Your Overview To Life Insurance Policy Success In This Age. The Most Effective Tips Available! |

Article created by-Lorenzen Sherwood

Life insurance can be seen as a kind of gamble. It sounds odd, but that is how some people think. However, enabling your family's security is a gamble that you should gladly partake in. This article can help you to make the right choices.

When choosing a life insurance policy, look into the quality of the company you choose. The company that holds your policy should be able to stand behind it. It is good to know if the company that holds your policy will stay around to service the policy if need be and eventually be around to pay the benefits of the death.

You have decided you need a life insurance policy, and figured out how much insurance you need, now you need to figure out what kind of insurance best fits your needs. Currently there are four varieties of life insurance available; variable life, universal life, whole life, and universal life.

Even if your employer offers life insurance, you shouldn't depend on this policy to meet all your needs. These policies are often fairly limited, and have the disadvantage of not being portable. If you leave your job, you will also leave your life insurance behind, which means you will have to find a new policy to replace it.

Try to determine for yourself how much life insurance you actually need. Many life insurance providers offer several ways in which they can make their own estimations. They usually over estimate in order to turn a larger profit. Do your own estimating so that you can be sure you aren't getting ripped off.

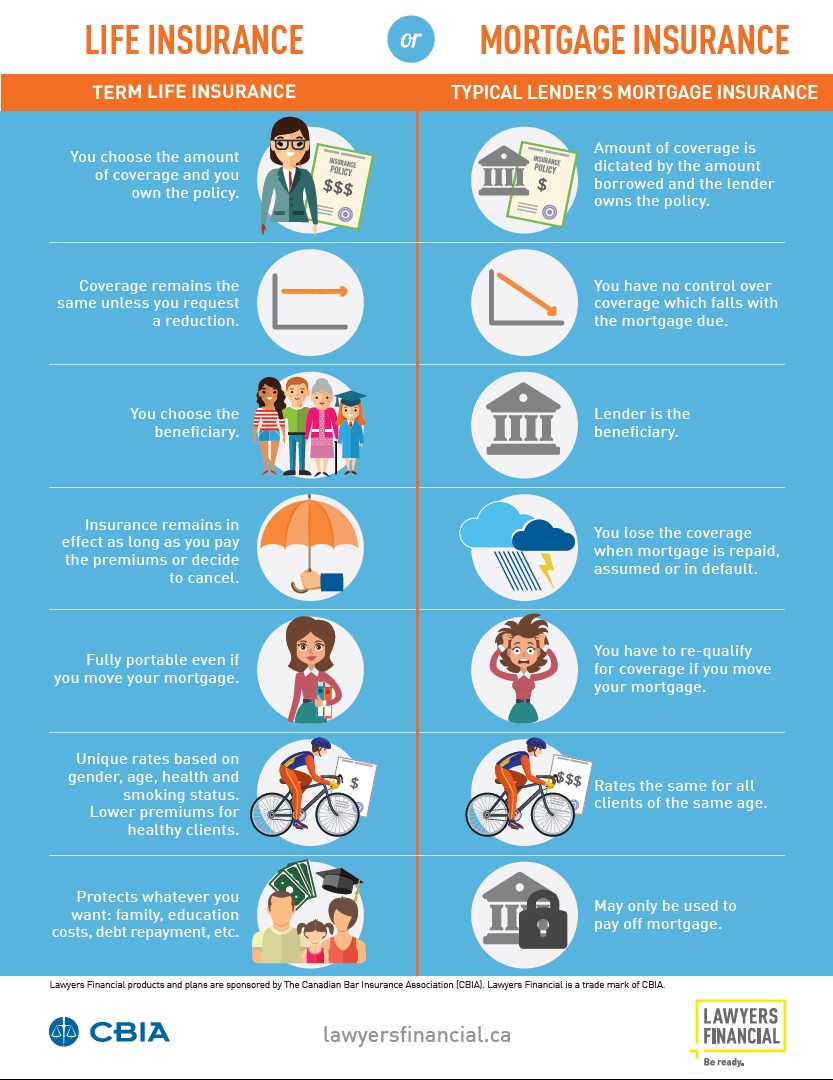

Some life insurance companies may suggest that you purchase a mortgage insurance policy, which pays off your mortgage should you die. However, it is wiser to take the amount of your mortgage into account when purchasing coverage for a term life insurance or whole life insurance policy. This makes more sense because your mortgage steadily declines over time, although your mortgage insurance premium does not. In the long run, it is more cost effective to include the amount of your mortgage in with your life insurance policy.

Before purchasing life insurance you should determine the amount of coverage that you need. The easiest way to do this is to take your average yearly salary and multiply it by eight. There are also a number of simple to use online calculators that will help you figure out how much life insurance you need.

Life insurance is a premium you will pay (we hope!)for a long time. Therefore it is important to consider affordability. But you don't want to let cost blind you to an equally important concern: trust. Can you trust this insurance agent? Does his company have the longevity and reliability you need?

Life insurance comes in many different variations that can fit just about any budget. Once you know the amount of coverage you need, decide whether you want insurance that provides permanent coverage, or just need term insurance to cover you until large expenses are paid off. Once debts are gone and the kids move out, you may decide to self-insure and won't need life insurance coverage anymore.

If you have a whole-life insurance policy and have had it for a long while, whatever you do, don't get rid of it or replace it with another one. Hold on to the old policy because you don't want to lose the investment that you have already made into past premiums. The better option is to keep the old policy without making any changes and purchase a new whole-life policy instead.

In order for the people you love to be cared for even when you aren't around to physically handle things yourself, life insurance is an important investment. The cost of funeral services are very expensive and can leave a large burden on your loved ones. Don't make the mistake of thinking you are invincible!

Try opting for a decreasing life insurance plan. web link of plan is used to supplement a policy holder's investments as if something caused them to die before reaching a certain amount with their investments. The more these grow, the less the monthly premiums are. That's why these make a great option for those who are looking to save over the life of their plan.

If you need more life insurance, try to get a rider instead of getting a new insurance policy. These are amendments or additions to existing insurance policies. They tend to be less expensive than purchasing a second insurance plan. If the holder is healthy, it is advisable for them to try to buy a second insurance policy, as it may be cheaper than a rider.

Check with your employer before purchasing life insurance from another source. Often various types of life insurance may be available through employee benefit packages. These policies are frequently less expensive because the employer is able to obtain a group rate for employees purchasing life insurance through this channel. https://www.cnbc.com/2020/04/13/how-the-coronaviru...our-plans-to-retire-at-65.html can be expanded to include family members as well.

When purchasing a life insurance policy, be truthful on all medical exams or history profiles. Should anything happen and the carrier discovers you provided false information when purchasing a policy, they can legally deny a claim which defeats the purpose of buying life insurance. Letting your insurance company know about any pre-existing conditions or risky hobbies, may result in slightly higher premiums, but prevent problems with claims.

There are many reasons to buy life insurance. Life insurance can help care for your loved ones if you died. It could help them pay for your final expenses, like debts, medical expenses and funeral costs. If your dependents could not get along without your income, life insurance can help pay their living expenses.

Never pay the life insurance agent instead of the company. If you are not sending your check directly to the company itself, something is wrong. No reputable agent will ask you to write a check out to them. If they do, stop communicating with them, and move on to a more reliable person.

Before you subscribe to a life insurance, you should carefully go over the policy. If you do not understand everything on your policy, have a professional explain it to you. If you notice anything unclear or that is not going to work at your advantage, you should probably consider another insurance company.

