Proven Techniques For Bring In Personal Financial Investment: Tips And Finest Practices You Need To Know |

Created By-Rodriquez Breum

When it concerns protecting personal funding for your ventures, grasping the art of verbalizing your organization's potential is extremely important. Yet beyond visit this hyperlink and an engaging pitch deck lies a realm where the nuances of human link and trust-building can make or break your fundraising initiatives. Interested to find out just how these social dynamics play out on the planet of private investments? Keep tuned to reveal the refined yet effective strategies that can establish you apart in the affordable landscape of securing private cash.

Developing a Compelling Organization Strategy

When elevating private money, establishing an engaging organization plan is necessary. Your service plan functions as a roadmap that describes your goals, methods, and monetary estimates. Investors wish to see a detailed strategy that demonstrates exactly how their financial investment will be made use of and just how it will certainly generate returns.

Start by plainly defining your service design, target market, and competitive advantage. Highlight what sets your business apart and why it has the potential for success.

In your organization strategy, be sure to include an extensive analysis of the market and market fads. Program investors that you understand the market dynamics and have a technique to maximize possibilities. In addition, describe your marketing and sales strategies to show exactly how you intend to acquire customers and drive income.

Financial projections are vital; provide realistic quotes of earnings, expenditures, and success over a specified duration.

Building Solid Relationships With Capitalists

To effectively increase exclusive money, developing and nurturing solid relationships with investors is paramount. Structure count on is type in this process. Be transparent regarding your company objectives, strategies, and prospective dangers. Interaction is important - maintain investors updated routinely, whether the information is good or negative. Show genuine interest in their viewpoints and feedback, and be open to constructive objection.

Personal connections issue, so take the time to recognize your financiers' backgrounds, passions, and investment choices. Tailoring your strategy to line up with their values and purposes can make a substantial distinction. Additionally, showing honesty and sincerity in all your dealings will aid strengthen these partnerships.

Remember that successful collaborations are built on common regard and understanding. By prioritizing financier connections and treating them as valued partners, you can boost your possibilities of securing the personal financing needed for your company undertakings.

Showcasing a Record of Success

Having actually established solid relationships with financiers, the next action in effectively raising exclusive money is showcasing a performance history of success.

Highlighting previous successful jobs or financial investments can infuse confidence in possible capitalists and show your ability to provide results. Providing https://www.journalofaccountancy.com/issues/2023/s...ons-on-rental-real-estate.html of your success, such as successful departures or profitable deals, can help validate your competence and reliability in the eyes of investors.

It's essential to present this info in a clear and engaging fashion, highlighting crucial metrics and outcomes that showcase your track record of success. In addition, sharing testimonials or endorsements from previous investors can additionally strengthen your track record and display the count on others have placed in your financial investment strategies.

Final thought

To conclude, by developing an engaging business strategy, building strong connections with financiers, and showcasing a performance history of success, you can effectively elevate personal cash for your service. Remember to highlight your distinct marketing factors, demonstrate market trends, and prioritize open communication to develop trust with prospective capitalists. By complying with these suggestions and finest practices, you can attract the funding needed to fuel the growth and success of your service.

Do You Find The Juxtaposition Of Standard And Cutting-Edge Strategies To Raising Income Flow Intriguing? |

Web Content Author-Aldridge Skinner

When taking into consideration the realm of enhancing income Velocity, the duality between conventional and innovative strategies provides a compelling landscape of opportunities. While traditional approaches provide stability with tried and true methods, checking out ingenious techniques can generate groundbreaking improvements in increasing revenue circulation. By weighing the advantages and disadvantages of each opportunity, you can obtain insights into which course might hold the key to opening boosted financial performance.

Traditional Approaches Evaluation

When examining typical approaches for improving revenue Velocity, it becomes obvious that the focus has actually largely been on recognized practices and standard techniques. Historically, businesses have counted on techniques such as minimizing costs, enhancing sales volumes, and maximizing functional performance to enhance revenue Velocity. By cutting unnecessary costs, companies intend to free up funding that can after that be reinvested to produce even more profits.

Likewise, increasing sales figures with advertising campaigns or broadening market reach aids accelerate the circulation of revenue. https://pr.franklintownnews.com/article/Barnaje-DA...oryId=6673ab462a4dd70008ec2a7f , like streamlining processes and decreasing preparations, likewise play a crucial role in quickening income generation.

Additionally, standard techniques commonly entail handling accounts receivable and accounts payable more effectively. By negotiating better settlement terms with distributors and incentivizing timely settlements from consumers, organizations can positively influence their capital and revenue Velocity.

Furthermore, implementing expense control measures and monitoring capital carefully are common practices utilized to preserve a healthy revenue Velocity.

Innovative Methods Analysis

Discovering innovative techniques to boost revenue Velocity includes welcoming advanced techniques and disruptive strategies that challenge traditional standards. By evaluating visit link , you can think about applying automation tools to enhance processes, using blockchain innovation for protected and reliable purchases, and leveraging expert system for data evaluation and decision-making. These strategies can reinvent exactly how income Velocity is boosted, supplying faster and a lot more effective remedies compared to typical techniques.

Another ingenious approach worth evaluating is taking on a peer-to-peer borrowing system, which can provide different financing sources for individuals and companies, therefore enhancing the blood circulation of cash within the economic climate.

Furthermore, exploring the capacity of tokenization can produce new chances for asset-backed protections trading and fractional ownership, additional boosting earnings Velocity in unique methods.

Implementing Finest Practices

To properly boost earnings Velocity with ingenious methods, the following step involves implementing best techniques that have confirmed to generate significant results. Beginning by evaluating effective study or market criteria to recognize the most effective techniques.

After that, tailor these techniques to fit your particular organization model and goals. Take into consideration enhancing procedures, boosting customer experience, and enhancing resource allocation to maximize earnings Velocity.

It's vital to include essential stakeholders in the implementation procedure to make sure buy-in and alignment with the total technique. Routinely screen and assess the effect of these best practices on revenue Velocity metrics to make data-driven modifications as required.

Final thought

In conclusion, when comparing standard and cutting-edge approaches to boosting revenue Velocity, it is clear that accepting sophisticated innovations and innovative strategies can lead to better performance gains and competitive advantages in today's dynamic service landscape. By carrying out best techniques and constantly keeping an eye on performance metrics, companies can attain sustainable development and success in raising their revenue Velocity. Welcoming innovation is essential to staying ahead in the ever-evolving market setting.

Evaluating Exactly How Your Abilities Impact The Rate Of Earnings Generation |

Short Article Composed By-Kline Jimenez

As you navigate the realms of ability acquisition and income generation, have you ever considered the complex dance between the two? Visualize a scenario where sharpening your capacities not just improves your experience yet likewise pushes your monetary gains. The interaction between your abilities and income Velocity holds the crucial to opening a world of possibility. Just how can tapping into your special abilities convert right into a quicker circulation of incomes? Let's explore the interesting characteristics that control this symbiotic relationship and uncover the techniques that can improve your financial landscape.

The Impact of Skills on Earnings

When it comes to understanding the connection between skills and earnings, one can not ignore the critical role that abilities play in determining one's earning capacity. https://pr.naticktownnews.com/article/Barnaje-DAO-...oryId=6675ebd692c1620008896715 are like devices in a toolbox, each one with the ability of unlocking various chances for boosted earnings. The even more diverse and polished your ability, the much more opportunities you have to improve your incomes.

Employers highly value individuals with specialized skills that remain in need, typically resulting in higher salaries and far better job leads. Additionally, developing soft skills such as interaction, team effort, and problem-solving can set you apart in the work environment, potentially resulting in promotions and raise.

