Ready Yourself To Disclose The Major Benefits Of Functioning Alongside A Registered Insurance Representative |

additional resources -Mann Serup

When navigating the complex globe of insurance policy, collaborating with a qualified representative proves important. From tailored coverage choices to skilled assistance, these professionals provide greater than just policy sales. Yet what sets them apart? The advantages prolong past plain policy option, making sure a personalized insurance policy journey that satisfies your one-of-a-kind requirements. So, exactly what can a qualified insurance agent give the table? Remain tuned to reveal the leading benefits that come with entrusting your insurance decisions to these experienced professionals.

Specialist Support and Recommendations

When working with a qualified insurance policy representative, you can gain from their professional support and advice on choosing the best insurance coverage choices for your needs. These professionals have the knowledge and experience to browse the intricate globe of insurance policy, aiding you recognize the different plans readily available and which ones straighten with your specific demands. https://drive.google.com/drive/folders/1wXy80unYAR...ZJQdxtq7VHTv3AR?usp=drive_open can assess your scenario, assess dangers, and suggest coverage that gives sufficient defense without unneeded prices.

Furthermore, qualified insurance agents keep up to day with market trends and adjustments in laws, making certain that they can provide you one of the most present and pertinent recommendations. Whether you're trying to find auto, home, life, or any other type of insurance, they can guide you with the process, explaining the small print and aiding you make informed choices. By leveraging their proficiency, you can have comfort recognizing that you're making educated options concerning your insurance policy coverage.

Tailored Insurance Coverage Options

To customize your insurance coverage to your specific demands, a licensed insurance agent will function very closely with you to understand your demands and choices. This tailored technique permits the representative to recommend insurance coverage alternatives that line up with your one-of-a-kind scenario. Whether you're trying to find car, home, life, or organization insurance, an agent can assist you customize your policy to give the appropriate degree of security.

Collaborating with a qualified representative ensures that you get expert suggestions on the types of insurance coverage readily available and the limits that finest suit your needs. Agents have the expertise and experience to lead you through the procedure of selecting protection options that resolve possible risks while staying within your spending plan. By examining your individual situations, an agent can suggest additional coverage or policy enhancements that might be beneficial to you.

Through this collective procedure, you can feel confident that your insurance policy is customized to fulfill your details needs, offering you with satisfaction knowing that you're sufficiently shielded.

Personalized Service and Assistance

For a genuinely tailored insurance experience, a qualified agent uses personalized solution and support satisfied your individual demands and choices. When you deal with an accredited insurance coverage agent, you can expect a level of individualized interest that exceeds just offering a policy. These representatives take the time to recognize your specific scenario, whether it's locating the right protection limitations for your home or crafting a tailored plan for your company.

Conclusion

In conclusion, dealing with a qualified insurance coverage representative uses you expert support, customized insurance coverage choices, and individualized solution and assistance.

Their knowledge and competence in the insurance coverage market can assist you make educated choices and ensure you have the appropriate level of security for your individual needs.

By selecting to work with a certified representative, you can have assurance understanding that you're well dealt with when it pertains to your insurance requires.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Building Count On With Customers: An Overview For Insurance Brokers |

Read the Full Write-up -Gross Egan

As an insurance coverage representative, you comprehend the value of building trust with your clients. Developing a strong structure of trust fund is not practically providing outstanding solution yet additionally concerning promoting a feeling of dependability and reliability. By carrying out tried and tested strategies and strategies, you can boost your relationships with clients and set yourself apart in the affordable insurance policy market. Yet how specifically can you navigate the intricacies of trust-building in a way that reverberates with your clients and guarantees their loyalty? Allow's check out some informative approaches to lead you in this important aspect of your career.

Comprehending Customer Demands

To build trust with your clients as an insurance policy agent, beginning by proactively paying attention to their needs and problems. Comprehending your clients' requirements is vital in giving them with the very best insurance options. When you listen attentively, you reveal them that their problems are valid and vital. By asking insightful concerns, you can dive deeper right into their particular requirements and customize your services to fulfill those needs effectively.

Empathy plays a significant function in recognizing your customers' viewpoints. Put yourself in their footwear to comprehend the feelings and challenges they may be facing. This strategy aids in constructing a strong connection and promoting trust fund with your clients. Additionally, being click the up coming post about the insurance policy items you offer and exactly how they align with their requirements infuses self-confidence in your customers.

On a regular basis reviewing and reassessing your clients' needs is vital. As their circumstances progress, so do their insurance needs. By remaining aggressive and alert to these modifications, you show your dedication to providing dependable and individualized service. Remember, understanding your clients' demands is the keystone of an effective and trust-based client-agent partnership.

Communication Methods

Understand that reliable communication approaches are key in keeping depend on and solidifying partnerships with your clients as an insurance agent. Clear and open interaction is necessary for ensuring that your customers feel heard and recognized. Make sure to actively pay attention to their problems, ask penetrating concerns to uncover their true demands, and offer clear information regarding insurance policies.

Utilize numerous communication channels such as phone calls, emails, and in-person meetings to stay connected with your clients and immediately address any kind of inquiries or problems they might have. Be proactive in keeping your customers informed regarding any kind of updates or adjustments in their policies, and always follow up to guarantee their complete satisfaction.

Additionally, customize your interaction design to match the choices of each customer, whether they like comprehensive explanations or a shorter approach. By consistently exercising effective communication strategies, you can build stronger partnerships with your clients and gain their trust in the future.

Building Reputation

Utilizing endorsements and study can boost your trustworthiness as an insurance coverage agent, showcasing real-life examples of exactly how you have actually successfully helped customers secure their properties and browse insurance policy complexities. By sharing stories of satisfied clients that have actually taken advantage of your expertise, you demonstrate your record of supplying outcomes. Prospective customers are most likely to trust you when they see evidence of your previous successes.

Additionally, acquiring qualifications and accreditations in the insurance industry can boost your reliability. These credentials act as tangible proof of your understanding and abilities, ensuring clients that you're fully equipped to guide them in making educated choices concerning their insurance policy needs.

Uniformity is type in developing reliability. Always follow up on guarantees, respond promptly to questions, and provide precise info. Your reliability and expertise will certainly make the trust of your customers and strengthen your reputation as a reliable insurance agent. Remember, reputation is the structure of depend on, and trust is crucial for lasting client relationships.

Verdict

To conclude, as an insurance agent, building depend on with your clients is important for long-lasting success. By recognizing their needs, interacting efficiently, and developing reputation, you can develop solid relationships that bring about customer complete satisfaction and loyalty.