As mentioned at the beginning of this article, life insurance is not just for the rich with money to spare. Life insurance can be a life saver for a family who depends on one income and finds that family breadwinner suddenly taken away. By implementing the sage advice in this article, you can help your family make it through an untimely death and not be stuck in debt.

|

Метки: Insurance For Seniors Life Insurance For Seniors Term Life Insurance Whole Life Insurance Life Insurance Companies Life Insurance Financial Security |

Expertise Is Money When Getting Life Insurance |

Content written by-Cummings Taylor

Many people find choosing a life insurance policy to be stressful, but as long as you do your research you will comfortable with the decision you make. As https://www.benzinga.com/money/dental-insurance-nc/ know, not having a life insurance policy can be even more stressful due to the fact that no one can predict when they will need it.

It is important to purchase life insurance when you are young and healthy. This is because many insurance companies do not want to provide the elderly, disabled and sick. And companies who do provider older or sick people with life insurance often raise the premium rate due to their condition.

If you worry a lot about your family, you should get life insurance for your own peace of mind. In the even of your death, your family would get money from your life insurance. If you are not earning enough money to support your family after you are gone, you should look into life insurance as an alternative.

Before purchasing life insurance, you must understand that insurance is for protection purposes only, which does not include investing. Term insurance gives you protection only, with no savings. Whole life and universal policies offer savings, but they are a lot more expensive and you would be better off using the cost savings to invest in something else.

Prior to looking for life insurance on your own, check with your employer to see if there is available coverage through them. In many cases, employers can negotiate a rate for their employees and their family members. This can save you a lot of money and give you a great policy as well.

Be sure to read over all of the information about the life insurance plan that your company offers. You may find that it will not be enough. You may want to invest in an additional policy to be sure that your family is going to have enough money in the event of your passing.

When buying term life insurance, make sure the duration of your policy matches the amount of time you need it. For example, buy term insurance that stays in force long enough until the kids become independent and also, that the remaining spouse has coverage until he or she, becomes eligible for retirement income.

When getting life insurance, you will need to find out how much the premiums are. All insurance policies have different premiums and you need to be certain that you will be able to afford the coverage. If you lapse on payment for the policy and someone passes away, you could find that the coverage you were counting on is not available because of the lapse.

No matter how many times you've read it somewhere, it bears repeating that knowledge is truly power when attempting to make a decision regarding your life insurance. Understand what https://www.bankrate.com/insurance/car/car-insurance-for-seniors/ getting into, what your family needs after you're gone and also how much of a burden the policy payments will be going forward.

If you are getting a free life insurance from your employer, make sure the coverage is enough. For instance, it might not cover your spouse. You should consider applying for an additional life insurance if you think you are going to need more coverage or want your spouse to be covered to.

If you cannot afford to pay an expensive policy, talk with your relatives about the best way to use this money. Perhaps they can invest the money they will get when you die, in a smart way so that they can make a small amount go a long way. Make sure they understand that what seems like a huge amount of money to get at once, might not last as long as they think.

Make sure you get enough coverage. $500,000 can seem like a windfall of cash for your family in the event of your passing. But when you take into consideration a $300,000 mortgage, car loans, student loans, burial and funeral expenses, credit card debt and the like, all those can add up fast.

Make sure to consider your future needs when choosing a life insurance plan. Do not only think about how much money your family would need to survive right now; remember that things like college tuition or your spouse's retirement may substantially change your family's expenditures one day. Plan accordingly.

You may not be aware of this, but life insurance can be used to finance retirement. The catch here, however, is that you need to take out a policy that offers a return of your premium payments. With a policy like this, you are entitled to receive the lump sum of your premium payments back, if you outlive the life of your particular policy. Use the money to fund a new hobby, vacation or other special treat.

If you are buying a life insurance policy for the first time, do not be afraid to ask questions with your adviser. Before you purchase a policy, you should clearly understand all of its ins and outs. An adviser who is unwilling to answer these questions is not an adviser to whom you should listen.

If your employer does not offer any life insurance coverage or only a very limited coverage, ask what you can do to get a better policy. Perhaps you can pay a small contribution out of your paycheck to get better insurance, or join a worker's union that will offer you more benefits.

Here is a simple way to calculate how much your life insurance should cover: ask yourself how much you earn in a year, and multiply this amount by how many years you want your family to benefit from this same income. You should add to this amount how much you expect your funeral and related expenses to cost.

Buying mortgage life insurance is a good way to provide protection for your loved ones. Mortgage life insurance can give you peace of mind knowing that your family will be able to live in their home if something happened to you. This type of life insurance will pay your mortgage if you die before it is fully paid off.

As was stated in the beginning of the article, it is important that you have a life insurance plan that will provide your family with enough money when you pass away. Use the advice given to you in the above article to help you to succeed in finding a reliable life insurance plan.

|

Метки: Insurance For Seniors Life Insurance For Seniors Term Life Insurance Whole Life Insurance Life Insurance Companies Life Insurance Financial Security |

Up In The Air Regarding Insurance policy? Try These Tips |

Content by-Thorsen McCann

Many people believe that finding the right insurance is a struggle, but that is only true if you don't know the right way to find what you need. Like anything else, you need to be educated about the right way to look for the insurance you want if you want to find it. This article contains a number of tips on insurance that will help you get what you are looking for.

If you receive your homeowner's insurance from a company that also sells health or auto insurance, consider combining your policies. Many companies offer bundled discounts, so if you combine policies you could save a considerable amount.

If you want insurance companies to deal fairly with you, then you must do the same for them. You might be tempted to pump up your claim or say you lost more than you did, but if you do this, you will add fuel to their concerns about claimant fraud and they are less likely to deal with you in an honest way. It's the Golden Rule, once again: report your loss fairly and honestly, with all the details needed, and accept what appears to be fair value (if in fact that is what you're offered).

When involved in an insurance claim, always be as professional as possible. Cheap Insurance Near Me are working with are people too, and you will see much more positive results if you are positive and professional. Your insurance company only wants to know the facts, not the emotions. Proofread all written material sent to them.

If you have determined you need more than your current coverage, consider getting a rider to your current policy instead of shopping for something new. Adding on a rider will generally be less expensive than a new policy and easier to manage. If you are in good health and still young, however, it may be worth it to shop around.

When you choose insurance for your car, qualify your insurer first. Besides evaluating coverage, it is also in your best interest to look for reviews on their customer service, claim responsiveness and even rate increases. Knowing who you are dealing with ahead of time can help you set expectations with your insurer.

Avoid signing-up for insurance policies that guarantee you will be approved. These types of insurance are much more expensive than a regular policy because they cannot manage the risk levels of their policy holders. Unless you are in bad health and have been turned down elsewhere, avoid these types of policies.

Ask your veterinarian where to find pet insurance. These people are the most familiar with the insurance process, and can easily help you find a reputable and trustworthy company to take care of your pet. Even the receptionist should be able to recommend someone, as they usually assist with the financial process.

Get a pet insurance policy with traveling coverage included. Some companies will not pay for any vet visits if you are on the road and this can lead to heavy expenses for the pet owner. Find a policy that lets you visit other vets and you will be able to securely travel with your furry friend.

Before purchasing life, disaster, car or home insurance of any kind, consult the laws of your current state, as well as national policy on insurance. This is becoming especially important in the realm of health insurance. Government mandates and fees are sure to impact your final choices in what insurance to buy. Make https://blogfreely.net/harry4386candace/prepare-yo...th-the-right-sort-of-insurance to familiarize yourself with these statutes before choosing a policy.