Purchasing continuous learning and ability development not only enhances your present task efficiency however additionally opens doors to new career paths with higher revenue possibility. Bear in mind, your abilities aren't simply possessions; they're paths to a more thriving monetary future.

Strategies to Increase Revenue Velocity

To better improve your making prospective and speed up the rate at which you generate earnings, it's important to concentrate on methods that boost earnings Velocity. One effective technique is diversifying your earnings streams. By having numerous sources of income, you can increase the total rate at which cash flows into your pockets.

One more technique is to maximize your pricing structure. Conduct marketing research to guarantee your costs are competitive yet profitable, enabling you to take full advantage of revenues per deal. Additionally, boosting your performance and performance can substantially impact income Velocity. Improve your processes, delegate jobs where feasible, and invest in tools that can assist you work smarter and faster.

Moreover, consider discussing greater rates for your services or products. Enhancing your rates tactically can bring about a straight boost in earnings without requiring to work more hours. By executing these approaches, you can efficiently improve your earnings Velocity and enhance your financial growth.

Leveraging Proficiency for Financial Growth

With your expertise as a beneficial property, you have the chance to utilize it for monetary growth. By focusing in on your specific abilities and expertise, you can raise your gaining possible and overall monetary security.

One way to utilize your proficiency is by offering consulting solutions in your field. Clients are usually going to pay a costs for professional advice and advice. Additionally, you can consider producing electronic items such as on the internet programs or e-books to share your understanding with a larger target market and create passive income.

Another efficient approach is to look for talking interactions or workshops where you can display your expertise and develop on your own as a thought leader in your industry. These opportunities not only offer additional revenue however likewise aid you construct integrity and attract even more customers in the future.

Moreover, networking with other professionals in your field can open doors to cooperations, joint ventures, and new incomes. By actively leveraging your experience, you can turn your skills into a profitable financial property.

Conclusion

By actively expanding your capability and continually discovering new skills, you can considerably raise your revenue Velocity and maximize your earning possibility. Leveraging your know-how and maximizing your prices structure can strategically improve your economic development. Remember, the relationship between your skills and earnings Velocity is crucial in accomplishing your monetary goals and securing a stable economic future. Keep exploring new opportunities and sharpening your skills to drive your earnings to new elevations.

Analyzing The Link Between Your Competencies And The Price Of Earnings Increase |

Material By-Kline Rossi

As you browse the worlds of ability procurement and revenue generation, have you ever before contemplated the elaborate dance between both? Envision a circumstance where honing your capabilities not only enhances your competence however likewise pushes your financial gains. The interplay in between your abilities and earnings Velocity holds the vital to unlocking a world of possibility. How can taking advantage of your unique talents equate into a much faster flow of incomes? Let's discover the remarkable characteristics that govern this cooperative relationship and discover the strategies that can reshape your monetary landscape.

The Effect of Skills on Earnings

When it involves understanding the partnership between abilities and earnings, one can't take too lightly the vital function that skills play in establishing one's making potential. Your skills are like devices in a tool kit, every one efficient in unlocking various chances for boosted income. The even more diverse and refined your capability, the more avenues you have to increase your profits.

Employers highly value people with specialized skills that remain in demand, commonly causing greater salaries and much better task prospects. In addition, honing soft skills such as communication, teamwork, and analytic can establish you apart in the work environment, potentially resulting in promotions and raise.

Purchasing constant knowing and skill growth not only improves your existing work performance but likewise opens doors to brand-new occupation paths with higher earnings possibility. Remember, your skills aren't just properties; they're pathways to a more thriving economic future.

Approaches to Boost Revenue Velocity

To better improve your gaining prospective and increase the rate at which you generate income, it's important to concentrate on techniques that enhance earnings Velocity. https://smb.cordeledispatch.com/article/Barnaje-DA...oryId=66a184c4b87cb2000825d440 is expanding your earnings streams. By having numerous sources of income, you can enhance the general speed at which money flows right into your pockets.

One more approach is to maximize your rates structure. Conduct marketing research to ensure your rates are competitive yet profitable, allowing you to optimize profits per purchase. Furthermore, enhancing your performance and performance can considerably affect earnings Velocity. Streamline your procedures, delegate tasks where feasible, and invest in devices that can aid you work smarter and much faster.

Furthermore, take into consideration discussing higher prices for your product or services. Raising your rates purposefully can result in a direct boost in earnings without requiring to function more hours. By carrying out these strategies, you can effectively improve your revenue Velocity and optimize your financial development.

Leveraging Knowledge for Financial Growth

With your competence as a valuable possession, you have the possibility to take advantage of it for monetary growth. By focusing in on your particular skills and knowledge, you can enhance your gaining possible and overall monetary security.

One means to take advantage of your competence is by supplying consulting services in your field. Clients are typically ready to pay a costs for expert recommendations and advice. Additionally, you can consider developing electronic items such as online programs or e-books to share your knowledge with a wider target market and produce easy earnings.

An additional efficient approach is to choose talking engagements or workshops where you can showcase your expertise and establish on your own as a thought leader in your market. These possibilities not just offer extra revenue however additionally help you develop integrity and draw in more customers in the future.

In addition, networking with other professionals in your field can open doors to partnerships, joint ventures, and brand-new sources of income. By proactively leveraging https://www.fool.com.au/2023/11/23/heres-why-these...ould-be-your-ticket-to-wealth/ , you can turn your skills into a financially rewarding financial property.

Verdict

By proactively diversifying your ability and continuously discovering brand-new abilities, you can significantly raise your income Velocity and maximize your gaining capacity. Leveraging your proficiency and enhancing your prices structure can purposefully increase your financial growth. Bear in mind, the connection between your abilities and revenue Velocity is vital in accomplishing your economic goals and securing a secure monetary future. Maintain checking out new chances and honing your skills to drive your earnings to new elevations.

How To Efficiently Elevate Private Money: Tips And Best Practices |

Web Content By-Worm Gravesen

When it comes to safeguarding exclusive financing for your endeavors, grasping the art of expressing your organization's possibility is paramount. However beyond a stellar organization strategy and a compelling pitch deck lies a realm where the nuances of human connection and trust-building can make or damage your fundraising initiatives. Intrigued to discover just how these interpersonal characteristics play out on the planet of personal investments? Keep tuned to reveal the refined yet powerful methods that can establish you apart in the affordable landscape of safeguarding exclusive cash.

Creating a Compelling Organization Strategy

When increasing private cash, establishing a compelling company strategy is vital. hop over to this web-site acts as a roadmap that outlines your goals, methods, and monetary forecasts. Financiers want to see an in-depth strategy that demonstrates exactly how their financial investment will be used and exactly how it will certainly produce returns.

Beginning by plainly defining your service design, target market, and competitive advantage. Highlight what establishes your organization apart and why it has the capacity for success.

In your organization plan, make sure to include a thorough evaluation of the market and sector trends. Program financiers that you comprehend the market characteristics and have a method to take advantage of possibilities. In addition, outline your advertising and sales methods to show how you plan to acquire clients and drive income.

Financial estimates are vital; give sensible quotes of revenue, costs, and success over a given duration.

Building Strong Relationships With Investors

To effectively elevate private cash, establishing and supporting solid relationships with capitalists is vital. Building trust is type in this procedure. Be transparent about your organization objectives, techniques, and potential threats. Interaction is essential - maintain capitalists updated regularly, whether the information is great or poor. Show genuine rate of interest in their viewpoints and responses, and be open to positive objection.

Individual connections issue, so put in the time to recognize your financiers' backgrounds, interests, and financial investment preferences. Customizing your approach to align with their worths and goals can make a considerable difference. Furthermore, demonstrating honesty and honesty in all your negotiations will aid strengthen these partnerships.

