The Definitive Handbook On Opting For The Perfect Wealth Monitoring Advisor |

Дневник |

Write-Up Created By-Silver McKinney

As you browse the detailed landscape of riches administration experts, one vital facet often neglected is the relevance of establishing a solid relationship with your chosen expert. Constructing a strong relationship goes beyond plain financial purchases; it involves count on, communication, and positioning of values. The structure of this partnership can considerably influence the success of your economic goals and the overall management of your riches. So, just how can you grow this essential bond with your consultant?

Comprehending Your Financial Goals

To establish a solid foundation for your economic trip, clearly define your wide range objectives. Beginning by assessing what you aspire to accomplish economically. Do you intend to retire early, acquire a 2nd home, or money your youngster's education and learning? Determining your certain purposes will certainly guide your wealth monitoring choices and assist you remain concentrated on what absolutely matters to you.

Take into consideration both short-term and lasting objectives when detailing your economic aspirations. Temporary goals might include building a reserve, settling financial obligation, or saving for a trip. On the other hand, lasting goals can entail spending for retired life, producing a heritage for your enjoyed ones, or accomplishing economic freedom. By distinguishing between these 2 groups, you can prioritize your goals properly.

Additionally, see to it your riches goals are realistic and quantifiable. Set clear targets with timelines affixed to monitor your development in the process. Remember, your economic objectives are personal to you, so ensure they line up with your values and desires. By comprehending your monetary objectives, you're taking the important very first step in the direction of protecting your monetary future.

Reviewing Expert Qualifications

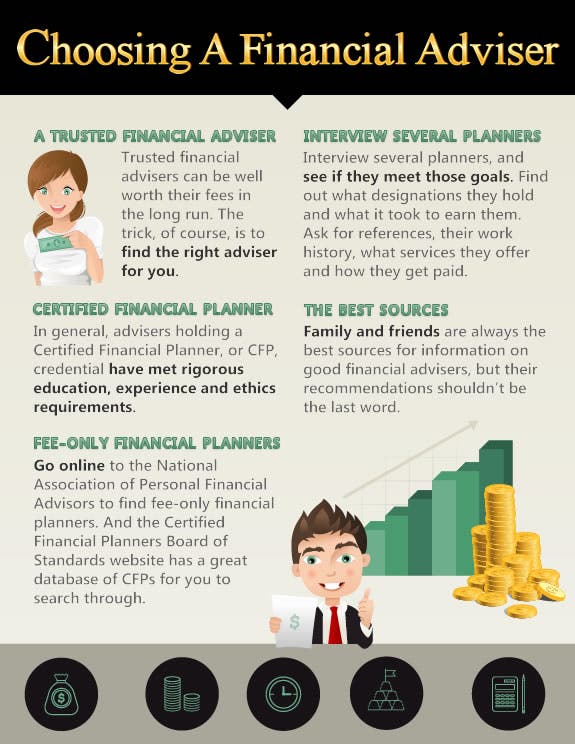

When choosing a wealth management advisor, analyze their credentials to guarantee they line up with your monetary purposes and aspirations. Seek consultants with appropriate certifications such as Licensed Financial Coordinator (CFP), Chartered Financial Analyst (CFA), or Certified Investment Administration Expert (CIMA). These classifications indicate that the consultant has satisfied specific education and learning and experience requirements, showing a commitment to specialist excellence.

Furthermore, take into consideration the consultant's experience in the sector and their performance history of efficiently taking care of customers' wide range. A skilled consultant who's browsed various market conditions can offer beneficial understandings and approaches to assist you achieve your financial objectives.

It's likewise necessary to review the expert's technique to wide range administration. https://calendar.google.com/calendar/embed?src=f2a...gle.com&ctz=America%2FNew_York might specialize in certain areas like retirement preparation, estate planning, or investment administration. Ensure that their expertise aligns with your demands. In addition, ask about their financial investment viewpoint and exactly how they customize their approaches to meet clients' specific situations.

Contrasting Charge Structures

Wondering just how numerous wide range management advisors structure their costs can help you make a knowledgeable choice regarding who to choose for your monetary needs.

When comparing fee structures, take into consideration whether the consultant bills a portion of possessions under administration (AUM), a per hour rate, a flat fee, or a combination of these. Advisors charging a percentage of AUM commonly take a portion of the complete possessions they take care of for you, making their fees proportionate to your wealth.

Hourly prices are based upon the time the expert invests in your monetary matters. Apartment costs are taken care of prices regardless of the properties handled. Some consultants might supply a tiered charge structure where the percent decreases as your properties raise.