Continually providing on pledges, offering precise details, and demonstrating reliability are crucial parts in earning and keeping count on. Keep focusing on openness, honesty, and fulfilling your customers' requirements to strengthen your credibility and make sure continued success in the insurance sector.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Achieving Sales Quality As An Insurance Representative: Techniques To Drive Outcomes |

Created By- https://www.insurancebusinessmag.com/us/guides/how...ts-make-per-policy-450135.aspx

To improve your sales as an insurance agent in today's affordable landscape, understanding efficient techniques is critical. By honing in on digital advertising methods, supporting client connections, and maximizing your sales funnel, you can pave the way for success. These approaches use a comprehensive technique to driving sales development and making certain long-lasting prosperity in the insurance sector. Stay tuned to discover how you can raise your sales video game and remain ahead of the curve.

Digital Advertising And Marketing Approaches

To successfully get to possible clients in today's electronic age, insurance agents should take advantage of targeted online advertising and engaging social media sites campaigns. Making use of online systems permits you to particularly target people who are most likely to be curious about your insurance policy products. Through platforms like Google Ads or social media sites marketing, you can get to a large audience while managing your budget plan and tracking the efficiency of your campaigns in real-time.

Engaging social networks campaigns are important for developing brand recognition and developing reliability with your target market. By regularly posting valuable web content, engaging with followers, and taking part in pertinent discussions, you can position yourself as a relied on and well-informed insurance policy agent. Social media platforms likewise provide opportunities for direct interaction with possible customers, permitting you to address their inquiries promptly and build connections.

Along with marketing, creating a solid on the internet presence through a professional website and energetic social media sites profiles is crucial for showcasing your knowledge and services. Routinely updating your online systems with useful web content and client reviews can further attract prospective customers and establish you aside from competitors. By proactively involving with online target markets and using targeted advertising, you can properly increase your reach and drive sales as an insurance policy representative in today's digital landscape.

Client Connection Building

Structure strong partnerships with your clients is vital to long-term success as an insurance coverage representative. Establishing depend on and just click the up coming website can lead to loyal clients who not only restore policies but also refer new clients to you. One reliable way to build connections is by actively listening to your customers' needs and problems. Program real rate of interest in recognizing their distinct situations and provide tailored services.

Interaction is an additional vital aspect of client relationship building. Maintain your customers informed about their policies, upcoming changes, and industry trends that may impact them. Routine check-ins, whether with phone calls, e-mails, or in-person meetings, demonstrate your commitment to their well-being.

Supplying exceptional customer care is also important. Be responsive to questions, attend to any issues without delay, and go the extra mile to help your customers. By being aggressive and mindful, you can exceed their expectations and strengthen your connections.

Sales Channel Optimization

Maximizing your sales funnel is crucial for making the most of conversions and enhancing the insurance policy sales procedure. Begin by assessing each stage of your channel to determine any potential bottlenecks or areas for improvement. Guarantee that your leads are qualified and targeted to raise the likelihood of conversion. Simplify the procedure by supplying clear and succinct details at each touchpoint to lead prospective clients in the direction of making a purchase.

Make use of automation tools to nurture leads and follow up with them without delay. Individualize your communication to deal with the specific demands and problems of each possibility. By supplying appropriate and prompt information, you can keep leads involved and move them with the funnel a lot more efficiently.

Track vital metrics such as conversion prices, lead reaction times, and consumer feedback to continuously enhance your sales funnel. Make data-driven choices to refine your methods and enhance the general effectiveness of your sales procedure. By continually checking and changing Car Insurance For Off Road Vehicles , you can drive sales and accomplish greater success as an insurance coverage representative.

Final thought

To conclude, by implementing electronic marketing approaches, building strong customer connections, and optimizing the sales channel, you can drive sales effectively as an insurance representative.

Keep in mind to utilize online marketing, take part in social media sites campaigns, give outstanding customer support, and personalize interaction to meet the needs of prospective clients.

By continuously reviewing and boosting your sales procedures, you can attain long-lasting success in the affordable insurance market.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Expert Knowledge: Revealing Insurance Agents' Tips For Obtaining The Very Best Insurance Coverage |

Article Developed By-Walter Mathis

When it comes to protecting the most effective insurance policy protection, have you ever before wondered what tricks insurance policy agents hold? From revealing hidden plan gems to optimizing your benefits, there's a wide range of expert understanding that can help you navigate the complex world of insurance. By peeling off back the layers of insurance policy complexities, you can reveal important ideas that may just transform the method you view your insurance coverage.

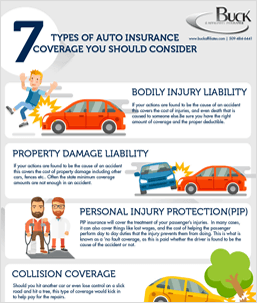

Comprehending Coverage Options

When considering insurance plan, it's critical to understand the numerous insurance coverage options readily available to guarantee you're adequately shielded. Among the vital elements to understand is the distinction in between obligation insurance coverage and extensive insurance coverage. Obligation coverage normally assists cover costs related to damage or injuries you cause to others, while comprehensive insurance coverage assists shield your own vehicle from various types of damages, such as burglary or all-natural disasters.

It's likewise crucial to be aware of the limits and deductibles of your plan. The insurance coverage limitations stand for the maximum amount your insurance provider will pay for a protected loss, so it's important to choose restrictions that align with your needs. Deductibles, on the other hand, are the out-of-pocket expenses you must pay before your insurance coverage begins. Understanding these facets can help you make informed decisions when picking the appropriate protection options for your scenario.

Additionally, think about added coverage alternatives that might be advantageous, such as uninsured driver coverage, roadside assistance, or rental compensation. By understanding these protection options thoroughly, you can guarantee you have the protection you need in various scenarios, giving you comfort on the road.

Making the most of Benefits

To maximize your advantages, thoroughly evaluate your insurance policy to comprehend all the readily available advantages and insurance coverage options. Take the time to acquaint yourself with the information of your policy, including any kind of exemptions, constraints, and unique arrangements. By recognizing what benefits you're qualified to, you can make enlightened decisions regarding utilizing them properly.

Look for opportunities to bundle your insurance policies. Many insurance companies offer discount rates to clients who buy several kinds of insurance policy from them. By combining your plans, such as integrating your vehicle and home insurance policy, you may have the ability to save money while still maintaining detailed coverage.

Don't neglect to capitalize on any kind of wellness programs or motivations provided by your insurance provider. Some insurers supply rewards for healthy and balanced behaviors or preventative treatment actions. By taking Condo Insurance Policy in these programs, you not just enhance your health and wellness but likewise possibly lower your insurance policy expenses in the long run.

Navigating Plan Complexities

Reviewing the intricate information of your insurance policy can help you navigate with the intricacies that may occur. When you obtain your policy papers, take the time to read through them thoroughly. Pay attention to the protection limitations, exemptions, and any kind of additional recommendations that might influence your security. Recognizing learn this here now can stop shocks in the event of a case.

If you come across any terms or stipulations that are unclear, do not be reluctant to reach out to your insurance policy agent for information. https://blogfreely.net/hang19dominique/in-the-purs...it-is-critical-to-bear-in-mind can provide important understandings and clarify exactly how particular arrangements might influence your protection. Being aggressive in looking for information can save you from potential misconceptions later on.