Remember that effective partnerships are improved shared regard and understanding. By focusing on financier partnerships and treating them as valued companions, you can raise your chances of securing the exclusive financing needed for your organization endeavors.

Showcasing a Track Record of Success

Having actually developed strong partnerships with investors, the next step in effectively elevating private money is showcasing a record of success.

Highlighting past effective tasks or investments can instill self-confidence in prospective investors and show your capability to supply outcomes. Providing concrete examples of your achievements, such as successful leaves or profitable bargains, can help validate your know-how and reputation in the eyes of financiers.

It's essential to provide this details in a clear and engaging way, emphasizing crucial metrics and end results that showcase your track record of success. In visit here , sharing endorsements or recommendations from previous financiers can additionally strengthen your track record and display the trust fund others have placed in your financial investment strategies.

Conclusion

To conclude, by developing an engaging service strategy, constructing solid connections with capitalists, and showcasing a record of success, you can successfully raise personal money for your company. Remember to highlight your distinct marketing points, show market trends, and focus on open communication to establish trust fund with possible investors. By following these ideas and ideal practices, you can attract the funding needed to sustain the growth and success of your organization.

Normal Missteps That Lower Your Revenue Momentum And Tips For Preventing Them |

Web Content Writer-Floyd Otto

To improve your revenue Velocity and stay clear of usual pitfalls, consider this: Are you unwittingly impeding your economic development by making avoidable mistakes? By addressing essential elements like diversification, easy revenue opportunities, and reliable money management, you might possibly unlock a path to accelerated earnings streams. Remain tuned to uncover practical strategies for maximizing your revenue Velocity and protecting a more thriving financial future.

Absence of Diversity

When managing your earnings Velocity, one common error to prevent is the lack of diversification in your investments. Putting all your money right into a single investment can be risky. If that financial investment doesn't execute well, you could deal with significant losses. Diversifying your investments throughout different possession courses, sectors, and geographic areas can aid spread risk and potentially improve returns.

By branching out, you can lower the effect of a solitary financial investment underperforming. For instance, if you only invest in one field and that market experiences a downturn, your entire profile might endure. Nevertheless, if you have financial investments in various fields, the negative influence of one industry's poor performance can be countered by others executing well.

Consider branching out not just throughout various kinds of investments but also across different threat degrees. By balancing https://www.theeastafrican.co.ke/tea/magazine/how-...t-to-make-money-online-4490444 -risk, high-return financial investments with even more steady, low-risk choices, you can develop an all-round portfolio that straightens with your financial objectives and run the risk of resistance.

Ignoring Passive Income Opportunities

Among the hustle of handling your revenue Velocity, ignoring passive earnings opportunities can prevent your financial growth capacity. Passive earnings streams can offer you with additional money without needing continuous initiative on your component. By neglecting these opportunities, you may be missing out on a chance to boost your overall revenue.

Purchasing dividend-paying stocks, rental residential properties, or developing digital products are just a few instances of easy income sources that can produce cash for you while you concentrate on other aspects of your life.

Stopping working to check out passive earnings options not just restricts your earning possibility however also keeps you entirely reliant on energetic revenue, which can be unsteady and limited in growth. Make the effort to study and understand numerous easy income methods that align with your passions and economic objectives.

Poor Money Management

Many people battle with bad money management, resulting in financial instability and missed out on possibilities for development. It's essential to prioritize reliable money management to enhance your revenue Velocity.

One common blunder is spending too much beyond your methods. By creating a budget and tracking your expenses, you can guarantee that you're living within your economic limitations.

https://smb.gatescountyindex.com/article/Barnaje-D...oryId=66a71f25d3a3cc00089b806e to save and invest is another pitfall. Alloting a part of your revenue for cost savings and financial investments can help protect your financial future and raise your wide range in time.

Additionally, overlooking to pay off high-interest financial obligations immediately can drain your finances. Prioritize settling debts with high-interest prices to stay clear of collecting unnecessary passion fees.

Finally, not having a reserve can leave you at risk to unanticipated monetary obstacles. Developing an emergency fund with at least three to 6 months' worth of costs can supply an economic safeguard during difficult times.

Final thought

Finally, to stay clear of decreasing your earnings Velocity, make certain to expand your financial investments, make the most of passive income possibilities, and technique reliable money management. By spreading danger, checking out brand-new earnings streams, and remaining on top of your funds, you can increase your revenue growth and safeguard a more stable monetary future. Don't allow common blunders hold you back from attaining your monetary objectives-- take action currently to enhance your income Velocity.

Excelling In The Art Of Protecting Private Financing: Key Insights For Accomplishing Success |

Write-Up By-Fulton Silverman

To do well in elevating private money, you need to understand the intricate characteristics of investor psychology, craft propositions that mesmerize rate of interest, and cultivate lasting capitalist connections. By understanding these crucial parts, you can place your endeavor for economic growth and sustainability. However just how do you really understand the subtleties of capitalist behavior and create propositions that stand apart in a sea of possibilities? Let's discover the crucial methods that can boost your fundraising efforts to new heights and lead the way for long-term success in safeguarding exclusive funding.

Recognizing Capitalist Psychology

To efficiently elevate personal money, it's critical to recognize investor psychology. Capitalists are driven by different aspects when choosing where to place their money. Confidence in the job, rely on the group, and a clear understanding of the possible threats and benefits are all vital factors to consider.

As you come close to possible investors, bear in mind that they're trying to find possibilities that not just promise returns but likewise straighten with their worths and objectives. Structure rapport and establishing reliability are essential action in getting their depend on.

Capitalist psychology likewise plays a considerable role in decision-making. Emotions, previous experiences, and danger tolerance levels all influence just how financiers regard chances.

Crafting Compelling Financial Investment Proposals

Crafting compelling financial investment propositions requires a critical technique that mesmerizes potential capitalists from the beginning. To begin, plainly verbalize the financial investment opportunity, highlighting the possible returns and benefits for the financier. Your proposal needs to attend to vital inquiries financiers may have, such as the market chance, competitive advantage, and possible risks involved.

Present a distinct organization plan that details the objectives, timeline, and departure approach, showing a comprehensive understanding of the task.

Furthermore, incorporating visual aids, such as graphs or charts, can boost the clarity and impact of your proposal. Usage language that's concise, engaging, and customized to your target market to maintain their passion and engagement throughout the discussion.

In addition, showcasing the know-how of your group and supplying relevant success tales or case studies can instill self-confidence in prospective capitalists.

Building Long-Term Financier Relationships

Establishing and nurturing long-term capitalist connections is essential for the continual success and growth of your endeavor. Structure count on and integrity with investors takes time and initiative, yet the payoff in regards to recurring financial backing and tactical partnerships is very useful.

To grow long-term investor partnerships, concentrate on clear interaction and openness. Maintain your financiers informed regarding the progress of your venture, sharing both successes and difficulties in the process. Show authentic passion in their comments and point of views, demonstrating that you value their input.

Along with routine updates, make an effort to personalize your interactions with capitalists. Take https://smb.clemmonscourier.net/article/Barnaje-DA...oryId=66a71f25d3a3cc00089b806e to comprehend their specific objectives and choices, customizing your communications to resonate with their passions. https://www.forbes.com/sites/rachelwells/2024/03/1...ome-with-5-easy-steps-in-2024/ based on shared regard and understanding will certainly set the foundation for a long-lasting collaboration.

Conclusion

To conclude, grasping the procedure of raising personal money calls for understanding investor psychology, crafting compelling financial investment propositions, and building lasting connections. By concentrating on clear interaction, dealing with risks and incentives, and lining up with financiers' worths, you can boost your chances of success. Remember to verbalize your financial investment opportunity effectively, present a well-defined business plan, and nurture relationships over time. By complying with these necessary insights, you can efficiently secure private financing for your ventures.