Remember that the cheapest plan is not always the best plan. Make sure to understand exactly what you will be paying before signing on the dotted line. If you have a very low cost plan, check on what the deductible amounts are. It may be better for you to pay more per month than to have to pay thousands of dollars out of pocket before your insurance kicks in.

The best way to keep your insurance premiums low is to never file a claim for a small item. When you are considering filing a claim, take into account the amount your premium is likely to go up and how much extra that will cost you. Next, compare that to the amount your claiming, and if the claim amount is lower you should pay for it yourself. This could save you hundreds of dollars in the long-term.

When any insurance policy has been purchased, take some time to sit down and read the fine print. Do not automatically assume that the policy is exactly as the seller presented it to you. There may be details in the terms and conditions that were not mentioned and discourage you from keeping the product. All policies have a short cancellation period after the date of purchase just in case it is needed.

If possible, purchase as much of your insurance from a single company to obtain applicable discounts. Many carriers offer significant premium reductions for customers purchasing multiple lines of insurance such as bundling home, car and life insurance. If a specific insurance company meets your needs, keeping your policies with one carrier can save you quite a bit of money.

If you want to continue to see your regular health care provider you need to make sure that they are in the network coverage area of any health insurance company that you wish to sign up for. https://pbase.com/topics/adela1elvis/obtain_the_right_insurance_c is important because you may be responsible for any doctor's bills that are from providers that are out of the network.

You should do your research on an insurance company's reliability as well the affordability of its policies before making a purchasing decision. You can find very useful information by just looking at a few websites. The JD Power internet site gives customer ratings against most major insurance providers. The NAIC, a regulatory organization, has a website where users can see legal complaints filed against companies. If you are curious about how established any particular company is, look it up on ambest.com.

Be sure you are comparing similar quotes when selecting an insurance policy. Different companies may offer different coverages or limits which affect the overall cost of the policy. To truly do a comparison of quotes, the policies should include similar coverages, limits and benefits. If there are significant differences in the facets of the quotes, a price comparison may not be adequate.

If you don't have health insurance coverage, you may want to add medical coverage to your vehicle insurance policy. Auto accidents are often a major cause of catastrophic medical bills and the medical coverage will cover everyone in the car, regardless of who the driver at fault it. This can protect your assets from being party to a lawsuit and can save you a lot of bills in the even an accident occurs.

Your insurance needs are unique to you. Understanding how insurance policies work and how they relate to you is essential. Using the information laid out here, you should be able to make the changes that you need to, in order to keep yourself and your family, safe and protected.

|

|

Insurance Coverage Tips That Will Assist You Make The Most Of Your Policy |

Content author-Irwin Butcher

In today's fast-paced society, a solid grasp of the basics of information is essential, regardless of your career or profession. Most people believe that matters regarding insurance are often too complex or confusing, and so they fail to educate themselves properly. It's never too late to learn, however!

If you receive your homeowner's insurance from a company that also sells health or auto insurance, consider combining your policies. Many companies offer bundled discounts, so if you combine policies you could save a considerable amount.

When you are filing a claim with an insurance company, ask for your claim number at the end of the original conversation with your agent. Write down and keep this number for reference. Any time you call for an update on your claim, you'll need this number, so it's better to have it on hand.

Your insurance rates are likely set by zip code. If you live near a big city, the closer your zip code to the actual city center, the higher your rates will be. Consider this when looking for a new place to live. Just one zip code away could seriously lower your payment.

You've probably heard the phrase about 15 minutes can save you 15%, but you might find that by spending just a couple of minutes on the phone with your current insurance provider can also save you money. When your insurance coverage is nearing the expiration date, call your insurance provider and ask them for a re-quote on your policy. They will have the incentive to give you the most favorable pricing in order to retain your business. Since https://www.storeboard.com/blogs/photography/gain-...-globe-with-these-tips/3506520 have all your information, it probably won't take 15 minutes and you can save time and money.

In order to get the best rates on insurance, you must shop around for the best prices. All you have to do is call your local agents or obtain rate quotes via the internet. Shopping around can save you hundreds of dollars a year and it takes very little time and effort.

If you find your insurance too expensive, look for a cheaper one. Make sure https://postheaven.net/chijoslyn/steps-on-how-to-o...the-very-best-insurance-around know how much your current insurance will charge you for canceling your policy. It might be more interesting to wait until you have to renew your insurance to switch so that you do not pay a ridiculously high cancellation fee.

If you are balking at the cost of renter's insurance, consider increasing your deductibles. Higher deductibles means lower monthly payments, however make sure that you'll be able to afford the deductible costs if the need comes up. The smaller monthly payment is useful, but if you end up not being able to meet your deductible then your coverage becomes useless.

Be completely honest, and disclose everything when getting a life insurance plan. Withholding certain information, even if you do not think it is important, can make your life insurance plan completely useless. Even the most expensive of plans will be void if the providers find that you were withholding information.

When applying for any kind of insurance it is of utmost importance that you know exactly what you're signing up for, so read the policy! Although it may seem like a daunting task, being prepared for any situation that comes up means peace of mind. Ask your insurance agent about any item in the policy you're unsure about, including what is actually covered in your policy and what will be your responsibility to pay for out of pocket.

Buy your insurance when you are young to save yourself money. The younger you are, the lower your insurance premiums are going to be. At a young age, you are extremely low risk for an insurance company so they are willing to charge you less as they know they probably won't have to pay out on your policy.

Always remember to shop around for the best insurance deals, if you are interested in saving the most money. Lots of websites provide insurance quotes for free, and compare different companies from the requirements that you choose.

If you have been denied coverage for a claim you feel should have been covered, appeal the decision to the insurance company. Learn what your company's process is to start an appeal and follow it. Do not just take a denial at face value, you always have the right to appeal any decision made by your insurance company.

Be aware that the premium quoted to you initially is subject to change as your policy goes through the underwriting and approval process. Most insurance company quotes are accurate, but there may be some differences in premiums once your prior claim history is pulled or your credit report is reviewed.

Customer service is an important consideration regarding insurance companies as you have to deal with them in emergencies. Find out what others think of your prospective insurer. If you are on the market for home owner insurance you can visit J. D. Power's website where consumers can rate the insurance companies.

When looking to purchase insurance, make sure that you are the one staying in control. Know what you want beforehand and how much you are willing to pay to get it. Also only give out information to companies you are truly interested in, as most are just looking to get your name/information to sell to other companies. Make sure that you choose when you want to talk to an agent and they don't choose you first.

Ensure that you receive fast payments in the event of insurance claims through the use of endorsements. Endorsements that prove the value of your most valuable property, such as expensive jewelry, pieces or artwork or state-of-the-art video equipment, are obtained and provided by you to your insurance company. In the event of a fire, flood or anything that results in your property being damaged, stolen or lost, you can receive payouts to cover the cost much quicker, when the specific items are endorsed.

When selecting insurance, it is important to remember the deductible. A deductible is an amount that must be paid from your own money before an insurance company pays any other expenses. A lower deductible means that you won't have to pay as much for the insurance company to cover your expenses.