Moreover, stay notified about any type of updates or changes to your policy. Insurance policies can be updated every year, and it's important to assess these modifications to guarantee you still have appropriate insurance coverage for your demands. By staying educated and proactively engaging with your plan details, you can successfully navigate the complexities of insurance policy protection.

Verdict

You've found out the secrets of insurance coverage representatives to get the best insurance coverage for your requirements. By comprehending your coverage options, maximizing benefits, and browsing policy complexities, you can make enlightened decisions.

Remember to evaluate your plan details, package insurance plan, and remain informed concerning updates. With these insider ideas, you can make sure that your security straightens with your needs and obtain the thorough protection you deserve.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Increasing Sales As An Insurance Coverage Representative: Key Strategies For Optimum Impact |

Authored By-Goode Lorentsen

To enhance your sales as an insurance policy representative in today's competitive landscape, grasping efficient strategies is essential. By focusing in on digital advertising and marketing methods, nurturing customer relationships, and optimizing your sales channel, you can pave the way for success. These strategies supply an extensive method to driving sales development and guaranteeing lasting success in the insurance sector. Keep tuned to uncover exactly how you can boost your sales game and stay ahead of the contour.

Digital Advertising Strategies

To properly reach potential customers in today's digital age, insurance coverage representatives must utilize targeted online marketing and involving social media projects. Utilizing on the internet systems enables you to specifically target individuals that are more probable to be curious about your insurance products. Via platforms like Google Ads or social media sites advertising and marketing, you can get to a broad audience while regulating your spending plan and tracking the performance of your campaigns in real-time.

Engaging social media sites projects are important for constructing brand name understanding and establishing credibility with your target market. By constantly posting important content, interacting with fans, and participating in relevant discussions, you can place on your own as a relied on and well-informed insurance agent. Social media platforms likewise supply possibilities for straight communication with prospective customers, allowing you to resolve their queries without delay and develop connections.

In addition to advertising, creating a solid on-line visibility with a specialist web site and energetic social media accounts is important for showcasing your competence and solutions. On a regular basis updating your online systems with informative material and customer testimonials can further draw in prospective customers and set you apart from rivals. By proactively involving with online audiences and using targeted marketing, you can efficiently increase your reach and drive sales as an insurance policy representative in today's electronic landscape.

Customer Connection Structure

Building solid relationships with your customers is essential to long-lasting success as an insurance policy agent. Developing depend on and connection can bring about loyal customers that not only restore plans but likewise refer new customers to you. One efficient method to construct connections is by actively listening to your customers' demands and problems. Program authentic rate of interest in recognizing their special situations and provide personalized services.

Communication is another essential facet of customer connection structure. Maintain your clients notified regarding their plans, upcoming adjustments, and market patterns that may influence them. Regular check-ins, whether through phone calls, e-mails, or in-person meetings, demonstrate your commitment to their wellness.

Offering phenomenal customer service is also essential. Be responsive to inquiries, address any concerns promptly, and go the extra mile to assist your clients. By being https://www.abc.net.au/news/2023-07-19/insurance-i...2022-flood-disasters/102618800 and conscientious, you can exceed their expectations and strengthen your connections.

Sales Channel Optimization

Optimizing your sales funnel is crucial for making the most of conversions and improving the insurance sales process. Start by examining each stage of your channel to identify any type of prospective bottlenecks or locations for renovation. Make sure that your leads are certified and targeted to boost the likelihood of conversion. Simplify the process by supplying clear and succinct info at each touchpoint to guide potential clients in the direction of purchasing.

Use automation devices to nurture leads and follow up with them without delay. Customize your communication to resolve the details needs and issues of each possibility. By offering appropriate and prompt details, you can maintain leads engaged and relocate them via the channel much more efficiently.

Track crucial metrics such as conversion prices, lead feedback times, and consumer comments to continuously optimize your sales funnel. Make data-driven decisions to improve your methods and boost the overall efficiency of your sales procedure. By regularly checking and changing your channel, you can drive sales and achieve higher success as an insurance representative.

Verdict

In conclusion, by executing digital advertising methods, building solid customer connections, and maximizing the sales funnel, you can drive sales efficiently as an insurance policy agent.

Bear in mind to leverage online advertising, participate in social networks campaigns, provide outstanding customer support, and customize communication to meet the needs of prospective customers.

By continuously examining and enhancing https://squareblogs.net/merrilee33fabian/utilize-t...es-to-find-an-insurance-policy , you can attain long-term success in the competitive insurance sector.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Prepare Yourself To Uncover The Leading Advantages Of Dealing With A Qualified Insurance Agent |

Author-Gilbert Albrechtsen

When browsing the complex globe of insurance, working with a certified representative verifies invaluable. From customized insurance coverage choices to professional guidance, these specialists provide more than just policy sales. However what establishes just click the following page ? The benefits prolong beyond mere plan selection, guaranteeing a personalized insurance journey that fulfills your unique requirements. So, what exactly can a certified insurance policy representative give the table? Remain tuned to uncover the top advantages that include entrusting your insurance policy decisions to these skilled experts.

Specialist Support and Recommendations

When collaborating with a qualified insurance policy representative, you can gain from their specialist guidance and recommendations on choosing the most effective insurance policy choices for your needs. These professionals have the expertise and experience to browse the intricate world of insurance policy, aiding you comprehend the different policies offered and which ones straighten with your certain requirements. They can evaluate your circumstance, evaluate threats, and suggest insurance coverage that gives sufficient security without unneeded costs.

Furthermore, licensed insurance policy representatives stay up to date with industry trends and adjustments in laws, guaranteeing that they can supply you the most current and relevant advice. Whether you're looking for automobile, home, life, or any other sort of insurance, they can lead you via the process, describing the fine print and helping you make informed decisions. By leveraging their knowledge, you can have assurance knowing that you're making educated choices concerning your insurance protection.

Tailored Coverage Options

To tailor your insurance coverage to your certain demands, an accredited insurance representative will certainly work closely with you to recognize your demands and preferences. This individualized strategy enables the agent to advise insurance coverage options that align with your unique scenario. Whether you're seeking vehicle, home, life, or organization insurance coverage, a representative can help you customize your policy to offer the ideal degree of protection.

Collaborating with a licensed representative makes certain that you receive professional recommendations on the kinds of protection readily available and the limits that finest fit your needs. Agents have the understanding and experience to assist you via the process of selecting insurance coverage options that resolve potential risks while staying within your spending plan. By assessing your individual conditions, an agent can suggest extra insurance coverage or plan enhancements that may be beneficial to you.

Through this collaborative process, you can feel great that your insurance policy is tailored to satisfy your specific requirements, offering you with assurance understanding that you're properly protected.