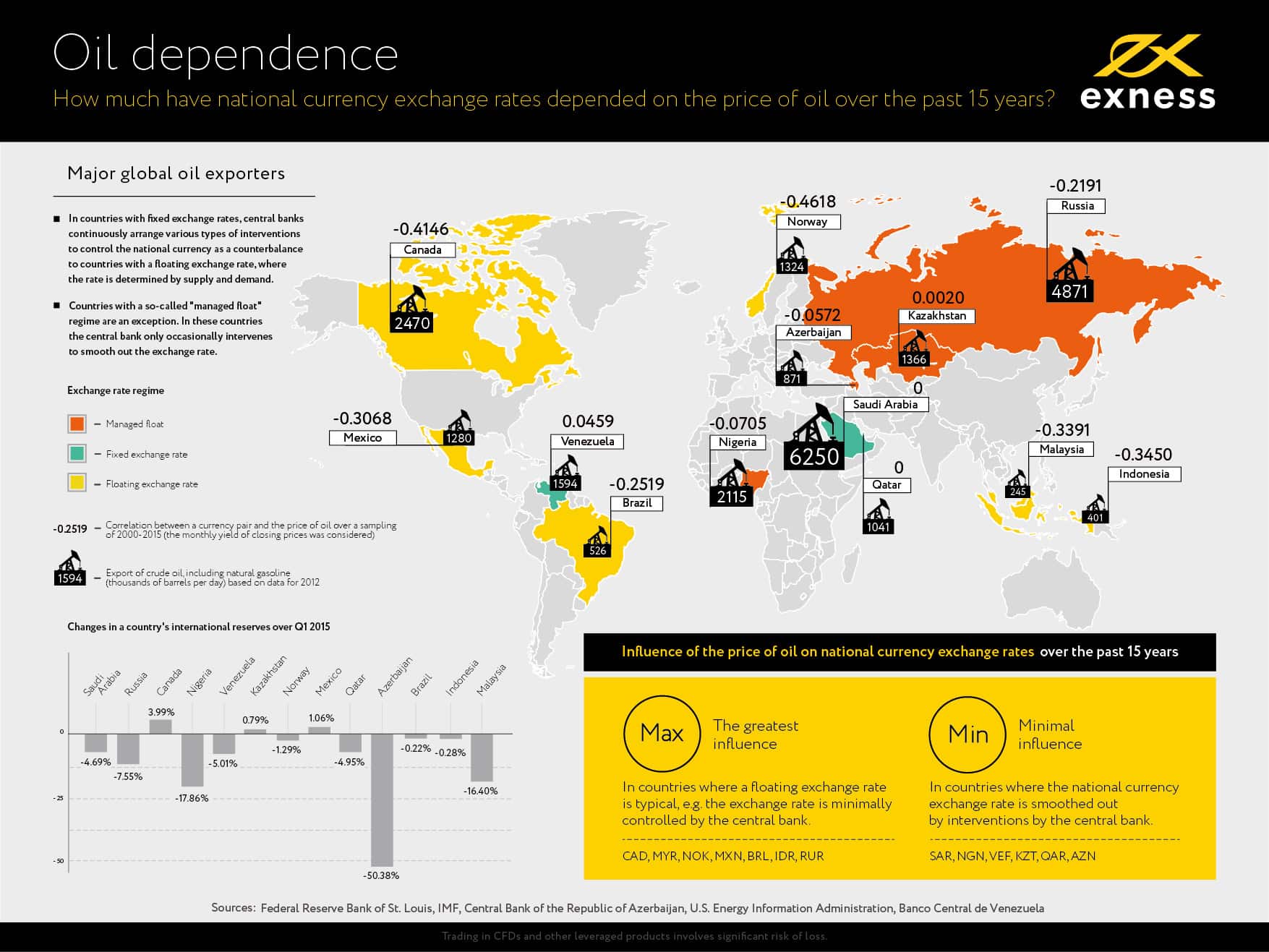

The Influence Of Financial Technology On Global Market Dynamics: What You Need To Know |

Developed By-Hoover Valencia

As you navigate the ever-evolving landscape of financial technology and its impact on global markets, it comes to be important to understand the complex web of modifications shaping the future of finance. From the increase of blockchain modern technology to the expansion of digital currencies, the influence of fintech reverberates across borders, presenting both challenges and possibilities for market individuals. Comprehending exactly how these innovations reshape standard practices and open brand-new opportunities for financial investment and financial inclusion is key to remaining ahead in today's interconnected world of money.

Evolution of Fintech Landscape

Check out how the fintech landscape has actually quickly progressed in recent years, reshaping conventional economic solutions. The rise of fintech firms has actually changed the method individuals gain access to and manage their financial resources.

You might have noticed the increasing appeal of mobile repayment applications, robo-advisors, and peer-to-peer borrowing platforms. These advancements have made economic solutions easier, efficient, and available to a larger audience.

As a customer, you now have more alternatives than ever before for handling your money. Fintech companies have actually introduced new methods to send out cash internationally, buy stocks, and also acquire car loans without ever entering a bank. The comfort of performing economic transactions online or via an app has actually changed the method people interact with standard banks.

In addition, the fintech market has forced traditional banks to adapt or run the risk of lapsing. Financial institutions are currently investing greatly in technology to boost their solutions and satisfy the altering needs of customers. This competition has actually eventually resulted in much better services and products for you as a consumer.

Disruption of Standard Financial Systems

The fintech industry is actively reshaping standard economic systems by challenging well established norms and methods. With https://www.fool.ca/2024/04/29/how-to-build-a-bull...olio-with-just-7000-in-2024-3/ of innovative modern technologies, conventional banks and financial institutions are facing boosting stress to adjust to a swiftly changing landscape.

Fintech firms are introducing brand-new methods of carrying out economic transactions, handling investments, and giving access to capital, interrupting the status.

One of the crucial means fintech is interrupting traditional economic systems is with the intro of online platforms that offer smooth and effective services, such as peer-to-peer loaning and digital payment services. These systems give users with higher ease, lower costs, and enhanced availability compared to typical banking approaches.

Additionally, fintech companies are leveraging large data and expert system to streamline procedures like credit rating and risk assessment, making it possible for faster decision-making and a lot more tailored economic services. This data-driven method is changing the means financial institutions operate, resulting in increased performance and improved customer experiences.

Global Market Impacts of Fintech

Fintech's influence on international markets appears through its impact on cross-border transactions and market characteristics. By leveraging innovative innovations, fintech companies have actually reinvented the way worldwide deals are conducted. Through blockchain and electronic payment systems, cross-border transactions have actually become much more efficient, cost-efficient, and safeguard. This has resulted in boosted international trade and investment chances, cultivating economic growth on an international range.

Additionally, fintech has played a significant role in shaping market dynamics by providing innovative services for financial investment, trading, and threat management. Mathematical trading platforms powered by artificial intelligence have actually improved market liquidity and price exploration.

Additionally, crowdfunding and peer-to-peer lending systems have equalized accessibility to resources, permitting businesses worldwide to secure funding even more quickly.

Final thought

Finally, fintech has actually reinvented international markets by introducing ingenious options that enhance performance and ease of access in economic solutions.

This improvement has interfered with standard monetary systems, leading to faster decision-making, personalized solutions, and raised trade possibilities.

With weblink continued development of fintech, we can anticipate to see additional developments in cross-border purchases, democratization of resources access, and the utilization of large information and AI to drive market characteristics.