In today's world, it's more important than ever to make sure that you are sufficiently insured so that you can stop worrying about yourself and your family. By making use of the advice you've read in this article, you can give yourself peace of mind and spend less time worrying about your insurance./insideevs.com/features/405372/by-miles-tesla-insurance/" target="_blank">https://insideevs.com/features/405372/by-miles-tesla-insurance/ /288/807/585/vehicle-insurance-infographic-health-insurance-fashion-automobile-insurance-business-vector-material.jpg" width="533" border="0" />

|

|

Usage This Advice To Make A Beneficial Insurance Decision |

Created by-Forrest Amstrup

Insurance can be one of your household's biggest expenses. It is important to make sure you are sufficiently insured, but at the same time, you also want to avoid being overcharged for your insurance. Full Coverage Auto Insurance in this article can help make sure you meet all of your insurance needs at the lowest cost possible.

Look into multiple insurance policy discounts. When you bundle your insurance contracts with one company, you will often get a discount of 10% or more. If you currently have home insurance with a company that you are satisfied with, contact them and get a quote for auto or life insurance. You may find that you will get a discount on every policy.

It's always a good idea to shop around for the best insurance rates, but remember, if you do decide to change insurers, have your old policy and your new policy overlap by a few days. Don't let there be any uninsured time between policies. This is a big risk in terms of the possibility of having a traffic accident or getting a ticket while uninsured.

The wise consumer will take their own loyalty into account when comparing insurance companies. An insurer that has provided years of effective, reliable and trouble-free service should not be abandoned the instant a slightly cheaper alternative becomes available. It is quite likely that an insurance company that offers rock-bottom prices is cutting corners somewhere in the service they provide their clients.

Small business owners need to insure more than just the building in which they operate. They also need to insure any special tools or equipment used in the conduct of their business. A business owner's equipment and tools are considered personal property and are not normally included in the coverage provision of most business liability policies. Therefore, they must be protected against loss, theft or damage, with a separate policy.

You can get health coverage for your pet. Dogs and cats are commonly covered, but you may be able to find insurance for other small animals too. Many pet owners elect to go without pet coverage, as they find limited options and high co-pays too difficult to deal with, but some appreciate the added peace of mind.

If you are one of the millions of people who rent rather than own a home, investing in renter's insurance is a smart way to ensure that your personal possessions are covered in the event of fire, theft or other hazards, as well as to protect yourself from injury or property damage claims. Most renter's insurance covers the cash value of your possessions, taking depreciation into account, so make sure to upgrade to replacement cost if you want to be able to repurchase your items with no out-of-pocket expenses. Your policy should also include a personal liability clause to protect you from lawsuits if someone is injured in your home or the property is damaged because of your negligence. Talk with an insurance agent to find out all the specifics of a policy before making a choice.

Do not settle for a pet insurance company with delayed coverage. When you purchase the insurance, you should be able to hang up the phone knowing that your furry loved one is covered should anything go wrong. Immediate coverage should not cost anything extra. If it does, the company you are dealing with may be disreputable.

Before heading off on your own to buy insurance, check with your employer to see if they offer a company plan that may work for you. Many companies use the power of their workforce size to get plans and discounts that are unreachable by the general public. The limits may be low however so study the plans carefully before making a choice.

Look at the pluses and minuses of different ways of the different methods of buying insurance and decide what works for you. You can buy insurance through a direct agent, direct through the company, or through a financial planner. They all have their own reasons for choosing them, make the choice that works best for you.

When you receive a bill from your insurance provider, make sure to match it up to the Explanation of Benefits (EOB) statement you would have received earlier. Review it and confirm that you are being charged the same amount that was shown on the EOB. If the numbers don't match, contact your insurance company and find out why.

Check with the company that holds your car insurance or life insurance policies to see if they also offer renter's insurance. Many companies offer significant discounts when you hold multiple policy types with them. Don't assume that it's the best price though, make sure to always have quotes from a few companies before making a choice.

Once you get involved in an insurance claim it is vital to remember that your insurance company is, ultimately, a profit-motivated corporation. Keep this in mind when you deal with company representatives. Do not be adversarial, just try to understand their viewpoint and their priorities. Understanding your insurer's motivations can help you bring a claim to a mutually-satisfactory resolution.

Make sure that the medical coverage on your travel insurance is going to be enough to cover the expenses that may incur if you fall ill or get injured during your travels. Check the guide online to be sure that the amount your insurance provides is enough to cover the costs.

When you are trying to consider how much insurance to buy it is best to purchase as much as you can comfortably afford. This is a good idea because you would not like it if you end up having losses that exceed your coverage and the difference in the premium was just a few dollars more.

Contrary to popular belief, a car insurance company will not charge you a heftier premium dependent on the color of your car. That has nothing to do with it, but some companies will charge a much higher premium if you have a sports car regardless of what color it is.

Stay with your current insurance carrier unless a competitor offers a significantly lower premium or better benefits. Often, stability with a single company leads to better rates over time and an increased likelihood that a few claims will not cause the carrier to non-renew your policy. Also, many insurance carriers consider the amount of time you spent with a prior carrier in their rating structure so jumping around may actually cost more in the long run.

The price is not the only thing that matters when trying to get a good insurance provider. Buy Car Insurance want to work with a person and company that is easy to work with as well as being rather responsive, so be sure to ask around and see who has had a good experience with their company.

https://kirbylawrycaa.wixsite.com/alvarado/post/us...cial-insurance-coverage-choice have read previously in this article that without insurance you may be looking back at some type of disaster and wish that you had gotten insurance. Well, now you know the information needed to get the insurance that best fits you, so don't wast any more time because disaster can strike at any moment.

|

|

Suggestions On How To Choose The Best Insurance Policy |

Content by-Mcclain Kragh

It is all too easy to overlook some of the possibilities for saving money and getting better service when you look for insurance. This article will present a few quick possibilities for improving the deals you get from insurance companies. A little research can help you get better treatment for less money.

You can insure just about anything these days. If you have an antique or family heirloom that you know is of great value, you can take out an insurance policy on that particular item in the event it is damaged, lost, or stolen. It won't be able to replace something that has sentimental value, but it will ease the pain a bit.

Much like car insurance or health insurance, having a higher deductible can save you money on your premium. The downside to all of this, is that if you have a small claim to make, you will most likely have to pay for the entire repair out of your own pocket.

If you own a small business, make sure you have the right insurance. An insurance should cover any damages that your employees might accidentally cause to your customers, as well as the value of the building and inventory. A small business insurance can be quite expensive, but is absolutely necessary.

Small business owners should always make sure that they have small business insurance. It provides you with financial protection against things like natural disasters and power shortages. Things that are unpredictable like that can cause a business to quickly go under if you are not properly covered with the correct insurance.

When shopping for a good insurance package, you need to weigh multiple options. Many people only look at the company they already have, rather than seeing if there's a better deal out there. It is possible to save a large amount of money on premiums, so taking the time to shop around is definitely worth it.

Save on all of your insurance policies with multiple policy discounts. If you have separate home, life, car and health insurance policies, it may be worth checking with each of your companies for quotes on your other policy types. Many insurance companies will offer a discount if you carry multiple policies with them.

Before purchasing life, disaster, car or home insurance of any kind, consult the laws of your current state, as well as national policy on insurance. This is becoming especially important in the realm of health insurance. Government mandates and fees are sure to impact your final choices in what insurance to buy. Make sure to familiarize yourself with these statutes before choosing a policy.

Consider adding additional insurance onto the policy that is provided by your work. A group insurance coverage does not move with you if you change jobs. These days most people do not stay with the same company through till retirement so an insurance policy tied to your job is not as useful as it used to be. Make sure and have coverage of your own that is not tied down to a particular employer.