In https://www.financial-planning.com/list/tips-for-i...enefits-and-tax-breaks-of-hsas , keep an eye out for any kind of concealed fees or commissions that could affect your total returns. By recognizing and contrasting fee frameworks, you can pick a wealth administration expert whose prices lines up with your monetary goals and preferences.

Conclusion

To conclude, by plainly specifying your financial objectives, assessing advisor qualifications, and comparing cost frameworks, you can make an informed decision when picking the best wide range monitoring advisor.

Keep in mind to prioritize your goals, consider your goals, and make sure that the expert's technique straightens with your needs.

With careful factor to consider and research, you can locate a consultant who'll assist you accomplish your economic objectives and safeguard your financial future.

Building Long-Term Financial Safety: Guidance For Millennials In Wide Range Management |

Дневник |

Web Content Writer-Feddersen Jiang

You've worked hard to safeguard your monetary stability, however have you thought about the particular approaches customized to millennials for developing lasting wealth? https://www.coutts.com/wealth-management/advice-service.html 's not just about conserving; it's about spending wisely and managing your money properly. By understanding the special obstacles millennials encounter in today's financial landscape, setting clear goals, and carrying out proven wealth-building approaches, you can lead the way for a more safe monetary future. However what are these strategies, and exactly how can you guarantee you get on the best path to achieving your long-lasting economic objectives?

Understanding Millennial Financial Difficulties

To recognize millennial financial obstacles, consider their distinct financial circumstances and societal impacts. As a millennial, you deal with a mix of factors that make accomplishing financial safety extra intricate than it was for previous generations. One considerable difficulty is the worry of pupil car loan financial debt, which limits your capacity to save for the future. This financial debt can prevent your capacity to invest, buy a home, or even begin a family. In addition, stationary incomes in comparison to the rising cost of living can make it hard to construct savings or invest for the long-term.

Additionally, social trends contribute fit your monetary landscape. The job economic situation, with its frequency of temporary agreements and freelance job, provides adaptability but lacks the security of standard employment. This unpredictability can make it challenging to prepare for retirement or unforeseen costs. Social media site also adds to economic pressures by developing a society of comparison and intake, leading to prospective overspending and debt build-up. By understanding these difficulties, you can begin to browse the path towards monetary safety efficiently.

Setting Financial Goals

Establishing clear monetary objectives is important for achieving long-lasting security and success in handling your riches. When setting economic goals, it's crucial to be details and realistic. Start by specifying what you intend to accomplish financially, whether it's purchasing a home, saving for retired life, or starting a business. These objectives will work as a roadmap to direct your economic choices and keep you concentrated on what is very important to you.

Consider setting short-term, medium-term, and long-lasting financial objectives. Temporary goals could include building an emergency fund or paying off high-interest debt. Medium-term objectives might entail saving for a down payment on a residence or financing further education and learning. Long-lasting objectives could focus on retired life planning or creating generational wealth.

Remember to consistently review and adjust your monetary goals as your conditions transform. By establishing clear and achievable monetary objectives, you can take control of your economic future and work towards developing the long-lasting protection and riches you want.

Implementing Wealth Building Techniques

When it pertains to wealth monitoring, taking workable actions to apply reliable wide range building approaches is essential to reaching your monetary objectives. One crucial approach is to create a budget plan that details your earnings, expenses, and financial savings objectives. By tracking where your money goes, you can recognize locations where you can cut back and redirect funds towards wide range building.

Another vital step is to begin spending early. The power of substance rate of interest means that the sooner you begin investing, the much more your money can grow in time.

Diversifying your investments is also crucial for long-lasting riches building. Instead of putting all your cash right into one investment, spreading it throughout various property courses can help in reducing risk and maximize returns.

Additionally, regularly evaluating and readjusting your financial strategy is crucial to guarantee you remain on track towards your goals. Life changes, market changes, and personal top priorities may require modifications to your riches building methods. By staying positive and adaptable, you can develop a solid foundation for long-term financial security.

Verdict

To conclude, taking control of your funds as a millennial is vital to developing lasting economic security. By setting go now , executing riches structure strategies, and staying aggressive in managing your money, you can pave the way in the direction of a stable financial future.

Remember to evaluate and adjust your plan consistently, expand your financial investments, and begin investing early to gain from compound rate of interest. With determination and technique, you can safeguard your monetary well-being for the years to come.