Personalized Service and Assistance

For an absolutely customized insurance coverage experience, a licensed agent supplies individualized solution and assistance dealt with your specific needs and choices. When you work with a certified insurance coverage representative, you can expect a degree of tailored focus that goes beyond just offering a plan. These representatives put in the time to recognize your details scenario, whether it's discovering the best protection limitations for your home or crafting a personalized package for your organization.

Verdict

To conclude, collaborating with a qualified insurance coverage agent offers you professional guidance, customized coverage alternatives, and personalized service and assistance.

Their understanding and experience in the insurance sector can assist you make informed decisions and ensure you have the right degree of protection for your private demands.

By choosing to collaborate with a qualified agent, you can have comfort knowing that you're well looked after when it involves your insurance policy needs.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Insurance Coverage Agents Looking For To Optimize Their List Building Efforts Can Follow These Efficient Approaches To Boost Their Business |

Short Article Created By-Oconnor Saunders

As an insurance policy agent, you could not be aware that lead generation is an essential facet of expanding your client base and growing your organization.

Have you ever before considered the possibility of using social media systems to get to a bigger audience and draw in brand-new prospects?

There are ingenious methods and proven approaches that can considerably enhance your list building efforts in today's open market.

Social Network Techniques

To increase your list building initiatives as an insurance policy representative, take advantage of reliable social media sites techniques.

Start by developing https://mgyb.co/s/dqjNN that educates and captivates your audience. Usage platforms like Facebook, LinkedIn, and Instagram to display your proficiency and develop integrity.

Involve with your followers by responding to remarks and messages promptly. Use targeted advertising and marketing to get to potential customers based on demographics, passions, and habits.

Collaborate with influencers or other companies in the market to expand your reach. Track your efficiency utilizing analytics devices to fine-tune your techniques continually.

Networking Occasions

Wondering how networking events can boost your list building initiatives as an insurance representative?

Networking events give a valuable system to get in touch with potential customers and sector specialists. By participating in these events, you can build relationships, develop credibility, and showcase your competence in the insurance coverage field. Participating in meaningful conversations and trading call information can lead to beneficial referrals and brand-new business chances. Bear in mind to bring your business cards and be prepared to review your services succinctly.

Furthermore, consider signing up with industry-specific networking groups or organizations to additional broaden your reach and presence.

Networking occasions supply a vibrant environment to cultivate leads and expand your insurance policy company successfully. Maximize these chances to establish on your own as a trusted insurance coverage agent in your area.

Reference Programs

As you involve with potential clients and market experts at networking occasions, think about implementing recommendation programs to leverage those connections and additional increase your lead generation initiatives. Reference programs can be an effective tool in growing your customer base and improving your organization.

Here are https://abcnews.go.com/US/wireStory/insurance-comp...after-blamed-helping-101106112 and suggestions to make the most of reference programs:

- ** Build Trust Fund **: Urge pleased customers to refer their loved ones.

- ** Incentivize Referrals **: Deal benefits or discounts for successful referrals.

- ** Track References **: Make use of a system to keep track of and act on referrals efficiently.

- ** Supply Excellent Solution **: Make certain all references get top-notch solution to motivate repeat company.

- ** Express Gratefulness **: Show appreciation to those that refer customers to you.

Conclusion

Finally, producing leads effectively as an insurance policy agent requires a calculated method. Utilizing social media sites, going to networking events, and applying referral programs are essential tactics to expand your customer base.

Did you understand that 74% of insurance agents that actively take part in social networks see a boost in lead generation? Picture the possibilities when you harness the power of social media sites to get in touch with prospective clients and drive your service onward.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Amplifying Your Insurance Representative Company With Social Media Site Strategies |

Content By-Fisker Mark

In the ever-evolving landscape of the insurance policy industry, remaining pertinent can be contrasted to browsing a puzzle without a map.

Nonetheless, there's a beacon of hope that can brighten your path in the direction of raised presence and engagement - social networks.

By using the power of systems like Facebook, Instagram, and LinkedIn, you can potentially transform exactly how you get in touch with customers and expand your insurance representative business.

Yet, just having a visibility on social media isn't enough.

Intend to learn exactly how to truly take advantage of these platforms to drive your business forward?

Social Media Platforms for Insurance Representatives

When seeking to develop a solid on the internet existence, insurance agents can utilize numerous social networks platforms to engage with possible customers efficiently.

Facebook, with its extensive customer base, supplies a platform for agents to share informative blog posts, client endorsements, and sector updates. Using Facebook Live can additionally supply a much more individual touch, enabling representatives to host Q&A sessions or talk about insurance coverage ideas in real-time.

Twitter, known for its concise messaging design, makes it possible for representatives to share quick updates, sector news, and engage in conversations making use of appropriate hashtags.

LinkedIn acts as a specialist platform where agents can display their experience with short articles, get in touch with industry specialists, and join insurance-related teams to increase their network.

Instagram, with its aesthetic focus, enables representatives to share aesthetically pleasing web content, such as infographics, client success stories, and behind-the-scenes glimpses, to draw in and involve with a more youthful demographic.

Techniques for Efficient Social Media Site Marketing

To boost your on the internet visibility and involve with potential customers effectively, execute strategic social media advertising and marketing strategies that align with your service goals.

Beginning by defining your target market and picking the systems where they're most energetic. Develop a content calendar to keep a regular posting schedule and make certain range in your posts, including useful write-ups, customer testimonials, and engaging visuals.

Utilize paid marketing to get to a wider target market and track the performance of your projects via analytics devices. Engage with https://www.ozarkradionews.com/local-news/state-fa...re-for-houston-school-district by replying to comments and messages promptly, revealing your dedication to client service.

Work together with influencers or various other organizations in your sector to broaden your reach and reliability. By following these techniques, you can take advantage of social media to grow your insurance policy agent business properly.

Devices for Assessing Social Media Site Performance

Enhance your social media marketing technique by utilizing innovative tools for analyzing your performance metrics properly. These tools can give beneficial insights right into the efficiency of your social media initiatives, aiding you make data-driven decisions to enhance your on the internet existence. By leveraging the best analytics tools, you can track key performance signs and optimize your web content technique for better results.

Below are related resource site to think about:

- ** Google Analytics **: Dive deep right into site web traffic and social media sites information.

- ** Buffer **: Set up messages and assess involvement metrics.

- ** Sprout Social **: Display social media sites discussions and track brand mentions.

- ** Hootsuite **: Handle numerous social networks accounts and determine campaign efficiency.

- ** BuzzSumo **: Identify top-performing content and track social shares.

Final thought

You've discovered just how to leverage social media sites to enhance your insurance coverage agent service. Currently it's time to put these methods right into activity. Are you prepared to connect with potential clients, develop your brand, and expand your service online?

With the right tools and strategies, you can get to brand-new heights in your insurance policy representative profession. Begin today and view your service grow in the digital world.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Leveraging Social Media To Boost Your Insurance Coverage Agent Organization |

Created By-Fisker Calderon

In the ever-evolving landscape of the insurance coverage industry, remaining appropriate can be compared to browsing a labyrinth without a map.