Keep educated and welcome the future of money with fintech.

|

Метки: Financial Technology CFD Trading Platform Trading Software Small Business Loans Financial Services |

Short Article Created By-Wulff Kerr

You've meddled the world of on-line lucrative, yet have you absolutely understood the art? Visualize having access to expert suggestions and tricks that could take your on the internet revenues to the next level. What happens if there were tactical tricks and proven approaches that could transform your digital endeavors right into lucrative opportunities? Remain tuned as we unwind the secrets behind successful online entrepreneurship and reveal the surprise treasures of optimizing your monetary possibility in the virtual world.

Secret Approaches for Success

To accomplish success in generating income online, focus on implementing crucial strategies that are customized to your strengths and goals. Start by identifying your particular niche market and comprehending the requirements of your target market. Research trending topics and keywords to enhance your content for online search engine. Develop high-quality, important material that involves your target market and drives traffic to your website.

Use email advertising and marketing to construct a loyal customer base and maintain them notified regarding your service or products. Establish a strong brand name existence by consistently delivering on your promises and providing outstanding client service. Monetize your web site through affiliate marketing, sponsored blog posts, or selling digital items.

Keep updated on the most recent digital marketing patterns and innovations to remain ahead of the competitors. https://www.moneycontrol.com/jobs/10-high-paying-r...eded-visual-story-2127770.html with other on-line entrepreneurs and collaborate on projects to increase your reach. Continually analyze your efficiency metrics and adjust your approaches based on the data. By concentrating on your toughness and establishing clear goals, you can efficiently monetize your on-line visibility and accomplish economic success.

Leveraging Social Media Site

As you navigate the world of generating income online, an effective tool for increasing your reach and involving with your audience is leveraging social networks. simply click the next web page like Facebook, Instagram, Twitter, and LinkedIn provide huge opportunities to get in touch with prospective customers and develop a devoted following. By creating compelling content customized to each system and engaging with your audience with remarks, likes, and shares, you can raise brand presence and drive web traffic to your online endeavors.

Making use of social networks also enables you to collect valuable understandings through analytics tools. By checking metrics such as engagement prices, click-through rates, and demographics of your followers, you can improve your strategies to better resonate with your target market. Additionally, social networks provides a cost-efficient method to run targeted advertising campaigns, getting to particular demographics based upon interests, place, and much more.

In essence, by successfully leveraging social media, you can amplify your on the internet existence, connect with your target market on an individual degree, and inevitably boost your making capacity in the electronic landscape.

Maximizing Money Making Opportunities

Optimizing your monetization opportunities requires calculated preparation and a keen understanding of your target market's requirements and choices. One effective method to boost your revenues is by diversifying your revenue streams. Rather than counting solely on one income source, check out multiple opportunities such as affiliate marketing, sponsored web content, online programs, and electronic products. By supplying a range of money making choices, you can deal with different audience sectors and optimize your earning capacity.

One more crucial method is to enhance your web site for money making. This includes purposefully positioning ads, creating engaging calls-to-action, and implementing reliable list building techniques. By making it very easy for site visitors to involve with your monetization channels, you can enhance conversion rates and generate more revenue.

Additionally, staying up to day with sector fads and customer behavior can aid you determine brand-new money making opportunities. By adjusting to modifications in the marketplace and customer choices, you can remain ahead of the curve and capitalize on emerging trends to maximize your on the internet profits.

Final thought

In conclusion, grasping the art of earning money online requires a tactical method and imaginative implementation. By understanding your target audience, producing important material, and leveraging social media sites platforms, you can build a faithful consumer base and optimize your online earnings.

Stay upgraded on market patterns, diversify income streams, and take advantage of emerging opportunities to guarantee continued success in the ever-evolving on-line landscape. With the best methods in position, you can turn your on the internet endeavors right into a fulfilling and successful venture.

Unlock To Financial Liberty With Easy Revenue Approaches, But Be Planned For The Unforeseen Twists That Lie In Advance |

Author-Ryan Leth

As you start the trip of structure riches through easy revenue, the attraction of monetary flexibility beckons. By understanding the art of creating cash while you sleep, you open doors to a world where your money helps you, not the other way around. Envision the possibilities that wait for as you strategically plant the seeds of your financial investments, nurturing them to flourish with time. But keep in mind, the path to passive earnings is not without its challenges and complexities. Are you ready to find the secrets that can lead you to economic independence?

Recognizing Passive Income Sources

When looking for to build riches with easy earnings, you must initially recognize the different sources that can generate cash with minimal effort on your component.

One usual resource of passive earnings is through rental homes. By owning property and leasing it out, you can earn a consistent stream of income without actively helping it.

Another rewarding resource is dividend-paying stocks. Buying firms that disperse a portion of their incomes to shareholders can give you with an easy revenue stream with regular reward payments.

Furthermore, producing and marketing electronic products, such as electronic books, on the internet training courses, or software program, can also produce easy revenue. As soon as you have actually produced the item, you can remain to make money from it as long as it remains appropriate and popular.

One more option is peer-to-peer lending, where you offer cash to individuals or companies via on the internet systems in exchange for rate of interest settlements.

Understanding these different resources of passive revenue is necessary in building a varied portfolio that can aid you attain financial flexibility.

Establishing Easy Income Streams

To develop passive income streams properly, consider diversifying your investments across different resources to make best use of earnings capacity. This technique helps spread out danger and guarantees a much more steady earnings flow. Start by researching various easy income chances such as real estate investments, dividend-paying supplies, peer-to-peer borrowing, or developing electronic products like electronic books or on-line programs.

https://www.businessinsider.com/passive-income-ideas-2023-1 of these methods provides distinct benefits and differing levels of involvement, enabling you to customize your profile to match your choices and monetary objectives.

When establishing easy earnings streams, it's critical to conduct extensive due persistance on each chance. Assess potential returns, linked dangers, and the quantity of time and initiative called for to preserve each earnings stream. By carefully examining and selecting varied income resources, you can build a robust passive revenue profile that creates income regularly.

Bear in mind to on a regular basis assess and change your financial investments as required to enhance your incomes and make sure long-lasting financial success.

Expanding Your Easy Income Portfolio

Think about broadening your passive earnings profile by checking out new investment chances and strategies. Expanding your portfolio can help in reducing danger and raise possible returns.

One means to grow your easy earnings is by buying dividend-paying supplies. https://barnaje.myportfolio.com can provide a stable stream of income with routine returns settlements.

An additional option is real estate crowdfunding, where you can buy residential or commercial properties without the problem of being a property manager.

Peer-to-peer borrowing platforms use the opportunity to make passion by offering money to individuals or services.

Furthermore, you might want to take into consideration purchasing exchange-traded funds (ETFs) that concentrate on producing easy income. These funds usually contain a varied portfolio of income-generating assets such as bonds, dividend supplies, or realty investment company (REITs).

Automated investing platforms can additionally assist you expand your easy revenue by instantly spending your cash in a diversified portfolio based on your threat tolerance and financial objectives.

Conclusion

Congratulations on taking the very first step towards building wealth with passive earnings! By diversifying your investments and continually growing your profile, you get on the best track to attaining your economic goals.

Bear in mind to stay informed, evaluate your returns, and change your financial investments as needed. With dedication and tactical planning, you can continue to construct wide range and safeguard your financial future through passive earnings streams.

Keep up the great work!

Unlock The Path To Economic Freedom With Passive Revenue Strategies, While Continuing To Be Alert For The Unpredicted Obstacles That Might Occur |

Writer-Gross Salisbury

As you start the trip of building wealth through easy income, the appeal of monetary liberty beckons. By mastering the art of generating cash while you rest, you open doors to a world where your money works for you, not vice versa. Visualize the opportunities that wait for as you purposefully plant the seeds of your investments, supporting them to flourish in time. But keep in mind, the course to easy revenue is not without its challenges and complexities. Are you prepared to find the tricks that can lead you to monetary self-reliance?