Avoid making monthly payments and instead pay your premium on an annual basis to save up to 60 dollars a year. Most companies charge between 3 to 5 dollars a month if you are paying every month. Put your money aside, and make the payment once a year or every six months instead of paying the extra fee.

To make sure https://www.investopedia.com/articles/personal-fin...top-10-insurance-companies.asp don't overpay on your insurance, seek out any discounts you may be eligible for. If you have healthy habits or have taken certain courses, you may be entitled to lower insurance rates. Talk to your insurance agent about available discounts and find out if they apply to you.

Accidents are extremely unpredictable, and that's why they're called accidents. Whether we're speaking about car insurance, home insurance or health insurance, having proper coverage is a must in an unpredictable world.

Use a personal insurance agent. They may be able to help you find the right kind of coverage for you and your family. They will know the guidelines and restrictions of different policies and will be able to get the one that will cost you as much as you like and give you the coverage that you need.

If you're planning on switching insurance providers, make sure you open your new policy BEFORE canceling your old one. If you cancel your policy first you could find yourself uninsured at the worst possible time, leaving you uncovered and paying for the situation yourself. Saving money isn't worth the risk!

To keep yourself and your assets protected, don't think of insurance as a luxury. Insurance may seem like wasted money when you don't need it, but when you're in a crisis situation you'll be happy to have it. Don't skimp on your coverage, and get all the insurance you think you may need.

In order to maximize your savings, check into the possibly of getting all of your insurance needs bundled into one multi-policy. For example, if you need homeowner's insurance and auto insurance coverage, you can typically find insurance companies which offer both. By combining all of your insurance policies through one company, you have the potential to obtain considerable savings.

Ensure that Truck Insurance receive fast payments in the event of insurance claims through the use of endorsements. Endorsements that prove the value of your most valuable property, such as expensive jewelry, pieces or artwork or state-of-the-art video equipment, are obtained and provided by you to your insurance company. In click the up coming web site of a fire, flood or anything that results in your property being damaged, stolen or lost, you can receive payouts to cover the cost much quicker, when the specific items are endorsed.

If you own a business such as a restaurant, it is very important that you have the right insurance coverage. This entails a variety of factors including the right coverage for your staff as well as any customer that may get hurt at the your place of business. It is key for you to have the right insurance for their business.

As you learned about in the beginning of this article, the more risks you take, the more you will have to pay when it comes to insurance. Apply the advice that you have learned about insurance and you'll be happy and feel less anxious getting this task out of the way.

|

|

Amazing Tips To Pursue Your Insurance Coverage Needs |

Created by-Mcclain Butcher

Insurance is a form of risk management. It is used mostly, to prevent the risk of a loss. An insurance agent will sell you the type of insurance that you feel is best for you. The more risk factors you have, the more you probably will need to pay. This article will give you many tips about insurance.

To make sure your insurance claim gets processed quickly and correctly, you should make note of who your adjuster is at the company. Many companies will hire an independent adjuster to make the visit to determine how accurate the damages reported are, but the adjuster who actually works for your company, is the one who makes the final determination of your case.

To avoid becoming the victim of a fraud when purchasing insurance, you should make sure you have all the paper work you need. After purchasing an insurance, you should receive a proof of insurance in the mail within a couple of weeks. If you do not receive anything, get in touch with your insurance company and consider canceling your insurance.

To cover your home for earthquake damage in California, you must purchase separate earthquake insurance. Regular homeowner's insurance will not cover quake damage. Your insurance company or broker can help you understand the risk in your area and provide the coverage for you. Many homeowners choose not to get earthquake coverage, as it can be quite expensive.

To make sure your insurance is providing the coverage that you are paying for make sure that you talk to your agent when you make any large purchase. Most policies have limits for any single item. If you buy a new ring that is worth $5,000 you may need to add an endorsement to cover it fully.

Get a pet insurance policy with traveling coverage included. Some companies will not pay for any vet visits if you are on the road and this can lead to heavy expenses for the pet owner. Find a policy that lets you visit other vets and you will be able to securely travel with your furry friend.

Save on all of your insurance policies with multiple policy discounts. If you have separate home, life, car and health insurance policies, it may be worth checking with each of your companies for quotes on your other policy types. Many insurance companies will offer a discount if you carry multiple policies with them.

Don't rule out using an insurance broker. https://www.motor1.com/reviews/404679/my-car-insurance-got-cancelled/ can save you time by doing a lot of research then presenting you with the insurance policies best suited to your needs. They can also explain legal terms in insurance policies and they can often offer you great discounts on policies.

Often, you will wish to consult other customer reviews of certain insurance companies before investing your money in their policies. By consulting websites like Angie's list and other such user comments, you can gain a sense of the current public opinion toward an insurance company. If most of the company's patrons are satisfied, that may help you form a decision, and vice-versa.

To make sure you get the coverage that's right for you, research the various types of coverage available. Educating yourself about coverage will make sure you don't pass up on anything you need, and will save you money on the things that you don't. Knowledge is power, and this knowledge gives you the power to get the perfect insurance plan.

Make your insurance premium one of the first payments you make every month. Most polices have language written into them that a missed payment cancels your insurance coverage. This can be especially dangerous as your health or risk status may have changed since you first purchased your insurance. A lapse in coverage will end up meaning higher premium payments so make it a priority.

The best way to keep your insurance premiums low is to never file a claim for a small item. When you are considering filing a claim, take into account the amount your premium is likely to go up and how much extra that will cost you. Next, compare that to the amount your claiming, and if the claim amount is lower you should pay for it yourself. This could save you hundreds of dollars in the long-term.

Ask Recreational Vehicle Insurance for a list of the discounts they offer, and check each one to see if you qualify. If you do not use an agent, check with the website you use and find it there. Spending a little extra time on the search can help you save a lot of money.

Sometimes, investing in insurance may not be the wisest choice. Ask yourself, will I spend more in monthly premiums and deductibles than I would if I paid the expenses completely out of pocket? For example, a healthy adult male who never sees a doctor, would be prudent to not invest in health insurance.

Make sure to take photos when you are claiming any type of damages to your homeowner's insurance company. This is extremely important because your insurance adjuster may not be around to take any pictures right away and some of the physical evidence of damages may not still be there, and that will negatively affect your claim.

Having a cell phone, especially a high-tech modern cell phone, is more and more common. So is the risk of having that cell phone robbed, lost or broken. Purchasing the insurance for your cell phone up front, is advised to halt the risk of headaches later, if anything happens to your cell phone.

You should know the different types of insurance available to you and whether you will need them or if they are required by the state you live in. For https://blogfreely.net/rosalba2trenton/the-keys-to...en-handling-insurance-coverage , most states require you have minimum coverages which vary in different states. Make sure you have the minimum coverage and no more unless you need it.

If something happens that involves more than one party who has been involved in a crime, do not contact your agent. You need to contact the police as soon as possible. You need to involve the police in any legal matters of this nature, since the agent can only work on your insurance policy.

When purchasing insurance of any type it is always important to obtain at least three quotes and do a line by line comparison of what you are getting for your money. You must compare deductibles, coverage for various categories, and the rating for the insurance company. How quickly do they settle claims? Doing some research up front will save you time and money in the long run.