Nonetheless, there's a sign of hope that can brighten your course towards boosted exposure and engagement - social media sites.

By harnessing the power of platforms like Facebook, Instagram, and LinkedIn, you can potentially change exactly how you connect with customers and increase your insurance agent service.

However, just having a visibility on social media isn't sufficient.

Intend to discover just how to genuinely take advantage of these systems to propel your business ahead?

Social Media Platforms for Insurance Coverage Brokers

When wanting to establish a solid online visibility, insurance policy representatives can leverage various social media systems to involve with prospective clients effectively.

Facebook, with its extensive user base, offers a system for representatives to share useful posts, client endorsements, and industry updates. Utilizing Facebook Live can likewise supply a much more individual touch, enabling representatives to host Q&A sessions or review insurance suggestions in real-time.

Twitter, understood for https://www.fox2detroit.com/news/southfield-insura...accused-of-ripping-off-clients messaging design, makes it possible for agents to share quick updates, market information, and engage in conversations utilizing appropriate hashtags.

LinkedIn works as an expert system where agents can display their proficiency through articles, get in touch with sector professionals, and join insurance-related groups to expand their network.

What Does Home Insurance Cover , with its visual emphasis, permits agents to share cosmetically pleasing material, such as infographics, client success tales, and behind-the-scenes glances, to draw in and involve with a more youthful market.

Strategies for Effective Social Network Advertising

To improve your online visibility and engage with prospective customers properly, carry out tactical social media sites marketing techniques that align with your service goals.

Beginning by specifying your target audience and selecting the systems where they're most active. Produce a material schedule to maintain a regular posting routine and make certain selection in your blog posts, consisting of useful short articles, customer endorsements, and engaging visuals.

Utilize paid marketing to reach a broader target market and track the performance of your campaigns via analytics tools. Involve with your followers by replying to remarks and messages without delay, showing your dedication to customer care.

Work together with influencers or other services in your market to increase your reach and trustworthiness. By complying with these approaches, you can leverage social media sites to grow your insurance policy agent business successfully.

Devices for Analyzing Social Network Performance

Boost your social media advertising and marketing technique by using innovative tools for analyzing your efficiency metrics successfully. These tools can provide valuable insights into the efficiency of your social networks initiatives, helping you make data-driven choices to enhance your online presence. By leveraging the ideal analytics tools, you can track vital performance indicators and enhance your content strategy for much better outcomes.

Right here are some devices to take into consideration:

- ** Google Analytics **: Dive deep right into internet site web traffic and social networks data.

- ** Buffer **: Arrange blog posts and analyze engagement metrics.

- ** Sprout Social **: Display social media discussions and track brand discusses.

- ** Hootsuite **: Handle multiple social networks accounts and gauge project performance.

- ** BuzzSumo **: Recognize top-performing material and track social shares.

Final thought

You have actually learned how to utilize social networks to boost your insurance representative business. Now it's time to put these techniques right into action. Are you all set to get in touch with prospective clients, build your brand name, and expand your service online?

With the right devices and strategies, you can reach new elevations in your insurance representative profession. Begin today and see your business prosper in the digital world.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Insurance Coverage Agents Looking For To Maximize Their Lead Generation Initiatives Can Adhere To These Reliable Techniques To Increase Their Business |

Content Writer-Hughes Woods

As an insurance coverage representative, you could not know that lead generation is a crucial element of broadening your client base and expanding your organization.

Have you ever considered the capacity of using social media platforms to reach a wider target market and draw in brand-new leads?

There are cutting-edge approaches and tried and tested approaches that can dramatically improve your list building initiatives in today's open market.

Social Media Site Approaches

To improve your list building efforts as an insurance policy agent, leverage efficient social media sites approaches.

Begin by developing engaging content that informs and amuses your audience. Usage systems like Facebook, LinkedIn, and Instagram to display your competence and build credibility.

Engage with your fans by replying to remarks and messages without delay. Utilize targeted advertising to reach potential customers based on demographics, interests, and habits.

Collaborate with influencers or various other organizations in the market to increase your reach. Track your efficiency using analytics tools to improve your approaches continuously.

Networking Occasions

Wondering how networking occasions can enhance your list building initiatives as an insurance coverage agent?

Networking occasions give an important platform to get in touch with possible clients and industry experts. By going to these occasions, you can develop partnerships, develop reputation, and showcase your expertise in the insurance coverage area. Taking part in significant discussions and exchanging contact details can result in important referrals and new business chances. Remember to bring https://mgyb.co/s/mzcWz and be prepared to review your services succinctly.

In addition, think about signing up with industry-specific networking groups or associations to further expand your reach and visibility.

Networking occasions offer a dynamic atmosphere to grow leads and expand your insurance coverage service properly. Make the most of these opportunities to develop yourself as a trusted insurance coverage representative in your neighborhood.

Recommendation Programs

As you involve with possible customers and industry professionals at networking events, consider carrying out referral programs to leverage those connections and more increase your list building efforts. https://www.usatoday.com/money/blueprint/travel-insurance/best-travel-insurance/ can be an effective tool in expanding your client base and enhancing your service.

Below are some essential benefits and tips to take advantage of reference programs:

- ** Build Depend On **: Encourage completely satisfied clients to refer their family and friends.

- ** Incentivize Referrals **: Deal incentives or price cuts for effective recommendations.

- ** Track Referrals **: Make use of a system to keep track of and act on references efficiently.

- ** Offer Excellent Service **: Ensure all referrals obtain superior service to motivate repeat service.

- ** Express Thankfulness **: Show appreciation to those who refer customers to you.

Final thought

Finally, creating leads properly as an insurance representative needs a critical approach. Utilizing social media, participating in networking occasions, and applying recommendation programs are crucial tactics to grow your client base.

Did you know that 74% of insurance policy representatives that proactively engage in social media sites see a rise in list building? Visualize the possibilities when you harness the power of social networks to get in touch with possible customers and drive your organization onward.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Magnifying Your Insurance Coverage Representative Organization With Social Network Approaches |

Content Writer-Church Vincent

In the ever-evolving landscape of the insurance coverage sector, remaining pertinent can be contrasted to navigating a puzzle without a map.

Nevertheless, there's https://www.insurancebusinessmag.com/us/guides/how...-farm--agents-make-448242.aspx of hope that can brighten your course in the direction of enhanced visibility and involvement - social media.

By harnessing the power of systems like Facebook, Instagram, and LinkedIn, you can possibly change exactly how you connect with customers and increase your insurance policy representative service.

Yet, simply having a presence on social media sites isn't enough.

Intend to discover just how to truly take advantage of these systems to thrust your business forward?

Social Network Operating Systems for Insurance Policy Brokers

When seeking to establish a strong on-line presence, insurance coverage agents can take advantage of numerous social networks systems to engage with potential clients effectively.