Recognizing Easy Income Sources

When seeking to construct riches with passive earnings, you need to initially understand the various sources that can produce cash with marginal initiative on your part.

One usual resource of easy earnings is via rental residential properties. By having https://barnaje.myportfolio.com and renting it out, you can gain a consistent stream of income without actively benefiting it.

An additional lucrative resource is dividend-paying stocks. Investing in firms that distribute a section of their profits to investors can give you with a passive earnings stream through regular returns payments.

Additionally, creating and offering digital products, such as electronic books, on-line training courses, or software application, can also produce easy earnings. Once you have actually produced the item, you can continue to earn money from it as long as it continues to be appropriate and popular.

An additional alternative is peer-to-peer borrowing, where you offer money to individuals or organizations with on-line platforms in exchange for passion payments.

Recognizing these different resources of easy revenue is important in developing a varied profile that can help you accomplish monetary flexibility.

Establishing Passive Earnings Streams

To establish easy revenue streams successfully, take into consideration expanding your financial investments throughout various sources to optimize revenues potential. This technique aids spread out risk and makes sure a more steady revenue circulation. Begin by researching various passive revenue chances such as real estate investments, dividend-paying supplies, peer-to-peer lending, or producing electronic items like electronic books or on-line programs.

Each of these opportunities uses special benefits and differing degrees of involvement, allowing you to customize your portfolio to suit your choices and monetary objectives.

When establishing passive earnings streams, it's essential to perform complete due diligence on each opportunity. Analyze potential returns, linked threats, and the amount of time and initiative required to keep each earnings stream. By meticulously evaluating and picking varied earnings resources, you can build a robust passive income profile that creates earnings regularly.

https://www.businessinsider.com/best-side-hustles-for-introverts-2023-11 in mind to on a regular basis examine and change your investments as required to enhance your profits and guarantee lasting financial success.

Growing Your Easy Earnings Profile

Think about increasing your passive earnings profile by discovering new financial investment chances and approaches. Expanding your portfolio can help reduce danger and increase prospective returns.

One method to expand your easy earnings is by purchasing dividend-paying supplies. These stocks can give a consistent stream of earnings via routine returns payments.

Another alternative is realty crowdfunding, where you can buy buildings without the trouble of being a proprietor.

Peer-to-peer loaning platforms use the possibility to gain interest by providing cash to people or businesses.

Furthermore, you may want to think about buying exchange-traded funds (ETFs) that concentrate on generating passive income. These funds usually include a varied portfolio of income-generating properties such as bonds, dividend supplies, or property investment trusts (REITs).

Automated spending systems can additionally aid you grow your passive revenue by automatically investing your money in a diversified portfolio based on your danger resistance and monetary goals.

Verdict

Congratulations on taking the initial step in the direction of structure wealth with easy revenue! By diversifying your investments and regularly expanding your profile, you're on the best track to accomplishing your monetary objectives.

Remember to remain notified, evaluate your returns, and adjust your investments as required. With devotion and critical preparation, you can continue to develop wide range and secure your financial future with easy income streams.

Maintain the great work!

Ignored Yet Crucial: Recognize The Essential Aspect That Might Improve The Performance Of Your Initial Financial Advisor Meeting And Add To Long-Lasting Success |

Web Content Author-Dalgaard Clark

As you prepare for your very first conference with a monetary advisor, guaranteeing you have all the essential records and a clear understanding of your economic objectives is essential. Nevertheless, there's one essential aspect that typically gets overlooked in the preparation procedure, something that might dramatically impact the end result of the meeting. It involves considering not just your short-term aspirations but likewise your lasting monetary vision. This essential component can pave the way for a much more fruitful conversation with your expert.

Gather Crucial Papers

Wondering what documents you require to gather before conference with a financial expert? To make the most of your very first meeting, it's important to have all the essential documentation all set. Start by accumulating recent bank statements, financial investment account declarations, and any pension details. These records will certainly give your consultant an extensive sight of your current economic scenario.

Next, gather your most recent income tax return, consisting of any appropriate schedules. Your income tax return provide useful insights into your earnings, deductions, and total monetary health.

Furthermore, bring along any insurance policy files you have, such as life insurance or long-lasting care plans. Comprehending your coverage is necessary for creating a holistic financial plan.

Do not neglect to put together details of any outstanding debts, such as credit card equilibriums, finances, or home mortgages. Understanding your liabilities will aid your expert establish approaches to take care of and decrease your financial obligation efficiently.

Specify Economic Goals

To make the most of your monetary consultant meeting, begin by clearly specifying your monetary goals. Think about what you intend to accomplish financially in the short-term and long term. Consider your priorities, whether it's saving for retired life, acquiring a home, moneying your youngsters's education and learning, or beginning a service. Setting specific and reasonable objectives will certainly assist guide the discussion with your advisor and tailor the economic recommendations to your requirements.

When specifying your monetary objectives, be as outlined as feasible. just click the up coming post out the specific amount you need to conserve, spend, or pay off. Establish http://ramiro87logan.xtgem.com/__xt_blog/__xtblog_...ng?__xtblog_block_id=1#xt_blog for every goal, whether it's one year, 5 years, or twenty years down the line. Comprehending the 'why' behind your objectives can also give motivation and direction as you function towards them.

Remember that your economic objectives might develop gradually, which's okay. Your consultant can help you readjust your strategy as needed to align with any kind of modifications in your scenarios or top priorities.

Study Advisor Background

Prior to meeting with a monetary expert, it's vital to thoroughly research their history to guarantee their qualifications and experience line up with your monetary requirements. Begin by checking if the consultant is a Licensed Economic Organizer (CFP), which shows they have actually satisfied strenuous criteria.

Look into their educational background, certifications, and any disciplinary background. Validate if they focus on locations relevant to your situation, such as retirement planning or investment administration. Online databases like the Financial Market Regulatory Authority's BrokerCheck can offer useful insights right into an advisor's qualifications and any previous governing concerns.

Additionally, take into consideration reading evaluations or requesting references from friends or household who've dealt with the expert. By performing this research study, you can enter your conference sensation confident in the advisor's capacity to assist you reach your monetary objectives and protect your financial future.

Final thought

In conclusion, by gathering necessary files, specifying clear financial objectives, and investigating your advisor's background, you're setting on your own up for a successful initial meeting with a monetary consultant.

Being prepared and open up to discussing your monetary situation will aid you take advantage of the guidance and guidance they can offer.

Best of luck on your journey in the direction of monetary security and accomplishing your objectives!

Stress The Essential Features That Have The Power To Positively Affect Your Retirement Planning Trajectory With The Assistance Of A Well-Informed Monetary Expert |

Material Produce By-Buch Matthiesen

When looking for economic advisors to guide your retirement planning trip, bear in mind to focus on essential qualities that can make a significant difference in safeguarding your financial future. From experience and experience to effective interaction skills and a client-focused approach, each aspect plays an essential function in picking the ideal expert for your requirements. By meticulously thinking about these important qualities, you can guarantee a strong foundation for your retired life preparation method.

Experience and Knowledge

When taking into consideration hiring economic consultants for retirement preparation, prioritize their experience and knowledge. It's crucial to pick advisors that have actually a proven track record in efficiently leading customers through their retirement years. https://www.thestreet.com/retirement-daily/saving-...-to-avoid-running-out-of-money that have actually years of experience especially in retired life preparation, as this demonstrates their capacity to navigate the intricacies of this phase in life.

Expertise in locations such as investment approaches, tax obligation planning, and estate preparation is also necessary to ensure that your retirement funds are maximized and shielded.