Hopefully, these tips have prepared you a little to make wise insurance decisions. Do not stop here, though. There is an abundance of free information available to teach you more about getting the most out of the money you spend on insurance. More education will protect you even better. Keep learning and keep saving money!

|

|

Overwhelmed Regarding What Insurance Coverage To Acquisition? Read This Excellent Listing Of Tips! |

Article by-Lawrence Kragh

If you are a first time buyer for insurance, it can get really confusing. If you look through this site, you will find all sorts of fantastic hints and tips that will make your first buying experience an enjoyable one. Make sure you check these tips out to make everything easier.

To save money on insurance, you should shop around and find out how different companies will discount for multiple policies for the same household. Most companies offer a standard 10% discount for placing all of your business with them but some firms will be able to make larger concessions.

Insurance is like any profession: it uses a lot of specialized words (indemnification, liability, etc.) So if you don't understand something about a policy you're about to buy, STOP. Ask the insurance professional you're talking with to back up and explain in terms that you can understand. If you still don't get it, make them explain it again. Nothing is worse than signing on for a policy that either costs too much or doesn't cover enough, because you didn't feel comfortable asking questions about it beforehand.

When involved in an insurance claim, always be as professional as possible. The people you are working with are people too, and you will see much more positive results if you are positive and professional. Your insurance company only wants to know the facts, not the emotions. Proofread all written material sent to them.

The wise consumer will take their own loyalty into account when comparing insurance companies. https://www.brookings.edu/research/how-to-protect-essential-workers-during-covid-19/ that has provided years of effective, reliable and trouble-free service should not be abandoned the instant a slightly cheaper alternative becomes available. It is quite likely that an insurance company that offers rock-bottom prices is cutting corners somewhere in the service they provide their clients.

Check with organizations that you belong to and find out if they have a relationship with any insurance companies to obtain a discount. For instance, professional organizations and alumni groups sometimes partner with a certain insurance company to offer discounts to their members. This can result in savings for you.

Avoid signing-up for insurance policies that guarantee you will be approved. These types of insurance are much more expensive than a regular policy because they cannot manage the risk levels of their policy holders. Unless you are in bad health and have been turned down elsewhere, avoid these types of policies.

Review your insurance policy regularly. It's possible that you'll find ways you can save additional money, or erroneous information that should be removed. Each of these items could wind up taking money from your pocket, so it is worth the effort.

When you receive a bill from your insurance provider, make sure to match it up to the Explanation of Benefits (EOB) statement you would have received earlier. Review it and confirm that you are being charged the same amount that was shown on the EOB. If the numbers don't match, contact your insurance company and find out why.

Check out your insurance policy yearly so that you can be sure it's still right for you. As an example, dropping a portion of unneeded insurance on the vehicle, or raising the deductible on another policy, could save you a large sum of money. You may also need to adjust your policy if there has been a change in medical needs or family size.

If a claim has been denied that does not automatically mean that you have to pay. There are a variety of reasons that can cause your insurer to deny a claim; from simple paperwork errors to lack of information provided. If https://kelleidol6ba.wixsite.com/snow/post/is-your...-out-even-more-with-these-tips receive a denial, contact your insurance company and find out what the reasons were and see if it is something that can be fixed.

If you feel that you are paying too much for your renter's insurance premiums, you may want to check with your insurance company to find out if the place that you are renting is considered to be a high risk structure. The higher premiums may be due to the fact that the building that you are renting is high risk and the cost is being passed on to you.

If you have determined you need more than your current coverage, consider getting a rider to your current policy instead of shopping for something new. Adding on a rider will generally be less expensive than a new policy and easier to manage. If you are in good health and still young, however, it may be worth it to shop around.

Having a cell phone, especially a high-tech modern cell phone, is more and more common. So is Truck Insurance of having that cell phone robbed, lost or broken. Purchasing the insurance for your cell phone up front, is advised to halt the risk of headaches later, if anything happens to your cell phone.

Pay special attention to the dates listed in your insurance policy. Be very aware of the expiration date. You need to be aware of this date so that you can renew it in time and not have to go through the entire process again.

Do not accept a check from your insurance company if you feel that you are owed more than what it is they are offering. You have the right to do some independent research and dispute any offers that you do not feel are in your best interest at that time.

File fewer claims to pay less on your insurance premiums. If you only have a few hundred or thousand dollars in damage, calculate what the increase in your premium will be for the next six years and weigh that versus what you need to pay to cover the damage.

If you find yourself in the position of needing to file a claim, be sure to report it to your agent as soon as possible. Take photos of whatever it is that you are claiming and be sure to document all losses. Do not make any changes to the damage before your adjuster comes to look at the damage.

You can learn so much more about insurance and find out how to really find the rates that you are interested in, which will give you a break in premiums. However, if you don't take the time to do the research needed, you could lose out on great information that you could use to get much lower rates. Take these tips and others to mind and get a search started with the right strategy.

|

|

Tips On Exactly How To Obtain The Best Insurance Coverage In Town |

Article by-Blackwell Bain

If you are looking for all of the basics regarding insurance plus some other tips that you might not have heard of, this article is for you. This can be a confusing subject with all of the different opinions and information that is available, especially when a lot of it is contradictory.

If you want to make sure you are getting the best deal on your insurance premiums, make sure that your credit score is as good. A negative credit score or mark on your credit report can put you into a different pricing structure and cost you money on a monthly or yearly basis.

When you are filing a claim with an insurance company, ask for your claim number at the end of the original conversation with your agent. Write down and keep this number for reference. Any time you call for an update on your claim, you'll need this number, so it's better to have it on hand.

To save money on insurance, you should shop around and find out how different companies will discount for multiple policies for the same household. Most companies offer a standard 10% discount for placing all of your business with them but some firms will be able to make larger concessions.

In order to get the best rates on insurance, you must shop around for the best prices. All you have to do is call your local agents or obtain rate quotes via the internet. Shopping around can save you hundreds of dollars a year and it takes very little time and effort.

You can get health coverage for your pet. Dogs and cats are commonly covered, but you may be able to find insurance for other small animals too. Many pet owners elect to go without pet coverage, as they find limited options and high co-pays too difficult to deal with, but some appreciate the added peace of mind.

If you are balking at the cost of renter's insurance, consider increasing your deductibles. Higher deductibles means lower monthly payments, however make sure that you'll be able to afford the deductible costs if the need comes up. The smaller monthly payment is useful, but if you end up not being able to meet your deductible then your coverage becomes useless.

In cases of regional disasters, some insurance companies will send special adjusters into the area to help expedite claims for policyholders, arrange temporary housing, and begin the rebuilding process. When shopping for a new homeowner's policy, you might wish to go with a carrier that has a history of helping out like this.

If you have determined you need more than your current coverage, consider getting a rider to your current policy instead of shopping for something new. Adding on a rider will generally be less expensive than a new policy and easier to manage. If you are in good health and still young, however, it may be worth it to shop around.

Make your insurance premium one of the first payments you make every month. Most polices have language written into them that a missed payment cancels your insurance coverage. This can be especially dangerous as your health or risk status may have changed since you first purchased your insurance. A lapse in coverage will end up meaning higher premium payments so make it a priority.

If you have not filed an insurance claim for years, check with your agent to see if you could be eligible for a discount. After a few years without filing a claim, an insurance company wants to keep you around. Use the advantage you have to negotiate for a better rate.

\

Don't just go with the first car insurance quote you hear. Of course, every insurance company is going to present its deal as if it were the best. It is important that you make an aggressive comparison to decide which one is the best for you and your situation. Compare policy benefits limits, ranges of coverage, premium quotes and deductibles to determine which car insurance policy will suit you best.