Facebook, with its comprehensive individual base, uses a platform for representatives to share insightful articles, client testimonials, and sector updates. Using Facebook Live can also supply an extra personal touch, allowing agents to host Q&A sessions or go over insurance policy ideas in real-time.

Twitter, known for its concise messaging style, allows representatives to share fast updates, market information, and engage in conversations utilizing pertinent hashtags.

LinkedIn acts as an expert platform where representatives can display their knowledge via short articles, connect with market experts, and join insurance-related groups to broaden their network.

Instagram, with its aesthetic focus, enables agents to share cosmetically pleasing material, such as infographics, customer success stories, and behind the curtain looks, to attract and involve with a more youthful demographic.

Methods for Effective Social Network Advertising And Marketing

To enhance your on-line visibility and engage with potential customers properly, implement calculated social media marketing strategies that straighten with your company goals.

Beginning by defining your target market and selecting the systems where they're most energetic. Produce a material calendar to preserve a constant posting routine and ensure selection in your blog posts, consisting of useful write-ups, client testimonies, and involving visuals.

Make pop over to this web-site of paid marketing to reach a larger target market and track the performance of your campaigns through analytics devices. Engage with your fans by reacting to comments and messages quickly, revealing your commitment to customer care.

Collaborate with influencers or various other organizations in your market to increase your reach and credibility. By following these methods, you can leverage social media to expand your insurance coverage representative organization properly.

Tools for Examining Social Media Site Performance

Enhance your social networks marketing strategy by making use of sophisticated tools for assessing your efficiency metrics effectively. These tools can provide useful insights right into the effectiveness of your social media initiatives, helping you make data-driven choices to boost your on-line visibility. By leveraging the ideal analytics tools, you can track essential performance signs and enhance your web content technique for much better results.

Here are some tools to consider:

- ** Google Analytics **: Dive deep into site web traffic and social media sites information.

- ** Buffer **: Set up articles and examine interaction metrics.

- ** Grow Social **: Screen social media discussions and track brand name states.

- ** Hootsuite **: Take care of numerous social media accounts and measure campaign performance.

- ** BuzzSumo **: Recognize top-performing material and track social shares.

Conclusion

You have actually learned just how to take advantage of social networks to enhance your insurance agent company. Currently it's time to place these methods into activity. Are you all set to connect with possible clients, build your brand, and expand your company online?

With the right tools and methods, you can get to brand-new heights in your insurance policy representative job. Start today and view your business thrive in the electronic world.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Our Detailed Overview Is Below To Assist You Make An Educated Decision And Discover The Ideal Firm For Your Unique Demands |

Posted By-Hicks Lindberg

You may assume selecting an insurance coverage agency is a simple job, yet with the myriad of choices readily available, it can rapidly end up being frustrating.

Discovering the ideal insurance agency for your needs involves more than just a fast online search. Recognizing your particular insurance coverage needs, contrasting various companies, and examining their degree of customer service are all important action in making a notified choice.

As you browse the complicated world of insurance coverage firms, you will soon understand that the choice you make can have a substantial effect on your monetary safety and comfort.

Assessing Your Insurance Coverage Protection Requirements

Assess what risks you encounter and how much insurance coverage you require prior to selecting an insurance plan. Think about variables like your health and wellness, building, and monetary scenario.

For medical insurance, assess your existing health condition, any kind of existing medical problems, and the probability of calling for treatment in the future.

When it pertains to residential or commercial property insurance coverage, examine the worth of your properties and the prospective dangers they're subjected to, such as burglary or all-natural catastrophes.

For economic protection, consider your revenue security, financial debts, and dependents that depend on you.

Contrasting Insurance Firm Options

After reviewing your insurance protection needs, the next action is to contrast various insurance coverage firm choices available to you. Beginning by researching the online reputation and financial security of each firm. Try to find consumer testimonials and scores to assess complete satisfaction levels.

Think about the variety of insurance policy products each agency provides and whether they line up with your requirements. Compare https://inews.co.uk/inews-lifestyle/money/life-ins...how-best-deal-good-ide-2487320 of premiums and deductibles across various agencies to find the very best worth for your budget plan. Review the high quality of client service by connecting with any type of questions you may have and assessing their responsiveness and helpfulness.

Furthermore, inspect if the agencies have any type of certifications or awards that showcase their reputation and proficiency in the insurance policy sector.

Reviewing Customer Service and Support

When evaluating customer service and assistance at an insurance coverage firm, prioritize clear communication and prompt aid to guarantee a favorable experience for insurance policy holders. Seek agencies that provide several communication channels, such as phone, e-mail, and online chat, to resolve your inquiries successfully.

Analyze their reaction times by connecting with queries and keeping track of just how promptly and properly they provide assistance. Take note of the demeanor and professionalism of customer service representatives throughout communications as this shows the company's commitment to customer fulfillment.

Furthermore, inquire about the accessibility of 24/7 support for emergencies and cases processing. By assessing these elements, you can gauge the degree of customer care and support a potential insurance coverage agency can offer you.

Verdict

Since you've browsed the sea of insurance coverage agencies, it's time to dive in with the best one for you. Remember, like a well-crafted ship, the best agency will provide smooth sailing via life's tornados.

So choose carefully, and allow their know-how be the directing North Star in safeguarding what matters most to you. Smooth seas and clear skies wait for with the right insurance coverage firm at hand.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Trip In The Direction Of Increasing Sales In The Insurance Policy Market With Innovative Strategies That Could Revolutionize Your Company |

Post Produced By-Burnett Lyhne

When looking for to rise sales in the insurance policy sector, think about crucial methods that can catapult your success. Leveraging https://maps.apple.com/place?auid=286638538736123083 of electronic marketing, improving customer partnerships, and implementing data-driven approaches are vital components in optimizing your capacity for development.

Nevertheless, there is one typically overlooked strategy that could be the game-changer you've been looking for.

Leveraging Digital Advertising And Marketing

To successfully raise sales in the insurance policy sector, take advantage of electronic marketing approaches to reach a bigger target market and drive consumer interaction. Beginning by maximizing your site for internet search engine and creating engaging content that resolves your target audience's demands.

Use social networks systems to engage with prospective customers, share beneficial insights, and promote your solutions. Email advertising projects can also work in nurturing leads and keeping your target market informed concerning your offerings.

In addition, think about purchasing on the internet advertising to increase exposure and attract new customers. By embracing electronic advertising devices and strategies, you can enhance your brand's on-line visibility, produce leads, and eventually improve sales in the affordable insurance market.

Enhancing Consumer Relationships

By proactively engaging with customers with personalized interactions and regular communication, you can grow stronger relationships and foster commitment within the insurance policy market. Applying a customer partnership monitoring (CRM) system can assist you track client interactions, preferences, and habits, allowing for customized services and targeted interaction.