Seasoned monetary advisors bring a wide range of expertise to the table, allowing them to prepare for possible obstacles and supply positive options. Their experience enables them to tailor financial strategies to match your distinct goals and situations successfully.

Interaction Abilities

Think about exactly how successfully financial advisors connect with you as it considerably affects the success of your retirement planning journey.

When looking for a financial advisor, focus on locating somebody that can describe complex monetary concepts in a manner that you understand. Clear communication is essential to ensuring that you're educated concerning your retirement choices and can make certain decisions.

Look for a consultant that proactively listens to your issues, objectives, and preferences. Financial Advice For Business Owners includes normal updates on the progression of your retirement and without delay addressing any concerns or unpredictabilities you might have.

A proficient economic consultant needs to have the ability to adapt their interaction design to fit your choices. Whether you prefer in-depth e-mails, phone calls, in-person conferences, or video clip meetings, your advisor ought to have the ability to suit your demands.

Transparent interaction develops trust fund and promotes a strong advisor-client connection, which is crucial for effective retirement preparation. See to it to assess a prospective advisor's communication skills throughout your preliminary conferences to make certain a good suitable for your economic journey.

Client-Focused Technique

To ensure an effective retirement planning experience, prioritize monetary consultants that prioritize a client-focused strategy. When selecting a monetary consultant for your retirement planning demands, it's critical to discover a person who puts your passions initially.

A client-focused technique implies that the consultant pays attention to your objectives, problems, and choices attentively. By understanding your special economic situation and goals, they can customize their recommendations and suggestions to suit your certain requirements.

A client-focused monetary consultant will certainly make the effort to explain complex economic concepts in a way that you can conveniently comprehend. They'll involve you in the decision-making procedure and ensure that you fit with the approaches suggested. This strategy promotes trust fund and transparency in the advisor-client connection, eventually bring about a much more effective retirement planning trip.

Additionally, a client-focused consultant will focus on routine interaction to keep you notified regarding the development of your retirement plan. They'll be readily offered to resolve any type of questions or uncertainties you may have in the process.

Verdict

In conclusion, when hiring financial experts for your retired life planning, bear in mind to prioritize experience, proficiency, interaction skills, and a client-focused strategy.

Search for experts who have actually a proven record in retirement planning, can clarify complicated concepts plainly, actively listen to your issues, involve you in decision-making, and maintain normal interaction.

By focusing on these essential qualities, you can make certain that you have a trusted companion to help you accomplish your retirement goals.

Undetected Yet Vital: Reveal The Pivotal Element That Has The Potential To Enhance The End Result Of Your First Meeting With A Financial Consultant For Continual Success |

Produced By-Dwyer Barlow

As you prepare for your very first conference with an economic advisor, ensuring you have all the necessary files and a clear understanding of your monetary goals is critical. Nonetheless, there's one crucial facet that usually obtains overlooked in the prep work process, something that can considerably affect the result of the conference. It involves taking into consideration not just your temporary aspirations yet likewise your lasting financial vision. This crucial element can lead the way for an extra worthwhile discussion with your advisor.

Gather Vital Documents

Wondering what documents you need to collect before meeting with a financial expert? To take advantage of your initial meeting, it's vital to have all the necessary documentation all set. Beginning by collecting recent financial institution statements, investment account statements, and any kind of retirement account details. These files will certainly provide your expert a detailed sight of your present monetary situation.

Next, gather your newest tax returns, consisting of any pertinent schedules. Your tax returns offer beneficial insights into your income, reductions, and overall economic health.

Additionally, bring along any type of insurance coverage papers you have, such as life insurance or lasting care policies. Understanding your protection is important for developing an alternative financial strategy.

Don't fail to remember to put together details of any type of arrearages, such as charge card balances, loans, or mortgages. Knowing your responsibilities will certainly aid your expert establish approaches to manage and lower your financial debt effectively.

Specify Economic Goals

To take advantage of your monetary consultant meeting, start by clearly specifying your monetary goals. Think about what you intend to achieve economically in the short term and long term. Consider your top priorities, whether it's saving for retired life, buying a residence, moneying your youngsters's education, or starting a company. Establishing certain and practical objectives will help guide the discussion with your consultant and customize the economic suggestions to your requirements.

When defining https://vertie-collene.blogbright.net/take-the-rei...eeling-of-financial-protection , be as described as feasible. Determine Asset Allocation require to save, invest, or repay. Develop clear timelines for each and every goal, whether it's one year, five years, or twenty years down the line. Comprehending the 'why' behind your objectives can likewise supply motivation and instructions as you function in the direction of them.

Bear in mind that your monetary goals may progress with time, and that's fine. Your consultant can help you change your plan as required to line up with any type of adjustments in your circumstances or priorities.

Research Advisor History

Before conference with an economic expert, it's important to completely investigate their history to ensure their credentials and experience align with your financial demands. Begin by inspecting if the advisor is a Qualified Monetary Organizer (CFP), which indicates they've satisfied rigorous requirements.

Check into their educational history, qualifications, and any type of disciplinary background. Verify if they focus on locations pertinent to your scenario, such as retirement preparation or investment management. Online data sources like the Financial Market Regulatory Authority's BrokerCheck can offer beneficial understandings right into a consultant's qualifications and any kind of past regulative problems.

Furthermore, take into consideration checking out evaluations or requesting for references from close friends or family members that have actually worked with the advisor. By conducting this research study, you can enter your conference feeling positive in the expert's ability to help you reach your monetary objectives and secure your monetary future.

Conclusion

To conclude, by collecting necessary documents, specifying clear monetary objectives, and researching your expert's history, you're establishing on your own up for an effective first conference with a monetary advisor.

Being ready and open to reviewing your economic circumstance will certainly assist you take advantage of the suggestions and guidance they can supply.

Good luck on your trip towards monetary security and achieving your goals!

Uncover The Secrets To Developing A Rock-Solid Monetary Plan With The Specialist Advice Of Financial Advisors - Your Trick To A Safe Future Awaits! |

Created By-Hickey Gallegos

When it concerns protecting your monetary future, having a competent financial consultant at hand can make all the difference. By delving into your economic landscape and tailoring methods to match your unique objectives, these specialists offer a roadmap in the direction of lasting monetary security. From retirement preparation to financial investment diversification, financial advisors offer an all natural approach that can pave the way for a secure and prosperous future. So, exactly how exactly do these experts navigate the complexities of finance to ensure your financial well-being?

Financial Analysis and Goal Setting

Before producing a strong financial plan, it's critical to perform a comprehensive economic assessment and plainly specify your objectives. Start by collecting all your economic files, including revenue statements, bank declarations, investment accounts, and any kind of financial debts you might have. Take a close take a look at your investing practices to understand where your money is going each month. This assessment will certainly offer a clear image of your current monetary situation and aid determine locations for improvement.

Next off, it is essential to set details, quantifiable, attainable, pertinent, and time-bound (SMART) goals. Whether you aim to buy a home, save for your children's education, or retire comfortably, specifying your objectives will offer your financial plan direction and purpose. Be practical about your purposes and think about both temporary and lasting desires.

Customized Financial Investment Strategies

Just how can monetary experts customize financial investment strategies to suit your special economic objectives and take the chance of tolerance?

https://www.goldstreamgazette.com/local-news/langf...-per-cent-tax-increase-7354916 have the competence to examine your economic situation comprehensively, considering aspects such as your earnings, expenditures, possessions, obligations, and long-lasting goals. By comprehending your threat resistance, time perspective, and investment preferences, they can develop a personalized investment method that aligns with your specific demands and comfort degree.

