversification is key; spreading your financial investments across various asset classes can assist minimize risk and boost total returns over time.

One reliable lasting method is dollar-cost averaging, where you regularly spend a fixed quantity no matter market problems. This method can help smooth out the influence of market volatility and potentially reduced your average cost per share over the long run. Furthermore, purchasing top quality dividend-paying supplies or index funds can give a consistent income stream and possibility for capital recognition over time.

what is it worth

In conclusion, by expanding your financial investments, executing threat monitoring strategies, and embracing long-lasting approaches, you can protect your wide range during market volatility.

Remember to remain concentrated on your objectives, stand up to impulsive choices, and routinely examine your approaches to navigate unclear times successfully.

With a critical approach and a lasting state of mind, you can protect your economic future and climate turbulent market conditions efficiently.

Intrigued By The Interaction Of Taxes And Riches Administration? |

Material Produce By-Mayo Power

As you navigate the realms of riches monitoring, taxes can wield a substantial impact on the trajectory of your monetary trip. Comprehending just how taxes intersect with your financial investment portfolio is not merely a matter of compliance however a critical consideration that can form your wealth accumulation course. By unwinding the intricacies of tax implications, you open doors to a world where notified decisions pave the way for ideal monetary results. Keep tuned to decipher the layers of tax obligation impact and find exactly how you can steer your riches monitoring ship in the direction of smoother tax obligation waters.

Tax Effects on Investments

When spending, think about exactly how tax obligations affect your portfolio's growth and overall returns. Taxes can significantly impact the performance of your investments. Funding gains, rewards, and interest revenue are all subject to tax, which can eat into your earnings. Recognizing the tax obligation ramifications of various types of investments is vital for maximizing your after-tax returns.

Funding gains tax obligation is related to the earnings made from selling assets such as stocks or real estate. The rate varies depending upon the length of time you held the possession prior to selling it. Temporary resources gains, from properties held for less than a year, are tired at a higher rate than long-lasting capital gains. Rewards from supplies are likewise taxed, with prices varying based on whether they're certified or non-qualified dividends.

Rate of interest earnings from bonds or interest-bearing accounts undergoes income tax. The tax obligation rate relies on your general revenue level. By bearing in mind these tax implications and thinking about tax-efficient investment strategies, you can better place your profile for growth and boosted overall returns.

Techniques for Tax Obligation Optimization

To enhance tax obligations in your riches administration portfolio, consider applying critical tax-saving strategies. One reliable technique is tax-loss harvesting, which includes selling financial investments at a loss to offset resources gains and minimize taxable income. By rebalancing Expat Investments via this approach, you can lessen tax liabilities while keeping your financial investment goals.

An additional useful method is investing in tax-efficient funds that intend to minimize distributions, such as index funds or exchange-traded funds (ETFs). These funds normally have lower turnover rates, resulting in less capital gains distributions, hence decreasing your tax obligation worry.