Giving positive customer service by expecting demands and using support before concerns occur can dramatically improve client complete satisfaction and retention. Urge feedback and proactively listen to your clients to show them that their point of views are valued.

Building count on with openness and sincerity in all your dealings will develop reputation and reliability in the eyes of your customers. Keep in mind, buying solid consumer partnerships is key to long-term success in the insurance coverage market.

Implementing Data-Driven Techniques

Apply data-driven techniques to enhance decision-making and drive sales growth in the insurance policy sector. By leveraging data analytics, you can obtain important understandings right into consumer habits, choices, and fads. Utilize this details to tailor your products and services to meet the particular requirements of your target audience properly.

Assessing data can also help you determine cross-selling and upselling possibilities, permitting you to take full advantage of the worth of each client interaction. Additionally, data-driven approaches allow you to personalize your advertising efforts, increasing client involvement and retention.

Implementing these strategies will not only boost your sales performance but likewise place your insurance policy business as a relied on consultant in the eyes of your customers.

Verdict

You have actually discovered leading techniques for boosting sales in the insurance policy sector.

Did you recognize that 73% of consumers are most likely to purchase from a brand name that personalizes their experience?

By carrying out Business Owners Insurance , enhancing customer relationships, and utilizing data-driven approaches, you can get in touch with consumers on a much deeper level and increase sales.

Benefit from these tactics to drive growth and construct long-term relationships with your clients.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

The Advantages Of Using An Insurance Coverage Broker For Small Companies |

Post Produced By-Mckinney Kline

You might not be aware that navigating the detailed world of insurance coverage can be a challenging job for small business owners. With the ever-evolving landscape of dangers and coverage options, it can be challenging to make certain that your organization is adequately protected.

However, there is https://maps.apple.com/place?auid=286638538736123083 that can simplify this process for you. Insurance brokers focus on helping organizations like your own find the appropriate protection at the very best rates.

The benefits they supply exceed just saving you time and money - they supply tailored solutions that accommodate your particular requirements.

Time-Saving Perks

By making use of an insurance coverage broker, small businesses can streamline the procedure of locating the most suitable insurance protection, ultimately saving useful time and resources. Rather than costs hours looking into various insurance policy options and attempting to browse intricate policy details by yourself, an insurance policy broker can successfully examine your requirements and present you with tailored choices that satisfy your needs.

This straight support not only saves you time however likewise guarantees that you're obtaining the most suitable insurance coverage for your company. By leaving https://www.sfgate.com/personal-finance/article/ho...ce-climate-change-18163539.php to an expert, you liberate your timetable to concentrate on other vital elements of running your local business, understanding that your insurance requirements are being expertly dealt with.

Cost-Effective Solutions

To maximize your small business's funds, consider how an insurance policy broker can offer economical solutions customized to your details requirements.

Insurance policy brokers have the experience to evaluate your organization risks precisely and recommend insurance policy protection that fits your budget plan. By leveraging their sector understanding and partnerships with multiple insurance coverage suppliers, brokers can bargain affordable costs in your place. This customized technique makes sure that you only spend for the protection you require, preventing costly insurance coverage spaces or unnecessary expenditures.

Furthermore, insurance coverage brokers can assist you navigate intricate policy phrasing and describe cost-saving possibilities, such as packing plans or accessing discounts. Inevitably, partnering with an insurance policy broker can lead to considerable price savings for your small business while making sure sufficient defense.

Tailored Protection Options

Wondering just how insurance brokers tailor insurance coverage alternatives to suit your local business needs effectively?

Insurance brokers stand out at comprehending the unique demands of your organization. By carrying out a detailed assessment of your procedures, they can identify prospective risks certain to your sector.

This personalized method permits brokers to advise coverage choices that address your vulnerabilities efficiently. Whether you run in a particular niche market or have distinctive risk aspects, brokers can tailor insurance policy plans to provide thorough security.

Additionally, brokers have access to a wide range of insurance policy companies, allowing them to contrast plans and bargain terms on your behalf. This tailored service makes sure that you receive the most ideal coverage at competitive prices, making best use of the worth of your insurance financial investment.

Conclusion

Finally, using an insurance coverage broker for your small business is like having an individual insurance coverage concierge within your reaches. They conserve you time, cash, and problem by locating the very best protection options tailored to your details needs.

So why anxiety over insurance coverage decisions when you can have a relied on professional guide you via the procedure? Sit back, relax, and allow an insurance coverage broker do the heavy lifting for you.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Yearning For The Perfect Insurance Policy Agency To Meet Your Demands? Discover Crucial Tips And Insights In This Comprehensive Guide |

Read Home Page Develop By-Miranda McDonald

You might believe choosing an insurance company is a simple job, however with the myriad of alternatives available, it can swiftly end up being overwhelming.

Finding the ideal insurance agency for your requirements involves greater than simply a fast online search. Understanding your details protection demands, contrasting different companies, and examining their level of client service are all vital steps in making a notified decision.

As you navigate the intricate world of insurance firms, you will soon recognize that the selection you make can have a substantial effect on your economic safety and peace of mind.

Assessing Your Insurance Coverage Coverage Demands

Evaluate what threats you deal with and how much coverage you require prior to picking an insurance plan. Consider factors like your wellness, residential or commercial property, and monetary scenario.

For health insurance, review your existing health and wellness standing, any kind of existing medical problems, and the possibility of needing healthcare in the future.

When it involves residential or commercial property insurance policy, examine the value of your properties and the potential threats they're exposed to, such as theft or natural disasters.

For monetary protection, think of your revenue security, financial debts, and dependents who rely on you.

Comparing Insurance Coverage Agency Options

After evaluating your insurance protection requires, the following action is to compare different insurance coverage company alternatives offered to you. Start by researching the online reputation and economic stability of each company. Try to find customer evaluations and ratings to determine contentment degrees.

Consider the range of insurance coverage products each agency offers and whether they align with your demands. Contrast the expense of costs and deductibles throughout various agencies to locate the very best value for your budget. Review the high quality of customer care by reaching out with any kind of inquiries you may have and examining their responsiveness and helpfulness.

Furthermore, check if the agencies have any kind of certifications or awards that display their trustworthiness and proficiency in the insurance policy industry.

Evaluating Customer Support and Assistance

When evaluating customer support and assistance at an insurance company, focus on clear communication and prompt support to guarantee a positive experience for insurance policy holders. Look for firms that provide multiple communication channels, such as phone, email, and on-line conversation, to resolve your questions efficiently.

Evaluate their action times by connecting with inquiries and keeping track of how promptly and efficiently they provide help. Pay attention to the temperament and professionalism and reliability of customer care representatives throughout communications as this reflects the agency's commitment to client complete satisfaction.

In addition, inquire about the schedule of 24/7 assistance for emergencies and insurance claims handling. By reviewing these aspects, you can evaluate the level of customer service and support a possible insurance company can offer you.