Financial experts use various investment cars such as stocks, bonds, mutual funds, and exchange-traded funds to develop a diversified portfolio that stabilizes threat and potential returns according to your choices. They can additionally integrate tax-efficient strategies to enhance your investment development while reducing tax implications.

Via recurring surveillance and changes, economic consultants make sure that your financial investment method stays in line with your advancing economic goals and market problems. By working very closely with an economic consultant to develop an individualized financial investment strategy, you can feel great that your financial future is in qualified hands.

Retired Life and Estate Planning

To protect your financial future, it is very important to consider retirement and estate preparation as essential elements of your total economic approach. Retired life preparation includes establishing details economic goals for your post-working years and establishing just how to attain them. A financial expert can assist you browse retirement account choices, such as 401( k) s or IRAs, and devise a tailored strategy tailored to your demands. By starting very early and consistently assessing your retirement, you can guarantee you're on track to satisfy your future monetary objectives.

Estate preparation, on the other hand, focuses on handling your properties and guaranteeing they're dispersed according to your wishes after you pass away. This procedure involves producing a will, establishing trusts, and marking recipients. A monetary expert can help you in creating an estate strategy that lessens tax obligations and takes full advantage of the value of your estate for your successors.

Conclusion

To conclude, monetary advisors can play a crucial duty in helping you develop a solid economic prepare for your future.

By conducting a detailed economic evaluation, establishing SMART objectives, and customizing financial investment strategies tailored to your demands, advisors make sure that you get on track to accomplish your short-term and long-lasting economic objectives.

With visit the up coming internet site and advice, you can feel great in your monetary outlook and protect your economic future.

Establish A Long-Lasting Collaboration With Your Financial Consultant By Fostering Open Interaction And Count On, Laying The Groundwork For Economic Success And Protection |

Published By-Levy Leonard

To establish an enduring partnership with your financial consultant, it all begins with efficient interaction and depend on. By openly sharing your monetary ambitions and life changes, you lay the groundwork for a collaboration that deals with your details demands. Nevertheless, there's even more to it than just communication and trust. It has to do with comprehending the nuances that go into making this partnership prosper - nuances that can establish you on a course to monetary stability and success.

Communication Is Trick

To establish a solid foundation with your economic expert, regularly keep open and transparent communication channels. have a peek at this website indicates being positive in sharing your monetary objectives, worries, and any type of adjustments in your life that might affect your economic situation. By freely reviewing your expectations and risk tolerance, your advisor can customize their recommendations to ideal fit your needs.

Keep in mind, your monetary expert exists to assist you browse essential decisions, so do not wait to ask concerns or look for explanation on any type of monetary issues.

Regularly scheduled check-ins with your advisor can also aid maintain you both on the exact same web page. Whether it's a quarterly testimonial or a yearly update conference, these discussions supply a possibility to analyze your development towards your goals, address any kind of new growths, and make adjustments as needed.

Additionally, do not be reluctant to connect between meetings if something considerable comes up that you require assistance on. Clear and constant communication is the keystone of a successful long-lasting partnership with your economic consultant.

Establish Trust Early

Developing a solid foundation for a long-term relationship with your monetary advisor begins with establishing trust at an early stage. Trust is the keystone of any successful partnership, particularly when it involves handling your funds.

To develop trust fund from the start, be open and honest about your economic goals, issues, and expectations. Share pertinent personal details and be transparent concerning your financial background, including any type of financial debts or investments you currently have.

It's vital to ask your economic expert inquiries to determine their know-how and ensure they've your best interests in mind. Review their technique to monetary planning, investment techniques, and how they'll maintain you educated concerning your profile's efficiency. Focus on how they communicate and whether they take the time to resolve your questions thoroughly.

Normal Evaluation and Feedback

Make certain that you arrange routine meetings with your financial consultant to evaluate your monetary objectives and give comments on your existing monetary strategy. These conferences are vital for keeping a successful long-lasting connection with your consultant.

Throughout these sessions, you can go over any adjustments in your life that may influence your financial circumstance, such as a brand-new task, a major purchase, or a change in your danger tolerance.

Routine evaluations enable you to track your progress towards your goals and make any kind of required adjustments to your monetary plan. This ongoing discussion makes certain that your consultant remains notified regarding your developing requirements and can customize their recommendations accordingly.

It also provides you with the opportunity to voice any kind of concerns or ask inquiries regarding your investments or financial strategy.

Conclusion

Finally, building a long-term relationship with your economic expert is all about interaction, depend on, and normal feedback. By freely sharing Portfolio Management and worries, being truthful regarding your background, and staying aggressive in your communication, you can establish a solid partnership that will aid you reach your economic goals.

Keep in Click On this website to arrange routine check-ins and provide comments to make certain that your economic plan remains on track. With a positive method, you can grow a lasting partnership with your advisor.

When Picking An Economic Advisor, Make Sure To Ask About The Adhering To |

Content Writer-Timmons Napier

When picking an economic consultant, have you thought about the crucial questions that could affect your monetary future? Understanding their qualifications, financial investment methods, and cost frameworks is crucial, but what about their interaction style? How they interact and inform you concerning monetary issues can substantially affect your decision-making process. This often-overlooked element can be a game-changer in creating a successful advisor-client connection.

Advisor's Qualifications and Experience

When choosing a financial advisor, guarantee you meticulously review their credentials and experience. Search for credentials like Licensed Economic Organizer (CFP) or Chartered Financial Analyst (CFA) to ensure they've undergone strenuous training and exams.

Experience is key, so ask about for how long they've been in the market and what kinds of clients they commonly deal with. A seasoned advisor might have experienced a selection of monetary situations, providing valuable understandings to assist you browse your very own.

Additionally, take into consideration the expert's field of expertise. Some concentrate on retired life preparation, while others excel in financial investment approaches or tax planning. Align their experience with your particular requirements to ensure they can provide the support you call for.

Do not be reluctant to request for references or testimonies from existing clients. This firsthand comments can offer beneficial understandings into the consultant's interaction design, reliability, and total satisfaction of their customers.

Investment Approach and Viewpoint

Evaluating an advisor's financial investment technique and ideology is vital in determining if their techniques straighten with your financial objectives and run the risk of resistance. When reviewing an expert, ask about their investment design. Are they extra inclined towards active monitoring, regularly buying and selling safety and securities, or do they prefer an easy method, concentrated on lasting growth? Recognizing their philosophy can offer you understanding right into just how they make investment decisions on your behalf.

Furthermore, inquire about please click the next page on risk. How do they assess risk, and what measures do they require to reduce it? Make sure that their method to take the chance of aligns with your comfort level.

In https://writeablog.net/emeline69dominga/take-the-r...using-on-retired-life-planning , inquire about their track record. Have they achieved success in attaining their customers' economic goals in the past? While past efficiency isn't indicative of future outcomes, it can use important info concerning their financial investment approach.

Fee Structure and Services

Understanding the charge framework and solutions supplied by a monetary expert is important for making educated decisions concerning your monetary future. When selecting visit the next web page , ensure you comprehend how they're compensated. Some advisors bill a portion of assets under administration, while others might have a fee-based on hourly rates or a flat cost. Be clear about these expenses upfront to prevent shocks later.

In addition, inquire about the series of solutions the monetary advisor offers. Do they offer extensive monetary preparation, retirement preparation, investment monitoring, or specific services customized to your requirements? Understanding the range of services provided will help you analyze whether the consultant can fulfill your economic goals properly.

Moreover, think about asking about any type of possible problems of rate of interest that might develop as a result of their fee framework. Transparency in how your expert is compensated and the solutions they use is vital for developing a trusting and effective monetary advisor-client relationship. By diving right into these aspects, you can make a knowledgeable choice when selecting a monetary consultant.

Final thought