Bundle up your insurance coverage for your home, car, life and health insurance whenever possible. You can enjoy as much as 10 percent off all your policies by bundling with most insurance companies. Get quotes for other types of insurance from the companies you use for each type, bundle your plans and discover how to keep more money in your pocket!

Open multiple policies with the same insurance company. Talk to your insurance company about multiple policy discounts if you purchase both auto and homeowners insurance with them. You might be able to save a significant amount on your premiums if you use this strategy, in some cases up to 20 percent of your total costs.

When https://www.cnbc.com/2020/04/03/coronavirus-latest-updates.html has been purchased, take some time to sit down and read the fine print. Do mouse click the next web page assume that the policy is exactly as the seller presented it to you. There may be Landlord Insurance in the terms and conditions that were not mentioned and discourage you from keeping the product. All policies have a short cancellation period after the date of purchase just in case it is needed.

Make sure you keep your insurance policy in an easy to find place in case a question arises. For example, keep a copy of your auto insurance policy in your car and in your wallet for quick reference. Many companies offer special cards for this purpose. Always have it with you in case an accident occurs then you have proof of coverage.

If you are newly married, examine your insurance policies closely. You may be able to save hundreds of dollars a year by combining auto insurance policies and other insurances. Pick the insurance agent who is offering the best deal and go with them. Don't waste too much time before you do this, it is best to combine right away and start saving money!

When selecting insurance, it is important to remember the deductible. A deductible is an amount that must be paid from your own money before an insurance company pays any other expenses. A lower deductible means that you won't have to pay as much for the insurance company to cover your expenses.

It can be difficult to wade through all the insurance types to find the one best for you and your family, but the tips in the article you just read should help you get on the right track. As in most things, the more you know, the better chance you have of getting the best possible fit for your needs.

|

|

General Insurance Policy Tips That Aid You Choose Smarter |

Author-Gottlieb Amstrup

Insurance is a very popular and important thing to have nowadays. The necessity for a policy that works just for you is great. Now is the time to start looking for that policy. Here are some tips that you can use to get you started with your insurance policy plans.

Look into multiple insurance policy discounts. When https://zenwriting.net/cedric5tad/general-insuranc...tips-that-aid-you-pick-smarter bundle your insurance contracts with one company, you will often get a discount of 10% or more. If you currently have home insurance with a company that you are satisfied with, contact them and get a quote for auto or life insurance. You may find that you will get a discount on every policy.

Much like car insurance or health insurance, having a higher deductible can save you money on your premium. visit the next post to all of this, is that if you have a small claim to make, you will most likely have to pay for the entire repair out of your own pocket.

Check with organizations that you belong to and find out if they have a relationship with any insurance companies to obtain a discount. For instance, professional organizations and alumni groups sometimes partner with a certain insurance company to offer discounts to their members. This can result in savings for you.

Small business owners should always make sure that they have small business insurance. It provides you with financial protection against things like natural disasters and power shortages. Things that are unpredictable like that can cause a business to quickly go under if you are not properly covered with the correct insurance.

The bigger the deductible, the lower your insurance costs will be. Just keep the amount of the deductible in a savings account in case of a claim. Many claims fall below the deductible amount, so neither you or the company has to bother with the claims process, saving everyone time and keeping the cost of the policy low.

In order to get cheap insurance rates it is best to buy insurance online. This reduces the cost of the insurance because most companies will not need to add overhead associated to the automation process of signing up for the insurance. Insurance rates taken online typically drop by five to ten percent.

Bundling both insurances with your provider can lead to large discounts. Compare their discounted rate to what you would pay if you bought a policy elsewhere, you may still find a better premium at another company.

Remember that the cheapest plan is not always the best plan. Make https://postheaven.net/van52emmanuel/check-out-the...nizing-of-your-insurance-needs to understand exactly what you will be paying before signing on the dotted line. If you have a very low cost plan, check on what the deductible amounts are. It may be better for you to pay more per month than to have to pay thousands of dollars out of pocket before your insurance kicks in.

Find a pet insurance company that allows you to submit claims in multiple ways. Some companies only allow you to fax in your claims, and if you are not near a fax machine, this will be troublesome. The best insurance companies will allow you to not only fax in your claim, but also have the vet call or email it for you.

When shopping for coverage, make sure to get quotes from multiple insurers and for different plans within a particular company. The prices of insurance plans vary wildly and you could be missing out on saving hundreds of dollars a year by not shopping around. Consider working with an insurance broker, who can help you understand your various options.

Bundle your home owner's or renter's insurance with your car insurance and you should save on overall costs. Don't buy insurance "a la carte." Most major insurance companies will offer significant cost-savings when you bundle different insurance policies under their umbrella. Shop around for the best deals and then make your purchase from one provider.

Keeping your credit report clean will also reduce the amount you pay on insurance. Your premiums are based on how much of a risk you appear to be to the insurance company, and not paying your debts can make you look like a deadbeat. If you pay off everything you owe, you will quickly find your premiums go down as a result.

If you are in the market for life insurance, you should explore buying a type of term life insurance called return of premium. This type of term life insurance is more expensive than others, but the insurance company pays you back your premium if there is no claim during the term of the contract.

Make sure that you adhere to any time limits for filing a claim that are set by your insurance company. You are required to file a claim within a specified time frame after an accident and if you fail to do that it can lead to the denail of your claim.

If your insurance agent gives you some type of estimate about the value of your claim keep in mind that they will often give you estimates that are lower than what your actual losses may be. Before you accept anything they say be sure to make your own estimations.

Contrary to popular belief, a car insurance company will not charge you a heftier premium dependent on the color of your car. That has nothing to do with it, but some companies will charge a much higher premium if you have a sports car regardless of what color it is.

There are so many reasons why you need insurance. There is not one person who would not benefit from some type of insurance policy, whether it is life, health, dental, or some other type. Insurance has a great place in this world, as it allows us to afford the things we need the most, when we need them the most.

If you want to know more about what you are doing as you are getting insurance. Regardless of the type and level of coverage that you require, you want to use tips like these that give you more of a stronghold in the process. There is a lot to learn about insurance, and this is the best place to start.

|

|

Insurance Tips That Are Easy To Understand |

Posted by-Blackwell Reynolds

Insurance is a form of risk management. It is used mostly, to prevent the risk of a loss. An insurance agent will sell you the type of insurance that you feel is best for you. The more risk factors you have, the more you probably will need to pay. This article will give you many tips about insurance.

By having all of your insurance policies with one company, you can often receive many different discounts that would otherwise not be available to you. Spend some time asking your representative about how much they could save you if you switched all of your other policies to their company.

When filing a claim with your insurance company, be proactive about getting updates and information about your claim status. If you simply wait for the insurance company to tell you how much they owe you, you could be in for a very long wait. As they say, the squeaky wheel gets the grease.

To avoid becoming the victim of a fraud when purchasing insurance, you should make sure you have all the paper work you need. After purchasing an insurance, you should receive a proof of insurance in the mail within a couple of weeks. If you do not receive anything, get in touch with your insurance company and consider canceling your insurance.

Insurance premiums can vary from location to location. They will also depend on the age of the person, claim or accident history, and several other things. To get the best rates on any type of insurance you want to be sure that you are inside each company's guidelines to minimum premiums.

Many insurers offer reduced rates for taking out multiple lines of insurance with them. For instance, insuring two vehicles and having a homeowner's policy with the same company is cheaper (and easier to remember) than insuring each separately. Do check the total cost against other policies and avoid adding on extra insurance that you do not need just for the multiple line discount.