The Top 5 Top Qualities To Search For In A Monetary Consultant |

Дневник |

Personnel Writer-Perez Dodson

When looking for an economic advisor, you strive to find somebody with a mix of proficiency, interaction skill, a history of success, charge transparency, and a dedication to your best interests. These qualities form the structure of a worthwhile partnership that can lead you in the direction of financial protection and success. However exactly what do they involve, and how can they affect your financial decisions and future stability? Let's discover each of these critical features in more detail to help you make an educated selection when selecting an economic consultant.

Experience in Financial Preparation

When seeking a monetary expert, focus on considerable experience in monetary planning to guarantee sound guidance customized to your specific goals and circumstances. A seasoned monetary expert brings a wide range of expertise and experience to the table, having actually navigated various market problems and helped clients achieve their monetary purposes throughout the years. Their experience permits them to prepare for possible difficulties, determine chances, and craft strategies that align with your special financial situation.

A knowledgeable economic planner can supply understandings that go beyond book concepts, drawing from real-world circumstances to offer sensible and reliable remedies. They've likely encountered a wide range of economic situations and can leverage this understanding to direct you in making informed choices that sustain your long-term economic health. In addition, their record of successful customer end results shows their capability to provide outcomes and instills self-confidence in their referrals.

Solid Interaction Abilities

To guarantee efficient cooperation and understanding between you and your economic advisor, it's essential that the expert possesses solid interaction skills. A monetary expert with solid interaction abilities can discuss complicated monetary concepts in a way that you can easily understand. They ought to actively pay attention to your objectives, problems, and inquiries, developing a setting where you really feel comfy discussing your economic circumstance freely.

Clear interaction is crucial for establishing sensible assumptions regarding your economic strategies and investments. An experienced communicator will keep you educated concerning market adjustments, investment strategies, and any kind of changes needed to align with your objectives. They must have the ability to offer normal updates in a clear, succinct manner, ensuring you're constantly aware of the standing of your funds.

Additionally, strong communication skills likewise include being responsive to your inquiries and resolving any kind of uncertainties quickly. https://www.professionalplanner.com.au/2024/05/how...-the-cost-of-financial-advice/ ought to be approachable and ready to clarify any kind of unpredictabilities you might have. By fostering open interaction, you can build a trusting relationship with your advisor, leading to a more effective economic preparation journey.

Proven Record of Success

Having a monetary advisor with a tried and tested record of success is necessary for guaranteeing the performance of your financial planning trip. When choosing an advisor, seek a person that's a background helpful customers attain their financial goals. A record of success can supply you with confidence in your consultant's abilities and methods.

A tested performance history shows that the consultant has the experience and experience to browse numerous market problems efficiently. It reveals that they have actually a background of making sound monetary decisions and supplying results for their clients. By choosing an advisor with a performance history of success, you're most likely to receive reliable assistance and accomplish your very own financial goals.

To examine an advisor's track record, you can request recommendations from past customers or inquire about their track record. Furthermore, try to find qualifications and associations that reflect their dedication to honest standards and expert development. Inevitably, Financial Advisors with an economic expert that's a proven record can significantly boost your financial preparation experience.

Clear Charge Framework

For a transparent monetary planning experience, recognizing your advisor's fee framework is key. When selecting an economic expert, it's essential to know precisely just how they're compensated for their solutions.

Look for advisors who plainly describe their charge structure upfront, consisting of any kind of potential added expenses or charges that might arise during the preparation process. Clear consultants generally charge either a level cost, a per hour rate, a portion of possessions under management, or a combination of these approaches.

By recognizing just how your advisor is compensated, you can much better evaluate whether their passions line up with your own. Additionally, recognizing the cost framework assists you stay clear of any kind of shocks down the road and makes certain that you're fully knowledgeable about what you're paying for.

Openness in charges cultivates count on and enables an extra open and honest partnership in between you and your monetary consultant. Remember, clarity in fees is a fundamental aspect of an effective financial planning partnership.

Fiduciary Obligation

Guarantee your economic expert upholds their fiduciary duty to act in your best interests in all times. A fiduciary responsibility needs consultants to prioritize your requirements over their own, ensuring they suggest methods and financial investments that profit you, not them. This obligation sets a high standard for honest conduct in the economic consultatory market. By selecting a fiduciary advisor, you can trust that they'll always operate in your favor, offering honest advice tailored to your particular monetary objectives and circumstances.