Final thought

Now that you've navigated the sea of insurance coverage companies, it's time to dive in with the excellent one for you. Remember, like a well-crafted ship, the best firm will certainly give plain sailing with life's storms.

So pick intelligently, and let their know-how be the directing North Celebrity in securing what matters most to you. http://www.yext.com/partnerpages/navmii/luxe-insur...s-scottsdale-arizona-us-052da0 and clear skies await with the appropriate insurance firm by your side.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Effective Ways To Boost Sales In The Insurance Coverage Sector |

Short Article Writer-Hays McKay

When seeking to surge sales in the insurance coverage sector, take into consideration essential techniques that can catapult your success. Leveraging the power of electronic advertising and marketing, improving client connections, and carrying out data-driven techniques are important parts in maximizing your capacity for development.

However, there is one commonly ignored technique that could be the game-changer you have actually been looking for.

Leveraging Digital Advertising

To efficiently boost sales in the insurance coverage industry, leverage electronic marketing techniques to get to a larger audience and drive client involvement. Begin by enhancing Temporary RV Rental Insurance for search engines and developing compelling content that addresses your target market's needs.

Utilize social media systems to interact with possible customers, share beneficial insights, and advertise your solutions. Email advertising projects can additionally be effective in nurturing leads and keeping your audience notified about your offerings.

In addition, consider investing in online marketing to raise visibility and attract brand-new clients. By embracing digital marketing tools and strategies, you can boost your brand name's on-line existence, create leads, and ultimately improve sales in the competitive insurance market.

Enhancing Consumer Relationships

By actively involving with consumers with customized interactions and constant interaction, you can grow stronger partnerships and foster commitment within the insurance coverage sector. Implementing a consumer connection administration (CRM) system can assist you track client interactions, preferences, and habits, allowing for customized solutions and targeted interaction.

Supplying proactive customer support by expecting demands and providing support before concerns arise can dramatically boost consumer complete satisfaction and retention. Urge comments and proactively pay attention to your clients to reveal them that their point of views are valued.

Building count on with openness and sincerity in all your ventures will develop reliability and reliability in the eyes of your clients. Keep in mind, purchasing solid client partnerships is crucial to long-lasting success in the insurance industry.

Implementing Data-Driven Methods

Carry out data-driven approaches to optimize decision-making and drive sales development in the insurance policy industry. By leveraging information analytics, you can acquire important understandings into client actions, choices, and fads. Utilize https://www.businessinsurance.com/article/20230127...urance-broker-jailed-for-fraud to customize your product or services to satisfy the specific requirements of your target audience efficiently.

Examining information can additionally assist you recognize cross-selling and upselling opportunities, allowing you to maximize the worth of each consumer communication. Additionally, data-driven strategies allow you to individualize your advertising and marketing initiatives, raising client interaction and retention.

Implementing these techniques won't just boost your sales performance however additionally position your insurance organization as a trusted consultant in the eyes of your customers.

Conclusion

You have actually found out about leading techniques for enhancing sales in the insurance coverage industry.

Did you understand that 73% of consumers are more likely to purchase from a brand name that customizes their experience?

By carrying out electronic marketing, enhancing consumer relationships, and utilizing data-driven strategies, you can get in touch with consumers on a much deeper degree and boost sales.

Take advantage of these tactics to drive development and develop long-term partnerships with your customers.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Valuable Guidance For Successfully Navigating The Competitive Market Of Insurance Representatives |

Posted By-Straarup Purcell

In the substantial sea of insurance policy representatives, navigating the open market can usually seem like searching for your means through a dense fog. With countless professionals trying clients' focus, sticking out becomes important.

How can you guarantee that you not just make it through yet flourish in this tough atmosphere? By developing https://writeablog.net/nichol3gudrun/distinctions-...insurance-coverage-agents-what and taking on methods that establish you apart from the rest.

Leveraging Modern Technology for Performance

To simplify your operations and improve efficiency, accept the current tech tools readily available in the insurance coverage agent market.

Utilize consumer relationship administration (CRM) software application to efficiently take care of customer info, track interactions, and simplify interaction.

Applying digital file management systems will enable you to store, organize, and accessibility important files firmly, removing the need for paper-based procedures.

Capitalize on information analytics devices to obtain useful understandings right into customer actions, market patterns, and efficiency metrics.

By incorporating these innovations right into your process, you can automate repetitive tasks, personalize client communications, and make data-driven choices to remain ahead in the affordable insurance policy market.

Welcoming technology is vital to enhancing effectiveness and delivering phenomenal service to your clients.

Building Solid Recommendation Networks

Leveraging relationships with various other professionals in the sector can dramatically increase your customer references and expand your network. Building a solid referral network is vital for insurance coverage representatives seeking to grow in a competitive market. Beginning by connecting with property agents, economic advisors, and attorneys who can refer customers in need of insurance coverage solutions.

Attend market occasions and networking functions to meet new contacts and strengthen existing connections. Actively engage with your network by offering value, such as sharing market understandings or giving references in return. By supporting these links, you can develop a reputable stream of recommendations that can help grow your customer base and enhance your credibility in the sector.

Continuous Expert Development

Boost your abilities and expertise via constant specialist growth to stay competitive in the insurance coverage representative market. Keep updated on market fads by participating in workshops, meetings, and on-line training courses.

Connecting with other professionals can provide useful understandings and brand-new perspectives. Take into consideration seeking innovative qualifications to display your competence and dedication to quality.

Embrace finding out possibilities to increase your product expertise and sales methods. https://www.theinsurer.com/news/hub-hails-6-9bn-de...broker-leveraged-finance-deal/ to review and enhance your procedures to improve customer satisfaction.

Conclusion

As you navigate the affordable insurance coverage representative market, remember to welcome modern technology, grow strong partnerships, and never quit discovering.

Just like a compass guides a sailor through stormy seas, these professional ideas will certainly assist guide you in the direction of success in your career.

Maintain adapting, networking, and expanding to stay ahead of the competitors and inevitably reach your location of becoming a top insurance agent.

The journey may be difficult, however the benefits will certainly deserve it. Safe travels!

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Exactly How To Discover The Right Insurance Policy Broker For Your Needs |

Composed By-Niebuhr Doherty

When it comes to insurance, did you recognize that 48% of small companies in the United States have never ever had insurance policy?

Discovering the best insurance policy broker for your demands can be an essential decision that influences your monetary safety and security and comfort.

With numerous alternatives offered, navigating the world of insurance policy can be overwhelming.

Understanding how to select the best broker who comprehends your distinct demands and offers the most effective insurance coverage can make all the distinction.

Aspects to Consider Before Choosing

Before selecting an insurance coverage broker, it's essential to extensively analyze your specific requirements and economic scenario. Take the time to assess what type of coverage you need and how much you can pay for to pay in premiums.

Research study different brokers to identify their knowledge in the areas that matter most to you, whether it's health, vehicle, home, or life insurance policy. Consider their track record, consumer evaluations, and any kind of issues lodged against them.