When filing a claim be sure to be completely honest with the insurance agent even if the situation is embarrassing to you. Not being totally honest can lead the agent you speak with to invalidate your insurance policy altogether, or red flag the account and deny your entire insurance claim.

To make sure someone gets the very best price for insurance rates, it's vital that this person searches around and does his or her homework. Being educated about https://postheaven.net/eldridge626winfred/tips-on-...-best-insurance-policy-in-town can help you receive the best plan. Learn the appropriate coverage for one's needs. Consider one's family circumstances. The more one knows, the better off one will be.

Consider signing up for a decreasing term insurance program. This type of insurance is designed to supplement your investments if you were to pass away before the investments reach a certain level. The higher the investment grows, the more affordable the monthly premium becomes. With this type of insurance you will save money over the life of your policy.

Insurance premiums can vary from location to location. They will also depend on the age of the person, claim or accident history, and several other things. To get the best rates on any type of insurance you want to be sure that you are inside each company's guidelines to minimum premiums.

A sure-fire way to save money on your insurance is to stay with your current insurance company. Having a track record with the company of paying your premiums on time and not filing many claims, will tell the company you are a safe bet to insure. In turn, they will keep your premiums low and give you special discounts for being a loyal customer.

Research insurance company lingo so you are prepared to fully read your policy. You do not want to be constantly asking your agent what every little word means, so do your homework ahead of time. Come prepared to read your policy effectively, and ask questions about unfamiliar topics. Your agent should be happy to see that you've worked ahead.

When paying for your premium, never send the insurance company cash. Write out a check or get a money order. This way, should any problems arise, you have a record for your purchase. This also prevents thieves from stealing your money, since they cannot cash a check or money order.

Look out for multi-insurance policy discounts. Sometimes insurance companies will offer customers a discount of 10% or more if they take out several contracts at the same time, for example home insurance, auto insurance and health insurance. So, when asking for insurance quotes from various insurance companies, be sure to ask them if they offer any discounts for taking out multiple policies.

Consider buying a renter's insurance policy after renting your new place. https://www.investopedia.com/terms/c/copay.asp doesn't cover the structure of the home, but pays for your belongings. Take pictures of your furniture, books, jewelry, CD and DVD collection, TV and electronics, so you can prove to the insurance company that you owned them.

One great tip when trying to purchase insurance is to comparison shop. Meaning check out all the companies that are out there and what they have to offer and how much they are expecting you to pay. Some companies offer the exact same thing but have completely different prices. Also check with your friends and the yellow pages and even your state's insurance insurance department for more options and information.

Purchase specialty insurance policies carefully. Some are useful, others are a waste of money. You might need flood insurance, but it's not likely if you live in the middle of a desert. Credit protection insurance might be helpful, but only if you buy it from the right company. Having http://louetta26hunter.nation2.com/insurance-polic...rds-for-insurance-maximization is helpful, but the wrong ones will only cost you money. Always investigate first, and buy cautiously.

Check your policies regularly to make sure they are still accurate. For instance, your auto insurance might no longer reflect the actual value of your car or you might be paying for health coverage you do not need anymore as your children grow up. Make sure you subscribe to plans that reflect your needs.

As stated before, life insurance is a great form of insurance for people to have. It provides loved ones with compensation in the event of your death, allowing them to feel safe, secure, and reassured. Though some may find selecting life insurance to be difficult, the advice from this article will help anyone with the process.

|

|

Points You Need To Not Forget Concerning Your Insurance Coverage Coverage |

Authored by-Haley Lyon

No doubt, there is a lot of advice about insurance available. You may have heard others discussing the subject. Well, here are some handy suggestions to help you make some decisions regarding insurance, read on:

You can insure just about anything these days. If you have an antique or family heirloom that you know is of great value, you can take out an insurance policy on that particular item in the event it is damaged, lost, or stolen. It won't be able to replace something that has sentimental value, but it will ease the pain a bit.

Sometimes, a good financial strategy is purchasing the correct insurance policy. Choosing a plan that has a low deductible will require paying more for your monthly premium, but will save you from large costs in the event of an accident. Choosing the right deductible can mean rolling the dice according to how much you are willing to pay up front for an accident.

Make sure to compare prices from multiple insurance companies before making a choice of who to sign with. Premiums can vary up to 40% between different companies for the same levels of insurance. With insurance shopping around is an absolute must if you want to get the most bang for your buck.

The bigger the deductible, the lower your insurance costs will be. Just keep the amount of the deductible in a savings account in case of a claim. Many claims fall below the deductible amount, so neither you or the company has to bother with the claims process, saving everyone time and keeping the cost of the policy low.

Do not file small claims, even if they would be covered. Premiums will probably rise higher than the cost of your small repairs. Many companies are offering incentives for staying claim-free, such as discounts and other rewards for customers they consider to be careful. You will still have the comfort of having comprehensive coverage in the event that it is needed.

The bigger the deductible, the lower your insurance costs will be. Just keep the amount of the deductible in a savings account in case of a claim. Many claims fall below the deductible amount, so neither you or the company has to bother with the claims process, saving everyone time and keeping the cost of the policy low.

Make your insurance premium one of the first payments you make every month. Most polices have language written into them that a missed payment cancels your insurance coverage. This can be especially dangerous as your health or risk status may have changed since you first purchased your insurance. A lapse in coverage will end up meaning higher premium payments so make it a priority.

\

You can get health coverage for your pet. Dogs and cats are commonly covered, but you may be able to find insurance for other small animals too. Many pet owners elect to go without pet coverage, as they find limited options and high co-pays too difficult to deal with, but some appreciate the added peace of mind.

Insurance coverage is a very important thing for those who own property, valuable items, or have motor vehicles. It ensures that if any damage is done to your property or the people using your property is covered under the insurance company. Specialty Dwelling Insurance can mean a lot when you need money to cover your losses.

Use a personal insurance agent. They may be able to help you find the right kind of coverage for you and your family. They will know the guidelines and restrictions of different policies and will be able to get the one that will cost you as much as you like and give you the coverage that you need.

Check with https://www.dailystrength.org/journals/discover-th...policy-for-you-with-these-tips about every six months to learn about any discounts that you may be eligible for. You can save ten to twenty percent with these discounts. It may not sound like a lot, but by the end of the year it could add up to some serious cash in your pocket.

Once you get involved in an insurance claim it is vital to remember that your insurance company is, ultimately, a profit-motivated corporation. Keep this in mind when you deal with company representatives. Do not be adversarial, just try to understand their viewpoint and their priorities. Understanding your insurer's motivations can help you bring a claim to a mutually-satisfactory resolution.

You should know the different types of insurance available to you and whether you will need them or if they are required by the state you live in. For instance, most states require you have minimum coverages which vary in different states. Make sure you have the minimum coverage and no more unless you need it.

Ask questions you feel should be answered. If you aren't asking the questions you think should be answered, you aren't really getting the help you need. just click the following website could end up getting into a policy that isn't appropriate to meet your needs, or one that has coverage that isn't needed by your or your family.

If you rent, renters insurance can be an invaluable asset. Renter's insurance will protect most of your things in the event that there is a fire in your apartment, water damages your belongings, or a burglar steals your belongings. Renter's insurance can also be cheap - as low as $20 a month. Not much if you have a computer, a lot of nice clothes, or a flat screen TV.