When your expert is a fiduciary, they're legally bound to reveal any kind of potential conflicts of interest that might occur and have to constantly be clear concerning exactly how they're made up for their services. This transparency aids develop a connection of trust between you and your advisor, understanding that their referrals are based only on what's finest for your economic health. By selecting a fiduciary consultant, you can rest assured that your passions are being guarded, giving you comfort as you navigate your monetary journey.

Conclusion

Finally, when selecting an economic consultant, prioritize the complying with high qualities:

- Experience

- Communication abilities

- Performance history

- Charge openness

- Fiduciary obligation

These top qualities make sure efficient partnership, customized suggestions, effective end results, clear understanding of fees, and ethical conduct. By picking an advisor that symbolizes these top qualities, you can confidently function in the direction of achieving your monetary goals with depend on and peace of mind.

Tips For Establishing Long-Term Financial Safety And Security In Wealth Administration For Millennials |

Дневник |

Published By- Highly recommended Reading 've striven to secure your economic security, however have you taken into consideration the certain strategies customized to millennials for constructing long-lasting wealth? It's not just about saving; it's about spending intelligently and managing your money successfully. By recognizing the special challenges millennials face in today's financial landscape, establishing clear goals, and carrying out tried and tested wealth-building methods, you can pave the way for a more safe and secure monetary future. But what are these approaches, and exactly how can you ensure you're on the right course to accomplishing your long-lasting financial objectives?

Understanding Millennial Financial Challenges

To recognize millennial financial challenges, consider their one-of-a-kind financial conditions and societal influences. As a millennial, you face a combination of factors that make attaining economic protection much more intricate than it was for previous generations. One considerable challenge is the concern of trainee funding financial debt, which restricts your ability to save for the future. This financial obligation can hinder your ability to spend, purchase a home, or perhaps start a family. Additionally, stagnant salaries in comparison to the rising expense of living can make it tough to build cost savings or spend for the long term.

Furthermore, societal trends play a role fit your financial landscape. The job economic situation, with its occurrence of short-term contracts and freelance job, supplies adaptability yet lacks the stability of standard employment. https://drive.google.com/file/d/1EV4ydKfsutVwdH1JRqgIZhR66DS6ISVE/view?usp=drive_link can make it challenging to plan for retired life or unanticipated costs. Social network likewise adds to monetary stress by producing a culture of comparison and intake, bring about potential overspending and financial debt buildup. By recognizing these challenges, you can start to navigate the path in the direction of financial safety successfully.

Setting Financial Goals

Setting clear economic objectives is vital for accomplishing long-term stability and success in managing your wide range. When establishing financial goals, it's essential to be certain and reasonable. Start by specifying what you intend to achieve financially, whether it's getting a home, saving for retired life, or starting a company. These objectives will act as a roadmap to lead your financial choices and keep you focused on what is necessary to you.

Consider setting short-term, medium-term, and long-term financial goals. Temporary goals could include building an emergency fund or repaying high-interest financial debt. Medium-term objectives may entail saving for a down payment on a residence or funding additional education and learning. Long-lasting objectives might focus on retirement planning or producing generational wealth.

Bear in mind to consistently examine and readjust your financial objectives as your conditions alter. By establishing clear and achievable financial goals, you can take control of your economic future and work in the direction of building the lasting protection and wide range you desire.

Implementing Wide Range Structure Methods

When it concerns wide range administration, taking workable steps to apply effective riches building strategies is key to reaching your financial goals. One necessary method is to create a budget that outlines your income, expenses, and savings objectives. By tracking where your cash goes, you can recognize areas where you can cut back and redirect funds in the direction of wide range structure.

Another important step is to start spending early. The power of compound rate of interest means that the quicker you begin spending, the more your money can grow in time.

Diversifying your investments is also essential for lasting riches building. Rather than putting all your cash into one financial investment, spreading it throughout different possession classes can help reduce risk and take full advantage of returns.

Furthermore, regularly evaluating and adjusting your financial strategy is important to ensure you remain on track towards your objectives. Life adjustments, market changes, and personal priorities might require adjustments to your riches structure approaches. By remaining positive and versatile, you can develop a strong structure for long-term monetary security.

Final thought

In conclusion, taking control of your financial resources as a millennial is vital to developing long-lasting economic protection. By establishing clear objectives, applying wealth building strategies, and staying aggressive in managing your money, you can pave the way in the direction of a steady monetary future.

Keep in mind to assess and readjust your strategy routinely, diversify your financial investments, and start investing very early to gain from substance interest. With resolution and self-control, you can protect your financial wellness for the years to come.

| Страницы: |